Professional Documents

Culture Documents

ROE

Uploaded by

shaeel ashrafCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ROE

Uploaded by

shaeel ashrafCopyright:

Available Formats

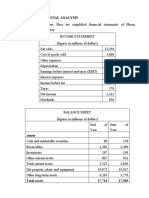

1. ROE = Net income/Total equity = 12,592,623/108,037,036 = 11.

66%

2. ROA = Net income/Total assets = 12,592,623/821,968,015 = 1.53%

3. Equity multiplier = Total assets/Total equity = 821,968,015/108,037,036 = 7.61

4. Net interest margin = (Interest income – Interest expense) / Average assets = (24,368,947-

11,594,145) / [(743,886,387+821,968,015)/2] = 12,774,802/782,927,201 = 1.63%

5. Earnings base = Earnings assets / Total assets = (Investments at fair value + Due from banks +

Reverse repo + Derivative instruments + Loans and advances + Non-trading investments +

Investment properties) / Total assets =

(20,099,181+17,026,502+24,678,375+15,917,321+407,903,028+114,644,422+7,956,854)/

821,968,015 = 74.00%

6. Burden: (Non-interest expense – non-interest income) / Average assets = [(Fee and commission

expense + Operating expense) – (Fee and commission income + Foreign exchange income + net

gain on investments and derivatives + Oher operating income)] / Average assets =

[(1,561,259+5,498,991) – (4,730,688+2,600,978+1,506,277+197,571)] / 782,927,201 = -0.25%

7. Efficiency ratio = non-interest expense/ (net interest income+ non-interest income) =

(1,561,259+5,498,991)/ [ (24,368,947-11,594,145) + (4,730,688+2,600,978+1,506,277+197,571)]

= 32.37%

8. Total revenue = Interest income + Fee and commission income + Net foreign exchange gain +

Net gain on investments and derivatives + Other operating income = 24,368,947 +

4,730,688+2,600,978+1,506,277+197,571 = 33,404,461

9. Asset utilization ratio = Total revenue / Average total assets = 33,404,461/782,927,201 = 4.27%

10. Expense ratio = Total operating expenses / Average total assets = 5,498,991/782,927,201 =

0.70%

11. Interest expense ratio = Interest expense / Average total assets = 11,594,145/782,927,201 =

1.48%

12. Non-interest expense ratio = non-interest expense / Average total assets =

(1,561,259+5,498,991)/782,927,201 = 0.90%

13. PLL ratio = Provision for loan and lease losses/Average total assets = 1,842,980/782,927,201 =

0.24%

You might also like

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- NBP Ratio Analysis 100% Sure Solved by Maha Shah Try To Understand First Then Solve.Document14 pagesNBP Ratio Analysis 100% Sure Solved by Maha Shah Try To Understand First Then Solve.Wajahat MuneerNo ratings yet

- FSDocument8 pagesFSafroza lataNo ratings yet

- Problem2 Financial ManagementDocument4 pagesProblem2 Financial ManagementCamille MenesesNo ratings yet

- 8.accounting Case Study G8 98Document23 pages8.accounting Case Study G8 98Hà GiangNo ratings yet

- Finance: Change in Inventories + Employee Benefit ExpensesDocument8 pagesFinance: Change in Inventories + Employee Benefit ExpensesParav BansalNo ratings yet

- Corporate Finance Chapter 4Document15 pagesCorporate Finance Chapter 4Razan EidNo ratings yet

- Analisis Rasio Dan Aktivitas Laporan Keuangan Pada PT. Unilever Indonesia TBK Tahun 2018Document17 pagesAnalisis Rasio Dan Aktivitas Laporan Keuangan Pada PT. Unilever Indonesia TBK Tahun 2018rahmat SetiawanNo ratings yet

- Finance Ratios GuideDocument8 pagesFinance Ratios GuideParav BansalNo ratings yet

- Tugas (6) - ALK L23 - Rasio PerbankanDocument5 pagesTugas (6) - ALK L23 - Rasio PerbankanEnzo 27No ratings yet

- Financial Ratios - Formula SheetDocument4 pagesFinancial Ratios - Formula SheetAira Dela CruzNo ratings yet

- Important financial ratios for banksDocument14 pagesImportant financial ratios for banksMd Alim100% (3)

- WACCDocument3 pagesWACCsalsabilawidyaNo ratings yet

- Amity University, Uttar PradeshDocument10 pagesAmity University, Uttar Pradeshdiksha1912No ratings yet

- Answer 5 - " Modern Appliances Corporation"Document4 pagesAnswer 5 - " Modern Appliances Corporation"Rheu ReyesNo ratings yet

- Topic 10-12 Alk (Hitungannya)Document6 pagesTopic 10-12 Alk (Hitungannya)Daffa Permana PutraNo ratings yet

- CH 04Document50 pagesCH 04Akbar LodhiNo ratings yet

- Industry OverviewDocument7 pagesIndustry OverviewBathula JayadeekshaNo ratings yet

- Financial Analysis Ratios Guide (FIN 1101Document21 pagesFinancial Analysis Ratios Guide (FIN 1101YASH BATRANo ratings yet

- Accounting Presentation (Beximco Pharma)Document18 pagesAccounting Presentation (Beximco Pharma)asifonikNo ratings yet

- Genting Plantations BerhadDocument11 pagesGenting Plantations Berhadboyuan XDNo ratings yet

- Company Ratios.Document3 pagesCompany Ratios.Joshua Marissah NaftaliNo ratings yet

- Pro Forma Financial Statements 2014 2015 2016 Income StatementDocument4 pagesPro Forma Financial Statements 2014 2015 2016 Income Statementpriyanka khobragadeNo ratings yet

- 2011 of Cimb BankDocument9 pages2011 of Cimb BankjagethiswariNo ratings yet

- JP Morgan Chase Strategic AnalysisDocument30 pagesJP Morgan Chase Strategic AnalysisSriSaraswathyNo ratings yet

- Cash Flow AssignmentDocument3 pagesCash Flow AssignmentAnonymous VrRc5PFbNo ratings yet

- Amerbran Company (B) SolutionDocument10 pagesAmerbran Company (B) SolutionHeruCakraNo ratings yet

- Mrs. Bella LlegoDocument182 pagesMrs. Bella Llegototo titiNo ratings yet

- SBL PBA4807 Assignment 1Document11 pagesSBL PBA4807 Assignment 1Charmaine Tshamaano MasuvheNo ratings yet

- DU Pont AnalysisDocument9 pagesDU Pont Analysisshani2010No ratings yet

- Business Valuation Cia 1 Component 1Document7 pagesBusiness Valuation Cia 1 Component 1Tanushree LamareNo ratings yet

- Strategic Valuation IssuesDocument29 pagesStrategic Valuation IssuesMohd Faiz67% (3)

- Lecture Common Size and Comparative AnalysisDocument28 pagesLecture Common Size and Comparative AnalysissumitsgagreelNo ratings yet

- Short Term Solvency, or Liquidity, Ratios: COGS / Inventory 14.117.080.050.134 / 3.719.405.670.574 3.8 4.8Document4 pagesShort Term Solvency, or Liquidity, Ratios: COGS / Inventory 14.117.080.050.134 / 3.719.405.670.574 3.8 4.8Michael AldrianusNo ratings yet

- Concept Questions: Chapter Seven Viewing The Business Through The Financial StatementsDocument10 pagesConcept Questions: Chapter Seven Viewing The Business Through The Financial StatementsSaguna DatarNo ratings yet

- Budgeting, Capital Structure, and Working Capital ManagementDocument11 pagesBudgeting, Capital Structure, and Working Capital Managementritu paudelNo ratings yet

- Exercises For Chapter 23 EFA2Document16 pagesExercises For Chapter 23 EFA2Thu LoanNo ratings yet

- Analysis of Reports and Financial Statements For The Year 2014 of Cimb Bank BerhadDocument9 pagesAnalysis of Reports and Financial Statements For The Year 2014 of Cimb Bank BerhadjagethiswariNo ratings yet

- Kolej Universiti Tunku Abdul Rahman Faculty of Accountancy, Finance and Business SEMESTER 2020/2021 BBMF 3073 Risk Management Tutorial 4 (Week 5)Document4 pagesKolej Universiti Tunku Abdul Rahman Faculty of Accountancy, Finance and Business SEMESTER 2020/2021 BBMF 3073 Risk Management Tutorial 4 (Week 5)Wong Ji ChingNo ratings yet

- Summit Bank Annual Report 2012Document200 pagesSummit Bank Annual Report 2012AAqsam0% (1)

- Praktikum FinancialDocument22 pagesPraktikum Financiallisa amaliaNo ratings yet

- Cara Menghitung Eva: Summary of Financial Statement 31 December 2006 (Million Rupiah)Document4 pagesCara Menghitung Eva: Summary of Financial Statement 31 December 2006 (Million Rupiah)Kusma WennyNo ratings yet

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisNyll GasconNo ratings yet

- Ratio Formula Computation Result InterpretationDocument2 pagesRatio Formula Computation Result InterpretationAleya MonteverdeNo ratings yet

- RP - CF1 - Financial Analysis and PlanningDocument22 pagesRP - CF1 - Financial Analysis and PlanningSamyu KNo ratings yet

- Analyzing Financing Decisions and Ratios for IDFC FIRST BANKDocument5 pagesAnalyzing Financing Decisions and Ratios for IDFC FIRST BANKMr. Pravar Mathur Student, Jaipuria LucknowNo ratings yet

- F.rep FormulasDocument3 pagesF.rep Formulaswaseemabbas965No ratings yet

- Tata Steel's Balance Sheet and Financial Ratios AnalysisDocument12 pagesTata Steel's Balance Sheet and Financial Ratios AnalysisDhwani ShahNo ratings yet

- Clase 1 Casos en Finanzas UDDDocument35 pagesClase 1 Casos en Finanzas UDDJuan Gallegos M.No ratings yet

- B. LiabilitiesDocument1 pageB. LiabilitiesSamuel OnyumaNo ratings yet

- Petroleum BSA 06 10Document44 pagesPetroleum BSA 06 10Haji Suleman AliNo ratings yet

- ENCANA COST OF CAPITAL CASEDocument3 pagesENCANA COST OF CAPITAL CASESamratNo ratings yet

- Airtel Ratio AnalysisDocument8 pagesAirtel Ratio AnalysishjiyoNo ratings yet

- Answers: Operating Income Changes in Net Operating AssetsDocument6 pagesAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNo ratings yet

- Ratio Analysis of URC-FS & ISDocument2 pagesRatio Analysis of URC-FS & ISMalou De MesaNo ratings yet

- Chapter 10: Analyzing Performance and ROICDocument11 pagesChapter 10: Analyzing Performance and ROICSandra NavarreteNo ratings yet

- Corporate Finance Assessment QuestionsDocument10 pagesCorporate Finance Assessment QuestionsJaydeep KushwahaNo ratings yet

- POS Malaysia Bhd revenue, costs, profits 2010-2009Document4 pagesPOS Malaysia Bhd revenue, costs, profits 2010-2009Najwa Vtec NajidNo ratings yet

- Q221Document2 pagesQ221shaeel ashrafNo ratings yet

- ROEDocument2 pagesROEshaeel ashrafNo ratings yet

- McDonald's Exam GuidelinesDocument3 pagesMcDonald's Exam Guidelinesshaeel ashrafNo ratings yet

- Revision Test Part 1Document4 pagesRevision Test Part 1shaeel ashrafNo ratings yet