Professional Documents

Culture Documents

Admission

Uploaded by

jovan candela0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

Admission (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesAdmission

Uploaded by

jovan candelaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

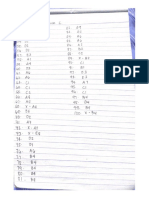

Quiz.

PARTNERSHIP ADMISSION

Problem I. Blue Company

Anthony, Ben, and Charlie are partners in Blue Company. Their capital

balances as at July 31, 2021, are as follows:

Anthony, Capital Ben, Capital Charlie, Capital

450,000 150,000 300,000

Each partner has agreed to admit Daniel to the partnership.

Required:

Prepare the entries to record Daniel’s admission to the partnership under

each of the following conditions:

a. Daniel paid Anthony P125,000 for 20% of Anthony’s interest in the

partnership.

b. Daniel invested P200,000 cash in the partnership and received an

interest equal to her investment.

c. Daniel invested P300,000 cash in the partnership for 20% interest in the

business. A bonus is to be recorded for the original partners on the basis

of their capital balances.

d. Daniel invested P300,000 cash in the partnership for 40% interest in the

business. The original partners gave Daniel a bonus according to the

ratio of their capital balances on July 31, 2021.

Problem II. Z Partnership

Lian and Kate are partners in Z Partnership with capital balances of

P550,000 and P350,000, respectively; they share income and loss in the

ratio 1:3, respectively. The partners are considering the admission of Ren.

Required:

Prepare the entries to record the admission of Ren under each of the

following independent situations:

1. Ren invested P100,000 cash in the partnership for a one-tenth

interest. The net assets of the partnership are fairly valued.

2. Ren invested P140,000 cash in partnership for a one-eight interest.

Assets of the partnership are fairly valued except for equipment,

which is undervalued by P80,000. Net assets of the partnership are to

be revalued and Ren is to be admitted.

3. Ren is to receive a one-tenth interest in the partnership upon

investing P180,000 cash. Net assets of the partnership are fairly

valued.

4. Ren is to receive a 20% interest in the partnership upon investing

P200,000 cash. Net assets of the partnership are fairly valued.

You might also like

- Module 9 - The Political SelfDocument5 pagesModule 9 - The Political Selfjovan candelaNo ratings yet

- Candela (Costaccounting)Document1 pageCandela (Costaccounting)jovan candelaNo ratings yet

- Candela, Mark Jovan G. Stem 12 - Carnation TestDocument4 pagesCandela, Mark Jovan G. Stem 12 - Carnation Testjovan candelaNo ratings yet

- Candela, Mark Jovan G. Stem 12 - Carnation Q3W2 Activity Sheet TestDocument4 pagesCandela, Mark Jovan G. Stem 12 - Carnation Q3W2 Activity Sheet Testjovan candelaNo ratings yet

- Division of Gen. Trias City: Project Isulat - As in English For Academic and Professional PurposesDocument2 pagesDivision of Gen. Trias City: Project Isulat - As in English For Academic and Professional Purposesjovan candelaNo ratings yet

- Comprehension Check - 2Document2 pagesComprehension Check - 2jovan candelaNo ratings yet

- Week 2: Practical Research 2Document1 pageWeek 2: Practical Research 2jovan candelaNo ratings yet

- 16051iied 0Document28 pages16051iied 0jovan candelaNo ratings yet

- Accounting For A Manufacturing BusinessDocument2 pagesAccounting For A Manufacturing Businessjovan candelaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)