Professional Documents

Culture Documents

Illustration

Uploaded by

NeelamegamBalaji JeyaramanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration

Uploaded by

NeelamegamBalaji JeyaramanCopyright:

Available Formats

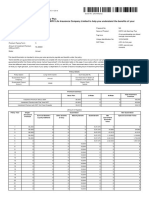

18-01-2020

Quote No : q9xui1l6vvyke

Benefit Illustration for HDFC Life Sanchay Plus

This Illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Sanchay Plus

DETAILS

Name of the Prospect/Policyholder: Mr Neelamegam Balaji Proposal No: NA

Age: 30 Name of Product: HDFC Life Sanchay Plus

A non-participating non-linked savings

Name of Life Assured: Mr Neelamegam Balaji Tag Line:

insurance plan

Age: 30 Unique Identification No: 101N134V03

Policy Term: 11 GST Rate: 4.5% for first year

2.25% second year

Premium Paying Term: 10

onwards

Amount of Instalment Premium

Rs.50000

(Without GST):

Mode: Annual

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

"Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers

guaranteed benefits then these will be clearly marked "guaranteed" in the illustration table on this page. If your policy offers variable benefits then the illustrations on this page will

show two different rates of assumed future investment returns, of 8% p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits

of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance."

Policy Details

Policy Option Long Term Income Sum Assured Rs. 625000

Guaranteed Payout Sum Assured on Death (at

Annual 625000

Freqency inception of the policy) Rs.

Guaranteed Payout Payout Term

46750 25

Amount (years)

Premium Summary

Total Instalment

Base Plan CI Rider IB Rider

Premium

Instalment Premium without GST 50,000 0 0 50,000

Instalment Premium with First Year GST 52,250 0 0 52,250

Instalment Premium with GST 2nd Year Onwards 51,125 0 0 51,125

(Amount in Rupees)

Policy Year Single/ Guaranteed Non Guaranteed

Annualized

Survival Benefits / Other benefits Maturity Benefit Death Benefit Min Special Surrender Value

Premium

Loyalty Additions (if any) Guaranteed

Surrender

Value

1 50,000 0 0 0 6,25,000 0 0

2 50,000 0 0 0 6,25,000 30,000 30,000

3 50,000 0 0 0 6,25,000 52,500 52,500

4 50,000 0 0 0 6,25,000 1,00,000 1,00,000

5 50,000 0 0 0 6,25,000 1,25,000 1,37,197

6 50,000 0 0 0 6,25,000 1,50,000 1,79,865

7 50,000 0 0 0 6,25,000 1,75,000 2,29,252

8 50,000 0 0 0 6,25,000 3,00,000 2,86,237

9 50,000 0 0 0 6,25,000 3,37,500 3,51,806

10 50,000 0 0 0 6,60,339 4,50,000 4,27,052

11 0 0 0 0 6,93,356 4,50,000 4,66,551

12 0 0 0 46,750 0 0 0

13 0 0 0 46,750 0 0 0

14 0 0 0 46,750 0 0 0

15 0 0 0 46,750 0 0 0

16 0 0 0 46,750 0 0 0

17 0 0 0 46,750 0 0 0

18 0 0 0 46,750 0 0 0

19 0 0 0 46,750 0 0 0

20 0 0 0 46,750 0 0 0

21 0 0 0 46,750 0 0 0

22 0 0 0 46,750 0 0 0

23 0 0 0 46,750 0 0 0

24 0 0 0 46,750 0 0 0

25 0 0 0 46,750 0 0 0

26 0 0 0 46,750 0 0 0

27 0 0 0 46,750 0 0 0

28 0 0 0 46,750 0 0 0

29 0 0 0 46,750 0 0 0

30 0 0 0 46,750 0 0 0

31 0 0 0 46,750 0 0 0

32 0 0 0 46,750 0 0 0

33 0 0 0 46,750 0 0 0

34 0 0 0 46,750 0 0 0

35 0 0 0 46,750 0 0 0

36 0 0 0 5,46,750 0 0 0

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods & Service Tax.

I , have explained the premiums charges and benefits under the product fully to the I Mr Neelamegam Balaji ,having received the information with respect to the above,

prospect / policy holder. have understood the above statement before entering into the contract.

Place:

Date: Signature of Agent /Intermediary / Official Date: Signature of Prospect / Policyholder

Note: Kindly note that name of the company has changed from "HDFC Standard Life Insurance Company Limited" to "HDFC Life Insurance Company Limited".

You might also like

- IllustrationDocument2 pagesIllustrationVivek SinghalNo ratings yet

- Illustration - 2022-12-21T143227.841Document2 pagesIllustration - 2022-12-21T143227.841Ashher UsmaniNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- IllustrationDocument2 pagesIllustrationamitkumar.nayek28101989No ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- IllustrationDocument2 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- Illustration Qatkwl5gp3chlDocument2 pagesIllustration Qatkwl5gp3chlRahul DipaliNo ratings yet

- Illustration 990Document2 pagesIllustration 990prachididwania13No ratings yet

- Sanchy Plus - Long Term Income 1 LDocument2 pagesSanchy Plus - Long Term Income 1 LVen NatNo ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- Illustration Qc0n0t6y4j58fDocument3 pagesIllustration Qc0n0t6y4j58fNavneet PandeyNo ratings yet

- IllustrationDocument2 pagesIllustrationKiran NNo ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- IllustrationDocument2 pagesIllustrationCHANDRAKANT RANANo ratings yet

- IllustrationDocument2 pagesIllustrationNeerja M GuhathakurtaNo ratings yet

- IllustrationDocument2 pagesIllustrationRajnandan shindeNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- Wa0007.Document2 pagesWa0007.Shashikumar RajkumarNo ratings yet

- Illustration - 2022-08-26T182737.117Document2 pagesIllustration - 2022-08-26T182737.117Soumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- IllustrationDocument2 pagesIllustrationashverya agrawalNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- IllustrationDocument2 pagesIllustrationvishnuNo ratings yet

- Illustration - 2024-01-04T213945.722Document2 pagesIllustration - 2024-01-04T213945.722Rishavdar ClassNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- IllustrationDocument2 pagesIllustrationSoumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationvishnuNo ratings yet

- Illustration - 2022-03-17T111744.362Document2 pagesIllustration - 2022-03-17T111744.362shubham gaundNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- Illustration 5Document2 pagesIllustration 5Phanindra GaddeNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- Illustration - 2022-08-26T182831.858Document2 pagesIllustration - 2022-08-26T182831.858Soumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationAshfaq hussainNo ratings yet

- Illustration QbfadmdqynhjlDocument2 pagesIllustration QbfadmdqynhjlAkshay ChaudhryNo ratings yet

- IllustrationDocument2 pagesIllustrationShambhu RaulNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- IllustrationDocument2 pagesIllustrationbalaghatjobsNo ratings yet

- Illustration PDFDocument2 pagesIllustration PDFArvind HarikrishnanNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- Pending 1692863217 IllustrationDocument2 pagesPending 1692863217 IllustrationDishani MaityNo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- Benefit Illustration For HDFC Life Super Income PlanDocument2 pagesBenefit Illustration For HDFC Life Super Income PlanVamsi Krishna BNo ratings yet

- IllustrationDocument2 pagesIllustrationsukh37949No ratings yet

- How To Read and Understand This Benefit Illustration?: Proposal NoDocument2 pagesHow To Read and Understand This Benefit Illustration?: Proposal NoDINESH JYOTHINo ratings yet

- Illustration 4 PDFDocument2 pagesIllustration 4 PDFsusman paulNo ratings yet

- Illustration - 42Document2 pagesIllustration - 42arvindan ram hariNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument3 pagesIllustrationsukh37949No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlussarthakNo ratings yet

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionFrom EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionNo ratings yet

- Lumark Xtor Crosstour SpecDocument3 pagesLumark Xtor Crosstour SpecNeelamegamBalaji JeyaramanNo ratings yet

- KesavanDocument102 pagesKesavanNeelamegamBalaji JeyaramanNo ratings yet

- The Analysis of Bus Accidents With Traffic Safety in TNSTCDocument37 pagesThe Analysis of Bus Accidents With Traffic Safety in TNSTCNeelamegamBalaji JeyaramanNo ratings yet

- CV GokulDocument2 pagesCV GokulNeelamegamBalaji JeyaramanNo ratings yet

- Electrical Data: Busbar SystemDocument1 pageElectrical Data: Busbar SystemNeelamegamBalaji JeyaramanNo ratings yet

- Elec Ed 103Document1 pageElec Ed 103NeelamegamBalaji JeyaramanNo ratings yet

- Production Engg-1Document4 pagesProduction Engg-1NeelamegamBalaji JeyaramanNo ratings yet

- Ijert Ijert: Power Quality Enhancement by Using UPFCDocument4 pagesIjert Ijert: Power Quality Enhancement by Using UPFCNeelamegamBalaji JeyaramanNo ratings yet

- Production Engg-1Document4 pagesProduction Engg-1NeelamegamBalaji JeyaramanNo ratings yet

- Facts: Documentation For FACTS PlantsDocument44 pagesFacts: Documentation For FACTS PlantsNeelamegamBalaji JeyaramanNo ratings yet

- Power Quality Improvement Using Fuzzy Logic Controller Based Unified Power Ow Controller (UPFC)Document10 pagesPower Quality Improvement Using Fuzzy Logic Controller Based Unified Power Ow Controller (UPFC)NeelamegamBalaji JeyaramanNo ratings yet

- Unified Power Flow Controller For Power Quality Improvement: Vaibhav S Kale, Prashant R Patil, Ravi KhatriDocument4 pagesUnified Power Flow Controller For Power Quality Improvement: Vaibhav S Kale, Prashant R Patil, Ravi KhatriNeelamegamBalaji JeyaramanNo ratings yet

- Networks and Quality Improvement: International Journal For Quality Research December 2009Document10 pagesNetworks and Quality Improvement: International Journal For Quality Research December 2009NeelamegamBalaji JeyaramanNo ratings yet

- DBA 5036 - Entrepreniual FinanceDocument287 pagesDBA 5036 - Entrepreniual FinanceShrividhyaNo ratings yet

- An Analytical Study On Pradhan Mantri Mudra Yojana: Summer Project Report ONDocument45 pagesAn Analytical Study On Pradhan Mantri Mudra Yojana: Summer Project Report ONRavi Joshi100% (1)

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Money and CreditDocument14 pagesMoney and CreditRajau RajputanaNo ratings yet

- Reading 21 Financial Analysis TechniquesDocument74 pagesReading 21 Financial Analysis TechniquesNeerajNo ratings yet

- Savings Bank DepositsDocument12 pagesSavings Bank DepositsLeo SaimNo ratings yet

- Ipru Assignment-D3Document4 pagesIpru Assignment-D3Rishi RajNo ratings yet

- Networth Certificate: Sl. No. Source of Funds Indian Currency (INR) Foreign Currency (CAD) ReferenceDocument3 pagesNetworth Certificate: Sl. No. Source of Funds Indian Currency (INR) Foreign Currency (CAD) Referencesamraju1No ratings yet

- Red Flags in Financial AnalysisDocument15 pagesRed Flags in Financial AnalysisHedayatullah PashteenNo ratings yet

- Imt 41Document4 pagesImt 41Nothing786No ratings yet

- ADCB WBG TCs English Sep2017 - tcm9 103698Document70 pagesADCB WBG TCs English Sep2017 - tcm9 103698Pulsara RajarathneNo ratings yet

- Exam 3 February 2018, Questions and AnswersDocument6 pagesExam 3 February 2018, Questions and AnswersjohnNo ratings yet

- Answer: Unsecured, Nonpriority ClaimsDocument5 pagesAnswer: Unsecured, Nonpriority ClaimsEleonora VinessaNo ratings yet

- Wi Application FormDocument2 pagesWi Application Formippon_osotoNo ratings yet

- Vikas CVDocument2 pagesVikas CVlegalitis.inNo ratings yet

- Banking Law Anu AroraDocument765 pagesBanking Law Anu AroraГога100% (3)

- Marine Insurance Math Solution SheetDocument5 pagesMarine Insurance Math Solution SheetIshtiaq S Emon100% (1)

- Chase B Statement-MarDocument4 pagesChase B Statement-MarЮлия ПNo ratings yet

- List of Financing Companies As of 31 MayDocument14 pagesList of Financing Companies As of 31 MayFordNo ratings yet

- Chapter 1 - Basic Insurance Concepts and PrinciplesDocument9 pagesChapter 1 - Basic Insurance Concepts and Principlesale802No ratings yet

- PWC Report-StartupsDocument17 pagesPWC Report-StartupsDhirendra TripathiNo ratings yet

- Instructions For Using Texas Instruments BA II Plus CalculatorDocument3 pagesInstructions For Using Texas Instruments BA II Plus Calculatorsir bookkeeperNo ratings yet

- Company Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMDocument11 pagesCompany Alembic Pharmaceuticals LTD.: Name Deepankar Tiwari Roll No 24 Class Mba HCMAryan RajNo ratings yet

- Introduction To Asset Valuation and Discounting: Mathias SchmitDocument38 pagesIntroduction To Asset Valuation and Discounting: Mathias SchmitPhương Phan Thị LanNo ratings yet

- CHAPTER 2 Mechanics of Futures MarketsDocument3 pagesCHAPTER 2 Mechanics of Futures MarketsAishwarya RajeshNo ratings yet

- Adoption of NPS in Chennai Port AuthorityDocument25 pagesAdoption of NPS in Chennai Port AuthorityTHOR -No ratings yet

- Debt Securities - BondsDocument6 pagesDebt Securities - BondsStacy SmithNo ratings yet

- FMPR 2 - Lesson 1Document11 pagesFMPR 2 - Lesson 1jannypagalanNo ratings yet

- NGO (Grameen Bank)Document14 pagesNGO (Grameen Bank)aulad999No ratings yet

- Auditing Notes 1Document793 pagesAuditing Notes 1Luvo100% (4)