Professional Documents

Culture Documents

Adjustments

Uploaded by

Audrey Roland0 ratings0% found this document useful (0 votes)

5 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views2 pagesAdjustments

Uploaded by

Audrey RolandCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Expenses Expense transferred to P&L A/c = Expense Paid + Accrued Expense

Expense transferred to P&L A/c = Expense Paid - Prepaid Expense

Revenues Revenue transferred to P&L A/c = Revenue Paid + Accrued Revenue

Revenue transferred to P&L A/c = Revenue Paid - Prepaid Revenue

Found in Trial Balance Additional Notes

We add Accruals and Subtract Prepayments

1. Accruals and Prepayments in the Balance Sheet

Current Assets Current Liabilities

Prepaid Expenses Accrued Expenses

Accrued Revenues Prepaid Revenue

2. Bad Debts written off is an expense goes in the Profit and loss A/c

3. Provision for Bad Debts

Profit and loss A/c First year of Provision for Bad debts, use amount give in TPL and BS.

Increase in Provision for Bad Debts (Expense) record amount of the

increase. Use difference between previous and current year.

Decrease in Provision for Bad Debts (Revenue) record amount of the

decrease. Use difference between previous and current year.

Balance Sheet Current Assets (Debtors-Provision for Bad Debts) use the total Provision not

difference.

4. Depreciation

Profit and loss Account Expense (Amount for the year)

Balance Sheet Fixed Asset – Depreciation (Use Accumulated Amount)

Depreciation amount may be given or calculated.

Common Methods of Calculation

1. You may be given a percentage to calculate a percentage of the cost.

Straight Line Method

Depreciation= Cost-residual value or Cost

# of years ` # of years

***Note Same amount used each year.

Reducing Balance Method

Year1 Cost * Rate

Year 2 onwards

(Cost – previous Depreciation )* rate

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Lect. 5 Easements - Characteristics and AquisitionDocument23 pagesLect. 5 Easements - Characteristics and AquisitionAudrey RolandNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- POB - Lesson 5 - Cottage Industries Sizes of Organizations and MISDocument4 pagesPOB - Lesson 5 - Cottage Industries Sizes of Organizations and MISAudrey RolandNo ratings yet

- POB - Lesson 2 - Money Scarcity SpecializationDocument2 pagesPOB - Lesson 2 - Money Scarcity SpecializationAudrey RolandNo ratings yet

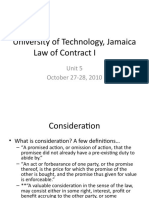

- Lect. 2.3.1 ConsiderationDocument11 pagesLect. 2.3.1 ConsiderationAudrey RolandNo ratings yet

- Queries: TH TH TH THDocument2 pagesQueries: TH TH TH THAudrey RolandNo ratings yet

- Digital Media BackgroundDocument5 pagesDigital Media BackgroundAudrey RolandNo ratings yet

- Digital MediaDocument9 pagesDigital MediaAudrey RolandNo ratings yet

- Information Technology Internal AssessmentDocument17 pagesInformation Technology Internal AssessmentAudrey RolandNo ratings yet