Professional Documents

Culture Documents

Assignment of Challenges Facing Agricultural or Livestock Insurance

Uploaded by

Abdi Majid Mohamed Hassan0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

assignment of challenges facing agricultural or livestock insurance - Copy

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

2 views2 pagesAssignment of Challenges Facing Agricultural or Livestock Insurance

Uploaded by

Abdi Majid Mohamed HassanYou are on page 1of 2

Name: Abdimajid Mohamed Hassan Register no: IV/325/19

Teacher: Chris Mutsami

Date: 02.03.2021

1- The challenges facing agricultural or livestock insurance in Somaliland:

a. Systemic risks

b. Adverse selection and moral hazard

c. Emergency Aids

d. Poor agriculture risk infrastructure

e. Low risk awareness

2- Address of the above mentioned challenges:

a) Systemic risks: to help manage systemic risk investors should ensure that their

portfolios include a variety of asset classes such as fixed income, cash and real

estate, each of which will react differently in the event of a major systemic

change.

b) Adverse selection and moral hazard: The way to eliminate the adverse

selection problem in a transaction is to find a way to establish trust between the

parties involved. A way to do this is by bridging the perceived information gap

between the two parties by helping them know as much as possible.

c) Emergency Aids: I will address this challenge by commanding insurance company

to give people that in the insurance one time a month, because if they give

insurance money if there is a problem that will cause problem or losses to the

insurance people.

d) Poor agriculture risk infrastructure: to build insurance company or firm

infrastructure support because it is an important supply-side barrier to the

condition of agricultural insurance in the country.

e) Low risk awareness: I advice to the insurance firm to make high risk awareness

because people severe and they tend to underestimate the likelihood or severity of

disaster events.

3- Five actions farmers may consider to overcome difficulties in meeting agreed

repayment schedules or time on their loans:

I. Production of more crops.

II. Increase the price of their crop.

III. To produce their crops three times a year or more than.

IV. To get a good market for their production.

V. To request their government to stop or reduce the taxes of crops.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Final Thesis Abdi Majid Mohamed HassanDocument26 pagesFinal Thesis Abdi Majid Mohamed HassanAbdi Majid Mohamed Hassan100% (1)

- Cutworms Identification Cutworm Damage: Some Species of Cutworms Feed Underground, While Others Feed AboveDocument2 pagesCutworms Identification Cutworm Damage: Some Species of Cutworms Feed Underground, While Others Feed AboveAbdi Majid Mohamed HassanNo ratings yet

- Cell MembraneDocument4 pagesCell MembraneAbdi Majid Mohamed HassanNo ratings yet

- Assigment of Epl1Document7 pagesAssigment of Epl1Abdi Majid Mohamed HassanNo ratings yet

- Assignment of HaemocytometerDocument2 pagesAssignment of HaemocytometerAbdi Majid Mohamed HassanNo ratings yet

- Genetic Crosses & HeredityDocument25 pagesGenetic Crosses & HeredityAbdi Majid Mohamed HassanNo ratings yet

- Physics Questions and Answers About Level 4 Physics: Abdul Majid Mohamed Hassan (Majaa)Document5 pagesPhysics Questions and Answers About Level 4 Physics: Abdul Majid Mohamed Hassan (Majaa)Abdi Majid Mohamed HassanNo ratings yet

- Baidoa Primary and Secondary School: Chromosome Numbers of Selected OrganismsDocument23 pagesBaidoa Primary and Secondary School: Chromosome Numbers of Selected OrganismsAbdi Majid Mohamed HassanNo ratings yet

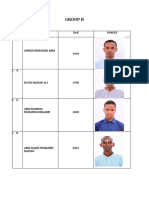

- Group B: S/No. Name Dob Images 1. 2Document5 pagesGroup B: S/No. Name Dob Images 1. 2Abdi Majid Mohamed HassanNo ratings yet