Professional Documents

Culture Documents

Carri Paige Court Document

Uploaded by

Scott Atkinson0 ratings0% found this document useful (0 votes)

27 views5 pagesCarri Paige court document

Original Title

Carri Paige court document

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCarri Paige court document

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views5 pagesCarri Paige Court Document

Uploaded by

Scott AtkinsonCarri Paige court document

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

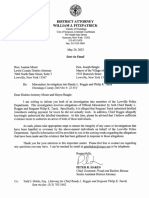

DD.Number: 27.22 FELONY COMPLAINT

Case Report No: _CA-W0357-22 Police Serial No: 0437 BlotterICC No; BL-002284-22

‘Appearance Ticket Return Date:

‘Amest Number:

Defendant in Custody from: to

DATE. OF BIRTH

(1) o9/031974

OFFENSE

GRAND

LARCENY 3RD

DEGREE

CLAss D

FELONY

COUNTIS): 1

PREPARED BY

DETECTIVE,

GREGORY GIBBS

‘Court Docket No:

WATERTOWN CITY COURT

245 WASHINGTON ST , WATERTOWN, NY 13601

‘THE PEOPLE OF THE STATE OF NY

against

‘CARRI MAE PAIGE (47)

218 MULLIN ST

WATERTOWN, NY 13601

STATE OFNY

‘COUNTY OF JEFFERSON

DETECTIVE GREGORY P GIBBS, Shield 0437, being duly sworn, deposes and says that helshe ie a member ofthe

Watertown Police Depactment, County of Jefferson, Sate of NY and that en 07/01/2020 at about 0800 at Jefferson

‘County Treasurers Office, 175 ARSENAL ST, WATERTOWN in the County of Jefferson, Ste of NY,

‘CARRI MAE PAIG!

§ PL 155,35 Grand larceny inthe third degree subdivision - 1. person i guilty of grand larceny inthe hid degree when

he steals property and wien the value ofthe property exceeds three thovsand dollars,

‘TO WIT: On the aforementioned dt, time and locaton the above mectioned defendant did knowingly anghentgnally

steal $11,003.01 from the Jefferson County Treasure. Al contrary to the provisions ofthe tatu in auch 8 mada and

povided a

‘This complaint is based on Information & Belief, the source being My icvestgation asa Police Det

‘Watertown and attached supporting depositions

‘Supporting Deposition of Karen Christie annexed hereto and made a pert hereof.

‘Any lle stnfments made herein are punishable a 4 Cass A Misdemeanor pursuant Section 210.48 ofthe Penal Law.

FN /

7 LIEUTENAPIUIOSEPITR DONOGTIUE ECTIVE GREGORY GIBBS

/ Commissioner of Deeds

10

an

a2

Fry

4s

16

18

1s

20

au

22

23

24

25

STATE OF NEW YORK BLOTTER# BL-2254 -22

COUNTY OF JEFFERSON SS: DATE: 05/16/2022

CITY OF WATERTOWN

I, Karen Christie, being born on QJM and being employed at the Jefferson County

‘Treasurer's Office, am providing this statement to Detective Gibbs of the Watertown Police

Department.

On January 19, 2022 we were told by Carri Paige that she had contracted COVID and would not

be in until she was well again,

Due to this circumstance, I started to process payments on installment contracts. Installment

contracts are entered into with taxpayers that have fallen behind on their eal property taxes and

‘want to make an effort to become current. In order to enter into ¢ contract agreement, they need

‘to make an initial payment of 25% of the back property taxes to show good faith. Many ‘ime

these transactions are in the form of cash. The tax payer then is supposed to make 4 payments.

per year for a term of 2 years. The tax payer comes in or mails payments to the Treasurer's

office and they are recorded in the general ledger based on the schedule from Tax Enforcement?

office for principal and intrest. We hold the payments in a general ledge acount and entrit™

into a spreadsheet as a double check of all payments made. After 7 payments are made the Tax

Enforcement office obtains a list of all payments and the dates they were made. They then

recalculate the amount paid, interest based on payments made and the dates and come up with a

final amount due. This calculation is sent by the Tax Enforcement office to the treasurer's office

and the tax payer comes and pays off the final amount due. Once we get the final payment, we

pay off the real property taxes in our tax program and make a final entry to clear the payments

being held.

10

rt

2

13

1a

16

uv

18

19

20

2a

22

23

24

28

Once I started to process some payments made by tax payers, I received a payoff request from

Tax Enforcement office for the contract agreement with David Sanford, contract #19-6295. 1

‘was unable to locate the contract for Mr. Sanford,

‘When down payments or regular payments are made and the clerks are busy, they leave the

record in a bin until Carri or I have time to update the spreadsheet, Once the spreadsheet is

updated, iti filed with the rest of the contracts in numerical order. As it appeared that the

spreadsheet with records of payments had not been updated, [tried to bring it up to date, I noted

that ithad been quite a while since this process had been completed

I found many contracts in a bin that we usually reserve for paid off contracts and other

Ue

correspondence from the employees of Tax Enforcement, such as notices of NSF checks or apher|

letters indicating some action from Tax Enforcement. When I update the spreadsheet, [try to [-

determine

‘the amount in the general ledger is relatively close to the excel spreadsheet, In Gey

todo that, all contract down payments and subsequent payments must be entered into the

You might also like

- Cease and Desist Letter To Mayor Jeffrey Smith, Dec. 16, 2022Document2 pagesCease and Desist Letter To Mayor Jeffrey Smith, Dec. 16, 2022NewzjunkyNo ratings yet

- Notice of ClaimDocument6 pagesNotice of ClaimScott Atkinson100% (3)

- Morse LawsuitDocument31 pagesMorse LawsuitScott AtkinsonNo ratings yet

- LTR - Da and Mayor - NoticeDocument1 pageLTR - Da and Mayor - NoticeScott AtkinsonNo ratings yet

- Career Probationary Firefighter Dies During SCBA ConfidenceDocument43 pagesCareer Probationary Firefighter Dies During SCBA ConfidenceScott AtkinsonNo ratings yet

- Division of Human Rights Determination After Investigation 1Document16 pagesDivision of Human Rights Determination After Investigation 1Scott AtkinsonNo ratings yet

- 2023 St. Lawrence County Budget in Brief Executive SummaryDocument2 pages2023 St. Lawrence County Budget in Brief Executive SummaryScott AtkinsonNo ratings yet

- Summons and ComplaintDocument8 pagesSummons and ComplaintScott AtkinsonNo ratings yet

- 23rd Annual Community SurveyDocument125 pages23rd Annual Community SurveyScott AtkinsonNo ratings yet

- St. Lawrence County News ReleaseDocument3 pagesSt. Lawrence County News ReleaseScott AtkinsonNo ratings yet

- Code and Safety Evaluation ReportDocument5 pagesCode and Safety Evaluation ReportScott AtkinsonNo ratings yet

- Division of Human Rights Determination After Investigation 1Document16 pagesDivision of Human Rights Determination After Investigation 1Scott AtkinsonNo ratings yet

- Letter of Support TemplateDocument1 pageLetter of Support TemplateScott AtkinsonNo ratings yet

- 2023 Ogdensburg Preliminary BudgetDocument135 pages2023 Ogdensburg Preliminary BudgetScott AtkinsonNo ratings yet

- Hotis Notice of ViolationDocument4 pagesHotis Notice of ViolationScott AtkinsonNo ratings yet

- 2021 Regional EISDocument7 pages2021 Regional EISScott AtkinsonNo ratings yet

- Final Report - Economic and Fiscal Impact of OHVs - Lewis CountyDocument34 pagesFinal Report - Economic and Fiscal Impact of OHVs - Lewis CountyScott AtkinsonNo ratings yet

- Hotis Order of RemedyDocument4 pagesHotis Order of RemedyScott AtkinsonNo ratings yet

- Appellate Division, Fourth Judicial Department: Supreme Court of The State of New YorkDocument14 pagesAppellate Division, Fourth Judicial Department: Supreme Court of The State of New YorkScott AtkinsonNo ratings yet

- Court FilingDocument2 pagesCourt FilingScott AtkinsonNo ratings yet

- Carri Paige Court DocumentDocument4 pagesCarri Paige Court DocumentScott Atkinson100% (1)

- Public Parking Letter To The City 2-7-22Document3 pagesPublic Parking Letter To The City 2-7-22Scott AtkinsonNo ratings yet

- Lewic County 15th Report Merged With Appendix 2-25-22Document82 pagesLewic County 15th Report Merged With Appendix 2-25-22Scott AtkinsonNo ratings yet

- Jefferson County Legislator Scott Gray Will Run For AssemblyDocument2 pagesJefferson County Legislator Scott Gray Will Run For AssemblyNorth Country This WeekNo ratings yet

- Updated Quarantine and Isolation 01.04.22Document2 pagesUpdated Quarantine and Isolation 01.04.22Scott AtkinsonNo ratings yet

- Goodwin DecisionDocument2 pagesGoodwin DecisionScott AtkinsonNo ratings yet

- CitiBus Modified ScheduleDocument1 pageCitiBus Modified ScheduleScott AtkinsonNo ratings yet

- Firefighters Union StatementDocument2 pagesFirefighters Union StatementScott AtkinsonNo ratings yet

- Updated Safety Policy DOCCSDocument1 pageUpdated Safety Policy DOCCSScott AtkinsonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)