Professional Documents

Culture Documents

Debt vs Equity Securities Classifications and Accounting for Bond Investments

Uploaded by

Cherryl Febryan ChristyantoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Debt vs Equity Securities Classifications and Accounting for Bond Investments

Uploaded by

Cherryl Febryan ChristyantoCopyright:

Available Formats

ANSWER OF THE QUESTIONS

1 A debt security is an instrument representing a creditor relationship with an entity. Debt securities

include U.S. government securities, municipal securities, corporate bonds, convertible debt, and

commercial paper. Trade accounts receivable and loans receivable are not debt securities

because they do not meet the definition of a security.

An equity security is described as a security representing an ownership interest such as common,

preferred, or other capital stock. It also includes rights to acquire or dispose of an ownership

interest at an agreed-upon or determinable price, such as warrants, rights, and call options or put

options. Convertible debt securities and redeemable preferred stocks are not treated as equity

securities

3 Cost of a long-term investment in bonds includes the total consideration to acquire the

investment, including brokerage fees and other costs incidental to the purchase

4 The three types of classifications for debt investments are:

Held-to-maturity: Debt investments that the company has the positive

intent and ability to hold to maturity.

Trading:Debt investments bought and held primarily for sale in the near

term to generate income on short-term price differences.

Available-for-sale: Debt investments not classified as held-to-maturity or trading securities.

8 €3,500,000 X 10% = €350,000; €350,000 ÷ 2 = €175,000. Wheeler would make the following entry:

Cash (€4,000,000 X 8% X 1/2) 160.000

Debt Investments 15.000

Interest Revenue (€3,500,000 X 10% X 1/2) 175.000

9 Fair Value Adjustment 89.000

Unrealized Holding Gain or Loss—Income 89.000

[€3,604,000 – (€3,500,000 + €15,000)*]

entity. Debt securities

convertible debt, and Nama Cristina Karimba

ebt securities Nim 202030141

Matkul AKM2 - 17

rest such as common,

of an ownership

nd call options or put

t treated as equity

acquire the

aturity or trading securities.

make the following entry:

EXERCISE 17

E17-1 (a) 2. (b) 4. (c) 2. (d) 1. (e) 1. (f) 4

E17-2 (a) January 1, 2020

Debt Investments 300.000

Cash

(b) December 31, 2020

Cash 30.000

Interest Revenue

(c) January 1, 2020

Cash 30.000

Interest Received

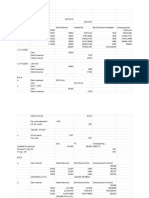

E17-5 (a) Schedule pf interest Revenue and Bond Discount Amortizatio

Straight-line method

9% Bond Purchased to Yield 12%

Date Cash Received Interest Revenue Bond Discount Amortization

1/1/2017 - - -

1/1/2018 $ 18.000 $ 22.80 4,804*

1/1/2019 $ 18.000 $ 22.80 $ 4.80

1/1/2020 $ 18.000 22,803** $ 4.80

*($200,000 - $185,589) / 3 = $4,804

**Rounded by $1.

(b) Schedule pf interest Revenue and Bond Discount Amortizatio

Effective-Interest method

9% Bond Purchased to Yield 12%

Date Cash Received Interest Revenue Bond Discount Amortization

1/1/2017 - - -

1/1/2018 $ 18.000 $22,270.68* $4,270.68

1/1/2019 $ 18.000 22,783.16 4,783.16

1/1/2020 $ 18.000 23,357.16** 5,537.16

*$185,589 X .12 = $22,270.68

**Rounded by $02.

(c) December 31, 2020

Interest Receivable 18,000.00

Debt Investments 4,804.00

Interest Revenue

(d) December 31, 2020

Interest Receivable 18,000.00

Debt Investments 4,783.16

Interest Revenue

300.000

30.000

30.000

ond Discount Amortization

ethod

o Yield 12%

Carrying Amount of Bonds

$ 185.59

$ 190.39

$ 195.20

$ 200.000

ond Discount Amortization

method

o Yield 12%

Carrying Amount of Bonds

$185,589.00

189,859.68

194,642.84

200,000.00

22,804.00

22,783.16

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Note Payable Irrevocably Designated As at Fair Value Through Profit or LossDocument4 pagesNote Payable Irrevocably Designated As at Fair Value Through Profit or Lossnot funny didn't laughNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- Chapter 14 HomeworkDocument10 pagesChapter 14 HomeworkSaja AlbarjesNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- PQ3 BondsDocument2 pagesPQ3 BondsElla Mae MagbatoNo ratings yet

- Ennea CoDocument3 pagesEnnea CoDavid Jung ThapaNo ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- Pascal Mosa Ananda W - Latihan KP Financial Accounting 2Document14 pagesPascal Mosa Ananda W - Latihan KP Financial Accounting 2Brenda FreitasNo ratings yet

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Chapter 14 AKM Kieso - Jawab SoalDocument6 pagesChapter 14 AKM Kieso - Jawab SoalNABILAH KHANSA 1911000089No ratings yet

- Prudential Life Insurance Policy Projected ReturnsDocument1 pagePrudential Life Insurance Policy Projected ReturnsterrygohNo ratings yet

- Sol. Man. Chapter 10 Investments in Debt Securities Ia Part 1a 2020 EditionDocument34 pagesSol. Man. Chapter 10 Investments in Debt Securities Ia Part 1a 2020 EditionMizza Moreno CantilaNo ratings yet

- Case 3Document13 pagesCase 3Prezi Toli100% (1)

- Leases (Part 2) : Problem 1: True or FalseDocument23 pagesLeases (Part 2) : Problem 1: True or FalseKim Hanbin100% (1)

- Bài tập về nhà - Trang tính1Document4 pagesBài tập về nhà - Trang tính1namhua54No ratings yet

- Bonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ADocument8 pagesBonds Payable Bond - Is A Formal Unconditional Promise, Made Under Seal, To Pay A Specified Sum of Money at ACamille BacaresNo ratings yet

- Module - IA Chapter 6Document10 pagesModule - IA Chapter 6Kathleen EbuenNo ratings yet

- Accounting 1Document10 pagesAccounting 1Jay EbuenNo ratings yet

- Chapter 11 Bonds PayableDocument27 pagesChapter 11 Bonds PayableNicho Deven HamawiNo ratings yet

- Assignment On LiabilitiesDocument7 pagesAssignment On LiabilitiesVixen Aaron EnriquezNo ratings yet

- Lagrimas, Sarah Nicole S. - PC&OL PART 2Document3 pagesLagrimas, Sarah Nicole S. - PC&OL PART 2Sarah Nicole S. LagrimasNo ratings yet

- AP-LIABS-3 (With Answers)Document4 pagesAP-LIABS-3 (With Answers)Kendrew SujideNo ratings yet

- Notes ReceivableDocument47 pagesNotes ReceivableAlexandria Ann FloresNo ratings yet

- 07 Loan Receivable MCPDocument4 pages07 Loan Receivable MCPkyle mandaresioNo ratings yet

- Tugas KB Aklan TM 13-Kelompok 1Document10 pagesTugas KB Aklan TM 13-Kelompok 1AdnanNo ratings yet

- Annual Results PresentationDocument25 pagesAnnual Results PresentationManik VermaNo ratings yet

- Intermediate Accounting II Chapter 17Document2 pagesIntermediate Accounting II Chapter 17izza zahratunnisaNo ratings yet

- Reclassification of Financial AssetsDocument30 pagesReclassification of Financial AssetsSheila Grace BajaNo ratings yet

- Akm 2Document10 pagesAkm 2Putu DenyNo ratings yet

- Test Bank Notes ReceivableDocument9 pagesTest Bank Notes ReceivableErrold john DulatreNo ratings yet

- A1C019118 Jurati Latihan7Document6 pagesA1C019118 Jurati Latihan7jurati100% (1)

- Chapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Document66 pagesChapter 20 - Effective Interest Method (Amortized Cost, FVOCI, FVPL)Never Letting GoNo ratings yet

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- Soal Debt InvestmentDocument5 pagesSoal Debt InvestmentKyle Kuro0% (1)

- Exercise 14Document11 pagesExercise 14dwitaNo ratings yet

- Tugas AKM 2 Proportional MetodeDocument3 pagesTugas AKM 2 Proportional MetodeSheny WulandariNo ratings yet

- Chapter 8 Leases Part 2Document9 pagesChapter 8 Leases Part 2Thalia Rhine AberteNo ratings yet

- Solutions Chapter 16Document7 pagesSolutions Chapter 16Kakin WanNo ratings yet

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- Module 5 Note Payable and Debt RestructureDocument15 pagesModule 5 Note Payable and Debt Restructuremmh100% (1)

- Chapter8 Note PayableDocument24 pagesChapter8 Note PayableKristine Joy Peñaredondo BazarNo ratings yet

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- ACY4001 Individual Assignment 2 SolutionsDocument7 pagesACY4001 Individual Assignment 2 SolutionsMorris LoNo ratings yet

- Pindi YulinarRosita - Chapter 15 IA 2Document10 pagesPindi YulinarRosita - Chapter 15 IA 2Pindi YulinarNo ratings yet

- Module 5-NOTE PAYABLE AND DEBT RESTRUCTUREDocument13 pagesModule 5-NOTE PAYABLE AND DEBT RESTRUCTUREJeanivyle Carmona100% (1)

- DateDocument2 pagesDateCamzz DumpNo ratings yet

- IAS 32 Compound Financial InstrumentsDocument19 pagesIAS 32 Compound Financial InstrumentsDiana KNo ratings yet

- Exercises Module 8 For UploadDocument16 pagesExercises Module 8 For UploadjpNo ratings yet

- Loans Receivable Origination FeesDocument15 pagesLoans Receivable Origination FeesTurksNo ratings yet

- Acctng FinalsDocument27 pagesAcctng FinalsErika Mae LegaspiNo ratings yet

- Fa 2 1Document8 pagesFa 2 1Quỳnh Anh NguyễnNo ratings yet

- Bài tập về nhà - Trang tính1Document3 pagesBài tập về nhà - Trang tính1namhua54No ratings yet

- Intermediate Accounting 2 Final ExamDocument35 pagesIntermediate Accounting 2 Final ExamJEFFERSON CUTE97% (32)

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Notes Payable and Debt Restructuring EssentialsDocument39 pagesNotes Payable and Debt Restructuring EssentialsJoshua Cabinas100% (1)

- Investments in Debt SecuritiesDocument34 pagesInvestments in Debt SecuritiesNobu NobuNo ratings yet

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- Chapter 18 PDFDocument2 pagesChapter 18 PDFkrygyztanNo ratings yet

- EASY ROUND INCOME TAXESDocument13 pagesEASY ROUND INCOME TAXESCamila Mae AlduezaNo ratings yet

- Pidilite Industries AnalysisDocument0 pagesPidilite Industries AnalysisAnitha Raja BNo ratings yet

- Exposure To Currency Risk, Definition and MeasurementDocument12 pagesExposure To Currency Risk, Definition and MeasurementGustavo Adolfo Leyva LópezNo ratings yet

- Liquidity Risk and FIs' ManagementDocument16 pagesLiquidity Risk and FIs' ManagementJose Anibal Insfran PelozoNo ratings yet

- AC78.6.2 Final Examinations Questions and Answers 1Document15 pagesAC78.6.2 Final Examinations Questions and Answers 1rheaNo ratings yet

- Forex MarketDocument102 pagesForex Marketbiker_ritesh100% (1)

- Form A Application FormDocument6 pagesForm A Application FormBoinzb TNo ratings yet

- Arbitrage Strategies ExplainedDocument26 pagesArbitrage Strategies ExplainedVeronica TabirtaNo ratings yet

- Manual For SOA Exam MLC.: Chapter 5. Life Annuities. Section 5.4. N-Year Certain AnnuitiesDocument10 pagesManual For SOA Exam MLC.: Chapter 5. Life Annuities. Section 5.4. N-Year Certain AnnuitiesadelNo ratings yet

- EBIT EPS AnalysisDocument17 pagesEBIT EPS AnalysisAditya GuptaNo ratings yet

- Must Have Investing Checklist FINAL PDFDocument2 pagesMust Have Investing Checklist FINAL PDFLao Quoc BuuNo ratings yet

- What Would Fisher SayDocument2 pagesWhat Would Fisher SayFeynman2014No ratings yet

- Ratio Analysis of BMWDocument16 pagesRatio Analysis of BMWRashidsarwar01No ratings yet

- Extra Practice Exam 2 SolutionsDocument9 pagesExtra Practice Exam 2 SolutionsSteve SmithNo ratings yet

- Introduction of Axis Bank (Modified)Document38 pagesIntroduction of Axis Bank (Modified)Ankit BadnikarNo ratings yet

- Entrep Mind Chapter 7Document4 pagesEntrep Mind Chapter 7Yeho ShuaNo ratings yet

- Corporate Finance Tutorial - Raising Capital GuideDocument2 pagesCorporate Finance Tutorial - Raising Capital GuideAmy LimnaNo ratings yet

- Chapter 12 Money and BankingDocument45 pagesChapter 12 Money and BankingAisha AroraNo ratings yet

- Green Infra Corporate InstrumentsDocument246 pagesGreen Infra Corporate InstrumentsSunny SinghNo ratings yet

- R.A. 7042 (Foreign Investments Act)Document5 pagesR.A. 7042 (Foreign Investments Act)Ya Ni TaNo ratings yet

- Preqin - Corp Investor - IndiaDocument21 pagesPreqin - Corp Investor - Indiasavan anvekarNo ratings yet

- Stock Market AnalysisDocument3 pagesStock Market AnalysisSanjay SainiNo ratings yet

- IFRS 9 Financial InstrumentsDocument38 pagesIFRS 9 Financial InstrumentsKiri chrisNo ratings yet

- Basic Financial Statements: Mcgraw-Hill/IrwinDocument39 pagesBasic Financial Statements: Mcgraw-Hill/IrwinxxmbetaNo ratings yet

- Eurex Euro-Swap Futures GuideDocument2 pagesEurex Euro-Swap Futures GuideMarco PoloNo ratings yet

- A. Preamble of The SyllabusDocument2 pagesA. Preamble of The SyllabussanjayNo ratings yet

- Infrastructure Investing - Interviews 101Document25 pagesInfrastructure Investing - Interviews 101mayorladNo ratings yet

- Eva Tree ModelDocument11 pagesEva Tree Modelwelcome2jungleNo ratings yet

- Chapter One: Book Building Method Problems and Its Implementation - 1Document18 pagesChapter One: Book Building Method Problems and Its Implementation - 1Zubayer HussainNo ratings yet

- Joka Bulls CaseDocument2 pagesJoka Bulls Caseshivam kumarNo ratings yet

- Relationship between Indian commodity and stock marketsDocument53 pagesRelationship between Indian commodity and stock marketssribalakarthik_21435No ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- How to Measure Anything: Finding the Value of Intangibles in BusinessFrom EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)