Professional Documents

Culture Documents

De minimis regimes overview

Uploaded by

Miguel Angel JaramilloOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

De minimis regimes overview

Uploaded by

Miguel Angel JaramilloCopyright:

Available Formats

Last update: 9 March 2018

Overview of de minimis value regimes open to express shipments world wide

Introduction: De minimis refers to the minimum value of the goods below which no duties and taxes are being collected by the Customs (see also

Transitional Standard 4.13 of the WCO Revised Kyoto Convention and Art. 8.2 (d) of the WTO TFA).

Disclaimer: This list contains information that GEA has been able to collect from publicly available sources. It is not an official source of information on such regimes world

wide. It may not be perfectly accurate or up to date. GEA and its affiliates do not accept any liability for any inaccuracies contained therein or decisions made on the basis

of the information listed here. Please help us improve this list by sending us additional information from authoritative sources to info@global-express.org and we will

update it as appropriate.

Note: Values in USD and SDR are for information only. The national currency applies!

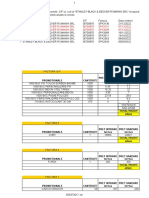

De minimis value "no duty/tax collection" Remarks

Country

in national currency in USD in SDR

Andorra 12 EUR 15 10

Angola 38000 Kwanza 187 128

Argentina 25 USD 25 17 only for postal shipments

Armenia 150000 Armenian Drams 300 206

Australia 1000 AUD 810 556 Decided elimination of de minimis for VAT

150 EUR (Customs duties) 186 128

Austria

22 EUR (VAT) 27 19 EU decided elimination of VAT threshold as from 2021

1000 USD 1.000 687 Only for non-commercial shipments below threshold

Azerbaijan

50 USD and <5 kg 50 34 For commercial shipments

Bahrain 100 BD 265 182

Bangladesh No deminimis - 0

22 Eur 27 19 Private person; non-commercial shipment

Belarus

200 Eur 248 170 Legal person; commercial shipment

150 EUR (Customs duties) 186 128

Belgium

22 EUR (VAT) 27 19

Belize 50 USD 50 34

Bhutan 5000 BTN 79 54

Bolivia 100 USD 100 69 only for postal shipments

Bosnia and

Hercegowina 10 EUR 12 9

150 EUR (Customs duties) 186 128

Bulgaria

15 EUR (VAT) 19 13

Brazil 50 USD 50 34 only for postal shipments

Brunei 400 BND 295 203

Cambodia 50 USD 50 34

Canada 20 CAD 15 10

Chile 30 USD 30 21 Duty preferences for postal shipments only

Shipments with duty and VAT liability less

China than RMB 50 8 6

Colombia 200 USD 200 137

Costa Rica No de minimis - 0

150 EUR (Customs duties) 186 128

Croatia

22 EUR (VAT) 27 19

150 EUR (Customs duties) 186 128

Cyprus

17 EUR (VAT) 21 14

150 EUR (Customs duties) 186 128

Czech Republic

22 EUR (VAT) 27 19

150 EUR (Customs duties) 186 128

Denmark

10 EUR (VAT) 12 9

Dominican

Republic 8600 Dom. Peso DOP 176 121

Ecuador 400 USD & 400 KG 400 275 Only for postal shipments. Express shipments pay 46 USD

El Salvador No de minimis 0

150 EUR (Customs duties) 186 128

Estonia

GEA Overview of De Minimis

Regimes World Wide 1 of 3

De minimis value "no duty/tax collection" Remarks

Country

in national currency in USD in SDR

Estonia

22 EUR (VAT) 27 19

Ethiopia 20 EUR 25 17

Fiji 100 FJD 50 34

150 EUR (Customs duties) 186 128

Finland

22 EUR (VAT) 27 19

150 EUR (Customs duties) 186 128

France

22 EUR (VAT) 27 19 Internet Shipments subject to VAT using "mail order" exemption

Gambia 112 GMD 259 178

Ghana 7 GHS 2 1

Georgia 300 GEL and 30 kg 217 149

150 EUR (Customs duties) 186 128

Germany

22 EUR (VAT) 27 19

150 EUR (Customs duties) 186 128

Greece

22 EUR (VAT) 27 19

Guatemala Not applicable - 0

Honduras 500 USD with certain exceptions 500 344

150 EUR (Customs duties) 186 128

Hungary

22 EUR (VAT) 27 19

Iceland 1500 Icelandic Krona 15 10 Increased from 1,000 to 1,500 ISK

India 10000 INR 150 103 Only samples and gifts

Indonesia 100 USD (fob) 100 69 as from 28 Aril 2018

Iran <50 USD 50 34

150 EUR (Customs duties) 186 128

Ireland

22 EUR (VAT) 27 19

Israel 100 USD 100 69

150 EUR (Customs duties) 186 128

Italy

22 EUR (VAT) 27 19

Japan 10000 JPY 90 62

Jordan 20 Jordan dinars for commercial samples 28 19

Korea 118,000 KRW 110 76 Only personal shipments and samples, except medicine, herb

medicine, wildlife-related products, quarantined items such as

agricultural, live stock and marine products, nutritional

supplement, food , alcoholic beverages, tobacco, cosmetics (only

applied to functional cosmetics, placenta-containing cosmetics,

cosmetics containing steroids, and hazardous cosmetics), and

others.

200 USD 200 137 Only for trade with USA and Puerto Rico as per Korea-US FTA.

Kyrgyzstan 70 48

150 EUR (Customs duties) 186 128

Latvia

22 EUR (VAT) 27 19

Liberia 255 LRD 2 1

150 EUR (Customs duties) 186 128

Lithuania

75 LTL (VAT) 27 19

150 EUR (Customs duties) 186 128

Luxembourg

22 EUR (VAT) 27 19

Macedonia 22 Eur 27 19

Madagascar 6700 MAG 2 1

Malaysia 500 MYR 128 88

150 EUR (Customs duties) 186 128

Malta

22 EUR (VAT) 27 19

Mexico 50 USD 50 34

Mexico 300 USD 0 only for postal shipments

Montenegro 150 EUR 186 128

Morocco 300 Moroccan Dirham 33 23

Myanmar 50 USD 50 34

150 EUR (Customs duties) 186 128

Netherlands

22 EUR (VAT) 27 19

New Zealand 400 NZD 295 203 The law states “If total duty tax is below 60 NZD, Customs will not

GEA Overview of De Minimis

Regimes World Wide 2 of 3

De minimis value "no duty/tax collection" Remarks

Country

in national currency in USD in SDR

Norway 350 NKR 45 31 Raised from 200 NKR

100 USD (Not implemented correctly in

Panama practice); down from 200 USD 100 69

Paraguay No deminimis - 0 De minimis of USD 100 removed in 2017

Peru 200 USD 200 137

Philippines 10000 PHP 192 132

150 EUR (Customs duties) 186 128

Poland

22 EUR (VAT) 27 19

150 EUR (Customs duties) 186 128

Portugal

22 EUR (VAT) 27 19

Qatar No de minimis - 0

150 EUR (Customs duties) 186 128

Romania

22 EUR (VAT) 27 19

Russia 5000 RUR 89 61

Rwanda <400 USD 400 275

Saint Lucia 60 XCD 22 15

Saudi Arabia 367 SAR 98 67

Singapore 400 SGD 305 210

150 EUR (Customs duties) 186 128

Slovakia

22 EUR (VAT) 27 19

150 EUR (Customs duties) 186 128

Slovenia

22 EUR (VAT) 27 19

150 EUR (Customs duties) 186 128

Spain

22 EUR (VAT) 27 19

150 EUR (Customs duties) 186 128

Sweden

22 EUR (VAT) 27 19

Total duties/taxes less

Switzerland than 5 CHF are waived 5 4

Chinese Taipeh 2000 TWD 68 47 Reduced from 3,000 TWD on 1/1/2018

Thailand 1000 Thai Baht 28 19

Turkey 30 EUR 37 26

Uganda 10 USD 10 7

Ukraine 100 USD 100 69

150 EUR (Customs duties) 186 128

United Kingdom

15 GBP (VAT) 21 15

Uruguay 200 USD 0 Non-commercial shipments, only 4 shipments per year per

United States 800 USD 800 550

Venezuela 100 USD 100 69

Vietnam 1000000 VND 40 27 New circular 191, which might be effective in April, will require

express carriers in Vietnam to comply with the following:

a. Import shipment with value under de minimis threshold and

export shipment with value under 5 million VND can be declared

using simplified mode in VNACCS system;

Footnote : USD and SDR conversions are based on exchange rates dated 06 April 2016; 1

GEA Overview of De Minimis

Regimes World Wide 3 of 3

You might also like

- RN 1083 1084Document3 pagesRN 1083 1084miroljubNo ratings yet

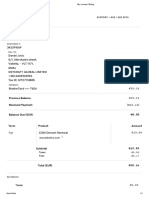

- My Account - Billing - Goddady 5 - AugDocument2 pagesMy Account - Billing - Goddady 5 - AugbrzicadarkoNo ratings yet

- Invoice - IN 202109 00213610Document1 pageInvoice - IN 202109 00213610EdvinNo ratings yet

- Commercial InvoiceDocument1 pageCommercial Invoice46swztng9xNo ratings yet

- Invoice 203265: GN Code: 3923.2100 - SwedenDocument2 pagesInvoice 203265: GN Code: 3923.2100 - SwedenArturo RiveroNo ratings yet

- Invoice: Page 1 of 2Document2 pagesInvoice: Page 1 of 2Stefan SmarandacheNo ratings yet

- 常见国家参考征税税率20210909Document9 pages常见国家参考征税税率20210909nanarefertoNo ratings yet

- Bastion. StatementDocument5 pagesBastion. StatementАндрей КрупникNo ratings yet

- Local & Foreign Mail PDFDocument3 pagesLocal & Foreign Mail PDFRyan L PaceNo ratings yet

- Inv 3856406Document1 pageInv 3856406Vasile AporcaritiNo ratings yet

- Ross Paul John - FinalDocument2 pagesRoss Paul John - FinalITNo ratings yet

- Facture Sweat BalenciagaDocument1 pageFacture Sweat Balenciagaspeak.luminonNo ratings yet

- Tax Invoice: Fees in GBP ( )Document1 pageTax Invoice: Fees in GBP ( )FaizalSecNo ratings yet

- ComercialInvoice TON128342663Document1 pageComercialInvoice TON128342663elizavetashvigarenkoNo ratings yet

- 93 Budget PackDocument66 pages93 Budget Packapi-3858042No ratings yet

- Russian First Aid NBC Protection KitDocument1 pageRussian First Aid NBC Protection KitAdi StefanNo ratings yet

- Account Holder Bank Information: Date Interest Date Counterparty Description AmountDocument23 pagesAccount Holder Bank Information: Date Interest Date Counterparty Description AmountAnia SonkaNo ratings yet

- ComercialInvoice ULD150761783Document1 pageComercialInvoice ULD150761783RealCosminNo ratings yet

- TSE S.R.O. Karpatské Námestie 10A 831 06 Bratislava SlovakiaDocument2 pagesTSE S.R.O. Karpatské Námestie 10A 831 06 Bratislava SlovakiaIronko Pepe100% (1)

- # Subscription/Product Title Qty Unit Price Total PriceDocument1 page# Subscription/Product Title Qty Unit Price Total PriceAll TutorialNo ratings yet

- DDP Sales InvoiceDocument1 pageDDP Sales InvoiceVladislavs RužanskisNo ratings yet

- Commercial InvoiceDocument1 pageCommercial Invoice46swztng9xNo ratings yet

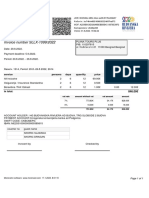

- Tax Invoice: Bill To Firlot LimitedDocument2 pagesTax Invoice: Bill To Firlot LimitedVõ Quốc CôngNo ratings yet

- doTERRA Europe Order SummaryDocument1 pagedoTERRA Europe Order SummaryYvonne IoanaNo ratings yet

- F214742 Marek Novotn LA FORME Gold Colibri Company SroDocument2 pagesF214742 Marek Novotn LA FORME Gold Colibri Company SroCristian CoffeelingNo ratings yet

- ComercialInvoice AMM156966014Document1 pageComercialInvoice AMM156966014Gabriela SanchezNo ratings yet

- EUR Statement: TransactionsDocument3 pagesEUR Statement: TransactionssadasdNo ratings yet

- Facture Vivienne WestwoodDocument1 pageFacture Vivienne Westwoodvivianestuart573No ratings yet

- FARFETCH RECEIPTDocument1 pageFARFETCH RECEIPTiAmKioKatsu ROSNo ratings yet

- Hermes Invoice 28974800Document1 pageHermes Invoice 28974800DT TrinidaNo ratings yet

- PRO210346 Eugene KopylDocument1 pagePRO210346 Eugene KopylCristian CoffeelingNo ratings yet

- Vali SpedDocument1 pageVali SpedDamjan SpasovskiNo ratings yet

- Facture Farftech 1Document1 pageFacture Farftech 1Adam-IsmailNo ratings yet

- Stanley Black & Decker Romania SRL invoices reportDocument4 pagesStanley Black & Decker Romania SRL invoices reportSportek RomaniaNo ratings yet

- Exemplu Cotatie+ProformaDocument2 pagesExemplu Cotatie+ProformaValeria GNo ratings yet

- Eu-Shadow Invoice 198SI5TTwEBjtNSwDocument1 pageEu-Shadow Invoice 198SI5TTwEBjtNSwMatisse BNo ratings yet

- 001in 45 Stops Moa (Muhammed Hussain) (Muhammed Hussain)Document2 pages001in 45 Stops Moa (Muhammed Hussain) (Muhammed Hussain)mohammad hussainNo ratings yet

- Q4January2022 FabioStephenBarreraIzquierdo-statementDocument3 pagesQ4January2022 FabioStephenBarreraIzquierdo-statementAna BenavidesNo ratings yet

- Tarife Pentru Colete Externe Cu Greutatea 10 KG (Scutite de Tva) Neprioritar PrioritarDocument4 pagesTarife Pentru Colete Externe Cu Greutatea 10 KG (Scutite de Tva) Neprioritar PrioritarAN0NIMOUS DanNo ratings yet

- Daily Cash Report Agents OR/Tran Date Code Dox PKG OR Number Cust Name Q/E Cash/ Fuel Sur Total Amount Net Comm ORDocument2 pagesDaily Cash Report Agents OR/Tran Date Code Dox PKG OR Number Cust Name Q/E Cash/ Fuel Sur Total Amount Net Comm ORenriquez eleanorNo ratings yet

- FCA FCA: To RefundDocument1 pageFCA FCA: To Refundbrzezin9No ratings yet

- Farfetch InvoiceDocument1 pageFarfetch InvoiceAhmad Syahrullah Firman100% (1)

- bp2000 01 FinalDocument64 pagesbp2000 01 Finalapi-3734450No ratings yet

- Home-N-More: Haji Ismail & Sons LimitedDocument6 pagesHome-N-More: Haji Ismail & Sons LimitedIqbal MalikNo ratings yet

- VodafoneDocument1 pageVodafonewarrenad977No ratings yet

- Bank statement details for account LT733500010010770181Document3 pagesBank statement details for account LT733500010010770181mohamed belkadiNo ratings yet

- January 7, 2022 08:15 Mohamed Elseghir Belkadi 5100 Log Ilot 09 BTM 104, OranDocument3 pagesJanuary 7, 2022 08:15 Mohamed Elseghir Belkadi 5100 Log Ilot 09 BTM 104, Oranmohamed belkadiNo ratings yet

- Statement of Account: Date: Soa: Client Code: Account NameDocument2 pagesStatement of Account: Date: Soa: Client Code: Account NameDaisy E SolivaNo ratings yet

- boucle d'oreille Vivienne facture zanataDocument1 pageboucle d'oreille Vivienne facture zanataetha vanerNo ratings yet

- Tabela Base ÁguaDocument5 pagesTabela Base ÁguaMais Graphite LdaNo ratings yet

- Billed To: Description Price Discount Total Excl. Vat VAT Amount (Eur)Document1 pageBilled To: Description Price Discount Total Excl. Vat VAT Amount (Eur)Victoria SantayNo ratings yet

- F214741 Berat Zeka Cafe Le Marche Cafe Le Marche EUDocument2 pagesF214741 Berat Zeka Cafe Le Marche Cafe Le Marche EUCristian CoffeelingNo ratings yet

- Paysera Statement 2022 01 07 08 15 15Document3 pagesPaysera Statement 2022 01 07 08 15 15fm8t6vvwf5No ratings yet

- View COD statement and shipping feesDocument2 pagesView COD statement and shipping feesDaisy E SolivaNo ratings yet

- RN 1099Document1 pageRN 1099miroljubNo ratings yet

- Payout StatementDocument1 pagePayout StatementKhuram JaveedNo ratings yet

- INVOICE-TITLEDocument2 pagesINVOICE-TITLEITNo ratings yet

- 2018 European Container Weight Limit RegulationsDocument1 page2018 European Container Weight Limit RegulationsFang NinaNo ratings yet

- Import Cost For Pipe FittingsDocument1 pageImport Cost For Pipe Fittingsnagwaga jamesNo ratings yet

- Examen Parcial - Semana 4 - Esp - Segundo Bloque-Ingles II - (Grupo b04)Document17 pagesExamen Parcial - Semana 4 - Esp - Segundo Bloque-Ingles II - (Grupo b04)Miguel Angel JaramilloNo ratings yet

- Examen Parcial - Semana 4 - ESP - SEGUNDO BLOQUE-INGLES GENERAL II - (GRUPO B02)Document14 pagesExamen Parcial - Semana 4 - ESP - SEGUNDO BLOQUE-INGLES GENERAL II - (GRUPO B02)Miguel Angel JaramilloNo ratings yet

- Examen Parcial - Semana 4 Intento 1Document14 pagesExamen Parcial - Semana 4 Intento 1Miguel Angel JaramilloNo ratings yet

- Examen Parcial - Semana 4 - Esp - Segundo Bloque-Ingles II - (Grupo b04)Document17 pagesExamen Parcial - Semana 4 - Esp - Segundo Bloque-Ingles II - (Grupo b04)Miguel Angel JaramilloNo ratings yet

- Examen Parcial - Semana 4 - INTENTODocument13 pagesExamen Parcial - Semana 4 - INTENTOMiguel Angel JaramilloNo ratings yet

- Healthy Living Tips from Sports PsychologistDocument13 pagesHealthy Living Tips from Sports PsychologistMiguel Angel JaramilloNo ratings yet

- Examen Parcial - Semana 4 - ESP - SEGUNDO BLOQUE-INGLES Primer IntentoDocument10 pagesExamen Parcial - Semana 4 - ESP - SEGUNDO BLOQUE-INGLES Primer IntentoFernanda TrujilloNo ratings yet

- Examen Parcial - Semana 4 - ESP - SEGUNDO BLOQUE-INGLES GENERAL III-segundo IntentoDocument10 pagesExamen Parcial - Semana 4 - ESP - SEGUNDO BLOQUE-INGLES GENERAL III-segundo IntentoMiguel Angel JaramilloNo ratings yet

- Examen Parcial - Semana 4 - Esp - Segundo Bloque-Ingles III - (Grupo b01)Document11 pagesExamen Parcial - Semana 4 - Esp - Segundo Bloque-Ingles III - (Grupo b01)Miguel Angel JaramilloNo ratings yet

- Presentacion Mayo 19Document7 pagesPresentacion Mayo 19Miguel Angel JaramilloNo ratings yet

- Examen Parcial - Semana 4 - INTENTODocument13 pagesExamen Parcial - Semana 4 - INTENTOMiguel Angel JaramilloNo ratings yet

- And You Got MeDocument2 pagesAnd You Got MeMiguel Angel JaramilloNo ratings yet

- D & C G T G N A. R E S P A, NY 12242: Esign Onstruction Roup HE Overnor Elson Ockefeller Mpire Tate Laza LbanyDocument18 pagesD & C G T G N A. R E S P A, NY 12242: Esign Onstruction Roup HE Overnor Elson Ockefeller Mpire Tate Laza LbanyAlexNo ratings yet

- A Review of Drug-Induced Acute Angle Closure Glaucoma For Non-Ophthalmologists PDFDocument8 pagesA Review of Drug-Induced Acute Angle Closure Glaucoma For Non-Ophthalmologists PDFMeida Putri UtamiNo ratings yet

- ProVent - MANN + HUMMEL ProVent - Oil Separator For Open and Closed Crankcase Ventilation SystemsDocument29 pagesProVent - MANN + HUMMEL ProVent - Oil Separator For Open and Closed Crankcase Ventilation SystemsJosephNo ratings yet

- Bacnet® Fixed Function Thermostat: For Fan Coil/Heat Pump/Conventional SystemsDocument8 pagesBacnet® Fixed Function Thermostat: For Fan Coil/Heat Pump/Conventional Systemsamjadjaved033148100% (1)

- Global Leader: in Glass IonomerDocument2 pagesGlobal Leader: in Glass IonomerAnggini ZakiyahNo ratings yet

- S35MC Engine Layout and Load DiagramsDocument17 pagesS35MC Engine Layout and Load DiagramsMuhammad AlfaniNo ratings yet

- Microwave TubesDocument36 pagesMicrowave TubesHINDUSTAN KNOW 1No ratings yet

- A300-600 Ammfx1 29 24 00 03 0Document5 pagesA300-600 Ammfx1 29 24 00 03 0Fahimeh HayatinasabNo ratings yet

- PN Junction Formation and Barrier PotentialDocument9 pagesPN Junction Formation and Barrier PotentialchristlllNo ratings yet

- History of Herbal TritmentDocument10 pagesHistory of Herbal TritmentTorentSpyNo ratings yet

- SG Salary Guide 2021-22Document66 pagesSG Salary Guide 2021-22Gilbert ChiaNo ratings yet

- Pro Boxberg en DownloadDocument6 pagesPro Boxberg en Downloadftzo3439No ratings yet

- Thermal Destruction of Microorganisms in 38 CharactersDocument6 pagesThermal Destruction of Microorganisms in 38 CharactersRobin TanNo ratings yet

- 2) Coa-Vitamin-Dsm-Lot # XW91707139-146 PDFDocument16 pages2) Coa-Vitamin-Dsm-Lot # XW91707139-146 PDFNaeem AnjumNo ratings yet

- A Review of Empathy Education in NursingDocument11 pagesA Review of Empathy Education in Nursinglora ardyaNo ratings yet

- Cathodic Protection of Subsea Systems: Lessons LearnedDocument9 pagesCathodic Protection of Subsea Systems: Lessons LearnedNguyen Ninh Binh100% (1)

- World Health OrganizationDocument13 pagesWorld Health OrganizationVincent Ranara Sabornido100% (1)

- Cultures and Beliefs NCM 120Document13 pagesCultures and Beliefs NCM 120Melanie AnanayoNo ratings yet

- 7Document40 pages7Felipe RichardiosNo ratings yet

- MONO POWER AMPLIFIER SERVICE MANUALDocument34 pagesMONO POWER AMPLIFIER SERVICE MANUALAlexey OnishenkoNo ratings yet

- Five Brothers and Their Mother's LoveDocument4 pagesFive Brothers and Their Mother's Lovevelo67% (3)

- Glycerol PDFDocument3 pagesGlycerol PDFTushar GaikarNo ratings yet

- Sub-Zero Icing Your Testicles For Increased Male Performance - MyBioHack Unlock Your Maximus PotentialDocument7 pagesSub-Zero Icing Your Testicles For Increased Male Performance - MyBioHack Unlock Your Maximus PotentialfortnitediscordbgweeNo ratings yet

- Chromosomal Basis of Inheritance - Final PDF-1Document3 pagesChromosomal Basis of Inheritance - Final PDF-1Aishwarya ShuklaNo ratings yet

- Which Statement On Physical Development of Infants and Toddlers Is TRUEDocument9 pagesWhich Statement On Physical Development of Infants and Toddlers Is TRUEKristylle Renz100% (1)

- Literature Review of ZnoDocument7 pagesLiterature Review of Znoea6mkqw2100% (1)

- (KBA BU HANUM) Senyawa Fenolik AlamDocument134 pages(KBA BU HANUM) Senyawa Fenolik AlamPoppyA.NamiraNo ratings yet

- Acromegaly: Excess Growth Hormone SecretionDocument4 pagesAcromegaly: Excess Growth Hormone SecretionKavita PathakNo ratings yet

- Survitec Mooring Ropes BrochureDocument20 pagesSurvitec Mooring Ropes Brochurearifsarwo_wNo ratings yet

- Lab Report 2Document5 pagesLab Report 2adrianeNo ratings yet