Professional Documents

Culture Documents

Part 1. Multiple Choice Questions There Are 10 Questions in This Part. Answer ALL Questions. Give ONE Answer Only For Each

Uploaded by

Dung Thùy0 ratings0% found this document useful (0 votes)

32 views5 pagesTrắc nghiệm

Multiple choices - Final Test

Original Title

Finance

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTrắc nghiệm

Multiple choices - Final Test

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views5 pagesPart 1. Multiple Choice Questions There Are 10 Questions in This Part. Answer ALL Questions. Give ONE Answer Only For Each

Uploaded by

Dung ThùyTrắc nghiệm

Multiple choices - Final Test

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

PART 1.

MULTIPLE CHOICE QUESTIONS

There are 10 questions in this part. Answer ALL questions. Give ONE answer only for each

question.

1. Loans made between borrowers and lenders are:

a. liabilities to the lenders and assets to the borrowers since the borrower obtains the

funds.

b. assets to the lenders and liabilities of the borrowers since the promises are made to the

lenders.

c. not part of either parties' assets or liabilities until the loans are repaid.

d. liabilities to both the lenders and the borrowers.

e. None of the answers is correct.

2. Financial instruments and money share which of the following characteristics?

a. Both can function as a means of payment and a store of value.

b. Both can function as a store of value and allow for trading of risk.

c. Both can function by acting as a means of payment and allow for trading of risk.

d. Both can function as a store of value even though they do not allow for trading of risk.

e. None of above.

3. Mutual funds have:

a. been created for very wealthy individuals with a lot of money to invest.

b. increased the risks associated with constructing a portfolio.

c. reduced the costs associated with gathering information on stocks and bonds.

d. increased the transactions costs associated with participating in financial markets.

e. None of the above.

4. Financial instruments used primarily as stores of value include each of the following,

except:

a. bonds.

b. futures contracts.

c. stocks.

d. home mortgages.

e. None of the above.

5. Which of the following are long-term financial instruments?

a. A six-month loan

b. A negotiable CD

c. A banker's acceptance

d. A U.S. Treasury bill

e. None of the above

6. Which of the following instruments is not traded in a money market?

a. Eurodollars

b. U.S. Treasury Bills

c. Banker's acceptances

d. Municipal bonds

e. None of the above

7. U.S. Treasury bills _________.

a. are issued in three-, six-, nine-, and twelve-month maturities.

b. are the most liquid of the money market securities.

c. sell at a discoun3t because they have no interest payments.

d. are all of the above.

e. are only (b) and (c) of the above.

8. What is the effective annual rate of a mortgage rate that is advertised at 8% (APR) over

the next twenty years and paid with quarterly payment?

a. 8.3%

b. 8.29%

c. 1.006%

d. 8.24%

e. None of the above

9. A share of common stock represents a(n):

a. claim from a lender against a borrower.

b. share in the company's debts.

c. share of ownership of the company.

d. unlimited liability to the owner of the stock.

e. None of above

10. The value of a financial instrument rises as:

a. the size of the payment promised decreases.

b. the promised payment is made sooner rather than later.

c. it is less likely the payment will be made.

d. the payments are made when the prospective investor needs them least.

e. None of the above

PART 2. EXERCISES AND SHORT QUESTIONS

1. You invest $8000 each year in bank with APR = 12.4%, beginning two years from

now. Compute the present value of the amount you receive after twelve years from now.

……………………………………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………………………………

2. What is the price of a 10 years coupon bond with face value $1000 and coupon rate is 7.8%

if the interest payment will be semiannual and the YTM is assumed to be 7.2%?

…………………………………………………………………………………………………………………………….

……………………………………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………………………………

………………………………………………………………………………………………………

3. Jessica has just graduated with her MBA. Rather than take the job she was offered at a

prestigious investment bank—3As—she has decided to go into business for herself.

She believes that her business will require an initial investment of $1 million. After that, it

will generate a cash flow of $100,000 at the end of one year, and this amount will grow by

4.5% per year thereafter. What is the IRR of this investment opportunity?

……………………………………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………………………………

…………………………………………………………………………………………………………………………………………

PART 3. Short questions

a. If an investor wants to compare commercial paper to a corresponding default-free

investment, which security would he/she use and why?

For those that are risk averse, those that are retired already or very close to doing so, and

those that cannot afford to lose any of their invested capital, treasury bill will be more

appropriate choice. However, for the risk lovers, the younger investors with time on their

hands, and those that do not mind as much if they lose any part of their invested capital,

taking the additional risk of for a couple basis points of added return from commercial

paper may be a better choice.

…………………………………………………………………………………………………………………………………………………

…………………………………………………………………………………………………………………………………………………

…………………………………………………………………………………………………………………………………………………

…………………………………………………………………………………………………………………………………………………

…………………………………………………………………………………………………………………

b. What kinds of asymmetric information problems do the life insurance companies have

to deal with? Give a solution that helps to reduce that problem.

……………………………………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………………………………

……………………………………………………………………………………………………………………………………………………

…………………………………………………………………………………………………………

PART 1. MULTIPLE CHOICE QUESTIONS

1) Every financial market has the following characteristic:

A) It allows loans to be made.

B) It channels funds from lenders-savers to borrowers-spenders. /

C) It allows common stock to be traded.

D) It determines the level of interest rates.

2) Which of the following can be described as involving direct finance?

A) A corporation buys commercial paper issued by another corporation. /

B) People buy shares in a mutual fund.

C) An insurance company buys shares of common stock in the over-the-counter markets.

D) A corporation takes out a loan from a bank.

E) None of the above.

3) Which of the following are securities?

A) A share of Texaco common stock

B) A Treasury bill

C) A certificate of deposit

D) Each of the above /

E) Only (a) and (b) of the above

4) Financial markets improve economic welfare because

A) they allow funds to move from those without productive investment opportunities to those

who have such opportunities.

B) they allow consumers to time their purchase better. /

C) they weed out inefficient firms.

D) they do each of the above.

E) they do (a) and (b) of the above.

5) Which of the following are long-term financial instruments?

A) A six-month loan

B) A negotiable certificate of deposit

C) A bankers acceptance

D) A U.S. Treasury bill

E) None of the above /

6) Which of the following are short-term financial instruments?

A) A bankers acceptance

B) A U.S. Treasury bill

C) A negotiable certificate of deposit

D) A six-month loan

E) All of the above /

7) Which of the following are primary markets?

A) The options markets

B) The U.S. government bond market

C) The over-the-counter stock market

D) The New York Stock Exchange

E) None of the above /

8) Which of the following are secondary markets?

A) The over-the-counter stock market

B) The options markets

C) The U.S. government bond market

D) The New York Stock Exchange

E) All of the above /

9) Which of the following instruments is not traded in a money market?

A) Eurodollars

B) U.S. Treasury Bills

C) Banker's acceptances

D) Commercial paper

E) None of the above /

10) Which of the following instruments are traded in a capital market?

A) Banker's acceptances

B) U.S. Government agency securities /

C) Negotiable bank CDs

D) Repurchase agreements

E) None of the above

PART 2. EXERCISES AND SHORT ANSWER:

1. A local bank advertises the following deal: “Pay us $100 a year for 10 years and then we

will pay you (or your beneficiaries) $100 a year forever”. Is this a good deal if the interest

rate available on other deposit is 6%?

2. Suppose that you invest $20,000 in an account paying 8% interest. You plan to withdraw

$2000 at the end of each year for 15 years. How much money will be left in the account

after 15 years?

3. You have an investment opportunity that requires an initial investment of $9500 today

and will pay $10,500 in one year. What is the IRR of this opportunity?

4. Consider a five-year, $1000 bond with a 5% coupon rate and semiannual coupons

presented. Suppose you are told that its yield to maturity has increased to

6.30% (expressed as an APR with semiannual compounding). What price is the bond

trading for now?

You might also like

- REVISION QUESTIONSDocument10 pagesREVISION QUESTIONSNguyễn Việt LêNo ratings yet

- FinanceDocument156 pagesFinancearavindan_net100% (2)

- ÔN THI CUỐI KÌ Ms Trang 1Document8 pagesÔN THI CUỐI KÌ Ms Trang 1Lưu Thu Thuỷ K24ATCANo ratings yet

- Answer-Introduction To FinanceDocument10 pagesAnswer-Introduction To FinanceNguyen Hong HanhNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- MQ 26Document8 pagesMQ 26Lester PioquintoNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Prelim Exam - For PrintingDocument4 pagesPrelim Exam - For PrintingThat's FHEVulousNo ratings yet

- DTTC 2Document44 pagesDTTC 2ngochanhime0906No ratings yet

- Hawassa University School of Management and Accounting Makeup Exam For The Course Financial Institutions and Capital MarketsDocument7 pagesHawassa University School of Management and Accounting Makeup Exam For The Course Financial Institutions and Capital Marketssamuel kebedeNo ratings yet

- Finals in FMDocument14 pagesFinals in FMJin AkanisheNo ratings yet

- Chapter 1 Quiz: Money, Financial Institutions, and Financial Markets in The United States Can Have A Major Impact OnDocument35 pagesChapter 1 Quiz: Money, Financial Institutions, and Financial Markets in The United States Can Have A Major Impact OnUmer Ejaz100% (1)

- Mock General ExamDocument13 pagesMock General ExamElio AseroNo ratings yet

- Capital Markets Activities 1Document13 pagesCapital Markets Activities 1Ian Eldrick Dela CruzNo ratings yet

- Economics of Money Banking and Financial Markets 9th Edition Mishkin Test BankDocument25 pagesEconomics of Money Banking and Financial Markets 9th Edition Mishkin Test BankCraigGonzalezaxzgd100% (15)

- Financial Markets OverviewDocument4 pagesFinancial Markets OverviewLê Thiên Giang 2KT-19No ratings yet

- Investor Knowledge Quiz: A Helpful Guide To Learning More About InvestingDocument16 pagesInvestor Knowledge Quiz: A Helpful Guide To Learning More About InvestingWensen ChuNo ratings yet

- FinMgt1Finals Regular 2019Document7 pagesFinMgt1Finals Regular 2019Franz Ana Marie CuaNo ratings yet

- Financial Markets Tutorial and Self Study Questions All TopicsDocument17 pagesFinancial Markets Tutorial and Self Study Questions All TopicsTan Nguyen100% (1)

- Tutorial 2 QuestionsDocument5 pagesTutorial 2 QuestionsSik WooNo ratings yet

- NotesDocument1,164 pagesNotesV HariNo ratings yet

- BFS L1 Imp QuestionsDocument20 pagesBFS L1 Imp QuestionsVishnu Roy0% (1)

- Banking Fundamentals QuizDocument5 pagesBanking Fundamentals QuizPhương Nghi LêNo ratings yet

- TTTC-ĐCTT (English)Document40 pagesTTTC-ĐCTT (English)31 Trà Thị Hoàng NhưNo ratings yet

- 1 Accounting-QuestionsDocument3 pages1 Accounting-QuestionsRocco KalasNo ratings yet

- Week 4 Tutorial QuestionsDocument5 pagesWeek 4 Tutorial QuestionsJess XueNo ratings yet

- Tutorial 1 Part 1. Questions For ReviewDocument4 pagesTutorial 1 Part 1. Questions For ReviewPham Thuy HuyenNo ratings yet

- CSC I - Fina 739 - Ch6-7 Q&ADocument14 pagesCSC I - Fina 739 - Ch6-7 Q&ANiranjan PaudelNo ratings yet

- Sample 12Document96 pagesSample 12sivakumarNo ratings yet

- BalagangaDocument71 pagesBalagangaSrinath BhattacherjeeNo ratings yet

- Economics of Money Banking and Financial Markets 10th Edition by Mishkin ISBN Test BankDocument30 pagesEconomics of Money Banking and Financial Markets 10th Edition by Mishkin ISBN Test Bankyvonne100% (26)

- Mortgage MarketsDocument7 pagesMortgage MarketsNishat FarhatNo ratings yet

- Corporate Finance Practice ExamDocument11 pagesCorporate Finance Practice ExamPeng Jin100% (1)

- CISI Mock Exam Questionnaires (Consolidated)Document17 pagesCISI Mock Exam Questionnaires (Consolidated)Jerome GaliciaNo ratings yet

- CTS CCP L0 BFS DumpsDocument28 pagesCTS CCP L0 BFS Dumpssamrat18850% (8)

- TRUE/FALSE AND MULTIPLE CHOICE FINANCE QUESTIONSDocument6 pagesTRUE/FALSE AND MULTIPLE CHOICE FINANCE QUESTIONSf100% (1)

- SampleQuestions Finance 1Document9 pagesSampleQuestions Finance 1YiğitÖmerAltıntaşNo ratings yet

- Done-BU7305 Midterm Exam S2 2020-2021 201700889 Amina AltimimiDocument15 pagesDone-BU7305 Midterm Exam S2 2020-2021 201700889 Amina AltimimiMoony TamimiNo ratings yet

- Corporate Finance Trial Questions 2Document11 pagesCorporate Finance Trial Questions 2Sylvia Nana Ama DurowaaNo ratings yet

- Latest UpdatedDocument26 pagesLatest UpdatedYuviNo ratings yet

- PrepartionDocument31 pagesPrepartionbaapanil100% (1)

- Quiz Questions - Unlocked PDFDocument6 pagesQuiz Questions - Unlocked PDFashirwad singhNo ratings yet

- MGT411 Quiz#2 File#2 02-01-2024 Miss MehwishDocument3 pagesMGT411 Quiz#2 File#2 02-01-2024 Miss MehwishhuzaifaalyanhfNo ratings yet

- Q&aDocument70 pagesQ&apaulosejgNo ratings yet

- ACC501 Latest Solved MCQsDocument11 pagesACC501 Latest Solved MCQsNaeem KhanNo ratings yet

- FIN 659 Assignment I: Security Industry Essentials MCQDocument15 pagesFIN 659 Assignment I: Security Industry Essentials MCQBryan RenzyNo ratings yet

- Final - MB 2021-QDocument4 pagesFinal - MB 2021-QABDULLAH ASALIEHNo ratings yet

- CTS C# DumbsDocument23 pagesCTS C# DumbsTuhin Guha RoyNo ratings yet

- Tutorial 2 QuestionsDocument5 pagesTutorial 2 QuestionsNguyễn Thùy Linh 1TC-20ACNNo ratings yet

- Overview of The Financial System: QuestionsDocument15 pagesOverview of The Financial System: QuestionsAmbra KoraNo ratings yet

- Ashford Bus401 Week 1 4 Quiz and Practice QuestionsDocument15 pagesAshford Bus401 Week 1 4 Quiz and Practice QuestionsDoreenNo ratings yet

- Bank L0 DumpDocument503 pagesBank L0 Dumpdhootankur60% (5)

- Fmi BazaDocument18 pagesFmi BazaАнель ПакNo ratings yet

- Tutorial 1 Answers Manegerial Finance)Document3 pagesTutorial 1 Answers Manegerial Finance)Khaled MirzaNo ratings yet

- 213 F Sample 4-11 VclassDocument12 pages213 F Sample 4-11 VclassbraveusmanNo ratings yet

- Midterm 3 AnswersDocument7 pagesMidterm 3 AnswersDuc TranNo ratings yet

- UTS Aplikasi Manajemen Keuangan Take HomeDocument10 pagesUTS Aplikasi Manajemen Keuangan Take HomeRifan Herwandi FauziNo ratings yet

- Đề trắc nghiệm TACNDocument4 pagesĐề trắc nghiệm TACN21063129No ratings yet

- Content: The Economics of Money, Banking, and Financial Markets Money, Banking, and Financial MarketsDocument12 pagesContent: The Economics of Money, Banking, and Financial Markets Money, Banking, and Financial MarketsDung ThùyNo ratings yet

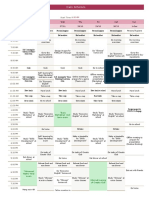

- Daily Schedule and ActivitiesDocument8 pagesDaily Schedule and ActivitiesDung ThùyNo ratings yet

- Content: The Economics of Money, Banking, and Financial MarketsDocument14 pagesContent: The Economics of Money, Banking, and Financial MarketsDung ThùyNo ratings yet

- Lecture 2 - Understanding Interest RatesDocument11 pagesLecture 2 - Understanding Interest RatesDung Thùy100% (1)

- Lecture 4 - The Term Structure of Interest RatesDocument14 pagesLecture 4 - The Term Structure of Interest RatesDung ThùyNo ratings yet

- CH 04 SVDocument75 pagesCH 04 SVDung ThùyNo ratings yet

- Financial Markets and Institutions: ReadingsDocument10 pagesFinancial Markets and Institutions: ReadingsQuang NguyenNo ratings yet

- CH 05 SVDocument73 pagesCH 05 SVDung ThùyNo ratings yet

- CH 03 SVDocument89 pagesCH 03 SVDung ThùyNo ratings yet

- HANDOUT Intellectual Property 2021Document365 pagesHANDOUT Intellectual Property 2021Dung ThùyNo ratings yet

- International Investment OverviewDocument83 pagesInternational Investment OverviewDung ThùyNo ratings yet

- 萬通終身年金Document16 pages萬通終身年金koiNo ratings yet

- Cash Management Challenges of Small Businesses in A Developing CommunityDocument11 pagesCash Management Challenges of Small Businesses in A Developing CommunitySuoi HoaNo ratings yet

- Ujjivan Annual Report 2009 10Document196 pagesUjjivan Annual Report 2009 10Rashmin TomarNo ratings yet

- Minakshikaura (8 0)Document2 pagesMinakshikaura (8 0)OYSTERNo ratings yet

- MT PS With Solutions PDFDocument11 pagesMT PS With Solutions PDFWilmar AbriolNo ratings yet

- Homework 3Document8 pagesHomework 3Aziezah PalintaNo ratings yet

- Sbi Bank Loan To Ev Car - Google SearchDocument1 pageSbi Bank Loan To Ev Car - Google Searchkalluri raviNo ratings yet

- CH 07Document99 pagesCH 07homeboimartinNo ratings yet

- FI Report Final (Sample)Document32 pagesFI Report Final (Sample)Haider AbbasNo ratings yet

- 12e TB Chapter01Document12 pages12e TB Chapter01Mashael AlYahyaNo ratings yet

- Mid Term Exam Oct 2016 With SolDocument11 pagesMid Term Exam Oct 2016 With Solsunflower33% (3)

- Credit CardDocument2 pagesCredit CardpauloNo ratings yet

- Merchant Banking Functions and RoleDocument91 pagesMerchant Banking Functions and Roledeepeshmahajan100% (1)

- How Compounding Interest Can Grow Your MoneyDocument4 pagesHow Compounding Interest Can Grow Your Moneymaria gomezNo ratings yet

- Jayaram Mudaliar vs. Ayyaswami and OrsDocument15 pagesJayaram Mudaliar vs. Ayyaswami and OrsBrijbhan Singh RajawatNo ratings yet

- 1 PF Audit ChecklistDocument8 pages1 PF Audit ChecklistAmbarish Gondhalekar75% (4)

- What I Have Learned in Chapter 1Document9 pagesWhat I Have Learned in Chapter 1ENGLAND DE ASIS ESCLAMADONo ratings yet

- Week-1: Homework/Lab Assignments Introduction To ExcelDocument19 pagesWeek-1: Homework/Lab Assignments Introduction To ExcelNeethu Maria JoseNo ratings yet

- Application Form Adarsh Awash YojnaDocument27 pagesApplication Form Adarsh Awash YojnaTilak Raj ChandanNo ratings yet

- 5 CsDocument1 page5 CsGroovy모니카No ratings yet

- DocumentDocument12 pagesDocumentTanuNo ratings yet

- Words GigiDocument102 pagesWords GigiNguyen Ha QuanNo ratings yet

- Compound InterestDocument5 pagesCompound Interestआई सी एस इंस्टीट्यूटNo ratings yet

- Financial Accounting and Reporting - Mock Board Examination (May 2022) - Attempt ReviewDocument35 pagesFinancial Accounting and Reporting - Mock Board Examination (May 2022) - Attempt ReviewJacob RaphaelNo ratings yet

- Long-Term Actuarial Mathematics Solutions To Sample Written Answer QuestionsDocument61 pagesLong-Term Actuarial Mathematics Solutions To Sample Written Answer QuestionsEmmanuelNo ratings yet

- Solved Ellsworth Enterprises Borrowed 425 000 On An 8 Interest Bearing Note OnDocument1 pageSolved Ellsworth Enterprises Borrowed 425 000 On An 8 Interest Bearing Note OnAnbu jaromiaNo ratings yet

- Assignment-2 (New) PDFDocument12 pagesAssignment-2 (New) PDFminnie908No ratings yet

- Solution Manual For Futures Options and Swaps 5th Edition by KolbDocument37 pagesSolution Manual For Futures Options and Swaps 5th Edition by Kolbsapiditysolvibleq3nl100% (12)

- BankingDocument27 pagesBankingObk AkashNo ratings yet

- Instant Download Pathophysiology The Biologic Basis For Disease in Adults and Children 7th Edition Mccance Test Bank PDF Full ChapterDocument32 pagesInstant Download Pathophysiology The Biologic Basis For Disease in Adults and Children 7th Edition Mccance Test Bank PDF Full Chapterpatentlymoietypuhae100% (6)