Professional Documents

Culture Documents

Financial Stateemnt of Banks

Uploaded by

shajiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Stateemnt of Banks

Uploaded by

shajiCopyright:

Available Formats

8.

84 ADVANCED ACCOUNTING

UNIT – 6: PREPARATION OF FINANCIAL

STATEMENTS OF BANKS

LEARNING OUTCOMES

❑ Learn how to prepare profit and loss account of a bank.

❑ Compute tax provision, transfer to statutory reserve, provisions

on non-performing assets, income recognition on NPA,

depreciation on current investments

❑ Learn how to prepare Balance-sheet

6.1 INTRODUCTION

While preparing financial statements, banks have to follow various guidelines /

directions given by RBI/Government of India governing the Financial Statements.

Profit and Loss Account and Balance Sheet are prepared as on 31st March every

year by all the Banks. They contain 18 schedules as under

Schedules forming part of Form A – Balance Sheet Schedule -

1. Capital Schedule

2. Reserves & Surplus Schedule

3. Deposits Schedule

4. Borrowings Schedule

5. Other Liabilities and Provisions Schedule

6. Cash and balances with RBI Schedule

7. Balances with Banks and money at call and short notice.

8. Investments

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.85

9. Advances

10. Fixed Assets

11. Other Assets

12. Contingent Liabilities / Bills for Collection

Schedules forming Part of Form B – Profit and Loss Account.

13. Interest Earned.

14. Other Income.

15. Interest Expended.

16. Operating Expenses.

17. Schedules forming Part of Annual Report

18. Significant Accounting Policies.

19. Notes forming part of accounts.

The Assets side of the Balance Sheet has been arranged in such a manner that liquid

assets such as Cash, Balances with Banks and Investments are shown in that order.

This enables the investor to quickly identify how much the Bank is liquid enough to

meet its commitment towards its customers. This arrangement of Assets is from

liquid to fixed assets in contrast to corporate balance sheets where the

arrangement is from fixed to liquid. While preparing financial statements, banks

have to follow various guidelines / directions given by RBI/Government of India

governing the Financial Statements.

Forms for the preparation and presentation of financial statements of banking

companies have been given in Annexure I & II along with compliance guidelines of

RBI given in Annexure III at the end of this chapter. In this unit we shall straightaway

go to the problems relating to preparation of final accounts of banks.

Illustration 1

From the following information, prepare a Balance Sheet of ADT International Bank

as on 31st March, 20X1 giving the relevant schedules and also specify any four

Principal Accounting Polices: ` in lakhs

Dr. Cr.

Share Capital 198.00

19,80,000 Shares of ` 10 each

© The Institute of Chartered Accountants of India

8.86 ADVANCED ACCOUNTING

Statutory Reserve 231.00

Net Profit before Appropriation 150.00

Profit and Loss Account 412.00

Fixed Deposit Account 517.00

Savings Deposit Account 450.00

Current Accounts 28.00 520.12

Bills Payable 0.10

Cash credits 812.10

Borrowings from other Banks 110.00

Cash in Hand 160.15

Cash with RBI 37.88

Cash with other Banks 155.87

Money at Call 210.12

Gold 55.23

Government Securities 110.17

Premises 155.70

Furniture 70.12

Term Loan 792.88

2,588.22 2,588.22

Additional Information:

Bills for collection 18,10,000

Acceptances and endorsements 14,12,000

Claims against the Bank not acknowledged as debt 55,000

Depreciation- Premises 1,10,000

Depreciation - Furniture 78,000

50% of the Term Loans are secured by Government guarantees. 10% of cash credit

(including Debit balance in Current A/c) is unsecured. Transfer 25% of its profit to the

reserve fund.

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.87

Solution

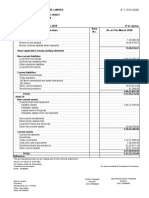

Balance Sheet of ADT International Bank

As on 31st March, 20X1

(` in lacs)

Capital and Liabilities Schedule As on As on

31.3.20X1 31.3.20X0

Share Capital 1 1,98.00

Reserves and Surplus 2 7,93.00

Deposits 3 14,87.12

Borrowings 4 1,10.00

Other liabilities and provisions 5 0.10

25,88.22

Assets

Cash and balances with RBI 6 219.63

Balances with banks and money

at call and short notice 7 344.39

Investments 8 1,65.40

Advances 9 16,32.98

Fixed Assets 10 2,25.82

Other Assets 11 –

25,88.22

Contingent liabilities 12 14.67

Bills for collection 18.10

Schedule 1— Capital

Authorised Capital –

Issued, Subscribed and

Paid up Capital

19,80,000 Shares of ` 10 each 1,98.00

© The Institute of Chartered Accountants of India

8.88 ADVANCED ACCOUNTING

Schedule 2— Reserves and Surplus

(1) Statutory Reserve-

Opening balance 2,31.00

Additions during the year 37.50

268.50

(2) Balance in Profit & Loss

Account (W.N. 1) 524.50

7,93.00

Schedule 3— Deposits

(i) Demand deposits from others 5,20.12

(ii) Saving bank deposits 4,50.00

(iii) Fixed Deposits 5,17.00

14,87.12

Schedule 4— Borrowings

Borrowing in India-

Other banks 1,10.00

Schedule 5— Other Liabilities and Provisions

Bills Payable 0.10

Schedule 6— Cash and balances with RBI

(i) Cash in hand 1,60.15

(ii) Balances with RBI

In current account (W.N. 2) 59.48

219.63

Schedule 7—Balances with banks and money at call and short notice

1. In India

(i) Balances with banks

(a) in current accounts (W.N. 3) 1,34.27

(ii) Money at call and short notice 2,10.12

344.39

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.89

Schedule 8— Investments

(1) Investment in India in

(i) Government securities 1,10.17

(ii) Others—Gold 55.23

1,65.40

Schedule 9— Advances

A. (i) Cash credits, overdrafts (includes Dr Bal in Current A/c as 8,40.10

ODs)

(ii) Term Loans 7,92.88

16,32.98

B (i) Secured by tangible assets (balancing fig) 11,52.53

(ii) Secured by bank/government guarantees 3,96.44

(iii) Unsecured 84.01

16,32.98

Schedule 10— Fixed Assets

1. Premises

At cost 156.80

Depreciation to date# 1.10

155.70

2. Other Fixed Assets

Furniture at cost 70.90

Depreciation to date# 0.78

70.12

Total (1 + 2) 2,25.82

#It has been assumed that the balances of Premises and Furniture given in the question

are after charging depreciation.

Schedule 11— Other Assets

Nil

© The Institute of Chartered Accountants of India

8.90 ADVANCED ACCOUNTING

Schedule 12— Contingent Liabilities

(` in lakhs)

(i) Claims against bank not acknowledged as debts 0.55

(ii) Acceptances, endorsements 14.12

14.67

Working Note:

(1) Balance in Profit & Loss Account: (` in lakhs)

Profit and Loss Account 4,12.00

Add : Net Profit before appropriation(Profit for the year) 1,50.00

5,62.00

Less : Transfer to statutory reserve

(25% of 150.00) (37.50)

524.50

(2) Transfer from Cash with other banks to Cash with RBI (when CRR is required

to be maintained at 4% of deposits w.e.f. January 29, 2013)

Cash reserve required (14,87.12 x 4%) 59.48

Cash with RBI (37.88)

Transfer needed to maintain cash reserve 21.60

(3) Liquid Assets:

Cash on hand 1,60.15

Cash with other Banks 1,55.87

Money at call and short notice 2,10.12

Gold 55.23

Government securities 1,10.17

6,91.54

Excess liquidity [6,91.54 – (1487.12 x 23%)] or (6,91.54 – 342.04) 349.50

The excess liquidity enables the transfer as per (2) above.

After the transfer, Cash with other Banks = ` (in lakhs) (1,55.87 - 21.60) = ` (in lakhs)

134.27.

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.91

Principal Accounting Policies:

(a) Foreign Exchange Transactions

(i) Monetary assets and liabilities have been translated at the exchange

rate prevailing at the close of year. Non-monetary assets have been

carried in the books at the historical cost.

(ii) Income and Expenditure items in respect of Indian branches have been

translated at the exchange rates on the date of transactions and in

respect of foreign branches at the exchange rates prevailing at the close

of the year.

(iii) Profit or Loss on foreign currency position including pending forward

exchange contracts have been accounted for at the exchange rates

prevailing at the close of the year.

(b) Investment: Permanent category investments are valued at cost. Valuation

of investment in current category depends on the nature of securities. While

valuation of government securities held as current investments have been made on

yield to maturity basis, the investments in shares of companies are valued on the

basis of book value.

(c) Advances: Advances due from sick nationalised units under nursing

programmes and in respect of various sticky, suit filed and decreed accounts have

been considered good on the basis of–

(i) Available estimate value of existing and prospective primary and collateral

securities including personal worth of the borrowers and guarantors.

(ii) The claim lodged/to be lodged under various credit guarantee schemes.

(iii) The claim lodged/to be lodged under various credit guarantee schemes.

(iv) Pending settlement of claims by Govt.

Provisions to the satisfaction of auditors have been made and deducted from

advances. Tax relief available when the advance is written off will be accounted for

in the year of write-off.

(d) Fixed Assets: The premises and other fixed assets except for foreign

branches are accounted for at their historical cost. Depreciation has been provided

on written down value method at the rates specified in the Income Tax Rules, 1962.

© The Institute of Chartered Accountants of India

8.92 ADVANCED ACCOUNTING

Depreciation in respect of assets of foreign branches has been provided as per the

local laws.

Illustration 2

From the following information, prepare Profit and Loss A/c of Dimple Bank for the

year ended 31-3-20X3 :

`’000 Item `’000

20X1-X2 20X2-X3

14,27 Interest and Discount 20,45

1,14 Income from investment 1,12

1,55 Interest on Balances with RBI 1,77

7,22 Commission, Exchange and Brokerage 7,12

12 Profit on sale of investments 1,22

6,12 Interest on Deposits 8,22

1,27 Interest to RBI 1,47

7,27 Payment to and provision for employees 8,55

1,58 Rent, taxes and lighting 1,79

1,47 Printing and stationery 2,12

1,12 Advertisement and publicity 98

98 Depreciation 98

1,48 Director’s fees 2,12

1,10 Auditor’s fees 1,10

50 Law charges 1,52

48 Postage, telegrams and telephones 62

42 Insurance 52

57 Repair & maintenance 66

Also give necessary Schedules.

Other Information:

(i) The following items are already adjusted with Interest and Discount (Cr.):

Tax Provision (’000 `) 1,48

Provision for Doubtful Debts (’000 `) 92

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.93

Loss on sale of investments (’000 `) 12

Rebate on Bills discounted (’000 `) 55

(ii) Appropriations:

25% of profit is transferred to Statutory Reserves

5% of profit is transferred to Revenue Reserve.

Solution

Dimple Bank

Profit and Loss Account for the year ended 31-3-20X3

(` 000’s)

Schedule Year Year

ended ended

No. 31-3-20X3 31-3-20X2

I. Income

Interest Earned 13 25,86 16,96

Other Income 14 8,22 7,34

Total 34,08 24,30

II. Expenditure

Interest Expended 15 9,69 7,39

Operating Expenses 16 20,96 16,97

Provisions and Contingencies 2,40

Total 33,05 24,36

III. Profit/Loss

Net Profit/Loss (—) for the year 1,03 (6)

Profit/Loss (—) brought forward (6)

Total 97 (6)

IV. Appropriations

Transfer to Statutory Reserve 25.75

Transfer to Other Reserve 5.15

Balance carried over to Balance 66.10

Sheet

Total 97.00

© The Institute of Chartered Accountants of India

8.94 ADVANCED ACCOUNTING

Schedule 13 - Interest Earned

(` 000’s)

Year ended Year ended

31-3-20X3 31-3-20X2

I. Interest/Discount 22,97 14,27

II. Income on Investments 1,12 1,14

III. Interest on Balances with RBI

and other inter-bank fund 1,77 1,55

IV. Others −

Total 25,86 16,96

Schedule 14 - Other Income

(` 000’s)

Year ended Year ended

31-3-20X3 31-3-20X2

I. Commission, Exchange and Brokerage 7,12 7,22

II. Profit on Sale of Investments 1,22 12

Less: Loss on sale of Investments (12) -

Total 8,22 7,34

Schedule 15 - Interest Expended

(` 000’s)

Year ended Year ended

31-3-20X3 31-3-20X2

I. Interest on Deposits 8,22 6,12

II. Interest on RBI/inter-bank borrowings 1,47 1,27

Total 9,69 7,39

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.95

Schedule 16 - Operating Expenses

(` 000’s)

Year ended Year ended

31-3-20X3 31-3-20X2

I. Payments to and provision for employees 8,55 7,27

II. Rent, taxes and lighting 1,79 1,58

III. Printing and stationery 2,12 1,47

IV. Advertisement and Publicity 98 1,12

V. Depreciation on the Bank’s Property 98 98

VI. Director’s fees, allowances and expenses 2,12 1,48

VII. Auditor’s fees and expenses

(including branch auditors) 1,10 1,10

VIII. Law charges 1,52 50

IX. Postage, telegrams, telephones etc. 62 48

X. Repairs and maintenance 66 57

XI. Insurance 52 42

XII. Other Expenditure −

Total 20,96 16,97

Illustration 3

From the following information, prepare Profit and Loss A/c of KC Bank for the year

ended 31st March, 20X1:

Items `000

Interest on cash credit 18,20

Interest on overdraft 7,50

Interest on term loans 15,40

Income on investments 8,40

Interest on balance with RBI 1,50

Commission on remittances and transfer 75

Commission on letters of credit 1,18

© The Institute of Chartered Accountants of India

8.96 ADVANCED ACCOUNTING

Commission on government business 82

Profit on sale of land and building 27

Loss on exchange transactions 52

Interest paid on deposit 27,20

Auditors’ fees and allowances 1,20

Directors’ fees and allowances 2,50

Advertisements 1,80

Salaries, allowances and bonus to employees 12,40

Payment to Provident Fund 2,80

Printing and stationery 1,40

Repairs and maintenance 50

Postage, telegrams, telephones 80

Other Information:

(i) Interest on NPA is as follows

Earned ( ` ’000) Collected ( ` ’000)

Cash credit 8,20 4,00

Overdraft 450 1,00

Term Loans 750 2,50

(ii) Classification of Non Performing Advances (’000 `)

Standard 30,00

Sub-standard 11,20

Doubtful assets not covered by security 2,00

Doubtful assets covered by security for one year 50

Loss Assets 2,00

(iii) Investments 27,50

Bank should not keep more than 25% of its investment as ‘held-for-maturity’ investment.

The market value of its rest 75% investment is ` 19,75,000 as on 31-3-20X1.

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.97

Solution

KC Bank

Profit and Loss Account

For the year ended 31st March, 20X1

Particulars Schedule (` ’000’)

Year ended

31-3-20X1

I Income

Interest earned 13 38,30

Other income 14 2,50

40,80

II Expenditure

Interest expended 15 27,20

Operating expenses 16 23,40

Provisions and Contingencies 6,80

57,40

III Profit/Loss (16,60)

IV Appropriations Nil

Schedule 13 - Interest Earned

Year ended 31-3-20X1

(` ’000’)

I Interest/discount on advances/bills

Interest on cash credit `(18,20-420) 14,00

Interest on overdraft `(750-350) 4,00

Interest on term loans `(15,40-500) 10,40 28,40

II Income on investments 8,40

III Interest on Balance with RBI 1,50

38,30

Interest on NPA is recognised on cash basis, hence excess reduced.

© The Institute of Chartered Accountants of India

8.98 ADVANCED ACCOUNTING

Schedule 14 - Other Income

Year ended

31-3-20X1

(` ’000’)

I Commission, Exchange and Brokerage

Commission on remittances and transfer 75

Commission on letter of credit 1,18

Commission on Government business 82 2,75

II Profit on sale of Land and Building 27

III Loss on Exchange Transactions (52)

2,50

Schedule 15 - Interest Expended

Year ended

31-3-20X1

I Interest on Deposits 27,20

Schedule 16 - Operating Expenses

Year Ended

31-3-20X1

I Payment and provision for employees

Salaries, allowances and bonus 12,40

Provident Fund Contribution 2,80 15,20

II Printing and Stationery 1,40

III Advertisement and publicity 1,80

IV Directors’ fees, allowances and expenses 2,50

V Auditors’ fees and expenses 1,20

VI Postage, telegrams, telephones etc. 80

VII Repairs and maintenance 50

23,40

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.99

Working Note:

Provisions and contingencies (` ’000)

Provision for NPA:

Standard 3,000 × 0.40% 12

Sub-standard 1,120 × 15%

1,68

Doubtful not covered by security 200 × 100% 2,00

Doubtful covered by security for one year 50 × 25% 12.5

Loss Assets 200 × 100% 2,00

592.5

Depreciation on current investments

Cost (75% of 27,50) 2,062.50

Less: Market value (1,975.00) 87.5

680.00

Note: 25% of the total investments are held to maturity. In the case of Held to

Maturity investments the valuation is done at cost and these are not marked to

market value generally. Hence, depreciation on investments has been calculated

only on other investments which can either be Held for Trading (HFT) or Available

for Sale (AFS)

Illustration 4

The following are the ledger balances (in Rupees thousands) extracted from the books

of Vaishnavi Bank as on March 31, 20X1:

Dr. Cr.

Share Capital 19,00,00

Current accounts control 9,70,00

Employee security deposits 74,20

Investments in Govt. of India Bonds 9,43,70

Gold Bullion 1,51,30

Silver 20,00

It is assumed that sub-standard asset is fully secured.

© The Institute of Chartered Accountants of India

8.100 ADVANCED ACCOUNTING

Constituent liabilities for

acceptances and endorsements 5,65,00 5,65,00

Borrowings from banks 7,72,30

Building 6,50,00

Furniture 50,00

Money at call and short notice 2,60,00

Commission & brokerage 2,53,00

Saving accounts 1,50,00

Fixed deposits 2,30,50

Balances with other banks 4,63,50

Other investments 5,56,30

Interest accrued on investments 2,46,20

Reserve Fund 14,00,00

P & L A/c 65,00

Bills for collection 4,35,00 4,35,00

Interest 6,20,00

Loans 18,10,00

Bills discounted 1,25,00

Interest 79,50

Discounts 4,20,00

Rents 6,00

Audit fees 50,00

Depreciation reserve (furniture) 2,00

Salaries 2,12,00

Rent, rates and taxes 1,20,00

Cash in hand and with Reserve Bank* 7,50,00

Miscellaneous income 39,00

Depreciation reserve (building) 8,00

Directors fees 10,00

Postage 12,50

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.101

Loss on sale of investments 2,00,00

Branch adjustments 2,00,00

79,10,00 79,10,00

*Details of Cash in hand and with Reserve Bank:

Cash in hand (including foreign currency notes) 3,50,00

Balances with Reserve Bank of India:

(i) In Current Account 3,20,00

(ii) In Other Account 80,00

Other Information:

The bank’s Profit and Loss Account for the year ended and Balance Sheet as on 31st

March, 20X1 are required to be prepared in appropriate form. Further information (in

Rupees thousands) available is as follows —

(a) Rebate on bills discounted to be provided 40,00

(b) Depreciation for the year

Building 50,00

Furniture 5,00

(c) Included in the current accounts ledger are accounts overdrawn to the extent

of 25,00.

Transfer to Statutory Reserve 25% of the Net Profits for the current year.

Solution

Balance Sheet of Vaishnavi Bank

as on 31st March, 20X1

(`‘ 000)

Capital and Liabilities Schedule As on As on

31-3-20X1 31-3-20X0

Capital 1 19,00,00

Reserves & Surplus 2 20,24,00

Deposits 3 13,75,50

Borrowings 4 7,72,30

© The Institute of Chartered Accountants of India

8.102 ADVANCED ACCOUNTING

Other liabilities and provisions 5 1,14,20

Total 61,86,00

(` ‘000)

Assets Schedule As on As on

31-3-20X1 31-3-20X0

Cash and balance with

Reserve Bank of India 6 7,50,00

Balances with bank and Money at call 7 7,23,50

and short notice

Investments 8 16,71,30

Advances 9 19,60,00

Fixed Assets 10 6,35,00

Other Assets 11 4,46,20

Total 61,86,00

Contingent liabilities 12 5,65,00

Bills for collection 4,35,00

Vaishnavi Bank

Profit and Loss Account for the year ended 31-3-20X1

(` ‘000)

I. Income

Interest & Discount 13 10,00,00

Other income 14 98,00

10,98,00

II. Expenditure

Interest Expended 15 79,50

Operating Expenses 16 4,59,50

Provisions and Contingencies -

5,39,00

III. Profits/Loss

Net profit for the year 5,59,00

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.103

Profit b/f 65,00

6,24,00

IV. Appropriations

Transfer to Statutory Reserve 1,39,75

Balance carried over to Balance Sheet 4,84,25

6,24,00

Schedule 1 - Capital

(` ’000)

As on 31-3-20X1

I. For Other Banks

Authorised Capital

Shares of ` ... each −

Issued Capital

Shares of ` ... each −

Subscribed Capital

Shares of ` ... each −

Called up capital

Shares of ` ... each 19,00,00

19,00,00

Schedule 2 - Reserves & Surplus

As on 31-3-20X1

I. Statutory Reserves

Opening Balance 14,00,00

Additions during the year 1,39,75

15,39,75

II. Balance in Profit and Loss Account 4,84,25

Total 20,24,00

© The Institute of Chartered Accountants of India

8.104 ADVANCED ACCOUNTING

Schedule 3 - Deposits

(` ’000)

As on 31-3-20X1

A. I. Demand Deposits 9,95,00

II. Saving Bank Deposits 1,50,00

III. Term Deposits 2,30,50

13,75,50

Current Accounts Control A/c shows a Credit Balance of ` 9,70,000/-. In the

additional information it is mentioned that in the above balance an OD of

` 25,000/- is included. Hence for presentation of the Balance Sheet the entries will

be as under:

Current Accounts 9,95,000 to be shown under deposits

ODs in Current Accounts To be shown as Advances along with cash credits & T

Loans

Schedule 4 - Borrowings

As on 31-3-20X1

I. Borrowings in India

(ii) Other banks 7,72,30

Total 7,72,30

Schedule 5 - Other liabilities and provisions

As on 31-3-20X1

I. Other liabilities including provisions:

Rebate on bills discounted 40,00

Employees Security Deposit 74,20

Total 1,14,20

Schedule 6 - Cash and Balances with Reserve Bank of India

As on 31-3-20X1

I. Cash in hand (including foreign currency notes) 3,50,00

II. Balances with Reserve Bank of India:

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.105

(iii) In Current Account 3,20,00

(iv) In Other Account 80,00

Total 7,50,00

Schedule 7 - Balances with Banks & Money at Calls & Short Notice

As on 31-3-20X1

I. (i) In India Balances with banks

(a) in Current accounts

(b) in Other accounts 2,63,50

(ii) Money at call and short notice 2,00,00

(a) with banks 2,30,00

(b) with other institutions 30,00

Total (i + ii) 7,23,50

Schedule 8 - Investments

As on 31-3-20X1

I. Investments in India in

(i) Government securities 9,43,70

(ii) Shares (assumed) 5,56,30

(iii) Gold 1,51,30

(iv) Silver 20,00

Total 16,71,30

Schedule 9 - Advances

As on 31-3-20X1

A. (i) Bills purchased and discounted 1,25,00

(ii) Cash credits, overdrafts and loans repayable

on demand 18,35,00

19,60,00

B. (i) Secured by tangible assets 12,00,00

(ii) Secured by Bank/Govt. Securities 2,00,00

(iii) Unsecured 5,60,00

19,60,00

© The Institute of Chartered Accountants of India

8.106 ADVANCED ACCOUNTING

C. I. Advances in India

(i) Priority sector 8,00,00

(ii) Public sector 1,00,00

(iii) Banks 20,00

(iv) Others 10,40,00

Total 19,60,00

(Details are assumed for explaining disclosures)

Schedule 10 - Fixed Assets

As on 31-3-20X1

I. Premises

At cost as on 31st March, 20X0 6,42,00

Depreciation to date (50,00) 5,92,00

II. Other fixed articles (including

Furniture and Fixture)

At cost as on 31st March, 20X0 48,00

Depreciation to date (5,00) 43,00

Total (I & II) 6,35,00

Schedule 11 - Other Assets

As on31-3-20X1

I. Inter-office adjustments (net) 2,00,00

II. Interest accrued 2,46,20

4,46,20

Schedule 12 - Contingent Liabilities

Year ended

31-3-20X1

I. Acceptances, endorsements

and other obligations 5,65,00

Total 5,65,00

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.107

Schedule 13 - Interest Earned

Year ended

31-3-20X1

I. Interest/discount on

advances, bills (6,20,00 + 4,20,00 –40,00) 10,00,00

Total 10,00,00

Schedule 14 - Other Income

Year ended

31-3-20X1

I. Commission, Exchange and Brokerage 2,53,00

II. Profit on sale of investments

Less: Loss on sale on investments (2,00,00) 53,00

III. Miscellaneous Income

Rent and Other Receipts 45,00

Total 98,00

Schedule 15 - Interest Expended

Year ended

31-3-20X1

I. Interest on Deposits 79,50

Total 79,50

Schedule 16 - Operating Expenses

Year ended

31-3-20X1

I. Payments to and provisions

for employees 2,12,00

II. Rent, Taxes and Lighting 1,20,00

III. Depreciation on Bank’s property 55,00

IV. Director’s fees, allowances and expenses 10,00

V. Auditor’s fees and expenses 50,00

VI. Postage, Telegrams, Telephones etc. 12,50

Total 4,59,50

© The Institute of Chartered Accountants of India

8.108 ADVANCED ACCOUNTING

SUMMARY

• Banks in India and their activities are regulated by the Banking Regulation

Act, 1949.

• The book-keeping system of a banking company is substantially different

from that of a trading or manufacturing enterprise. A bank maintains a large

number of accounts of various types for its customers.

• Every bank should maintain a minimum capital adequacy ratio based on

capital funds and risk assets.

• As per the prudential norms, all Indian scheduled commercial banks

(excluding regional rural banks) as well as foreign banks operating in India

are required to maintain capital adequacy ratio (or capital to Risk Weighted

Assets Ratio) which is specified by RBI from time to time.

• Capital is divided into two tiers according to the characteristics/qualities of

each qualifying instrument.

• Tier I capital consists mainly of share capital and disclosed reserves and it is

a bank’s highest quality capital because it is fully available to cover losses.

• Tier II capital on the other hand consists of certain reserves and certain types

of subordinated debt.

• With reference to Bills, a banking company performs the following functions:

Discounting of bills; Collection of bills; Acceptances on behalf of customers

• The banks have to classify their advances into four broad groups (i) standard

assets, (ii) sub-standard assets, (iii) doubtful assets and (iv) loss assets.

• Rates of Provisioning for Non-Performing Assets

Category of Advances Revised Rate (%)

Standard Advances

(a) direct advances to agricultural and SME 0.25

(b) advances to Commercial Real Estate (CRE) Sector 1.00

(c) all other loans and advances not included in (a) and (b) above 0.40

Sub-standard Advances

(a) Secured Exposures 15

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.109

(b) Unsecured Exposures 25

(c) Unsecured Exposures in respect of Infrastructure loan

accounts where certain safeguards such as escrow

accounts are available. 20

• Doubtful Advances

(a) Unsecured Portion 100

(b) Secured Portion

For Doubtful upto 1 year 25

For Doubtful > 1 year and upto 3 years 40

For Doubtful > 3 years 100

Loss Advances 100

• The secured value of an asset is the realizable value of its security and not its

face value or book value.

• The provisions on standard assets should not be reckoned for arriving at net

NPAs.

• While preparing financial statements, banks have to follow various

guidelines/directions given by RBI/Government of India governing the

Financial Statements.

• The provisions towards Standard Assets need not be netted from gross advances

but shown separately as ‘Contingent Provisions against Standard Assets' under

'Other Liabilities and Provisions’ in Schedule 5 of the balance sheet.

© The Institute of Chartered Accountants of India

8.110 ADVANCED ACCOUNTING

TEST YOUR KNOWLEDGE

MCQs

1. A banking company can pay dividend on its shares

(a) After writing off all its capitalized expenses including preliminary

expenses.

(b) After charging depreciation on its investments.

(c) After charging bad debts where adequate provisions has been made to

the satisfaction of the auditor.

(d) Before charging depreciation on its investments and writing off all its

capitalized expenses.

2. On 1.4.20X1 Bills for collection were ` 10,000. During 20X1-20X2 bills

received for collection amounted to ` 1,00,000, bills collected were ` 80,000

and bills dishonoured and returned were ` 5,000. What will be the amount

of bills for collection (assets) account as on 31.3.20X2?

(a) 25,000.

(b) 30,000.

(c) 35,000.

(d) None of the above.

3. Rebate on bill discounted is shown in the

(a) Assets side of the balance sheet.

(b) Liabilities side of the balance sheet.

(c) Income side of the income statement.

(d) Expense side of the income statement.

4. Bills for collection are shown

(a) On Assets side of the balance sheet.

(b) On liabilities side of the balance sheet.

(c) On the income side of the income statement.

(d) As note below the balance sheet.

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.111

5. What percentage of provision is required on standard assets (other than

advances to agricultural, SME and Commercial Real Estate)?

(a) 10

(b) 40

(c) 0.40

(d) 0.25.

6. In case of direct advances to agricultural and SME, What percentage of

provision is required on standard assets?

(a) .25

(b) 40

(c) 0.40

(d) 25.

7. When income is to be recognized on cash basis by Safe Trust Bank, a

distinction should be made between

(a) Banking and Non-banking assets.

(b) Monetary and Non-banking assets.

(c) Current and Non-current assets.

(d) Performing and Non-performing assets.

8. For the year ended 31st March, 20X1 non-performing assets classified as sub-

standard in Centura Bank Ltd. will be classified as doubtful after

(a) 24 months.

(b) 18 months.

(c) 12 months.

(d) 180 days.

9. In case of advances to Commercial Real Estate (CRE) Sector, What percentage

of provision is required on standard assets?

(a) .25

(b) 1.00

(c) 0.40

(d) 25.

© The Institute of Chartered Accountants of India

8.112 ADVANCED ACCOUNTING

10. The provisions on _________assets should not be reckoned for arriving at net

NPAs.

(a) Sub-standard.

(b) Standard.

(c) Doubtful.

(d) Loss.

11. For more than three years (unsecured) doubtful advances, provision will be

made for

(a) 10%

(b) 40%

(c) 100%

(d) 25%.

Theoretical Questions

Question 1

Write short notes on Slip system of posting and double voucher system.

Question 2

What are the restrictions imposed by the Banking Regulations Act, 1949 on

payment of dividend in case of banking companies?

Question 3

Write short note on Classification of investments by a banking company.

Question 4

Write short note on Non-Performing Assets.

Question 5

Write short note on Classification of advances in the case of a Banking Company.

Practical Problems

Question 1

From the following information find out the amount of provisions required to be

made in the Profit & Loss Account of a commercial bank for the year ended

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.113

31st March, 20X1:

(i) Packing credit outstanding from Food Processors `60 lakhs against which the

bank holds securities worth ` 15 lakhs. 40% of the above advance is covered

by ECGC. The above advance has remained doubtful for more than 3 years.

(ii) Other advances:

Assets classification ` in lakhs

Standard 3,000

Sub-standard 2,200

Doubtful :

For one year 900

For two years 600

For three years 400

For more than 3 years 300

Loss assets 600

Question 2

From the following information find out the amount of provisions to be shown in

the Profit and Loss Account of a Commercial Bank:

Assets (` in lakhs)

Standard 4,000

Sub-standard 2,000

Doubtful upto one year 900

Doubtful upto three years 400

Doubtful more than three years 300

Loss Assets 500

Question 3

From the following information, compute the amount of provisions to be made in

the Profit and Loss Account of a Commercial bank:

Assets ` in lakhs

(i) Standard (Value of security `6,000 lakhs) 7,000

(ii) Sub-standard 3,000

(iii) Doubtful

© The Institute of Chartered Accountants of India

8.114 ADVANCED ACCOUNTING

(a) Doubtful for less than one year 1,000

(Realisable value of security `500 lakhs)

(b) Doubtful for more than one year, but less than 3 years 500

(Realisable value of security `300 lakhs)

(c) Doubtful for more than 3 years (No security) 300

Question 4

Statement of interest on advances in respect of Performing assets and Non-

Performing Assets of Omega Bank is as follows:- (`in lakhs)

Performing Assets Non-Performing

Assets

Interest Interest Interest Interest

earned received earned received

Cash credits and overdrafts 1800 1060 450 70

Term Loan 480 320 300 40

Bills purchased and discounted 700 550 350 36

Find out the income to be recognized for the year ended 31st March, 20X1.

Question 5

State with reason whether the following cash credit accounts are NPA or not:

Case-1 Case-2

Sanctioned limit 60,00,000 45,00,000

Drawing power 56,00,000 42,00,000

Amount outstanding continuously 01-01-X1 48,00,000 30,00,000

to 31-03-X1

Total interest debited for the above period 3,84,000 2,40,000

Total credits for the above period Nil 3,20,000

Question 6

For a banking company, bills for collection was ` 21 lakhs as on 1st April, 20X1.

During 20X1-X2, bills received for collection amounted to ` 193.50 lakhs. Bills

collected were ` 141 lakhs. Bills dishonoured was ` 16.50 lakhs. Prepare Bills for

Collection (Assets) and Bills for Collection (Liabilities) Account .

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.115

Question 7

ABC bank Ltd. has a balance of ` 40 crores in “Rebate on bills discounted” account

as on 31st March, 20X1. The Bank provides you the following information:

(i) During the financial year ending 31 st March, 20X2 ABC Bank Ltd. discounted

bills of exchange of ` 5,000 crores charging interest @ 14% and the average

period of discount being 146 days.

(ii) Bills of exchange of ` 500 crores were due for realization from the

acceptors/customers after 31 st March, 20X2. The average period of

outstanding after 31 st March, 20X2 being 73 days. These bills of exchange of

` 500 crores were discounted charging interest@ 14% p.a.

You are requested to pass necessary Journal Entries in the books of ABC Bank Ltd.

for the above transactions.

Question 8

How will you disclose the following Ledger balances in the Final accounts of DVD bank:

` in lacs

Current accounts 700

Saving accounts 500

Fixed deposits 700

Cash credits 600

Term Loans 500

Bills discounted & purchased 800

Additional information:

(i) Current accounts ledger (not included in above figure) are accounts

overdrawn to the extent of ` 250 lacs.

(ii) One of the cash credit account of ` 10 lacs (including interest ` 1 lac) is

doubtful.

(iii) 60% of term loans are secured by government guarantees, 20% of cash

credits are unsecured, other portion is secured by tangible assets.

© The Institute of Chartered Accountants of India

8.116 ADVANCED ACCOUNTING

Question 9

The following figures are extracted from the books of KLM Bank Ltd. as on 31-03-20X2:

`

Interest and discount received 38,00,160

Interest paid on deposits 22,95,360

Issued and subscribed capital 10,00,000

Salaries and allowances 2,50,000

Directors Fees and allowances 35,000

Rent and taxes paid 1,00,000

Postage and telegrams 65,340

Statutory reserve fund 8,00,000

Commission, exchange and brokerage 1,90,000

Rent received 72,000

Profit on sale of investment 2,25,800

Depreciation on assets 40,000

Statutory expenses 38,000

Preliminary expenses 30,000

Auditor's fee 12,000

The following further information is given:

(1) A customer to whom a sum of ` 10 lakhs was advanced has become insolvent

and it is expected only 55% can be recovered from his estate.

(2) There was also other debts for which a provisions of ` 2,00,000 was found

necessary.

(3) Rebate on bill discounted on 31-03-20X1 was ` 15,000 and on 31-03-20X2

was ` 20,000.

(4) Income tax of ` 2,00,000 is to be provided.

The directors desire to declare 5% dividend and transfer 25% of its profit to the

reserve fund.

Prepare the Profit and Loss account of KLM Bank Ltd. for the year ended

31-03-20X2 and also show, how the Profit and Loss account will appear in the

Balance Sheet if the Profit and Loss account opening balance was NIL as on

31-03-20X1. Assume that the preliminary expenses had been fully written off during

the year.

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.117

ANSWERS/ HINTS

MCQs

1. (a), 2. (a), 3. (b), 4. (d), 5. (c), 6. (a),

7. (d), 8. (c), 9. (b), 10. (b), 11. (c)

Theoretical Questions

Answer 1

Slip system of posting: Under this system used in banking companies, entries in

the personal ledgers are made directly from vouchers instead of being posted from

the day book. Pay-in-slips (used by the customers at the time of making deposits)

and the cheques are used as slips which form the basis of most of the transactions

directly recorded in the accounts of customers. As the slips are mostly filled by the

customers themselves, this system saves a lot of time and labour of the bank staff.

The vouchers entered into different personal ledgers are summarised on summary

sheets every day, totals of which are posted to the different control accounts which

are maintained in the general ledger.

Double voucher system: In a bank, two vouchers are prepared for every

transaction not involving cash—one debit voucher and another credit voucher. This

system is called double voucher system. The vouchers are sent to different clerks

who make entries in books under their charge. This is designed to increase the

quality of internal check.

Answer 2

Refer para 1.3 of unit 1.

Answer 3

Refer para 4.4 of unit 4.

Answer 4

Refer para 4.2 of unit 4.

Answer 5

Refer para 4.2 of unit 4.

© The Institute of Chartered Accountants of India

8.118 ADVANCED ACCOUNTING

Practical Problems

Answer 1

(i) Packing Credit

(` in lakhs)

Amount outstanding (packing credit) 60

Less: Realisable value of securities (15)

45

Less: ECGC cover (40%) (18)

Balance being unsecured portion of packing credits 27

Required provision :

Provision for unsecured portion (100%) 27.0

Provision for secured portion (100%) 15.0

42.0

(ii) Other advances:

(` in lakhs)

Assets Amount % of provision Provision

Standard 3,000 0.40 12

Sub-standard 2,200 15 330

Doubtful :

For one year 900 25 225

For two years 600 40 240

For three years 400 40 160

For more than three years 300 100 300

Loss 600 100 600

Required provision 1,867

Note: Sub-standard and Doubtful advances have been assumed as fully

secured. However, in case it is assumed that no security cover is available for

these advances, provision will be made for @ 25% for sub-standard and 100%

for doubtful advances.

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.119

Answer 2

Computation of provision in the Profit & Loss Account of the Commercial Bank:

Assets Amount % of Provision

(` in lakhs) Provision (` in lakhs)

Standard 4,000 0.40 16

Sub-standard* 2,000 15 300

Doubtful upto one year* 900 25 225

Doubtful upto three years* 400 40 160

Doubtful more than three years* 300 100 300

Loss 500 100 500

1,501

* Sub-standard and doubtful assets are assumed as fully secured.

Answer 3

Statement showing Provisions on various performing and non-performing

assets

Amount % of Provision

` in lakhs provision ` in lakhs

Standard 7,000 0.40 28

Sub-standard 3,000 15 450

Doubtful (less than one year)

On secured portion 500 25 125

On unsecured portion 500 100 500

Doubtful (more than one year but less

than three years)

On secured portion 300 40 120

On unsecured portion 200 100 200

Doubtful Unsecured (more than three 300 100

years) 300

Total provision 1,723

© The Institute of Chartered Accountants of India

8.120 ADVANCED ACCOUNTING

Answer 4

Interest on performing assets should be recognised on accrual basis, but interest

on NPA should be recognised on cash basis.

` in lakhs

Interest on cash credits and overdraft (1800+70)= 1,870

Interest on Term Loan (480+40) = 520

Income from bills purchased and discounted (700+36) = 736

3,126

Answer 5

Case 1 Case 2

` `

Sanctioned limit 60,00,000 45,00,000

Drawing power 56,00,000 42,00,000

Amount outstanding continuously from 48,00,000 30,00,000

1.01.20X1 to 31.03.20X1

Total interest debited 3,84,000 2,40,000

Total credits - 320,000

Is credit in the account is sufficient to cover the No Yes

interest debited during the period

NPA NOT NPA

Answer 6

Bills for Collection (Assets) Account

` in lacs ` in lacs

To Balance b/d 21 By Bills for collection 141

To Bills for collection 193.5 By Bills dishonoured 16.5

By Balance c/d 57

214.5 214.5

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.121

Bills for Collection (Liabilities) Account

` in lacs ` in lacs

To Bills for collection 141 By Balance b/d 21

To Bills dishonoured 16.5 By Bills for collection 193.5

To Balance c/d 57

214.5 214.5

Answer 7

In the books of ABC Bank Ltd.

Journal Entries

` in crores

Particulars Debit Credit

Rebate on bills discounted A/c Dr. 40

To Discount on bills A/c 40

(Being the transfer of opening balance in ‘Rebate on

bills discounted A/c’ to ‘Discount on bills A/c’)

Bills purchased and discounted A/c Dr. 5,000

To Discount on bills A/c 280

To Clients A/c 4,720

(Being the discounting of bills of exchange during the

year)

Discount on bills A/c Dr. 14

To Rebate on bills discounted A/c 14

(Being the unexpired portion of discount in respect of

the discounted bills of exchange carried forward)

Discount on bills A/c Dr. 306

To Profit and Loss A/c 306

(Being the amount of income for the year from

discounting of bills of exchange transferred to Profit

and loss A/c)

Working Notes:

1. Discount received on the bills discounted during the year

` 5,000 crores x 14/100 x 146/365 = ` 280 crores

© The Institute of Chartered Accountants of India

8.122 ADVANCED ACCOUNTING

2. Calculation of rebate on bill discounted

` 500 crores x 14/100 x 73/365 = `14 crores

3. Income from bills discounted transferred to Profit and Loss A/c would be

calculated by preparing Discount on bills A/c.

Discount on bills A/c ` in crores

Date Particulars Amount Date Particulars Amount

31.3.20X2 To Rebate on 14 1.4.20X1 By Rebate on bills 40

bills discounted discounted b/d

” To Profit and 20X1-x2 By Bills purchased

Loss A/c(Bal. Fig.) 306 and discounted 280

320 320

Answer 8

Relevant Schedules (forming part of the Balance sheet) of DVD Bank

Schedule 3: Deposits

` in lacs

A Demand deposits 700

B Saving bank deposits 500

C Term deposits (Fixed Deposits) 700

1,900

Schedule 9: Advances

` in lacs

A (i) Bills discounted and purchased 800

(ii) Cash credits and overdrafts 850

(iii) Term loans 500

2,150

B. (i) Secured by tangible assets (bal. fig.) 1,730

(ii) Secured by Bank/Government guarantees (500 x 60%) 300

(iii) Unsecured (600 x 20%) 120

2,150

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.123

Schedule 5: Other Liabilities & Provisions

`in lacs

Others (Provision for doubtful debts) 10

Profit and Loss Account (an extract)

` in lacs

Less: Provision for doubtful debts* 10

Note: The overdrawn extent in Current Accounts will be shown as Overdrafts.

* It is assumed that the cash credit has been in ‘doubtful’ category for more than

three years, hence provision made at 100%.

Answer 9

KLM Bank Limited

Profit and Loss Account for the year ended 31 st March, 20X2

Schedule Year ended

31.03.20X2

`

I. Income:

Interest earned 13 37,95,160

Other income 14 4,87,800

Total 42,82,960

II. Expenditure

Interest expended 15 22,95,360

Operating expenses 16 5,70,340

Provisions and contingencies

(4,50,000+2,00,000+2,00,000) 8,50,000

Total 37,15,700

III. Profits/Losses

Net profit for the year 5,67,260

Profit brought forward Nil

5,67,260

© The Institute of Chartered Accountants of India

8.124 ADVANCED ACCOUNTING

IV. Appropriations

Transfer to statutory reserve (25% of 5,67,260) 1,41,815

Proposed dividend 50,000

Balance carried over to balance sheet 3,75,445

5,67,260

Profit & Loss Account balance of ` 3,75,445 will appear under the head ‘Reserves and

Surplus’ in Schedule 2 of the Balance Sheet.

Year ended 31.3.20X2 (`)

Schedule 13 – Interest Earned

I. Interest/discount on advances/bills (Refer W.N.) 37,95,160

37,95,160

Schedule 14 – Other Income

I. Commission, exchange and brokerage 1,90,000

II. Profit on sale of investment 2,25,800

III. Rent received 72,000

4,87,800

Schedule 15 – Interest Expended

I. Interests paid on deposits 22,95,360

22,95,360

Schedule 16 – Operating Expenses

I. Payment to and provisions for employees (salaries & allowances) 2,50,000

II. Rent, taxes paid 1,00,000

III. Depreciation on assets 40,000

IV. Director’s fee, allowances and expenses 35,000

V. Auditor’s fee 12,000

VI. Statutory (law) expenses 38,000

VII. Postage and telegrams 65,340

VIII. Preliminary expenses 30,000

5,70,340

© The Institute of Chartered Accountants of India

BANKING COMPANIES 8.125

Working Note:

`

Interest and discount received 38,00,160

Add: Rebate on bills discounted on 31.3. 20X1 15,000

Less: Rebate on bills discounted on 31.3. 20X2 (20,000)

37,95,160

© The Institute of Chartered Accountants of India

You might also like

- Autodesk Invoice #9122128059 1.255,60Document1 pageAutodesk Invoice #9122128059 1.255,60Rambabu kNo ratings yet

- RN - 2103213618 - 1 - MT - 697758 638063847099525545 Ist 618 Final Exam 22Document5 pagesRN - 2103213618 - 1 - MT - 697758 638063847099525545 Ist 618 Final Exam 22shajiNo ratings yet

- Tax Guidance On Red Hill ReimbursementsDocument5 pagesTax Guidance On Red Hill ReimbursementsHNNNo ratings yet

- Managerial Skills and Roles at Bashundhara GroupDocument31 pagesManagerial Skills and Roles at Bashundhara Grouprythm QUraishiNo ratings yet

- Unit 6 Banking Companies Final AccDocument79 pagesUnit 6 Banking Companies Final Acctimoni5707No ratings yet

- 66651bos53803 Cp8u6Document39 pages66651bos53803 Cp8u6Siddhant GuptaNo ratings yet

- Banking CompanyDocument1 pageBanking CompanyHilary GaureaNo ratings yet

- FR MTP 2Document8 pagesFR MTP 2gaurav gargNo ratings yet

- FR Last 4 MTPDocument98 pagesFR Last 4 MTPSHIVSHANKER AGARWALNo ratings yet

- Final HO 1 MOBDocument1 pageFinal HO 1 MOBParthNo ratings yet

- H One Pvt Ltd FY 2020/21 Financial Statements HighlightsDocument164 pagesH One Pvt Ltd FY 2020/21 Financial Statements HighlightsShehara GamlathNo ratings yet

- Fa 6 Ans Key Q.P Code 75847 PDFDocument16 pagesFa 6 Ans Key Q.P Code 75847 PDFAmar ChapniyaNo ratings yet

- 120 Financial Statements and Ratio Analysis PDFDocument20 pages120 Financial Statements and Ratio Analysis PDFMohit WaniNo ratings yet

- IRMA Financial Accounting Exam Cash Flow AnalysisDocument5 pagesIRMA Financial Accounting Exam Cash Flow AnalysisDharampreet SinghNo ratings yet

- LDB FS End of 2012Document2 pagesLDB FS End of 2012ThinkingPinoyNo ratings yet

- ADVANCED ACCOUNTING 2BDocument4 pagesADVANCED ACCOUNTING 2BHarusiNo ratings yet

- Adv Acc QN Bank Compiler PDF With Imp Questions - n22Document500 pagesAdv Acc QN Bank Compiler PDF With Imp Questions - n22harshita23hrNo ratings yet

- Rabichakra/Ridarc J.V. Balance Sheet and Financial StatementsDocument8 pagesRabichakra/Ridarc J.V. Balance Sheet and Financial StatementsNayan MallaNo ratings yet

- Question ADV GMDocument6 pagesQuestion ADV GMsherlockNo ratings yet

- Balance Sheet For The Year Ended March 31, 2021Document45 pagesBalance Sheet For The Year Ended March 31, 2021parika khannaNo ratings yet

- Corporate AccontingDocument4 pagesCorporate AccontingIshita GuptaNo ratings yet

- CFS 2023 PyqDocument15 pagesCFS 2023 PyqAnshul JainNo ratings yet

- Dhanuka Agritech Limited financial reportDocument48 pagesDhanuka Agritech Limited financial reportTWINKLE MEHTANo ratings yet

- 10 PMJTLDocument67 pages10 PMJTLanascrrNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- Priyanshi Traders 2078.079Document17 pagesPriyanshi Traders 2078.079Raaz KunwarNo ratings yet

- Aafr Updated Past PapersDocument491 pagesAafr Updated Past PapersSummama Ahmad LodhraNo ratings yet

- Chartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Document81 pagesChartered Accountancy Professional Ii (Cap-Ii) : Revision Test Paper Group I December 2021Arpan ParajuliNo ratings yet

- Balance Sheet: As at 31st March, 2015Document20 pagesBalance Sheet: As at 31st March, 2015Yatin BhardwajNo ratings yet

- 2023 Grade 12 Controlled Test 1 QPDocument5 pages2023 Grade 12 Controlled Test 1 QPannabellabloom282007No ratings yet

- Balance Sheet: As at 31st March, 2015Document2 pagesBalance Sheet: As at 31st March, 2015Dhairyaa BhardwajNo ratings yet

- Valuation of Goodwill (Akshit)Document12 pagesValuation of Goodwill (Akshit)akshit jainNo ratings yet

- NeracaDocument1 pageNeraca21Dwi Athaya SalsabilaNo ratings yet

- Indian Accounting Standard 101Document19 pagesIndian Accounting Standard 101RITZ BROWNNo ratings yet

- Financial Resultnov 2021!2!7Document6 pagesFinancial Resultnov 2021!2!7Udit AgrawalNo ratings yet

- Topic No. 1 - Statement of Financial Position PDFDocument4 pagesTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESNo ratings yet

- DJ BANK LTD. BALANCE SHEET AS ON 31-03-2018Document7 pagesDJ BANK LTD. BALANCE SHEET AS ON 31-03-2018jaimin vasaniNo ratings yet

- Balance SheetDocument2 pagesBalance Sheetobroymanas0No ratings yet

- Analysing Financial Performance: Centre For Financial Management, BangaloreDocument24 pagesAnalysing Financial Performance: Centre For Financial Management, Bangalorepankaj9mayNo ratings yet

- Standalone Balance Sheet As at March 31, 2021Document4 pagesStandalone Balance Sheet As at March 31, 2021Tuhin SenNo ratings yet

- Balance Sheet For The Year Ended March 31, 2021Document43 pagesBalance Sheet For The Year Ended March 31, 2021parika khannaNo ratings yet

- 65702c1011638100188060f2_##_Financial Statement of a Company DPP 01Document9 pages65702c1011638100188060f2_##_Financial Statement of a Company DPP 01Accounting HelpNo ratings yet

- Studying The Financial Statements of A Bank: Balance Sheet of ICICI Bank LTD As On 31.03.2003. (Figures in Rs'000)Document10 pagesStudying The Financial Statements of A Bank: Balance Sheet of ICICI Bank LTD As On 31.03.2003. (Figures in Rs'000)Anand KumarNo ratings yet

- Definition of Money and its FunctionsDocument38 pagesDefinition of Money and its FunctionsAsif HussainNo ratings yet

- Budhanilkantha Healthcare Pvt. LTD: For: R. Puri & AssociatesDocument3 pagesBudhanilkantha Healthcare Pvt. LTD: For: R. Puri & AssociatesSanjiv GuptaNo ratings yet

- Habib Bank Fiji 2000 financial summaryDocument2 pagesHabib Bank Fiji 2000 financial summaryShahid AwanNo ratings yet

- PC3 9Document11 pagesPC3 9ScribdTranslationsNo ratings yet

- Financial Statement F.Y 19-20Document9 pagesFinancial Statement F.Y 19-20jmpnv007No ratings yet

- Chapter 3 108-117Document10 pagesChapter 3 108-117Leony SantikaNo ratings yet

- FR (New) A MTP Final Apr 2021Document16 pagesFR (New) A MTP Final Apr 2021ritz meshNo ratings yet

- Sample Questions For End Term - 4th LotDocument10 pagesSample Questions For End Term - 4th LotAbhinav MitraNo ratings yet

- Chapter 3 Financial Statement Taxes and CashflowDocument33 pagesChapter 3 Financial Statement Taxes and CashflowlovejkbsNo ratings yet

- SIF Oltenia Net Asset ValueDocument3 pagesSIF Oltenia Net Asset ValueMihai RusNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Financial StatementsDocument25 pagesFinancial StatementsNafaâ DRAOUINo ratings yet

- Unit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsDocument9 pagesUnit II Analysis and Interpretation of Financial Statements Vertical Balance Sheet Balance Sheet As On 31/3/2022 Liabilities Rs. Assets RsKirti RawatNo ratings yet

- DR Group - 2019-2020Document43 pagesDR Group - 2019-2020Mohammad Rejwan UllahNo ratings yet

- VUICO Projected Financial StatementsDocument18 pagesVUICO Projected Financial StatementsRoseinthedark TiuNo ratings yet

- Wells FargoDocument11 pagesWells FargoRafa BorgesNo ratings yet

- Presentación Situacion Fiscal Municipio Aguadilla 2022Document13 pagesPresentación Situacion Fiscal Municipio Aguadilla 2022La Isla OesteNo ratings yet

- Cash Flow Statement TestDocument2 pagesCash Flow Statement TestHitesh SemwalNo ratings yet

- Preparation of Financial Statements - QBDocument26 pagesPreparation of Financial Statements - QBHindutav arya100% (1)

- Balance SheetDocument2 pagesBalance SheetChetan SinghNo ratings yet

- 1 MarketreportDocument2 pages1 MarketreportshajiNo ratings yet

- 1 TM TM MF BondseriesDocument1 page1 TM TM MF BondseriesshajiNo ratings yet

- Detailed Consolidated Financial Report for Oakland Municipality FY 2003Document2 pagesDetailed Consolidated Financial Report for Oakland Municipality FY 2003shajiNo ratings yet

- GovernmentalDocument25 pagesGovernmentalshajiNo ratings yet

- Ab'saberDocument1 pageAb'sabershajiNo ratings yet

- Spilker TIBE 10e Ch09 SMDocument55 pagesSpilker TIBE 10e Ch09 SMshajiNo ratings yet

- EquityDocument3 pagesEquityshajiNo ratings yet

- Municipal Capital Project Financing: Best Option AnalysisDocument1 pageMunicipal Capital Project Financing: Best Option AnalysisshajiNo ratings yet

- EquityDocument3 pagesEquityshajiNo ratings yet

- Economic ArticleDocument1 pageEconomic ArticleshajiNo ratings yet

- 1 TM C StockvalueDocument1 page1 TM C StockvalueshajiNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- 05 IMY WoM enDocument6 pages05 IMY WoM enshajiNo ratings yet

- Poblem and SolutionDocument8 pagesPoblem and SolutionshajiNo ratings yet

- BakeryDocument9 pagesBakeryshajiNo ratings yet

- Symmetry: EEG Frontal Asymmetry in Dysthymia, Major Depressive Disorder and Euthymic Bipolar DisorderDocument13 pagesSymmetry: EEG Frontal Asymmetry in Dysthymia, Major Depressive Disorder and Euthymic Bipolar DisordershajiNo ratings yet

- OklandDocument2 pagesOklandshajiNo ratings yet

- Relevance of Corporate GovernanceDocument3 pagesRelevance of Corporate GovernanceshajiNo ratings yet

- Jayawant Institute of Management StudiesDocument22 pagesJayawant Institute of Management StudiesshajiNo ratings yet

- EyecareDocument6 pagesEyecareshajiNo ratings yet

- Day 2 - Session 6 - Project Cost ManagementDocument48 pagesDay 2 - Session 6 - Project Cost ManagementshajiNo ratings yet

- Federal Grants To State and Local Governments: A Historical Perspective On Contemporary IssuesDocument43 pagesFederal Grants To State and Local Governments: A Historical Perspective On Contemporary IssuesshajiNo ratings yet

- Persistent Depressive Disorder or Dysthymia: An Overview of Assessment and Treatment ApproachesDocument13 pagesPersistent Depressive Disorder or Dysthymia: An Overview of Assessment and Treatment ApproachesshajiNo ratings yet

- Pub CH Rating Credit RiskDocument69 pagesPub CH Rating Credit RiskshajiNo ratings yet

- Mathematics 1 OnesideDocument114 pagesMathematics 1 OnesideshajiNo ratings yet

- Rare Materials in Academic Libraries Remain Important for Scholarly ResearchDocument19 pagesRare Materials in Academic Libraries Remain Important for Scholarly ResearchshajiNo ratings yet

- Project Cost Estimation: Promoting Quality of Cost Estimation To Reduce Pro-Ject Cost VarianceDocument131 pagesProject Cost Estimation: Promoting Quality of Cost Estimation To Reduce Pro-Ject Cost VarianceshajiNo ratings yet

- Bank Lines of Credit and Corporate LiquidityDocument48 pagesBank Lines of Credit and Corporate LiquidityshajiNo ratings yet

- PFC 5 Cs of CreditDocument1 pagePFC 5 Cs of CreditshajiNo ratings yet

- Sample Essay Muet Question 1Document2 pagesSample Essay Muet Question 1Hudzaimi100% (4)

- ACCY 303 Midterm Exam ReviewDocument12 pagesACCY 303 Midterm Exam ReviewCORNADO, MERIJOY G.No ratings yet

- The History of Accounting: From Ancient Record Keeping to Modern StandardsDocument5 pagesThe History of Accounting: From Ancient Record Keeping to Modern StandardsFahrull Hidayatt100% (4)

- Table of Contents for Warehousing Project ProposalDocument20 pagesTable of Contents for Warehousing Project ProposalMachel100% (1)

- Financial RatiosDocument35 pagesFinancial RatiosLetsah Bright100% (1)

- INTERESTS AND INSTITUTIONSDocument32 pagesINTERESTS AND INSTITUTIONSEdward KarimNo ratings yet

- To Prosperity: From DEBTDocument112 pagesTo Prosperity: From DEBTمحمد عبدﷲNo ratings yet

- HarvardDocument5 pagesHarvardMahima KumariNo ratings yet

- Basic AccountingDocument17 pagesBasic AccountinglizNo ratings yet

- Section 3 (Other Definition)Document26 pagesSection 3 (Other Definition)jinNo ratings yet

- Instant Download Ebook PDF Ethics in Marketing International Cases and Perspectives 2nd Edition PDF ScribdDocument29 pagesInstant Download Ebook PDF Ethics in Marketing International Cases and Perspectives 2nd Edition PDF Scribdchester.whelan111100% (42)

- Genentech Account StatementDocument1 pageGenentech Account StatementThanh ĐứcNo ratings yet

- SFM CA Final Mutual FundDocument7 pagesSFM CA Final Mutual FundShrey KunjNo ratings yet

- Anarock - Annual - Report 2022 - Residential Real EstateDocument39 pagesAnarock - Annual - Report 2022 - Residential Real EstatekabithNo ratings yet

- International Logistics Management 522222229Document207 pagesInternational Logistics Management 522222229sidgeo20No ratings yet

- Merchandise ManagementDocument32 pagesMerchandise ManagementMonika Sharma100% (1)

- Stock Investing Mastermind - Zebra Learn-85Document2 pagesStock Investing Mastermind - Zebra Learn-85RGNitinDevaNo ratings yet

- Shipping DocumentsDocument5 pagesShipping DocumentsMahendran MaheNo ratings yet

- Acjc 2021 H2 Ec P2Document3 pagesAcjc 2021 H2 Ec P2anonymous wheatsNo ratings yet

- Module 1Document12 pagesModule 1Sajid IqbalNo ratings yet

- Nur Amaliyah - 041811333032 AKLDocument5 pagesNur Amaliyah - 041811333032 AKLNur AmaliyahNo ratings yet

- 26th Floor, Annexe Block, Menara Takaful Malaysia, No 4, Jalan Sultan Sulaiman, 50000 Kuala Lumpur, P.O. Box 11483, 50746 Kuala LumpurDocument4 pages26th Floor, Annexe Block, Menara Takaful Malaysia, No 4, Jalan Sultan Sulaiman, 50000 Kuala Lumpur, P.O. Box 11483, 50746 Kuala LumpurIlove MiyamuraNo ratings yet

- SKF Intelligent Clean Strategy MR 0Document29 pagesSKF Intelligent Clean Strategy MR 0Andres Elias Fernandez PastorNo ratings yet

- Disclosures Under Regulation 29 (2) of SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011Document9 pagesDisclosures Under Regulation 29 (2) of SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011Contra Value BetsNo ratings yet

- SEC Objection To Binance VoyagerDocument7 pagesSEC Objection To Binance VoyagerGMG EditorialNo ratings yet

- BacklogDocument8 pagesBacklogamitdesai92No ratings yet

- Chapter One: 1.1. Back Ground of The StudyDocument31 pagesChapter One: 1.1. Back Ground of The StudyBobasa S AhmedNo ratings yet