Professional Documents

Culture Documents

Vinfast Electric Motor Showroom and Warehouse Project in Thailand NPV Analysis

Uploaded by

Đoan ThụcOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vinfast Electric Motor Showroom and Warehouse Project in Thailand NPV Analysis

Uploaded by

Đoan ThụcCopyright:

Available Formats

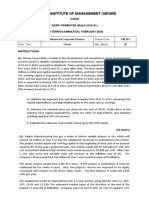

Question 1 (8 mark): The Vinfast Electric moto company currently wants to

build a showroom branch and business warehouse in Thailand. Use the following

information to evaluate the project.

- Initial investment capital for showroom & warehouse is 3,000,000 Bath, one

time payment, and need to add about 100,000,000 Bath as working capital to

import goods.

- Price, quantity demanded, and variable cost for the average of each exported

product and the exchange rate are estimated as follows

-. Price: (Bath): 30,000 Bath

- Product demand

Year 1: 2,000

Year 2: 2,100

Year 3: 2,200

- Cost of importing goods from Vietnam: 7,000,000 VND/product

- Fixed costs (eg office costs) are estimated at 1,000,000bath/year

- The branch uses working capital to support business operations. The company

intends to borrow from a bank in Thailand for X% of working capital , mortgaged

with the same goods, with an interest rate of 12%/year (excluding tax) (X is the

two digit of your SV code) . Loan capital is paid annually, principal payment will

be paid at the end of year 3.

The Thai governments apply 25% corporate tax and a 10% profit transfer tax

(No other taxes). All funds collected by the branch can be transferred to the

parent company at the end of the year.

- The current exchange rate of Bath is 500VND/bath.

- Showroom will depreciate over 3 years using the straight-line method.

- The project will end after 3 years. The company will then decide to invest

further or not if it achieves a positive NPV. The required profit of the project is

20%/year.

a. Determine the NPV of this project? Clearly show how to calculate by excel file,

then note the result here. (2mark)

b. If inflation is 10%/year, how is the NPV of the project? Assume that Inflation

affects both cost & price, but not interest rate. (1 mark)

c. In the bad scenario, the sale is just a half of expection. The working capital,

therefore, is half too. What happens with NPV? (1 mark)

Note: For a,b,c Excel file should have name & ID at the top, and transfer to

pdf/word , then submitted to Msteam , clearly name as follow”

“studentID_Fullname.pdf”,

d. Assuming the company expects the exchange rate to fluctuate according to a

normal distribution, the fluctuation range of the VND/bath exchange rate is 0.1

%/month. With 99% confidence, what is the company's maximum loss in the

first year (1 mark)? How much VAR for the whole project? (1 mark) (Assuming

that the company only pay COGS at the beginning of each year and collects money

at the end of each year).

e. Assume that Vinfast needs to import from all the COGS through export

contract, and each product sold at (~7,000,000 VND) and receive payment in the

end of each year. The exchange rate is fluctute 0.1%/month . In the worst case

(99% confident) can Vinfast uses MM market to hedge the transaction risk for

this contract in the first year, and is it effective? (assume that the interest rate of

VND is only 6%) (1 mark)

f. If the exchange rate is unchanged throughout 3 years, and Vinfast shareholders

require a profit margin for the project of 40% or more. Should the company

invest? If investing, the company should borrow at least how much % of capital.

(Assuming the company can borrow up to 95% of working capital, the loan ratio

does not affect the investor's required rate, but limits borrowing) (1 marks)

Question 2. Please analyse an MNC company working in Vietnam (Samsung,

Big4, Starbuck, Google, Unilever, Capitaland….) , considering the following:

a. the country risk (1 mark),

b. Agency problem (1 mark)

Keep the answer short, bullet and simple.

You might also like

- Assignment 1Document2 pagesAssignment 1Babar Ali Roomi0% (1)

- Adds Math Project 2010 (Tugasan 3)Document5 pagesAdds Math Project 2010 (Tugasan 3)Aaron Lai Chin ChenNo ratings yet

- Group Assignment Fm2 A112Document15 pagesGroup Assignment Fm2 A112Ho-Ly Victor67% (3)

- Financial Management AssignmentDocument2 pagesFinancial Management AssignmentYared AddiseNo ratings yet

- 440 Mid 1_Fall 2020Document21 pages440 Mid 1_Fall 2020tanvir.ahammad01688No ratings yet

- Soal Uas MK Gasal 2021-2022 KkiDocument6 pagesSoal Uas MK Gasal 2021-2022 KkiRifqi RinaldiNo ratings yet

- Post - AF3313 - Sem 1 Midterm 2015-16Document9 pagesPost - AF3313 - Sem 1 Midterm 2015-16siuyinxddNo ratings yet

- Engineering Economy Problems SolvedDocument11 pagesEngineering Economy Problems SolvedfrankRACENo ratings yet

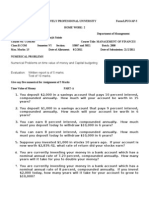

- Jaipuria Institute of Management, Indore: PGDM THIRD TRIMESTER (Batch 2019-21) Mid Term Examination, February-2020Document2 pagesJaipuria Institute of Management, Indore: PGDM THIRD TRIMESTER (Batch 2019-21) Mid Term Examination, February-2020RAVI JAISWANI Student, Jaipuria IndoreNo ratings yet

- Business Finance AssignmentDocument3 pagesBusiness Finance Assignmentk_Dashy8465No ratings yet

- HW 2Document3 pagesHW 2Love MittalNo ratings yet

- Proj Fin Quest Paper 1Document2 pagesProj Fin Quest Paper 1Sunil PeerojiNo ratings yet

- INDE PreviousDocument4 pagesINDE PreviousOrangeNo ratings yet

- Problem Set 04 - Introduction To Excel Financial FunctionsDocument3 pagesProblem Set 04 - Introduction To Excel Financial Functionsasdf0% (1)

- Time Value and Capital BudgetingDocument9 pagesTime Value and Capital BudgetingaskdgasNo ratings yet

- PRQZ 2Document31 pagesPRQZ 2Yashrajsing LuckkanaNo ratings yet

- Assignment 1 2015Document2 pagesAssignment 1 2015marryam nawazNo ratings yet

- Đề thi cuối kìDocument3 pagesĐề thi cuối kìHoàng HuyNo ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- Financial Analysis Authentic AssessmentDocument5 pagesFinancial Analysis Authentic AssessmentZubairLiaqatNo ratings yet

- QP March2012 p1Document20 pagesQP March2012 p1Dhanushka Rajapaksha100% (1)

- MS 291 - Assignment 1 MUDocument3 pagesMS 291 - Assignment 1 MUM HarisNo ratings yet

- 14-EC-1 - Version Anglaise - Novembre 2014Document6 pages14-EC-1 - Version Anglaise - Novembre 2014LuisAranaNo ratings yet

- Unit 2 - Problem 1Document1 pageUnit 2 - Problem 1Ivana BalijaNo ratings yet

- ProblemSet Cash Flow Estimation QA1Document13 pagesProblemSet Cash Flow Estimation QA1Ing Hong0% (1)

- Tutorial 3 For FM-IDocument5 pagesTutorial 3 For FM-IarishthegreatNo ratings yet

- AUBG Midterm Exam 2 Solutions GuideDocument15 pagesAUBG Midterm Exam 2 Solutions GuideCyn SyjucoNo ratings yet

- Du An 2 - EnglishDocument2 pagesDu An 2 - English6fxg774ggfNo ratings yet

- Chapter 1 - Updated-1 PDFDocument29 pagesChapter 1 - Updated-1 PDFj000diNo ratings yet

- Corporate Valuation NumericalsDocument47 pagesCorporate Valuation Numericalspasler9929No ratings yet

- p1 Managerial Finance August 2017Document24 pagesp1 Managerial Finance August 2017ghulam murtazaNo ratings yet

- Corporate Finance Problem Set NPV AnalysisDocument3 pagesCorporate Finance Problem Set NPV AnalysisWuhao KoNo ratings yet

- Corporate Financial Management I: SBS - BA Dual Program: BBA - BFDocument4 pagesCorporate Financial Management I: SBS - BA Dual Program: BBA - BFDanik El ZuniNo ratings yet

- Chapter 1 - CompleteDocument27 pagesChapter 1 - Completemohsin razaNo ratings yet

- Mini Cases FMDocument3 pagesMini Cases FMAishwaryaNo ratings yet

- Excel - Project Exercise 1 (4)Document11 pagesExcel - Project Exercise 1 (4)thaithanh.tdhtNo ratings yet

- 2.BMMF5103 - EQ Formattedl May 2012Document7 pages2.BMMF5103 - EQ Formattedl May 2012thaingtNo ratings yet

- Assignment Practice ProblemsDocument5 pagesAssignment Practice ProblemsibrahimmoizNo ratings yet

- Tutorial Sheet 2Document2 pagesTutorial Sheet 2siamesamuel229No ratings yet

- CE1 Exercises - 2020Document6 pagesCE1 Exercises - 2020Vũ KhangNo ratings yet

- FIN 514 Financial Management: Spring 2021 InstructionsDocument4 pagesFIN 514 Financial Management: Spring 2021 InstructionsAkash KarNo ratings yet

- Mba026 Corporate Finance - 895727188Document2 pagesMba026 Corporate Finance - 895727188Bhupendra SoniNo ratings yet

- MFE 10 - Project Planning and AppraisalDocument4 pagesMFE 10 - Project Planning and AppraisalKushan Chanaka AmarasingheNo ratings yet

- PRQZ 2Document26 pagesPRQZ 2Hoa Long ĐởmNo ratings yet

- Financial Budgeting Report: 1. Business OverviewDocument9 pagesFinancial Budgeting Report: 1. Business OverviewPhạm DungNo ratings yet

- Financial Budgeting Report SummaryDocument9 pagesFinancial Budgeting Report SummaryPhạm DungNo ratings yet

- Calculate compound interest amounts and ratesDocument16 pagesCalculate compound interest amounts and ratesOdysseYNo ratings yet

- TVM Practice QuestionsDocument10 pagesTVM Practice QuestionsSalvador RiestraNo ratings yet

- Ch4 ApplicationDocument4 pagesCh4 ApplicationMUSTAFANo ratings yet

- Chapter 2 ExercisesDocument13 pagesChapter 2 ExercisesKiều PhươngNo ratings yet

- Du An 2 - EnglishDocument3 pagesDu An 2 - EnglishHoàng Phương ThảoNo ratings yet

- Assignment 2 EEPCDocument2 pagesAssignment 2 EEPCMuizzuddin SalehNo ratings yet

- solution-CEL 779 Abid HasanDocument36 pagessolution-CEL 779 Abid HasanM M100% (2)

- Solution Cel 779 Abid Hasan CompressDocument36 pagesSolution Cel 779 Abid Hasan CompresscricketloversiitNo ratings yet

- Chapter 2: The Present ValueDocument4 pagesChapter 2: The Present ValueVân ĂnggNo ratings yet

- Assess Smart TV InvestmentDocument3 pagesAssess Smart TV InvestmentArka Narayan DashguptaNo ratings yet

- C1 D1 Doc Tech 1Document3 pagesC1 D1 Doc Tech 1Ganesh AnandNo ratings yet

- Chapter one cash flow worksheetDocument3 pagesChapter one cash flow worksheetrobel popNo ratings yet

- Chapter 5 - Profitability Analysis - SVDocument39 pagesChapter 5 - Profitability Analysis - SVĐoan Thục100% (1)

- Chuyển Slide: 1. The definitionDocument10 pagesChuyển Slide: 1. The definitionĐoan ThụcNo ratings yet

- Final Exam Questions Tacn - Business Contract Mock Test 1: Paper No.Document2 pagesFinal Exam Questions Tacn - Business Contract Mock Test 1: Paper No.Đoan ThụcNo ratings yet

- Bài giải NN6 ADJUSTEDDocument106 pagesBài giải NN6 ADJUSTEDĐoan ThụcNo ratings yet

- FOREIGN TRADE MID-TERM TEST QUESTIONSDocument7 pagesFOREIGN TRADE MID-TERM TEST QUESTIONSĐoan ThụcNo ratings yet

- Potensi Pengembangan Rute Bandara PaluDocument12 pagesPotensi Pengembangan Rute Bandara PaluErie TambnNo ratings yet

- Principle of MarketingDocument108 pagesPrinciple of Marketingvanshak singlaNo ratings yet

- Ch2.1. Optimal ChoiceDocument92 pagesCh2.1. Optimal ChoiceNguyễn Thị Anh ĐàiNo ratings yet

- Husteel Industry Group project reference documentDocument5 pagesHusteel Industry Group project reference document袁袁No ratings yet

- Detailstatement - 27 9 2021@14 15 21Document18 pagesDetailstatement - 27 9 2021@14 15 21Kshitija BirjeNo ratings yet

- CASE KelloggsDocument3 pagesCASE KelloggsJuan Jose KardonaNo ratings yet

- Chapter 13 Section 1: The Growth of Industrial ProsperityDocument9 pagesChapter 13 Section 1: The Growth of Industrial ProsperityJacori LandrumNo ratings yet

- Islamic Participative Financial Intermediation and Economic GrowthDocument17 pagesIslamic Participative Financial Intermediation and Economic GrowthAmNo ratings yet

- 11th Commerce 3 Marks Study Material English MediumDocument21 pages11th Commerce 3 Marks Study Material English MediumGANAPATHY.SNo ratings yet

- (Routledge Explorations in Economic History) Helen Paul - The South Sea Bubble - An Economic History of Its Origins and Consequences (2010, Routledge) PDFDocument176 pages(Routledge Explorations in Economic History) Helen Paul - The South Sea Bubble - An Economic History of Its Origins and Consequences (2010, Routledge) PDFАрсен ТирчикNo ratings yet

- Foreign Trade Multiplier: Meaning, Effects and CriticismsDocument6 pagesForeign Trade Multiplier: Meaning, Effects and CriticismsDONALD DHASNo ratings yet

- 3D Printing FDI International TradeDocument19 pages3D Printing FDI International TradeSumant AlagawadiNo ratings yet

- Important Weekly Current Affairs PDF 7 To 13 JuneDocument20 pagesImportant Weekly Current Affairs PDF 7 To 13 Junerajeshraj0112No ratings yet

- Gujarat Post Office DetailsDocument188 pagesGujarat Post Office DetailsRishi WadhwaniNo ratings yet

- Gopal Major Project Phase 1Document15 pagesGopal Major Project Phase 1shaik adilNo ratings yet

- CV Nata TERBARUDocument6 pagesCV Nata TERBARUArif L Khafidhi100% (1)

- Billing Report - 02-17-23Document13 pagesBilling Report - 02-17-23Wilman FigueroaNo ratings yet

- Engineering Economy: Replacement & RetentionDocument13 pagesEngineering Economy: Replacement & RetentiononatbrossNo ratings yet

- Principles of Economics Chapter 20Document26 pagesPrinciples of Economics Chapter 20rishisriram04No ratings yet

- Site Report Check ListDocument4 pagesSite Report Check ListShureendran Muniandy RajanNo ratings yet

- FM Jack Tar Case StudyDocument2 pagesFM Jack Tar Case StudyjanelleNo ratings yet

- Ip ProjectDocument11 pagesIp ProjectDhruvNo ratings yet

- KTN 55 Communication MatrixDocument18 pagesKTN 55 Communication MatrixHugo PimentaNo ratings yet

- A. R. Leen and M. C. Huang - How A Free Market System Resulted in Hegemony and A Magnificant Era - The Case of Nobunga Oda, 16th Century, JapanDocument13 pagesA. R. Leen and M. C. Huang - How A Free Market System Resulted in Hegemony and A Magnificant Era - The Case of Nobunga Oda, 16th Century, JapanTeukuRezaFadeliNo ratings yet

- RBI Keeps Key Policy Rates On HoldDocument15 pagesRBI Keeps Key Policy Rates On HoldNDTVNo ratings yet

- Partnership Dissolution 1of 2 PDFDocument2 pagesPartnership Dissolution 1of 2 PDFAngelo VilladoresNo ratings yet

- Acctg122 - Chapter 1Document25 pagesAcctg122 - Chapter 1Ice James Pachano0% (1)

- Crypto Signal Date Target To Buy 1st Target 2nd Target Price Done (Date) Price Trading Flat FormDocument10 pagesCrypto Signal Date Target To Buy 1st Target 2nd Target Price Done (Date) Price Trading Flat FormDinuka ChathurangaNo ratings yet

- Qualitative Characteristics of Financial Reporting: An Evaluation According To The Albanian Users' PerceptionDocument13 pagesQualitative Characteristics of Financial Reporting: An Evaluation According To The Albanian Users' PerceptionCatherine LorentonNo ratings yet

- Relationship Between Residential Status and Incidence of TaxDocument5 pagesRelationship Between Residential Status and Incidence of Taxsuyash dugarNo ratings yet