Professional Documents

Culture Documents

Institute of Management Sciences, Jammu Cost Accounting Course No: UBBATC-301

Uploaded by

DrVivek SansonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Institute of Management Sciences, Jammu Cost Accounting Course No: UBBATC-301

Uploaded by

DrVivek SansonCopyright:

Available Formats

INSTITUTE OF MANAGEMENT SCIENCES, JAMMU

COST ACCOUNTING

Course No: UBBATC-301

Time allowed-2.5 Hours Maximum Marks-80

Important Instructions.

1. The maximum marks for the above questions paper is 80 marks.

2. The students are directed to attempt only 50% of the maximum marks i.e

at least 40 marks.

3. You may attempt:-

Section A – Only 2 questions of 3 marks each.

Section B – Only 3 questions of 7 marks each.

Section C – Only 1 question of 15 marks.

SECTION-A

Note: Each question carries (3) marks.

1. Enlist any two objectives of Standard Costing.

2. How is normal loss treated in process cost accounts?

3. What do you mean by cost sheet?

4. What is contribution?

5. Calculate Profit Volume Ratio. Sales 200000, Variable cost 50000, Fixed

Cost 30000.

SECTION-B

Note: Each question carries (7) marks. (5*7=35)

6. What do you mean by process costing? In which type of industries

process costing is used.

7. Define the following terms:

A) Material Variance

B) Labour variance

C) Overhead Variance

8. What is Cost Accounting? Discuss its advantages and limitations of Cost

accounting.

9. What is meant by Break-Even Analysis? Discuss its assumptions and

limitations of this techniques.

10.The Vardhman ltd. Manufacturers one product. A summary of its

activities for the year 2016 is given below:

Sales (80000 units) 800000 : Finished goods 31-12-201 (34000

units)

Material Inventory 1-1-2016 40000 : Material Purchased 152000

Material Inventory 31-12-2016 32000: Direct Labour 145000

W.I.P. 1-1-2016 55000 : Manufacturing Overheads 108000

W.I.P.31-12-2016 72000 : Selling Expenses 50000

Finished goods 1-1-2016 (16000 units) 64000: General Expenses 40000

Prepare a statement of Cost and Profit.

SECTION-C

Note: Each question carry 15 Marks.

11. Distinguish between Cost accounting and Financial Accounting. Discuss

the limitation of financial accounting and how they can be overcome with

cost Accounting.

12. Mr. Gopal furnishes the following data relating to the manufacturer of a

standard product during the month of April, 2017:

Raw material Consumes 15000: Administration Overheads 20% on work

cost. Direct labour charges 9000: Selling Overheads 0.50 per unit

Machine Hour worked 900: Units Produced 17100

Machine Hour Rate 5 : Units sold 16000 @ 4 per unit.

You are require to prepare a cost sheet from the above, showing; (a) the

cost of Production per unit. (B) The profit per unit sold and profit for the

period.

13.What is the meaning and importance of standard costing? Discuss the

preliminary steps for establishing a system of standard costing.

14.What do you understand by the term “cost-volume profit’’ analysis? Why

is this relationship important in business management? Explain the

advantages and limitation of marginal costing.

You might also like

- MANAV PPT ProjectDocument37 pagesMANAV PPT ProjectDrVivek SansonNo ratings yet

- Study on Consumer Behavior Towards Online Trading at Karvy Stock BrokingDocument30 pagesStudy on Consumer Behavior Towards Online Trading at Karvy Stock BrokingDrVivek SansonNo ratings yet

- Reetik SharmaDocument22 pagesReetik SharmaDrVivek SansonNo ratings yet

- Bba Sem-Vi Factors Influencing The Adoption of Net Banking ServicesDocument35 pagesBba Sem-Vi Factors Influencing The Adoption of Net Banking ServicesDrVivek SansonNo ratings yet

- A Study On Employee Satisfaction Toward Exoways Web TechnologiesDocument29 pagesA Study On Employee Satisfaction Toward Exoways Web TechnologiesDrVivek SansonNo ratings yet

- Concealment and Conversion: CA Ranjana Soni FCA M. No: 9855200619Document15 pagesConcealment and Conversion: CA Ranjana Soni FCA M. No: 9855200619DrVivek SansonNo ratings yet

- Management Accounting Unit No 1st BBA 5th SemesterDocument4 pagesManagement Accounting Unit No 1st BBA 5th SemesterDrVivek SansonNo ratings yet

- Consumer Behaviour Unit 2 (MBA311)Document64 pagesConsumer Behaviour Unit 2 (MBA311)DrVivek SansonNo ratings yet

- "A Study On Motivating Factors at Work For Employees": TopicDocument37 pages"A Study On Motivating Factors at Work For Employees": TopicDrVivek SansonNo ratings yet

- Institute of Management Sciences, Jammu Ist Mid Semester Test Management Accounting Course No: UBBATC-502Document2 pagesInstitute of Management Sciences, Jammu Ist Mid Semester Test Management Accounting Course No: UBBATC-502DrVivek SansonNo ratings yet

- Study MaterialDocument17 pagesStudy MaterialRohit KumarNo ratings yet

- Derivatives NotesDocument21 pagesDerivatives NotesDrVivek SansonNo ratings yet

- Consumer Behavior Unit No 1 NotesDocument6 pagesConsumer Behavior Unit No 1 NotesDrVivek SansonNo ratings yet

- Management Accounting Unit No 1st BBA 5th SemesterDocument4 pagesManagement Accounting Unit No 1st BBA 5th SemesterDrVivek SansonNo ratings yet

- Udhampur Campus Conference-5Document18 pagesUdhampur Campus Conference-5DrVivek SansonNo ratings yet

- Full Paper On Entrepreneurship With Abstract-1Document17 pagesFull Paper On Entrepreneurship With Abstract-1DrVivek SansonNo ratings yet

- Industrial Development PDFDocument33 pagesIndustrial Development PDFDrVivek SansonNo ratings yet

- Educational Research Chapter 1 Introduction To Educational Research Gay, Mills, and AirasianDocument41 pagesEducational Research Chapter 1 Introduction To Educational Research Gay, Mills, and AirasianNicolaus Copernicus100% (2)

- Udhampur Campus Conference-3Document18 pagesUdhampur Campus Conference-3DrVivek SansonNo ratings yet

- Industrial Development For The 21st CenturyDocument432 pagesIndustrial Development For The 21st CenturyacibilsNo ratings yet

- Thesis 1 PDFDocument14 pagesThesis 1 PDFDrVivek SansonNo ratings yet

- J&K BankDocument64 pagesJ&K BankDrVivek SansonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lesson 5 Classifications of CommunicationDocument48 pagesLesson 5 Classifications of CommunicationRovenick SinggaNo ratings yet

- Indigo CaseDocument13 pagesIndigo Caseharsh sainiNo ratings yet

- Sadie's Drawing Materials: Buy Your Supplies atDocument5 pagesSadie's Drawing Materials: Buy Your Supplies atAlison De Sando ManzoniNo ratings yet

- Warren BuffetDocument11 pagesWarren BuffetSopakirite Kuruye-AleleNo ratings yet

- Performance Theory For Hot Air Balloons: The Balloon Works, Inc., Statesville, N.CDocument4 pagesPerformance Theory For Hot Air Balloons: The Balloon Works, Inc., Statesville, N.CEbubekir ErkanNo ratings yet

- Lesson Plans by Noman Niaz MaharDocument3 pagesLesson Plans by Noman Niaz MaharNoman Niaz 13No ratings yet

- Are The Risk Management Tools at Your Law Firm Working?Document17 pagesAre The Risk Management Tools at Your Law Firm Working?vantoffNo ratings yet

- SDM - Session 6Document21 pagesSDM - Session 6Rohith NairNo ratings yet

- Geraldez Vs Ca 230 Scra 329Document12 pagesGeraldez Vs Ca 230 Scra 329Cyrus Pural EboñaNo ratings yet

- SD NEGERI PASURUHAN PEMERINTAH KABUPATEN TEMANGGUNGDocument5 pagesSD NEGERI PASURUHAN PEMERINTAH KABUPATEN TEMANGGUNGSatria Ieea Henggar VergonantoNo ratings yet

- Chapter 3 of LPL Textbook PDFDocument26 pagesChapter 3 of LPL Textbook PDFandreaNo ratings yet

- California State Bar Order of Discipline of Louis "Skip" Miller For Jury TamperingDocument33 pagesCalifornia State Bar Order of Discipline of Louis "Skip" Miller For Jury TamperingAlan RomeroNo ratings yet

- New Monasticism: An Interspiritual Manifesto For Contemplative Life in The 21st CenturyDocument32 pagesNew Monasticism: An Interspiritual Manifesto For Contemplative Life in The 21st CenturyWorking With Oneness100% (8)

- UITM Faculty of Business Entrepreneurship Rubric Social Media PortfolioDocument9 pagesUITM Faculty of Business Entrepreneurship Rubric Social Media PortfolioShamsyul AriffinNo ratings yet

- Amelia Wills CV 2021 VDocument4 pagesAmelia Wills CV 2021 Vapi-446566858No ratings yet

- OsteoporosisDocument57 pagesOsteoporosisViviViviNo ratings yet

- Form of SpesDocument2 pagesForm of SpesMark Dave SambranoNo ratings yet

- Emotion-WPS OfficeDocument2 pagesEmotion-WPS OfficemikaNo ratings yet

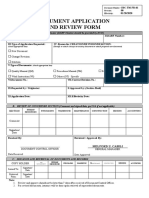

- Document Application and Review FormDocument1 pageDocument Application and Review FormJonnel CatadmanNo ratings yet

- Arts, Sciences& Technology University in Lebanon: Clinical Booking WebsiteDocument25 pagesArts, Sciences& Technology University in Lebanon: Clinical Booking WebsiteTony SawmaNo ratings yet

- KluberDocument20 pagesKluberJako MishyNo ratings yet

- Masai School Code of Conduct - Prefinal 11.10.2019Document3 pagesMasai School Code of Conduct - Prefinal 11.10.2019xavigatorNo ratings yet

- OUM Human Anatomy Final Exam QuestionsDocument5 pagesOUM Human Anatomy Final Exam QuestionsAnandNo ratings yet

- Diseñadores Del Siglo XX - Las Figuras Clave Del Diseño y - Dormer, Peter - 1993 - Barcelona - Ceac - 9780747202684 - Anna's ArchiveDocument264 pagesDiseñadores Del Siglo XX - Las Figuras Clave Del Diseño y - Dormer, Peter - 1993 - Barcelona - Ceac - 9780747202684 - Anna's ArchiveSilvina RodríguezNo ratings yet

- A Cause For Our Times: Oxfam - The First 50 YearsDocument81 pagesA Cause For Our Times: Oxfam - The First 50 YearsOxfamNo ratings yet

- Dasakam 31-40Document16 pagesDasakam 31-40Puducode Rama Iyer RamachanderNo ratings yet

- Wiring Diagram Obp 1 v2Document5 pagesWiring Diagram Obp 1 v2Jorge Luis Vera AlmeidaNo ratings yet

- Common Expressions in Business 2Document2 pagesCommon Expressions in Business 2abdeljelil manelNo ratings yet

- Jumpin' Beans Cafe Near SchoolDocument4 pagesJumpin' Beans Cafe Near SchoolJhon Axl Heart RaferNo ratings yet

- Buckley V UkDocument12 pagesBuckley V UkShriya ChandankarNo ratings yet