Professional Documents

Culture Documents

Fundamentals of Accountancy, Business, and Management 2 ASSESSMENT 3

Uploaded by

Kie Magracia BustillosOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fundamentals of Accountancy, Business, and Management 2 ASSESSMENT 3

Uploaded by

Kie Magracia BustillosCopyright:

Available Formats

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS, & MANAGEMENT 2

MODULE 2

DUE DATE: November 26, 2020 (THURSDAY, ANYTIME)

OPTIONS IN ANSWERING THE ASSESSMENT:

Choice A: Type your answers on Microsoft Word

Choice B: Write your answers on your notebook or on a separate sheet

of paper and take a photo of it.

ASSESSMENT DESTINATION:

Your assessment should be sent through email:

jackmarioancuna@gmail.com

SUBJECT: (YOUR NAME) FOABM 2 ASSESSMENT 3

CHAPTER 3 – ASSESSMENT

MIKIE BUSTILLOS 12ABM

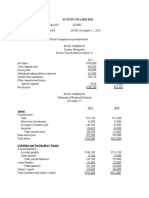

A. The December 31, 2022 balance sheet and income statement of SHOE-

SHOE MERCHANDISING are shown below:

SHOE-SHOE MERCHANDISING SHOE-SHOE MERCHANDISING

Balance Sheet

As of December 31, 2022 Income Statement

For the year ended December 31, 2022

ASSETS 2022 2021

Cash and cash equivalents ₱45,000 65,000

Accounts receivable - net 1,563,000 720,000 Sales (credit sales amount to ₱ 4,300,000) ₱ 5,400,000

Inventory 500,000 300,000

Prepaid assets 56,000 45,000 Cost of Sales (2,300,000)

Total current assets 2,164,000 1,130,000 GROSS PROFIT 3,100,000

Property, plant & equipment 850,000 650,000 Salaries expense (750,000)

Total noncurrent assets 850,000 650,000

TOTAL ASSETS 3,014,000 1,780,000

Utilities expense (150,000)

Rent expense (200,000)

LIABILITIES

Accounts payable - net 870,000 450,000

Depreciation expense (320,000)

Notes payable (current portion) 160,000 200,000 Bad debts expense (83,000)

Total current liabilities 1,030,000 650,000

Interest expense (45,000)

Notes payable (noncurrent portion) 350,000 430,000 PROFIT OF THE YEAR ₱ 1,552,000

Total noncurrent liabilities 350,000 430,000

TOTAL LIABILITIES 1,380,000 1,080,000

EQUITY

Owner's capital 1,634,000 700,000

TOTAL LIABILITIES & EQUITY ₱ 3,014,000 1,780,000

FOABM 2|Chapter 3 Page 1|4

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS, & MANAGEMENT 2

MODULE 2

Answer the MULTIPLE CHOICE QUESTIONS that follow. Encircle the letter of the

correct answer. Show your solutions on a separate sheet.

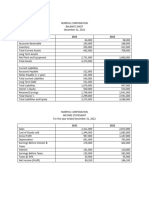

1. What is the current ratio?

a. 2.10 b. 2.20 c. 2.30 d. 2.40

2. What is the quick ratio?

a. 1.26 b. 1.37 c. 1.56 d. 1.87

3. How much is the working capital?

a. 1,134,000 b. 1,204,000 c. 1,351,000 d. 1,134,000

4. What is the Inventory turnover?

a. 5.25 b. 5.75 c. 5.92 d. 6.05

5. What is the days of the inventory?

a. 48.63 b. 52.54 c. 31.21 d. 63.48

6. What is the accounts receivable turnover?

a. 3.77 b. 3.87 c. 3.92 d. 4.13

7. What is the days of receivable?

a. 96.82 b. 98.62 c. 98.26 d. 92.86

8. What is the debt ratio?

a. 0.46 b. 0.48 c. 0.52 d. 0.63

9. What is the equity ratio?

a. 0.48 b. 0.54 c. 0.63 d. 0.72

10. What is the Debt-to-equity ratio?

a. 0.48 b. 0.54 c. 0.63 d. 0.84

11. What is the gross profit ratio?

a. 0.48 b. 0.54 c. 0.57 d. 0.72

12. What is the Net profit ratio?

a. 0.92 b. 0.54 c. 0.36 d. 0.29

13. How much is the return on assets?

a. 0.48 b. 0.54 c. 0.51 d. 0.72

FOABM 2|Chapter 3 Page 2|4

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS, & MANAGEMENT 2

MODULE 2

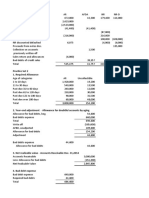

LIQUIDITY RATIOS

A. Current ratio: 2,164,000/1,030,000 = 2.10

B. Quick 45,000 1,563,000 ratio:

1.56

1,030,000

C. Working capital 2,164,000 1,030,000 1,134,000

ACTIVITY RATIOS

500, 000 300, 000 2,300,000

D. Inventory turnover ( 2 400,000)( 5.75)

400,000

365

E. Days of Inventory 63.48

5.75

4,300,000

F. Accounts receivable turnover 1,563,000 720,000 1,141,500 3.77

2 1,141,500

365

G. Days of receivables 96.82

3.77

LEVERAGE RATIOS

1,380,000

H. Debt Ratio 0.46

3,014,000

1,634,000

I. Equity Ratio 0.54

3,014,000

1,380,000

J. Debt-to-equity ratio 0.84

1,634,000

PROFITABILITY RATIOS

3,100,000

K. Gross profit ratio 0.57

5,400,000

1,552,000

L. Net profit ratio 0.29

5,400,000

FOABM 2|Chapter 3 Page 3|4

FUNDAMENTALS OF ACCOUNTANCY, BUSINESS, & MANAGEMENT 2

MODULE 2

1,552,000

M. Return on assets 0.51

3,014,000

1,552,000

N. Return on equity 0.95

1,634,000

FOABM 2|Chapter 3 Page 4|4

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- ACTY04 s.2020 2021Document3 pagesACTY04 s.2020 2021Gelay MagatNo ratings yet

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Group Assignment 2Document2 pagesGroup Assignment 2sebsibeboki01No ratings yet

- Case Study 2 (Class)Document6 pagesCase Study 2 (Class)ummieulfahNo ratings yet

- Assignment Financial Ratio Fin420Document8 pagesAssignment Financial Ratio Fin420FATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- P14 - Statement of Cashflows Requirement No. 1: Kim Zairelle Bibal Bsa - IiiDocument7 pagesP14 - Statement of Cashflows Requirement No. 1: Kim Zairelle Bibal Bsa - Iiishineneigh00No ratings yet

- CMA Part2 EssaysDocument128 pagesCMA Part2 EssaysSandeep Sawan100% (1)

- Part One: True /false Items: Write "True" If The Statement Is Correct & Write "False" If TheDocument3 pagesPart One: True /false Items: Write "True" If The Statement Is Correct & Write "False" If TheAbatneh MengistNo ratings yet

- Lesson 2 - Activity FSA2Document4 pagesLesson 2 - Activity FSA2jeffrey galanzaNo ratings yet

- Activity 2 Financial RatiosDocument2 pagesActivity 2 Financial RatioscontactitsshunNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Accounting MBA Sem I 2018Document4 pagesAccounting MBA Sem I 2018yogeshgharpureNo ratings yet

- Section A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesDocument7 pagesSection A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesgeofreyNo ratings yet

- Sukoako Company Statement of Financial Position Current Assets Year 1 Year 2Document5 pagesSukoako Company Statement of Financial Position Current Assets Year 1 Year 2Kevin GarnettNo ratings yet

- B2 Nov 2022 AnsDocument15 pagesB2 Nov 2022 AnsRashid AbeidNo ratings yet

- Case Study #2: Growing PainsDocument3 pagesCase Study #2: Growing PainsMissey Grace PuntalNo ratings yet

- Feb 27 - AssignmentDocument1 pageFeb 27 - AssignmentGeofrey RiveraNo ratings yet

- FS Analysis Horizontal Vertical ExerciseDocument5 pagesFS Analysis Horizontal Vertical ExerciseCarla Noreen CasianoNo ratings yet

- Cash Flow Statement Activity Wise 05-02-24Document7 pagesCash Flow Statement Activity Wise 05-02-24navyabindra28No ratings yet

- 2.0 Telus AnalysisDocument6 pages2.0 Telus Analysiskevin kipkemoiNo ratings yet

- Advance Financia AnalysesDocument35 pagesAdvance Financia AnalysesXsellence AccountsNo ratings yet

- Material Complementario - Cafes Monte BiancoDocument20 pagesMaterial Complementario - Cafes Monte BiancoGlenda ChiquilloNo ratings yet

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Events After The Reporting PeriodDocument5 pagesEvents After The Reporting PeriodIohc NedmiNo ratings yet

- Mini Case: Bethesda Mining Company: Disusun OlehDocument5 pagesMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- BusFin PT 5Document5 pagesBusFin PT 5Nadjmeah AbdillahNo ratings yet

- Finals Quiz Assignment Private Equity Valuation Methods With AnswersDocument7 pagesFinals Quiz Assignment Private Equity Valuation Methods With AnswersRille Estrada CabanesNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Practice Set 1Document6 pagesPractice Set 1moreNo ratings yet

- End Term On 24.09.2019 FR MBA 2019-21 Term IDocument10 pagesEnd Term On 24.09.2019 FR MBA 2019-21 Term Ideliciousfood463No ratings yet

- Indian Institute of Management Rohtak: End Term ExaminationDocument14 pagesIndian Institute of Management Rohtak: End Term ExaminationaaNo ratings yet

- Corrections: Suggested SolutionDocument5 pagesCorrections: Suggested SolutionZairah FranciscoNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- Accounts AIP FINALDocument14 pagesAccounts AIP FINALManthanNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Important QuestionsDocument3 pagesImportant QuestionsNayan JainNo ratings yet

- The Institute of Finance Management: AnswersDocument6 pagesThe Institute of Finance Management: AnswersAli SalehNo ratings yet

- Tutorial 4B : Excel: More Applications in AccountingDocument7 pagesTutorial 4B : Excel: More Applications in Accountingasdsad dsadsaNo ratings yet

- Ejercicios de FinanzasDocument25 pagesEjercicios de Finanzasmvelasco5172No ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Financial Statement Anaysis-Cat1 - 2Document16 pagesFinancial Statement Anaysis-Cat1 - 2cyrusNo ratings yet

- Home Depot Final DCFDocument120 pagesHome Depot Final DCFapi-515120297No ratings yet

- AC4301 FinalExam 2020-21 SemA AnsDocument9 pagesAC4301 FinalExam 2020-21 SemA AnslawlokyiNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument8 pagesFinancial Statements, Cash Flow, and TaxesAdwa Al-NaimNo ratings yet

- Sample Financial Management ProblemsDocument8 pagesSample Financial Management ProblemsJasper Andrew AdjaraniNo ratings yet

- 3 Solution Q.5Document4 pages3 Solution Q.5Aayush AgrawalNo ratings yet

- Mahmudin Saepullah - Assignment 5BDocument10 pagesMahmudin Saepullah - Assignment 5BRomi Prabowo De jongNo ratings yet

- TsefaDocument4 pagesTsefaAhmed SaeedNo ratings yet

- Unit 1 - Essay QuestionsDocument7 pagesUnit 1 - Essay QuestionsJaijuNo ratings yet

- National Law Institute University: BhopalDocument3 pagesNational Law Institute University: BhopalMranal MeshramNo ratings yet

- Financial Ratios 2017Document5 pagesFinancial Ratios 2017Marian PajarNo ratings yet

- Mayes 8e CH03 Problem SetDocument8 pagesMayes 8e CH03 Problem SetBunga Mega WangiNo ratings yet

- Chapter 6 Mini Case: SituationDocument9 pagesChapter 6 Mini Case: SituationUsama RajaNo ratings yet

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonNo ratings yet

- Prelims - Ratio AnalysisDocument3 pagesPrelims - Ratio AnalysisMarinel Mae ChicaNo ratings yet

- Lembar Jawaban Mahesa - SalinDocument10 pagesLembar Jawaban Mahesa - Salinricoananta10No ratings yet

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- RESA TOA Special Handouts MAY2015Document11 pagesRESA TOA Special Handouts MAY2015Jeffrey CardonaNo ratings yet

- MODULE 6 QuizDocument1 pageMODULE 6 QuizKie Magracia BustillosNo ratings yet

- Accounting For Investments Probs SAS16Document1 pageAccounting For Investments Probs SAS16Kie Magracia BustillosNo ratings yet

- Invest in Debt SecuritiesDocument1 pageInvest in Debt SecuritiesKie Magracia BustillosNo ratings yet

- Accounting For Intangible Assets SAS18Document1 pageAccounting For Intangible Assets SAS18Kie Magracia BustillosNo ratings yet

- CFASDocument17 pagesCFASKie Magracia BustillosNo ratings yet

- Bustillos Powerpoint Documentary PeDocument9 pagesBustillos Powerpoint Documentary PeKie Magracia BustillosNo ratings yet

- Time Value of Money Formulas SheetDocument1 pageTime Value of Money Formulas SheetBilal HussainNo ratings yet

- Invest in Assoc MCQDocument1 pageInvest in Assoc MCQKie Magracia BustillosNo ratings yet

- Accounting For Intangible Assets T or FDocument1 pageAccounting For Intangible Assets T or FKie Magracia BustillosNo ratings yet

- Invest in Assoc T or FDocument1 pageInvest in Assoc T or FKie Magracia BustillosNo ratings yet

- Gender IdentityDocument2 pagesGender IdentityKie Magracia BustillosNo ratings yet

- Accounting For Intangible Assets MCQDocument1 pageAccounting For Intangible Assets MCQKie Magracia BustillosNo ratings yet

- Accounts Receivables Continuation MCQDocument2 pagesAccounts Receivables Continuation MCQKie Magracia BustillosNo ratings yet

- Accounts Receivables MCQDocument2 pagesAccounts Receivables MCQKie Magracia BustillosNo ratings yet

- Notes For PrelimDocument1 pageNotes For PrelimKie Magracia BustillosNo ratings yet

- BORROWING COSTS - THEORIES pt.3Document2 pagesBORROWING COSTS - THEORIES pt.3Kie Magracia BustillosNo ratings yet

- Principles and Particles of Management Pt.2Document1 pagePrinciples and Particles of Management Pt.2Kie Magracia BustillosNo ratings yet

- Adjusting-Accounts - Q&A pt.2Document1 pageAdjusting-Accounts - Q&A pt.2Kie Magracia BustillosNo ratings yet

- Educator SpeechDocument1 pageEducator SpeechKie Magracia BustillosNo ratings yet

- Interview For PEDocument1 pageInterview For PEKie Magracia BustillosNo ratings yet

- Borrowing-Costs TheoriesDocument1 pageBorrowing-Costs TheoriesKie Magracia BustillosNo ratings yet

- Principles and Particles of Management Pt.4Document1 pagePrinciples and Particles of Management Pt.4Kie Magracia BustillosNo ratings yet

- Basic AccountingDocument1 pageBasic AccountingKie Magracia BustillosNo ratings yet

- Ppe Theories Pt3Document2 pagesPpe Theories Pt3Kie Magracia BustillosNo ratings yet

- Accts Receivables Rev Recog - TheoriesDocument1 pageAccts Receivables Rev Recog - TheoriesKie Magracia BustillosNo ratings yet

- Basic Accounting pt.2Document1 pageBasic Accounting pt.2Kie Magracia BustillosNo ratings yet

- Principles and Particles of ManagementDocument1 pagePrinciples and Particles of ManagementKie Magracia BustillosNo ratings yet

- Preference SharesDocument2 pagesPreference SharesKie Magracia BustillosNo ratings yet

- Shareholder Agreement 17Document19 pagesShareholder Agreement 17Kimosa FuygaNo ratings yet

- Books of Accounts and Double Entry Sytem BSAIS 1A Group 2Document27 pagesBooks of Accounts and Double Entry Sytem BSAIS 1A Group 2Marydelle De Austria-De GuiaNo ratings yet

- Chapter 14 Non Current Liabilities Test BankDocument36 pagesChapter 14 Non Current Liabilities Test BankSlamet Tri Prastyo100% (2)

- Cae05-Chapter 5 Bonds and Other ConceptsDocument9 pagesCae05-Chapter 5 Bonds and Other ConceptsSteffany RoqueNo ratings yet

- Pc101 Applicationactivity Managingfinances Template 2Document4 pagesPc101 Applicationactivity Managingfinances Template 2Nancy Carolina Caceres TaboraNo ratings yet

- Commercial - Bank - v. Republic Armored CarDocument4 pagesCommercial - Bank - v. Republic Armored CarrdescabarteNo ratings yet

- Article 1521Document3 pagesArticle 1521John Russel Dela CruzNo ratings yet

- Non Banking Finance Companies and Notified Entities Regulations 2008 Updated Till May 17 2023Document216 pagesNon Banking Finance Companies and Notified Entities Regulations 2008 Updated Till May 17 2023haseeb ahmedNo ratings yet

- Sposes Villaluz Vs Land Bank of The Philippines (Article 1347)Document1 pageSposes Villaluz Vs Land Bank of The Philippines (Article 1347)Wayne ForbesNo ratings yet

- 12 Acc c3 Prelim Exam p1 2023 QP AbDocument26 pages12 Acc c3 Prelim Exam p1 2023 QP AbPax AminiNo ratings yet

- Financial StatementsDocument13 pagesFinancial Statementsmhel cabigonNo ratings yet

- Sources of CapitalDocument17 pagesSources of Capitaliniwan.sa.ere0No ratings yet

- Workshop Lecture 4 QsDocument8 pagesWorkshop Lecture 4 QsabhirejanilNo ratings yet

- CHAP - 04 - Financial Statements of Bank - For StudentDocument87 pagesCHAP - 04 - Financial Statements of Bank - For Studentkhanhlmao25252No ratings yet

- 171317-2015-Go Tong Electrical Supply Co. Inc. v. BPIDocument10 pages171317-2015-Go Tong Electrical Supply Co. Inc. v. BPIKarl OdroniaNo ratings yet

- Business Law-Chapter 5Document59 pagesBusiness Law-Chapter 5MaureenNo ratings yet

- Summer Internship Project Report On WorkDocument43 pagesSummer Internship Project Report On WorkDivya Kapadne BorseNo ratings yet

- How Can A Bank Help Millennial and Gen Z Consumers Plan To Start A FamilyDocument5 pagesHow Can A Bank Help Millennial and Gen Z Consumers Plan To Start A Familynaveck kouangaNo ratings yet

- A Study On Non Performing Assets at SBI, BengaluruDocument79 pagesA Study On Non Performing Assets at SBI, BengaluruRahul KumarNo ratings yet

- Amala 33 B HarshaDocument2 pagesAmala 33 B HarshaLegal DepartmentNo ratings yet

- SDocument15 pagesSdebate ddNo ratings yet

- Acctg 13 - Partnership Formation - Assignment 2Document3 pagesAcctg 13 - Partnership Formation - Assignment 2Kimberlie Jane GableNo ratings yet

- Project Report)Document38 pagesProject Report)Swathi JNo ratings yet

- ACI Limited FMDocument13 pagesACI Limited FMTariqul Islam TanimNo ratings yet

- 102 Licaros vs. GatmaitanDocument2 pages102 Licaros vs. GatmaitanJemNo ratings yet

- The Doctrine of Lifting The Corporate VeilDocument17 pagesThe Doctrine of Lifting The Corporate VeilUday singh cheemaNo ratings yet

- Basic Accounting GuideDocument76 pagesBasic Accounting GuideBSA3Tagum MariletNo ratings yet

- RTP May 2021 Law EnglishDocument14 pagesRTP May 2021 Law EnglishVISHALNo ratings yet

- Philippine Bloomig Mills and Ching Vs CaDocument3 pagesPhilippine Bloomig Mills and Ching Vs CaBrian Jonathan ParaanNo ratings yet

- Chapter 03Document40 pagesChapter 03Tarif IslamNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)