Professional Documents

Culture Documents

CamScanner 03-03-2022 20.55

Uploaded by

MD Hafizul Islam Hafiz0 ratings0% found this document useful (0 votes)

61 views35 pagesAudit & assurance

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAudit & assurance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

61 views35 pagesCamScanner 03-03-2022 20.55

Uploaded by

MD Hafizul Islam HafizAudit & assurance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 35

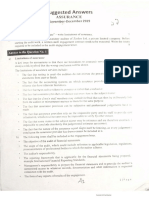

Suggested Answers

Assurance

Nov-Dec 2018

4) How would you define auditing service, attestation service and assuranceservice”

Give {wo examples from each of these services.

anawer to the Question No.1

Auditing

Auxiting 6 @ systemotic process of objectively obtaining and evaluating evidence regarding asvertc

‘about econorivc actions andl events to ascertain the degree of correspondence between the asserts 3

fectablished Criteria and communicating the results to interested users. The objective of an audit

Jaiciol statements is to enable the auditor to express an opinion whether the financial staterr

grepared, in all maternal respects, in accordance with an applicable financial reporting framewior

Exninptes. 1, Loci Authority audits; 2. Bank audit

Attestation Services

Attestation involves an engagement resuiting in the issuance of @ regort on the subject mater oF

assertion about the subject matter that is the responsibilty of anotrer party.

Eainples: 1, Financial Forecast or Projection; 2. Compliance attestation

Assurance Services

An assurance engagement is one in which 2 practitioner expresses a conclusion designed to enhance t

degree Of confidence of the intended users other than the responsible party about the outcome of t

evaluation oF measurement o! a subject matter against criteria, Assurance services ere inderende*

professional services that improve the quality of information, of its context, for decision makes

Assurance services indude many areas of information, including non-financial areas.

Examples: 1, Due diligence; 2. Fraud investigations

b) Iman audit engagement, what are overall objectives of an auditor as per ISA 200?

Answer to the Question No. (‘b):

JSA 200 states that the overall objectives of the auditor are

1 Toobtain reasonable assurance about whether the financial statements as a whole are free from

material misstatement, whether due to fraud or error, theredy enabling the auditor to expre

fn opinion on whether the financial statements ave prenaed, in all material respects,

accordance with an applicable reporting framework; and

2

Torepott on the financial statements, and communicate 2s required by the ISAs, in accordas

with the auditor's findings

Jn order to do this, the auditor must:

'* Comply wath relevant ethical requirements

© Plan and perform the audit with professional skepticis~

© Exercise pnfessional judament

Obtain audit evidence that is both sufficient and appropriate, from which reasonab

conchusions

may be drawn, on which the auditor's opinion is then based.

2) The IESBA code of ethics sets out rules as to how a new appointment should be

accepted. Whatarethose proceduresthat auditors should abide by while accepting new

dv :

Page | 5

‘Answer to the Question No. (2):

AS guided by the IESBA code of ethics, auditors should abide by following procedures before accepting «

new client

‘+ Determine whether acceptance would create any threat to compliance with the

fundamental principles.

‘* Determine potential threats to integrity and professional behavior due to the predominant

influential attitude of the owners, management etc.

‘Review if the client has/had involvement in illegal actvities

‘Evaluate the magnitude of the threats and apply suitable safeguard. If the threats are unlikely to

be eliminated or reduced to an acceptable level, itis better declining to enter into the relationship,

* Accept only those engagements which professional accountant in practice ks competent to perform.

* Evaluate the significance of the threats and apply suitable safeguard to eliminate them orreduce

to an acceptable level. Safeguards may include:

Acquiring sufficient knowledge of the industries and related activities,

Deploying adequate staff with due competencies

~ Using expert services wherever necessary

3) Write short notes on the following:

(Professional skepticism

(\))__ Professional judgment

(ii) Audit strategy

tw) Audit tan

Answer to the Question No. (3):

) Professional skepticism

An attitude of professional skepticism means the auditor makes a critical assessment, with a

questioning mind, of the validity of audit evidence obtained and is alert to audit evidence that

contradicts, or brings into question, the reliability of documents and responses to inquiries and

other informacion obtained from management and those charged with govemance.

(\) Professional judgment

Professional judgment is the application of relevant training, knowledge and experience in

‘making informed decisions about the courses of action that are appropriate in the crcumstances of

the audit engagement.

(ili) Audit strategy

‘The formulation of the general strategy for the audit, which sets the scope, timing and direction of

the audit and guides the development of the audit plan,

(iv) Audit plan

An auait plan is more detailed than the strategy and sets out the nature, timing and extent of audit

procedures (Including risk assessment procedures) to be performed by engagement team members in

‘Order to obtain sufficient appropriate audit evidence:

4. (a) What do we mean by internal controls? What are two types of controls in a

computerized environment? Cite example.

Answer to the Question No. 4(a):

‘BSA 315 captioned with ‘Understanding the Entity and its Environment and Assessing the Risks of

Material Misstatement’ defines internal controls as follows: eee

regard to reliability of financial reporting, effectiveness and efficiency of operations and compliance with

Applicable laws and regulations. Itfolows that internal control is designed and implemented to address.

vi

Page | 6

re

sgentied business rsks that threaten the achievement of these objectives

controls in a computerized environment

‘re internal controls in-@ computerized erivironment include both manual jt

rtrrato te computer programs. Such manual and computer contra roses comprise Wo

toes of conto. hese controls ate biely described below: _

General Controls:

Gera conta ae polices a pr cedures, that relate to many applications and the effective function

of application ' helping to ensure the continued proper operation of information. Examp!

u ample

indude: Convo over development of computer applications; prevention and detection of Snauthont

cans aa tang ard documentation of program changes; controls to prevent wrong

09" files being used; controls to prevent unauthorized amendmer ols

Prarie cee bey os ro authored amendments to data files and controls

Application controls:

‘Applicaton controls are manual or automated procedures that apoty s 2

's that apoly to the processing of individbe

apne tO ensure that transactions occurred are authorized and are completely and accurate'y

recorded and processed. Examples may include: Control over input, processing, data files and output

may be carried out by the IT personnel; Control over users of the system; a separate control group may

be programmed into the appircation software.

4, (b) Describe an effective design of control mechanism applicable for payment system.

‘Answer to the Question No, 4 (b):

The arrangements for controling payments have substantial bearing upon the size of the company

and ts nature of business transaction with the volume of payments :nvolved. Considering these factors

an effective design may cover following aspects:

‘Cheque or cash The cashier should generally not be concerned with keeping or wnting-up

payments generally | books of account other than those recording payments, Nor should have

access to, or be responsible for the custody of, secuntes or tie deecs

|. belonging to the company.

The person responsible for prepanng cheques should not himself be 2

| cheque signatory. Cheque signatories in turn should not be responsible *<~

| recording payments

Cheque and bank transfer requisitions:

‘transfer payments Appropriate supporting documents (for example: Invoices, Purch:

orders etc.) should accompany

> Approval be accorded by aporopriate level of management

| } Presentation of approved documents to cheques signatories (in c2s2_ |

| of cheque)

Instigation of transfer by approoriate staff

| Authority to sign cheques:

Signatories should not be assigned to approve cheque requisitions

> Limitations on authority to specific amounts

Signatories should be more thsn one to enable a cheque to be valid '2

| encashment

Blank cheques must not be signed

Signed cheques must be promptly dispatched

Information with regards to parc cheques should be obtained from

Payment must be promptly recorded. cash book, nominal and pay ment led

\

Cash payments Fach expenditure must beauthonzes in accordance with, approval author

Cancellation of vouchers must be ensured to deter duplication of payment

Approved limit of cash payment must not exceed.

‘There must be approved Policies and rules with respect to cash advances

a | _taemployees, 10Us and cheque cashing.

vil

Page

' | control. Define

'5) Information system is a critical component of internal

) information system that is relevant to financial reporting. What are the areas oy

financial reporting, the auditor should be interested of?

Answer to the Question No. (5):

Information system relevant to financial reporting:

‘A component of internal control that indudes the financial reporting system and consists of the

Drocedures and record established to inate, record, press and report entity transactions (25 wel ze

‘events and conditions) and to maintain accountability fr the related assets, abilities and equy.

The auditor will be interested in: .

= The classes of transactions that are significant to the entity's financial statements

© Theprocedures by which transactions are initiated, recorded, processed, corrected and reported

The related accounting records and supporting information

= How the information system captures events other than transactions that are significant to the

financial statements 3

= The process of preparing the financial statements

This will typically involve the financial controller and/or director and the use of journals, whict

auditors will be interested: in.

The auditors will be interested in how this process links in with other internal controls and wheth

at this point that controls are overridden or ignored (by use of journals for example).

) — Hesithy Pharmaceuticals Ltd. (HPL) has recently undergone an investigation of the

‘VAT Commissionerate with respect to errors in their invoicing system that impacts

- on VAT deciaration. HPL appoints you being anassuraice provider to conduct a “ev =»:

» the controls in place over invoicing to explore the areas of implement wits

system,

Answer to the Question No. (6):

As an assurance provider, the minimum you have to revew the fellowing contr.

__ preparation:

+ _Evidencethatthe salesinvoehas been agreedto thegoadsdispatch note:o confirmquantities

sold

Evidence that the sales imoice has been agreed tothe order to confirm the price of the coeds sais

Evidence that the calaulaions on the invoice, induding the VAT calculation, have been checkes

{na large computerized function, these checks are likely tobe caried out by @ computer program, so

‘could be checked by processing ‘dummy’ invoices through the system, some of which conta’ er:

to ensure that the appropriate checks are being made. - see conta, vay

‘na less complex system, these checks might be made manually by 2 member of staff. In this case, he

might be evidenced by sgnature or initials by that staff member. Thisis sometimes done by ug

printed stamp on the copy ofthe invoice, such asthe folowing:

[Quantity agreed to dispatch note? Sarr >

‘agreed to price ist? Saf

checked cea

Purpose does audit documentation serve?

{work papers) is the record of procedures performed, relevant evidence

fe A.sulficieet and appropriate record oF (Ive bale for Hye apeuraried (nerviler ® op

subject matters and

fe bvwience that the engaqernent war performed ms mcrorcharice watts ataricar la ae aime at

egal and feguiatory requirement

aust documentation serves a RUNDE OF AdKhtONal gutpHeeS, Inc Hud lve fullest

assisting the engagement (eat to plan and perte

Acsasting celevant members to ditect and sup

Enabling the audit team to be accountal

agncance for future audits

2 Enabling the conduct OF quality Control reviews and inspections

Enabling the experienced auditor to conduct external inept

egal regulatory oF other requirements

he uit

we Ue aut cr

for its vaork, Retaining w verted of *t

isin ccentinnce with nenhea

b) Whatare the key matters that affect the form

Answer to the Question No. 7(b):

1d content of documentation”

Working papers shoul be sufficiently complete ard detailed 10 pro

engagement. Typically following matters affect the form and conten

© The size and complexity of the entity being audited

«The nature of the audit procedures to be performed

+The Wentified risks of material misstatement-and undeviying analy

© The significance of the audit evidence obtained

1 erver al under stare

Wf the dor umentater

The nature and extent of exceptions Wlentified

‘The need to document a conclusion or the basis for a conclusion not readity determunane freer the

_dzcumentation of the work performed or aut evidence obtained

‘+ The audit methodology and tools used

8. a) Appropriateness isthe indicator of quality and: reliability of the audit evidence. What are

the generalized indicators that may help auditors to assess the quality of sud evidenrs”

‘Answer to the Question No.

pgproprtneness (6 the measure of the qualty of relevance and relbiy Of the auas ove

folowing generalized indicators may help in assessing the ‘quality and reiabilay of the audt erderce

‘External Auditeviden J fromexternal surcesis more reliable than that obtained from the entity rez":

‘Auditor _, Evidence obta directly by audtorsis more reliable than thatcbtamenncwetiycx V4 ete

JEentity | Evidence obtained from vive entity records 15 mere reliable wien related orth ersten

| operate effectively : -

Written jEvidence in the form of documents (paper or Clectronie) oF written representations are more

| {Fettable than oral representation

{Griginals [Original dacuments are more reabe than photocopscs facies

itor wat often use Information produced by tne entity when cnainwd ude ender e. athens

this wil not always be a strong form of audit evidence When doing $0, the ISA requires that t

‘auditor ensures it is sufficiently reliable, including “obtaining audit rience atanA the accuracy #

Seremantee of the information and evauating whether the infos ficiently preene

Fee acantr’s purposes’ This may be ecleved by tesing covers in Wie tehahed m0

b) Define following terminologies commonly used in wudit engagement

| Migstatement

Error

4 Tolerable misstatement

«Tolerable rate of deviation

IK

page| 9

Aaromer te the Question NO. 8D):

2) Mestatannent

Agiherence between the amount, Gassifcation, presentation, or disclosure of 2 reported finankiat

‘satement hem ane ee amouN Ciasecation, presentation, oF disclosure that is required for

‘De tem tolbe naccareiance with the applicable francal reporting framework, Misstatements can

ese For era a head,

2 i

epinmentional msstatement in Francia! statements, including the omission of an amount or a

see

] Toleranie misstatement

Toles misstatament’s monetary amount set bythe auctor in respect of which the auctor seeks

so abenin an amprapriate level of assurance that the monetary amount set by the auditor is not

aceeder Dy the actus misstatement in the ponuisbon

) Toverable rate af deviabon

Taeable rate af deviaton 1S a rate of deviaton from prescribed internal control procedures set

ty the autor nnespect of which the auditor seeks to obtain an appropriate level of assurance that

‘De rate of Gewanon set dy the auditor is nat eameeded by the actual rate of deviation in the

UE

9) What do you understand by Financial Statement Assertions? Give a description of

the assertons applicable to classes of transactions, account balances and disclosures

tm prewide @ basis far designing and performing further audit procedures.

Answer to the Question Wa. (3):

Financial statement assertions. Represetat0rs by Management, Explicit or otherwise, that are

erhadad & De Anacel Satemews Auct Assetins are the imphot or explict daims end

cepresmcatons Made oy the Managen|AX response for th preparation of finsnoal statements

ceganding the aroropmmeress.cf The varous OLNEY of Fnanoal Statements anc disosures.

@Ssertons apolicanle D Glasses of Tarsactons, account balaanes and disclosures are descrded delow:

Aseertions | Ocmurrence: Tansoctions and events that have been recorded have ocuned and

abot pertain to te entity

lasses of Complennness: all trencacions a events that should have been recorded have been

Deesaction — reqyded. Accuracy: 2mounts and other cata relating to recorded transactions and

s events have Deen recordad appropriately.

Quboff: transactions and events have been recorded in the correct accounting period,

Gassiication: transactions and events have been recorded in the proper accounts. |

Assertion | Existence: assets, liabilities anc equity interests exist. -

about —_—Rights and obligations: the entity halts ox controls the rights to assets, and libilt

acount ae he ablgabions af the enty. *s

‘Balances —_Campleteness: ail assets, labilties and equity interests that should have been recorded |

‘have Deen recorded.

Valuation and allocation: assets, sbilties, and equity interests are induded in the

| | franca! Statements at appropriate amounts and any resulting valuation or allocation |

a |_adustments are anpropriataly recorded.

SSS ]

tnattess have occurred and pertan to the entity.

Completeness: all cisciosures that should hive been included in the fnancal statements

have been induced. |

| Gassification and understandabilty:.«6al information| ted

os and na ; is appropriately presented

| | Mecuracy and valuation: financial and other information are discs faity and at |

| appropriate amounts. J

x

10. a) Brave & Co. Chartered Accountants, a partnership fit inted

of Glittering Paints Bangladesh Itd. (GBPL) in its recently h eld AGM against fees of

8072.5 million. GBPL is one of the highly acclaimed listed companies in the country

with shares being traded through both DSE and CSE. Mr. Brave, the Engagement

Partner to the subject audit is a member to the City Golf Club (CGC) where among

others the CEO of GBPL is a member too. Incidentally, both Mr. Brave and the said

ceEO are members to the CGC Development Committee for many years. As a result,

azart from their auditor-clent relationship, they have many ‘other common social

How would you evaluate this situation keeping in view the ethi i

How -tonal'accountants in practice? ping in view the ethical codes applicable to

[Answer to the Question No. 10(a):

In the given case, appointment has been made properly and the firm has apparently no problem to

deal with such audit, provided they have adequate appropriate resources with due professional

‘competence. However, we see that the partner engaged to deal with this audit is very well known to

the CEO of the company over many years, being member to a Golf Club. Moreover, both the CEO and

the proposed engagement partner have been working together for the development work of Golf Club.

So, itis natural that some level of reciprocal respect anid friendship has been built over time.

Under this circumstance, there is an apparent threat to objectivity being 2 fundamental principle with

few other threats such as femiliarity threats, threat to independence etc

When there are situations that pose threat to objectivity as well as other principles, rn

must be taken to avoid those threat or reduce respective threats to an acce

the fim may change the engagement part keeping Mr. Brave completely away ‘rom the activity relat

to the seid audit. In case the proposed engagement partner cannot be replaced, there must be a second

partner as an independent reviewer. Care must be taken that this audit must pass through the designated

review partner's clearance. Additionally, the matter of golf club membership may be disclosed to those

charged with governance.

b) Afinancial interest in a client constitutes a substantial self-interest threat. What are

available safeguards to avoid such threat?

Answer to the Question No. 10(b):

Following are the safeguards available to avoid self-interest threat (financial

Disposing of the interest what i th

any of its critical staff member;

> Removing the individual from the team, if required;

> Keeping the client’s audit committee informed of the situation;

> Using an independent partner to review work carried out, if necess2ry

Assurance firm should have quality control procedures requiring staff to disclose relevant

francial interests for themselves and immediate family members. They should also foster 3

+. qulture of voluntary disclosure of an ongoing basis so that any potential problems are identified

ona timely basis.

a. In the recent promulgation of the Code of Ethics applicable for professional

3 cluntants, Independence has been taken out of the list of fundamental principles!

But it remains at its own merit as an ethical code for the professional accountants.

What is your comment about its position beyond the list of fundamental principles?

os

Answer to the Question No. 11(2):

ded as one of the fundamental principles. But later

In the recent pastigdependence used to be regart

In the recent pact Woe that fundamental pincpes are of @ general nate and are almost Ny

applicable for tonts in profession as well as in the business. Independence, although 3

sophia for BO Esble forthe aceountants in business to demonstrate in ther activiy 2¢ "5 core

; x)

“le. r Page | 11

various unconraliabe factors On the pare

iat al, due f0 contrary the degree of independence ,°" Sic,

spi they can demonstrate © degree. On the

Rremains at

FEQuin

pgscmng OR cee

is highest audit engagement,

‘engagements

nclesbenggenercby nature andevenyanpican.

Censderratherstyanground fdanenal Pr, independence. pase has been 95,

both rou of aomurtants have Jon keeping it separate rom the fundamental principles,

ee Chartered Acountants in publi practice can accept contingeny

b. page east teas 5 ‘to ethical codes applicable @ Members of

fees and referral ~ E

the ICAB,

Answer to the Question No. 11(b):

estesing ito negotiations regarding professonal sevices, a professional accountant in pubic

ee ee appropriate A seinterest threat to profestions

Conptac an ue cre € cree fhe fe quted soon tat R may be diffu to Perform the

a ae with applicable technical and professonal standards for that orice

Wiese fan he atove ctatns tha series teats cata nepobiatng/acceptin, fees against

professional services of the professional accountants in public practice. Therefore, we Aeed to be

2s Gru while aceptnglnegotatng any fees or chaes

servces

to be received against professions|

Sotmngent fees are fees calculated on a predetermined bass rating to the outcome of a transaction

ne result ofthe services performed by the firm. They may ceate a self-interest threat to objectivity

Sy AAS Bre ans ested as profesional misc. So, we See akougy TESBA does not

Soph tae eaa acounants fo acept contingent ees ICAB by reference te the Bye-La:

=2pplcahile to its members debars ‘accepting Such fee,

Tegan 2 eal fee or commision rating to ie ot fom tind Party may create 3

ap wd oases acddhecare Sexing t otcan, fir

eying and receiving referal fees of concern,

a par aera Ks Concern, Therefore, if at all profess

Ze Sf

‘Sfeece tthe cue of ethics aswel st the see oft ae remain careful by

“The End--—.

xi

* Page | 12

a

Suggested Anggesay 2 ral yous

‘Assurance mee Fok Ne

one 91813

Question N

(a) The opinion given in an assurance engagement depends on what type of engagement it ss €

appropriate examples of opinion given in different types of assurance ae —

(b) Before accepting an engagement, the audit firm wil consider whether the client is likely to be b

oe low risk othe firm in terra of being able to draw an approprisie assurance opaniun, What +

the primary indications of low and high nsk clients” : —

(c)_ Here are some extracts of financial statements of

ecently acce

audit chet

2017 2016

Tk. “000 k. “000

Revenue 1.566.088 950.339

Cost of sales 1.237.231 737.700

Gross profit 328,857 192,637

Salaries and wages 141.984 185,664

Other administrative costs 10,988 9.939

Audit fee 5,400 5.35

Bank charges 64 3

Other finance costs 2 -

Advertsing 276 465

‘You are required to identify three areas which analysical procedures may suggest as risky and will require

special attention. 6

‘Amser tothe Question, No, La)

‘Types of assurance engagement

The framework identifies two types of assurance e1

«Reasonable assurance engagement : A high. but rot absolute, level of assurance and

‘e Limited assurance engagement: A lower level of assurance

gement,

“The types of opinion given in each engagement are stated below

«Positive opinion: A practitioner is secking evidence 10 conclude whether the report sssued by the

Chairman of a company in the financial statements is reasonable or nol, he cauld seek evidence conclndc

that the statement is reasonable and state m a report something like this:

tm my opinion. the statement by the chairman regarding X 1s reasonable”. This fsa postive state

‘of his conclusion that the statement is reasonable

like this.

tn the course of my secking evidence about the statement by the chairman, nothing has come 1013

‘attention indicating that the statement is not reasonable.”

edu

| ‘© Negative opinion: In the same scenario, the practitioner could alternatively state m a report sone thing

Page| 1

ie : il

)

enter cttctor en

pee Roce es ze -

arr eel increased output

eit ro Si” ;

SS ee

‘

cen eee nt cement

i

sa ae cet cs 1 pts ons fm mag ener and continues 10

get Saeco trees ms eee el ohne

leer emares opis Smet onal mech cleted evidences.

Were fete copes de apap ies”

Ree or es ee lw

©) Symmes seca

2 Seger bik ei

a Momeney ot caging

aw toes ecm werkng pap ir wi fi 5 ae :

Ammer the Question No. 21a)

epee iener weld proealy mci sefeneace 10

the

> Maeatgecine a eran of fms following:

, ee

> The scape of he sai, mctaing re

dts te och 0 eden ein, psetins or pronouncements of

> Tae fam fey sept er comm

rt the

mf remus o the managemeat

Papi xiv :

ee weekeesiaoe nherens Ninnaations of wn audit, together wth the

jumnitaticntnn of any Berenurnting internal ontral eystem. there 16 an unaverdabhe

ieee eral setae MAY Ferri nore ered “an

weaned access 10 whaleve records, documentation and wer information requested in common

c sweats the anal

Ananer to the Question. No.2)

{systematic selection:

“hip method involves selecting items using a constant interval between selections, the first interval having

a rador start, When using sysematic selection assurance providers must ensure that the population is

wot swear ‘such » manger that the sampling interval corresponds with & pariculas patiern sn the

rapa

A. Sequence or block selection:

sampling may be wed to check whether certain items have

cexnmple, an auditor may use «sample of SO consecutive cheyues we check whether cheques are s

authorized signatories rather than picking 50 single cheques throughout the year

particular characterisucs. For

sgned by

{ih Monetary unit sampling:

‘Tie is selection method that ensures that every CUI in a population has an equal chance of deg

seleaed for testing, [tis easy when computers are used. and that every material em will sutorastically be

3 dors

fanpled If computers are not used, can be ime consuming to pick up the sarcple, and the b

oreope well with the errors of understatement or neyative Yelances

Answer to the Qiiestion. No. 266)

» Aulomaied working paper packages have been developed which can make the docurnent

much easier, Such programs aid preparation of werking papers, lead whedules. tral balanc

ftaiemonis themselves, These are automatically cross referenced, ‘adjusted and balanced by the ¢

‘The advantages of automated working papers are as follows

‘¢ The risk of errors 1s reduced

o The working papers will be neater and easier to res ie

J Thetime saved will be substantial as adjustments can be made easly all working papers. inc!

‘working papers summarizing the key analytical information

. Staridard forms do not have to be carried to the audit locations

‘s Audit work papers can be emailed or faxed for review

foding

Question No. 3

4) Define audit documentation. Who is the owner of audit documentation and ho have the night

of access to those documents? 4

by {b) Critically assess the procedures ‘of obtaining evidence. How are these methods used by the

‘auditors to obtain evidence/s? 2

co) Hassan is working on the audit of Hussein Lad, a large chain. He has been allocated

the audit of non-cutent assets. One aspect of this audits the fact

oa rec bring the year, which have ben capitalised into now-curen see, 1

ha vorking on are that al the relevant cot have Been capitalised (complies)

ot al oes re valued corey a co (austin low will Haan con

these two assertions? 7

, roaN

“smswor to che Question NOMA)

_\pait docamentation (working papers?

and documentation (working pagans te recor of poses parformed, relevent evidence oy,

and eoactusions reaches n

Working papers are the property of assurance providers. T

enity’s accounting records, Howeve, the report becomes the

As woeking papers belong tothe frm, the assut

However, the firm may show woeig PANTS

proces is ot prejudiced. fnformaton should not

‘of the clieat,

Inspection of tangible assets: Inspection (physteal examination) of tangible assets that are recorded in

the accounting records confirms existence, but does not confirm rights and obligations oF valuation. Fo,

cxample, machinery record in asset register ca be inspected by assurance providers.

Confirmation that assets seen are revorded in ateounting records gives evidence of completeness. Inspection

of asse isa good procedure, particularly in the case of assets tha the ely ‘could not function without (for

‘example its production plant), but the weakness associated with inspection i that assets not used in daily

production could be hidden from the assurance providers and not included in financial statements.

rey are ot a substitute FOF, OOF part gg

property ofthe client once It has been is,

Ne

rance powers ar nt ured 1 tHe 1th ley

to the client at their discretion, 80 long as the assurang,

Ie made avaiable t thd partes without the Permission

Procedures of obtaining evidence

Anspection of documentation:

Inspection of documents involves examining records or document, fr example, looking a sales contract

‘ot a share certificate.

Looking at source documents (e.g saes invoices) and tracing to financial statements gives evidence of

completeness (eg. of revenue). The strength ofthis procedure depends on what is be

i ing inspected to give

evidence. For instance, inspection of a purchase invoice gives better quality evidence fe recta

‘ales invoice, because a purchase invoice s created by a third party 7

‘Observation: This involves watching a procedure being performed (for example, post openi

n « le, post opening)

This procedure is relatively weak, ast only confirms that the ing pe =

‘ ly tthe procedure is being performed correctly when

Inquiry: This involves

secking information from client management or staff or external sources and

The suengh or weakness of this procedure will depend

cof whoa the inquiry

ETE Ac letter eis fhe save pir chat alee

«question or they are seeking to conceal a ero oF fraud. ir alemdar ie eee of toe

ances Seeking confirmation from a third party €g. confirmation from bank of bank

Page | 4 xv]

be a very strong procedure but there may be instances where ird party is motivated

may the thi

\ ated 10

gecalelation: Checking mathematical accuracy of lens tecords, for example, adding up led

. ledger accounts.

gecaleulaton is evidence created by the assurance provider s0is strong evidence

: Independent! :

eperformance: Independently executing procedures

ee a raad aid brick Pp or controls, either manually or through the use of

the fact that the assurance provider i

se carries out the performance of a control himself makes it strong

Analytical procedures: Evaluating and companng financial fe

Na nod investigating uncapccted ee fal and/or non-financial data for plausible

idence here is limited by the strength or weakness of the underlying accounting system

Hower, this can a song procedure if comparison is made to items that do not rely on the seme

‘accounting system of that the assurance provider can corroborate outside the accounting system.

Answer to the Question, No, 3(c)

Completeness

Hassan will:

> Oblain architect's certificates for the stores. certifying that the work 1s complete

> Oblain a schedule ofall the costs capitalised into the stores; this is also likely to have been verified by

the contractor, giving comfort that the costs are complete

Valuation

Hassan will:

Mech asample of costs to appropriate sources of evxdence, for example, bout costs to payroll records

gr contractor bills, materials costs to purchiase invoices or contractor bills, finance costs to statements

from lenders (for example, bank statements) 5

> Inrespect of finance costs, Hassan will review bank statements to ensure that all relevant finance costs

have been included.

Question No. 4

(a) What are the different applications controls that auditors may test and how? 9

(6) What are the objectives of establishing control over recording of wages and salaries and

deductions? 5

(© NHN Hotels Ltd. (hereafter referred to as NHN) is listed company which owns a number of

hotels in Bangladesh. Each hotel is a subsidiary company of NHN, for example, NHN Dhaka

Ld is a hotel in Dhaka, NHN charges each hotel a management charge, which is determined

tie Tred calcnlation depending on the number of rooms at the hotel. One of the things this

cee cage ontexs is the interoel suiit department which is managed centrally. The

Kv)

Page

eg A

carry out cyclical operational audits ayy), ho

internal audit departiment is required riven ces isaudited annually, y,./%

rel hoe

Chiagons Hotel, Wi och tl being auited al least once in three rc

rege aaa von at activites that shouldbe performed by he iments

Separan ~ Ny

7

* Answer to the Question No. 4(a)

Application controls ee

[ f application controls : —

Mam

i the system's output is comp

cs asonable assurance that the s “A Plete,

seeciaed by Ge Z a a ise the auditor may decide to limit tests of controts

these manual controls. |

| user

| Controls over In addition tothe manual controls exercised bythe user, the controls tobe

system output | tested using information produced by the computer or are contained within

computer programs, sch controls may be tested by examining the system

output using either manual procedures or computer sided audit techniques

(CAAT) Such outputs may be inthe form of magnetic media, micrfn,o-

Printouts. Alternately, the auditor may test the control by performing it

the use of CAATs.

| Programmed | In the case of cerlain computer systehs, the auditor may find that it is no

| control proce- | possible or, in some cases, not practical to test by examining only use;

| dures controls or the system’s output. The auditor may cor

of control by using CAATS, such as test data, reprocessing transaction data

| of in ubusual situations examining the coding ofthe application

ace stel situations, examining the coding of the applicati

General If controls may have pervasive effet onthe processing of transactions in application systems

ia Rese general consol ae not effective, there may be a risk that misstatement occur ev 0 undetected

‘application consis possible that manual procedures exercised by users may provide effective conito|

at the application level.

Wages and salaries are coretly recorded inthe nominal ledger

all deductions have been calculated correctly and are authorized

> the correct amounts are paid to NBR.

| Page | 6 VII!

Answer to the Question.) 4a

goomon audit activities should be performed by the inte department as follows

cag audit” comprises a nuber of elements, all of which have been carried out (alt q

{22 Sme me) for the fll eycical audit to have been completed These ee =

» surprise cash counts i key cash transactions areas (rection bu, restaurant)

eset inspections, particularly linens and leisure facilities

saventory count for certain assets, particularly the ladder and bar

rest of controls in key svstems; sales, purchases, p2\tol!

health and safety cont. systems testing

+ review actual results agamst budget for the ye

> In addition, af any area shows indication of irregularities, for exany le, VAT and revenue recognition

that area should be audited in detail sie reven “en

Question No. S

(a) Why ethical guidelines are required for the professional accountants? c

{b) Describe in bref the following terminologies alongwith related threats and safeuards as they

are used in discussing about ethics in accountants’ business: 9

i) Conflict of interest

ii) Second opinion

iii) Gifts and hospitalities ”

(©) Sayema is a qualified accountant. She has recently moved out of practice and Wken UP the

position of financial controllef of a small, non-listed company, Lavender Lane Ltd The company

Posticlbort-term cash flow problem. Sayema was recently called into the board meetme ond

saved If abe could defer some income from the previous financial year so as to influence when

‘he tax (both VAT and corporation tax) would be due on those sales, The directors were messteit

tre euch deferral was necessary and that she should consider this request more yn the nature of

fan order, Comment on the following options availaQ.le to Sayema

1) Repor ber concems to the audit commustee of the board of & tes

ii) Take advice from ICAB

iii) Take advice from legal advisor’s. : 6

Answer to the Question No.S{a)

Ethical guidelines

Professional accountants have a responsibility to consider the public interest and maintain the reputation

ofthe accounting profession. Personal self-interest must not prevail over these dutics. The IFAC and ICAB

Codes of Ethies help accountants to meet these obligations by setting out ethical guidance to be followed.

Acting in the public interest involves having regard to the legiiriae interests of clients, government

financial institutions, employees, investors, the business and financial community and others who rely upon

the objectivity and integrity of the ‘accounting profession to support the propriety and orderly functioning:

of commerce.

In summary, then, the key reason accountants need {© have an ethical code is that people rely on them and

their expertise. It is important to note that this reliance ‘extends beyond clients to the general community

xls Page| 7

4

by rel

gis 700 and also by relevay,

regulated DY nents should be included in a

ny

audit report is ee ais

6

this context, what

sentially

_ The content of the

Banglades!

audit report? ‘Write seq!

‘

ic elements, usually jn,

Answer:

According to BSA 700, th

che following layout.

> Title

audit report should include the following basi

Addressee

atements audited

financial sta

juctory paragraph identifying the

for the financial statements

>

> Introd

> A statement of management's responsibilty

of the auditors responsibility

scription ofthe work

> A statement

performed by the auditor

> Scope paragraph, including a

ragraph containing an expression of opinion on the financial

v

Opinion pa

statements

v

Date of the report

> Auditor's address

> Auditor's signature

4 measure of uniformity in the form and content of the aut report is desirable because it helps

to promote the reader's understanding and to identify unusual circumstances when they-occur,

4. ICAB and IFAC Code of ethies sets out the rules under which auditors should accept

new appointment.

What procedures should the new auditors follow to comply with the above set of rules? 6

Answer:

ICAB Code of Ethics as well as IFAC Code of Ethics sets out the rules under which auditors

should meceptner appointments. Before a new audit client is accepted, the auditors must ensure

oe is no independence or other ethical issues likely to cause significant problems with

ical. Furthermore, new auditors should ensure tt er

ir S nsure that they have been appointed in a proper

Page|6 24

.

ASSURAN( E

Suggested Answer

‘Nov-Dec 2017

uation No. I.

‘hat is the meaning of auditor's normal ex u - oi

» : - ‘ A report which

ny ey of absolute assurance or corre: ss cannot be provided duc ic som aitations. What

ae $

‘¢)_ Define assurance engagement in an audit function 3

@ In an audit engagement, the engagement team docs so mrs “hnos /!) sing the defined

methodology the Engagement Partner approves. | these are « itable report is

jssved 8s Per prescription of International © sds on Auditing You =. scicv) ~ked to draft an

soqualified audit report as per ISA 700 app ...e for a company. 10

Answer to the Question No. 1(a):

The auditor will normally express his audit opinion by reference to the ‘true and fair ~'~ »", which is an

of reasonable assurance’ Whilst this term is at the heart of the audit, ‘truc fair view’ are

fox defined in law or audit guidance. However, for practical purposes the follow. definitions are

geazrlly accepted:

ree: Information is factual and conforins with reality, not false. In addition, the information conforms

wih required standard and law. The accounts have been correctly extracted from the books and records

Fair: Information is free from discrimination and bias in compliance with expected standards and rules.

The accounts should reflect tlre commercial reality and substance of company’s underlying transactions.

Answer to the Q No. 1(b):

Assurance can never be absolute. Assurance providers will never give a certification of absolute

‘correctness due to the limitations of the nature of the service.

‘The limitations of assurance services include :

The fact that testing is used-the auditors do not oversee the process of building’ the financial

statements from start to finish

1s The fact that the accounting systems on which assurance providers may place a degree of reliance

also have inherent limitations

‘© The fact that most audit evidence is persuasive rather than conclusive

‘s) The fact that the client's staff members may collude in fraud that can then be deliberately hidden from

the auditor or misrepresent matters are the sare purpose.

© The fact that assurance provision can be subjective and professional judgements is an essential part

‘whale concluding an opinion

© The fact that assurance providers rely on the responsible party and staff to prov ide correct

information, which in some cases may be impossible to verify by other means.

© “The fact that some items in the subject matter may be based on estimates and are therefore uncertamn.

Its impossible to conclude absolutely that judgmental estimates are correct.

Page | 5

report Colght sell be Li

“

hve Caet Uat the ature at HIve an vert wii

. Jhon the annowanse piven tren Oat

Aono 40 ne venta Nt LUD,

ou Woe wh #4 ARNE CORIO, desig ene he

SN ewe wubb oss ir than te rspoible party, aba the atone of

Sea ashy cK AN TH TT AVE varios examples of tg

FT aaarey mi flanglateah (the ait. Asturance engagements can sive either a reasonable leve}

itt We anit [hay at won, alo gives reasonable level ef wma

Avnet the Qnietion Ne. tat)

INDEPENDENT AUDITORS REPORT

HLINB, a8 every judgment ang

degyee of eanttione

‘To the Shareholters of ANC Company

We have auntie the assownyrany ng financial statements of ANC Company, which comprise the statement

‘Of fnanial panition as at December V1, 20N1, and the statement of comprehensive incame, statement of

‘vies 1h eAUHTY aA taternent OF cash Hows fOr the year then ended, and a summary of significant

eeteie polo explanatory information,

Management's Responsibility for the Pinanctal Statements

i Management GFABE Company is responsible for the preparation and fair presentation of these financial

Hatemien Hh AaGOAMANKCS wih Irvermational Financial Reporung Standards (IFRS), the Companies Act

i 1994 aie thio Applicable laws anc! regulations anal for such internal control as management determines is

| AP MADIE THe prepration of financial statements that are free from material misstatement

‘hater de Wi fhauad oy cr

I statements based on our audit, We

With Bangladesh Standards on Auditing (BSA). Those standards

Toquirements and plan and perform the audit to obtain reasonable

Statements are tree from material misstatement.

Pes 10 obtain audit evidence about the amounts and disclosures in

dures selected depend on the auditor's judgment, including the

erent of the financial statements, Whether due to fraud or error.

itor considers internal control relevant to the entity's preparation

ats in order to design audit procedures that are appropriate in

ose of expressing an opinion on the effectiveness of the entity's

-evalvating the appropriateness of accounting policies used and the

made by mangement, as well as evaluating the overall

obtained is sufficient and appropriate to provide a basis for

4 true and fair view of the financial position of ABC

cial performance and its cash flows for the year then

ing Standards.

a February 20X2 Chartered Accountants

question No.2:

a) Define control activities. Explain the types of control activities with examples 10

1) What will be the tests of Controls in recor:‘ng wages and sa! and any deductions thergof? 9

| Define CAAT. What are the main types AT re being used while conducting an

audit? 6

serio he Question No.2 (ef

control activitie: Explain the | The policies and procedures thet help «

+ | types of control activitie wish management directives are carried out |

examples. | |

. [Wperat Fem Taplnaton |

conte!

activity = |

‘asthorie | Approval | Trans tions should be | | |

ation | and approved by an | |

| Control | appropriate person, for || |

of example overtime |

documen | should be approved by

ts | department manager.

Performa | Reconcili | Reconciliations involve

|[nce | ations | comparison of a |

| | review Specific balance in the ||

accounting records

with what another

: source says the

balance should be

| Differences between

the two figures should

only be reconciling

- items. For example a

bank reconciliation.

‘Compari_| For example

ng ‘comparing records of

internal | Goods dispatched to

data with | customers with

external | customers’

| sources | acknowledgement of

| of goods that have been |

p informati | received. |

i a _

5 Page |7

be

a nemmeeey

,-— oT Wala ono! acount BNE

together transactions

| reviewio | irvdividua! ledger:

| control rial balances DANG

er al

ara tint | casa forthe

tatances | crganiiation a whole

| Preparing these ca"

nightight unusual

transactions oF

accounts. _

| | ama fc [For esto cer

| on we to see If Individual

process) | adthmeti | voices have been

ry al added up correctly

| accuracy

of

| records | __

| Physkal | Comparl | fi ymple a physical

control | ngthe | count of petty cash

results of | The balance shown ia

cash, | the cash book should

‘security | be the same amount as | |

and | inthe petty cash box

| account

a

records

| Aimniting | Only authored

| physical | personnel should have

access to | access to certain

assets

and

records

tiny be directed, and the exient of ove

inquiries, the —muditor considers — whut

formation iriny be obtained that helps the

sunitor in identifying risks of material

‘misstatement

Annlytical procedures may be helpful in

\dentitying the existence of unusual

Hransnetions of events, and amounts, ratios

and trends the ght indicw th

Nave financial — statement

nyplications. tn performing

procedires as risk assessment procedures,

the suditor develops expectations about

plausible relationships that are reasonably

expected 19 exist. When comparison of

those expectations with recorded amounts or

ration developed from recorded amounts

yields unusual or unexpected relationships.

the auditor Considers those results in

identifying risks of material misstatement

However, when such analytical procedures

use data aggregated at a high level, the

results of those analytical procedures only

provide a broad initial indication about

whether a material misstatement may exist

Accordingly, the auditor considers the

results of such analytical procedures along,

with other information — gathered in

identifying the risks of material

misstatement

Observation and inspection may support

inquiries of management and others, and

also provide information about the entity

‘and its environment. Such audit procedures

‘ordinarily include the following:

Observation of entity activities and

‘operations.

Inspection of documents (such as business

plans and strategies), records,

‘and internal control manvals.

sReading reports prepared by management

(such as quarterly management

‘and interim financial statements) and

| those charged with governance (such_as

Page | 9

‘What wil ba the wuts of Convo ol [A bey control assurance prodder will be]

recording wages and salaries and concerned with the reconciliation of wages and

deduction thereof? seats for wegen, tree re showid heve been

ro

|

i

|

Question No. 3:

The audince should obsain writen represematons om camagement on

maners selaang @ the Snaacw!

soremems when other appropriate audi cndences collecied may sot be 5

ct w be sufSocent

3) How does Leter of Representation support 2s aadit evidence? $

1) Want actioes should the auditor take when oo other endence 5 salable amb only smernel

confirmations form significant basis for opimicn?

@ What actions should the auditor wke when camermct s heat pas

evidence of management's acceptmce of respunsitility and

of the financial satements and design and mplemencove

a

Competence ofthe management

+ Honesty ont integrity of the yuanayenent

Sense of diligence at

Hie care at the Avuaina ger

Answer fo the Question No, Wh)

Assuming that wineorroborAted internal confirmations are permitted Am ypecitically fled

SIFUINSTANCRS SCH AF MaNAgeMent's ‘vient, snanagernent’s judgement, andl facts Anowledye confined

10 management, an alitor may concliste that Ho other evidence 1s avyilable for an aysertion that form 4

‘Significant basis OF the opinion. Iv those exceptional cases, the matter omy be of such siynifican © the

‘nuditors refer to the tepresentations in theis report as boing relevant to a proper understanding Of the basis

‘Of thei opinion. There are instances where management intention ard whew the matter is juclysnental

‘uv opinion, fran example the tain sion of «patie estos iaaiaiiel

‘When fio other evidence is available (ix an assertion not specifically ilcntified above and he y itor

should modify the report

‘lates that when management refuses tw provide necessary represent udlitor should

Aisclaimy bis OF Her Opinion. 16 the principle As that internal confirmation dernonstrates the

by the ement of | wsibility and accountability for the assertion ts valid. the refusal to.

plies management's unwillingness tw accept responsibility and

In such circumstances, the auditor's confidence si management

Ao such an extent that a qualified opinion may not be a detensible

from the engagement should be the options when management

However, there may be circumstances when the auditor

ot obtained does nol undermine his or het conclusion

Ment’s refusal to provide ternal confirmations

tions,

tations can be expected to be well informed on

the representations received do not agree with

should:

janaking further inquiries, to ascertain whether

carry out altermative audit procedures

esentations made by management (i¢

Aah

peers detrei ‘oF inateriality. ts @ onatter of profesional judgerme', ond is affected by the

vr percegtin of ie financial information ees of wsers ofthe financial statements. The concept of

al ry boy the audlitor both da planning and performing the audit, amd un evahaating the

Aico ents aiataterents wt the aunlit and of uncorrected misstatements, 1f any, on the financial

‘aon! tay forimiag (he opinion in the auditor's report

Ws 10 tne tha heater shoul Be conshered by the audlitor

‘o Detereitinyg the nature, (ining ‘anal extent of procedures, and

ivauating the effect of misstatements

.

Trough the Kit prosesire, aunhtor must Keep nam that ¢ marer e-atertal iE Hts omission oe

Frssatement wOUKE ceasoniably ynthuence the eeomorn) aken on the basis of the

Financial statements, Materiality depends on. the sies tert of its omission of

Anger tothe Qa Not (hs

Materiality considerations and fivation during auslit planning are exiremely important, The assessment of

woteiality at this stage should be based on the recent and reliable financial information andl wall help to

tan effective and efficient aut approach Materialty assessment and fixation will help the

saditors to decide

‘+ How many and what items to examine

4 Whether to use sampling techniques

4¢ What level of error is likely to lead to anv auditor to say the financial statements do not give true and

far view :

‘The resulting combination of audit procedures should help to redice audit tsk to am appropriately low

jewel. This ts how risk and materiality are closely connected. The value of discovered errors should be

‘at the end of the audit to ensure the total is below tolerable error, To set the matersality level

seeitors need to deeide the level of error which would distort the view given by the accounts, Because

framy users of accounts are primarily interested in the profitabijity of the company, the level if often

expressed as a proportion of its profits

Answer to the Question No.4 is)

‘Subsequent Events are those events occurring between the date of the financial statements and the date of

the nuitor’s report, and] facts that become known tothe auditor afer the date ofthe autor sr Venfy rights and obligations by agreeing Ue addition of plant and equipment to a supplier

invoice in the name of audited company”

} Review the list of additions and confirm that they relate to capital expenditure items rather than,

repairs and maintenance

| & Review board mimutes to ensure that significant capital expenditure purchases have been

authorized by the board

4 Fora sample of additions recorded in P&E physically verify them on the factory floor to confirm

existence. 7

Disposals:

4 Obtain a breakdown of disposals, cast the list and agree all assets removed {rom the non-current

asset register to confirm existence.

__& Select a sample of disposals and agree sale proceeds to supporting documentation such as sunry

sales invoices.

4 Recalculate the profitoss on disposal and agree to the income statentent

| Answer Q. No. 3 (2)

There are various types control activities identified in a sound ‘control environment. Those activities

_itchide authorization, performance reviews, information processing, physical controls, segreystion of

duties etc. Brief description of these activities ig given in the table below:

ba : WW

Page |9

=} Transactions must be approved by a,

4

Differences between the two fi ures oa |

only be reconciling iterns

For example, comparing records of goods —~

dispatched to customers with customers | +

acknowle germent_

For example, checking to see if individual —~)

imvoges have been added up correctly

For ample, aphysical count of petty cash

Answer Q.No.3(8)

Audit Document ok paper) isthe eon of rocedes performed, relevant evidence obtained

7

8 conclusion reached,

‘fit document t work papers should provide;

{> \efccn ad apopiaterevord of he bas forte assurance provider's opinion on the

mater; and

4 alge tthe eagagment was performed it accordance wih sandards and applicable legal ond

regulatory requrement

Aust documentation serves a number of additional purposes, including the following:

‘Assisting the engagement team to plan and perform the audit

4 Assisting relevant members to direst and supervise the audit work;

‘Enabling the audit team to be accountable for its work,

4 Retaining’ record of continuing significance for future audits;

© Enabling th conduct of quality contro eviews and inspections

& Fhabling the experienced auditor to conduct external ,

posneyeatessati inspections in accordance with applicable legal,

Question No.4

(a) The Audit Engagement Letter is a very vitl document underly

required to have salient knowledge about the engagement lense eet eugagement. As you are

i) What are the objectives of Aut Engagement Let?

1) Write in brief the basic contents of an Audit Engagement Letter, : 5

(&) Despite having substantial uncertainty on ving Concer issue, Sp . 7

Financial stdement on Going Concem bass What effec il ae eeu LW. prepared its

report in the event of uncertainty over Going Concem under following cna nye O8 YOU indit’ /

1) The matter fully disclosed in the financial statements.

1) The matter not disclosed in the financial statements.

subject

Pe 18

gover N04)

pe ctjectvs ofthe engagement letter are to,

F the extent of the firm’

> Define clearly firm’ svauditor’s responsibilities and so minimize the possibility of an

smisundersizading between the client and the auditor oes

i ‘written confirmation of the firm's/auditor’ i scope of 1

Provide Bee bre cree. /auditor’s acceptance of the appointment, the scope of the

fan engagement letter is not issued to clients, both new and existing, there is scope for argument about

precise extent of the respective obligations of the client and its directors and the: auditors The

tlements of an engagement letter should be discussed and agreed with management before i 1s sent

answer Q. No.4 (aii)

he engagement letter would generally include reference to the following,

4 The objective of the audit of financial statements

4 Management's responsibility with respect to accuracy of the financial statements -and ensuring

intemal controls.

& The scope of the audit, including reference to applicable legislation, regulations, or pronouncements

cof professional bodies to which the auditors adhere

“The form of any report or other communication of results to the management.

4 The fact that because of the test nature and other inherent limitations of an audit, together with the

inherent limitations of any accounting and internal control system, there is an unavo?

even some material misstatement may remain undiscovered.

© Unrestricted access to whatever records, documentation and other information 1s requested in

connection with the audit

& Expectation of receiving from the management writen confirmation of representations made \n

‘connection with the audit,

°

Answer Q.No. 4 (b.i)

Effects on audit report will be as follows

Unqualified Opinion with Emphasis of matter paragraph on going concem uncertainty highlighting the

existence of material uncertainty relating to the events or condition that may cast significant doubt about

the entity's ability to continue as a going concern and draw attention to the notes to the financial

statements that disclose the matters where management's plans to deal with the events are explained.

Answer Q. No.4 (b.ii)

Qualified opinion with ‘except for’ phrasing if considered material without being pervasive;

* Adverse opinion if considered material and pervasive;

= Disagreement over non-disclosure resulting in issuance of qualified opinion or disclaimer of opinion

depending on the significance of the potential impact on the financial statements due to disagreement.

Question No. 5

Ethics in the business is considered as the most expected core vale which individuals should follow and

demonstrate in their respective field of activites. International Ethics Standards Board for Accountins

(QESBA) has usued a set of Code of Ethics which [CAB being a member of IFAC has adopted word for

‘word for its members to follow in their respective field of work

19 Page | 11

sal acc Une AND hy

yoo

oa yence in fact aud ivleperiten ,

wt ont

oo) a 5

) we Oy wo rest teat, What are vagy,

abst § 5

juts *

»

ally. Cite 160 SUCH eXanpi

et penne rei

2 sew pap ae :

i uta 10 8 (i, steel,

oes!

Na (8) on on all PO elient’S

oN bol tio eo ata affect the Objectivity of th

ity poses

The re mes. CS eee a honest assessment and evahiation of

vet compat management is unlikely tg

to them ral she auditors

' aitor’s protessic

ical pics ene any but be sen 10 De independent. Th

Mich as financial intrest in the client, close

fopmanagement May impair

onal responsibilities. its

sjonal accountants.

aero oe 7

airthe objectivity, should not tke

ind remain free

Answer Q.No.5(0)

Independence of Mind: The sate of mind th pis the expression of a conclusion without being

ere sdunes at compromise profs judgnent allowing an individual (9 sx‘ with

integrity and ees betty and profession skein.

i“ ni ;

independence in fact: beevins in fact exits when the auditor is actually able to maintain 3”

Independence in

snpedence epson: lpn parish rest of oes interpretations this

Terao eterna ne Cento that 8 reasonable and

reasonably conclude fms ora members ofthe mation, including safeguards applied, would

skepticism had ben compromised assurance team’s integrity, objectivity or profession!

Answer Q.No.5 (6)

Foll

lowing are the sfegurds available to avoid

% Disposing of te inert, eet threat (financial interest)

wot firm ped _ quality control procedures requiring staff to disclose relevant financial

for themselves and mmediae family members. They shoul also foster «cure of voluntary

| we of an ongoing basis so that any potential problems are identified on a timely basis,

| pre NOE)

4 110 remember that accountants in business are subject to the same fundamental principles as

wins in price ae, However, an accountant i Business may find himself in a position that faces

essure from the management to act uncthically or to act to the interest of a small community

a goes cory 10 the respet ofthe profession, Unlike professional accountant in practice. those are

5 usiness appear to be more vulnerable in terms of independent behavior. Apart from established

Miser press, Often there appear situations when such accountants are guided by the call of the

Page

‘gen accountants 1” business find themselves in dilemma when they are guided by the management as to

(patent of certain accounting transactions o presentation of financial statements in the interest of a

0? of people or to the contrary of the national exchequer.

fale of such unethical acts may include

4g Lieto or mislead auditors or regulators,

{sue or be associated with published reports (for example, financial statements, statement of tax

computations) that materially represent the facts .

Oat Page| 13

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IAS 16 Property Plant EquipmentDocument4 pagesIAS 16 Property Plant EquipmentMD Hafizul Islam HafizNo ratings yet

- Group 01 Report UpdateDocument24 pagesGroup 01 Report UpdateMD Hafizul Islam HafizNo ratings yet

- 1st MidtermDocument9 pages1st MidtermMD Hafizul Islam HafizNo ratings yet

- 16 Ais 010Document13 pages16 Ais 010MD Hafizul Islam HafizNo ratings yet

- CamScanner 03-03-2022 20.50Document7 pagesCamScanner 03-03-2022 20.50MD Hafizul Islam HafizNo ratings yet

- Impact of Price Hike Over Lower Middle Class: A Case Study On Barishal Metropolitan Area. Literature Review AbstractDocument1 pageImpact of Price Hike Over Lower Middle Class: A Case Study On Barishal Metropolitan Area. Literature Review AbstractMD Hafizul Islam HafizNo ratings yet

- Accounting Treatment (Ias - 21) Recognition and Initial MeasurementDocument8 pagesAccounting Treatment (Ias - 21) Recognition and Initial MeasurementMD Hafizul Islam HafizNo ratings yet

- Systems Development Life Cycle (SDLC) - A Five-Step Process Used To Design and Implement A New SystemDocument4 pagesSystems Development Life Cycle (SDLC) - A Five-Step Process Used To Design and Implement A New SystemMD Hafizul Islam HafizNo ratings yet

- Group 3Document29 pagesGroup 3MD Hafizul Islam HafizNo ratings yet

- IAS 21: The Effects of Changes in Foreign Exchange RatesDocument5 pagesIAS 21: The Effects of Changes in Foreign Exchange RatesMD Hafizul Islam HafizNo ratings yet

- Risk and ReturnDocument11 pagesRisk and ReturnMD Hafizul Islam HafizNo ratings yet

- All Math pdf2Document6 pagesAll Math pdf2MD Hafizul Islam HafizNo ratings yet

- Right Form of Verb Subject-Verb Agreement Corrections: BB MCKB I Qe/A V Ci Cixÿv - ©X 'I RB # Bs Iwr FVLV #1Document28 pagesRight Form of Verb Subject-Verb Agreement Corrections: BB MCKB I Qe/A V Ci Cixÿv - ©X 'I RB # Bs Iwr FVLV #1MD Hafizul Islam HafizNo ratings yet

- Group 7 Transfer PricingDocument18 pagesGroup 7 Transfer PricingMD Hafizul Islam HafizNo ratings yet

- IAS 02: Inventories: Requirement: SolutionDocument2 pagesIAS 02: Inventories: Requirement: SolutionMD Hafizul Islam Hafiz100% (1)

- Midterm 5101Document4 pagesMidterm 5101MD Hafizul Islam HafizNo ratings yet