Professional Documents

Culture Documents

Lesson 15 Considering Fraud, Error and Non-Compliance With Laws and Regulations

Uploaded by

Mark TaysonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lesson 15 Considering Fraud, Error and Non-Compliance With Laws and Regulations

Uploaded by

Mark TaysonCopyright:

Available Formats

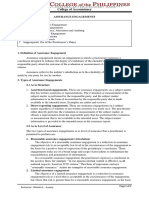

College of Accountancy

CONSIDERATION OF FRAUD, ERROR, AND NON-COMPLIANCE WITH LAWS

AND REGULATIONS

Contents:

1. Characteristics of Fraud

2. Types of Fraud

3. Responsibility for the Prevention and Detection of Fraud

4. Auditor’s Consideration of Fraud

5. Withdrawing from Engagement Because of Fraud

6. Non-compliance with Laws and Regulations

7. Responsibility for Compliance with Laws and Regulations

8. Auditor’s Consideration of Laws and Regulations

9. Difficulty in Detecting Non-compliance

1. Characteristics of Fraud

Misstatements in the financial statements can arise from either fraud or error. The

distinguishing factor between fraud and error is whether the underlying action that results in the

misstatement of the financial statements is intentional or unintentional.

Fraud is an intentional act by one or more individuals among management, those charged

with governance, employees, or third parties, involving the use of deception to obtain an unjust

or illegal advantage. On the other hand, error is an unintentional misstatement or omission of

amounts or disclosures in the financial statements.

Fraud Terms

a. Embezzlement (defalcation) – involves theft of fund placed in one’s trust or care.

b. Larceny – involves theft of personal property.

c. Forgery – act of forging or producing a copy of a document, signature, etc.

d. Bribery – persuading someone to act in one’s favor illegally by a gift.

e. Extortion (blackmail) – obtaining something (e.g., money) through force or threats.

f. Conspiracy (collusion or connivance) – agreement between two or more people to

commit a crime.

g. Earnings management – use of accounting to enhance financial performance.

h. Income smoothing – a form of earnings management in which revenues and expenses are

shifted between periods to reduce fluctuations in earnings.

2. Types of Fraud

Although fraud is a broad legal concept, the auditor is concerned with fraud that causes a

material misstatement in the financial statements. Two types of intentional misstatements are

relevant to the auditor – misstatements resulting from fraudulent financial reporting and

misstatements resulting from misappropriation of assets. Although the auditor may suspect or, in

rare cases, identify the occurrence of fraud, the auditor does not make legal determinations of

whether fraud has actually occurred.

Fraudulent Financial Reporting

Fraudulent financial reporting involves intentional misstatements including omissions of

amounts or disclosures in financial statements to deceive financial statement users. It can be

caused by the efforts of management to manage earnings in order to deceive financial statement

users by influencing their perceptions as to the entity’s performance and profitability. Such

earnings management may start out with small actions or inappropriate adjustment of

assumptions and changes in judgments by management. Pressures and incentives may lead these

actions to increase to the extent that they result in fraudulent financial reporting. Such a situation

could occur when, due to pressures to meet market expectations or a desire to maximize

Instructor: Orlando L. Ananey Page 1 of 8

College of Accountancy

compensation based on performance, management intentionally takes positions that lead to

fraudulent financial reporting by materially misstating the financial statements. In some entities,

management may be motivated to reduce earnings by a material amount to minimize tax or to

inflate earnings to secure bank financing.

Fraudulent financial reporting may be accomplished by the following:

• Manipulation, falsification (including forgery), or alteration of accounting records or

supporting documentation from which the financial statements are prepared.

• Misrepresentation in, or intentional omission from, the financial statements of events,

transactions or other significant information.

• Intentional misapplication of accounting principles relating to amounts, classification,

manner of presentation, or disclosure.

Fraudulent financial reporting often involves management override of controls that

otherwise may appear to be operating effectively. Fraud can be committed by management

overriding controls using such techniques as:

• Recording fictitious journal entries, particularly close to the end of an accounting period,

to manipulate operating results or achieve other objectives.

• Inappropriately adjusting assumptions and changing judgments used to estimate account

balances.

• Omitting, advancing or delaying recognition in the financial statements of events and

transactions that have occurred during the reporting period.

• Concealing, or not disclosing, facts that could affect the amounts recorded in the financial

statements.

• Engaging in complex transactions that are structured to misrepresent the financial

position or financial performance of the entity.

• Altering records and terms related to significant and unusual transactions.

Misappropriation of Assets

Misappropriation of assets involves the theft of an entity’s assets and is often perpetrated

by employees in relatively small and immaterial amounts. However, it can also involve

management who are usually more able to disguise or conceal misappropriations in ways that are

difficult to detect. Misappropriation of assets can be accomplished in a variety of ways

including:

• Embezzling receipts (for example, misappropriating collections on accounts receivable or

diverting receipts in respect of written-off accounts to personal bank accounts).

• Stealing physical assets or intellectual property (for example, stealing inventory for

personal use or for sale, stealing scrap for resale, colluding with a competitor by

disclosing technological data in return for payment).

• Causing an entity to pay for goods and services not received (for example, payments to

fictitious vendors, kickbacks paid by vendors to the entity’s purchasing agents in return

for inflating prices, payments to fictitious employees).

• Using an entity’s assets for personal use (for example, using the entity’s assets as

collateral for a personal loan or a loan to a related party).

Misappropriation of assets is often accompanied by false or misleading records or

documents in order to conceal the fact that the assets are missing or have been pledged without

proper authorization.

Instructor: Orlando L. Ananey Page 2 of 8

College of Accountancy

3. Responsibility for the Prevention and Detection of Fraud

Management and Those Charge with Governance

The primary responsibility for the prevention and detection of fraud rests with both those

charged with governance of the entity and management. It is important that management, with

the oversight of those charged with governance, place a strong emphasis on fraud prevention,

which may reduce opportunities for fraud to take place, and fraud deterrence, which could

persuade individuals not to commit fraud because of the likelihood of detection and punishment.

This involves a commitment to creating a culture of honesty and ethical behavior which can be

reinforced by an active oversight by those charged with governance. In exercising oversight

responsibility, those charged with governance consider the potential for override of controls or

other inappropriate influence over the financial reporting process, such as efforts by management

to manage earnings in order to influence the perceptions of analysts as to the entity’s

performance and profitability.

Auditor

An auditor conducting an audit in accordance with PSAs is responsible for obtaining

reasonable assurance that the financial statements taken as a whole are free from material

misstatement, whether caused by fraud or error. Owing to the inherent limitations of an audit,

there is an unavoidable risk that some material misstatements of the financial statements will not

be detected, even though the audit is properly planned and performed in accordance with the

PSAs.

The risk of not detecting a material misstatement resulting from fraud is higher than the

risk of not detecting one resulting from error. This is because fraud may involve sophisticated

and carefully organized schemes designed to conceal it, such as forgery, deliberate failure to

record transactions, or intentional misrepresentations being made to the auditor. Such attempts at

concealment may be even more difficult to detect when accompanied by collusion. Collusion

may cause the auditor to believe that audit evidence is persuasive when it is, in fact, false. The

auditor’s ability to detect a fraud depends on factors such as the skillfulness of the perpetrator,

the frequency and extent of manipulation, the degree of collusion involved, the relative size of

individual amounts manipulated, and the seniority of those individuals involved. While the

auditor may be able to identify potential opportunities for fraud to be perpetrated, it is difficult

for the auditor to determine whether misstatements in judgment areas such as accounting

estimates are caused by fraud or error.

Furthermore, the risk of the auditor not detecting a material misstatement resulting from

management fraud is greater than for employee fraud, because management is frequently in a

position to directly or indirectly manipulate accounting records, present fraudulent financial

information or override control procedures designed to prevent similar frauds by other

employees.

When obtaining reasonable assurance, the auditor is responsible for maintaining an

attitude of professional skepticism throughout the audit, considering the potential for

management override of controls and recognizing the fact that audit procedures that are effective

for detecting error may not be effective in detecting fraud. The requirements in this PSA are

designed to assist the auditor in identifying and assessing the risks of material misstatement due

to fraud and in designing procedures to detect such misstatement.

Instructor: Orlando L. Ananey Page 3 of 8

College of Accountancy

4. Auditor’s Consideration of Fraud

Summary:

Risk Assessment Risk Response Conclusion and Reporting

Perform risk assessment Perform overall responses to Perform concluding analytical

procedures. fraud. procedures.

Perform discussion Perform intensive Obtain written representations.

among the engagement procedures for specific

team (brainstorming) risks. Evaluate audit evidence obtained.

Identify and assess risks On all audits, consider the Communicate audit results about

of material misstatements possibility of management fraud to management and those

due to fraud by override of controls on charged with governance.

considering: adjusting journal entries,

a. Fraud risk factors accounting estimates, and Document consideration of fraud;

and fraud unusual transactions. and, if improper revenue

triangle; and recognition not considered a risk,

b. Internal controls describe why.

that address the

identified risks

Auditor should always apply professional judgement and professional skepticism.

Identifying and Assessing the Risks of Material Misstatements due to Fraud

The auditor shall evaluate whether the information obtained from risk assessment

procedures indicates that one or more fraud risk factors are present. Fraud risk factors refer to

events or conditions that indicate an incentive or pressure to commit fraud provide an

opportunity to commit fraud. They are referred to as “fraud triangle” because when all three

conditions are present, it is highly likely that fraud has occurred or may be occurring.

The Fraud Triangle

Opportunity

Incentive or Pressure

Incentive or pressure to commit fraudulent financial reporting may exist when

management is under pressure, from sources outside or inside the entity, to achieve an

expected (and perhaps unrealistic) earnings target or financial outcome – particularly

since the consequences to management for failing to meet financial goals can be

significant. Similarly, individuals may have an incentive to misappropriate assets, for

example, because the individuals are living beyond their means.

Instructor: Orlando L. Ananey Page 4 of 8

College of Accountancy

Opportunity

A perceived opportunity to commit fraud may exist when an individual believes

internal control can be overridden, for example, because the individual is in a position of

trust or has knowledge of specific weaknesses in internal control.

Attitudes or Rationalization

Individuals may be able to rationalize committing a fraudulent act. Some

individuals possess an attitude, character or set of ethical values that allow them

knowingly and intentionally to commit a dishonest act. However, even otherwise honest

individuals can commit fraud in an environment that imposes sufficient pressure on them.

Risk Responses Relating to Fraud

Overall Response: FS Level ROMM

a. Heighten professional skepticism;

b. Assign people with specialized skills/knowledge, such as information technology;

c. Develop specific procedures to identify the existence of fraud; and

d. Incorporate an element of unpredictability in selecting the nature, timing and extent of

audit procedures.

Specific Responses to Potential Fraud Risks: Assertion Level ROMM

a. Change the nature, timing and extent of procedures to address the risk, such as:

- Obtain more reliable and relevant audit evidence or additional corroborative

information to support management’s assertions,

- Perform a physical observation or inspection of certain assets,

- Observe inventory counts on an unannounced basis, and

- Perform further review of inventory records to identify unusual items, unexpected

amounts, and other items for follow-up procedures.

b. Perform further work to evaluate the reasonableness of management’s estimates and the

underlying judgements and assumptions.

c. Increase sample sizes or perform substantive audit procedures at more detailed level.

d. Use computer-assisted audit techniques (CAATs). For example,

- Gather more evidence about data contained in significant accounts,

- Perform more expensive testing of electronic transactions and files,

- Select sample transactions from key electronic files,

- Sort transactions with specific characteristics, and

- Test an entire population instead of a sample.

e. Request additional information in external confirmations.

f. Change the timing of substantive procedures from interim date to one near the period

end.

Conclusions and Reporting Relating to Fraud

Written Representations

The auditor shall obtain written representations from management and, where

appropriate, those charge with governance that they:

a. Acknowledge their responsibility for internal control to prevent and detect fraud;

b. Have disclosed to auditor the results of their assessment of risks of material

misstatements due to fraud;

Instructor: Orlando L. Ananey Page 5 of 8

College of Accountancy

c. Have disclosed to auditor their knowledge of fraud, or suspected fraud, involving

management, employees who have significant roles in internal control; or others where

the fraud could have a material effect on the financial statements; and

d. Have disclosed to auditor their knowledge of any allegations of fraud, or suspected fraud,

affecting the financial statements communicated by employees, former employees,

analysts, regulators or others.

Communication of Misstatements Resulting from Fraud or Error

a. Communication with Management

- The communication is made even if the matter might be considered inconsequential

(for example, a minor defalcation by an employee at a low level in the entity’s

organization). The determination whom to communicate is a matter of professional

judgement which normally is at least one level above the person involved.

b. Communication with Those Charged with Governance

- Due to the nature and sensitivity of fraud involving senior management, or fraud that

results in a material misstatement in the financial statements, the auditor reports such

matters on a timely basis and may consider it necessary to also report such matters in

writing. In some cases, the auditor may consider it appropriate to communicate fraud

involving employee other than management that does not result in material

misstatement.

c. Communication with Regulatory and Enforcement Authorities

- The auditor’s professional duty to maintain confidentiality of client information may

preclude reporting fraud to a party outside. However, in certain circumstances, the

duty of confidentiality may be overridden by regulatory requirements, statute, the law

or courts of law. For example, under a BSP requirement, the auditor of financial

institution has a statutory duty to report the occurrence of fraud to the BSP. Also,

under SEC requirement, the auditor has a duty to report material audit findings, such

as those involving fraud or error, in those cases where management and those charge

with governance fail to report those findings to the SEC within the prescribed period.

5. Withdrawing from Engagement Because of Fraud

Examples of exceptional circumstances that may arise that may bring into question the

auditor’s ability to continue performing the audit include:

• The entity takes no appropriate action about fraud, even if not material to financial

statements;

• The risks of material misstatements due to fraud and the result of audit tests indicate a

significant risk of material and pervasive fraud; or

• Significant concern about the competence or integrity of management or those charge

with governance.

The auditor may seek legal advice when deciding whether to withdraw from an engagement.

6. Non-compliance with Laws and Regulations

Laws and regulations applicable to the entity constitutes the legal and regulatory

framework in which it operates. Non-compliance refers to acts of omission or commission,

intentional or unintentional, committed by the entity, or by those charge with governance, by

management or by other individuals working for or under the direction of the entity, which are

contrary to the prevailing laws or regulations. Non-compliance does not include personal

misconduct unrelated to the business activities of the entity. Non-compliance could include tax

evasions, illegal labor practices, insider trading, bribing officials, environmental laws violation,

check fraud, illegal price fixing, money laundering, etc.

Instructor: Orlando L. Ananey Page 6 of 8

College of Accountancy

Laws and regulations can have direct or indirect effect on the financial statements. Laws

and regulations that have direct effect on financial statements results in amounts and disclosures

reported on the financial statements. For example: tax laws and pension laws. On the other hand,

laws and regulations that have indirect effect on the financial statements are not reported in the

financial statements since they are primarily operational in nature. However, non-compliance

may result in fines, litigation or other consequences for the entity that may have a material effect

on the financial statements. For example: labor laws, environmental protection laws, health laws,

operating license, regulatory solvency requirements.

7. Responsibility for Compliance with Laws and Regulations

The responsibility for the compliance, including prevention and detection of non-

compliance with laws and regulations rests with the management and those charged with

governance. The management, with oversight of those charged with governance, must institute

actions aimed to address risks of non-compliance with laws and regulations. These could

include:

• Maintaining a register of significant laws, and a record of any complaints received;

• Monitoring legal requirements and designing procedures/internal controls to ensure

compliance with these requirements;

• Engaging legal advisors to assist in monitoring legal requirements; and

• Developing, publicizing, implementing, and following a code of conduct.

8. Auditor’s Consideration of Laws and Regulations

Summary:

Risk Assessment Risk Response Conclusion and Reporting

Obtain general For laws and regulation with direct Obtain written

understanding of: effect: representations that all

1. Legal and 1. Read minutes, documents, known instances of non-

regulatory correspondence, etc.; compliance with laws and

framework 2. Inquire of management and legal regulations have been

2. Entity’s counsel about litigation and disclosed to auditor.

compliance claims; and

3. Perform test of details Form an appropriate opinion.

Identify and assess

risks of material For laws and regulations with indirect Determine whether to report

misstatements due to effect: non-compliance with laws

non-compliance with 1. Inquire of management and those and regulations to an outside

laws and regulations charged with governance about authority.

compliance; and

2. Inspect correspondence with Document results and

regulatory authorities findings, such as:

1. Copies of relevant

If identified or suspected non- records or documents;

compliance with laws and regulations: and

1. Understand the nature and 2. Minutes of discussions

circumstances to evaluate possible with management, those

effect on financial statements. charge with governance,

2. Discuss with management and or other parties outside

those charged with governance on the entity.

a timely basis.

3. May obtain legal advice.

4. Evaluate other audit implications.

Instructor: Orlando L. Ananey Page 7 of 8

College of Accountancy

The auditor’s considerations of laws and regulations are:

• Obtaining sufficient appropriate audit evidence regarding compliance with laws and

regulations that have direct effect on the financial statements

• Limited undertaking of specified audit procedures to help identify con-compliance with

laws and regulation that have indirect effect on the financial statements; and

• Responding appropriately to instances of non-compliance with laws and regulations

9. Difficulty in Detecting Non-compliance

During the audit, the auditor shall remain alert to the possibility that other audit

procedures applied may bring instances of non-compliance with laws and regulations to auditor’s

attention. However, non-detection of material misstatements with non-compliance with laws and

regulations are greater, because:

- Operational in nature and not captured in financial statements;

- Concealed (e.g., collusion, forgery); and

- Matter of legal determination by a court of law.

As a result, generally, the further removed non-compliance is from the financial

statements, the less likely the auditor will recognize the non-compliance.

Instructor: Orlando L. Ananey Page 8 of 8

You might also like

- Module 4 - Auditor's ResponsibilityDocument28 pagesModule 4 - Auditor's ResponsibilityMAG MAG100% (1)

- Detecting Fraud in Financial Statements (DFSDocument3 pagesDetecting Fraud in Financial Statements (DFSPaula Mae DacanayNo ratings yet

- Debt RestructuringDocument3 pagesDebt RestructuringBrunx AlabastroNo ratings yet

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionFrom EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionNo ratings yet

- Forensic Accounting FinDocument33 pagesForensic Accounting FinakanshagNo ratings yet

- AUDCISE Unit 4 Lecture Notes 2022-2023Document32 pagesAUDCISE Unit 4 Lecture Notes 2022-2023Eijoj MaeNo ratings yet

- Overview of Risk Based Audit ProcessDocument17 pagesOverview of Risk Based Audit ProcessAira Nhaira Mecate100% (1)

- Fraud Chapter 14Document11 pagesFraud Chapter 14Ann Yuheng DuNo ratings yet

- Audit of Overview: Auditing IsDocument26 pagesAudit of Overview: Auditing IsMaria BeatriceNo ratings yet

- Fundamentals of Assurance ServicesDocument32 pagesFundamentals of Assurance ServicesDavid alfonsoNo ratings yet

- Auditing Debt Obligations TransactionsDocument9 pagesAuditing Debt Obligations TransactionsBeatrize ValerioNo ratings yet

- CH 12Document8 pagesCH 12Aditya NugrohoNo ratings yet

- CHAP 1.the Demand For Audit and Other Assurance ServicesDocument11 pagesCHAP 1.the Demand For Audit and Other Assurance ServicesNoroNo ratings yet

- Auditors' Responsibilities and Legal Liabilities (Chapter 5 of Arens)Document102 pagesAuditors' Responsibilities and Legal Liabilities (Chapter 5 of Arens)Wen Xin GanNo ratings yet

- Cash Receipts Procedure SummaryDocument2 pagesCash Receipts Procedure SummaryRaca DesuNo ratings yet

- Ch1 Part 2 Audit Sampling For Tests of Details of BalanceDocument46 pagesCh1 Part 2 Audit Sampling For Tests of Details of BalancesimaNo ratings yet

- ReSA CPA Review Batch 42 Risk Assessment and ResponsesDocument3 pagesReSA CPA Review Batch 42 Risk Assessment and ResponsesMichelle GubatonNo ratings yet

- Consideration of Internal ControlDocument10 pagesConsideration of Internal ControlMAG MAGNo ratings yet

- CH 10Document37 pagesCH 10yurisukmaNo ratings yet

- ACC200 Tuturial Sem 3 2019 PDFDocument74 pagesACC200 Tuturial Sem 3 2019 PDFanon_255678422100% (1)

- Chapter 2 Auditing It Governance ControlsDocument54 pagesChapter 2 Auditing It Governance ControlsMary Joy AlbandiaNo ratings yet

- Human Resource and Payroll Cycle: Submitted By: Ramos, Michaela Russell M. BSA 4-2Document7 pagesHuman Resource and Payroll Cycle: Submitted By: Ramos, Michaela Russell M. BSA 4-2Michaela Russell RamosNo ratings yet

- IT Audit 4ed SM Ch10Document45 pagesIT Audit 4ed SM Ch10randomlungs121223No ratings yet

- AIS Chapter 2Document69 pagesAIS Chapter 2Loren Jel HallareNo ratings yet

- Ch07 The Conversion Cycle PDFDocument50 pagesCh07 The Conversion Cycle PDFVRNo ratings yet

- Chapter One On ScreenDocument60 pagesChapter One On Screenadane24No ratings yet

- Paper Tech IndustriesDocument20 pagesPaper Tech IndustriesMargaret TaylorNo ratings yet

- Overview of Risk-Based Audit ProcessDocument18 pagesOverview of Risk-Based Audit ProcessWillma Palada100% (1)

- 07 - Acceptance & Continuance of The Audit EngagementDocument57 pages07 - Acceptance & Continuance of The Audit EngagementHaythem TrabelsiNo ratings yet

- Evaluate Ebusiness Revenue Recognition, Information Privacy, and Electronic Evidence IssueDocument4 pagesEvaluate Ebusiness Revenue Recognition, Information Privacy, and Electronic Evidence IssueNomcangJung'ziizNo ratings yet

- The Auditorx27s Responsibilitydocx PDF FreeDocument9 pagesThe Auditorx27s Responsibilitydocx PDF FreeGONZALES CamilleNo ratings yet

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Chapter 6 Accounting Information SystemDocument11 pagesChapter 6 Accounting Information SystemRica de guzmanNo ratings yet

- Audit of BanksDocument8 pagesAudit of BanksCatherine Bercasio Dela CruzNo ratings yet

- Auditing QuestionsDocument10 pagesAuditing Questionssalva8983No ratings yet

- Strategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingDocument10 pagesStrategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingAnnamarisse parungaoNo ratings yet

- Module IV: MUS Sampling - Factory Equipment Additions: RequirementsDocument2 pagesModule IV: MUS Sampling - Factory Equipment Additions: RequirementsMukh UbaidillahNo ratings yet

- 29Document141 pages29Anandbabu RadhakrishnanNo ratings yet

- Guide On Cooperative Audit PDFDocument25 pagesGuide On Cooperative Audit PDFNichole DouglasNo ratings yet

- Essential Elements of a Contract of SaleDocument11 pagesEssential Elements of a Contract of SaleJanaisa BugayongNo ratings yet

- Internal control weaknesses in purchasing system under 40 charactersDocument3 pagesInternal control weaknesses in purchasing system under 40 charactersRosaly JadraqueNo ratings yet

- UntitledDocument10 pagesUntitledPrincesNo ratings yet

- Fraud Error NoclarDocument17 pagesFraud Error NoclarChixNaBitterNo ratings yet

- WorldCom Accounting ScandalSummaryDocument6 pagesWorldCom Accounting ScandalSummarysamuel debebeNo ratings yet

- The Revenue CycleDocument72 pagesThe Revenue CycleShannon MojicaNo ratings yet

- ACCTG-SPCL-TRANSDocument8 pagesACCTG-SPCL-TRANSMikaella BengcoNo ratings yet

- AAS Notes P1Document4 pagesAAS Notes P1Nicah Acojon100% (1)

- Chapter 2 Audit of CashDocument11 pagesChapter 2 Audit of Cashadinew abeyNo ratings yet

- Jérôme Kerviel Case of EthicsDocument4 pagesJérôme Kerviel Case of EthicsHoward Rivera RarangolNo ratings yet

- The Expenditure Cycle: Purchasing To Cash Disbursements: Discussion QuestionsDocument5 pagesThe Expenditure Cycle: Purchasing To Cash Disbursements: Discussion QuestionsMayang SariNo ratings yet

- QG To FundAcc PDFDocument110 pagesQG To FundAcc PDFRewsEnNo ratings yet

- Evaluate Internal Controls and Audit ProceduresDocument3 pagesEvaluate Internal Controls and Audit Proceduresmatifadza2No ratings yet

- Chapter 25Document62 pagesChapter 25pauline020395No ratings yet

- Intermediate Accounting I - Notes (9.13.2022)Document18 pagesIntermediate Accounting I - Notes (9.13.2022)Mainit, Shiela Mae, S.No ratings yet

- TOPIC 3e - Risk and MaterialityDocument33 pagesTOPIC 3e - Risk and MaterialityLANGITBIRUNo ratings yet

- Auditing Risks of Material MisstatementsDocument6 pagesAuditing Risks of Material MisstatementsDenny June CraususNo ratings yet

- IFRS For SMEs ComparisonDocument120 pagesIFRS For SMEs ComparisonLiz Liiz100% (1)

- Auditor's Responsibility Fraud ErrorDocument5 pagesAuditor's Responsibility Fraud ErrorMaria Beatriz MundaNo ratings yet

- Lesson 14 Audit SamplingDocument9 pagesLesson 14 Audit SamplingMark TaysonNo ratings yet

- Auditor considerations using work of predecessors, service auditors, internal auditorsDocument7 pagesAuditor considerations using work of predecessors, service auditors, internal auditorsMark TaysonNo ratings yet

- Lesson 16 Job Order CostingDocument3 pagesLesson 16 Job Order CostingMark TaysonNo ratings yet

- Lesson 15 Home Office, Branch and Agency AccountingDocument11 pagesLesson 15 Home Office, Branch and Agency AccountingMark TaysonNo ratings yet

- Lesson 8 Identifying and Assessing The ROMMDocument5 pagesLesson 8 Identifying and Assessing The ROMMMark TaysonNo ratings yet

- Lesson 6 Pre-Engagement ActivitiesDocument5 pagesLesson 6 Pre-Engagement ActivitiesMark TaysonNo ratings yet

- Lesson 2 Auditing OverviewDocument2 pagesLesson 2 Auditing OverviewMark TaysonNo ratings yet

- College standards guide accountancy auditsDocument8 pagesCollege standards guide accountancy auditsMark TaysonNo ratings yet

- Lesson 10 Understanding The Entity and Its EnvironmentDocument8 pagesLesson 10 Understanding The Entity and Its EnvironmentMark TaysonNo ratings yet

- Lesson 3 Financial Statements AuditDocument5 pagesLesson 3 Financial Statements AuditMark TaysonNo ratings yet

- 4 Revenue From Contracts With Customers (PFRS 15)Document11 pages4 Revenue From Contracts With Customers (PFRS 15)Mark TaysonNo ratings yet

- Lesson 1 Assurance EngagementsDocument7 pagesLesson 1 Assurance EngagementsMark TaysonNo ratings yet

- 2 Corporate LiquidationDocument12 pages2 Corporate LiquidationMark Tayson100% (1)

- 5 Long-Term Construction ContractDocument12 pages5 Long-Term Construction ContractMark TaysonNo ratings yet

- 1b Partnership OperationDocument7 pages1b Partnership OperationMark TaysonNo ratings yet

- 1d Partnership LiquidationDocument8 pages1d Partnership LiquidationMark TaysonNo ratings yet

- Chapter 4 Review KEYDocument4 pagesChapter 4 Review KEYMark TaysonNo ratings yet

- College Accountancy Partnership DissolutionDocument9 pagesCollege Accountancy Partnership DissolutionMark TaysonNo ratings yet

- Ethics, Fraud and Internal Controls ExplainedDocument21 pagesEthics, Fraud and Internal Controls ExplainedAngel YbanezNo ratings yet

- EnronDocument13 pagesEnronkarthikmaddula007_66No ratings yet

- Class Viii Reading Worksheet Read The Following Passage To Answer ANY TEN of Given Twelve QuestionsDocument3 pagesClass Viii Reading Worksheet Read The Following Passage To Answer ANY TEN of Given Twelve QuestionsVirajNo ratings yet

- AMLA HandbookDocument13 pagesAMLA Handbookclcornerstone defenseNo ratings yet

- 33 BPI Family Bank v. Franco and CADocument2 pages33 BPI Family Bank v. Franco and CAEnrico DizonNo ratings yet

- Wells4e Ch02Document16 pagesWells4e Ch02Audrey NathasyaNo ratings yet

- Re118290249us City of Detroit-Pfrs Invoice November 2020 MailedDocument8 pagesRe118290249us City of Detroit-Pfrs Invoice November 2020 Mailedkingtbrown50No ratings yet

- Taylor VillansAndVictimsDocument35 pagesTaylor VillansAndVictimsradinstiNo ratings yet

- Gonzales Carungcong Vs PeopleDocument2 pagesGonzales Carungcong Vs PeopleJhay CarbonelNo ratings yet

- 0 BIRTH CERTIFICATE FRAUD BCCRSS - Lose The NameDocument9 pages0 BIRTH CERTIFICATE FRAUD BCCRSS - Lose The NameRon Ferlingere100% (3)

- Sun Life of Canada (Philippines), Inc. vs. SibyaDocument1 pageSun Life of Canada (Philippines), Inc. vs. SibyaLucky P. RiveraNo ratings yet

- Contract Act (18 7 2) (Sections 1 To 269) Recommended BooksDocument68 pagesContract Act (18 7 2) (Sections 1 To 269) Recommended BooksMahrukh ChohanNo ratings yet

- The Ketan Parekh Stock Market Scam Corporate Governance: Submitted By: Group 8 (Division-A)Document9 pagesThe Ketan Parekh Stock Market Scam Corporate Governance: Submitted By: Group 8 (Division-A)Parth Hemant PurandareNo ratings yet

- I. Thesis Statement of The ArticleDocument2 pagesI. Thesis Statement of The Articletankofdoom 4No ratings yet

- US DIS OHND 5 20cv2494 Ex Parte Motion For Temporary Restraining Order FiDocument288 pagesUS DIS OHND 5 20cv2494 Ex Parte Motion For Temporary Restraining Order FiMark SchnyderNo ratings yet

- Types of Computer and Occupational Fraud ExplainedDocument23 pagesTypes of Computer and Occupational Fraud Explainedmuhammad_ramadhan_18No ratings yet

- Teen 8 - Reading Comprehension and Vocabulary PracticeDocument7 pagesTeen 8 - Reading Comprehension and Vocabulary PracticeNgan TranNo ratings yet

- Lecture On Free ConsentDocument36 pagesLecture On Free ConsentSabrina NishatNo ratings yet

- People vs. Lea Sagan Juliano, G.R. No. 134120, January 17, 2005Document8 pagesPeople vs. Lea Sagan Juliano, G.R. No. 134120, January 17, 2005Joseph BatonNo ratings yet

- LATESTTMAascritofghs BESTFINALEJSSformat Mon Feb 42013Document19 pagesLATESTTMAascritofghs BESTFINALEJSSformat Mon Feb 42013yemiasine8No ratings yet

- Handle Aroma Resort Scandal with Youtuber Khoa PugDocument8 pagesHandle Aroma Resort Scandal with Youtuber Khoa PugHằng ThuNo ratings yet

- Breach of Promise to Marry CaseDocument2 pagesBreach of Promise to Marry CaseKatherence D DavidNo ratings yet

- Criminal Law Plan 3Document10 pagesCriminal Law Plan 3mpbm8jhdfpNo ratings yet

- Presentation On Kidnapping and AbductionDocument7 pagesPresentation On Kidnapping and AbductionAastha ShrivastavaNo ratings yet

- Power Point Republic Act No 11449Document14 pagesPower Point Republic Act No 11449MonisahNo ratings yet

- Breach of Promise To MarryDocument1 pageBreach of Promise To MarryAline Marie DivinagraciaNo ratings yet

- PBB Cia & FbiDocument19 pagesPBB Cia & FbiQIWIL R FADLI WIRYA channelNo ratings yet

- Chapter 1Document20 pagesChapter 1Moody PrincessNo ratings yet

- Kukorinisvwalmart KukorinisdeclarationDocument25 pagesKukorinisvwalmart KukorinisdeclarationReutersLegalNo ratings yet

- Muslim Werewolves: Howling at The Moon GodDocument56 pagesMuslim Werewolves: Howling at The Moon GodChrista Louise0% (1)