Professional Documents

Culture Documents

CHAPTER 9 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answers

Uploaded by

Mich0 ratings0% found this document useful (0 votes)

102 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

102 views1 pageCHAPTER 9 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answers

Uploaded by

MichCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

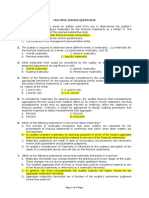

CHAPTER 9 c.

More thorough credit investigations made by the

1. Of the following procedures, which does not produce company late in 2014

analytical evidence? d. Fictitious sales in 2015

a. Compare revenue, cost of sales, and gross profit with 9. Which of the following would not be classified as an

the prior year and investigate significant variations analytical procedure?

b. Examine monthly performance reports and investigate a. Benchmarking the company’s profitability ratios

significant revenue and expense variances against others in the industry

c. Confirm customers account receivable and clear all b. Variance analysis of actual revenue versus budgeted

material exceptions. amounts for production

d. Compare sales trends and profit margins with industry c. Reperforming the client’s depreciation expense using

average and investigate significant differences the client’s accounting policies for capital expenditures

made during the year

2. Which of the following comparisons is most useful to an d. Reconciling fixed assets disposition with the fixed asset

auditor in evaluating the results of an entity’s operations? ledger.

a. Prior year accounts payable to current year accounts

payable 10. An auditor compares this year’s revenues and expenses with

b. Prior year payroll expense to budgeted current year those of the prior year and investigates all changes exceeding

payroll expense 10%. By this procedure the auditor is most likely to learn

c. Current year revenue to budgeted current year revenue that

d. Current year warranty expense to current year a. An increase in property tax rates has not been

contingent liabilities. recognized in the client’s accrual

b. This year’s provision for uncollectible account is

3. Which of the following analytical procedures should be inadequate because of worsening economic conditions

applied to the income statement? c. December payroll taxes were not paid

a. Select sales and expense items and trace amounts to d. The client changed its capitalization policy for small

related supporting documents tools during the year.

b. Ascertain that the new income amount in the

statement of cash flows agrees with the net income

amount in the income statements

c. Obtain from the client representatives, the beginning

and ending inventory amounts that were used to

determine costs of sales

d. Compare the actual revenues and expenses with the

corresponding figures of the previous year and

investigate significant differences.

4. Which of the following tends to be most predictable for the

purpose of analytical procedures applied as substantive test?

a. Relationships involving balance sheet accounts

b. Transactions subject to management discretion

c. Relationships involving income statement accounts.

d. Data subject to audit testing in the prior year

5. Auditors try to identify predictable relationships when using

analytical procedures. Relationships involving transactions

from which of the following accounts most likely would

yield the highest level of evidence?

a. Accounts payable

b. Advertising expense

c. Accounts receivable

d. Interest expense.

6. Auditors sometimes use comparison of ratios as audit

evidence. For example, an unexplained decrease in the ratio

of gross profit to sales may suggest which of the following

possibilities?

a. Unrecorded purchases

b. Unrecorded sales.

c. Merchandise purchase being charged to operating

expense

d. Fictitious sales

7. Which result of an analytical procedure suggests the

existence of obsolete merchandise?

a. Decrease in the inventory turnover rate.

b. Decrease in the ratio of gross profit to sales

c. Decrease in the ratio of inventory to accounts

payable

d. Decrease in the ratio of inventory to accounts

receivable

8. If accounts receivable turned over 8 times in 2014 as

compared to only 6 times in 2015, it is possible that there

were

a. Unrecorded credit sales in 2015.

b. Unrecorded cash receipts in 2014

You might also like

- CHAPTER 5 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument2 pagesCHAPTER 5 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- CHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument2 pagesCHAPTER 6 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- MAC Material 2Document33 pagesMAC Material 2Blessy Zedlav LacbainNo ratings yet

- MAS Compilation of QuestionsDocument21 pagesMAS Compilation of QuestionsHazel Joy GaboNo ratings yet

- Acctg205 TransferPricing-SampleQuestions PDFDocument2 pagesAcctg205 TransferPricing-SampleQuestions PDFEliseNo ratings yet

- Chapter 8 Franchise AccountingDocument11 pagesChapter 8 Franchise AccountingFaithful FighterNo ratings yet

- MANAGEMENT SERVICES MAY 2018 PREWEEK LECTUREDocument38 pagesMANAGEMENT SERVICES MAY 2018 PREWEEK LECTURELara FloresNo ratings yet

- PAS 1 and PFRS 1 Multiple Choice QuestionsDocument4 pagesPAS 1 and PFRS 1 Multiple Choice Questionsjahnhannalei marticioNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- Pre EngagementDocument3 pagesPre EngagementJanica BerbaNo ratings yet

- Differential Analysis:: The Key To Decision MakingDocument32 pagesDifferential Analysis:: The Key To Decision MakingkimmyNo ratings yet

- CH 07 Intercompany Inventory TransactionsDocument38 pagesCH 07 Intercompany Inventory TransactionsKyla Ramos DiamsayNo ratings yet

- THEORY26PROBLEMSDocument10 pagesTHEORY26PROBLEMSIryne Kim PalatanNo ratings yet

- DocxDocument13 pagesDocxMingNo ratings yet

- Diamond Motors installment sales profits analysisDocument4 pagesDiamond Motors installment sales profits analysisGoal Digger Squad VlogNo ratings yet

- Chapter 7Document27 pagesChapter 7phillipNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Interactive Model of An EconomyDocument142 pagesInteractive Model of An Economyrajraj999No ratings yet

- Revenue From Contracts With CustomersDocument39 pagesRevenue From Contracts With Customersnglc srzNo ratings yet

- QuizDocument13 pagesQuizPearl Morni AlbanoNo ratings yet

- MAS Practice Set Problems 1Document4 pagesMAS Practice Set Problems 1Kristine Wali0% (1)

- MULTIPLE CHOICE - Capital BudgetingDocument9 pagesMULTIPLE CHOICE - Capital BudgetingMarcuz AizenNo ratings yet

- Relevant Costing Simulated Exam Ans KeyDocument5 pagesRelevant Costing Simulated Exam Ans KeySarah BalisacanNo ratings yet

- AT-07 (FS Audit Process - Audit Planning)Document4 pagesAT-07 (FS Audit Process - Audit Planning)Bernadette PanicanNo ratings yet

- Tax DrillsDocument21 pagesTax DrillsJewelle CantosNo ratings yet

- TAX-301 (VAT-Subject Transactions)Document10 pagesTAX-301 (VAT-Subject Transactions)Edith DalidaNo ratings yet

- Aasi CompilationDocument23 pagesAasi CompilationSheie WiseNo ratings yet

- Accounting Gov ReviewerDocument20 pagesAccounting Gov ReviewerShane TorrieNo ratings yet

- Quiz BeeDocument15 pagesQuiz BeeRudolf Christian Oliveras UgmaNo ratings yet

- Acctg 15 - Midterm ExamDocument6 pagesAcctg 15 - Midterm ExamAngelo LabiosNo ratings yet

- Chapter 16 Summary: Accounting for Non-Profit OrganizationsDocument27 pagesChapter 16 Summary: Accounting for Non-Profit OrganizationsEllen MNo ratings yet

- Donors Tax TheoriesDocument6 pagesDonors Tax TheoriesAstrid VargasNo ratings yet

- BSA 3202 Topic 2 - Joint ArrangementsDocument14 pagesBSA 3202 Topic 2 - Joint ArrangementsjenieNo ratings yet

- Income Based ValuationDocument25 pagesIncome Based ValuationApril Joy ObedozaNo ratings yet

- Comparison Between Estate Tax and Donor's TaxDocument5 pagesComparison Between Estate Tax and Donor's TaxImma Therese YuNo ratings yet

- Pure TheoriesDocument5 pagesPure Theorieschristine angla100% (1)

- 4 Franchise Ifrs 15 2020Document15 pages4 Franchise Ifrs 15 2020natalie clyde matesNo ratings yet

- Lyceum-Northwestern University: L-NU AA-23-02-01-18Document8 pagesLyceum-Northwestern University: L-NU AA-23-02-01-18Amie Jane MirandaNo ratings yet

- Govt Acctg - Semi FinalsDocument5 pagesGovt Acctg - Semi Finalsrustylopez1112No ratings yet

- CW6 - MaterialityDocument3 pagesCW6 - MaterialityBeybi JayNo ratings yet

- Law On Obligations and Contracts Quiz Bee Round 1 EasyDocument6 pagesLaw On Obligations and Contracts Quiz Bee Round 1 EasyadssdasdsadNo ratings yet

- Management Advisory Budget ModuleDocument8 pagesManagement Advisory Budget ModuleJohn DoesNo ratings yet

- Exempt Sale of Goods Properties and Services NotesDocument2 pagesExempt Sale of Goods Properties and Services NotesSelene DimlaNo ratings yet

- 01 The Accountancy ProfessionDocument8 pages01 The Accountancy ProfessionKristine TiuNo ratings yet

- Multiple Choice Questions: Finance and Investment CycleDocument19 pagesMultiple Choice Questions: Finance and Investment Cyclemacmac29No ratings yet

- MAS 2 Prelim Exam To PrintDocument3 pagesMAS 2 Prelim Exam To PrintJuly LumantasNo ratings yet

- Module 3 Quiz EssayDocument1 pageModule 3 Quiz EssayVon Andrei MedinaNo ratings yet

- Chapter 19 Professional EthicsDocument26 pagesChapter 19 Professional EthicsSavya SachiNo ratings yet

- Problem 7-1: True or False False: Fact PatternDocument6 pagesProblem 7-1: True or False False: Fact Patternrichmond naragNo ratings yet

- Nonprofit Organization Cash FlowsDocument6 pagesNonprofit Organization Cash FlowsCresca Cuello CastroNo ratings yet

- Foreign Currency TransactionsDocument24 pagesForeign Currency TransactionsCAPSNo ratings yet

- Marisol Guino BSA-3A Midterm Exam-Strategic Business AnalysisDocument5 pagesMarisol Guino BSA-3A Midterm Exam-Strategic Business AnalysisMarisol GuinoNo ratings yet

- 06 MAS - FS AnalysisDocument8 pages06 MAS - FS AnalysisRimuru TempestNo ratings yet

- Chapter 05 - Audit Evidence and DocumentationDocument44 pagesChapter 05 - Audit Evidence and DocumentationALLIA LOPEZNo ratings yet

- AbuegDocument10 pagesAbuegswit_kamoteNo ratings yet

- NPO Accounting Activity May 26 2021Document5 pagesNPO Accounting Activity May 26 2021Cassie PeiaNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Acct 3Document25 pagesAcct 3Diego Salazar100% (1)

- Auditing Theory MCQsDocument21 pagesAuditing Theory MCQsDawn Caldeira100% (1)

- Audtheo Part 1Document2 pagesAudtheo Part 1MichNo ratings yet

- Audtheo Part 3Document3 pagesAudtheo Part 3MichNo ratings yet

- Audtheo Part 2Document2 pagesAudtheo Part 2MichNo ratings yet

- CHAPTER 10 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersDocument1 pageCHAPTER 10 Auditing-Theory-MCQs-Continuation-by-Salosagcol-with-answersMichNo ratings yet

- CHAPTER 8 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument1 pageCHAPTER 8 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- CHAPTER 7 Auditing-Theory-MCQs-by-Salosagcol-with-answersDocument2 pagesCHAPTER 7 Auditing-Theory-MCQs-by-Salosagcol-with-answersMichNo ratings yet

- CPA ethics and principlesDocument2 pagesCPA ethics and principlesMichNo ratings yet

- CHAPTER 1 Auditing-Theory-MCQs-by-Salosagcol-with-answers 1Document2 pagesCHAPTER 1 Auditing-Theory-MCQs-by-Salosagcol-with-answers 1MichNo ratings yet

- Detect Financial FraudDocument2 pagesDetect Financial FraudMichNo ratings yet

- Understanding Internal ControlsDocument2 pagesUnderstanding Internal ControlsMichNo ratings yet

- Managing Performance Through Training and Development 6th Edition Saks Solutions Manual 1Document10 pagesManaging Performance Through Training and Development 6th Edition Saks Solutions Manual 1marc100% (39)

- Cga-Canada External Auditing (Au1) Examination June 2011 Marks Time: 3 HoursDocument14 pagesCga-Canada External Auditing (Au1) Examination June 2011 Marks Time: 3 Hoursyinghan2203031No ratings yet

- Audit Committee EY-Staying-on-course-guide-for-audit-committeesDocument80 pagesAudit Committee EY-Staying-on-course-guide-for-audit-committeesVeena HingarhNo ratings yet

- Auditor Auditee Audit Zone: Audit Date: 5S Audit Check List - Scoring GuidelinesDocument2 pagesAuditor Auditee Audit Zone: Audit Date: 5S Audit Check List - Scoring GuidelinesRishi Gautam100% (2)

- Jawaban Kasus 20-29 Auditing II ArensDocument4 pagesJawaban Kasus 20-29 Auditing II ArensAchmad Syafi'i33% (3)

- Auditing I Course OutlineDocument3 pagesAuditing I Course Outlinebrook butaNo ratings yet

- Chapter 10 IS Audit Tools and TechniquesDocument8 pagesChapter 10 IS Audit Tools and TechniquesMuriithi MurageNo ratings yet

- Assignment On Bata India LTD: Presented by A.Ch - Kalyani (M.B.A)Document20 pagesAssignment On Bata India LTD: Presented by A.Ch - Kalyani (M.B.A)sanafatemaNo ratings yet

- The Sarbanes-Oxley Act of 2002: Recommendations For Higher EducationDocument11 pagesThe Sarbanes-Oxley Act of 2002: Recommendations For Higher EducationHeeyNo ratings yet

- Tesda Vs CoaDocument11 pagesTesda Vs Coamelchor1925No ratings yet

- First Minutes of A TrustDocument4 pagesFirst Minutes of A Trustemgee70193% (14)

- All Bookish Knowledge Parts in ONE FILE- AADocument30 pagesAll Bookish Knowledge Parts in ONE FILE- AAtuitiontutoraNo ratings yet

- Minutes of MRM: STANDARD: IATF 16949: 2016Document7 pagesMinutes of MRM: STANDARD: IATF 16949: 2016Raja Durai100% (1)

- ISO Standards Comparison: 9001, 14001 & 450001Document6 pagesISO Standards Comparison: 9001, 14001 & 450001muhammad AndiNo ratings yet

- Field Report at TIADocument36 pagesField Report at TIAOmaryMakalle65% (26)

- Business Planning Banking Sample PaperDocument13 pagesBusiness Planning Banking Sample Papercima2k15No ratings yet

- LUMS ACCT 130 Principles of Management AccountingDocument7 pagesLUMS ACCT 130 Principles of Management Accountingnetflix accountNo ratings yet

- Heat Treating Task Group MinutesDocument17 pagesHeat Treating Task Group Minutesmahmood750No ratings yet

- CFO Checklist For The 21stDocument4 pagesCFO Checklist For The 21stChristian JoneliukstisNo ratings yet

- Head of Electrical Department Electrical QAQC Engineer-InspectorDocument4 pagesHead of Electrical Department Electrical QAQC Engineer-InspectorAkramKassisNo ratings yet

- CORP GOV ISSUESDocument18 pagesCORP GOV ISSUESTayyab Ahmad100% (2)

- Acc140 NotesDocument72 pagesAcc140 NotesSalim Yusuf BinaliNo ratings yet

- Mariano Marcos State University: Corporate ScandalDocument6 pagesMariano Marcos State University: Corporate Scandalrheyalhane tumamaoNo ratings yet

- Agency Theory, Costs, and Director DutiesDocument49 pagesAgency Theory, Costs, and Director DutiesMohsin ZafarNo ratings yet

- Board DevelopmentDocument82 pagesBoard Developmentsuerock100% (1)

- Business Contacts Bulletin - May Sri LankaDocument19 pagesBusiness Contacts Bulletin - May Sri LankaDurban Chamber of Commerce and IndustryNo ratings yet

- The Extent of Testing Normally AppliesDocument8 pagesThe Extent of Testing Normally AppliesCarlo ParasNo ratings yet

- 2022 CNOOC Annual ReportDocument175 pages2022 CNOOC Annual ReportBlack RiverNo ratings yet

- Energy Data Collection and Tracking for Benchmarking and ManagementDocument35 pagesEnergy Data Collection and Tracking for Benchmarking and ManagementmahNo ratings yet

- Exam 1 Review Sheet GuideDocument12 pagesExam 1 Review Sheet GuidejhouvanNo ratings yet