Professional Documents

Culture Documents

Oil-To-Chemicals: New Approaches: A Review of Developments and Trends in The Expanding Business of Oil-To-Chemicals

Uploaded by

AsifOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oil-To-Chemicals: New Approaches: A Review of Developments and Trends in The Expanding Business of Oil-To-Chemicals

Uploaded by

AsifCopyright:

Available Formats

Oil-to-chemicals: new approaches

A review of developments and trends in the expanding business of oil-to-chemicals

JOHN J MURPHY and CLYDE F PAYN

The Catalyst Group

C

rude oil-to-chemicals (COTC)

continues to be a powerful 70

industry driver and a strong

Energy-related CO2 emissions, B t

60

trend of high interest to all inte-

grated refineries and chemicals pro- 50

ducers in Asia/Pacific, China, the

Middle East, and Eastern Europe. 40

This is reinforced by many factors,

most notably the forecasts which 30

predict a slowing of transportation 20

fuels growth approaching 2040 (with

hybrids and electric vehicles), while 10

growth in chemicals is expected to

increase as populations and middle 0

2000 GDP CO2 Energy 2016 GDP CO2 Energy 2040

class wealth continue to rise, leading growth intensity efficiency growth intensity efficiency

to increasing demand for packaging,

consumer goods, and automobiles. Figure 1 Energy efficiency gains are expected to nearly double by 2040, while carbon

Are you aware that more than 12 emissions are projected to increase by a modest 10%1

corporations have committed over

$315 billion to date to reconfigure lower cost alternatives, and we have it is also only one of many factors.

their assets to produce more petro- examined these R&D pipelines. New advanced configurations

chemicals than transportation fuels, Already a large number of com- will now start to incorporate the

as revamps as well as building new panies are closely examining their planning of improved efficiency

grassroots refineries during the own responses and investments, gains and reduced CO2 emissions.

next 5-6 years? Based on announce- bearing in mind each of these ExxonMobil forecasts that by 2040,

ments to date, we anticipate in the investment objectives will be site while energy efficiency gains are

next five years that another $300+ specific, influenced by feedstock expected to nearly double, car-

billion, or more, will be announced choices, product slates/markets, bon emissions are only projected

as refiners and chemical companies energy/utility balances, capital/ to increase by a modest 10%.1 BP

all reassess their positions, know- operating efficiencies, and health, statistics, along with Chevron fore-

ing that the longer term outlook safety and environmental (HSE) casts, the IEA and the EIA, show

for transportation fuels from crude performance. It is clear from pub- similar trends (see Figure 1).

oil is expected to plateau and then lic domain information (such as Regarding competitive crude

decline. All players are taking this the ongoing announcements by oil-to-chemicals developments, in

trend seriously and therefore you ADNOC, MOL and others) to see addition to Saudi Aramco/SABIC

should also. the progress in differentiation that is announcements, we are already

Considerable flexibility is being already under way. seeing ongoing investments from

offered by petrochemical licensors, Two main interests of produc- others. In a more recent exam-

in particular petrochemical resid ers are: to decrease capital inten- ple, private chemical producers

and VGO FCC upgrading units sity through scale, simplicity, and Hengli and Rongshengin in China

today. These are global changes location; and to expand/maximise are back-integrating their chemical

including deep catalytic cracking flexibility towards use of current plants to add over 9 million t/y of

(DCC) from Sinopec, as well as (heavier) feedstocks in considering paraxylene capacity by 2021. This

Western leaders such as Total’s R2R the oil-to-chemicals approach. The is expected to reduce imports by 4

modifications, and Axens’ high-se- idea of better utilising assets from million t/y, with plans to yield up

verity FCC (HSFCC) with Saudi within an integrated refinery site to 45 wt% of chemicals processing

Aramco. Technologies do not stand means that most likely you are heavy crudes, which will tighten

still. Advances in catalytic visbreak- already dealing at 10x plus the medium to heavy crude markets

ing may also be important in the size of a world-scale petrochemi- while also adding a 40% surplus to

future, when looking into advanced cal plant. Although scale counts, distillates and gasoline markets.

www.digitalrefining.com/article/1002467 PTQ Q2 2020 49

One of the most difficult com- with other processes, and firming up figuration will be high liquid yields,

ponents has been to understand design tools for supercritical solvent high removal of contaminants, and

that all licensors need to prioritise recovery configurations. reliable operation.

their own businesses. Therefore, For heavy feedstocks, which will

they will prefer greenfield invest- increase in amounts as hydrocrack- Holistic economics and approaches

ments to revamps – even if these ing feedstocks, reactor designs will to complexes

can be accomplished at lower ISBL continue to focus on online catalyst From a comprehensive or holis-

and OSBL costs. This is not a crit- addition and withdrawal. Fixed bed tic perspective, the following

icism but rather a statement of fact designs have suffered from mechan- approaches have been assessed as

based on desired business focus. ical inadequacy when used for the commercially viable or considered to

Moreover, one of the understand- heavier feedstocks, as well as short become commercially viable in spe-

ings is to appreciate how existing catalyst lives – six months or less – cific situations:

and new configurations can be tai- even though large catalyst volumes • New pipeline technology

lored towards either aromatics or are used (LHSV typically of 0.5- • Advances in new configurations

olefins – but this may not be the 1.5). Refiners will attempt to over- • New catalyst approaches

best measure if indeed your goal come these shortcomings through • Economics of different catalysts

is towards more olefins. In this innovative designs, allowing better and process improvements

regard, assuming you have an exist- feedstock flow and catalyst utilisa-

ing steam cracker, your revamp tion, or online catalyst removal. For Competitive and strategic

approach may be quite different. example, the OCR process, in which implications

a lead moving bed reactor is used In reviewing some of the key find-

Advances in heavy oil processes to demetallise the heavy feedstock ings from our report (The Catalyst

In focusing on the processes by ahead of the fixed bed hydrocrack- Group Resources 2019),2 as well as

which the higher molecular weight ing reactors, has seen some success. the limits of current state-of-the-

constituents of petroleum (the heavy But whether this will be adequate for art based on the basket of crudes

ends) can be converted to products continuous hydrocracking of heavy defined in the report, here are some

that are suitable for use as feedstocks feedstocks remains a question. key considerations:

for the petrochemical section of the Catalyst development will be key • No study can take into account

refinery, our assessments include car- in the modification of processes and all possible site-specific issues and

bon rejection and hydrogen addition the development of new ones to questions, as they may relate to

approaches, along with process com- make environmentally acceptable existing configurations for revamp

binations and new configurations: distillable liquids. Although crude vs greenfield choices because they

1. Carbon rejection oil conversion is expected to remain are highly dependent on each refin-

2. Hydrogen addition the principal future source of pet- ery’s crude slates, availability/pric-

3. Combining processes and treat- rochemicals, natural gas reserves ing, and the local/regional products

ment of intermediates are emerging, and will continue to desired. Given this situation, the

4. Configuration issues and advances emerge, as a major hydrocarbon study takes a 10 000ft view, looking

5. New processes likely to be resource. This trend has already into the hypothesis of a 50/50 fuels/

deployed during the next five years started to result in a shift toward use petrochemicals refinery, and then

For decades, propane has been of natural gas (methane) as a signif- discusses future technology options/

the mainstay in deasphalting heavy icant feedstock for chemicals. As a changes in the pipeline in the direc-

feedstocks, especially in the prepa- result, deployment of technology tion for 40/60 fuels/petrochemicals.

ration of high quality lubricating oils for direct and indirect conversion • Today’s resid FCCs (RFCC)

and feedstocks for catalytic crack- of methane will probably displace can process feeds with up to 8

ing units. Future units, which may much of the current production of Concarbon, though 6-7 is more

well be derived from KBR’s ROSE liquefied natural gas. comfortable. Today’s RFCCs are

process, will use solvent systems The detrimental effect of coke on designed for catalyst metals lev-

that will allow operation at elevated catalyst is a reduction of support els of 10 000 wtppm. However, it is

temperatures relative to conven- porosity, leading to diffusional lim- cheaper to take the metals out on an

tional propane deasphalting temper- itations, and finally blocked access HDM pretreater catalyst which holds

atures, thereby permitting easy heat to active sites. Nevertheless, mov- up to 50% of their weight in met-

exchange. This will require changes ing bed or ebullated bed processes, als. A standard design is to include

to the solvent composition and the alone or in combination with fixed an extra riser for making olefins. A

inclusion of solvents not usually bed reactor technology and/or also 100 000 b/d RFCC can make over

considered to be deasphalting sol- coupled with thermal processes 500 000 t/y of propylene, assuming

vents. Other areas of future process employing suitable catalyst with a 10 wt% yield. Additional technol-

modification will be in extractor metal retention capacity, represent ogies can increase this to 30-40 wt%.

tower internals, studies with higher the most efficient way of handling For instance, VGO processing with

molecular weight solvent, accurate petroleum bottoms and other heavy an HDM/HDS unit can give around

estimation of physical properties of hydrocarbons for upgrading. The 29 wt% propylene. The FCC gasoline,

mix stream, studies in combination features of the resulting process con- which is about 50 wt% BTX, can also

50 PTQ Q2 2020 www.digitalrefining.com/article/1002467

Announced oil-to-chemicals investments 2019, $billion

Zhejiang Petroleum and Chemical Zhoushan, China $26 Greenfield 2019 (Phase 1)

Hengli Petrochemical Changxin Island, China $11 Greenfield 2019

Shenghong Petrochemical Lianyungang, China $11.84 Greenfield 2019

Ningbo Zhongjin Petrochemical (subs Rongsheng Petrochemical) Ningbo, China $5 (est) Revamp 2018

Saudi Aramco/NORINCO/Panjun Sincen (Huajin Aramco Petrochemical) Liaoning Province, China $10+ Greenfield 2024

SABIC/Fuhaichuang Petrochemical Zhangzhou, China NA Greenfield NA

SINOPEC/SABIC (Tianjin Petrochemical) Tianjin, China $45 Revamp Operating, pre-2017

PetroChina Dalian, China combined Revamp Operating, pre-2017

PetroChina Yunnan, China (est) Revamp Operating, pre-2017

CNOOC Huizhou, China Revamp Operating, pre-2017

SINOPEC Lianyungang, China $2.80 Greenfield NA

SINOPEC Caofeidian, China $4.2 Greenfield NA

SINOPEC Gulei, China $4.26 Greenfield 2020

Total China $120.1

Other Asia

Hengyi Group Pulau Muara Besar, Brunei $20 Greenfield 2020

Saudi Aramco/ADNOC/India Consortium Raigad, India $44 Greenfield 2025

Petronas/Saudi Aramco (RAPID) Pengerang, Malaysia $2.7 Greenfield 2019

ExxonMobil (Singapore Chemical Plant) Jurong lsland, Singapore <$1 Revamp 2023

Pertamina/Rosneft Tuban, East Java, Indonesia $15 Greenfield 2025

Total other Asia $82.7

Middle East

ADNOC Al Ruwais, UAE $45 Revamp 2025

Saudi Aramco/SABIC Yanbu, Saudi Arabia $30 Greenfield 2025

Saudi Aramco/Total Jubail, Saudi Arabia $5 Greenfield 2024

KNPC/KIPIC (Al-Zour Refinery) Al Ahmadi, Kuwait $13 Greenfield 2019

Oman Oil Company/Kuwait Petroleum International (Duqm Refinery) Oman $15 Greenfield NA

Total Middle East $108

Europe

MOL Group Hungary, Croatia $4.5 Revamp 2030

Total Europe: $4.5

Total Greenfield $215 Total revamps $100 Total global $315

Table 1 Source: TCGR 2019

be partially processed in the aromat- Critical to an assessment of the doing so it has chosen two steps, uti-

ics plant. Fine tuning in the RFCC potential for oil-to-chemicals is the lising Lummus OCT and a CDHydro

for propylene is a lot less costly than number and types of committed Deisobutenizer which will generate

propane dehydrogenation. investments to date (mid-2019). This an isobutene-rich stream, whereas

• When processing heavier feed- study documents those announced OCT will generate increased propyl-

stocks, the consensus is to have investments declared during the ene production. These modifications

hydrogen-in revamps or greenfield last five years as oil-to-chemicals are reportedly available for less than

designs. projects, along with company, loca- $50 million. Also, the MOL revamp

• Increasing the severity of RDS/ tion, size of project, and investment. is interesting as the company intends

RFCC to produce more propylene Where available and announced, to incorporate Innovacat swing fixed

decreases both gasoline and diesel we have also included the wt% fuel bed technology in the refinery.

yield. Forwarding heavy naphtha vs chemical targets (see Table 1). Another example we highlight,

is required for reformate feed to These all have been more closely which we think stands out with

aromatics. Improving liquid yields researched, with sources and notes some interesting conclusions, is the

can be done to different degrees by provided. What it does highlight revamp for the Polish refiner Grupa

upping VGO+DAO, while reducing is there is at least $315 billion in LOTOS when, in 2011, it installed

coke to almost zero. already committed investment, of and made operational a new gen-

• Smaller (100 000 b/d) refineries which $100 billion is in revamps, eration of DAO hydrocracking

will not be as likely to have the capi- $120 billion in China, $82.7 billion in technology as part of a major resid

tal to integrate like >250 000 b/d and Asia/Pacific, and $108 billion in the upgrading project called the 10+

larger sites. Middle East. Programme. In this case, it raised

• All licensors, by their remits, will There are project examples where refining capacity by 75%, focused

try to sell complex greenfield site these considerations have already on higher margin diesel fuels to

configurations based on their com- been reviewed. For example, MOL increase market share, and enhanced

petitive advantages. Others have Petrochemicals in Tiszaujvoros, margins by $5 per barrel.

different levels of revamp expertise. Hungary, has decided to upgrade In this case, the two units added by

When we use examples throughout its 100 000 t/y to produce more pol- Shell Global Solutions were a 45 000

our analyses, they are to highlight ymer grade propylene from steam b/d DAO hydrocracker using 50/50

real world examples. cracking and refinery feedstocks. In VGO/DAO straight off these units,

52 PTQ Q2 2020 www.digitalrefining.com/article/1002467

with the added DAO unit. What is the traditional business models of remain a ‘go-to’ for carbon out

interesting is that, using Urals feed- segregated refining vs chemicals pro- with any advances having outsized

stock, the hydrocrackers, inclusive of duction no longer hold true. impacts (due to the breath of imple-

HDM, HDS and HDN, were able to The ongoing drive for improved mentation). Hydrogen supplies will

increase conversion to 85% from 60% profitability profiles, derived by pro- need to increase or become more

with a recycle mode. ducing petrochemicals as opposed to flexible (without additional energy/

Based on the information from fuels, has justified the increased pace CO2 impacts) in order to address the

these examples and assuming the of the oil-to-chemicals movement. range of upgrading requirements.

VDU and ADU are already in-place Not only are demands for olefins

investments, then an SDA unit (KBR and aromatics growing more quickly References

ROSE, Axens Hyvahl or Selex-Asp), than gasoline and diesel, the profit 1 ExxonMobil, Outlook for Energy, 2018,

depending on the product slate cho- margins for these petrochemicals are https://corporate.exxonmobil.com/energy-

sen, is a considered first step at a also higher, and even more so when and-environment/energy-resources/outlook-

for-energy

lower approximate cost of $250-280 made directly via oil-to-chemicals

2 The Catalyst Group Resources (TCGR),

million. conversion routes.

Oil-to-Chemicals II: New Approaches from

Although moderate to date, the Resid and VGOs, 2019, www.catalystgrp.com/

Conclusion commitments to these plant config- multiclient_studies/oil-chemicals-ii-new-

In summary, there has been a long urations will require retrofits as well approaches-resid-vgos

history (decades in fact) of incremen- as new capex using skilled labourers

John J Murphy is President of The Catalyst

tal developments leading to what can and EPCs. As the former are limited Group Resources and Clyde F Payn is CEO

be described as ‘oil-to-chemicals’. For and the latter is notoriously cyclical of The Catalyst Group, a global boutique

a long period, building larger and (as is the energy/fuels industry), it consultancy serving clients via client directed

larger world scale and more com- is important to assess how large and projects (TCG Consulting) and various

plex refineries and steam cracking when these events will impact the programmes and studies (TCG Resources).

plants was the economic solution availability of (and price for) skilled

best suited to the fundamentals of labour. To what degree will envi-

medium to heavy crude oil conver- sioned projects be delayed or their

LINKS

sion and, in some countries, this will price increase as a result?

More articles from the following

still be the case. However, today we The two oil-to-chemicals

categories:

have entered a different era, where approaches – carbon out and hydro-

Catalysts and Additives

the socio-economic as well as sup- gen in – have implications across Heavy and Sour Feedstocks

ply/demand trends are shifting, and related technologies. Coking will

www.digitalrefining.com/article/1002467 PTQ Q2 2020 53

You might also like

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Catalytic Naphtha Reforming: January 2006Document12 pagesCatalytic Naphtha Reforming: January 2006AsifNo ratings yet

- Process Control Fundamentals - ADDDocument115 pagesProcess Control Fundamentals - ADDAsifNo ratings yet

- FCC Petrochemicals Production at Minimum CapexDocument5 pagesFCC Petrochemicals Production at Minimum CapexAsifNo ratings yet

- Treatment of Automotive Wastewater by Coagulation-Flocculation Using Poly-Aluminum Chloride (PAC), Ferric Chloride and Aluminum Sulfate (Alum)Document7 pagesTreatment of Automotive Wastewater by Coagulation-Flocculation Using Poly-Aluminum Chloride (PAC), Ferric Chloride and Aluminum Sulfate (Alum)AsifNo ratings yet

- Maximising Yields and Profits From The FCC UnitDocument4 pagesMaximising Yields and Profits From The FCC UnitAsifNo ratings yet

- Raw Water Flow SchemeDocument1 pageRaw Water Flow SchemeAsifNo ratings yet

- Crude Switch OptimizationDocument23 pagesCrude Switch OptimizationAsifNo ratings yet

- 59a f2015 Lng-Aaa SD SrreportDocument24 pages59a f2015 Lng-Aaa SD SrreportAsifNo ratings yet

- Dissolved Air Flotation and Me PDFDocument30 pagesDissolved Air Flotation and Me PDFtallef001No ratings yet

- Refiners Must Optimize FCC Feed Hydrotreating When Producing Low-Sulfur GasolineDocument8 pagesRefiners Must Optimize FCC Feed Hydrotreating When Producing Low-Sulfur GasolineDaniel VillanuevaNo ratings yet

- Dissolved-Air Flotation (DAF) Application and DesignDocument3 pagesDissolved-Air Flotation (DAF) Application and DesignAsifNo ratings yet

- Ellis Corporation - Dissolved Air Flotation (DAF)Document3 pagesEllis Corporation - Dissolved Air Flotation (DAF)AsifNo ratings yet

- Manit PongchalermpornDocument54 pagesManit PongchalermpornAsifNo ratings yet

- Wastewater Treatment-BlanksDocument17 pagesWastewater Treatment-BlanksAsifNo ratings yet

- Tower Internals FailureDocument22 pagesTower Internals FailureAsifNo ratings yet

- Pilot Scaleup Techniques For Solid Dosage Form - An Overview For TabletsDocument7 pagesPilot Scaleup Techniques For Solid Dosage Form - An Overview For TabletsAsifNo ratings yet

- 1000444Document5 pages1000444Semih ÖzsağıroğluNo ratings yet

- 13 Heat Integration in A Crude Distillation Unit Using Pinch Analysis ConceptsDocument29 pages13 Heat Integration in A Crude Distillation Unit Using Pinch Analysis ConceptsxinghustNo ratings yet

- Energy Integration of Kero Hydrotreating Unit A Case Study of Nigerian Refinery 2157 7048 1000386Document8 pagesEnergy Integration of Kero Hydrotreating Unit A Case Study of Nigerian Refinery 2157 7048 1000386AsifNo ratings yet

- Corrosion of Boiler Tubes Some Case Studies.... 15Document27 pagesCorrosion of Boiler Tubes Some Case Studies.... 15Leonardo Della MeaNo ratings yet

- Ripi - Light Naphtha IsomerizationDocument4 pagesRipi - Light Naphtha IsomerizationAsifNo ratings yet

- Modelling and Optimisation of A Crude Oil Hydrotreating Process Using Neural NetworksDocument6 pagesModelling and Optimisation of A Crude Oil Hydrotreating Process Using Neural NetworkshamodiNo ratings yet

- Investigation of Economizer Tube Failure in Shuqaiq Plant Boiler No. 1Document16 pagesInvestigation of Economizer Tube Failure in Shuqaiq Plant Boiler No. 1Mohammad Sazid AlamNo ratings yet

- Benzene Reduction PDFDocument11 pagesBenzene Reduction PDFAsifNo ratings yet

- PPD ClariantDocument9 pagesPPD ClariantAsifNo ratings yet

- Benzene Reduction PDFDocument11 pagesBenzene Reduction PDFAsifNo ratings yet

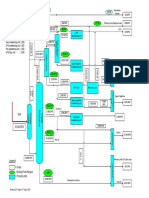

- NHT PDFDocument1 pageNHT PDFAsifNo ratings yet

- Wed Sep 30 17:24:56 2020 Case: NHT and GRU - HSC Flowsheet: Case (Main)Document1 pageWed Sep 30 17:24:56 2020 Case: NHT and GRU - HSC Flowsheet: Case (Main)AsifNo ratings yet

- Visio ORC 1@35000BPD New HRA PDFDocument1 pageVisio ORC 1@35000BPD New HRA PDFAsifNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CAT C13 Specification ManualDocument141 pagesCAT C13 Specification ManualCristina93% (15)

- Construction Cover LetterDocument1 pageConstruction Cover LetterMuhammad Tamoor Malik0% (1)

- ACCELEROMETER SEMINAR TITLEDocument13 pagesACCELEROMETER SEMINAR TITLESupriya Hegde100% (1)

- ChemistrySec4ExpressPreliminaryExam2011 P2Document213 pagesChemistrySec4ExpressPreliminaryExam2011 P2Madeleine AgiusNo ratings yet

- (1952) Válv. Ventosa Dav-Ms DorotDocument3 pages(1952) Válv. Ventosa Dav-Ms DorotHOSMANNo ratings yet

- ( (C) - CURR. DENSITY) X SHOE T.V.D. X 0.052 X 3.281Document5 pages( (C) - CURR. DENSITY) X SHOE T.V.D. X 0.052 X 3.281Nitin GandhareNo ratings yet

- Introduction To Reservoir Engineering (RE)Document82 pagesIntroduction To Reservoir Engineering (RE)Sharizan MohamarNo ratings yet

- 1-2 Apt12080lvrgDocument4 pages1-2 Apt12080lvrgRick JohnsonNo ratings yet

- Hydropower: The Hashemite UniversityDocument24 pagesHydropower: The Hashemite Universityلينا جودةNo ratings yet

- Bladeless FanDocument16 pagesBladeless FanGenius MakNo ratings yet

- IAPWS95Document18 pagesIAPWS95mealtunNo ratings yet

- Adhesion and Bonding To Polyolefins PDFDocument142 pagesAdhesion and Bonding To Polyolefins PDFJesse Haney IIINo ratings yet

- Car, Truck & Motorcycle EWD, Fuses & Relay Schematics for Renault Megane 2Document3 pagesCar, Truck & Motorcycle EWD, Fuses & Relay Schematics for Renault Megane 2Cristina Stoenescu100% (1)

- (AMW0001) Biasing LDMOS FETs For Linear OperationDocument3 pages(AMW0001) Biasing LDMOS FETs For Linear OperationThanhha NguyenNo ratings yet

- Outdoor Vacuum Circuit Breaker 12/36kVDocument4 pagesOutdoor Vacuum Circuit Breaker 12/36kVEnergy TecNo ratings yet

- Redox Equilibria Revision NotesDocument5 pagesRedox Equilibria Revision Notes6thuraiNo ratings yet

- KerjaDocument6 pagesKerjaPreetharan RavindranNo ratings yet

- Choosing Between Steam and ORC Cycles for Small-Scale PowerDocument38 pagesChoosing Between Steam and ORC Cycles for Small-Scale PowerGrazia CovinoNo ratings yet

- English For Chemistry StudentsDocument3 pagesEnglish For Chemistry StudentsDaniela Tecucianu100% (1)

- Brochure - Porcelain Ventilated FaçadeDocument100 pagesBrochure - Porcelain Ventilated Façadebatteekh100% (1)

- Installation, Operation, and Maintenance Manual Magnitude Magnetic Bearing Centrifugal Chillers IOM 1210-1Document68 pagesInstallation, Operation, and Maintenance Manual Magnitude Magnetic Bearing Centrifugal Chillers IOM 1210-1Armando Jesus CedeñoNo ratings yet

- WebpdfDocument1,063 pagesWebpdfThiyagarajanNo ratings yet

- Amine Basis GuidelinesDocument63 pagesAmine Basis Guidelinesgion_ro401No ratings yet

- Environmental Impacts of Electromagnetic Waves of Mobile Phones On HumanhealthDocument5 pagesEnvironmental Impacts of Electromagnetic Waves of Mobile Phones On HumanhealthPooja AroraNo ratings yet

- Spark IgnitionDocument23 pagesSpark IgnitionRoshaan RoshanNo ratings yet

- Jenbacher Combustion Air CoolingDocument10 pagesJenbacher Combustion Air CoolingAli AbbasiNo ratings yet

- Tappi TIP 0404-63 PDFDocument25 pagesTappi TIP 0404-63 PDFmd ibrahimNo ratings yet

- Methanol SynthesisDocument6 pagesMethanol SynthesisGaurav BurdeNo ratings yet

- ABB ACS 6000 Tech Catalog RevDDocument171 pagesABB ACS 6000 Tech Catalog RevDmaria_bustelo_2100% (5)

- Starlette Plus: The Small Range of Refrigeration DryersDocument4 pagesStarlette Plus: The Small Range of Refrigeration DryersJas SumNo ratings yet