Professional Documents

Culture Documents

Date

Uploaded by

Camzz Dump0 ratings0% found this document useful (0 votes)

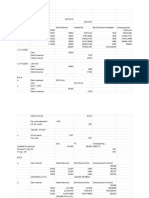

17 views2 pagesThe document contains information about accounting for bonds. It provides details of interest received, interest income, discount amortization, and carrying amounts for bonds measured at fair value through other comprehensive income (FVOCI) and amortized cost over multiple periods. For the FVOCI bond, it also includes the market value in 2019 and 2020, calculation of unrealized gains/losses, and journal entries. For the amortized cost bond, it shows the calculation of interest at 12% of the face value of $5 million over several years.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains information about accounting for bonds. It provides details of interest received, interest income, discount amortization, and carrying amounts for bonds measured at fair value through other comprehensive income (FVOCI) and amortized cost over multiple periods. For the FVOCI bond, it also includes the market value in 2019 and 2020, calculation of unrealized gains/losses, and journal entries. For the amortized cost bond, it shows the calculation of interest at 12% of the face value of $5 million over several years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

17 views2 pagesDate

Uploaded by

Camzz DumpThe document contains information about accounting for bonds. It provides details of interest received, interest income, discount amortization, and carrying amounts for bonds measured at fair value through other comprehensive income (FVOCI) and amortized cost over multiple periods. For the FVOCI bond, it also includes the market value in 2019 and 2020, calculation of unrealized gains/losses, and journal entries. For the amortized cost bond, it shows the calculation of interest at 12% of the face value of $5 million over several years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

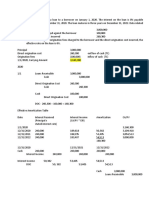

1.

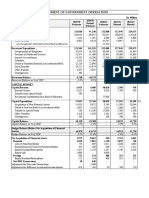

Date Interest received Interest income Discount Carrying amount

amortization

1/1/2019 4 562 000

12/31/2019 400 000 456 200 56 200 4 618 200

12/31/2020 400 000 461 820 61 820 4 680 020

12/31/2021 400 000 468 002 68 002 4 748 022

2.

Investment on bonds 946 000

Cash 946 000

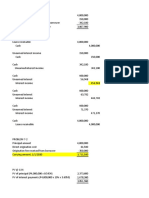

3.

Date Interest Interest income Discount Carrying amount

received amortization

1/1/2019 4 206 000

12/31/2019 400 000 336 480 63 520 4 142 480

12/31/2020 400 000 331 398 68 602 4 073 878

12/31/2021 400 000 326 122 73 878 4 000 000

Market value 12/31/2019 (4m x 95%) 3 800 000

Carrying amount 12/31/2019 4 142 480

Unrealized loss-2019 (342 480)

Market value /12/31/2020 (4m x 90%) 3 600 000

Carrying amount 12/31/2020 4 073 878

Cumulative unrealized loss (473 878)

Unrealized loss -2019 (342 480)

Increase in unrealized loss – 2020 131 398

2019

Jan 1 Financial Asset – FVOCI 4 206 000

Cash 4 206 000

Dec. 31 Cash (4m x 10%) 400 000

Interest Income 400 000

Interest income 63 520

Financial asset – FVOCI 63 520

Unrealized loss – OCI 342 480

Financial asset 342 480

2020

Dec.31 Cash 400 000

Interest Income 400 000

Interest income 68 602

Financial asset – OCI 68 602

Unrealized loss – OCI 131 398

Financial asset 131 398

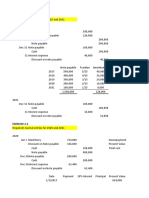

4. 5 000 000 x 12% = 600 000

5.

Date Interest Interest income Discount Carrying amount

received amortization

1/1/2019 5 380 000

12/31/2019 600 000 538 000 62 000 5 318 000

12/31/2020 600 000 531 800 68 200 5 249 800

12/31/2021 600 000 529 980 75 020 5 174 780

12/31/2022 600 000 517 478 82 522 5 092 258

Carrying amount – 12/31/2021 5 174 780

Face amount 5 000 000

Unamortized cost 174 780

You might also like

- 2019 Vol 1 CH 5 AnswersDocument21 pages2019 Vol 1 CH 5 AnswersArkhie Davocol80% (5)

- DOF Order No. 137-87Document3 pagesDOF Order No. 137-87Eleasar Banasen Pido0% (1)

- Audit of Long-Term Liabilities - SDocument6 pagesAudit of Long-Term Liabilities - SEva DagusNo ratings yet

- Loan Receivable ProblemsDocument6 pagesLoan Receivable ProblemsKathleen Frondozo100% (1)

- Case 3Document13 pagesCase 3Prezi Toli100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- HR Operations SpecialistDocument2 pagesHR Operations SpecialistMuhammad FarhanNo ratings yet

- Chapter 7 Loans ReceivableDocument12 pagesChapter 7 Loans ReceivableJohn Fraleigh Dagohoy Carillo100% (2)

- Actg6146 ReviewerDocument21 pagesActg6146 ReviewerRegine Vega100% (1)

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- Position Paper 3Document5 pagesPosition Paper 3Blythe Leyva100% (9)

- L4M1 Scope and Influence of Procurement and Supply Lesson PlanDocument50 pagesL4M1 Scope and Influence of Procurement and Supply Lesson PlanSelimur RashidNo ratings yet

- Loan ReceivableDocument10 pagesLoan ReceivableClyde SaladagaNo ratings yet

- Problem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueDocument11 pagesProblem 7-1 2019: Date Interest Received Interest Income Amortization Carrying ValueJane Carla GarbidaNo ratings yet

- Date Cash Flows Payments Interest Total Cash Flows PV of 1 at 6%Document4 pagesDate Cash Flows Payments Interest Total Cash Flows PV of 1 at 6%ambiNo ratings yet

- Acctng FinalsDocument27 pagesAcctng FinalsErika Mae LegaspiNo ratings yet

- Test Bank Answer NRDocument12 pagesTest Bank Answer NRErrold john DulatreNo ratings yet

- Problem 20-2 Requirement 1 Discount Carrying Date Interest Received Interest Income Amortization AmountDocument1 pageProblem 20-2 Requirement 1 Discount Carrying Date Interest Received Interest Income Amortization AmountVi VidNo ratings yet

- HW On Sinking Fund C Solutions and AnswersDocument5 pagesHW On Sinking Fund C Solutions and AnswersAmjad Rian MangondatoNo ratings yet

- PPE1&2Document3 pagesPPE1&2Kailah CalinogNo ratings yet

- Bài tập về nhà - Trang tính1Document3 pagesBài tập về nhà - Trang tính1namhua54No ratings yet

- Bài tập về nhà - Trang tính1Document4 pagesBài tập về nhà - Trang tính1namhua54No ratings yet

- Face Amount 5,000,000 Cost 4,562,000 Bond Discount 438,000Document2 pagesFace Amount 5,000,000 Cost 4,562,000 Bond Discount 438,000Tin BatacNo ratings yet

- FAR 1 Chapter - 6Document13 pagesFAR 1 Chapter - 6Klaus DoNo ratings yet

- Nasty Bank Date Debit Credit 2020Document18 pagesNasty Bank Date Debit Credit 2020AnonnNo ratings yet

- Receivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesDocument3 pagesReceivables Morning Star Corporation: I Will Manually Check Your Answer For Rounding Off DifferencesGlance BautistaNo ratings yet

- Assignment #3Document3 pagesAssignment #3Tricia Mae LuceroNo ratings yet

- Bonds Payable and Compound Financial InstrumentsDocument7 pagesBonds Payable and Compound Financial InstrumentsGina Bernardez del CastilloNo ratings yet

- Intermediate Accounting II Chapter 17Document2 pagesIntermediate Accounting II Chapter 17izza zahratunnisaNo ratings yet

- FM Must Do List!! May - 2023 (1) - 230501 - 220727Document86 pagesFM Must Do List!! May - 2023 (1) - 230501 - 220727Regan DcunhaNo ratings yet

- Vederinus Stefanus 86220 0Document9 pagesVederinus Stefanus 86220 0PdoneeverNo ratings yet

- Chapter 7Document18 pagesChapter 7Raven Vargas DayritNo ratings yet

- IA Chap7Document13 pagesIA Chap7Patrick Jayson VillademosaNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document16 pagesCambridge International AS & A Level: ACCOUNTING 9706/31waheeda17No ratings yet

- 2019 Vol 1 CH 5 AnswersDocument23 pages2019 Vol 1 CH 5 AnswersDummy Number 2No ratings yet

- Rima Uts - Pakm IIDocument97 pagesRima Uts - Pakm IIkaptenNo ratings yet

- Cherryl Febryan Christyanto - 202030225Document6 pagesCherryl Febryan Christyanto - 202030225Cherryl Febryan ChristyantoNo ratings yet

- IA2Document9 pagesIA2Claire BarbaNo ratings yet

- P76983 LCCI Level 3 Certificate in Financial Accounting ASE20097 RBDocument8 pagesP76983 LCCI Level 3 Certificate in Financial Accounting ASE20097 RBhlaingminnlatt149No ratings yet

- 07 Loan Receivable Section 2 PSDocument2 pages07 Loan Receivable Section 2 PSkyle mandaresioNo ratings yet

- Chapter 4-Book ExercisesDocument3 pagesChapter 4-Book ExercisesRita Angela DeLeonNo ratings yet

- Acctg Lab 7Document8 pagesAcctg Lab 7AngieNo ratings yet

- 07 Loan Receivable PSDocument6 pages07 Loan Receivable PSkyle mandaresioNo ratings yet

- SPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesDocument8 pagesSPREADSHEET APPLICATIONS - PEA 2021-2022 SESSION - Case StudiesOladapo Oluwakayode AbiodunNo ratings yet

- Audit of Liabilities SolManDocument3 pagesAudit of Liabilities SolManReyn Saplad PeralesNo ratings yet

- Annual Results PresentationDocument25 pagesAnnual Results PresentationManik VermaNo ratings yet

- Quiz 2 - Audit of Receivables SolutionDocument1 pageQuiz 2 - Audit of Receivables SolutionmillescaasiNo ratings yet

- Quiz Box 2 - QuestionnairesDocument13 pagesQuiz Box 2 - QuestionnairesCamila Mae AlduezaNo ratings yet

- Hy RFL 2019Document2 pagesHy RFL 2019anup dasNo ratings yet

- 21 Problems - and - Answers - Reclassification - of - Financial - AssetDocument30 pages21 Problems - and - Answers - Reclassification - of - Financial - AssetSheila Grace BajaNo ratings yet

- Cash Flow QuestionDocument2 pagesCash Flow QuestionomairNo ratings yet

- Pfa3163 Set G QPDocument5 pagesPfa3163 Set G QPNur hidayah putriNo ratings yet

- Prime Bank 1st ICB AMCL MF 31.12.2019 PDFDocument2 pagesPrime Bank 1st ICB AMCL MF 31.12.2019 PDFAbrar FaisalNo ratings yet

- Trading Securities and FA at FV Through OCI and FA at Amortized Cost (Prob 21-25)Document11 pagesTrading Securities and FA at FV Through OCI and FA at Amortized Cost (Prob 21-25)Lorence Patrick LapidezNo ratings yet

- Draft Nine Months AccountsDocument5 pagesDraft Nine Months AccountsHenry James NepomucenoNo ratings yet

- Date of Bonds Date of Issue Interest Payment Dates Marurity Face Value Nominal Rate Effective Interest RateDocument5 pagesDate of Bonds Date of Issue Interest Payment Dates Marurity Face Value Nominal Rate Effective Interest RateJa RedNo ratings yet

- Statement of Government Operations: O/w Exceptional Contribution From Bank of Mauritius 33,000Document2 pagesStatement of Government Operations: O/w Exceptional Contribution From Bank of Mauritius 33,000Yashas SridatNo ratings yet

- Problem 7-5Document2 pagesProblem 7-5Micah April SabularseNo ratings yet

- Page 4Document1 pagePage 4Ekushey TelevisionNo ratings yet

- Financial Statement RevisonDocument4 pagesFinancial Statement RevisonZaara AshfaqNo ratings yet

- Psaf Revision Day 3 May 2023Document8 pagesPsaf Revision Day 3 May 2023Esther AkpanNo ratings yet

- Date Payment Interest Principal Present Value: Table of AmortizationDocument6 pagesDate Payment Interest Principal Present Value: Table of AmortizationJekoeNo ratings yet

- CC 0742 - 2031 AnnuityDocument1 pageCC 0742 - 2031 AnnuityterrygohNo ratings yet

- ACC2002 Practice 2Document8 pagesACC2002 Practice 2Đan LêNo ratings yet

- MaDocument1 pageMaCamzz DumpNo ratings yet

- Speak Up Y2Document1 pageSpeak Up Y2Camzz DumpNo ratings yet

- Speak Up 3Document3 pagesSpeak Up 3Camzz DumpNo ratings yet

- Speak UpDocument1 pageSpeak UpCamzz DumpNo ratings yet

- Accounting SeedDocument4 pagesAccounting SeedCamzz DumpNo ratings yet

- Emily in ParisDocument2 pagesEmily in ParisCamzz DumpNo ratings yet

- Theory Is A Supposition or A System of Ideas Intended To Explain SomethingDocument4 pagesTheory Is A Supposition or A System of Ideas Intended To Explain SomethingCamzz DumpNo ratings yet

- Trade Lifecycle Management With TIBCO Business Events and TIBCO IprocessDocument27 pagesTrade Lifecycle Management With TIBCO Business Events and TIBCO IprocessAnil KumarNo ratings yet

- Sohar University Faculty of Business International Business (BUBS4402)Document8 pagesSohar University Faculty of Business International Business (BUBS4402)AmalNo ratings yet

- Honeywell Automation India LTDDocument19 pagesHoneywell Automation India LTDManish BuxiNo ratings yet

- MD-L2-Various FormsDocument21 pagesMD-L2-Various FormsSonia CamposanoNo ratings yet

- Uniform Certified Public Accountant Examinations May 1957 To Nov PDFDocument191 pagesUniform Certified Public Accountant Examinations May 1957 To Nov PDFSweet EmmeNo ratings yet

- WSP Indonesia WSS Turning Finance Into Service For The FutureDocument88 pagesWSP Indonesia WSS Turning Finance Into Service For The FutureLutfi LailaNo ratings yet

- Valuation Concepts and MethodsDocument5 pagesValuation Concepts and MethodsCessna Nicole MojicaNo ratings yet

- Study On Financial Report of Emami and Calculation of RatiosDocument30 pagesStudy On Financial Report of Emami and Calculation of RatiosanupsharmahrmNo ratings yet

- EO 179 On The Coco Levy FundsDocument5 pagesEO 179 On The Coco Levy FundsImperator FuriosaNo ratings yet

- Group Annual Report 2020Document260 pagesGroup Annual Report 2020Prysmian GroupNo ratings yet

- 2010 A Definition and Valuation of The UK Offsite Construction SectorDocument14 pages2010 A Definition and Valuation of The UK Offsite Construction SectormabuhamdNo ratings yet

- Chapter 1 4Document58 pagesChapter 1 4Jessica CortesNo ratings yet

- Chanda D. Kochhar: Executive ProfileDocument5 pagesChanda D. Kochhar: Executive ProfileRahul PandeyNo ratings yet

- Background: Power of Attorney & InstructionsDocument5 pagesBackground: Power of Attorney & InstructionsPrakash Chandra TripathyNo ratings yet

- Module 8 SLM PLACE AND PROMOTIONDocument8 pagesModule 8 SLM PLACE AND PROMOTIONRealyn MatandacNo ratings yet

- The Wasatch Front Green Infrastructure PlanDocument12 pagesThe Wasatch Front Green Infrastructure PlanRick LeBrasseurNo ratings yet

- Rosy Project Final LatDocument85 pagesRosy Project Final LatDebasis SahooNo ratings yet

- How To Describe A Line GraphDocument28 pagesHow To Describe A Line GraphMANDEEP100% (1)

- E-Magazine of The Department of MHRM, IISWBM - November 09Document21 pagesE-Magazine of The Department of MHRM, IISWBM - November 09E magazine of department of MHRM,IISWBM100% (1)

- Direct Product ProfitabilityDocument8 pagesDirect Product ProfitabilityPramod Geddam RobinsonNo ratings yet

- Previous and Present Compliance Situation of RMGDocument24 pagesPrevious and Present Compliance Situation of RMGMamia PoushiNo ratings yet

- Nikko - Contract Performance AnalystDocument1 pageNikko - Contract Performance AnalystLee Yi WeiNo ratings yet

- 01 - Ishares 7-10 Year Treasury Bond FundDocument0 pages01 - Ishares 7-10 Year Treasury Bond FundRoberto PerezNo ratings yet

- Technical Analysis Explained PDF Book Secrets of TradingDocument10 pagesTechnical Analysis Explained PDF Book Secrets of TradingMadhan KannanNo ratings yet

- Accounting For LeasesDocument25 pagesAccounting For LeasesAnna Lin100% (1)