Professional Documents

Culture Documents

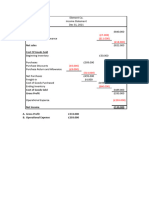

WORKINGS

WORKINGS

Uploaded by

Duong ThaiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WORKINGS

WORKINGS

Uploaded by

Duong ThaiCopyright:

Available Formats

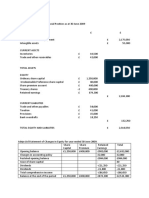

1.

WORKINGS

a. Calculation of purchases

PURCHASES TOTAL ACCOUNT

£ £

Cash paid for purchases 81,400 Opening balance 12,100

Closing balance 14,200 Purchases 83,500

95,600 95,600

b. Calculation of sales revenue

Sales prices are fixed by doubling cost – Sales revenue is therefore cost

of sales £ 101,200 × 2 = £202,400

c. Fixed assets and depreciation

Cost Accumulated

Depreciation

£ £

As at 1 February 20X0 14,800 6,900

Less: items sold (800) (600)

14,000 6,300

Addition 1,800

15,800

Depreciation for year

£ 14,000 at 10% 1,400

£ 1, 8000 at 10% for 6 months 90

As at 31 January 2001 15,800 7,790

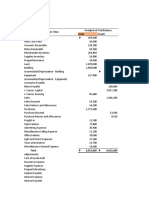

d. Calculation of cash received from sales revenue

SALES TOTAL ACCOUNT

£ £

Opening balance 14,400 cash for sales 201,100

Sales 202,400 closing balance 15,700

216,800 216,800

e. Calculation of drawing

CASH SUMMARY

£ £

Opening balance 800 cash banked 131,600

Cash from customers 201,100 drawings 69,400

Closing balance 900

201,900 201,900

You might also like

- Rahma Yeni Rosada - F0120105 - EPDocument6 pagesRahma Yeni Rosada - F0120105 - EPRahma RosadaNo ratings yet

- Cash FlowDocument6 pagesCash Flowsilvia indahsariNo ratings yet

- Session 4 - Mohali Gifts ShopDocument12 pagesSession 4 - Mohali Gifts ShopArpita DalviNo ratings yet

- FaldoDocument10 pagesFaldodinda ardiyaniNo ratings yet

- Chap14 The Calculation & Interpretation of Accounting RatiosDocument6 pagesChap14 The Calculation & Interpretation of Accounting RatiosSaiful AliNo ratings yet

- CHAPTER-7 Merchandising AnswerDocument24 pagesCHAPTER-7 Merchandising AnswersaphirejunelNo ratings yet

- The Hospitality Business ToolkitDocument18 pagesThe Hospitality Business ToolkitOanaa Coman100% (1)

- UTS Pengantar AkuntansiDocument7 pagesUTS Pengantar AkuntansiYudi HariyonoNo ratings yet

- Chapter 14 Club Accounts: Adjustments A1 Opening Depreciation On Fixed AssetsDocument5 pagesChapter 14 Club Accounts: Adjustments A1 Opening Depreciation On Fixed AssetsStephenNo ratings yet

- (IFA 8) - Rendy Filiang - 1402210324Document15 pages(IFA 8) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- AccountingDocument13 pagesAccountingbeshahashenafe20No ratings yet

- M SamiDocument5 pagesM SamiMah rukh M.yaqoobNo ratings yet

- MAPEL104 Lesson 7 - Final Accounts and Financial Statements - 10062021Document59 pagesMAPEL104 Lesson 7 - Final Accounts and Financial Statements - 10062021Maria Jeannie CurayNo ratings yet

- Requirement 2 Group 9 48K06.1 124Document24 pagesRequirement 2 Group 9 48K06.1 124nnhuquynh538No ratings yet

- Correct Amount of Inventory 677,500Document8 pagesCorrect Amount of Inventory 677,500Maria Kathreena Andrea AdevaNo ratings yet

- Assignment - Financial Accounting I - Quiz - 2440038830 - I Gusti Ayu Tresza DharmayaniDocument5 pagesAssignment - Financial Accounting I - Quiz - 2440038830 - I Gusti Ayu Tresza DharmayaniRicky ChenNo ratings yet

- Trial BalanceDocument4 pagesTrial BalanceRonnie Lloyd JavierNo ratings yet

- 3Document4 pages3Wasita 10No ratings yet

- Financial Accounting - Tugas 2 - 28 Agustus 2019Document3 pagesFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNo ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- FA2 Inventories - QDocument8 pagesFA2 Inventories - Qmiss ainaNo ratings yet

- SECTION 3 (80 Marks) : Page 8 of 8Document1 pageSECTION 3 (80 Marks) : Page 8 of 8Muhammad Salim Ullah KhanNo ratings yet

- Kunci Kuis AKL 2Document9 pagesKunci Kuis AKL 2Ilham Dwi NoviantoNo ratings yet

- Audit of Financial Statements Part 2Document2 pagesAudit of Financial Statements Part 2Brit NeyNo ratings yet

- Sesi 11 & 12 SharedDocument28 pagesSesi 11 & 12 SharedDian Permata SariNo ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- Chapter 7 ExtraDocument8 pagesChapter 7 ExtraMai Lâm LêNo ratings yet

- Principles of Accounting ExerciseDocument4 pagesPrinciples of Accounting ExerciseAin FatihahNo ratings yet

- Acctg 205A Midterm Examinations Problem 1Document1 pageAcctg 205A Midterm Examinations Problem 1YameteKudasaiNo ratings yet

- 2023 11 13 08 00 22 A021231048 William Mangumban A021231048 Tugas AkuntansiDocument1 page2023 11 13 08 00 22 A021231048 William Mangumban A021231048 Tugas AkuntansiWilliam MangumbanNo ratings yet

- Pertemuan - 5Document12 pagesPertemuan - 5Frida SalsabilaNo ratings yet

- Workshop Lecture 4 AsDocument8 pagesWorkshop Lecture 4 AsabhirejanilNo ratings yet

- SOLUTION MANUAL Akm 1 PDFDocument4 pagesSOLUTION MANUAL Akm 1 PDFRizka khairunnisaNo ratings yet

- Tugas Kelompok 11 November - Cicilia Cindy (20-026) - Siska Muliatri (20-066)Document22 pagesTugas Kelompok 11 November - Cicilia Cindy (20-026) - Siska Muliatri (20-066)Cicilia Cindy100% (1)

- 2016 Vol 3 CH 6 AnsDocument6 pages2016 Vol 3 CH 6 Ansjohn lloyd JoseNo ratings yet

- KIESODocument21 pagesKIESOMuhammad Faris100% (2)

- The Hospitality Business ToolkitDocument17 pagesThe Hospitality Business ToolkitOanaa ComanNo ratings yet

- Tugas Prof EttyDocument3 pagesTugas Prof EttywindyNo ratings yet

- Practice Multiple Choice Akuntansi PengantarDocument11 pagesPractice Multiple Choice Akuntansi Pengantarfirdauscollege.faNo ratings yet

- 2Document1 page2Wasita 10No ratings yet

- Profit & Loss (Accrual)Document1 pageProfit & Loss (Accrual)ToyStoryNo ratings yet

- Triple - M-Trading - SARAYDocument10 pagesTriple - M-Trading - SARAYLaiza Cristella SarayNo ratings yet

- Tugas REVENUE FatriisaDocument5 pagesTugas REVENUE FatriisaFatrisia RahmyNo ratings yet

- Book 1Document4 pagesBook 1nguyennvpgbd191181No ratings yet

- Management and Cost Accounting 44Document4 pagesManagement and Cost Accounting 44Themba Patrick MolefeNo ratings yet

- ACC 102 - QuizDocument11 pagesACC 102 - QuizSarah Mae EscutonNo ratings yet

- Love Mug Question PRE WORKSHOPDocument4 pagesLove Mug Question PRE WORKSHOPMd Abdullah Al SiamNo ratings yet

- Lecture 2 Independent Study Exercises - Suggested SolutionsDocument5 pagesLecture 2 Independent Study Exercises - Suggested SolutionsSam TaylorNo ratings yet

- Soal 1Document1 pageSoal 1j8zpmzcnjxNo ratings yet

- Laurente Cleaning Services LedgerDocument3 pagesLaurente Cleaning Services LedgerAriel Palay100% (1)

- Laurente Cleaning Services LedgerDocument3 pagesLaurente Cleaning Services LedgerAriel PalayNo ratings yet

- ForumDocument5 pagesForumMariana Hb0% (1)

- Putri Amalia Fillah - AKL II - Assignment 4Document3 pagesPutri Amalia Fillah - AKL II - Assignment 4Amalia FillahNo ratings yet

- Day 2 Assignment (HW CHP 3-2) - M Farhan I (29120616) YP64CDocument3 pagesDay 2 Assignment (HW CHP 3-2) - M Farhan I (29120616) YP64Cfarhan izharuddinNo ratings yet

- Acct HW3Document11 pagesAcct HW3Natalie ChoiNo ratings yet

- Ujian 1 AdvDocument33 pagesUjian 1 AdvaraNo ratings yet

- Rigel. T. F. Rotinsulu - C3 - Tugas AKM2Document3 pagesRigel. T. F. Rotinsulu - C3 - Tugas AKM2Rigel RotinsuluNo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet