Professional Documents

Culture Documents

Meeting 8

Uploaded by

cc0 ratings0% found this document useful (0 votes)

5 views4 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views4 pagesMeeting 8

Uploaded by

ccCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 4

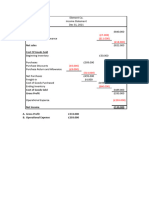

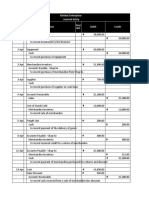

General Journal

Date Transaction Ref Debit Credit

Apr

2 Inventory £ 6,200

Account Payable £ 6,200

(to record purchase)

4 Account Receivable £ 5,500

Sales £ 5,500

COGS £ 3,400

Inventory £ 3,400

(to record sales)

5 Freight Out £ 240

Cash £ 240

(to record freight out)

6 Account Payable £ 500

Inventory £ 500

(to record purchase return)

11 Account Payable £ 5,700

Cash £ 5,643

Inventory £ 57

(to record paymet)

13 Cash £ 5,445

Sales Discount £ 55

Account Receivable £ 5,500

(to record receive)

14 Inventory £ 3,800

Cash £ 3,800

(to record purchase)

16 Cash £ 500

Inventory £ 500

(to record purchase return)

18 Cash £ 4,500

inventory £ 4,500

(to record purchase)

20 Inventory £ 160

Cash £ 160

(to record freight in)

23 Cash £ 7,400

Sales £ 7,400

COGS £ 4,120

Inventory £ 4,120

(to record sales)

26 Inventory £ 2,300

Cash £ 2,300

(to record purchase)

27 Account Payable £ 4,500

Cash £ 4,410

Inventory £ 90

(to record payment)

29 Sales Return and Alowance £ 90

Cash £ 90

Inventory £ 30

COGS £ 30

(to record sales return)

30 Account Receivable £ 3,400

Sales Revenue £ 3,400

COGS £ 1,900

Inventory £ 1,900

(to record sales)

£ 59,740 £ 59,740

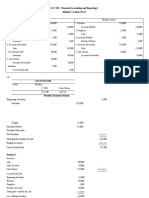

Income Statement

Net Sales :

Sales £ 16,300

Sales Discount -£ 55

Sales Return and Allowance -£ 90

£ 16,155

Cost of Good Sold £ 9,390

Gross Profit £ 6,765

Sales Operating

COGS Gross Profit Net Income

Revenue Expense

£ 78,000 £ 48,000 £ 30,000 £ 19,200 £ 10,800

£ 108,000 £ 55,000 £ 55,000 £ 25,500 £ 29,500

£ 163,500 £ 83,900 £ 79,600 £ 39,500 £ 40,100

You might also like

- QUIZ SolutionsDocument21 pagesQUIZ SolutionsElyjah Thomas AvilaNo ratings yet

- Soal 2Document1 pageSoal 2j8zpmzcnjxNo ratings yet

- Loma, Abigail Joy C.Document6 pagesLoma, Abigail Joy C.LOMA, ABIGAIL JOY C.No ratings yet

- FaldoDocument10 pagesFaldodinda ardiyaniNo ratings yet

- Soal 1Document1 pageSoal 1j8zpmzcnjxNo ratings yet

- Start-Up General MerchandiseDocument31 pagesStart-Up General MerchandiseCelyn DeañoNo ratings yet

- A. Journalize The Transactions Using A Perpetual Inventory System. Date Accounts Debit CreditDocument5 pagesA. Journalize The Transactions Using A Perpetual Inventory System. Date Accounts Debit CreditMinh Anh NguyễnNo ratings yet

- Chapter 9Document5 pagesChapter 9syraNo ratings yet

- Financial Accounting - Accounting Is A Fundamental Aspect of Business OperationsDocument37 pagesFinancial Accounting - Accounting Is A Fundamental Aspect of Business OperationsZamzam AbdelazimNo ratings yet

- Perpetual Inventory System Every Sales Transaction, You Are Already Recording The Cost Periodic Inventory SystemDocument5 pagesPerpetual Inventory System Every Sales Transaction, You Are Already Recording The Cost Periodic Inventory SystemjepsyutNo ratings yet

- Tugas Team Acc 2Document7 pagesTugas Team Acc 2meifangNo ratings yet

- Quiz #2 - Set C - Solutions To PSDocument2 pagesQuiz #2 - Set C - Solutions To PSPia DigaNo ratings yet

- Akuntansi Sistem PeriodikDocument1 pageAkuntansi Sistem Periodikm habiburrahman55No ratings yet

- The Income Statement and Inventories: Total of Goods That COULD Be SoldDocument4 pagesThe Income Statement and Inventories: Total of Goods That COULD Be SoldKenshin HayashiNo ratings yet

- Accounting Altivo HAAHAHADocument10 pagesAccounting Altivo HAAHAHAtabudishtleeNo ratings yet

- Accounting Final OuputDocument14 pagesAccounting Final OuputMichaella DometitaNo ratings yet

- Tugas 5 Akuntansi Keuangan MenengahDocument5 pagesTugas 5 Akuntansi Keuangan MenengahLiussetiawan AndyNo ratings yet

- ACC 101 - Financial Accounting and Reporting 1Document14 pagesACC 101 - Financial Accounting and Reporting 1Rc RocafortNo ratings yet

- Akuntan P5-1aDocument8 pagesAkuntan P5-1a2310102052.refatNo ratings yet

- Acctg 205A Midterm Examinations Problem 1Document1 pageAcctg 205A Midterm Examinations Problem 1YameteKudasaiNo ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- The Hospitality Business ToolkitDocument18 pagesThe Hospitality Business ToolkitOanaa Coman100% (1)

- Merchandise Business Class Performance AnswersDocument14 pagesMerchandise Business Class Performance AnswersLerry RosellNo ratings yet

- Cho Cho's - SarayDocument6 pagesCho Cho's - SarayLaiza Cristella SarayNo ratings yet

- The Sport Shop Adjusting Entries For The Years Ended December 31, 19 Date Account Title REF DebitDocument7 pagesThe Sport Shop Adjusting Entries For The Years Ended December 31, 19 Date Account Title REF DebitSrNo ratings yet

- (IFA 12) - Rendy Filiang - 1402210324Document6 pages(IFA 12) - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- April-22 - Louise Peralta - 11 - FairnessDocument3 pagesApril-22 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- Suggested Answers: ExercisesDocument3 pagesSuggested Answers: ExercisesJinrikisha TimoteoNo ratings yet

- Naura Alya Khalista - EA E - E5 P5Document18 pagesNaura Alya Khalista - EA E - E5 P5Naura AlyaNo ratings yet

- Acc Mod 5 Activity 4 PerezDocument13 pagesAcc Mod 5 Activity 4 PerezKenneth PerezNo ratings yet

- Wasita P5.2Document5 pagesWasita P5.2Wasita 10No ratings yet

- Chapter 10 Accounting Cycle of A Merchandising BusinessDocument37 pagesChapter 10 Accounting Cycle of A Merchandising BusinessArlyn Ragudos BSA1No ratings yet

- Rahma Yeni Rosada - F0120105 - EPDocument6 pagesRahma Yeni Rosada - F0120105 - EPRahma RosadaNo ratings yet

- Inventories and Related Expenses: Multiple Choice - TheoryDocument14 pagesInventories and Related Expenses: Multiple Choice - TheoryMadielyn Santarin MirandaNo ratings yet

- Merchandising Concern 09-26-2022Document8 pagesMerchandising Concern 09-26-2022Rhandy OyaoNo ratings yet

- April-22 - Louise Peralta - 11 - FairnessDocument3 pagesApril-22 - Louise Peralta - 11 - FairnessLouise Joseph PeraltaNo ratings yet

- Book 1Document4 pagesBook 1nguyennvpgbd191181No ratings yet

- CHAPTER-7 Merchandising AnswerDocument24 pagesCHAPTER-7 Merchandising AnswersaphirejunelNo ratings yet

- ABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 2 (A02) - Inventory Accounting Systems 3.0Document4 pagesABANILLA, LORRAINE JOY M. - INTACC & 075 - Activity 2 (A02) - Inventory Accounting Systems 3.0Lorraine Joy AbanillaNo ratings yet

- Chapter 7 AlcaparasDocument7 pagesChapter 7 AlcaparasChristian AlcaparasNo ratings yet

- Kimkat Enterprise Journal Entry: Date Items Debit Credit Post RefDocument22 pagesKimkat Enterprise Journal Entry: Date Items Debit Credit Post RefGeorge Lubiano PastorNo ratings yet

- Computerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENTDocument24 pagesComputerized Bookkeeping of Joseph Landscaping and Plant Store Business Case STUDENThello nasty100% (1)

- Dutching Extra Place Races 4 PlacesDocument3 pagesDutching Extra Place Races 4 PlacesGustavo Neuberger0% (1)

- Bookkeeping Nciii Set 1 & 2Document4 pagesBookkeeping Nciii Set 1 & 2Chris MiroNo ratings yet

- Acc Unit-13-AnswersDocument5 pagesAcc Unit-13-AnswersGeorgeNo ratings yet

- Perpetual System Periodic System: InventoryDocument2 pagesPerpetual System Periodic System: InventoryPRINCESS HONEYLET SIGESMUNDONo ratings yet

- Absorption and Marginal Costing TemplateDocument13 pagesAbsorption and Marginal Costing TemplateGeorge PNo ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Book Exercises 2Document20 pagesBook Exercises 2Ace Hulsey TevesNo ratings yet

- Chapter 4.3Document5 pagesChapter 4.3IlovejjcNo ratings yet

- Tugas Perpetual 1 - Rendy Filiang - 1402210324Document4 pagesTugas Perpetual 1 - Rendy Filiang - 1402210324RENDY FILIANGNo ratings yet

- 4355913Document2 pages4355913mohitgaba19No ratings yet

- 9825Document7 pages9825Adam CuencaNo ratings yet

- SW 8Document4 pagesSW 8Tifanny MallariNo ratings yet

- Cash In-Flows: Starting Point Description (As Required)Document4 pagesCash In-Flows: Starting Point Description (As Required)Marinoiu MarianNo ratings yet

- Problem# 17 Mariano Lerin Bookstore Journalizing MARCH 2021 Date Account Titles PR Debit CreditDocument3 pagesProblem# 17 Mariano Lerin Bookstore Journalizing MARCH 2021 Date Account Titles PR Debit CreditAndrea Tugot50% (2)

- HW Chap 5Document9 pagesHW Chap 5uong huonglyNo ratings yet

- 2023 11 13 08 00 22 A021231048 William Mangumban A021231048 Tugas AkuntansiDocument1 page2023 11 13 08 00 22 A021231048 William Mangumban A021231048 Tugas AkuntansiWilliam MangumbanNo ratings yet

- Ii Week 12 (Seminar)Document30 pagesIi Week 12 (Seminar)ccNo ratings yet

- Bahan Kul 4Document12 pagesBahan Kul 4ccNo ratings yet

- Kim 2019Document16 pagesKim 2019ccNo ratings yet

- I Week 10Document21 pagesI Week 10ccNo ratings yet

- Dampak Kejahatan Seksual - TRIBRATANEWS POLDA KEPRIDocument1 pageDampak Kejahatan Seksual - TRIBRATANEWS POLDA KEPRIccNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument27 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeccNo ratings yet

- Scanned DocumentsDocument1 pageScanned DocumentsccNo ratings yet

- Weygand 8e ch2 SolutionDocument5 pagesWeygand 8e ch2 SolutionSeany Sukmawati0% (1)

- Scanned Documents 2Document1 pageScanned Documents 2ccNo ratings yet

- Absen 14Document2 pagesAbsen 14ccNo ratings yet

- Luster Inc Produces The Basic Fillings Used in Many PopularDocument1 pageLuster Inc Produces The Basic Fillings Used in Many PopularAmit PandeyNo ratings yet

- Risk Management in Supply ChainDocument2 pagesRisk Management in Supply Chaintuoyinopuo nobapuoNo ratings yet

- REDcert EU SchemeDocument4 pagesREDcert EU Schemeahfaz ahmedNo ratings yet

- Global Business Today 3rd Edition Hill Test BankDocument23 pagesGlobal Business Today 3rd Edition Hill Test Bankcoltonjonessdfngaibtz100% (15)

- A319, A320, A321 ATA 00 Documentation eDocument114 pagesA319, A320, A321 ATA 00 Documentation eRomel David Carrera Tapia75% (8)

- Agarwal Automobiles: Inventory ManagementDocument10 pagesAgarwal Automobiles: Inventory ManagementAmit Sen50% (2)

- Long Arm LC-2-135121020010Document3 pagesLong Arm LC-2-135121020010yNo ratings yet

- Product Costing Design Document - BusinessDocument18 pagesProduct Costing Design Document - Businesshemanthreganti81100% (1)

- Project Integration ManagementDocument21 pagesProject Integration ManagementNurul IbrahNo ratings yet

- CH 10 NotesDocument13 pagesCH 10 NotesmohamedNo ratings yet

- CH - 5 Purchasing EthicsDocument8 pagesCH - 5 Purchasing EthicsAssistant DirectorNo ratings yet

- Kpi - Admin AsstDocument1 pageKpi - Admin AsstHR SCPCNo ratings yet

- LULU ReportDocument4 pagesLULU Reportyovokew738No ratings yet

- Kinney 8e - IM - CH 06Document19 pagesKinney 8e - IM - CH 06Nonito C. Arizaleta Jr.No ratings yet

- Choice-Based Conjoint (CBC) AnalysisDocument3 pagesChoice-Based Conjoint (CBC) AnalysisMarc CastilloNo ratings yet

- 2023 Manufacturing EbookDocument54 pages2023 Manufacturing EbookRicky ChangNo ratings yet

- Auditing and Assurance Services in Australia 9th Edition Arens Test Bank 200102091047Document28 pagesAuditing and Assurance Services in Australia 9th Edition Arens Test Bank 200102091047Phạm Ngọc ÁnhNo ratings yet

- Construction Disputes and R.A. 9184 Provisions On Government InfrastructureDocument1 pageConstruction Disputes and R.A. 9184 Provisions On Government InfrastructureQueenie PerezNo ratings yet

- Adaptation Processes in Supplier-Customer Relationships: Journal of Customer Behaviour June 2002Document25 pagesAdaptation Processes in Supplier-Customer Relationships: Journal of Customer Behaviour June 2002Ready GoNo ratings yet

- Investment and Portfolio AnalysisDocument24 pagesInvestment and Portfolio Analysis‘Alya Qistina Mohd ZaimNo ratings yet

- Supply Chain Management SCM: Course: Management Information System MIS 201Document10 pagesSupply Chain Management SCM: Course: Management Information System MIS 201Abdelrahman MohamedNo ratings yet

- G1 - Minutes of The Proposal DefenseDocument4 pagesG1 - Minutes of The Proposal DefensePotri Malika DecampongNo ratings yet

- Mega Projects Saudi ArabiaDocument15 pagesMega Projects Saudi ArabiaAB100% (1)

- A Leading Independent Investment Bank Based in Southern Europe, Latam and ChinaDocument32 pagesA Leading Independent Investment Bank Based in Southern Europe, Latam and ChinaDaniel GalvánNo ratings yet

- Financial Tools Week 5 Block BDocument9 pagesFinancial Tools Week 5 Block BBelen González BouzaNo ratings yet

- CHP 1 - Setting Up A New Enterprise - UpdatedDocument33 pagesCHP 1 - Setting Up A New Enterprise - UpdatedAbdullah :No ratings yet

- (MC 2022-083) Form 2 - Region XIDocument39 pages(MC 2022-083) Form 2 - Region XIDilg LuponNo ratings yet

- Students Satisfaction On The Services Provided by The School Canteens in Catanduanes State UniversityDocument31 pagesStudents Satisfaction On The Services Provided by The School Canteens in Catanduanes State UniversityAnthony HeartNo ratings yet

- 23ATT033EMDDocument2 pages23ATT033EMDResearch GatewayNo ratings yet

- Chapter 4 (Core Competencies, Resources, & Capabilities)Document4 pagesChapter 4 (Core Competencies, Resources, & Capabilities)Sagita RajagukgukNo ratings yet