Professional Documents

Culture Documents

Chapter 14 Club Accounts: Adjustments A1 Opening Depreciation On Fixed Assets

Uploaded by

StephenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 14 Club Accounts: Adjustments A1 Opening Depreciation On Fixed Assets

Uploaded by

StephenCopyright:

Available Formats

Chapter 14 Club accounts

Higher Level

St. Mary’s Rugby Club

Adjustments

A1 Opening Depreciation on fixed assets

Asset Cost Depreciation to date Net value

€ € €

Clubhouse and Pitches 750,000 €600,000 x 2% x 3 years = 36,000 714,000

Equipment 34,000 34,000 x 20% x 3 years = 20,400 13,600

A2 Investments and Investment Interest A3 Loan and Loan Interest

Amount received €1,600 Loan interest 8% x 1.25 10%

Less amount due 01/01/28 (Last yr) (€ 600) 110% = €33,000

Add amount due 31/12/28 (This yr) € 400 ⟶ 100% = €33,000/110 x 100 €30,000

Receivable € 1,400 Interest € 3,000

Interest

⟶ 2% = €1,400 Due €3,000/15 x 7 months € 1,400

⟶100%= €1,400/2 x 100 €70,000 Payable €3,000 / 15 x 8 months € 1,600

A4 Catering A5 Lotto

Catering receipts €15,000 Lotto sales €27,400

Less cost of sales Less lotto prizes (€18,400)

Purchases €8,300 Lotto profit € 9,000

Less stock (€500) (€7,800)

Catering profit €7,200 A6 Equipment - depreciation

Opening €34,000 x 20% € 6,800

A7 Subscriptions New €40,000 x 20% x 3/12 € 2,000

Amount received €160,000 Total charged € 8,800

Less due 01/01/28 - last year (€ 2,100)

Less life membership (A9) (€12,000) A8 Life Membership

Less subscriptions 2029 (next year) (€ 1,500) Value 01/01/2028 € 54,000

Less levy for 2028 (€60 x 1,000) (€60,000) ⟶ €54,000/9 = €6,000 x 2 € 12,000

Less levy for 2027 (€60 x 12) (€ 720) € 66,000

Total €83,680 €66,000 / 11 (income) (€ 6,000)

Value 31/12/2028 € 60,000

A9 Levy reserve fund A10 Sports Council Grant

Value 01/01/2028 € 60,000 Amount received €18,000

This years levy € 60,000 Capital € 7,800

Value 31/12/2028 €120,000 Annual €10,200

A11 Coaching Expenses A12 General expenses

Amount paid €12,300 Amount paid €91,200

Less wages due 01/01/2028 (€1,800) Less insurance prepaid * (€1,500)

Add wages due 31/12/2028 € 4,500 Total payable €89,700

Total payable €15,000 * €3,600 x 5/12 = €1,500

A13 Depreciation Clubhouse

€600,000 x 2% €12,000

A14 Assets/depreciation re balance sheet

Asset Cost Dpr 01/01/28 Dpr. 2028 Dpr. 31/12/28

€ € €

Clubhouse and pitches 750,000 36,000 12,000 48,000

Equipment 74,000 20,400 8,800 29,200

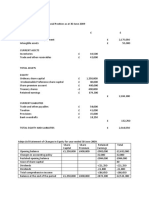

(a) Statement of Accumulated Fund of the St Mary’s Rugby Club on 01/01/2028

€ €

Assets

Clubhouse and pitches (A1) 714,000

Equipment (A1) 13,600

Bar stock 9,400

Investment interest due 600

Bar debtors 700

Subscriptions due 2,100

Building society deposit 22,000

Investments (A2) 70,000

Levy due (A7) 720 833,120

Less Liabilities

Life membership 54,000

Bar creditors 900

Wages due 1,800

Levy reserve fund 60,000

Bank 10,500

Loan (A3) 30,000

Loan interest due (A3) 1,400 (158,600)

Accumulated Fund 01/01/2028 674,520

(b) Bar Trading Account

€ €

Bar sales (€92,300 - €700 + €800) 92,400

Less Cost of sales

Opening stock 9,400

Purchases (€71,200 - €900 + €1,490) 71,790

81,190

Less closing stock (€12,100 - €500) (11,600) (69,590)

Bar profit 22,810

(c) Income and Expenditure of St. Mary’s Rugby Club for the year ended 31/12/2028

€ €

Income

Investment interest (A2) 1,400

Bar profit (part b) 22,810

Catering profit (A4) 7,200

Entrance fees 4,800

Annual sponsorship 15,600

Lotto profit (A5) 9,000

Subscriptions (A7) 83,680

Life membership (A8) 6,000

Sports council grant (A10) 10,200 160,690

Less Expenditure

Loan interest (A3) 1,600

Coaching expenses (A11) 15,000

General expenses (A12) 89,700

Depreciation

Equipment (A6) 8,800

Clubhouse (A13) 12,000 (127,100)

Excess/surplus income over expenditure 33,590

(d) Balance Sheet of St. Mary’s Rugby Club as at 31/12/2028

€ € €

Fixed Assets Cost Aggregate Dpr. Net Book Value

Clubhouse and pitches (A14) 750,000 48,000 702,000

Equipment (A14) 74,000 29,200 44,800

824,000 77,200 746,800

Financial assets

2% Investments (A2) 70,000

816,800

Current Assets

Stocks 12,100

Bar debtors 800

Investment interest due (A2) 400

Insurance prepaid (A12) 1,500

Bank 71,800

86,600

Creditors : amounts falling due within 1 year

Bar creditors 1,490

Subscriptions prepaid (A7) 1,500

Wages due (A11) 4,500 (7,490) 79,110

Total net assets 895,910

Financed by

Creditors amounts falling due after 1 year

Accumulated fund 01/01/2028 674,520

Add Sports Council grant (A10) 7,800

682,320

Levy reserve fund (A9) 120,000

Life membership (A8) 60,000

Surplus income over expenditure (part c) 33,590 895,910

Funds Employed 895,910

(e) As treasurer I would make the following points in response to this proposal:

• A reduction in subscriptions of 10% for 2029 would involve a reduction in club income of

€8,368 (€83,680 x 10%).

• The club is capable of bearing such a decrease based on the surplus income for the

year 2028 of €33,590. However almost all of this surplus is provided by entrance fees

€4,800, sponsorship of €15,600 and an annual grant from Sporting Ireland €10,200.

• The club has planned capital expenditure in the future (levy reserve fund €120,000).

Even though the club has a healthy bank balance of €71,800, Investments €70,000,

these funds are not of a recurring nature and even the sponsorship may not be

guaranteed in future years.

• It would therefore not be prudent to reduce subscription fees at present. Instead it

would be advisable to retain the present level of fees and use these fees to provide

improved facilities for existing members and possibly attract new members into the

club.

You might also like

- Seminar 2 FeedbackDocument5 pagesSeminar 2 FeedbackjekaterinaNo ratings yet

- TK3 - AccDocument6 pagesTK3 - AccmeifangNo ratings yet

- TK4 AccDocument5 pagesTK4 AccmeifangNo ratings yet

- D6 F0121108 Helmy FebrianoDocument9 pagesD6 F0121108 Helmy FebrianohelmyNo ratings yet

- Lecture 2 Independent Study Exercises - Suggested SolutionsDocument5 pagesLecture 2 Independent Study Exercises - Suggested SolutionsSam TaylorNo ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- Andreas B. IntermediateDocument4 pagesAndreas B. IntermediateAndreasNo ratings yet

- Tutor 6Document26 pagesTutor 6MERINANo ratings yet

- S 5.8-5.13 Limited CompaniesDocument11 pagesS 5.8-5.13 Limited CompaniesIlovejjcNo ratings yet

- FAR Problem Quiz 2Document3 pagesFAR Problem Quiz 2Ednalyn CruzNo ratings yet

- Flynn Design AgencyDocument4 pagesFlynn Design Agencycalsey azzahraNo ratings yet

- Dac 318 AssignmentDocument6 pagesDac 318 AssignmentLenny MuttsNo ratings yet

- Appendix D - Answers To Self-Test Problems PDFDocument32 pagesAppendix D - Answers To Self-Test Problems PDFgmcrinaNo ratings yet

- Rigel. T. F. Rotinsulu - C3 - Tugas AKM2Document3 pagesRigel. T. F. Rotinsulu - C3 - Tugas AKM2Rigel RotinsuluNo ratings yet

- Anisa Muzaqi 4c Lat 22 Castleman Holdings, IncDocument6 pagesAnisa Muzaqi 4c Lat 22 Castleman Holdings, Incanisa MuzaqiNo ratings yet

- MAPEL104 Lesson 7 - Final Accounts and Financial Statements - 10062021Document59 pagesMAPEL104 Lesson 7 - Final Accounts and Financial Statements - 10062021Maria Jeannie CurayNo ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- ForumDocument5 pagesForumMariana Hb0% (1)

- 2014 CommentaryDocument46 pages2014 Commentaryduong duongNo ratings yet

- Ast Chapter 1 MCPDocument14 pagesAst Chapter 1 MCPElleNo ratings yet

- P12-1 Dan P 12-5 - Ak KeuanganDocument2 pagesP12-1 Dan P 12-5 - Ak KeuanganNenna SadukNo ratings yet

- Minggu 9 - Statement of Cash Flows - Indirect Method and Free Cash FlowDocument4 pagesMinggu 9 - Statement of Cash Flows - Indirect Method and Free Cash FlowFirda YantiNo ratings yet

- Problem 16.2 Nikken Microsystems (B)Document2 pagesProblem 16.2 Nikken Microsystems (B)Julie SpringNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- Accounting Quation Quiz CambrioDocument1 pageAccounting Quation Quiz Cambriov1v1subrotoNo ratings yet

- Accounting Quation Quiz DaderioDocument1 pageAccounting Quation Quiz Daderiov1v1subrotoNo ratings yet

- Soal 1 A. Time Co Laporan Rekonsiliasi Bank Per 31 Januari Cash Balance Per Bank Statement $ 3,660.20Document6 pagesSoal 1 A. Time Co Laporan Rekonsiliasi Bank Per 31 Januari Cash Balance Per Bank Statement $ 3,660.20meifangNo ratings yet

- Accounting Quation Quiz ClaymountDocument1 pageAccounting Quation Quiz Claymountv1v1subrotoNo ratings yet

- Accounting Quation Quiz ViladenoDocument1 pageAccounting Quation Quiz Viladenov1v1subrotoNo ratings yet

- PPE SolutionDocument6 pagesPPE SolutionHuỳnh Thị Thu BaNo ratings yet

- Statement of Profit and LossDocument1 pageStatement of Profit and Lossmatthew amadeusNo ratings yet

- Accounting Quation Quiz OxtangDocument1 pageAccounting Quation Quiz Oxtangv1v1subrotoNo ratings yet

- Chapter-01 Introduction Accounting Principles SDocument10 pagesChapter-01 Introduction Accounting Principles SShifatNo ratings yet

- Kelompok 1 (Intan)Document14 pagesKelompok 1 (Intan)Amanda VeronikaNo ratings yet

- January February March Beginning Cash BalanceDocument6 pagesJanuary February March Beginning Cash BalanceALBERTO MARIO CHAMORRO PACHECONo ratings yet

- 3Document4 pages3Wasita 10No ratings yet

- MockDocument6 pagesMockWEI QUAN LEENo ratings yet

- CFAB - Accounting - QB - Chapter 13Document14 pagesCFAB - Accounting - QB - Chapter 13Huy NguyenNo ratings yet

- Modern Advanced Accounting - Assignment 3Document12 pagesModern Advanced Accounting - Assignment 3Anita Kharod ChaudharyNo ratings yet

- Accounting Quation Quiz OseanoDocument1 pageAccounting Quation Quiz Oseanov1v1subrotoNo ratings yet

- WORKINGSDocument2 pagesWORKINGSDuong ThaiNo ratings yet

- Tugas Hutang Jangka Panjang - Nur Vina 2011070599Document3 pagesTugas Hutang Jangka Panjang - Nur Vina 2011070599muhammad fadillahNo ratings yet

- T Fraser, Motif and Meath Cash Flow QuestionsDocument5 pagesT Fraser, Motif and Meath Cash Flow Questionschalah DeriNo ratings yet

- 1-1hkg 2002 Dec ADocument8 pages1-1hkg 2002 Dec AWing Yan KatieNo ratings yet

- Tugas Kelompok 11 November - Cicilia Cindy (20-026) - Siska Muliatri (20-066)Document22 pagesTugas Kelompok 11 November - Cicilia Cindy (20-026) - Siska Muliatri (20-066)Cicilia Cindy100% (1)

- f6 ANSDocument14 pagesf6 ANSSarad KharelNo ratings yet

- Financial Accounting IFRS Student Mark Plan June 2019Document16 pagesFinancial Accounting IFRS Student Mark Plan June 2019scottNo ratings yet

- Coactg1-Chapter 4 Graded Prob3Document5 pagesCoactg1-Chapter 4 Graded Prob3AGATHA REINNo ratings yet

- Accounting Quation Quiz JiwendaDocument1 pageAccounting Quation Quiz Jiwendav1v1subrotoNo ratings yet

- Accounting Quation Quiz GregoryDocument1 pageAccounting Quation Quiz Gregoryv1v1subrotoNo ratings yet

- Madaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Document17 pagesMadaraka Ltd. Statement of Comprehensive Income For The Year Ended 31 March 2020 KES'000' KES'000'Maryjoy KilonzoNo ratings yet

- Exercise 21Document3 pagesExercise 21Ruth UtamiNo ratings yet

- Kelompok: Achmad Bahari Ilmi (041711333127) Yohanes Bosko Arya Bima (041711333195)Document3 pagesKelompok: Achmad Bahari Ilmi (041711333127) Yohanes Bosko Arya Bima (041711333195)ulil alfarisyNo ratings yet

- Yohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.4Document3 pagesYohanes Bosko Arya B - 041711333195 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- AI Amended Online Tutorial 4 Slides - Block 3Document26 pagesAI Amended Online Tutorial 4 Slides - Block 3Allan GhmNo ratings yet

- Hanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4Document3 pagesHanny Rofiun Nafi' - 041711333288 - AKM E23.11, P23.4ulil alfarisyNo ratings yet

- Accounting Quation Quiz PoxtarDocument1 pageAccounting Quation Quiz Poxtarv1v1subrotoNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chapter 5 NotesDocument8 pagesChapter 5 NotesAntonio Mark AnthonyNo ratings yet

- Case 9 Amanda Tremblay at Citrine Software SolutionsDocument4 pagesCase 9 Amanda Tremblay at Citrine Software SolutionsTangirala AshwiniNo ratings yet

- PPP & IrpDocument14 pagesPPP & IrpManish PatelNo ratings yet

- Shareholders Agreement TemplateDocument14 pagesShareholders Agreement TemplateBernard Chung Wei Leong84% (25)

- Business Level Strategy SAMSUNGDocument5 pagesBusiness Level Strategy SAMSUNGGrosaru FlorinNo ratings yet

- Chap-1 - TariffDocument40 pagesChap-1 - TariffRita Mitra100% (1)

- Unit 8 Research Project AsignmentDocument4 pagesUnit 8 Research Project AsignmentPaul OlenicNo ratings yet

- Chapter 9 External Economic Influences On Business Behaviour - STUDENTDocument53 pagesChapter 9 External Economic Influences On Business Behaviour - STUDENTradhikaiyerNo ratings yet

- BLDG3012 - Week 4 PDFDocument27 pagesBLDG3012 - Week 4 PDFQingyang PanNo ratings yet

- June 2017Document599 pagesJune 2017Asif sheikhNo ratings yet

- Sale of Goods NotesDocument4 pagesSale of Goods NotesCha Eun Woo0% (1)

- RICO KP-603 Food FactoryDocument1 pageRICO KP-603 Food FactoryUjjal Kumar BhattacharyaNo ratings yet

- ConceptualizingDocument8 pagesConceptualizingHyacinth'Faith Espesor IIINo ratings yet

- Labour CostsDocument17 pagesLabour Costszeebee17100% (1)

- Which of The Following Contains An Item That Is Not An Output of The Plan Procurement Management Process?Document98 pagesWhich of The Following Contains An Item That Is Not An Output of The Plan Procurement Management Process?Itc HcmNo ratings yet

- Mckinsey-Full Article 25 PDFDocument7 pagesMckinsey-Full Article 25 PDFjcmunevar1484No ratings yet

- Progress Report 5Document2 pagesProgress Report 5Angelica AnneNo ratings yet

- Reasons For Google's MonopolyDocument2 pagesReasons For Google's MonopolyArbaz ShahNo ratings yet

- Annex L: Rev. 00 S. 2023Document4 pagesAnnex L: Rev. 00 S. 2023marygrace hamblosaNo ratings yet

- 03b-PPRA Public Procurement Rules 2004Document22 pages03b-PPRA Public Procurement Rules 2004Misama NedianNo ratings yet

- MIS - 3 E - CommerceDocument14 pagesMIS - 3 E - CommerceRichard PholoshieNo ratings yet

- Management Advisory Services: BudgetedDocument26 pagesManagement Advisory Services: Budgetedi hate youtubersNo ratings yet

- Final AccountsDocument4 pagesFinal AccountsMayuri More-KadamNo ratings yet

- Introduction To Presentation of Final AccountsDocument36 pagesIntroduction To Presentation of Final AccountsSoumya GhoshNo ratings yet

- Sanction Saurhav PDFDocument7 pagesSanction Saurhav PDFDigambar mhaskar officialsNo ratings yet

- RMDocument40 pagesRMIrish Pauline L. EreñoNo ratings yet

- Industry Structure AnalysisDocument71 pagesIndustry Structure AnalysisSanat Kumar100% (2)

- Management of Nominated Subcontractors in The Construction of Commercial Buildings in Sri LankaDocument20 pagesManagement of Nominated Subcontractors in The Construction of Commercial Buildings in Sri LankaCrazyBookWormNo ratings yet

- Financial Accounting Syllabus KNEC DiplomaDocument4 pagesFinancial Accounting Syllabus KNEC DiplomaEsther SaisiNo ratings yet

- Electronic Invoice Data DictionaryDocument119 pagesElectronic Invoice Data Dictionarysahira TejadaNo ratings yet