Professional Documents

Culture Documents

Sociall Media

Uploaded by

Mohsin Khan0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

sociall media

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageSociall Media

Uploaded by

Mohsin KhanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

1. Hello everyone. My presentation topic is Risk Management. So lets get started.

2. So before discussing about Risk management we have to understand what is risk

a. Risk is defined in financial terms as the chance that an outcome or investment's actual gains. Risk includes

the possibility of losing some or all of an original investment.

b. It is an uncertain event which may occur in the future

3. Now what is risk management : The risk management process is a framework for the actions that need to be taken.

There are five basic steps that are taken to manage risk.

The initial step in the risk management process is to identify the risks that the business is exposed to in its

operating environment. There are many different types of risks like Legal risks, Environmental risk, market risk,

regulatory risk.

Once a risk has been identified it needs to be analyzed. To determine the severity and seriousness of the risk it

is necessary to see how many business functions the risk affects. Evaluation of risks will let us know the far-

reaching effects of each risk.

Now third step is to evaluate the risk. Risks need to be ranked and prioritized Depending on the severity of the

risk. A risk that may cause some inconvenience is rated lowly, risks that can result in catastrophic loss are rated

the highest. It is important to rank risks because it allows the organization to gain a holistic view of the risk

exposure of the whole organization.

Now the forth step is to treat the risk : Every risk needs to be eliminated or contained as much as possible. This

is done by connecting with the experts of the field to which the risk belongs.

And the last step is to monitor and review the risk : Not all risks can be eliminated – some risks are always

present. Market risks and environmental risks are just two examples of risks that always need to be monitored..

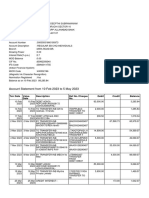

4. Here is of pictorial representation of cycle of risk management that we have just discussed in the previous slide.

5. So, what is the importance of risk management. Risk management is important because it tells businesses about the

threats in their operating environment and allows them to preemptively mitigate risks. In the absence of risk

management, businesses would face heavy losses because they would be blindsided by risks. And there are some

benefits of risk management like it promotes the growth of the business empowers it And ensures the level of risks

in the business.

6. Catagories of risk : There are multiple ways into which risks can be categorized like Financial

a. It is the possibility of losing money on an investment or business venture. Which causes reduction in

funding and poor budegeting.

b. Operational: These risks result from failed or inappropriate policies, procedures, systems or activities.

Example failure of an IT system.

c. Next is reputational, means when an Organization engages in activities that could threaten it’s good name

example, Staff or members acting in a criminal or unethical way.

d. And the last strategic means the internal and external events that may make it difficult, or even impossible,

for an organisation to achieve their objectives and strategic goals.

7. Why Risk Management May Fail . here are some reasons of why it may fail.

a. When there is a limitation of scope, when there’s is a lack of management support, and when the

management is not engaged with all the stakeholders or owners which results in the miscommunation and

uneven share of information.

8. Now lets discuss Response to Risks : It is the process of controlling identified risks.

a. Avoid : Change your strategy or plan to avoid the risk.

b. Mitigrate : Means Take actions to reduce the risk example taking work procedures.

c. Transfer : Tranfer the risk to a third party. Example purchase fire insurance for an unfinished building.

d. Acceptance : Decide to take or retain the risk .

9. So finally here comes the conclusion.

Based on this presentation. I have concuded that risk management improves decision making. Though

Risk management does not guarantee success but it improves decision making.

Improves chances of success : It is obvious when the risk is minimum then the chances of success is

maximum

And the last is Risk is essential for progress and failure is key part of learning.

10. So that is all from my side on this presentation. THANK YOU!

You might also like

- Macro Environment and MarketingDocument10 pagesMacro Environment and MarketingMohsin Khan100% (1)

- Macro Environment and MarketingDocument19 pagesMacro Environment and MarketingMohsin KhanNo ratings yet

- Aligarh Muslim University: 1 AssignmentDocument10 pagesAligarh Muslim University: 1 AssignmentMohsin Khan100% (1)

- 21BAMMW179 Risk ManagementDocument11 pages21BAMMW179 Risk ManagementMohsin KhanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Feb-May SBI StatementDocument2 pagesFeb-May SBI StatementAshutosh PandeyNo ratings yet

- Portland Cement: Standard Specification ForDocument9 pagesPortland Cement: Standard Specification ForHishmat Ezz AlarabNo ratings yet

- RTD IncotestDocument2 pagesRTD IncotestJabari KaneNo ratings yet

- Grade 6 q2 Mathematics LasDocument151 pagesGrade 6 q2 Mathematics LasERIC VALLE80% (5)

- Muhammad Firdaus - A Review of Personal Data Protection Law in IndonesiaDocument7 pagesMuhammad Firdaus - A Review of Personal Data Protection Law in IndonesiaJordan Amadeus SoetowidjojoNo ratings yet

- Finite State MachineDocument75 pagesFinite State Machinecall_asitNo ratings yet

- Mortars in Norway From The Middle Ages To The 20th Century: Con-Servation StrategyDocument8 pagesMortars in Norway From The Middle Ages To The 20th Century: Con-Servation StrategyUriel PerezNo ratings yet

- Description - GB - 98926286 - Hydro EN-Y 40-250-250 JS-ADL-U3-ADocument6 pagesDescription - GB - 98926286 - Hydro EN-Y 40-250-250 JS-ADL-U3-AgeorgeNo ratings yet

- RRB 17 Sep Set 2 Ibps Guide - Ibps Po, Sbi Clerk, RRB, SSC - Online Mock TestDocument46 pagesRRB 17 Sep Set 2 Ibps Guide - Ibps Po, Sbi Clerk, RRB, SSC - Online Mock TestBharat KumarNo ratings yet

- Nptel Online-Iit KanpurDocument1 pageNptel Online-Iit KanpurRihlesh ParlNo ratings yet

- Medha Servo Drives Written Exam Pattern Given by KV Sai KIshore (BVRIT-2005-09-ECE)Document2 pagesMedha Servo Drives Written Exam Pattern Given by KV Sai KIshore (BVRIT-2005-09-ECE)Varaprasad KanugulaNo ratings yet

- System of Linear Equation and ApplicationDocument32 pagesSystem of Linear Equation and Applicationihsaanbava0% (1)

- Digital Speed Control of DC Motor For Industrial Automation Using Pulse Width Modulation TechniqueDocument6 pagesDigital Speed Control of DC Motor For Industrial Automation Using Pulse Width Modulation TechniquevendiNo ratings yet

- American J of Comm Psychol - 2023 - Palmer - Looted Artifacts and Museums Perpetuation of Imperialism and RacismDocument9 pagesAmerican J of Comm Psychol - 2023 - Palmer - Looted Artifacts and Museums Perpetuation of Imperialism and RacismeyeohneeduhNo ratings yet

- Eea2a - HOLIDAY HOMEWORK XIIDocument12 pagesEea2a - HOLIDAY HOMEWORK XIIDaksh YadavNo ratings yet

- CBLM - Interpreting Technical DrawingDocument18 pagesCBLM - Interpreting Technical DrawingGlenn F. Salandanan89% (45)

- MT Im For 2002 3 PGC This Is A Lecture About Politics Governance and Citizenship This Will HelpDocument62 pagesMT Im For 2002 3 PGC This Is A Lecture About Politics Governance and Citizenship This Will HelpGen UriNo ratings yet

- General Introduction: 1.1 What Is Manufacturing (MFG) ?Document19 pagesGeneral Introduction: 1.1 What Is Manufacturing (MFG) ?Mohammed AbushammalaNo ratings yet

- BGP PDFDocument100 pagesBGP PDFJeya ChandranNo ratings yet

- sp.1.3.3 Atoms,+Elements+&+Molecules+ActivityDocument4 pagessp.1.3.3 Atoms,+Elements+&+Molecules+ActivityBryaniNo ratings yet

- Boq Cme: 1 Pole Foundation Soil WorkDocument1 pageBoq Cme: 1 Pole Foundation Soil WorkyuwonoNo ratings yet

- Model Personal StatementDocument2 pagesModel Personal StatementSwayam Tripathy100% (1)

- CompTIA A+ Lesson 3 Understanding, PATA, SATA, SCSIDocument8 pagesCompTIA A+ Lesson 3 Understanding, PATA, SATA, SCSIAli Ghalehban - علی قلعه بانNo ratings yet

- IOM - Rampa Hidráulica - Blue GiantDocument32 pagesIOM - Rampa Hidráulica - Blue GiantPATRICIA HERNANDEZNo ratings yet

- List of Institutions With Ladderized Program Under Eo 358 JULY 2006 - DECEMBER 31, 2007Document216 pagesList of Institutions With Ladderized Program Under Eo 358 JULY 2006 - DECEMBER 31, 2007Jen CalaquiNo ratings yet

- Harish Raval Rajkot.: Civil ConstructionDocument4 pagesHarish Raval Rajkot.: Civil ConstructionNilay GandhiNo ratings yet

- 3Document76 pages3Uday ShankarNo ratings yet

- Python Cheat Sheet-1Document8 pagesPython Cheat Sheet-1RevathyNo ratings yet

- OMM807100043 - 3 (PID Controller Manual)Document98 pagesOMM807100043 - 3 (PID Controller Manual)cengiz kutukcu100% (3)

- TakeawaysDocument2 pagesTakeawaysapi-509552154No ratings yet