Professional Documents

Culture Documents

Auditing-I-Chapter Two

Uploaded by

mulunehCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Auditing-I-Chapter Two

Uploaded by

mulunehCopyright:

Available Formats

Madawalabu University, School of Business and Economics, Accounting Department Nov.

2010

CHAPTER TWO

PROFESSIONAL ETHICS

AND

LEGAL RESPONSIBILITIES AND LIABILITIES OF

AUDITORS

2.1 PROFESSIONAL ETHICS AND RULES OF PROFESSIONAL CONDUCT

INTRODUCTION

All recognized professions have recognized the importance of ethical behavior and have

developed codes of professional ethics. The fundamental purpose of such codes is to

provide members with guidelines for maintaining a profession attitude and conduct them

in a manner that will enhance the professional stature of their discipline. Our purpose in

this chapter is to discuss the nature of professional ethics, to present and discuss the

AICPA code professional conduct, and auditors’ legal liabilities and responsibilities

WHAT ARE ETHICS?

Ethics can be broadly defined as a set of moral principles or values. Each of us has such

set of values, even though we may or may not have considered them explicitly.

Philosophers, religious organizations, and other groups have defined in various ways

ideal sets of moral principles or values. Examples of prescribed sets of moral principles

or values at the implementation level include: laws and regulations, church doctrine,

codes of business ethics for professional groups like CPAs, and codes of conduct within

individual organizations.

It is common for people to differ in their moral principles and values and the relative

importance they attach to these principles. These differences reflect life experiences,

successes and failures, as well as the influences of parents, teachers, and friends.

Ethical Dilemmas- ethical dilemma is a situation that an individual faces involving a

decision about appropriate behavior. A simple example of an ethical dilemma is

presented below

Assume that a student at Madawalabu University finds a lost mobile in the University

compound while he is going to his auditing class. What action, if any, does the student

take to find the original owner?

Ethical dilemmas generally involve situations in which the welfare of one or more other

individuals is affected by the results of the decision. In the dilemma presented above, the

welfare of the original owner of the lost mobile is affected by the student’s decision.

Ethical dilemmas faced by auditors often have an effect on the welfare of a large member

of individuals or groups. For example, if an auditor made an unethical decision about the

content of an audit report, the welfare of thousands of investors, creditors and other

members of the society would be affected.

It is therefore essential for professions to have ethical and moral standards in addition to

other professional and technical standards so that the profession can provide quality

services that can properly address the interest and welfare of its users.

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 1

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

NEED FOR ETHICS IN AUDITING

Ethical behavior is necessary for a society to function in an orderly manner. It can be

argued that ethics is the glue that holds a society together. Imagine, for instance, what

would happen if couldn’t depend on the people we deal with to be honest. If parents,

teachers, employers, co-workers, and friends all consistently lied, it would be almost

impossible for effective communication to occur.

The public attaches a special meaning to the term professional. Professionals are

expected to conduct themselves at a higher level than most other members of society. For

example, when it is reported that a physician, clergyperson, or CPA has committed

crime, most people fell more disappointment than when the same thing happened by

people who are not labeled as professional.

The underlining reason for high level of professional conduct by any profession is the

need for public confidence in the quality of services provided by the profession,

regardless of the individual providing it. For the CPA, it is essential that the client and

external financial statements users have confidence in the quality of audits and other

assurance services. If the users of these services do not have confidence in professionals,

the need of the users for the services provided by professionals is diminished.

It is not practical for users to evaluate the quality of the performance of most professional

services because of the complexity. A patient cannot be expected to evaluate whether an

operation was properly performed or not. Similarly, a financial statements user cannot be

expected to evaluate audit performance. Most users have neither the competence nor the

time for such an evaluation. Public confidence in the quality of professional services is

enhanced when the profession encourages high standards of performances and conduct

on the part of all practitioners.

CPA firms have a different relationship with users of financial statements than most other

professionals have with the users of their services. Attorneys, for instance, are typically

engaged and paid by a client and have primary responsibility to be an advocate for that

client. CPA firms are engaged and paid by the company issuing the financial statements,

but the primary beneficiaries of the audit are the users of these financial statements.

Often, the auditor does not know or have contact with the statement users but has

frequent meetings and ongoing relationships with client personnel.

It is essential that users regard CPA firms as competent and unbiased. If users believe

that CPA firms do not perform a valuable service (reduce information risk), the value of

CPA firms’ audit and other attestation reports is reduced and the demand for audits will

thereby also be reduced. Therefore, there is considerable incentive for CPA firms to

conduct themselves at high professional level.

CHARACTERISTICS OF A PROFESSION

The development of audit as a profession is tied to the involvement of the importance of

independence in audit. Thus, this is the reason for naming professional auditing as

independent audit. All of the generally recognized professions such as auditing,

medicine, engineering, theology, architecture and the like are characterized by the

following elements/ features/.

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 2

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

a. Specialized body of knowledge- A highly developed profession has a very

highly specialized written body of knowledge. The body of knowledge is dynamic

and in continuous development and growth and not static. The body of knowledge

here goes far beyond general education knowledge. Always, there is need for

technical competence and familiarity with current/contemporary/ standards of

practice that might be embodied in the code of professional conducts.

b. Standards of qualification for admission- A profession to be a profession must

have well recognized and accepted predetermined criterion of qualification for

admission into the profession. The standards include educational requirements as

well as other moral and legal criteria fulfillment. The educational requirement is

composed of theoretical knowledge and practical experience. Thus, attaining a

license to practice as a certified public accountant requires an individuals or group

members, to meet minimum standards of education and experience.

c. Standards of conduct of behavior- A profession has a standard of conduct of

behavior to be observed by the professionals through prescribed code of ethics

that attempt to enforce general rules of conducts, and maximum and minimum

rules on competence and responsibility to client and colleagues.

d. Level of status recognition- The quality and level of professional services

demanded by society determines the level of status and recognition to the

profession. The level of status and recognitions earned in a society is a function of

the quality of professional services rendered which in turn is a function of the

standards of profession qualification and the degree of the social, moral, and legal

responsibility assumed. (They have direct relationship). Thus, careless work or

lack of integrity on part of any auditor(s) may lead the public to negative view

towards the entire profession. Accordingly, reasonable level of competence to

practice their service as required by standards and to give clients and the public an

assurance that the profession intends to maintain high standards and enforce

compliance by individual member broads the reputation of the profession.

e. Acceptance of social responsibility/ Responsibility to serve the public/ – A

professional to be a profession must accept responsibility for the consequence of

its action. Not only legal responsibilities which arises out of contractual

obligation, but also moral responsibility to the profession itself and to the society

at large. Accordingly, auditors are representatives of the public-creditors,

stockholders, consumers, employees, and others-in the financial reporting

process. The role of the independent auditors is to ensure that financial statements

are fair to all parties and not biased to benefit one group at the at the expense of

another. This responsibility to serve the public interest must be a basic motivation

for the professional.

Significance of professional ethics in accounting- Careless work or lack of integrity on

the part of any public auditor is a reflection upon the entire profession. Consequently, the

members of the public accounting profession / auditing profession/ have acted in unison

through the certain appropriate code of conduct such as the AICPA code of conduct. This

code provides practical guidance to the individual members in maintaining a professional

attitude. In addition, this code gives assurance to clients and to the public that the

profession intends to maintain high standards and to enforce compliance by individual

members.

Evidence that public accounting has achieved the status of a profession is found in the

willingness of its members to accept voluntarily standards of conduct more rigorous than

those imposed by law. These standards of conduct set forth the basic responsibilities of

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 3

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

auditors to the public, clients and fellow practitioners. To be effective, a body

professional ethics must be attainable and enforceable; it must be consists not merely of

abstract ideals but of attainable goals and practical working rules that can be enforced.

2.2 THE AICPA CODE OF PROFESSIONAL CONDUCT

The AICPA code of professional conduct is designed to provide a framework for

expanding professional services and responding to other changes in the profession, such

as the increasingly competitive environment.

The AICPA code of professional conduct consists of two sections. These are:

Section-1: Principles- is a goal oriented, positively stated discussion of the profession’s

responsibilities to the public, clients and fellow practitioners. It provides overall frame

work for the rules.

Section- 2: Rules- are enforceable applications of the principles. They define acceptable

behavior and identify sources of authority for performance standards.

Additional Interpretations-provide guidelines as to the scope and

guidance applications of rules to particular

issued by factual circumstances

AICPA Ethical Rulings-summarizes applications of rules and

interpretations to particular

factual circumstances

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 4

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

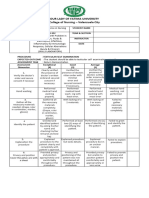

The relationships among the principles, Rules, interpretations and Ethical rulings is

summarized in the following figures

Principles-provide

overall frame

work for rules

Code of professional

Conduct

Rules- govern performance of

professional services

Interpretations-provide guideline as to

the scope and application of rule

Additional

Guidance Ethics rulings-summarize application of rules and

interpretations to particular factual

circumstance

Fig 2.1: AICPA professional Ethics

Section-I: Principles

These principles of AICPA express the profession’s recognition of its responsibilities to

the public to clients, and to colleges. They guide members in the performance of their

professional responsibilities and express the basic tenets of the ethical and professional

conduct. The principles call for an unlimited commitment to honorable behavior, even at

the sacrifice of personal advantages. These principles are explained below article by

article.

Article-I: Responsibilities

In carrying out their responsibilities as professionals, members should exercise

sensitive professional and moral judgments in all their activities.

Article-II: The public interest

Members should accept the obligation to act in a way that will serve the public

interest, honor the public trust and demonstrate commitment to professionalism

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 5

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

A distinguishing mark of a profession is acceptance of its responsibilities to the public.

The accounting profession’s public consists of clients, credit grantors, governments,

employers, investors, the business and financial community and others who rely on the

objectivity and integrity of certified public accountants to maintain the orderly

functioning of their business.

The public interest is thus defined as the collective well being of the community of

peoples and institutions the profession serves. Those who rely on certified public

accountants expect them to discharge their responsibilities with integrity, objectivity,

due professional, and a genuine interest in serving the public i.e. they are expected to

provide quality services, enter into fee arrangements, and offer a range of services- all in

a manner that demonstrates a level of professionalism consistent with these principles of

the code of professional conduct.

Article-III: Integrity1

To maintain and broaden public confidence, members should perform all professional

responsibilities with the highest sense of integrity, i.e. a member shall be free of conflict

of interest, and /or not deliberately misrepresent facts or subordinate his/ her judgments

to others.

Article-IV: Objectivity and independence

A member should maintain objectivity and be free of conflicts of interest in discharging

professional responsibilities. A member in public practice should be independent in fact

and appearance when providing auditing and other attestation services.

Article-V: Due professional care

A member should observe the professions technical and ethical standards, strive

continually to improve competence and the quality of services, and discharge

professional responsibilities to the best of the member’s ability.

Article-VI: Scope and Nature of services

A member in public practice should observe the scope and nature of services to be

provided.

Each of these principles should be considered by members in determining whether or

not to provide specific services in individual circumstances. As there is no hard- and-fast

rules that can be developed to help members reach these judgments, they must be sure

whether they are satisfied that they are meeting the spirit of the principles in this regards.

Section-II-Rules

Applicability-the bylaws of AICPA require that members adhere to the rules of the code

of professional conduct. Members must be prepared to justify departures from these

rules.

Rule -101: Independence

A member in public practice shall be independent in the performance of professional

services as required by standards promulgated by bodies designated by council.

Interpretation 101-1 of the code contains examples of transactions, interests, and

relationships that result in lack of independency during the period covered by financial

1

Be principled, honourable, upright, courageous, and do not be two-faced

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 6

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

statements, during the period of professional engagements, and / or at the time of

expressing opinion. These circumstances include the following:

1) If a member or member’s firm had or was committed to acquire any direct

financial interest such as investment in the client ( owning capital stock) and/

or acquire any material indirect financial interest (direct and indirect financial

interest)

2) If a member or member’s firm was a trustee of any trust or executor or

administer of any estate if such trust or estate, had or was committed to

acquire any direct or material indirect financial interest in the enterprise to be

audited.

Independency of partners and staff requires partners (or stockholders),

managerial employees and all professional staff be free from any interest of

the client enterprise. Thus, not all employees of an audit firm are required to

be independent.

3) If a member or member’s firm had any joint, closely held business investment

with the enterprise or with any officer, director, or principal stockholders

thereof that was material in relation to the member’s net worth, or to the net

worth of the member’s firm.

4) If a member or member’s firm had any loan to or from the enterprise or any

officer, director, or principal stockholders to the enterprise.

5) If a member or members firm was connected with the enterprise as promoter,

underwriter, or voting trustee, a director or officer or in any capacity

equivalent to that of a member of management or of an employee.

6) If a member or member’s firm was a trustee for any pension or profit-sharing

trust of the enterprise.

Lack of independency may also arise from financial interests that may result from past

employment relationship with the client, interest of a close relatives of an auditor such as

her or his spouse and dependents. Other situations that may impair independency of

auditor are past due fees, gifts from client, and client auditor or CPA litigation if any.

Two distinct ideas are involved in the concept of independency. These are:

1) Independence in fact- A CPA (auditor) must in fact be independent of any

enterprise for which they provide attestation services i.e. an auditor must be able

to maintain an objective and impartial mental attitude throughout the engagement.

2) Independent in appearance- The relationship between the CPAs and their client

must be such that the auditor will appear independent to third party i.e. an auditor

must be able to maintain an objective and impartial mental attitude throughout the

engagement.

NB. The independency rule does not apply to all services performed by public auditor(s).

Services in which the client is a major beneficiary such as management consultancy

service, tax services, accounting/compilation/ service and the like do not require

independency.

The independency rule applies to auditing, and other attestation services such as review

of financial statements, examination of financial forecasts, performance of agreed up on

procedures and the like.

Independency - a matter of degree i.e. the concept of independency is not absolute; no

CPA/auditor/ can claim complete independence of a client. Rather, independence is

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 7

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

relative i.e. a matter of degree. Thus, CPAs must strive for the greatest degree of

independence consistent with this business environment.

Rule-102: Integrity and objectivity

In the performance of any professional service, a member shall maintain objectivity and

integrity, shall be free of conflicts of interest, and shall not knowingly misrepresent facts

or subordinate his/her professional judgments to others.

Interpretation 102-1 states that a CPA or auditor(s) will be found to have knowingly

misrepresented facts in violation of rule102, when he/she knowingly:

Makes, or permits or directs another to make, materially incorrect entries in a

client’s financial statements or records.

Fail to correct financial statements that are materially false or misleading when

the member has such authority.

Signs or permits or directs another to sign, a documents containing materially

false and misleading information.

Objectivity means impartiality in performing all services. For example, assume that an

auditor believes that accounts receivable may not be collectible, but accepts

management’s opinion without an independent evaluation of collectability. The auditor

has subordinated his/her judgment and thereby lacks objectivity.

Free from conflicts of interest means the absence of relationships that might interfere

with objectivity or integrity. For example, it would be inappropriate for an auditor who is

also an attorney to represent a client in legal matters. The attorney is an advocate for the

client, whereas the auditor must be impartial.

Rule-201: General standards

A member shall comply with the following standards and with any interpretations

thereof by bodies designated by council.

a) Professional competence- undertakes only those professional services that the

member or member’s firm can reasonably expect to be completed with

professional competence.

b) Due professional care- Exercise due professional care in the performance of

professional services.

c) Planning and supervision- adequately plan and supervise the performance of

professional services.

d) Sufficient relevant data- Obtain sufficient relevant data to afford a reasonable

basis for conclusions or recommendations in relation to any professional

services performed.

Rule-202: Compliance with standards

A member who performs auditing, review, compilation, management consultancy, tax

return preparation, or other professional services shall comply with standards

promulgated by bodies designated by council.

Rule-203: Accounting principles

A member shall not (1) express an opinion or state affirmatively that the financial

statements or other financial data of any entity are presented in conformity with GAAP

or (2) state that he/she is not aware of any material modification that should be made to

such statements or data in order for them be in conformity with GAAP, if such statements

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 8

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

or data contain any departure from accounting principles promulgated by bodies

designated by council.

If however, the statements or data contain such departure and the members can

demonstrate that due to unusual circumstance, the financial statements or data would

otherwise have been misleading, the members can comply with the rule by describing the

departure, its approximate effects, if practicable; and the reasons why compliances with

the principle would result in misleading statements.

Rule-304: Confidential client information

A member in public practice shall not disclose any confidential client information

without the specific consent of the client.

This rule shall not be construed:

(1) To relieve a member of the member’s professional obligations under rule 202

and 203 presented above.

(2) To affect in any way the member’s obligation to comply with a validity issued

and enforceable subpoena or summons

(3) To prohibit review of a member’s professional practice under AICPA or state

CPA society authorization, or

(4) To preclude a member from initiating with or responding to any inquiry by a

recognized investigative or disciplinary bodies.

Thus, except for the above mentioned circumstances and other related interpretation,

members of a recognized investigative or disciplinary bodies and professional

practice reviewers shall not use to their own advantage or disclose any member’s

confidential client information that comes to their attention in carrying out their

professional responsibilities.

Confidential vs. privileged communications-The communication between CPAs

and their clients are confidential, but not privileged. This is because; legally

privileged communications cannot be required by a subpoena or court order. Thus,

CPAs may be compelled to disclose their communication with clients in certain types

of court proceedings

Reporting illegal act – many countries have adopted laws that require members in a

public practice (auditors) to reports illegal acts committed by organizations whenever

they come across it if:

A) It has a material effect on the financial statements

B) Senior management and the board directors have not taken appropriate

remedial action

C) The failure to take remedial action is reasonably expected to warrant a

departure from standards of audit report or a resignation by the auditors.

Under such circumstances, the auditor must as soon as possible communicate

their conclusion directly to the client’s board of directors or if that is not possible

directly communicate the matter to the appropriate authoritative bodies.

Rule-302: Contingent fees

A member in public practice shall not perform for an contingent fee any professional

services for, or receive such a fee from a client for whom the member or member’s firm

performs services such as:

(a) An audit or review of financial statements

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 9

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

(b) Compilation of financial information expected to be used by third party,

(c) An examination of prospective financial information or

(d) Prepare an original or amended tax return or claim for a tax refund.

A contingent fee is a fee established for the performance of any service pursuant, or an

arrangement in which no fee will be charged unless a specified finding or result is

attained, or in which the amount of the fee is otherwise dependent upon the finding or

result of such services.

Rule-501: Acts Discreditable

A member shall not commit an act discreditable to the profession.

Rule-501 gives the AICPA the authority to discipline those members who act in a manner

damaging to the reputation of the profession. The three circumstances outlined in

interpretation 101-1 presented above relating to misleading entries and financial

statements are considered discreditable acts

An interesting practices have been interpreted to be discreditable is failure to return client

records, may be when the auditors discharges their responsibilities and not been paid for

their services. To refuse to return a clients ledger or other records is clearly wrong but

refusing to return audit work papers needed by client is not constitutes acts discreditable,

because, audit work paper is the property of the auditors not the property of the client

company.

Rule-502: Advertising and other forms of solicitation

A member in public practice shall not seek to obtain clients by advertising or other forms

of solicitations in a manner that is false, misleading, or deceptive. Solicitation by the use

of coercion, overreaching or harassing conduct is prohibited.

Rule-503: Commission and Referral fees

1) Prohibited commissions- a member in public practice shall not for a commission

recommend or refer to client any product or service, or for a commission

recommend or refer any product or service to be supplied by a client, or receive a

commission, when the member or the member’s firm also performs for that client,

services such as auditing and review of financial statements, a compilations of

financial statements and/ or examination of financial statements.

2) Disclosure of permitted commissions and referral fees- a member of CPA or

auditor who receive/or paid a permitted commission and/or referral fees shall

disclose such acceptance or payments to the client.

Rule-505: Form of organization and Name

A member may practice public accounting in a form of organization permitted by law or

regulation whose characteristics conform to resolution of council.

A member shall not practice public accounting under a firm name that is misleading.

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 10

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

2-4: Legal liabilities and responsibilities of auditors

We live in an era of litigation in which persons with real or fancied grievances are likely

to take their complaints to curt. In this environment, investors and creditors who suffer

financial damages or reversals find CPAs, as well as attorneys and corporate directors,

tempting targets for lawsuits alleging malpractice.

Thus, CPAs must approach every engagement with the prospect that they may be

required to defend their work in court. Even if the court finds in favor of the CPAs, the

costs of defending a legal action can be very high. Moreover, lawsuits can be extremely

damaging to a professional’s reputation. In extreme cases, the CPA may even be held

criminal for professional malpractice. Thus, every member considering a career in public

accounting should be aware of the legal liability inherent in the practice of this profession

and should conduct the audit with reasonable skill and care. Though audit report is not a

guarantee that the figures are free from error, the auditor must conduct the audit that it

stands a reasonable chance of discovering a material error in the figure. It is difficult to

determine what is meant by reasonable skill and care. The auditors’ principal duties

center around the report on the truth and fairness of the financial statements. The

auditors are not required to make any positive statement if they are satisfied with the

audit matters. They must, however state any reservations in the audit report. There is

always a possibility that someone will disagree with some of the assumptions upon which

the figures have been based. The auditors are also required to form an opinion on several

matters ant properly report them in their report.

Discussion of Auditors liabilities is best prefaced by a definition of some of the common

business law terms such as negligence, liability for gross negligence, liabilities for

fraud, and liabilities for constructive fraud.

Negligence- also referred to as ordinary or simple negligence is violation of a legal duty

to exercise a degree of care that an ordinary prudent person would exercise under similar

circumstances. For an auditor, negligence is failure to perform a duty in accordance with

applicable standards such as failure to exercise due professional care.

Gross Negligence- is the lack of even slight care, indicative of reckless disregards for

one’s professional responsibilities. Substantial failures on the part of an auditor to

comply with GAAS might be interpreted as gross negligence.

Fraud-is defined as misrepresentation by a person of a material fact, known by that

person to be untrue or made with reckless indifferences as to whether the fact is true with

the intention of deceiving the other party and with the result that the other party is

injured.

Constructive fraud- differs from fraud as defined above in that constructive fraud does

not involve a misrepresentation with intent to deceive. Gross negligence on the part of an

auditor as been interpreted by the courts is constructive fraud.

Privity- is the relationship between parties to contract. A CPA firm is in privity with the

client it is serving, as well as with any third party beneficiary.

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 11

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

Breach of contract- is failure of one or both parties to a contract to perform in

accordance with the contacts provisions. For example, failure by auditors(s) to perform in

accordance with contractual specifications indicated in the engagement letter.

Proximate/immediate/ cause-exists when damage to another is directly attributable to a

wrong doer’s act. The issue of proximate cause may be raised as a defense in litigation

cases. Even though the CPA firm might have been negligent in rendering services, it will

not be liable for the plaintiff’s loss if its negligence was not the proximate cause of the

said loss.

Contributory negligence-is negligence on the part of the plaintiff that has contributed to

his or her having incurred loss.

Comparative negligence- is a concept used by courts to allocate damages between

negligent parties based on the degree to which each party is at fault. The allocation of

damages is also referred to as proportionate liabilities.

The plaintiff-is the party claiming damages and bringing suit against the defendant.

A third party beneficiary- is a person or institution not a contracting party who is

named in a contract or intended by the contracting parties to have definite rights and

benefits under the contract

. E.g. If W-Thomas audit firm is engaged to audit the financial statements of Shell-

Ethiopia and if it is indicated in the contract that a copy of the audit report will be sent to

Awash International Bank as a support for a loan, then, the bank is a third-third party

beneficiary under the contractual agreement between W-Thomas Audit firm and Shell-

Ethiopia company.

An engagement letter- is the written contract summarizing the contractual relationships

between the CPA and client. It typically specifies the nature and scope of professional

services to be rendered , expected completion date of the engagement, the amount of

audit fees, responsibility of auditors and responsibility of client/manager/ and other

related matters.

An auditor holds position of great responsibility and has to perform a given duties,

statutory or otherwise, allotted to him. In performance of his duties, he has to exercise

reasonable care and skill. His client expects him to follow generally accepted auditing

standards and he/she may be held liable in case he does not act with reasonable care and

skill required from him in the particular circumstances.

In other words, if his client suffers any loss due to his negligence or breach of trust or

duty and, the errors or frauds remain undetected, he would be held liable for the same and

may be called upon to pay the damages suffered by the client on account of his

negligence or breach of duty. The auditor may be penalized for failing to apply

reasonable care and skill. This could take the form of a disciplinary action by the

professional body or civil or criminal proceedings.

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 12

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

Auditor’s liability can be classified as:

1. Auditor’s civil liability

The civil liability of an auditor can be for

a. Liability for negligence

b. Liability for Misfeasance.

A. Liability for negligence: An auditor is appointed to perform certain specific duties

and in performing his duties he must exercise reasonable care and skill to perform his

duties for which he is employed. If he acts negligently on account of which the client

is made to suffer loss, the auditor may be held liable and may be called upon to make

good the damages, which the client suffered due to this negligence. The auditor can

be held liable if the following conditions are satisfied.

i. There should be sufficient ground for holding him liable for negligence. A general

charge will not be enough and the specific matter in respect of which he failed must

be indicated

ii. It must be proved that the client has suffered a loss on account of this negligence

The auditor cannot be held liable if there is loss to the client without his negligence or

there has been negligence of the auditor but it has not resulted into the loss to the client.

At the same time, it must be proved that the auditor has acted negligently, i.e. he did not

exercise the reasonable care and skill in the performance of his duties. What is

reasonable care and skill should be determined on the basis of the particular

circumstances of the each case. It should be largely determined by a comparison with

the standard, which the members in this profession generally observe. It may be noted

that the auditor does not act as an insurer and does not guarantee the accuracy of the

books of account

B. Liability for breach of contract /Misfeasance / The term misfeasance implies

breach of trust or breach of duty. An auditor has to perform certain duties, which may

arise out of the contract with the client as in the case sole proprietor or partnerships or

it may be statutory as laid down in the various statutes. If the auditor does not

perform his duties properly and as a result his client suffers a loss, he may be held

liable for misfeasance.

2. Auditor’s criminal liability: Criminal liability of an auditor arises because of

offences against the statutory provisions specifically laid down. In such cases, an

auditor is liable not only to the shareholders but also to the state. It may arise

because of some criminal at on his part or gross neglect of certain provisions of

the statute. In case of criminal liability, an auditor is punishable with fine or

imprisonment or both as might be provided in the relevant statute.

3. Auditor’s contractual liability: The contractual liability arises out of the

contract entered between the auditor and the client. This arises when there is no

statute governing the rights or duties of an auditor. Since there are no statutory

provisions, the question of liability has to be settled in accordance with the terms

and conditions settled by the auditor with his client in the agreement. Hence the

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 13

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

agreement with the auditor has to be in written clearly specifying the terms of

duties, responsibilities and scope of the audit. The auditor will be liable if he does

not observe high standards of his profession and work honestly. Sometimes, the

auditor will be in a delicate situation because of the frauds or irregularities carried

on by the client’s parents or close relatives. In such cases, he must not give way to

emotions. He must honestly and truthfully report the matter to his client in clear

words without any hesitation, laying aside all other considerations. If he does not

do so, he fails in the performance of his duties and may be held liable for the

same.

Liabilities to clients from audits often arise from a failure to uncover an

embezzlement or defalcation being performed against the client by client employees

and also failure to provide reasonable assurance of detecting misstatements due to

errors and fraud that are material to the financial statements.

In general, to establish auditors’ liabilities, a client must prove

a) Duty- that the auditor(s) or audit firm accepted a duty of care to exercise skill,

prudence, and diligence.

b) Breach of duty- that the auditor(s) or audit firm breached his/her/its duty of

care through negligent performance.

c) Loss-that the client suffered a loss.

d) Proximate-cause- that the loss is resulted from the auditor(s) negligent act or

performance

Auditors Defense against client Suits-As defendants, auditors’ basic defense is

ordinarily that the audit was performed with reasonable care and that they were

not negligent in the performance of their duties. Alternatively, they, might

attempt to prove that, regardless of whether negligence was involved, such

alleged negligence was not the proximate cause of the client loss. Moreover,

demonstrating contributory negligence by the client is one means of showing

that the auditors’ negligence was not the sole cause of the client’s loss.

4. Auditor’s third party liability- In addition to being sued by clients under

common law, auditors may be liable to third parties under common law. This is

due the fact that the audited financial statements are used be many people other

than the client. These users of financial statements may completely rely upon the

audited statements and enter into transactions with the company without any

further enquiry. This are known as third parities which includes individual and

group society members such as potential stockholders/investors/, venders,

bankers, and other creditors, employers, employees, and customers, tax

authorities and others.

An audit firm may be liable to such third parities if a loss was incurred by the

claimant due to reliance on misleading financial statements. A typical suit might

occur when a bank is unable to collect a major loan from an insolvent customer. The

bank may claim that the misleading audited financial statements were relied on in

making the loan and that the audit firm should be held responsible because it failed to

perform the audit with due care.

Auditors Defense against Third Party Suits- Three of the four defenses available to

auditors in suits by client are also available in third party lawsuits. Contributory

negligence is ordinarily not available because a third party is not in a position to

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 14

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

contribute to misstated financial statements. The preferred defense in third party suits

is no negligent performance. If the auditor performed the engagement in accordance

with GAAS, the other defenses are unnecessary.

2-5: Appointment, remuneration and removal of auditors

Appointment of auditors-

In most cases the audit of business concerns other than corporate entity is voluntary and

not compulsory. But with regard to corporate entities, many countries have set

laws that make their audit mandatory. Therefore, provisions regarding appointment of

auditors, his/her qualification, powers, duties etc are governed. To assure independence,

auditors are appointed by the highest body and are solely responsible to this body who

appoints them. In a corporation such responsibility is given to the stockholders meetings

or the board of directors at the suggestion to the management, and it is to this body that

the independent auditors submit his audit report for approval. This is to avoid

compromises; nowadays this function is one of the functions given to audit committees.

In principles, it is this body that should be responsible to determine or negotiate the fee

payable to independent auditors.

The primary objective of appointment of auditor(s) in a corporate entity is to safeguard

the interest of the absentee owner (shareholders) and investors as it is not possible for

every shareholder or investors to inspect the books of accounts of the company. Hence an

auditor is a representative of shareholders and work on their behalf. Company auditors

may by appointed by board of directors, shareholders, central government and /or by

other special resolutions.

Generally, auditors are appointed for a term of one year, although this is often extended.

Auditor’s remuneration

Many CPA codes of ethics prohibit independent auditor from basing his professional

audit fee on contingency fee basis. That is independent auditor’s remuneration should not

be attached to of investment or total value of audit under consideration or amount of

default findings, just like lawyers who base their fees on percentage of amounts involved

in lawsuit. This is done in order to prevent compromises in audit work and bias in mental

attitude. Customarily, audit fees are based either on number of man-hour required to

complete the audit at the rate payable to the quality of manpower used, or just on flat

lump sum fee agreed upon. The auditor’s remuneration is generally fixed with the

directors or the audit committee of the client, and the auditors have a contract with the

client

Auditor’s removal procedures

It is uncommon for auditors for reign, or to be removed by their client before the end of

the term of office. If auditors disagree with their client over fee or accounting policies,

they simply do not offer themselves for re-appointment when their contract is finished.

It is generally more difficult to remove auditors tan to appoint them as shareholders

and/or directors need to be properly informed as to the nature of the problem. A simple

majority, two-thirds, or 75% majority resolution of directors and/or shareholders is

usually required to remove auditors, along with some sort of special notice in writing to

those concerned. The auditor is sometimes given the right to make written representation

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 15

Madawalabu University, School of Business and Economics, Accounting Department Nov.2010

and to speak at the meeting at which it is proposed to remove them. It is also common for

the auditor to be required to make some sort of statement, either orally or in writing to the

effect that there are no circumstances surrounding his/her removal that ought to be

brought to the attestation of the shareholders or others. If such circumstances exist,

where, for example, there is a severe disagreement over accounting policies or suspected

fraud, and then the auditor should say so! This is commonly referred to as a ‘Statement

of Circumstances’. Removals must usually be notified to regulatory authorities.

These provisions are necessary to ensure that auditors are not removed for improper

reasons without the knowledge of shareholders, and that auditors do not seek to avoid the

responsibilities by ‘going quietly’, where problems arise, without informing shareholders.

Auditor’s resignation procedures

Resignation usually requires written notice by the auditor to the client and to the

regulatory authorities. It also requires a statement of circumstances as discussed above

and the auditor is again, permitted to speak and communicate in writing with

shareholders and others. In some cases, he/she is also allowed to require the client to call

the meeting in order to discuss the reasons for his/her resignation. This time, it is the

auditor who may be breach of contract, and he may be sued by the client.

Both removal and resignation before the end of the audit contract indicates serious

disagreement between auditor and client and is often accompanied by litigation.

Lecture note on professional Ethics (Auditing), Compiled by Teferi D. Page 16

You might also like

- The Auditing Profession: Ethics and Professional ConductDocument26 pagesThe Auditing Profession: Ethics and Professional ConductHussen AbdulkadirNo ratings yet

- Auditing Chapter2Document7 pagesAuditing Chapter2Getachew JoriyeNo ratings yet

- Answer of MidtermDocument4 pagesAnswer of MidtermVega AgnityaNo ratings yet

- Concepts of ProfessionalismDocument10 pagesConcepts of ProfessionalismVikram UnnikrishnanNo ratings yet

- Vi Ethics and ProfessionsDocument13 pagesVi Ethics and ProfessionseskautmeljaneNo ratings yet

- Certified Risk and Compliance ProfessionalFrom EverandCertified Risk and Compliance ProfessionalRating: 5 out of 5 stars5/5 (3)

- #C C C$ C%C& C' C (CDocument4 pages#C C C$ C%C& C' C (CThong Chee WheiNo ratings yet

- Chartered Risk Governance and Compliance OfficerFrom EverandChartered Risk Governance and Compliance OfficerRating: 5 out of 5 stars5/5 (1)

- Professional Ethics OverviewDocument46 pagesProfessional Ethics OverviewMayank SharmaNo ratings yet

- EthicsDocument7 pagesEthicsdominicNo ratings yet

- Accountancy As A ProfessionDocument3 pagesAccountancy As A Professionace100% (1)

- ENG4B - Research PaperDocument19 pagesENG4B - Research PaperDardar AlcantaraNo ratings yet

- Foundations in Professionalism ModuleDocument34 pagesFoundations in Professionalism Moduleteslims100% (2)

- Related Literature LocalDocument3 pagesRelated Literature Localchrryrs_snchz0% (3)

- Ethical Disposition and Perceived Professional Ethics Among Accounting Employees of Accounting Firms in Davao CityDocument20 pagesEthical Disposition and Perceived Professional Ethics Among Accounting Employees of Accounting Firms in Davao CityZejkeara ImperialNo ratings yet

- Professional Ethics Guide Auditors Clients PublicDocument18 pagesProfessional Ethics Guide Auditors Clients PublicMussaNo ratings yet

- R01 Ethics and Trust in The Investment Profession: Instructor's NoteDocument26 pagesR01 Ethics and Trust in The Investment Profession: Instructor's NoteMani ManandharNo ratings yet

- Project On Accounting EThicsDocument39 pagesProject On Accounting EThicsChidi EmmanuelNo ratings yet

- Evaluating the Effect of Accounting Ethics on PerformanceDocument40 pagesEvaluating the Effect of Accounting Ethics on PerformanceChidi EmmanuelNo ratings yet

- Code of EthicsDocument36 pagesCode of EthicsDavid CoolNo ratings yet

- Five Dimensions of the Institutional Framework of ProfessionalismDocument2 pagesFive Dimensions of the Institutional Framework of ProfessionalismJoshua LuisNo ratings yet

- Project Management As A ProffesionDocument3 pagesProject Management As A ProffesionMirara SimonNo ratings yet

- Professional Ethics MonitoringDocument30 pagesProfessional Ethics MonitoringumairNo ratings yet

- Professional Ethics and Professionalism in IndiaDocument5 pagesProfessional Ethics and Professionalism in IndiaImti Lemtur0% (1)

- Characteristics of a Profession: Knowledge, Independence, Trust and Public InterestDocument6 pagesCharacteristics of a Profession: Knowledge, Independence, Trust and Public InterestEmanuel nyongesaNo ratings yet

- Module 1Document5 pagesModule 1powerzoom2002No ratings yet

- 16,32,34 - Teacher Accountability Unit 1 Part BDocument19 pages16,32,34 - Teacher Accountability Unit 1 Part BPriya SinghNo ratings yet

- Understanding Professionalism, Ethics and Public InterestDocument45 pagesUnderstanding Professionalism, Ethics and Public InterestGirma DagneNo ratings yet

- Module 3 - The Nature of Work EthicsDocument10 pagesModule 3 - The Nature of Work EthicsMaria Jasmin LoyolaNo ratings yet

- Assignment Sem-4: Master of Business AdministrationDocument117 pagesAssignment Sem-4: Master of Business Administrationgagan cpmNo ratings yet

- Chapter 1Document19 pagesChapter 1ReshmajitKaurNo ratings yet

- Characteristics of A Profession: ForewordsDocument5 pagesCharacteristics of A Profession: ForewordsNaresh JirelNo ratings yet

- Morality PP TwoDocument28 pagesMorality PP Twowondifraw girmaNo ratings yet

- Ethics in ConsultingDocument5 pagesEthics in Consultingranmao1408No ratings yet

- Business Ethics Module ExplainedDocument4 pagesBusiness Ethics Module ExplainedddddddaaaaeeeeNo ratings yet

- Od EthicsDocument6 pagesOd EthicsNidhi SinghNo ratings yet

- 1.1 Ethics and Trust in The Investment ProfessionDocument5 pages1.1 Ethics and Trust in The Investment ProfessionAlvin PhuongNo ratings yet

- Accounting Code of Ethics ExplainedDocument7 pagesAccounting Code of Ethics ExplainedBeby AnggytaNo ratings yet

- Assignment 7Document4 pagesAssignment 7Jojen100% (1)

- Ethical Principles of Responsibility and AccountabilityDocument4 pagesEthical Principles of Responsibility and Accountabilityanon_180314026No ratings yet

- Legal Requirement of Auditing and The Professional EthicsDocument16 pagesLegal Requirement of Auditing and The Professional EthicsyebegashetNo ratings yet

- GGSR - Written Report by TayloDocument3 pagesGGSR - Written Report by TayloCzarina Jayne QuintuaNo ratings yet

- ETHICSDocument2 pagesETHICSMai RosaupanNo ratings yet

- Term Paper On: The Importance of Ethical Issue in Financial AccountingDocument14 pagesTerm Paper On: The Importance of Ethical Issue in Financial AccountingMehedi HasanNo ratings yet

- Corpor 2Document47 pagesCorpor 2Rosario Garcia CatugasNo ratings yet

- Unit II - Code of EthicsDocument7 pagesUnit II - Code of EthicsRama SugavanamNo ratings yet

- 08 JournalDocument6 pages08 Journalits me keiNo ratings yet

- Primary Role of Company AuditorDocument5 pagesPrimary Role of Company AuditorAshutosh GoelNo ratings yet

- Ethical Issues in The Financial Services IndustryDocument23 pagesEthical Issues in The Financial Services IndustrySubodh Mayekar50% (2)

- CH 2 Professional EthicsDocument53 pagesCH 2 Professional EthicsAbdi Mucee TubeNo ratings yet

- Learning-Module Buscor Module2Document15 pagesLearning-Module Buscor Module2Gale KnowsNo ratings yet

- Business Ethics For The Modern Man: Understanding How Ethics Fit Into The Business PlaceFrom EverandBusiness Ethics For The Modern Man: Understanding How Ethics Fit Into The Business PlaceNo ratings yet

- Dinesh AuditDocument6 pagesDinesh AuditNishtha ChhabraNo ratings yet

- BSc Hons Construction Management Professional StandardsDocument11 pagesBSc Hons Construction Management Professional StandardsMiskatul JannatNo ratings yet

- USAID Nutrition Strategy 5-09-508Document60 pagesUSAID Nutrition Strategy 5-09-508mulunehNo ratings yet

- Project Management For VAsDocument3 pagesProject Management For VAsmulunehNo ratings yet

- Audit I Chapter FiveDocument8 pagesAudit I Chapter FivemulunehNo ratings yet

- Specialisation As A VADocument5 pagesSpecialisation As A VAmulunehNo ratings yet

- Church Administration: Theme: "The Pentecostal Minister and The Work of The Church"Document16 pagesChurch Administration: Theme: "The Pentecostal Minister and The Work of The Church"mulunehNo ratings yet

- Systems Development and Documentation TechniquesDocument12 pagesSystems Development and Documentation TechniquesmulunehNo ratings yet

- Chapter-Four Internal Control SystemsDocument12 pagesChapter-Four Internal Control SystemsmulunehNo ratings yet

- Auditing Cash and Marketable SecuritiesDocument21 pagesAuditing Cash and Marketable SecuritiesmulunehNo ratings yet

- Describe The Nature of Interest-Bearing DebtDocument4 pagesDescribe The Nature of Interest-Bearing DebtmulunehNo ratings yet

- Audit-II-Chapter 6Document11 pagesAudit-II-Chapter 6mulunehNo ratings yet

- HABTAMU AccountingDocument30 pagesHABTAMU AccountingmulunehNo ratings yet

- Arens Chapter18Document39 pagesArens Chapter18AdityahikkaruzNo ratings yet

- Audit-I - Chapter ThreeDocument12 pagesAudit-I - Chapter ThreemulunehNo ratings yet

- What Is The Need For Ethics in Auditing? Explain BrieflyDocument3 pagesWhat Is The Need For Ethics in Auditing? Explain BrieflymulunehNo ratings yet

- CHAPTER 12B Simulation Monte Carlo MethodDocument24 pagesCHAPTER 12B Simulation Monte Carlo MethodmulunehNo ratings yet

- Ambo Univercity - Edited - Research-1Document48 pagesAmbo Univercity - Edited - Research-1mulunehNo ratings yet

- Research of Management 2Document40 pagesResearch of Management 2mulunehNo ratings yet

- CHAPTER 12B Simulation Monte Carlo MethodDocument24 pagesCHAPTER 12B Simulation Monte Carlo MethodmulunehNo ratings yet

- CHAPTER 11 Inventory ModelDocument24 pagesCHAPTER 11 Inventory ModelmulunehNo ratings yet

- Final PaperDocument50 pagesFinal PapermulunehNo ratings yet

- CHAPTER 11 Inventory ModelDocument24 pagesCHAPTER 11 Inventory ModelmulunehNo ratings yet

- CHAPTER 11 Inventory ModelDocument24 pagesCHAPTER 11 Inventory ModelmulunehNo ratings yet

- CHAPTER 5 Duality in LPPDocument20 pagesCHAPTER 5 Duality in LPPmulunehNo ratings yet

- CHAPTER 3 Graphical AnalysisDocument28 pagesCHAPTER 3 Graphical AnalysismulunehNo ratings yet

- CHAPTER 2 LPP Mathematical ModellingDocument48 pagesCHAPTER 2 LPP Mathematical ModellingmulunehNo ratings yet

- CHAPTER 6 Transportation ModelDocument26 pagesCHAPTER 6 Transportation ModelmulunehNo ratings yet

- Brooklyn College - Syllabus 3250 - Revised 2Document8 pagesBrooklyn College - Syllabus 3250 - Revised 2api-535264953No ratings yet

- ISnack - Sec A Group6Document11 pagesISnack - Sec A Group6Avik BorahNo ratings yet

- 1-Verified-Assignment Brief P1 P2, M1 M2 & D1Document2 pages1-Verified-Assignment Brief P1 P2, M1 M2 & D1Altaf Khan100% (1)

- Workshop Francisco (Guardado Automaticamente)Document12 pagesWorkshop Francisco (Guardado Automaticamente)Helena AlmeidaNo ratings yet

- TB CH 01 AppendixDocument15 pagesTB CH 01 AppendixtheplumberNo ratings yet

- Batra, Kanika - Kipps, Belsey, and Jegede - Cosmopolitanism, Transnationalism, and Black Studies in Zadie Smith's On BeautyDocument15 pagesBatra, Kanika - Kipps, Belsey, and Jegede - Cosmopolitanism, Transnationalism, and Black Studies in Zadie Smith's On Beautyjen-leeNo ratings yet

- Neelam Shahzadi CVDocument3 pagesNeelam Shahzadi CVAnonymous Jx7Q4sNmtNo ratings yet

- High risk patient dental questionsDocument3 pagesHigh risk patient dental questionsFoysal SirazeeNo ratings yet

- Control Valves & Actuators: Course OnDocument4 pagesControl Valves & Actuators: Course OnHarish GundaNo ratings yet

- The Future of The Past: The Contemporary Significance of The Nouvelle ThéologieDocument15 pagesThe Future of The Past: The Contemporary Significance of The Nouvelle ThéologiefesousacostaNo ratings yet

- PRODUCT DATA SHEET CCT15854Document1 pagePRODUCT DATA SHEET CCT15854Miloš AćimovacNo ratings yet

- RelativeResourceManager PDFDocument113 pagesRelativeResourceManager PDFMuhammad Irfan SalahuddinNo ratings yet

- Đề Thi và Đáp ÁnDocument19 pagesĐề Thi và Đáp ÁnTruong Quoc TaiNo ratings yet

- TASK 9adhDocument5 pagesTASK 9adhAyan FaridiNo ratings yet

- Simple Steel BridgeDocument2 pagesSimple Steel BridgeAnonymous 1GK9Hxp5YKNo ratings yet

- UNITED STATES, Appellee, v. Joseph AITORO, Defendant, AppellantDocument14 pagesUNITED STATES, Appellee, v. Joseph AITORO, Defendant, AppellantScribd Government DocsNo ratings yet

- Testicular Self ExamDocument3 pagesTesticular Self ExamChristine JoyNo ratings yet

- Kotler Mm15e Inppt 12Document26 pagesKotler Mm15e Inppt 12aldi_unantoNo ratings yet

- Royal Ranks and OrdersDocument15 pagesRoyal Ranks and OrdersАнастасия ГроссулNo ratings yet

- Case StudyDocument14 pagesCase StudyAdel AbdulrhmanNo ratings yet

- Arjun Bora Career ResumeDocument2 pagesArjun Bora Career Resumeapi-261820740No ratings yet

- 1988 Ojhri Camp Disaster in PakistanDocument3 pages1988 Ojhri Camp Disaster in PakistanranasohailiqbalNo ratings yet

- Guide Number 5 My City: You Will Learn To: Describe A Place Tell Where You in The CityDocument7 pagesGuide Number 5 My City: You Will Learn To: Describe A Place Tell Where You in The CityLUIS CUELLARNo ratings yet

- Paschal CHAPTER TWODocument20 pagesPaschal CHAPTER TWOIdoko VincentNo ratings yet

- If Only I Had Been More Careful, That Wouldn't Have Happened.Document2 pagesIf Only I Had Been More Careful, That Wouldn't Have Happened.3112teohjw50% (2)

- Meridian Passage 08jDocument12 pagesMeridian Passage 08jiZhionNo ratings yet

- A Bibliometric Analysis of Creativity in The Field of Business EconomicsDocument9 pagesA Bibliometric Analysis of Creativity in The Field of Business EconomicsDanielaNo ratings yet

- Liquidity and Profitability AnalysisDocument100 pagesLiquidity and Profitability Analysisjoel john100% (1)

- Difference Between Heat and TemperatureDocument8 pagesDifference Between Heat and TemperatureMarivic MirandaNo ratings yet

- Magnetic Effects of Current PDFDocument32 pagesMagnetic Effects of Current PDFAdarshNo ratings yet