Professional Documents

Culture Documents

Steaming US Jobs Market Gives Fed Green Light On Rate Hikes - Unemployment News - Al Jazeera

Uploaded by

pan0Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Steaming US Jobs Market Gives Fed Green Light On Rate Hikes - Unemployment News - Al Jazeera

Uploaded by

pan0Copyright:

Available Formats

News Ukraine war Features Economy Opinion Video More LIVE

Economy | Unemployment

Steaming US jobs market gives Fed green

light on rate hikes

It was just two weeks ago that the Fed raised interest rates by a

quarter-of-a-percentage point in its first policy tightening in three

years.

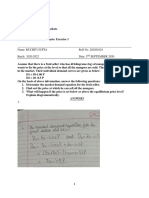

Participation in the labour force by workers in their "prime" years of 25 to 54 rose to 82.5 percent, the highest level in two

years [File: Andrew Kelly/Reuters]

1 Apr 2022

It is not as if United States central bankers needed more reasons to step up the pace of

interest rate raises.

But that is what they got on Friday, when the Bureau of Labor Statistics latest jobs

report showed employers added 431,000 to payrolls last month and the unemployment

rate fell to a two-year low of 3.6 percent.

KEEP READING

Meme darling: GameStop shares surge on stock split news

Russia not turning off gas taps, buyers have weeks for rouble pay

US hiring stays strong as jobless rate falls, wages accelerate

Amazon workers at NYC warehouse vote to unionize

All are signs of a strong labour market with little need for the kind of super-easy

monetary policy that the Fed is currently delivering and has begun to unwind.

“A very tight labour market got even tighter,” wrote Oxford Economics’ Kathy

Bostjancic and Lydia Boussour.

Futures contracts tied to the Fed’s policy rate fell after the jobs report, as expectations

intensified that the Fed will go bigger at the Fed’s next three meetings, raising by a

half-a-percentage point each time to deal a more decisive blow to price pressures.

Rate futures contracts reflect odds-on bets for the policy rate to end the year in the

range of 2.5 percent to 2.75 percent, with about a one-in-three chance of going even

higher. Either way that is high enough to put the brakes on growth.

It was just two weeks ago that the Fed raised interest rates by a quarter-of-a-

percentage point in its first policy tightening in three years, and signaled ongoing rate

raises ahead to rein in inflation at a 40-year high and climbing.

With average hourly pay that is 5.6 percent higher than a year earlier, March’s labour

market report reflected strong demand for workers despite rising borrowing costs that

may, to central bankers, also contain a warning signal for a building “wage price spiral”

that could make inflation even worse.

At their mid-March meeting, policymakers had projected an end-of-year policy rate of

about 1.9 percent. Since then a number, including Fed Chair Jerome Powell, have

signaled their readiness to move faster.

Chicago Fed President Charles Evans, who personally prefers the more measured path,

told reporters Friday that he does not see a big risk in using “some” half-point rate

raises to bring borrowing costs to neutral sooner, as long as the goal was not to raise

rates much faster and push them much higher.

Sign up for Al Jazeera

Americas Coverage

Newsletter

US politics, Canada’s multiculturalism, South America's geopolitical rise—we

bring you the stories that matter.

Email address Sign up

By signing up, you agree to our Privacy Policy

The worry there would be that the Fed ends up tightening too much, tipping the

economy into recession. Historically it has been rare that the Fed has avoided such an

outcome once the unemployment rate falls as low as it is now.

With inflation looking set to accelerate even more after Russia’s invasion of Ukraine

sent oil prices higher and a COVID-19 outbreak in China threatens to further damage

already strained supply chains, tamping down inflation is “essential” to sustaining a

strong labour market, Fed’s Powell has said.

The Fed targets 2 percent inflation by a measure known as the personal consumption

expenditures price index. In February that measure jumped to 6.4 percent.

Policymakers do not want to risk that expectations for ever-higher prices get baked into

American household and business psychology. Rate raises are designed to curb

demand and blunt that risk.

Besides, policymakers have argued, the labour market has met the standard of full

employment, and is strong enough to withstand the kind of fairly rapid withdrawal of

support they are contemplating.

Friday’s report offered more grist for that argument. The unemployment rate was

“little different” than the pre-pandemic rate of 3.5 percent, the report’s authors said.

And it helps ratify the Fed’s hope that workers sidelined by the pandemic would find

their way back to the labour force as COVID-19 cases fall.

Participation in the labour force by workers in their “prime” years of 25 to 54 rose to

82.5 percent, the highest level in two years. Most industries are now above or close to

their pre-pandemic level of employment

US employment overall is still 1.6 million below the pre-pandemic level, the report

showed.

But Fed policymakers increasingly see that deficit as likely to get filled only slowly and

not prone to be hurried along by keeping rates low.

SOURCE: REUTERS

RELATED

In ation bites: US prices hike is tempering

consumer demand

Americans are dealing with the fastest pace of price increas-

es in 40 years.

31 Mar 2022

US consumer con dence edges up in March

despite in ation

Even though consumer con dence increased, Americans are

facing the highest in ation since 1982.

29 Mar 2022

Asian stocks rise as US bonds tumble on

hawkish signals from Fed

Stocks rise in Australia, South Korea and Japan, where a

weaker yen may bolster the outlook for exporters.

22 Mar 2022

US Fed hikes rates, signals aggressive

stance to ght in ation

The quarter-percentage-point hike is likely the rst of many to

rein in the highest US in ation in over 40 years.

16 Mar 2022

MORE FROM ECONOMY

Oil prices ease as Sri Lanka declares

nations agree to state of

tap reserves emergency as

protests spread

Spare parts: Brazil’s central

Russia war bank workers

sanctions hurt strike as chief

Cuba’s Lada vacations in Miami

drivers

MOST READ

OPINION

Ukraine latest

updates: ICRC What will Russia’s

says Mariupol post-invasion

evacuation on hold economy look

like?

In Syria, Russia UN sending top

leads effort to o cial to Moscow

recruit ghters for to seek

Ukraine humanitarian

cease re

About Connect Our Channels Our Network Follow Al Jazeera English:

About Us Contact Us Al Jazeera Arabic Al Jazeera Centre for

Studies

Code of Ethics Apps Al Jazeera English

Al Jazeera Media

Terms and Conditions Channel Finder Al Jazeera Institute

Investigative Unit

EU/EEA Regulatory TV Schedule Learn Arabic

Notice Al Jazeera Mubasher

Podcasts Al Jazeera Centre for

Privacy Policy Al Jazeera Public Liberties &

Submit a Tip Documentary

Cookie Policy Human Rights

© 2022 Al Jazeera Media Network

Al Jazeera Balkans Al Jazeera Forum

Cookie Preferences

AJ+

Sitemap Al Jazeera Hotel

Partners

Community Guidelines

Work for us

HR Quality

You might also like

- Powell Says Taming Inflation 'Absolutely Essential,' and A 50 Basis Point Hike Possible For MayDocument1 pagePowell Says Taming Inflation 'Absolutely Essential,' and A 50 Basis Point Hike Possible For Maypan0No ratings yet

- Elon Musk Has A Gloomy Financial Prediction For 2022 - Times of IndiaDocument1 pageElon Musk Has A Gloomy Financial Prediction For 2022 - Times of Indiapan0No ratings yet

- More Countries Agree To Ruble Payments For Gas - Russian Deputy PM - RT Business NewsDocument1 pageMore Countries Agree To Ruble Payments For Gas - Russian Deputy PM - RT Business Newspan0No ratings yet

- Russia Formally Protests US Weapons Shipments To Ukraine - CNNPoliticsDocument1 pageRussia Formally Protests US Weapons Shipments To Ukraine - CNNPoliticspan0No ratings yet

- Mariupol Capture Could Be A Crucial Turning Point' For Ukraine-Russia Conflict - Global TimesDocument1 pageMariupol Capture Could Be A Crucial Turning Point' For Ukraine-Russia Conflict - Global Timespan0No ratings yet

- Pentagon Makes No Comment On Data About US Weapons Destroyed in Ukraine - World - TASSDocument1 pagePentagon Makes No Comment On Data About US Weapons Destroyed in Ukraine - World - TASSpan0No ratings yet

- How Did Russian Oligarchs Get Their Wealth - The Jerusalem PostDocument1 pageHow Did Russian Oligarchs Get Their Wealth - The Jerusalem Postpan0No ratings yet

- Food Diplomacy' - EU Plans To Counter Russia in MENA, Balkans - Food News - Al JazeeraDocument1 pageFood Diplomacy' - EU Plans To Counter Russia in MENA, Balkans - Food News - Al Jazeerapan0No ratings yet

- Fed's James Bullard Says Interest Rate Policy Is 'Behind The Curve'Document1 pageFed's James Bullard Says Interest Rate Policy Is 'Behind The Curve'pan0No ratings yet

- Russian Armed Forces Offer Militants in Mariupol To Surrender - Defense Ministry - Military & Defense - TASSDocument1 pageRussian Armed Forces Offer Militants in Mariupol To Surrender - Defense Ministry - Military & Defense - TASSpan0No ratings yet

- Surging Interest Rates Push Mortgage Demand Down More Than 40% From A Year AgoDocument1 pageSurging Interest Rates Push Mortgage Demand Down More Than 40% From A Year Agopan0No ratings yet

- Fed's Harker 'Acutely Concerned' Inflation, Sees 'Deliberate' HikesDocument1 pageFed's Harker 'Acutely Concerned' Inflation, Sees 'Deliberate' Hikespan0No ratings yet

- Cold War Under The Scorching Sun - How A New Conflict Is Brewing in Africa - RT World NewsDocument1 pageCold War Under The Scorching Sun - How A New Conflict Is Brewing in Africa - RT World Newspan0No ratings yet

- Here's Why The Dollar's Dominance Will Most Likely ContinueDocument1 pageHere's Why The Dollar's Dominance Will Most Likely Continuepan0No ratings yet

- Jamie Dimon Says Post-Pandemic Boom - Could Extend Well Into 2023 - CBS NewsDocument1 pageJamie Dimon Says Post-Pandemic Boom - Could Extend Well Into 2023 - CBS Newspan0No ratings yet

- Russia Accuses Ukraine of Hiding Military Losses - RT Russia & Former Soviet UnionDocument1 pageRussia Accuses Ukraine of Hiding Military Losses - RT Russia & Former Soviet Unionpan0No ratings yet

- JPMorgan Chase's Jamie Dimon Says The U.S. Economy Faces - Unprecedented - Risks - CBS NewsDocument1 pageJPMorgan Chase's Jamie Dimon Says The U.S. Economy Faces - Unprecedented - Risks - CBS Newspan0No ratings yet

- Most Americans Are Worried About A Recession Hitting The U.S. in 2022Document1 pageMost Americans Are Worried About A Recession Hitting The U.S. in 2022pan0No ratings yet

- Mortgage Refinance Demand Plunges 60%, As Rates Hit Their Highest Level Since 2018Document1 pageMortgage Refinance Demand Plunges 60%, As Rates Hit Their Highest Level Since 2018pan0No ratings yet

- The Ransomware Wars - Here's How Much Cash The Top Gangs Reel in - CBS NewsDocument1 pageThe Ransomware Wars - Here's How Much Cash The Top Gangs Reel in - CBS Newspan0No ratings yet

- Ford's First Quarter Sales Fall 17% As Automaker Battles Chip ShortageDocument1 pageFord's First Quarter Sales Fall 17% As Automaker Battles Chip Shortagepan0No ratings yet

- N.Y. Fed's Williams Says Could Begin Trimming Balance Sheet As Soon As MayDocument1 pageN.Y. Fed's Williams Says Could Begin Trimming Balance Sheet As Soon As Maypan0No ratings yet

- Biden To Release Oil From Strategic Petroleum Reserve To Cut Gas PricesDocument1 pageBiden To Release Oil From Strategic Petroleum Reserve To Cut Gas Pricespan0No ratings yet

- 2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A RecessionDocument1 page2-Year Treasury Yield Tops 10-Year Rate, A 'Yield Curve' Inversion That Could Signal A Recessionpan0No ratings yet

- Sanctions Games' Weaken Dollar and Euro - Kremlin - RT Business NewsDocument1 pageSanctions Games' Weaken Dollar and Euro - Kremlin - RT Business Newspan0No ratings yet

- Bubblicious Used Car Prices Rising Faster Than Bitcoin, Jim Bianco WarnsDocument1 pageBubblicious Used Car Prices Rising Faster Than Bitcoin, Jim Bianco Warnspan0No ratings yet

- Fed's Patrick Harker Says He Thinks The U.S. Can Avoid A Recession, Even Amid Troubling SignsDocument1 pageFed's Patrick Harker Says He Thinks The U.S. Can Avoid A Recession, Even Amid Troubling Signspan0No ratings yet

- Biden Believes Putin Has Decided To Attack Ukraine in Coming DaysDocument1 pageBiden Believes Putin Has Decided To Attack Ukraine in Coming Dayspan0No ratings yet

- The Average Size of A New Mortgage Just Set A RecordDocument1 pageThe Average Size of A New Mortgage Just Set A Recordpan0No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ACI PolicyBrief CreatingFertileGroundsforPrivateInvestmentinAirportsDocument48 pagesACI PolicyBrief CreatingFertileGroundsforPrivateInvestmentinAirportsIndranovsky IskandarNo ratings yet

- ExpandedAppendixChapter12 PDFDocument4 pagesExpandedAppendixChapter12 PDFfunam2No ratings yet

- Exercise 1Document24 pagesExercise 1yu yuNo ratings yet

- Ch. 18: Elasticity: Del Mar College John DalyDocument24 pagesCh. 18: Elasticity: Del Mar College John DalyManthan PatelNo ratings yet

- MF 441 - Process Planning and Cost Estimation Unit-1 Key ConceptsDocument31 pagesMF 441 - Process Planning and Cost Estimation Unit-1 Key ConceptsnivilogNo ratings yet

- Tutorial 6 - SolutionsDocument8 pagesTutorial 6 - SolutionsNguyễn Phương ThảoNo ratings yet

- Blas v. Linda Angeles-HutallaDocument2 pagesBlas v. Linda Angeles-HutallaHoward Chan100% (2)

- Đàm PhánDocument2 pagesĐàm PhánHoàng KhangNo ratings yet

- Free Cash Flow ValuationDocument14 pagesFree Cash Flow ValuationabcNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireMillicent Belle Tolentino100% (1)

- Azatbek A. ClassworkDocument3 pagesAzatbek A. ClassworkAzatbek AshirovNo ratings yet

- The Diluted Earnings Per Share FormulaDocument6 pagesThe Diluted Earnings Per Share FormulaMariella AngobNo ratings yet

- 6W2X - Business Model Canvas With ExplanationsDocument4 pages6W2X - Business Model Canvas With ExplanationsFrancisco AyalaNo ratings yet

- Risk and Capital BudgetingDocument51 pagesRisk and Capital BudgetingSanaNaeemNo ratings yet

- MCS 035 NotesDocument7 pagesMCS 035 NotesAshikNo ratings yet

- CH 5 Quiz 1Document2 pagesCH 5 Quiz 1Jessa BasadreNo ratings yet

- InterCompany POSO SAPDocument9 pagesInterCompany POSO SAPTejendra SoniNo ratings yet

- 5.1 Quiz Fair Value Measurement AssetsDocument17 pages5.1 Quiz Fair Value Measurement AssetsSanath Fernando100% (1)

- 4 80 Bms Semester I and II Syllabus With Course Structure 1Document88 pages4 80 Bms Semester I and II Syllabus With Course Structure 1api-292680897No ratings yet

- Boeing Market Outlook 2005Document39 pagesBoeing Market Outlook 2005mdshoppNo ratings yet

- Rural Marketing Activities ofDocument31 pagesRural Marketing Activities ofKeerthy Thazhathuveedu T R0% (1)

- DACE Price BookletDocument1 pageDACE Price Bookletcostingh67% (3)

- Tutorial: Eco162 ElasticityDocument3 pagesTutorial: Eco162 ElasticityyasmeenNo ratings yet

- Assignment CFM (RUCHIT GUPTA) PDFDocument11 pagesAssignment CFM (RUCHIT GUPTA) PDFruchit gupta50% (2)

- Case Study - Somerset Furniture CompanyDocument8 pagesCase Study - Somerset Furniture CompanyGINANo ratings yet

- Cost Analysis of 3 Coat White Washing for 100 sqm AreaDocument4 pagesCost Analysis of 3 Coat White Washing for 100 sqm AreaARSENo ratings yet

- Lesson 3 DepreciationDocument8 pagesLesson 3 DepreciationJAN ERWIN LACUESTANo ratings yet

- The Cost of Production: Questions For ReviewDocument14 pagesThe Cost of Production: Questions For ReviewVinaNo ratings yet

- Global Steel Market Outlook 2023: Post-Pandemic Recovery Amid Geopolitical RisksDocument21 pagesGlobal Steel Market Outlook 2023: Post-Pandemic Recovery Amid Geopolitical RisksLian PutraNo ratings yet

- CHPT 7 in Class ExercisesDocument3 pagesCHPT 7 in Class ExercisesKaran Pahwa0% (1)