Professional Documents

Culture Documents

Assignment # 6 Financial Ratios

Uploaded by

Anil Verma0 ratings0% found this document useful (0 votes)

3 views2 pagesFM

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFM

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesAssignment # 6 Financial Ratios

Uploaded by

Anil VermaFM

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

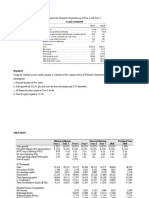

Assignment 6 Financial Ratios ( APM Industries ) By Anil Verma ( EPGP-13D-

010)

Solvency

S.No Short Term Solvency FY 2020 FY 2019

1 Net marking Capital In Crores 21.2 15.55

2 Current Ratio 1.37 1.23

3 Quick Ratio 0.5 0.53

4 Average Daily Exp ( in Cr) 0.5922 0.5962

5 Cash cover for daily exp. 9.49 10.96

6 Quick asset cover for daily exp. (days) 7.83 10.02

7 Current asset cover foe dailyt exp.(days) 21.52 23.07

Current liabilities cover for daily exp.

8 15.7 18.81

(days)

9 Account receivable T/O 11.29 9.23

10 Average collection period 31.47 39.53

11 Inventory turnover 5.54 5.7

12 Inventory conversion period 66.06 64.04

13 Average payable (days) 8.73 9.14

Long term solvency

1 Total debt to total capital Paid 0.62 0.73

2 Long term debt to total capital 0.41 0.45

3 Times Interest covered 1.54 1.83

Profitability

Margin On Sales

1 Gross Profit marginal (%) 23.31% 21.30%

2 Operating Profit marginal (%) 6% 6.60%

3 Net Profit marginal (%) 2.66% 2.68%

Return on Investment

1 Operating asset to operating sales (%) 12.45% 12.84%

2 net income to total asset (%) 2.97% 3.01%

3 Return on equity (%) 5.46% 6.01%

Efficiency of use of asset

1 Total asset T/O 1.12 1.123

2 operating asset 2.08 2.27

3 marking capital 12.67 17.6

1: Short Term solvency:

A: APM industries is in an average condition in terms of fulfilling their short term

commitment in supporting better short term solvency status.

B: In APM industries current ratios is slightly better in comparison to FY 2019 due to slight

increase in inventory.

C: Liquid ratio / Quick ratio is slightly lesser than FY 2019, this is the tougher test of short

term solvency

D: In comparison to FY-20 and FY 19 , in most of the ratios fluctuation can be seen, avg.

collection is lesser in FY 20 & inventory conversion is slightly higher in FY 20.

2: Long Term solvency:

A: The ratio is lesser in FY 20 1.54 crores FY 19 it was 1.83 crores , interest covered ratio is

not improved in 2020 , due to which company is burdened by debt expenses.

B: Total debt to total capital paid & Long term debt to total capital ratio has decreased in

2020 .

3: Margin on sales :

A : Margin of sales has gone up in FY 20 , due to cost of goods sold .

B: Operating profit margin has slightly decreased due to less operating efficiency , financial

insufficiency .

4: Return on investment :

A: Return on operating asset has slightly decreased in FY 20 compared to FY 19 mainly due

to slight decrease in sales & changes in inventory & WIP.

B: return on total asset & equity both has slightly decreased in FY 20 , due to less income

earned the whole year .

5: Efficiency of use of asset :

A: Total asset T/O remained same in both the years .

B: The operating asset to turnover ratio has decreased probably due to size of capital

invested, but below avg. return can be seen.

C: The working capital turnover has decreased to 12.67 in FY 20 compared to 17.6 in FY 19,

this is due to decrease in efficiency of the use to net working capital i.e revenues earned to

working capital investment has decreased .

The End

You might also like

- 2022 Victor Tamayo YourDocument9 pages2022 Victor Tamayo YourCiber 13100% (3)

- S F S P: The Pecial Actor Taking LanDocument7 pagesS F S P: The Pecial Actor Taking LanMG7FILMESNo ratings yet

- Mergers and Acquisitions ValuationDocument10 pagesMergers and Acquisitions ValuationJack JacintoNo ratings yet

- Balance Sheet VerticalDocument22 pagesBalance Sheet VerticalberettiNo ratings yet

- Wells Fargo Bank StatementDocument4 pagesWells Fargo Bank StatementBanjiNo ratings yet

- Albermarle Financial ModelDocument38 pagesAlbermarle Financial ModelParas AroraNo ratings yet

- Agreement IBBA-HCIM - V20211026 SignedDocument16 pagesAgreement IBBA-HCIM - V20211026 SignedНизами КеримовNo ratings yet

- LBO Case Study 1Document2 pagesLBO Case Study 1Zexi WUNo ratings yet

- Excel Shortcut Master KeyDocument15 pagesExcel Shortcut Master KeyBajazid NadžakNo ratings yet

- Dharthi DredgingDocument6 pagesDharthi DredgingshankarswaminathanNo ratings yet

- Ias 16Document33 pagesIas 16Kiri chris100% (1)

- Equity Portfolio Management StrategiesDocument30 pagesEquity Portfolio Management StrategiesSdNo ratings yet

- New Pacific Timber Vs SenerisDocument2 pagesNew Pacific Timber Vs SenerisWilfred MartinezNo ratings yet

- Solutions To Chapter 17 Financial Statement AnalysisDocument10 pagesSolutions To Chapter 17 Financial Statement Analysishung TranNo ratings yet

- BF AssignmentDocument13 pagesBF AssignmentMomina waseemNo ratings yet

- Assignment6 HW6Document7 pagesAssignment6 HW6RUPIKA R GNo ratings yet

- Excel01 PDFDocument1 pageExcel01 PDFanupam rahman srizonNo ratings yet

- Wells Fargo - First-Quarter-2020-EarningsDocument40 pagesWells Fargo - First-Quarter-2020-EarningsAlexNo ratings yet

- FMA Group 7 AssDocument20 pagesFMA Group 7 AssWeldu GebruNo ratings yet

- Annual Report SIB 2019-20Document189 pagesAnnual Report SIB 2019-20SREE RAMNo ratings yet

- Final Term Exam-Spring 2022Document5 pagesFinal Term Exam-Spring 2022bolaemil20No ratings yet

- Final Press ReleaseDocument4 pagesFinal Press ReleaseMeghaNo ratings yet

- A Presentation On Action StandardDocument40 pagesA Presentation On Action StandardBikash MagarNo ratings yet

- Estadosfinancieros FerreycorpDocument2 pagesEstadosfinancieros Ferreycorpluxi0No ratings yet

- Financial Reporting and Analysis PDFDocument2 pagesFinancial Reporting and Analysis PDFTushar VatsNo ratings yet

- 1 Ratio ProblemDocument3 pages1 Ratio ProblemChandni AgrawalNo ratings yet

- FIN254 Assignment# 1Document6 pagesFIN254 Assignment# 1Zahidul IslamNo ratings yet

- 2019 Westpac Group Full Year TablesDocument25 pages2019 Westpac Group Full Year TablesAbs PangaderNo ratings yet

- BOB Analyst Presentation Q4 FY 2019 27052019 PDFDocument77 pagesBOB Analyst Presentation Q4 FY 2019 27052019 PDFSandeep KumarNo ratings yet

- Astral - XLS: Assumptions / InputsDocument6 pagesAstral - XLS: Assumptions / InputsNarinderNo ratings yet

- Working Capital: Apl Apollo Tubes LTDDocument17 pagesWorking Capital: Apl Apollo Tubes LTDDhirajsharma123No ratings yet

- Example - Group Project - Accounting and Financial ReportingDocument8 pagesExample - Group Project - Accounting and Financial ReportingIslam NabilNo ratings yet

- Vaibhav BFDocument9 pagesVaibhav BFVaibhav GuptaNo ratings yet

- Estados Financieros Colgate. Analísis Vertical y HorizontalDocument5 pagesEstados Financieros Colgate. Analísis Vertical y HorizontalXimena Isela Villalpando BuenoNo ratings yet

- AFM Project Report FinalDocument19 pagesAFM Project Report FinalRitu KumariNo ratings yet

- J&J FS AnalysisDocument5 pagesJ&J FS AnalysisEarl Justine FerrerNo ratings yet

- 3q 2022 Earnings ReleaseDocument46 pages3q 2022 Earnings Releasecerohad333No ratings yet

- Press Release: Bank of Baroda Announces Financial Results For The Quarter Ended 30 September 2022Document4 pagesPress Release: Bank of Baroda Announces Financial Results For The Quarter Ended 30 September 2022Mahesh DhalNo ratings yet

- Research Problem Michael Franco AccountingDocument5 pagesResearch Problem Michael Franco AccountingMichael FrancoNo ratings yet

- 02C) Financial Ratios - ExamplesDocument21 pages02C) Financial Ratios - ExamplesMuhammad AtherNo ratings yet

- Colgate Estados Financieros 2021Document3 pagesColgate Estados Financieros 2021Lluvia RamosNo ratings yet

- Browning Ch03 P15 Build A ModelDocument3 pagesBrowning Ch03 P15 Build A ModelAdam0% (1)

- Financial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismDocument18 pagesFinancial Management Report FPT Corporation: Hanoi University Faculty of Management and TourismPham Thuy HuyenNo ratings yet

- D. Complete The Balance Sheet For General Aviation, Inc. Based On The Following Financial DataDocument2 pagesD. Complete The Balance Sheet For General Aviation, Inc. Based On The Following Financial DataJanelleNo ratings yet

- With Financials Student Excel Ratio Analysis Case Study I 7022Document17 pagesWith Financials Student Excel Ratio Analysis Case Study I 7022sarahNo ratings yet

- Please Click On The Link For The Report:: cm09MjgDocument2 pagesPlease Click On The Link For The Report:: cm09Mjgneil5mNo ratings yet

- INS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Document4 pagesINS3030 - Financial Report Analysis - Chu Huy Anh - Đề 3Thảo Thiên ChiNo ratings yet

- Tugas Ii Financial Management - Mery Oktori Uly BinuDocument7 pagesTugas Ii Financial Management - Mery Oktori Uly BinuMerryNo ratings yet

- Latihan Bab 3Document19 pagesLatihan Bab 3Noura AdriantyNo ratings yet

- Calculation of Financial Ratios and Its Analysis: Advance Performance ManagemntDocument8 pagesCalculation of Financial Ratios and Its Analysis: Advance Performance ManagemntZeeshan AbdullahNo ratings yet

- Total Revenue: Income StatementDocument4 pagesTotal Revenue: Income Statementmonica asifNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- SailashreeChakraborty 13600921093 FM401Document12 pagesSailashreeChakraborty 13600921093 FM401Sailashree ChakrabortyNo ratings yet

- RequiredDocument3 pagesRequiredKplm StevenNo ratings yet

- Assignment 01Document18 pagesAssignment 01Md. Real MiahNo ratings yet

- Finance Questions 4Document3 pagesFinance Questions 4asma raeesNo ratings yet

- Prob - 13-4Document9 pagesProb - 13-4NavinNo ratings yet

- Manac Assignment PDFDocument7 pagesManac Assignment PDFGunjanNo ratings yet

- Assignment On Ratio AnalysisDocument3 pagesAssignment On Ratio AnalysisMahmudul Hasan TusharNo ratings yet

- Finance M-5Document30 pagesFinance M-5Vrutika ShahNo ratings yet

- Particulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018Document6 pagesParticulars (All Values in Lakhs Unless Specified Otherwise) 2019 2018MOHIT MARHATTANo ratings yet

- Dimaano CaseStudyPresentationDocument13 pagesDimaano CaseStudyPresentationRJ DimaanoNo ratings yet

- Financial Management FinalDocument14 pagesFinancial Management FinalNeal KNo ratings yet

- Financial-Analysis-Procter&Gamble-vs-Reckitt BenckiserDocument5 pagesFinancial-Analysis-Procter&Gamble-vs-Reckitt BenckiserPatOcampoNo ratings yet

- NguyenThiQuynhHuong BaiThi ĐTTC L01Document9 pagesNguyenThiQuynhHuong BaiThi ĐTTC L01Huy ĐăngNo ratings yet

- C18Y1101 Sadhurshan Sathyawelu BAIBF10020Document14 pagesC18Y1101 Sadhurshan Sathyawelu BAIBF10020saran.woowNo ratings yet

- ECN 134: Solution Key To Problem Set 2 Part A: CF Statement. You Are Given The Following Information of XYZ Corporation For 2011Document11 pagesECN 134: Solution Key To Problem Set 2 Part A: CF Statement. You Are Given The Following Information of XYZ Corporation For 2011Ashekin MahadiNo ratings yet

- GGP Final2010Document23 pagesGGP Final2010Frank ParkerNo ratings yet

- BUSS 207 Quiz 2 - SolutionsDocument4 pagesBUSS 207 Quiz 2 - Solutionstom dussekNo ratings yet

- Assignment # 4Document2 pagesAssignment # 4Anil VermaNo ratings yet

- Assignment #3 (Anil Verma) EPGP 13D 010Document2 pagesAssignment #3 (Anil Verma) EPGP 13D 010Anil VermaNo ratings yet

- Assignment # 1 Company Assigned - APM Industries LTD Annual Report - 2019-2020 1: Balance Sheet EquationDocument1 pageAssignment # 1 Company Assigned - APM Industries LTD Annual Report - 2019-2020 1: Balance Sheet EquationAnil VermaNo ratings yet

- Assignment 5 (APM Industries) by Anil Verma (EPGP-13D-010)Document3 pagesAssignment 5 (APM Industries) by Anil Verma (EPGP-13D-010)Anil VermaNo ratings yet

- NCR T-265-ND 012023Document31 pagesNCR T-265-ND 012023Patrick LorenzoNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementJonathanKelly Bitonga BargasoNo ratings yet

- Government of Kerala: Rs. Rs. RsDocument25 pagesGovernment of Kerala: Rs. Rs. RsmuhammedNo ratings yet

- Formal Report-CompressedDocument12 pagesFormal Report-Compressedapi-457467141No ratings yet

- IJCRT2203243Document10 pagesIJCRT2203243Tushar MusaleNo ratings yet

- C-I-302-F35 Dog Concierges, LLCDocument10 pagesC-I-302-F35 Dog Concierges, LLCCarlosNo ratings yet

- ICICI Prudential Multi-Asset Fund Tactical Note-1Document7 pagesICICI Prudential Multi-Asset Fund Tactical Note-1sdaobtrinNo ratings yet

- From Inception of Operations To December 31 2008 Blaise PascalDocument1 pageFrom Inception of Operations To December 31 2008 Blaise PascalM Bilal SaleemNo ratings yet

- Coffee Table Booklet 19012024Document244 pagesCoffee Table Booklet 19012024Antony ANo ratings yet

- New Signature Update FormDocument3 pagesNew Signature Update FormKRIZMAL TRADING SOLUTIONS PVT LTDNo ratings yet

- 7a Exact and Ordinary InterestDocument9 pages7a Exact and Ordinary InterestVj McNo ratings yet

- Gente 2015Document27 pagesGente 2015Very BudiyantoNo ratings yet

- Application For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFDocument6 pagesApplication For Margin Money Loan To S.S.I. Units Promoted by Non-Resident Keralites From The Government of Kerala PDFdasuyaNo ratings yet

- Chapter 1 Afar (Bus Com)Document24 pagesChapter 1 Afar (Bus Com)jajajaredredNo ratings yet

- SIP 2023 Project Akshay Dakhale 20233Document48 pagesSIP 2023 Project Akshay Dakhale 20233Aniket KambleNo ratings yet

- 2008 Global Economic Crisi1Document8 pages2008 Global Economic Crisi1Carlos Rodriguez TebarNo ratings yet

- 4 AdjustmentDocument19 pages4 AdjustmentMina AmirNo ratings yet

- Treynor RatioDocument1 pageTreynor Ratiosana_sr_96No ratings yet

- Sneha Burud ASWDocument7 pagesSneha Burud ASWPrathmesh KulkarniNo ratings yet

- Training Report On Anand RathiDocument92 pagesTraining Report On Anand Rathirahulsogani123No ratings yet