Professional Documents

Culture Documents

LS Sar-Page14

Uploaded by

Ljubisa Matic0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

LS_sar-page14

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageLS Sar-Page14

Uploaded by

Ljubisa MaticCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

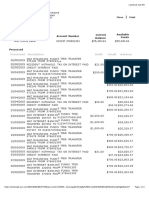

Investment results of the Lifestyle Funds

Performance for the six months ended November 30, 2020

All of the five Lifestyle Funds produced gains for the six-month period and

outperformed their respective composite benchmarks. Institutional Class

returns ranged from 7.22% for the Lifestyle Income Fund to 23.47% for the

Lifestyle Aggressive Growth Fund. The performance tables show returns for all

share classes of the funds.

The margin of outperformance of individual Lifestyle Funds, in relation to

their respective composite benchmarks, ranged from 0.53 of a percentage point

for the Lifestyle Aggressive Growth Fund to 1.85 percentage points for the

Lifestyle Income Fund. (All results for the Lifestyle Funds are for the Institutional

Class.)

Stocks and bonds advanced amid economic rebound

U.S. markets posted healthy gains for the period as the economic implications

of the COVID-19 pandemic diminished. Real gross domestic product (GDP),

which measures the value of all goods and services produced in the United

States, contracted at an annualized rate of 31.4% during the second quarter of

2020. GDP recovered dramatically during the third quarter, however, expanding

at an annualized rate of 33.1%, according to the government’s “second”

estimate. The unemployment rate, which began the period in double digits,

eased over the six months to 6.7% in November. Core inflation, which includes

all items except food and energy, rose to 1.6% over the twelve months ended

November 30, 2020. Oil prices climbed higher over the period.

The Federal Reserve left the federal funds target rate unchanged throughout

the period, maintaining the key short-term interest-rate measure at 0.00%–

0.25%. Policymakers said they do not intend to raise the rate without ongoing

signs of solid economic recovery.

Domestic and international equities generated strong gains for the period.

The Russell 3000®Index, a broad measure of the U.S. stock market, advanced

22.59%. The MSCI ACWI ex USA Investable Market Index (IMI), which measures

the performance of large-, mid- and small-cap equities in 22 of 23 developed-

markets countries (excluding the United States) and 26 emerging-markets

countries, rose 23.69% in U.S.-dollar terms.

U.S. investment-grade bonds posted steady gains for the period. The broad

domestic investment-grade fixed-rate bond market, as measured by the

Bloomberg Barclays U.S. Aggregate Bond Index, returned 1.79%. Short-term

bonds, as measured by the Bloomberg Barclays U.S. 1–3 Year

Government/Credit Index, returned 0.55%.

14 2020 Semiannual Report TIAA-CREF Lifestyle Funds

You might also like

- LS Sar Page7Document1 pageLS Sar Page7Ljubisa MaticNo ratings yet

- Important Information About Expenses: Expense ExamplesDocument1 pageImportant Information About Expenses: Expense ExamplesLjubisa MaticNo ratings yet

- Important Information About Expenses: Expense ExamplesDocument1 pageImportant Information About Expenses: Expense ExamplesLjubisa MaticNo ratings yet

- LS Sar Page8Document1 pageLS Sar Page8Ljubisa MaticNo ratings yet

- Important Information About Expenses: Expense ExamplesDocument1 pageImportant Information About Expenses: Expense ExamplesLjubisa MaticNo ratings yet

- Important Information About Expenses: Expense ExamplesDocument1 pageImportant Information About Expenses: Expense ExamplesLjubisa MaticNo ratings yet

- Important Information About Expenses: Expense ExamplesDocument1 pageImportant Information About Expenses: Expense ExamplesLjubisa MaticNo ratings yet

- Lifestyle Income Fund: Performance As of November 30, 2020Document1 pageLifestyle Income Fund: Performance As of November 30, 2020Ljubisa MaticNo ratings yet

- LS Sar Page17Document1 pageLS Sar Page17Ljubisa MaticNo ratings yet

- Lifestyle Moderate Fund: Performance As of November 30, 2020Document1 pageLifestyle Moderate Fund: Performance As of November 30, 2020Ljubisa MaticNo ratings yet

- LS Sar Page21Document1 pageLS Sar Page21Ljubisa MaticNo ratings yet

- LS Sar Page19Document1 pageLS Sar Page19Ljubisa MaticNo ratings yet

- Important Information About Expenses: Expense ExamplesDocument1 pageImportant Information About Expenses: Expense ExamplesLjubisa MaticNo ratings yet

- Equity Funds Posted Largest Gains: TIAA-CREF Lifestyle Funds 2020 Semiannual Report 15Document1 pageEquity Funds Posted Largest Gains: TIAA-CREF Lifestyle Funds 2020 Semiannual Report 15Ljubisa MaticNo ratings yet

- Lifestyle Aggressive Growth Fund: Performance As of November 30, 2020Document1 pageLifestyle Aggressive Growth Fund: Performance As of November 30, 2020Ljubisa MaticNo ratings yet

- Lifestyle Conservative Fund: Performance As of November 30, 2020Document1 pageLifestyle Conservative Fund: Performance As of November 30, 2020Ljubisa MaticNo ratings yet

- LS Sar Page23Document1 pageLS Sar Page23Ljubisa MaticNo ratings yet

- LS Sar Page25Document1 pageLS Sar Page25Ljubisa MaticNo ratings yet

- LS Sar-Page28Document1 pageLS Sar-Page28Ljubisa MaticNo ratings yet

- Lifestyle Growth Fund: Performance As of November 30, 2020Document1 pageLifestyle Growth Fund: Performance As of November 30, 2020Ljubisa MaticNo ratings yet

- LS Sar-Page28Document1 pageLS Sar-Page28Ljubisa MaticNo ratings yet

- LS Sar-Page28Document1 pageLS Sar-Page28Ljubisa MaticNo ratings yet

- LS Sar-Page30Document1 pageLS Sar-Page30Ljubisa MaticNo ratings yet

- Statements of Assets and Liabilities: TIAA-CREF Lifestyle Funds November 30, 2020Document1 pageStatements of Assets and Liabilities: TIAA-CREF Lifestyle Funds November 30, 2020Ljubisa MaticNo ratings yet

- LS Sar Page31Document1 pageLS Sar Page31Ljubisa MaticNo ratings yet

- Statements of Operations: TIAA-CREF Lifestyle Funds For The Period Ended November 30, 2020Document1 pageStatements of Operations: TIAA-CREF Lifestyle Funds For The Period Ended November 30, 2020Ljubisa MaticNo ratings yet

- LS Sar-Page28Document1 pageLS Sar-Page28Ljubisa MaticNo ratings yet

- Statements of Changes in Net Assets: TIAA-CREF Lifestyle Funds For The Period or Year EndedDocument1 pageStatements of Changes in Net Assets: TIAA-CREF Lifestyle Funds For The Period or Year EndedLjubisa MaticNo ratings yet

- LS Sar Page41Document1 pageLS Sar Page41Ljubisa MaticNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Financial Statement Analysis of HUL and Dabur India LtdDocument12 pagesFinancial Statement Analysis of HUL and Dabur India LtdEdwin D'SouzaNo ratings yet

- Key Notes - Bankers Committee RetreatDocument3 pagesKey Notes - Bankers Committee RetreatLola OniNo ratings yet

- FMCG DataDocument2 pagesFMCG DataPinky Piano GirlNo ratings yet

- SSI Exclusion For Pandemic Related Financial AssistanceDocument1 pageSSI Exclusion For Pandemic Related Financial AssistanceIndiana Family to FamilyNo ratings yet

- Pre-Class International EconomicsDocument11 pagesPre-Class International Economicshfyau123100% (5)

- Fema CDocument5 pagesFema Capi-3712367No ratings yet

- SALES TAX PAYMENT RECEIPTDocument1 pageSALES TAX PAYMENT RECEIPTSAWERA TEXTILES PVT LTDNo ratings yet

- DECLARATION OF SINGLE CLAIM and Double ClaimDocument2 pagesDECLARATION OF SINGLE CLAIM and Double Claimpen AbraNo ratings yet

- AccountStatement JUL 2021Document2 pagesAccountStatement JUL 2021Hatem FaroukNo ratings yet

- ANZ Internet Banking2Document2 pagesANZ Internet Banking2Waifubot 2.1No ratings yet

- Target of Yolanda Affected Local Government Units (Lgus) Were Based On 25% of Their 2012 CollectionDocument2 pagesTarget of Yolanda Affected Local Government Units (Lgus) Were Based On 25% of Their 2012 CollectionKent Elmann CadalinNo ratings yet

- Statement of Protest by DR D Narasimha ReddyDocument3 pagesStatement of Protest by DR D Narasimha ReddyFirstpostNo ratings yet

- Market IntegrationDocument22 pagesMarket IntegrationCatherine Acutim50% (2)

- Euro To Egp - Google SearchDocument1 pageEuro To Egp - Google SearchNadine MahmoudNo ratings yet

- Cbe 2016 - 17Document147 pagesCbe 2016 - 17Abate GashawNo ratings yet

- 04 Holmsteinn WSJ - Com Miracle On IcelandDocument3 pages04 Holmsteinn WSJ - Com Miracle On IcelandDalma KaszásNo ratings yet

- Special Economic Zone (SEZ)Document15 pagesSpecial Economic Zone (SEZ)Sahil VermaNo ratings yet

- De minimis regimes overviewDocument3 pagesDe minimis regimes overviewMiguel Angel JaramilloNo ratings yet

- SCSC 13n LT 3.1 BSED IIIB MIRALLESDocument2 pagesSCSC 13n LT 3.1 BSED IIIB MIRALLESJovi Ann Quartel MirallesNo ratings yet

- Tax InvoiceDocument1 pageTax InvoiceHsnsbsNo ratings yet

- Circular Flow of IncomeDocument15 pagesCircular Flow of IncomeJimmyNo ratings yet

- Pakistan's Energy Crisis: Causes and ConsequencesDocument2 pagesPakistan's Energy Crisis: Causes and ConsequencestariqNo ratings yet

- Presantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemDocument27 pagesPresantation On Special Economic Zone (Sez) by Rahul Jagtap PGDM 1stsemcimr33No ratings yet

- PNB v CA ruling on unilateral interest rate increasesDocument1 pagePNB v CA ruling on unilateral interest rate increasesRey Benitez100% (1)

- Economic Survey PresentationDocument27 pagesEconomic Survey PresentationcoolkurllaNo ratings yet

- Statement of Financial Position As at 31st December 2013Document5 pagesStatement of Financial Position As at 31st December 2013Joseph KanyiNo ratings yet

- International Trade TheoryDocument28 pagesInternational Trade TheoryArpita ArtaniNo ratings yet

- Materi KTF Transfer PricingDocument35 pagesMateri KTF Transfer PricingpacekelanNo ratings yet

- Introduction To BankingDocument12 pagesIntroduction To BankingPraveen Kumar SinhaNo ratings yet

- National IncomeDocument16 pagesNational IncomeMazhar Ul HaqNo ratings yet