Professional Documents

Culture Documents

Arida Fitriani Keuangan 01

Arida Fitriani Keuangan 01

Uploaded by

arida fitriani0 ratings0% found this document useful (0 votes)

4 views4 pagesThis document analyzes the profitability and solvency ratios of PT Aneka Gas Industri Tbk and PT Bank Rakyat Indonesia (Persero) Tbk for the years 2017-2018 and 2010, respectively. The profitability ratios examined include gross profit margin, operating ratio, net profit margin, return on assets, and return on equity. The solvency ratios analyzed consist of debt to asset ratio, debt to equity ratio, long-term debt to equity ratio, times interest earned, and fixed charge coverage. The ratios are calculated using data from the companies' financial statements.

Original Description:

Original Title

arida fitriani keuangan 01

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document analyzes the profitability and solvency ratios of PT Aneka Gas Industri Tbk and PT Bank Rakyat Indonesia (Persero) Tbk for the years 2017-2018 and 2010, respectively. The profitability ratios examined include gross profit margin, operating ratio, net profit margin, return on assets, and return on equity. The solvency ratios analyzed consist of debt to asset ratio, debt to equity ratio, long-term debt to equity ratio, times interest earned, and fixed charge coverage. The ratios are calculated using data from the companies' financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views4 pagesArida Fitriani Keuangan 01

Arida Fitriani Keuangan 01

Uploaded by

arida fitrianiThis document analyzes the profitability and solvency ratios of PT Aneka Gas Industri Tbk and PT Bank Rakyat Indonesia (Persero) Tbk for the years 2017-2018 and 2010, respectively. The profitability ratios examined include gross profit margin, operating ratio, net profit margin, return on assets, and return on equity. The solvency ratios analyzed consist of debt to asset ratio, debt to equity ratio, long-term debt to equity ratio, times interest earned, and fixed charge coverage. The ratios are calculated using data from the companies' financial statements.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

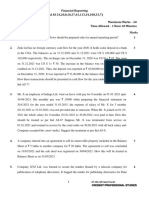

TUGAS

ANALISIS RASIO PROFITABILITAS DAN RASIO SOLVABILITAS

PT ANEKA GAS INDUSTRI Tbk Dan PT BANK RAKYAT INDONESIA (PERSERO) Tbk

DOSEN : ALIAH PRATIWI, M. AK

NAMA : ARIDA FITRIANI

NIM : 17010002/M

KLS : KEUANGAN 01

SEKOLAH TINGGI ILMU EKONOMI (STIE) BIMA

TAHUN AKADEMIK 2020-2021

A. RASIO PROFITABILITAS

1. Rasio gross profit margin

GPM = LABA BRUTO * 100%

PENJUALAN NETO

2017 = 399.891 * 100% = 46.10%

867.390

2018 = 448.984 * 100% = 47.23%

950.487

2. Operating rasio

OR = hpp + biaya operasional * 100%

Penjualan bersih

2017 = 467.499 + 3.910 * 100% = 54%

867.390

2018 = 501.503 + 7.199 *100% = 53%

950.487

3. Net profit margin

NPM = laba setelah pajak *100%

Penjualan neto

2017 = 44.501 *100% = 5.1%

867.390

2018 = 49.005 * 100% = 5.1%

950.487

4. Return on assets (ROA)

ROA = laba bersih operasi (EBIT) * 100%

Asset bersih

2017 = 61.105 * 100% = 4.17%

1.526.964

2018 = 64.199 *100% = 3.92%

1.637.292

5. Return on equity (ROE)

ROE = eat * 100%

Modal sendiri (EQUITY)

2017 = 44.501 *100% = 1.32%

3.358.010

2018 = 49.005 *100% = 1.43%

3.407.015

B. RASIO SOLVABILITAS

1. Debt to asset ratio

DAR = total debt (hutang) *100%

Total asset

2010 = 367.612.492 *100% = 90.9%

404.285.602

2. Debt to equity ratio

DER = total debt (hutang) *100%

Ekuitas ( equity)

2010 = 367.612.492 *100% = 1.02%

36.673.110

3. Long term debt to equity ratio

LTDtER = long term debt ( utang jk panjang) *100%

Ekuitas (equity)

2010 = 3.988.585 *100% = 10.8%

36.673.110

4. time interest earnet

time interest earned = ebit =

biaya bunga (interest)

2010 = 14.402.001 = 0.43

32.888.603

5. fixed charge covarage (fcc)

fcc = ebit + biaya bunga + kewajiban sewa / lease

biaya bunga + kewajiban/ lease

2010 = 14.402.001 + 32.888.603 + 9.766.026 =1.33kali

32.888.603 + 9.766.026

You might also like

- Mahindra and Mahindra AnalysisDocument17 pagesMahindra and Mahindra Analysisrahul_raj198815220% (2)

- Answer 5 - " Modern Appliances Corporation"Document4 pagesAnswer 5 - " Modern Appliances Corporation"Rheu ReyesNo ratings yet

- Question 1Document8 pagesQuestion 1elvitaNo ratings yet

- Southwestern Sugar and Molasses Company VsDocument2 pagesSouthwestern Sugar and Molasses Company Vsrbolando100% (1)

- Amity University, Uttar PradeshDocument10 pagesAmity University, Uttar Pradeshdiksha1912No ratings yet

- Assignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementDocument10 pagesAssignment OF Accounting Principles IN Ratio Analysis & Fund Flow StatementIshu AroraNo ratings yet

- 1Document7 pages1Fikri SukmaNo ratings yet

- 8.accounting Case Study G8 98Document23 pages8.accounting Case Study G8 98Hà GiangNo ratings yet

- Quiz 3 in Fm-Elec 101Document6 pagesQuiz 3 in Fm-Elec 101Krizia Mae ColegaNo ratings yet

- Rasio Keuangan IndofoodDocument7 pagesRasio Keuangan IndofoodsalsabilawidyaNo ratings yet

- Prefinals - Investment ManagementDocument6 pagesPrefinals - Investment ManagementCharles John DolNo ratings yet

- Corporate Finance Chapter 5Document11 pagesCorporate Finance Chapter 5Razan EidNo ratings yet

- Cash Flow AssignmentDocument3 pagesCash Flow AssignmentAnonymous VrRc5PFbNo ratings yet

- FDNBUSM Simple Interest and Simple Discount - BALATBATDocument4 pagesFDNBUSM Simple Interest and Simple Discount - BALATBATJe BNo ratings yet

- ROEDocument2 pagesROEshaeel ashrafNo ratings yet

- Vietjet Aviation Joint Stock Company: Financial Statement AnalysisDocument4 pagesVietjet Aviation Joint Stock Company: Financial Statement AnalysisMinh ThưNo ratings yet

- Fin 22 Chapter 12Document37 pagesFin 22 Chapter 12Jao FloresNo ratings yet

- Tugas Individu MKDocument7 pagesTugas Individu MKferawaty hutabaratNo ratings yet

- 5: Investment and Development Appraisal: Construction Financial ManagementDocument33 pages5: Investment and Development Appraisal: Construction Financial ManagementTafadzwa NyoniNo ratings yet

- Amen FMDocument4 pagesAmen FMGetu WeyessaNo ratings yet

- Problem2 Financial ManagementDocument4 pagesProblem2 Financial ManagementCamille MenesesNo ratings yet

- Student Name: Student ID MBA FinanceDocument27 pagesStudent Name: Student ID MBA FinanceAhsan RaoNo ratings yet

- Calculation of RatiosDocument3 pagesCalculation of RatiosGurjot SinghNo ratings yet

- Hafiz 10,11, ConclusionDocument10 pagesHafiz 10,11, ConclusionMuhd FiekrieNo ratings yet

- Module 3 ActivityDocument3 pagesModule 3 ActivityLezi WooNo ratings yet

- Final Finance Report (Sara Nabil + Sadika Hnadi + Yasmin Hany Elfar)Document12 pagesFinal Finance Report (Sara Nabil + Sadika Hnadi + Yasmin Hany Elfar)Yasmine hanyNo ratings yet

- Vietjet Aviation Joint Stock Company: Financial Statement AnalysisDocument4 pagesVietjet Aviation Joint Stock Company: Financial Statement AnalysisMinh ThưNo ratings yet

- Short Term Solvency, or Liquidity, Ratios: COGS / Inventory 14.117.080.050.134 / 3.719.405.670.574 3.8 4.8Document4 pagesShort Term Solvency, or Liquidity, Ratios: COGS / Inventory 14.117.080.050.134 / 3.719.405.670.574 3.8 4.8Michael AldrianusNo ratings yet

- Answers 8-1: Surname 1Document6 pagesAnswers 8-1: Surname 1Alkadir del AzizNo ratings yet

- Running Head: Investment Management 1Document9 pagesRunning Head: Investment Management 1Stellamaris MutukuNo ratings yet

- CH 04Document50 pagesCH 04Akbar LodhiNo ratings yet

- University Malaya Executive Diploma in Business Management: Accounting & Financial Management AssignmentDocument6 pagesUniversity Malaya Executive Diploma in Business Management: Accounting & Financial Management AssignmentLystra OngNo ratings yet

- FSDocument8 pagesFSafroza lataNo ratings yet

- Problem BankDocument10 pagesProblem BankSimona NistorNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisKana jillaNo ratings yet

- Group Assignment - Manajeman Keuangan - Fathur Rahman - 2221011026Document8 pagesGroup Assignment - Manajeman Keuangan - Fathur Rahman - 2221011026Fathur WarhollNo ratings yet

- Tugas Keuangan 2 Mencari Rasio Keuangan Perusahaan (WIKA) : OlehDocument6 pagesTugas Keuangan 2 Mencari Rasio Keuangan Perusahaan (WIKA) : OlehHildaaNo ratings yet

- F.rep FormulasDocument3 pagesF.rep Formulaswaseemabbas965No ratings yet

- Ratio AssignmentDocument6 pagesRatio AssignmentMuhd FiekrieNo ratings yet

- Alternative Investments - II PG QP DEC 2023 AssignmentDocument5 pagesAlternative Investments - II PG QP DEC 2023 Assignmentsachin.saroa.1No ratings yet

- Kerja Projek Matematik Tambahan 2019Document18 pagesKerja Projek Matematik Tambahan 2019anon_157118857No ratings yet

- Bond Markets Revised PDFDocument20 pagesBond Markets Revised PDFVinay Gowda D MNo ratings yet

- Assignment FicdDocument5 pagesAssignment FicdEiril DanielNo ratings yet

- Liquidity RatioDocument30 pagesLiquidity RatioMuhd FiekrieNo ratings yet

- Finance: Change in Inventories + Employee Benefit ExpensesDocument8 pagesFinance: Change in Inventories + Employee Benefit ExpensesParav BansalNo ratings yet

- Lambino Keino Mod 3 HW TVMDocument8 pagesLambino Keino Mod 3 HW TVMloganramenNo ratings yet

- Finance: Gross Profit MarginDocument8 pagesFinance: Gross Profit MarginParav BansalNo ratings yet

- Afar by Dr. Ferrer First Preboard Review 85Document4 pagesAfar by Dr. Ferrer First Preboard Review 85Julie Neay AfableNo ratings yet

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerFrans HechanovaNo ratings yet

- Tugas Analisis (Manajemen Keuangan) Mirna Puspita Rahayu 2051030227-DikonversiDocument3 pagesTugas Analisis (Manajemen Keuangan) Mirna Puspita Rahayu 2051030227-DikonversiFICKY ardhikaNo ratings yet

- AfarDocument4 pagesAfaroxennnnNo ratings yet

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerJade GomezNo ratings yet

- Group 1 - Exercise 5Document4 pagesGroup 1 - Exercise 5Nguyen Tan AnhNo ratings yet

- Unit 1 P1 - SolDocument4 pagesUnit 1 P1 - SolSyed Hasnain Ali ShahNo ratings yet

- 11-Integrity Module 2 Yu LeonDocument7 pages11-Integrity Module 2 Yu LeonCaroline LaynoNo ratings yet

- Uts Comprehensive Case PT WikaDocument7 pagesUts Comprehensive Case PT WikaFerial FerniawanNo ratings yet

- Quiz 1 Practice ProblemsDocument8 pagesQuiz 1 Practice ProblemsUmaid FaisalNo ratings yet

- Financial Management and Strategic Management 01 - Class NotesDocument108 pagesFinancial Management and Strategic Management 01 - Class NotesSiya GoyalNo ratings yet

- Case Valuation PT Semen Gresik - CemexDocument7 pagesCase Valuation PT Semen Gresik - CemexsyifanoeNo ratings yet

- Gen - Math G11 Q2 Wk2 Compound-InterestDocument9 pagesGen - Math G11 Q2 Wk2 Compound-InterestHababa AziwazaNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- ScribdDocument10 pagesScribdJon StewartNo ratings yet

- Land Surveying in UgandaDocument11 pagesLand Surveying in UgandaAlex NkurunzizaNo ratings yet

- Donato Reyes Civil Case No. 0001: PlaintiffDocument8 pagesDonato Reyes Civil Case No. 0001: Plaintiffmikhael100% (1)

- 19-05-28 Qualcomm Motion To Shorten TimeDocument10 pages19-05-28 Qualcomm Motion To Shorten TimeFlorian Mueller100% (1)

- Decentralization and BureacratizationDocument23 pagesDecentralization and BureacratizationClare JavierNo ratings yet

- Johnson Victor Bridge Engineering: EBOOK ID 7-JVBEPDF-0 - PDF: 36 Pages - File Size 2,357 KB - 2 Aug, 2019Document2 pagesJohnson Victor Bridge Engineering: EBOOK ID 7-JVBEPDF-0 - PDF: 36 Pages - File Size 2,357 KB - 2 Aug, 2019Yash SharmaNo ratings yet

- Architectural InteriorsDocument1 pageArchitectural InteriorsGhie DomingoNo ratings yet

- NPK Notes Roshan Desai Sir 5 Financial ManagementDocument43 pagesNPK Notes Roshan Desai Sir 5 Financial ManagementSatwik RaiNo ratings yet

- Mesr 2003Document14 pagesMesr 2003SureshkumaryadavNo ratings yet

- LEGAL TECHNIQUE AND LOGIC ReviewerDocument11 pagesLEGAL TECHNIQUE AND LOGIC ReviewerJude JacildoNo ratings yet

- Rotary Club of Biak-Na-Bato Induction Souvenir Program 2013-2014Document10 pagesRotary Club of Biak-Na-Bato Induction Souvenir Program 2013-2014Jose Jhoolz PlazaNo ratings yet

- Cat CampingDocument3 pagesCat Campingmaesue1996No ratings yet

- Open Membership Form - 1.0Document1 pageOpen Membership Form - 1.0vijayindia87100% (8)

- Affi. of Small Claims Edgar DizonDocument2 pagesAffi. of Small Claims Edgar DizonAnn SC100% (1)

- SOP NBU-Install Backup Restore v1 0Document32 pagesSOP NBU-Install Backup Restore v1 0Suraya Hani100% (13)

- DAO 2011-14 Sinocalan-Dagupan River System WQMADocument6 pagesDAO 2011-14 Sinocalan-Dagupan River System WQMAEton CaguiteNo ratings yet

- SB 12-163 - Reduction of Controlled Substances Possession Penalties-2Document2 pagesSB 12-163 - Reduction of Controlled Substances Possession Penalties-2Senator Mike JohnstonNo ratings yet

- 1-9 Sources of Obligations CasesDocument100 pages1-9 Sources of Obligations CasesVhinj CostillasNo ratings yet

- Topo TOPOGRAPHIC SURVEY.25201217 PDFDocument8 pagesTopo TOPOGRAPHIC SURVEY.25201217 PDFfreddy ramdinNo ratings yet

- Descriptive Questions With Answers: 1. To Which Proceedings Is The Indian Evidence Act Applicable?Document47 pagesDescriptive Questions With Answers: 1. To Which Proceedings Is The Indian Evidence Act Applicable?Alisha VaswaniNo ratings yet

- 0275970345Document164 pages0275970345Ana NovovicNo ratings yet

- Natural Resources SyllabusDocument7 pagesNatural Resources SyllabusPaulineNo ratings yet

- Recto LawDocument6 pagesRecto LawJenniferPizarrasCadiz-CarullaNo ratings yet

- ImportsDocument55 pagesImportsDeepthi RavichandhranNo ratings yet

- FR Phase 2 - TestDocument5 pagesFR Phase 2 - TestMayank GoyalNo ratings yet

- Orms of Usiness Rganisation: HapterDocument31 pagesOrms of Usiness Rganisation: HapterPrabakaran V.No ratings yet

- D.C Wadhwa Vs UOIDocument2 pagesD.C Wadhwa Vs UOIJennifer Xavier0% (1)

- Narra Nickel v. RedmontDocument3 pagesNarra Nickel v. RedmontMina AragonNo ratings yet

- Joints For Drain and Sewer Plastic Pipes Using Flexible Elastomeric SealsDocument3 pagesJoints For Drain and Sewer Plastic Pipes Using Flexible Elastomeric Sealsastewayb_964354182No ratings yet