Professional Documents

Culture Documents

Su 1: Foundations of Internal Auditing

Uploaded by

jayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Su 1: Foundations of Internal Auditing

Uploaded by

jayCopyright:

Available Formats

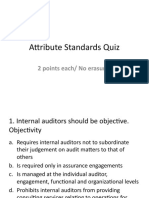

Not participate in any activity or Work with honesty,

Engage only in those services for which we have Be prudent in the use and relationship that may impair or be diligence, and responsibility

the necessary knowledge, skills, and experience protection of information presumed to impair their unbiased

4. Competency acquired in the course of duties assessment OR professional judgment Make disclosures

Perform internal audit services in commitment to acquiring

expected by the law

accordance with Standards and maintaining an Not use information for any Disclose all material facts known to

appropriate level of personal gain or in any manner that, if not disclosed, may distort the Not knowingly be a party to any

Continually improve the proficiency and knowledge and skill that would be contrary to the law reporting of activities under review illegal activity, or engage in acts that

the effectiveness and quality of services are discreditable to the profession

3. Confidentiality 2. Objectivity Respect and contribute to the

1. To enhance and protect organizational

Refusal to use Commitment to providing legitimate and ethical

value by providing risk-based and

organizational information stakeholders with unbiased objectives of the organization

objective assurance, advice, and insight.

for private gain information

2. Facilitating the achievement (A) Mission of 1. Integrity

of this mission is the IPPF Internal Audit Refusal to compromise

professional values for

1. Core Principles: Basis for personal gain

internal audit effectiveness

5. principles

2. Definition of Internal Auditing: Concise

of role of the internal audit activity 1. Mandatory

Guidance 4. Components (2)

3. Code of Ethics SU 1 : FOUNDATIONS OF

(4 elements)

4. Standards: International Standards for the INTERNAL AUDITING 1. Principles that are

Professional Practice of Internal Auditing relevant to the profession &

(B) International practice of internal auditing

1) Attribute Standards (1000s) Professional Practices

Framework (IPPF) 2. Rules of Conduct that

2) Performance Standards (2000s) describe behavior norms

expected of internal auditors

3) Interpretations 2. Strongly

4) Implementation Standards Recommended

Guidance (D) CODES OF

ETHICAL The Code are applied to all

3. Applicability

CONDUCT organizations and persons

(a) Implementation (b) Supplemental who perform internal audit

Guidance (IG) Guidance Final approval of the charter

services, not just CIAs

(C) Internal Audit resides with the boar d.

Charter Violations of rules of ethics

should be reported to The

IIA’s board of directors

1. Purpose of the 3. Responsibility

internal audit activity 1. Reasons

To provide the organization 2. Aspects

with assurance and

consulting services that will 1. To promote an ethical 1. Existence of a code does

add value and improve the culture among professionals not ensure that its principles

Assurance Consulting organization’s operations who serve others are followed or trustworthy

services services

2. Communicating acceptable 2. It is impossible to require

2. Authority values to all members equality of competence by

Definition: Objective examination of evidence Definition: activities intended 3. Establishing objective standards all members of a profession

for the purpose of providing an independent to add value and improve an Internal audit activity should against which individuals can

assessment on governance (Opinion) organization’s governance be empowered to require measure their own performance

auditees to grant access to 3. The code should provide for

Nature and Scope: determined by Nature and Scope: Subject 4. Communicating the disciplinary action for violators

all records, personnel, and

the internal auditor to agreement organization’s values to outsiders

physical properties relevant

Participants: 3 parties (Process Participants: 2 parties to the performance of every

owner, internal auditor, & user) (Internal auditor, & Client) engagement

Summary of CIA Part 1 - Gleim 1 samehacc1@gmail.com

Internal auditors must enhance their

Components: The CAE is responsible for ensuring that the Deming Cycle can be used to knowledge, skills, and other competencies Internal auditors must apply the care and skill expected of a

(a) internal assessments, internal audit activit y conducts: establish the QAIP (4 steps: through continuing professional reasonably prudent and competent internal audit or, through:

(b) external assessments, (a) Internal assessments (ongoing monitoring Plan-Do-Check-Act Cycle) development a. conformance with Code of Ethics, b. systematic and

(c) communication of QAIP results, and periodic self-assessments) disciplined approach included in IA policies & procedures, c.

(d) proper use of a conformance statement, and (b) External assessments (independent applic ation of the IPPF’s Mandatory Guidance

(e) disclosure of nonconformance. assessment every 5 years) CIAs demonstrate their continuing Considerations:

professional development by completing 1. Needs and expectations of clients.

(H) QUALITY continuing professional education (CPE).

The freedom from conditions that threaten the 2. Relative complexity and extent of work needed.

ASSURANCE AND CIAs must complete CPE annually (40

ability of the internal audit activity to carry out 3. Cost of the consulting in relation to benefits

IMPROVEMENT hours for Practicing & 20 hours for

internal audit responsibilities in an unbiased Definition PROGRAM (QAIP) nonpracticing) including at least 2 hours

manner. of ethics training).

(A) INDEPENDENCE (F) DUE PROFESSIONAL CARE

Functional reporting to the board (at

least annual meeting) (G) Continuing Practices will help the CAE to identify the

Achieve Independence through CAE must communicate the result s of Professional available resources:

Administrative reporting to Dual Reporting QAIP to senior management and the Development A. Hiring practices

senior management board.

B. Periodic skills assessments

The internal audit activity conforms with

Internal C. Staff performance apprais als

Unbiased mental attitude that allows internal auditors Standards ONLY if supported by the

Resources D. Continuing professional development

to perform engagements in such a manner that they results of QAIP.

believe in their work product and that no quality Definition

compromises are made. Top of Improvement and innovation

Is any “relationship that is, or

SU 2 : INDEPENDENCE, Framework Internal audit delivery

External

appears to be, not in the best OBJECTIVITY, PROFICIENCY, Resources

Personal Skills Critical thinking

interest of the organization Conflict of (To promote the Persuasion and collaboration

Interest

(B) OBJECTIVITY CARE, AND QUALITY top) Communication

Internal auditors must avoid any Organization may outsource Business acumen

conflict of interest all, or some of the functions Technical

Governance, risk and control

(C) IMPAIRMENT TO (E) INTERNAL of the internal audit activity. Expertise

Objectivity refers to im partial and unbiased INDEPENDENCE AND AUDIT However, oversight of and IPPF

mindset, which is facilitated by avoiding Aspects responsibility for the internal Internal audit management

OBJECTIVITY RESOURCES Foundation/Basis

conflicts of interest audit activity must not be of Framework Professional ethics

If independence or objectivity is impaired in outsourced

Many CAEs have an internal audit policy fact or appearance, the details of the

manual or handbook that may describe: impairment must be disclosed to Competency Framework

appropriate parties (10 core competencies)

(D) PROFICIENCY

a. Critical importance of objectivity Examples of Examples of

independence objectivity

b. Situations that could undermine objectivity

impairments impairments

c. Actions the internal auditor should take if Meaning

1. The CAE has broader functional 1. An internal auditor audits an area in

(s)he becomes aware of a current or potential

responsibility than internal audit which he or she recently worked

objectivity concern

2. The CAE does not have direct communication or 2. An internal auditor audits an area where a Internal auditors must possess

d. Reporting requirements, where each internal interaction with the board relative or close friend is employed the knowledge, skills, and

auditor periodically considers & discloses other competencies needed to

conflicts of interest 3. The budget for the internal audit activity is reduced to 3. An internal auditor assumes, without evidence, that an area

perform Their individual

the point that internal audit cannot fulfill its responsibilities being audited has effectively mitigated risks

responsibilities. Internal audit

When assigning internal auditors to specific as outlined in the charter

4. An internal auditor modifies the planned approach or result s activity is considered

engagements, CAE should avoid assigning team

based on the undue influence of another person proficient if it collectively

members who may have a conflict 4. Scope limitation (restriction placed on a. internal audit possesses or obtains the

charter, b. access to records, personnel, and physical 5. Accept fees, gifts, or entertainment from an employee, client, competencies needed to

CAE needs to be thoughtful in designing the internal audit properties, c. Approved engagement work schedule, or d.

performance evaluation and compensation customer, supplier, or business associate perform its responsibilities

Approved staffing plan and financial budget)

Summary of CIA Part 1 - Gleim 2 samehacc1@gmail.com

1) Establis hing policies and procedures 1) Reaction: Organization denies responsibility Global Reporting Initiative

(GRI): reporting that provides ISO 26000: how

2) Setting objectives & strategies 5. CSR 2) Defense: Organization uses legal action or public specific guidance on to implement

Processes + Structures implemented Business relations efforts to avoid additional responsibilities measuring CSR performance and manage a

3) integrating CSR into business Activities CSR initiative

by board to inform, direct, manage, 3) Accommodation: Organization assumes against predefined criteria

decision-making

and monitor the activities of the additional responsibilities only when pressured

organization toward the achievement 4) Monitoring, evaluating results

4) Proaction: Organization takes the 4. Strategies

of its objectives (influenced by 5) Engaging stakeholders initiative in implementing a CSR program

internal & external mechanisms) 3. Frameworks

6) Auditing (by element & by

stakeholder group.

1) Economic responsibility (foundation)

7) External and internal reporting 2. Responsibilities (4) of 2) Legal responsibility (Mandated)

(A) Definition Scholar Archie B. Carroll to be 3) Ethical responsibility (Expected)

[using a 5-level maturity scale (level 1 6. CSR Maturity called socially responsible 4) Philanthropic responsibility (Desired)

is “initial” and level 5 is “optimizing”) Model

(B) Principles (15) (F) CSR

(c) corporate citizenship

Governance + RM + Control 1. Element (Corporate Social

(GRC) 7. Auditing CSR Responsibility) (b) sustainable development

2. Stakeholder group (2 Approaches)

Is a voluntary practice 1. Refers to (a) social responsibility

(C)

Components

Each person should be an ethics

Chief advocate, whether officially or informally

Strategic Direction Oversight Ethics

SU 3 : Governance Officer

Organizations may designate a chief ethics officer

Internal auditors may have the role of chief ethics

officer, but this may conflict with the independence

1. Board’s responsibilities to

1. Business Model attribute of the internal audit activity

stakeholders

2. Overall Objectives 2. Risk management activities Ethical Culture

3. Approach to risk appetite 3. Internal and external

assurance activities

4. limits of organizational conduct Advice given by internal audit depend on the

maturity of the governance

(E) Practices

(Organizational culture)

Less mature system: IA emphasizes

(D) Roles compliance with policies, & addresses

Reflected in the basic risks to the organization

Board: Responsible for oversight, identify stakeholders and their More mature system: IA emphasis on

expectations, Selection and removal of officers optimizing structure and practices

Management: establishes & maintains the organizational culture, a) Setting values, objectives, and

and Day-to-day governance functions, and determine who will be risk strategies; Ensure the 1) Complies with society’s legal

owners

b) Defining roles and behaviors; Affect organization 2) Satisfies the accepted business norms

Internal Audit: Assesses and makes recommendations to improve

governance processes 3) Provides overall benefit to society

c) Measuring performance;

Risk owners: Evaluating the adequacy of the design of RM activities 4) Reports fully and truthfully to stakeholders

and whether they are operating as designed & Establishing d) Specifying accountability; and

monitoring activities, and reports are accurate The Overall control environment and individual engagement risks and controls.

e) Complying with corporate social * Risk aggressive = im portance of control is Low = engagement risks and controls is High

Risk committee: a. Identifies key risks, b. Connects them to RM

processes, c. Delegates them to risk owners, d. Considers tolerance responsibilities. * Risk averse = im portance of control is High = engagement risks and controls is Low

levels delegated

Summary of CIA Part 1 - Gleim 3 samehacc1@gmail.com

Risk is the possibilit y of an event occurring that will have an impact on the achievement

of objectives.

Risk management is “a process to identify, assess, manage, and control potential

events or situations to provide reasonable assurance regarding the achievement of (A) d) Technology

a) Laws and regulations

the organization’s objectives” Definitions

b) Capital projects e) Market risk

(C) COSO

FRAMEWORK c) Business processes f) Organizations

1. Identification of

(ERM) context

SU 4 : RISK

Culture, capabilities, and practices, integrated with

strategy-setting and performance, that organizations rely MANAGEMENT 2. Risk identification

on to manage risk in creating, preserving, and realizing 1. Definition

value.

At every level of internal & external risk

(B) Processes

factors, considering past events (trends)

2. Concepts and future possibilities.

5. Risk monitoring

1) Culture: attitudes about risk and reflect mission, vision, and core values

2) Capabilities: skills needed to carry out the mission & vis ion RA formal or informal using factors, and

(a) Tracks identified risks the results are used to prioritize risks

3) Practices: collective methods used to manage risk. (b) Evaluates current ris k

4) Integrating strategy setting Risk profile for specific strategy response plans

3. Risk assessment

and performance Qualitative

Portfolio view for entity-wide strategy (c) Monitors residual risks (RA) & Prioritization

5) Managing risk. (d) Identifies new risks Quantitativ e

Risk capacity maxim um risks the organization can assume Methods

Risk modeling

Inherent risk the ris k in the absence of actions or controls

6) Value: a) Created, b) Preserved, c) Realized, d) Eroded

4. Risk response

Controls Actions taken by

management to manage risk

3. Components

Risk that remains after risk

Residual

1. Governance and 4. Review & 5. Information, responses are executed

2. Strategy and 3. Performance risk

Culture revision communic ation, and

objective-setting,

reporting Sharing: reduce risk by

1. Board oversight transferring to another party

1. Analyze 1. Changes affect strategy

1. Identify Risks 1. Leverage the

2. Establishment of business context Strategies Reduction: reduce risk within

2. Severity of risk 2. Review performance Information systems

operating structures the organization (internally)

2. Define risk appetite results and consider risk

3. Prioritize risks 2. Communication

3. Define the channels Retention (acceptance): No action is

3. Evaluate alternative 3. Improvement of ERM

desired culture 4. risk responses taken to alter the severity of the risk

strategies 3. Report on risk, culture &

5. portfolio view of risk performance Avoidance: Action is

4. Commitment to 4. Establish business

taken to remove the risk

core values objectives

5. Attracts, develops, and

retains capable individuals

Summary of CIA Part 1 - Gleim 4 samehacc1@gmail.com

SU 4.2 : COSO Framework - ERM Components

Supporting Aspect Common Process

Information, communication, and

Governance and culture Strategy and objective-setting Performance Review and Revision

reporting

5 Principles 4 Principles 5 Principles 3 Principles

3 Principles

1. Board oversight 1. Leverage its Information systems 1. Analyze business context 1. Identify Risks 1. Changes affect strategy

i) Reviewing and challenging decisions Internal and external environments *Affect the reasonable expectation of achieving i) Internal environment include those due to

Elements of effective data management:

related to strategy, risk appetite, Business context may be: strategy rapid growth, innovation, and turnover of key

i) Data and information governance

and significant business decisions. i) Dynamic. *Identify New, emerging, and changing risks and personnel.

ii) Processes and controls

ii) Approving management compensation. ii) Complex. opportunities ii) changes in external environment include those

iii) Data management architecture

iii) Participating in stakeholder relations. iii) Unpredictable. *The risk inventory consists of all risks in the economy or regulations.

2. Reviews performance results and considers

2. Establish operating structures 2. Communication channels 2. Define risk appetite 2. Severity of risk

risk

i) Organizations should adopt open *Impact & Likelihood with time horizon at Performance results that deviate from target

communication channels multiple levels. performance or tolerance may indicate (1)

i) The legal structure ii) Communication methods include written Expressed qualitatively or *Qualitative and quantitative methods may be unidentified risks, (2) improperly assessed risks,

ii) The management structure documents, electronic messages, public quantitatively used to assess risk. (3) new risks, (4) opportunities to accept more

events or forums, and informal or spoken *Reassess severity whenever triggering events risk, or (5) the need to revise target performance

communications occur. or tolerance.

3. Define the desired culture 3. Report on risk, culture & performance 3. Evaluate alternative strategies 3. Prioritize risks 3. Improvement of ERM

Factors when prioritizing:

i) Agreed-upon criteria. (Complexity, Velocity,

Qualitative and quantitative risk Persistence, Adaptability, and Recovery)

Culture is shaped by internal and external SWOT, Competitor analysis, and continual or separate evaluations and peer

information that supports forward-looking ii) Risk appetite

factors scenario analysis. comparisons

decisions. iii) The importance of the affected business

objective(s)

iv) The organizational level(s) affected

4. Commitment to core values 4. Establishes business objectives 4. Risk responses

(1) specific, (2) measurable, (3)

When risk-aware culture and tone are

observable, and (4) obtainable. Acceptance, Avoidance, Pursuit, Reduction, and

aligned, stakeholders have confidence that

Performance measures, targets, and Sharing

the organization is abiding by its core values.

tolerances

5. Attract, develop, and retain capable

5.Portfolio view of risk

individuals

Four risk views:

i) Risk view (minimal integration)

ii) Risk category view (limited integration)

Contingency plans for succession.

iii) Risk profile view (partial integration) Risk and

performance.

iv) Portfolio view (full integration)

When the components, principles, and supporting controls are present and functioning, ERM is reasonably expected to manage risks effectively and to help create, preserve, and realize value.

1) Present means the components, principles, and controls exist in the design and implementation of ERM to achieve objectives.

2) Functioning means the components, principles, and controls continue to operate to achieve objectives.

Summary of CIA Part 1 - Gleim 5 samehacc1@gmail.com

4.3 ISO 31000 RISK MANAGEMENT FRAMEWORK

1. Principles-Based Approach (11 principles that are the

2. ISO 31000 Risk Management Framework (5 components) 3. The ISO 31000 risk management process (7 elements)

foundation for an effective risk management process)

1) Creates and protects value 1. Mandate and commitment 1) Communication and consultation

2) Is an integral part of organizational processes 2. Design the framework for managing risk. Foundation involves: 2) Establishing the context

3) Is part of decision making a) Understanding the organization and its context 3) Risk identification

4) Explicitly addresses uncertainty b) Establishing a risk management policy 4) Risk analysis (impact and likelihood)

5) Is systematic, structured and timely c) Delegating accountability and authority 5) Risk evaluation (prioritizes the risks)

6) Is based on the best available information d) Integrating risk management into organizational processes 6) Risk treatment (decides risk response)

7) Is tailored to each organization e) Allocating the necessary resources 7) Monitor and review (evaluates whether treatments are effective)

8) Considers human and cultural factors f) Internal & external communication and reporting methods

9) Is transparent and inclusive 3. Implementing risk management

10) Is dynamic, repetitive and responsive to change 4. Monitoring and review of the framework

11) Promotes continuous improvement 5. Continual improvement of the framework

5. Maturity Model (maturity curve) is the capability

4. ISO 31000 – Assurance Approaches (3 approaches) 6. Turnbull Risk Management Framework Emphasis is on:

maturity model (CMM) (5 maturity levels)

1) key principles (a) Initial. Few processes 1. Internal control

2) process element (b) Repeatable. basic processes are established 2. Assessment of its effectiveness

3) maturity model (maturity curve) (c) Defined. Standards are developed 3. Risk analysis

(d) Managed. Performance measures are defined

(e) Optimizing. Continuous improvement is enabled

Principle of this approach is that RM must add value.

RM plan should be linked with a performance measurement system

i) Performance standards

ii) How the standards can be satisfied

iii) Comparing actual performance with each standard

iv) Recording and reporting performance and improvements

v) Periodic independent verification of management’s assessment

Summary of CIA Part 1 - Gleim 6 samehacc1@gmail.com

a. Preventive: deter the c. Corrective: correct the negative

occurrence of unwanted events effects of unwanted events

1. Primary

b. Detective: alert the proper d. Directive: cause or encourage the

Control: Any action taken by management or other parties to manage risk and

people after an unwanted event Controls occurrence of a desirable event

increase the likelihood that established objectives and goals will be achieved

a. Compensatory (mitigative): do not, by

Control processes: Policies, procedures , and activities that are part of a themselves, reduce risk to an acceptable level

control framework, designed and operated to ensure that risks are contained b. Complementary: their synergy is more effective

2. Secondary

within the level that an organization is willing to accept than either control by itself

Controls

Control environment: Attitude and actions of the board and management

a. Batch Processing: Transactions

regarding the importance of control within the organization

accumulated and submitted as a single batch

(A) Definitions 3. Two Basic b. Online, Real-Time Processing: database is

Processing Modes updated immediately upon entry of the transaction

1) Establis hing standards for the operation to be controlled,

(B) Control a. IT General Controls: pertain to all systems

2) Measuring performance against the standards,

Process components, processes, and data in IT environment

3) Examining and analyzing deviations, 4. IT b. Application Controls: pertain to the scope of

individual business processes or application systems

4) Taking corrective action, and

1) Financial totals: summarize monetary amounts

5) Reappraising the standards based on experience. in an information field in a group of records

2) Record counts: track the number of records processed by

Human judgment is faulty 5.Batch Input the system for comparis on to the total produced manually

Controls

Overridden by Management 3) Hash totals: control totals without a defined meaning

(C) Inherent

Can be circumvented by collusion

Limitations 1) Preformatting of data entry screens

Cost must not be greater than benefits SU 5.1 & 5.2:

6. Online Input 2) Field/format checks: test the characters in a field

CONTROLS Controls 3) Validity checks: compare the data entered in a

1. Transaction Trails

given field with a table of valid values for that field

2. Uniform Processing of Transactions

7. Processing 4) Limit (reasonableness) & range checks:

3. Segregation of Functions (E) Types based on known limits for given information

(D) Characteristics of controls

4. Potential for Errors and Fraud 5) Check digits: are an extra reference

Automated Processing Concurrency: manage situations number that follows an identification code

5. Potential for Increased where two or more users attempt

13. People-Based vs. to access or update a file 6) Sequence checks: processing efficiency

Management Supervision

a. People-based controls: System-Based Controls simultaneously is greatly increased when files are sorted on

6. Initiation or Subsequent Execution depend on humans’ intervention some designated field before operations

of Transactions by Computer 7) Zero balance checks: reject any

b. System-based controls: 8. Output ensure that

executed with no human intervention transaction or batch in which sum of all debits

7. Dependence of Controls in Other Areas 11. Time-Based controls processing and credits does not equal zero

on Controls over Computer Processing results are

Classification complete, accurate, and

a. Feedback controls: report properly distributed

12. Financial vs.

information about completed activities monitor data to ensure it

Operating Controls 9. Integrity remains consistent and correct

b. Concurrent controls: adjust ongoing processes controls

a. Financial controls: based on accounting principles

c. Feedforward controls: anticipate and

prevent problems (long-term perspective)

10. Management trail enable management to track transactions

b. Operating controls: based on management

principles (e.g. production and support activities) e.g. policies and procedures (or audit trail) from their source to their output

Summary of CIA Part 1 - Gleim 7 samehacc1@gmail.com

Control 1. Operating

Soft controls should be distinguished from hard controls (I) Soft Principles objectives

(E) The eSAC

Controls (4) (ORCS) 2. Reporting

Control self-assessment (CSA) is an approach to auditing soft controls Model

3. Compliance

1) General top-down and risk- 1) Availability

Internal Control: Guidance for Directors on the Combined Code (J) Turnbull based approach used too in IT Business 4. Safeguarding of assets

Report (U.K.) 2) Capability

2) General IT risks are those assurance

objectives 3) Functionality

Internal control is a process, effected by an entity’s affect critical IT functionality in

board of directors, management, and other 1. Definition financially significant applications 4) Protectability Establishes best practices that

personnel, designed to provide reasonable contribute to the process of

3) General IT risks exist 5) Accountability

assurance regarding the achievement of objectives value creation, and maximizes

relating to operations, reporting, and compliance. 4) IT risks are mitigated by the the realization of business

achievement of IT control value from investment in IT.

(A) COSO objectives, not individual controls

a) Operations: achieving the mission & Objective

Framework 1) Value governance: relationship

safeguarding of assets. between IT and the organization

(U.S.) Guidance for assessing the scope (D) VAL IT

b) Reporting: Financial and nonfinancial of IT general controls using a top- 2) Investment management:

reporting (Internal or external) 2. Objectives down and risk-based approach manages the organization’s portfolio

c) Compliance: Policies and procedures, (ORC) Consists of 3 of IT-enabled business investments

laws, rules, and regulations. (F) Guides to the Domains 3) Portfolio management:

Assessment of IT Risks maximizes quality of business cases

1. Commitment to integrity

and Ethical values (GAIT) The complexity of the modern enterprise for IT-enabled business investments

requires governance and management

2. Board independence & oversight

to be treated as distinct activities. a) Principles, policies,

3. Organizational structures & authorities Control COBIT5 associates governance with the and frameworks

Environment board of directors, and associates the

(5 EBOCA) b) Processes

4. Commitment to Competence activities with executive management

c) Organizational

5. Accountability SU 5.3 structures

3. Components

(5 CRIME)

CONTROL FRAMEWORKS 5. Separating Governance d) Culture, ethics, and

1. Specify objectives from Management behavior

2. Identify & analyze Risks Risk e) Information

assessment (C) COBIT 5 f) Services, infrastructure,

3. Consider potential Fraud (4 S A F R) and applications

5 Principles 4. Enabling a Holistic

4. Identify & Assess changes Approach (7 enablers) g) People, skills, and

(B) CoCo Model competencies

1. Select and develop

(Canada)

Control Activities

Control

2. Control over Technology activities

1. Meeting Stakeholder 2. Covering the Enterprise 3. Applying a Single,

3. Policies & Procedures (3 CA T P) Integrated Framework

Needs End-to-End

Components COBIT 5 provides an

1. Obtain relevant quality info. IT governance must be

(4 PCCML) 1. Value Creation (Stakeholder Needs): i) Realization overall framework for

Information & integrated with enterprise

2. Internally communicates info. communication of benefits ii) Optimization (not minimization) of risk enterprise IT. Its principles

1) Purpose governance. it cannot be

(3 O I E) iii) Optimal use of resources can be applied regardless

3. Communicate with External viewed as a function

parties Commitment distinct from other of the particular hardware

2. Stakeholder drivers: Influence of Internal &

activities. IT must be and software in use.

External factors

3) Capability considered enterprise-

1. Separate and/or Ongoing evaluations 3. Enterprise goals: A response to stakeholder needs wide and end-to-end

4) Monitoring

Monitoring and Learning

2. Communicate control Deficiencies (2 SO D) 4. IT-related goals: To address the enterprise goals

5. Enablers: Anything that helps to achieve objectives

Summary of CIA Part 1 - Gleim 8 samehacc1@gmail.com

Uses:

* Are graphical representations of the step-by-step progression

of information. The system depicted may be manual,

Procedures are methods employed to carry out

computerized, or both of them Definition activities in conformity with prescribed policies

* Is used during the preliminary survey to gain an

understanding of the client’s processes and controls. (H)

Procedures Same principles applicable to policies also are

applicable to procedures. In addition Procedures should:

Horizontal Flowcharts (system flowcharts): depict areas of 1) Be coordinated so that one employee’s work is

Principles automatically checked by another.

responsibility (departments or functions) arranged horizontally. So,

activities, controls, and document flows are shown in the same column. 2) Not be so detailed as to stifle the use of judgment.

3) Be as simple and as inexpensive as possible

(A) FLOWCHARTS 4) Not be overlapping, conflicting, or duplicative

5) Be periodically reviewed and improved as necessary

Vertical Flowcharts (program flowcharts): present successive steps in a

top-to-bottom format. Their principal use is in the depiction of the specific

actions carried out by a computer program.

A policy is any stated principle that requires, guides, or

Data Flow Diagrams: show how data flow to, from, and within an Definition restricts action

information system and the processes that manipulate the data. This can

be used to depict at lower-level details & higher-level processes.

SU 6 : CONTROLS:

(G) Policies

Process Mapping a simple form of flowcharting used to depict a client

APPLICATION 1. Stated in writing in systematically organiz ed handbooks,

process. manuals, or other publications and should be properly approved

Principles 2. Systematically communicated to all officials and appropriate

employees

3. Conformed with applicable laws and regulations

4. Designed to promote the conduct of authorized activities in an

Should reduce the risk of errors and prevent an individual (B) Internal effective, efficient, and economical manner

from perpetrating and concealing fraud 5. Periodically reviewed when circumstances change

Controls

Any transaction should be performed by separate (F) Sawyer’s The employment of all the means devised in an enterprise to promote, direct,

individuals through 3 functions: (C) Segregation of Definition of restrain, govern, and check upon its various activit ies for the purpose of seeing

(a) Authorization, (b) Recordkeeping, (c) Custody that enterprise objectives are met. These means of control include, but are not

Duties Control

limited to, form of organization, policies, systems, procedures, instructions,

standards, committees, charts of accounts, forecasts, budgets, schedules, reports,

records, checklists, methods, devices, and internal audit ing.

1) Sales and recognition of receiv ables

2) Collections from receivables

(E) Imposed Control

3) Purchases and recognition of payables (D) Accounting and Self-Control

Cycles

4) Payment (disbursement)h to trade payables

5) Payment of salaries for employees Imposed control is the traditional, mechanical approach. It Self-control evaluates the entire process of management and

measures performance against standards and then takes the functions performed. Thus, it attempts to improve that

corrective action through the individual responsible for the process instead of simply correcting the specific performance of

function or area being evaluated the manager. Management by objectives is an example.

Summary of CIA Part 1 - Gleim 9 samehacc1@gmail.com

Internal auditors, lawyers,

(1) Policies & procedures and other specialists

1. Internal auditor has already gathered facts and is seeking confirmation 2. Investigators

4. Interrogation of (2) Preserving evidence 3. Controls over

2. Internal auditor should NOT accuse the employee of committing a crime Employees, differs from investigation

interview with (3) Responding to the results Uses accounting and auditing

3. Most evidence should be obtained before Interrogation to obtain a confession

(4) Reporting knowledge and skills in

4. All evidence should subject to chain -of-custody procedures matters having civil or criminal

(5) Communications legal implications.

1. Forensic

Fraud: any illegal act characterized by deceit, concealment, or auditing

violation of trust. These acts are not dependent upon the threat of Procedures: Interviewing,

violence or physical force. Frauds are perpetrated by parties and (K) Fraud investigating, and testing.

organizations to obtain money, property, or services; to avoid payment INVESTIGATION

or loss of services; or to secure personal or business advantage 5. Fraud

Reporting Control is the principal means of managing fraud

Fraud risk: The possibility that fraud will occur and the and ensuring the components of the fraud

potential effects to the organization when it occurs. management program are present and functioning

(A) Definitions CAE is responsible for fraud reporting (oral

or written, interim, or final communications) COSO’s Fraud Risk Management is similar

Pressure or incentive: The need a person to COSO Internal Control Framework

tries to satisfy by committing the fraud Conclusion of the investigation includes:

(e.g., financial difficulties) (a) tim e frames, (b) observations, Preventing fraud: By setting the correct tone at

(c) conclusions, (d) resolution, and (J) Fraud the top and instilling a strong ethical culture.

Opportunity: The ability to commit the fraud (B) (e) corrective action to improve controls. Control

(Lack of controls / segregation of duties) Characteristics Detecting fraud: By employee feedback (whistle-blower

A draft of the proposed final communication hotline, exit interviews & employee surveys)

Rationalization: The ability to justify the fraud should be submitted to legal counsel

1) Company ethics policy

Monetary losses

2) Fraud awareness

Time

(C) Effects SU 7 : FRAUD RISKS AND 3) Fraud risk assessment

Productivity (I) Components Fraud

Reputation

CONTROLS Management Program 4) Ongoing reviews

Customer Relationships 5) Prevention and detection

(D) Types 6) Investigation

1. Asset misappropriation 8. Corruption

(G) Indicators (H) Types of

2. Skimming 9. Bribery of Fraud Fraudulent

3. Payment fraud a. Lapping Processes

10. Conflict of interest

1) Lack of employee rotation in sensit ive positions Receivables

4. Expense reimbursement 11. Diversion

fraud 2) Inappropriate combination of job duties

12. Wrongful use

5. Payroll fraud 3) Unclear lines of responsibility and accountability

13. Related-party fraud

6. Financial statement Meaning: A person (or persons)

14. Tax evasion 4) Unrealistic sales or production goals with access to customer payments

misrepresentation

5) Employee refuses to take vacations or refuses promotion and accounts receivable records

7. Information misrepresentation steals a customer’s payment. The

(E)Low-Level vs. 6) Establis hed controls not applied consistently shortage in that customer’s

Executive Frauds account then is covered by a

7) High reported profits when competitors are

Low-Level: intended to benefit individuals & consists of suffering from an economic downturn subsequent payment from another

theft of property or embezzlement of cash customer. b. Check Kiting

8) High turnover among supervisory positions in

Executive level: intended to benefit the organization & finance and accounting areas

consists of materially misstating financial statements Discover it when (a) a customer

9) Excessive or unjustifiable use of sole-source procurement complains about his or her Kiting exploits the delay

payment not being posted, (b) an between (a) depositing a check

a. Document symptom 10) Increase in sales far out of proportion to the

absence by the perpetrator allows (insufficient funds check) in one

(F) Symptoms increase in cost of goods sold

another employee to discover the bank account and (b) clearing

b. Lifestyle symptom of Fraud

11) Material contract requirements in the actual fraud, or (c) the perpetrator covers the check through the bank on

c. Behavioral symptom contract differ from those in the request for bids the amount stolen. which it was drawn

Summary of CIA Part 1 - Gleim 10 samehacc1@gmail.com

You might also like

- Foundations of Internal Audit (IPPFDocument4 pagesFoundations of Internal Audit (IPPFS4M1Y4No ratings yet

- Auditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlFrom EverandAuditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlNo ratings yet

- Cia Part 1 - Study Unit 1 Mandatory Guidance Core Concepts: Applicable StandardsDocument1 pageCia Part 1 - Study Unit 1 Mandatory Guidance Core Concepts: Applicable StandardsKhurram AbbasiNo ratings yet

- IIA CIA PART1 DemoDocument16 pagesIIA CIA PART1 DemoVinayaNo ratings yet

- Cia Part 3 - Study Unit 10 Leadership and Conflict Management Core ConceptsDocument3 pagesCia Part 3 - Study Unit 10 Leadership and Conflict Management Core ConceptsfloricelfloricelNo ratings yet

- Attribute Standards QuizDocument16 pagesAttribute Standards QuizJao FloresNo ratings yet

- CIA and CRMA 2013 Exam SyllabusDocument13 pagesCIA and CRMA 2013 Exam SyllabusChengChengNo ratings yet

- Final 2021 CRMA Syllabus Risk Management AssuranceDocument2 pagesFinal 2021 CRMA Syllabus Risk Management AssuranceDenNo ratings yet

- AidotDocument18 pagesAidotLong NgoNo ratings yet

- Internal Auditing Role and IndependenceDocument11 pagesInternal Auditing Role and IndependenceMhmd Habbosh100% (2)

- Cia Review: Part 1 Study Unit 3: Control Frameworks and FraudDocument14 pagesCia Review: Part 1 Study Unit 3: Control Frameworks and FraudjorgeNo ratings yet

- Pass4Test: IT Certification Guaranteed, The Easy Way!Document8 pagesPass4Test: IT Certification Guaranteed, The Easy Way!Ruther SumiliNo ratings yet

- CIA P1 SII Independence and ObjectivityDocument47 pagesCIA P1 SII Independence and ObjectivityJayAr Dela Rosa100% (1)

- Part 2 NotesDocument21 pagesPart 2 NotesFazlihaq DurraniNo ratings yet

- Sawyer'S: ExcerptDocument12 pagesSawyer'S: Excerptrakhasurya0% (1)

- CIA Part 1 Unit 2 AxiomDocument1 pageCIA Part 1 Unit 2 Axiomhammi0322No ratings yet

- CIA - Part 1 - Unit 1 - Session 1-2Document32 pagesCIA - Part 1 - Unit 1 - Session 1-2AnjuNo ratings yet

- CIA Exam Syllabus, Part 1Document4 pagesCIA Exam Syllabus, Part 1Aaron VillaflorNo ratings yet

- PROF-Interaction With The Board PG PDFDocument13 pagesPROF-Interaction With The Board PG PDFJundel AbieraNo ratings yet

- CIA P1 Plan A4Document9 pagesCIA P1 Plan A4Vasil TraykovNo ratings yet

- CIA Brochure PDFDocument11 pagesCIA Brochure PDFerram raviNo ratings yet

- The Internal Audit Handbook - The Business Approach to Driving Audit ValueFrom EverandThe Internal Audit Handbook - The Business Approach to Driving Audit ValueNo ratings yet

- CIA Exam NotesDocument1 pageCIA Exam NotesMahesh ToppaeNo ratings yet

- 1Q1 2Document14 pages1Q1 2Balaji Santhanakrishnan100% (1)

- Chapter 7 Independence and Objectivity A Framework For Rese Auditing PDFDocument39 pagesChapter 7 Independence and Objectivity A Framework For Rese Auditing PDFkennedy gikunjuNo ratings yet

- Net Metering Installation Checklist - Gertrudes Santos - 07-01-2022Document4 pagesNet Metering Installation Checklist - Gertrudes Santos - 07-01-2022Nina Rachell RodriguezNo ratings yet

- Cia17 Cia1 Su2 TFDocument3 pagesCia17 Cia1 Su2 TFNora AlNo ratings yet

- CRMA Exam References GuideDocument1 pageCRMA Exam References GuideJoe FrostNo ratings yet

- SoaaallllDocument60 pagesSoaaalllltsziNo ratings yet

- Part 1 - Unit 7 of 7 Procedures, Analysis, Conclusions, and DocumentationDocument14 pagesPart 1 - Unit 7 of 7 Procedures, Analysis, Conclusions, and DocumentationMuhammad Shahzad KhanNo ratings yet

- Iia Whitepaper - Auditing Operational EffectivenessDocument6 pagesIia Whitepaper - Auditing Operational EffectivenessTendai ChirambaNo ratings yet

- CIA 1 Test-ALL Units-2019 Part 3Document50 pagesCIA 1 Test-ALL Units-2019 Part 3El Aachraoui Salah EddineNo ratings yet

- Risk AsssesmentDocument13 pagesRisk Asssesmentutkarsh agarwalNo ratings yet

- WileyCIA P1 All Q ADocument333 pagesWileyCIA P1 All Q APaul Arjay TatadNo ratings yet

- GTAG 3 Continuous Auditing 2nd EditionDocument30 pagesGTAG 3 Continuous Auditing 2nd EditionDede AndriNo ratings yet

- Control, Governance and Risk ManagementDocument6 pagesControl, Governance and Risk Managementadamazing25No ratings yet

- Gleim's CIA Test Prep Part III Answer Key (1312 QuestionsDocument11 pagesGleim's CIA Test Prep Part III Answer Key (1312 QuestionsMichaela RonquilloNo ratings yet

- Free Certified Internal Auditor Practice TestDocument3 pagesFree Certified Internal Auditor Practice TestRENITA FERNANDESNo ratings yet

- Internal Audit Financial Services RiskDocument10 pagesInternal Audit Financial Services RiskCHUKWUMA EGBENo ratings yet

- Iia CIA v5-0 Part1 SectioniiiDocument108 pagesIia CIA v5-0 Part1 Sectioniiiamira naroNo ratings yet

- Final OAP Practice Guide Dec 2011Document29 pagesFinal OAP Practice Guide Dec 2011Pramod AthiyarathuNo ratings yet

- IIA CIA v6-0 Part1 Section IVDocument19 pagesIIA CIA v6-0 Part1 Section IVJunior BakerigaNo ratings yet

- Fall-17 - Session 8 - QAIPDocument56 pagesFall-17 - Session 8 - QAIPAllin John Francisco100% (1)

- The Revised CIA Syllabus PDFDocument9 pagesThe Revised CIA Syllabus PDFVMendoza MjNo ratings yet

- Freepdf Iiav7ce Part3Document284 pagesFreepdf Iiav7ce Part3msoodNo ratings yet

- Faq - CrmaDocument8 pagesFaq - Crmahammi0322100% (1)

- Audit Plan New OkDocument32 pagesAudit Plan New OkSilvia zaharaNo ratings yet

- Internal Audit Manual NewDocument26 pagesInternal Audit Manual NewhtakrouriNo ratings yet

- Gtag Understanding and Auditing Big DataDocument42 pagesGtag Understanding and Auditing Big DataJustine Jireh PerezNo ratings yet

- IIA Prep4sure IIA-CIA-Part3 v2021-04-28 by Toby 171qDocument74 pagesIIA Prep4sure IIA-CIA-Part3 v2021-04-28 by Toby 171qviet.nguyenhoang01No ratings yet

- Part 2 - Internal Audit Practice ADocument2 pagesPart 2 - Internal Audit Practice AmuniveerappaNo ratings yet

- Property Loan Form V001 Oct 2021 - 4Document6 pagesProperty Loan Form V001 Oct 2021 - 4Amirtharaaj VijayanNo ratings yet

- MBO self care guideDocument2 pagesMBO self care guidejayNo ratings yet

- Audit PlanDocument15 pagesAudit PlanjayNo ratings yet

- 1623645873282Document36 pages1623645873282lekha1997No ratings yet

- Humanitarian Affairs Officer Interview Questions and Answers GuideDocument12 pagesHumanitarian Affairs Officer Interview Questions and Answers GuidemohmedNo ratings yet

- Soal PTS Kelas 6 B. INGGRIS 2022Document3 pagesSoal PTS Kelas 6 B. INGGRIS 2022SITI NUR'ARIYANINo ratings yet

- Summary Report Family Code of The Pihilippines E.O. 209Document41 pagesSummary Report Family Code of The Pihilippines E.O. 209Cejay Deleon100% (3)

- Understanding Diverse LearnersDocument13 pagesUnderstanding Diverse LearnersMerry Grace Aballe Abella100% (2)

- Now You Can: Music in Your LifeDocument1 pageNow You Can: Music in Your LifeDiana Carolina Figueroa MendezNo ratings yet

- Tatmeen - WKI-0064 - Technical Guide For Logistics - v3.0Document88 pagesTatmeen - WKI-0064 - Technical Guide For Logistics - v3.0Jaweed SheikhNo ratings yet

- KBC Terms and ConditionsDocument30 pagesKBC Terms and ConditionspkfmsNo ratings yet

- Life and General InsuranceDocument28 pagesLife and General InsuranceAravinda ShettyNo ratings yet

- Finland's Top-Ranking Education SystemDocument6 pagesFinland's Top-Ranking Education Systemmcrb_19100% (2)

- 3 Factors That Contribute To Gender Inequality in The ClassroomDocument3 pages3 Factors That Contribute To Gender Inequality in The ClassroomGemma LynNo ratings yet

- InDefend Data SheetDocument3 pagesInDefend Data Sheetabhijit379No ratings yet

- ICAR IARI 2021 Technician T1 Recruitment NotificationDocument38 pagesICAR IARI 2021 Technician T1 Recruitment NotificationJonee SainiNo ratings yet

- Traffic ConflictsDocument7 pagesTraffic ConflictsAngel HasnaNo ratings yet

- GMA Network v. COMELEC limits freedom of expressionDocument36 pagesGMA Network v. COMELEC limits freedom of expressionKobe BullmastiffNo ratings yet

- G47.591 Musical Instrument Retailers in The UK Industry Report PDFDocument32 pagesG47.591 Musical Instrument Retailers in The UK Industry Report PDFSam AikNo ratings yet

- Aeronautical Office Media KitDocument18 pagesAeronautical Office Media Kitapi-655212626No ratings yet

- Jasa Vol. 3 (1) Jul-Sep 2013Document4 pagesJasa Vol. 3 (1) Jul-Sep 2013AdityaKumarNo ratings yet

- So Ping Bun's Warehouse Occupancy DisputeDocument4 pagesSo Ping Bun's Warehouse Occupancy DisputeVincent BernardoNo ratings yet

- Manager, Corporate Strategy & Business Development, Payor and Care Markets - McKesson Canada - LinkedInDocument6 pagesManager, Corporate Strategy & Business Development, Payor and Care Markets - McKesson Canada - LinkedInshawndxNo ratings yet

- Old Glory Issue 363-May 2020Document103 pagesOld Glory Issue 363-May 2020EloyAlonsoMiguelNo ratings yet

- Grade 11 Religion Summative TestDocument5 pagesGrade 11 Religion Summative TestEngelbert TejadaNo ratings yet

- The Global Diamond Industry: So-Young Chang MBA '02Document17 pagesThe Global Diamond Industry: So-Young Chang MBA '02Pratik KharmaleNo ratings yet

- Wedding ScriptDocument9 pagesWedding ScriptMyn Mirafuentes Sta AnaNo ratings yet

- DR - Thagfan Diagnostic Center E RegisterDocument3 pagesDR - Thagfan Diagnostic Center E RegisterKh FurqanNo ratings yet

- Mythology and FolkloreDocument6 pagesMythology and FolkloreSampaga, Lovely Grace FerraroNo ratings yet

- The Illumined Man Knows Worldly Enjoyment Is UnrealDocument4 pagesThe Illumined Man Knows Worldly Enjoyment Is UnrealMadhulika Vishwanathan100% (1)

- wcl-20-24 11 2023Document15 pageswcl-20-24 11 2023Codarren VelvindronNo ratings yet

- Constitutional Law II Digest on Poe vs. Comelec and TatadDocument49 pagesConstitutional Law II Digest on Poe vs. Comelec and TatadMica Joy FajardoNo ratings yet

- Rules of The ASUN Senate, 76th SessionDocument23 pagesRules of The ASUN Senate, 76th SessionVis Lupi Est GrexNo ratings yet

- BCG (Task 2 Additional Data) - VIPULDocument13 pagesBCG (Task 2 Additional Data) - VIPULvipul tutejaNo ratings yet