Professional Documents

Culture Documents

Indian Income Tax Return Acknowledgement 2021-22: Assessment Year

Indian Income Tax Return Acknowledgement 2021-22: Assessment Year

Uploaded by

GURJEET SINGHOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Income Tax Return Acknowledgement 2021-22: Assessment Year

Indian Income Tax Return Acknowledgement 2021-22: Assessment Year

Uploaded by

GURJEET SINGHCopyright:

Available Formats

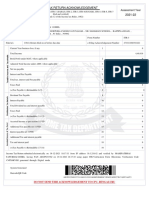

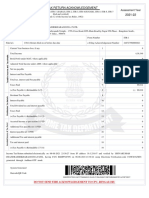

INDIAN INCOME TAX RETURN ACKNOWLEDGEMENT

[Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3, ITR-4(SUGAM), ITR-5, ITR-6, ITR-7

Assessment Year

filed and verified] 2021-22

(Please see Rule 12 of the Income-tax Rules, 1962)

PAN EKYPK0401B

Name KULWINDER KAUR

Address VILLAGE CHANDPUR , P.O. LOUDI MAJRA , RUPNAGAR , RUPNAGAR , 26-Punjab , 91-India , 140113

Status Individual Form Number ITR-4

Filed u/s 139(4) Belated- Return filed after due date e-Filing Acknowledgement Number 495388430300322

Current Year business loss, if any 1 0

Total Income 4,95,360

Book Profit under MAT, where applicable 2 0

Adjusted Total Income under AMT, where applicable 3 0

Net tax payable 4 0

Interest and Fee Payable 5 1,000

Total tax, interest and Fee payable 6 1,000

Taxes Paid 7 1,000

(+)Tax Payable /(-)Refundable (6-7) 8 0

Dividend Tax Payable 9 0

Interest Payable 10 0

Total Dividend tax and interest payable 11 0

Taxes Paid 12 0

(+)Tax Payable /(-)Refundable (11-12) 13 0

Accreted Income as per section 115TD 14 0

Additional Tax payable u/s 115TD 15 0

Interest payable u/s 115TE 16 0

Additional Tax and interest payable 17 0

Tax and interest paid 18 0

(+)Tax Payable /(-)Refundable (17-18) 19 0

Income Tax Return submitted electronically on 30-03-2022 16:07:54 from IP address 10.1.82.90 and verified by KULWINDER KAUR having

PAN EKYPK0401B on 05-04-2022 10:24:36 using Electronic Verification code XVY748QK2I generated through Aadhaar OTP mode

System Generated

Barcode/QR Code

EKYPK0401B04495388430300322ACCDD611D4DCB96958CD48299C1AC5991E5C8C2D

DO NOT SEND THIS ACKNOWLEDGEMENT TO CPC, BENGALURU

You might also like

- Partnership Operation Exercises With Answers and SolutionsDocument6 pagesPartnership Operation Exercises With Answers and SolutionsKristel Joyce Laureño75% (16)

- Sending Money With World RemitDocument9 pagesSending Money With World RemitBabatunde toheebNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAryan KulhariNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAditya Adi SinghNo ratings yet

- IRS TaxDocument28 pagesIRS TaxAntonio MolinaNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Handbook of Tax Simplification - Web VersionDocument258 pagesHandbook of Tax Simplification - Web VersionasoygantengNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearBrajesh kumar sharmaNo ratings yet

- Ashok S R 2021-22 AckDocument1 pageAshok S R 2021-22 AckSHIFAZ SULAIMANNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearAmiya Ranjan PaniNo ratings yet

- Multiple-Choice-Questions FinalDocument3 pagesMultiple-Choice-Questions FinalFreann Sharisse AustriaNo ratings yet

- ArmafDocument1 pageArmafRafa Peña VillarrealNo ratings yet

- Inv 12360Document1 pageInv 12360Saket DhamiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSUDHEESH KUMARNo ratings yet

- PDF 990850220061221Document1 pagePDF 990850220061221Olympia FitnessNo ratings yet

- Prepare Journal Entries 2Document1 pagePrepare Journal Entries 2Rie CabigonNo ratings yet

- 2122 ItrDocument1 page2122 ItrAjay PratapNo ratings yet

- PDF 441907670270322Document1 pagePDF 441907670270322shryeasNo ratings yet

- Hetzner 2021-02-04 R0012764148Document1 pageHetzner 2021-02-04 R0012764148Ольга СувороваNo ratings yet

- Tarun Naib 21-22Document1 pageTarun Naib 21-22Shaheen SobtiNo ratings yet

- PDF 416493940240322Document1 pagePDF 416493940240322HarshVardhan Singh RathorNo ratings yet

- PDF 317138280100322Document1 pagePDF 317138280100322anjana19780316No ratings yet

- Krina Ashokkumar PatelDocument1 pageKrina Ashokkumar PatelFMG PATELNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearsafiNo ratings yet

- Kanuji Jivaji ThakorDocument1 pageKanuji Jivaji ThakorFMG PATELNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearIshan DhodyNo ratings yet

- PDF 240303030171221Document1 pagePDF 240303030171221Hasan KhanNo ratings yet

- Itr Ay 2021-22Document1 pageItr Ay 2021-22Ubfinancial ServicesNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearneerajNo ratings yet

- PDF 492974040281221Document1 pagePDF 492974040281221Sumit MurumkarNo ratings yet

- PDF 330427890221221Document1 pagePDF 330427890221221Asfa rehmanNo ratings yet

- J Itr 2021-22Document1 pageJ Itr 2021-22prabhjeet singh antalNo ratings yet

- PDF 196540320141221Document1 pagePDF 196540320141221ANIKET ROYNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSuresh PrasadNo ratings yet

- Saral - 2021 - 22Document1 pageSaral - 2021 - 22Basker BillaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSwapna BahaddurNo ratings yet

- Itr - 21-22Document1 pageItr - 21-22Ruloans VaishaliNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: PDF Created With Pdffactory Trial VersionDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: PDF Created With Pdffactory Trial VersionRenu KhetanNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNirav TailorNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSanket DeolNo ratings yet

- PDF 763168470311221Document1 pagePDF 763168470311221jasjeetNo ratings yet

- PDF 135304110091221Document1 pagePDF 135304110091221soutan chakrabortyNo ratings yet

- PDF 590366920301221Document1 pagePDF 590366920301221Kishan UnadkatNo ratings yet

- PDF 678141790131021Document1 pagePDF 678141790131021bodana vijayNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearninja gamerNo ratings yet

- PDF 440143000261221Document1 pagePDF 440143000261221Atinderpal SinghNo ratings yet

- Itr Ack Ay 21-22Document1 pageItr Ack Ay 21-22Paswan LokeshNo ratings yet

- PDF 507970650300322Document1 pagePDF 507970650300322Kishan UnadkatNo ratings yet

- PDF 791391180061121Document1 pagePDF 791391180061121VeriNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearImtiaz SkNo ratings yet

- PDF 113926490081221Document1 pagePDF 113926490081221Saravana SaruNo ratings yet

- Itrv Sarath 21-22Document1 pageItrv Sarath 21-22bindu mathaiNo ratings yet

- LJ 21-22Document1 pageLJ 21-22sunil jadhavNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNarayan KumbharNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearJeeva BharathiNo ratings yet

- AcknowledgmentDocument1 pageAcknowledgmentKanchan AgrawalNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearNayab Rasool SKNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearRia SinghalNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearshivu patilNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSai SanthoshNo ratings yet

- RJ 21-22Document1 pageRJ 21-22sunil jadhavNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearMeharchand ChoudharyNo ratings yet

- SAHIL SAMIM KHAN - 29-Dec-2021 - 572667530Document1 pageSAHIL SAMIM KHAN - 29-Dec-2021 - 572667530Anil kadamNo ratings yet

- ITR EverifiedDocument1 pageITR EverifiedDay by day fit fitnessNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSumal kumarNo ratings yet

- PDF 812625500111121 PDFDocument1 pagePDF 812625500111121 PDFPranav NegiNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment Yearjagroshansingh97855No ratings yet

- PDF 411173710251221Document1 pagePDF 411173710251221Raghav SharmaNo ratings yet

- Axis-1-4-21 To 31-8-21Document2 pagesAxis-1-4-21 To 31-8-21Sachin MishraNo ratings yet

- Module 1.2 - Partnership Operation PDFDocument3 pagesModule 1.2 - Partnership Operation PDFMila MercadoNo ratings yet

- Blackbook Project On Modernization in Banking System in India - 163418955Document81 pagesBlackbook Project On Modernization in Banking System in India - 163418955Varun ParekhNo ratings yet

- Paytm ProjectDocument7 pagesPaytm ProjectRashmi MishraNo ratings yet

- Basis of Accounting: Cash Basis Accrual BasisDocument4 pagesBasis of Accounting: Cash Basis Accrual BasisAndraNo ratings yet

- Fabian Bortz Feb 2020 StatementDocument4 pagesFabian Bortz Feb 2020 StatementChamp HillaryNo ratings yet

- Tax Audit - Sec.44abDocument82 pagesTax Audit - Sec.44absathya300No ratings yet

- IAS 7: Statement of Cash Flows NotesDocument4 pagesIAS 7: Statement of Cash Flows NotesNepo SerokaNo ratings yet

- HSBC Amanah Malaysia Berhad ("HSBC Amanah") Universal Terms & ConditionsDocument41 pagesHSBC Amanah Malaysia Berhad ("HSBC Amanah") Universal Terms & ConditionsfaridajirNo ratings yet

- Income Tax Questions and AnswersDocument9 pagesIncome Tax Questions and AnswersHeraldWilsonNo ratings yet

- Fy 20-21Document5 pagesFy 20-21Pranav PandeyNo ratings yet

- Fee Confirmation Details: Atma Ram Sanatan Dharma CollegeDocument1 pageFee Confirmation Details: Atma Ram Sanatan Dharma CollegeAmarjeet SharmaNo ratings yet

- A Quick Guide To Taxation in GhanaDocument55 pagesA Quick Guide To Taxation in GhanaEnoch DaviesNo ratings yet

- Definition of Supply Under GSTDocument8 pagesDefinition of Supply Under GSTRohit Bajpai100% (1)

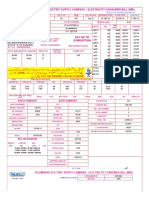

- Pesco Online BillDocument2 pagesPesco Online Billshahjahan_173960965No ratings yet

- NBK Kuwait Bank Tariff EDocument12 pagesNBK Kuwait Bank Tariff Emahesh_mzp1954No ratings yet

- CustomInvoice 2488574255Document1 pageCustomInvoice 2488574255Man Hok WaiNo ratings yet

- Iesco Online Bill PDFDocument2 pagesIesco Online Bill PDFAdnan MunirNo ratings yet

- Taxation QuestionsDocument7 pagesTaxation QuestionsRONILO YSMAELNo ratings yet

- TXROM 2018 Dec QDocument16 pagesTXROM 2018 Dec QKAH MENG KAMNo ratings yet

- Tax Invoice: Page 1 of 2Document2 pagesTax Invoice: Page 1 of 2HamzaNo ratings yet