Professional Documents

Culture Documents

Download-Online-Free 78

Uploaded by

mcemce0 ratings0% found this document useful (0 votes)

11 views1 pageOriginal Title

elliott-wave-principle-frost-anpdf.com_-download-online-free 78

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views1 pageDownload-Online-Free 78

Uploaded by

mcemceCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

1907 panic low to 1962 panic low 55 years

1949 major bottom to 1962 panic low 13 years

1921 recession low to 1942 recession low 21 years

January 1960 top to October 1962 bottom 34 months

Taken in toto, these distances appear to be a bit more than coincidence.

Walter E. White, in his 1968 monograph on the Elliott Wave Principle, concluded that "the next

important low point may be in 1970." As substantiation, he pointed out the following Fibonacci

sequence: 1949 + 21 = 1970; 1957 + 13 = 1970; 1962 + 8 = 1970; 1965 + 5 = 1970. May 1970, of

course, marked the low point of the most vicious slide in thirty years.

The progression of years from the 1928 (possible orthodox) and 1929 (nominal) high of the last

Supercycle produces a remarkable Fibonacci sequence as well:

1929 + 3 = 1932 bear market bottom

1929 + 5 = 1934 correction bottom

1929 + 8 = 1937 bull market top

1929 + 13 = 1942 bear market bottom

1928 + 21 = 1949 bear market bottom

1928 + 34 = 1962 crash bottom

1928 + 55 = 1982 major bottom (1 year off)

A similar series has begun at the 1965 (possible orthodox) and 1966 (nominal) highs of the third Cycle

wave of the current Supercycle:

1965 + 1 = 1966 nominal high

1965 + 2 = 1967 reaction low

1965 + 3 = 1968 blowoff peak for secondaries

1965 + 5 = 1970 crash low

1966 + 8 = 1974 bear market bottom

1966 + 13 = 1979 low for 9.2 and 4.5 year cycles

1966 + 21 = 1987 high, low and crash

In applying Fibonacci time periods to the pattern of the market, Bolton noted that time "permutations

tend to become infinite" and that time "periods will produce tops to bottoms, tops to tops, bottoms to

bottoms or bottoms to tops." Despite this reservation, he successfully indicated within the same book,

which was published in 1960, that 1962 or 1963, based on the Fibonacci sequence, could produce an

important turning point. 1962, as we now know, saw a vicious bear market and the low of Primary

wave [4], which preceded a virtually uninterrupted advance lasting nearly four years.

In addition to this type of time sequence analysis, the time relationship between bull and bear as

discovered by Robert Rhea has proved useful in forecasting. Robert Prechter, in writing for Merrill

Lynch, noted in March 1978 that "April 17 marks the day on which the A-B-C decline would consume

1931 market hours, or .618 times the 3124 market hours in the advance of waves (1), (2) and (3)."

Friday, April 14 marked the upside breakout from the lethargic inverse head and shoulders pattern on

the Dow, and Monday, April 17 was the explosive day of record volume, 63.5 million shares. While this

time projection did not coincide with the low, it did mark the exact day when the psychological

pressure of the preceding bear was lifted from the market.

Benner's Theory

Samuel T. Benner had been an ironworks manufacturer until the post Civil War panic of 1873 ruined

him financially. He turned to wheat farming in Ohio and took up the statistical study of price

movements as a hobby to find, if possible, the answer to the recurring ups and downs in business. In

1875, Benner wrote a book entitled Business Prophecies of the Future Ups and Downs in Prices. The

forecasts contained in his book are based mainly on cycles in pig iron prices and the recurrence of

financial panics over a fairly considerable period of years. Benner's forecasts proved remarkably

accurate for many years, and he established an enviable record for himself as a statistician and

forecaster. Even today, Benner's charts are of interest to students of cycles and are occasionally seen

in print, sometimes without due credit to the originator.

Benner noted that the highs of business tend to follow a repeating 8-9-10 yearly pattern. If we apply

this pattern to high points in the Dow Jones Industrial Average over the past seventy-five years

starting with 1902, we get the following results. These dates are not projections based on Benner's

forecasts from earlier years, but are only an application of the 8-9-10 repeating pattern applied in

retrospect.

Year Interval Market Highs

You might also like

- Download-Online-Free 101Document1 pageDownload-Online-Free 101mcemceNo ratings yet

- Download-Online-Free 98Document1 pageDownload-Online-Free 98mcemceNo ratings yet

- Download-Online-Free 99Document1 pageDownload-Online-Free 99mcemceNo ratings yet

- Download-Online-Free 97Document1 pageDownload-Online-Free 97mcemceNo ratings yet

- Download-Online-Free 100Document1 pageDownload-Online-Free 100mcemceNo ratings yet

- Download-Online-Free 96Document1 pageDownload-Online-Free 96mcemceNo ratings yet

- Download-Online-Free 94Document1 pageDownload-Online-Free 94mcemceNo ratings yet

- Download-Online-Free 89Document1 pageDownload-Online-Free 89mcemceNo ratings yet

- Download-Online-Free 95Document1 pageDownload-Online-Free 95mcemceNo ratings yet

- Download-Online-Free 92Document1 pageDownload-Online-Free 92mcemceNo ratings yet

- Download-Online-Free 91Document1 pageDownload-Online-Free 91mcemceNo ratings yet

- Download-Online-Free 90Document1 pageDownload-Online-Free 90mcemceNo ratings yet

- Download-Online-Free 93Document1 pageDownload-Online-Free 93mcemceNo ratings yet

- Download-Online-Free 86Document1 pageDownload-Online-Free 86mcemceNo ratings yet

- Download-Online-Free 87Document1 pageDownload-Online-Free 87mcemceNo ratings yet

- Download-Online-Free 79Document1 pageDownload-Online-Free 79mcemceNo ratings yet

- Download-Online-Free 83Document1 pageDownload-Online-Free 83mcemceNo ratings yet

- Download-Online-Free 85Document1 pageDownload-Online-Free 85mcemceNo ratings yet

- Download-Online-Free 84Document1 pageDownload-Online-Free 84mcemceNo ratings yet

- Download-Online-Free 82Document1 pageDownload-Online-Free 82mcemceNo ratings yet

- Download-Online-Free 81Document1 pageDownload-Online-Free 81mcemceNo ratings yet

- Download-Online-Free 80Document1 pageDownload-Online-Free 80mcemceNo ratings yet

- Download-Online-Free 74Document1 pageDownload-Online-Free 74mcemceNo ratings yet

- Download-Online-Free 76Document1 pageDownload-Online-Free 76mcemceNo ratings yet

- Download-Online-Free 77Document1 pageDownload-Online-Free 77mcemceNo ratings yet

- Download-Online-Free 75Document1 pageDownload-Online-Free 75mcemceNo ratings yet

- Download-Online-Free 73Document1 pageDownload-Online-Free 73mcemceNo ratings yet

- Download-Online-Free 71Document1 pageDownload-Online-Free 71mcemceNo ratings yet

- Download-Online-Free 72Document1 pageDownload-Online-Free 72mcemceNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Cost of Production and Organization of IndustryDocument3 pagesCost of Production and Organization of IndustryAnonymous SecretNo ratings yet

- BinlistDocument39 pagesBinlistPicou LanineNo ratings yet

- ADMS 3351 FormulasDocument13 pagesADMS 3351 Formulasenlong suNo ratings yet

- Test Bank For Busn 11th Edition Marcella Kelly Chuck WilliamsDocument30 pagesTest Bank For Busn 11th Edition Marcella Kelly Chuck WilliamsJoseph Ellison100% (33)

- RichQUACK WhitepaperDocument13 pagesRichQUACK Whitepaperradesh.reddyNo ratings yet

- Tubes - Analisa Laporan Keuangan - M Revivo Andrea Vadsya - 1202194122 - Si4307Document8 pagesTubes - Analisa Laporan Keuangan - M Revivo Andrea Vadsya - 1202194122 - Si4307M REVIVO ANDREA VADSYANo ratings yet

- Class 10 BankingDocument3 pagesClass 10 BankingPATASHIMUL GRAM PACHAYATNo ratings yet

- Chapter 9 - Crafting The Brand PositioningDocument39 pagesChapter 9 - Crafting The Brand PositioningArman67% (3)

- Science Q1 W1 EditedDocument15 pagesScience Q1 W1 Editedkatherine EspirituNo ratings yet

- Jawaban 3.7: Diagram Konteks Sistem Penerimaan Uang Tunai Di S & SDocument3 pagesJawaban 3.7: Diagram Konteks Sistem Penerimaan Uang Tunai Di S & Syoungk jaehyungNo ratings yet

- RDL Masterclass Version 2Document35 pagesRDL Masterclass Version 2Vic Speaks100% (1)

- TVL - ACCTG 2 - G12 - Q1 WORKSHEET WK1 7pagesDocument6 pagesTVL - ACCTG 2 - G12 - Q1 WORKSHEET WK1 7pagesEunise OprinNo ratings yet

- Chapter 2 - Ideas and Theories of Economic Development, Part 2Document20 pagesChapter 2 - Ideas and Theories of Economic Development, Part 2Rio RamilNo ratings yet

- Pertemuan 4 - SCM - SDL - Genap - 19 - 20 - Lec6,7Document29 pagesPertemuan 4 - SCM - SDL - Genap - 19 - 20 - Lec6,7DivaNo ratings yet

- SWOT Analysis of Robotic Vacuum CleanerDocument7 pagesSWOT Analysis of Robotic Vacuum Cleanerhilalcrypto67No ratings yet

- Practice Problem Set 2 SolutionsDocument4 pagesPractice Problem Set 2 SolutionsHemabhimanyu MaddineniNo ratings yet

- TermontDocument21 pagesTermontSumi ChandraNo ratings yet

- Enclosure 3512BDocument6 pagesEnclosure 3512BaguswNo ratings yet

- ACCT2522 Past Year In-Class Test ExampleDocument13 pagesACCT2522 Past Year In-Class Test Examplea7698998No ratings yet

- Product Catalogue 2022: Luxury Vinyl TilesDocument53 pagesProduct Catalogue 2022: Luxury Vinyl TilesIlina AncaNo ratings yet

- Haircare Import ExcelDocument7 pagesHaircare Import Excelmark john CammaraoNo ratings yet

- Hotel Swagath GrandDocument1 pageHotel Swagath GrandYuvarajNo ratings yet

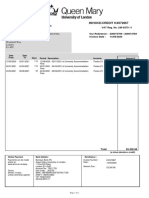

- KX072867 Invoice/Credit: Miss Margarita Pantelidou (200073769) Pooley 21I Pooley House Westfield Way London E1 4PUDocument1 pageKX072867 Invoice/Credit: Miss Margarita Pantelidou (200073769) Pooley 21I Pooley House Westfield Way London E1 4PUMarita PantelNo ratings yet

- Full Download Ebook PDF Macroeconomics Fifth Edition 5th Edition by Charles I Jones PDFDocument41 pagesFull Download Ebook PDF Macroeconomics Fifth Edition 5th Edition by Charles I Jones PDFcarol.martinez79491% (35)

- Daily Market Report On 10 May 2021Document10 pagesDaily Market Report On 10 May 2021Chiranjaya HulangamuwaNo ratings yet

- Foldable - Pit - Ladder - RPLDocument10 pagesFoldable - Pit - Ladder - RPLKYALO PAULNo ratings yet

- Quantitative Demand AnalysisDocument34 pagesQuantitative Demand AnalysisNhi BuiNo ratings yet

- DWK DURAN Flyer Youtility EN LOWDocument2 pagesDWK DURAN Flyer Youtility EN LOWsudhirbhuvadNo ratings yet

- HMFBNP Public Presentation of Approved 2022 FGN Budget FinalDocument69 pagesHMFBNP Public Presentation of Approved 2022 FGN Budget Finalmayowa89No ratings yet

- Eta Halfen Hbs 05-11-21 enDocument26 pagesEta Halfen Hbs 05-11-21 enAhmad MalekianNo ratings yet