Professional Documents

Culture Documents

Tugas (6) - ALK L23 - Rasio Perbankan

Uploaded by

Enzo 27Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tugas (6) - ALK L23 - Rasio Perbankan

Uploaded by

Enzo 27Copyright:

Available Formats

Tugas ALK L23 - Rasio Keuangan Perbankan

Dimas Hikmah Wicaksana - 2031011057

STIA LAN - ABSP

I. Rasio Likuiditas Bank

1. Quick Ratio

Cash assets Kas, giro pada BI, giro pada bank lain, aktiva likuid dalam valuta asing

Total deposit Giro, tabungan, deposito berjangka.

- Quick Ratio = Cash asset / total deposit x 100%

= (136,800 + 961,200 + 330,000 + 990,000) / (2,506,500 + 450,750 + 1,021,500)

= 2,418,000 / 3,978,000

= 0.607 x 100 = 60.7% dibulatkan ke atas menjadi 60.8%

2. Investing policy ratio

Securities Efek-efek, deposito.

Total deposit Giro, tabungan, deposito berjangka.

- Investing policy ratio = Securities / total deposito x 100%

= (240,000 + 450,000) / (2,506,000 + 450,750 + 1,021,500)

= 690,000 / 3,978,000

= 0.173 x 100 = 17.3%

3. Banking ratio

Loans Pinjaman dalam rupiah dan valuta asing

Total deposit Giro, tabungan, deposito berjangka.

Banking ratio = Total loans / total deposit

= (3,750,000 + 1,620,000) / (2,506,000 + 450,750 + 1,021,500)

= 5,370,000 / 3,978,000

= 0.983 x 100 = 98.3%

4. Assets to lean ratio = Total loan / total aset x 100

= (3,750,000 + 1,620,000) / 10,020,000

= 5,370,000 / 10,020,000

= 0.535 x 100 = 53.5%

5. Cash ratio

Liquid assets Kas, giro pada BI, giro pada bank lain, aktiva likuid valas

Short term borrowing Giro, kewajiban yang harus dibayar dalam rupiah dan valas

- Cash ratio: Liquid assets / STR x 100

= (136,800 + 961,200 + 330,000 + 990,000) / (2,506,000 + 122,250 + 2,176,500)

= 2,418,000 + 4,804,000

= 0.503 x 100 = 50.3%

6. Loan to deposit ratio = Total loan / total deposit + equity

Equity Modal disetor, dana setoran modal, cadangan umum, cadangan lain,

sisa laba tahun lalu, sisa laba tahun berjalan

= (3,750,000 + 1,620,000) / 3,978,750 + (2,250 + 195,000 + 42,000 + 285,000) + 64,500 +

216,000)

= 5,370,000 / (3,978,750 + 804,750)

= 1.122 x 100 = 112.2%

II. Rasio Solvabilitas Bank

1. Primary Ratio = Equity capital / total assets x 100%

= (2,250 + 195,000 + 42,000 + 285,000) + 64,500 + 216,000) / 10,020,000

= 804,750 / 10,020,000

= 0.0803 x 100 = 8.03%

2. Risk assets ratio = Equity capital / Total assets - cash assets - securities

= 804,750 / (10,020,000 - 2,418,000 - 690,000)

= 804,750 / 6,912,000

= 0.116 x 100 = 11.6 % atau dibulatkan ke atas jadi 11.7%

3. Secondary risk ratio.

Low risk assets Benda tetap dan inventaris + rupa-rupa

Secondary risk asset Total aset - cash aset - securities - low risk assets

= Equity capital / secondary risk assets x 100

= 804,750 / 10,020,000 - 2,418,000 - 690,000 - (132,000 + 180,000)

= 804,750 / 10,020,000 - 2,418,000 - 690,000 - 312,000

= 804,750 / 6,600,000

= 0.121 x 100 = 12.1%

4. Capital adequacy ratio = equity capital / total loans + securities x 100

= 804,750 / (5,370,000 + 690,000)

= 0.132 x 100 = 13.2%

III. Rasio Rentabilitas Bank

1. Gross profit margin

Operating income Jumlah pendapatan bunga, pendapatan operasional lainnya

Operating expenses Beban bunga, beban operasional

GPM = Operating income - operating expense / operating income x 100

= (504,000 + 733,500) - (276,000 + 733,500) / (504,000 + 733,500)

= (1,237,000 - 1,009,500) / 1,237,000

= 227,500 / 1,237,000

= 0.183 x 100 = 18.3 %

2. Net profit margin

Net income Laba rugi sebelum pajak - taksiran pajak penghasilan

NPM = Net income / operating income x 100

= (302,400 - 86,400) / 1,237,000

= 216,000 / 1,237,000

= 0.174 x 100 = 17.4%

3. Return on equity capital = Net income / equity capital x 100

= 216,000 / 804,750

= 0.268 x 100 = 26.8%, dibulatkan ke atas menjadi 26.9%

4. Gross yield on total assets = operating income / total asset

= 1,237,500 / 10,020,000

= 0.123 x 100 = 12.3%

5. Net income total assets = net income / total assets

= 216,000 / 10,020,000

= 0.021 x 100 = 2.1%

You might also like

- FSDocument8 pagesFSafroza lataNo ratings yet

- ROEDocument2 pagesROEshaeel ashrafNo ratings yet

- Budgeting, Capital Structure, and Working Capital ManagementDocument11 pagesBudgeting, Capital Structure, and Working Capital Managementritu paudelNo ratings yet

- Financial Ratios Wal MartDocument4 pagesFinancial Ratios Wal MartValerie SantiagoNo ratings yet

- FM AssignmentDocument7 pagesFM Assignmentkartika tamara maharaniNo ratings yet

- Solution - Financial Leverage and Capital StructureDocument7 pagesSolution - Financial Leverage and Capital StructureEkjon DiptoNo ratings yet

- Faculty of Business & Accountancy (ACADEMIC YEAR: 1/20/34) : Pms3393 Strategic ManagementDocument30 pagesFaculty of Business & Accountancy (ACADEMIC YEAR: 1/20/34) : Pms3393 Strategic ManagementSriSaraswathyNo ratings yet

- Selected Solutions From Chapter 22: QuestionsDocument6 pagesSelected Solutions From Chapter 22: QuestionsmimitayelNo ratings yet

- Self Study Solutions Chapter 13Document11 pagesSelf Study Solutions Chapter 13ggjjyy0% (1)

- Calculate Interest ExpensesDocument13 pagesCalculate Interest ExpensesThái Minh Châu100% (1)

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Document3 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-4Pramod VasudevNo ratings yet

- ACC Group Assignment 1Document13 pagesACC Group Assignment 1aregahegn bisetNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-2Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-2Pramod VasudevNo ratings yet

- MobDocument4 pagesMobJun TdhNo ratings yet

- Tutorial Chapter 11 - SolutionDocument4 pagesTutorial Chapter 11 - SolutionMahina NozirovaNo ratings yet

- Jawaban GSLC Fin Mene - Sesi 7&8 - Calvin Glenn - 2301912454Document6 pagesJawaban GSLC Fin Mene - Sesi 7&8 - Calvin Glenn - 2301912454Apotik MajuNo ratings yet

- Kolej Universiti Tunku Abdul Rahman Faculty of Accountancy, Finance and Business SEMESTER 2020/2021 BBMF 3073 Risk Management Tutorial 4 (Week 5)Document4 pagesKolej Universiti Tunku Abdul Rahman Faculty of Accountancy, Finance and Business SEMESTER 2020/2021 BBMF 3073 Risk Management Tutorial 4 (Week 5)Wong Ji ChingNo ratings yet

- 5ffb Ims03Document32 pages5ffb Ims03Azadeh AkbariNo ratings yet

- Mohd Azmezanshah Bin SezwanDocument4 pagesMohd Azmezanshah Bin SezwanMohd Azmezanshah Bin SezwanNo ratings yet

- Corporate Finance - Sem 3Document4 pagesCorporate Finance - Sem 3payablesNo ratings yet

- Working Capital Manageme NT: Weekend Assignment: 3Document10 pagesWorking Capital Manageme NT: Weekend Assignment: 3Ankit KhandelwalNo ratings yet

- 8.accounting Case Study G8 98Document23 pages8.accounting Case Study G8 98Hà GiangNo ratings yet

- Your Company Sponsors A 401Document8 pagesYour Company Sponsors A 401JOHNNo ratings yet

- Dde 321 - Solutions Exercise 5Document3 pagesDde 321 - Solutions Exercise 5Foititika.netNo ratings yet

- Problem Set 2 Solution 2021Document8 pagesProblem Set 2 Solution 2021Pratyush GoelNo ratings yet

- Cost of CaptialDocument16 pagesCost of Captialbhushandhu12No ratings yet

- CH 18 ADocument9 pagesCH 18 AAlex YaoNo ratings yet

- MBA 530 Corporate Finance HomeworkDocument6 pagesMBA 530 Corporate Finance HomeworkHarris LuiNo ratings yet

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsDocument9 pagesCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaNo ratings yet

- AFS Solution 2Document31 pagesAFS Solution 2Danish SajjadNo ratings yet

- Working NoteDocument1 pageWorking NoteDamilare ElijahNo ratings yet

- Chapter 12 (Updated Oct 5)Document29 pagesChapter 12 (Updated Oct 5)Zoe LamNo ratings yet

- NBP Ratio Analysis 100% Sure Solved by Maha Shah Try To Understand First Then Solve.Document14 pagesNBP Ratio Analysis 100% Sure Solved by Maha Shah Try To Understand First Then Solve.Wajahat MuneerNo ratings yet

- Ratio Analysis and Example PDFDocument9 pagesRatio Analysis and Example PDFthexplorer008No ratings yet

- Ratios Solved ProblemsDocument8 pagesRatios Solved ProblemsYasser Maamoun50% (2)

- Average Daily FloatDocument4 pagesAverage Daily FloatAn DoNo ratings yet

- Extra Note-Bank (Eco211)Document6 pagesExtra Note-Bank (Eco211)Amsyar AmsNo ratings yet

- Ratio Analysis Problems and SolutionsDocument11 pagesRatio Analysis Problems and SolutionsAira Nhaire Cortez MecateNo ratings yet

- Week 2 Treasury Management by LCLEJARDEDocument34 pagesWeek 2 Treasury Management by LCLEJARDEErica CadagoNo ratings yet

- BONEO Pup Receivables3 SRC 2 1Document13 pagesBONEO Pup Receivables3 SRC 2 1hellokittysaranghaeNo ratings yet

- Answer To 1aDocument28 pagesAnswer To 1asharib zaidiNo ratings yet

- Ebook2024 1051Document51 pagesEbook2024 1051margaret.martz245No ratings yet

- Name: Vu Hanh Trang Student ID: 1605136 Class: FIN3331 - IVFA HW1Document2 pagesName: Vu Hanh Trang Student ID: 1605136 Class: FIN3331 - IVFA HW1Trang VUNo ratings yet

- CORPORATE FINANCE Final Exam June 2022Document11 pagesCORPORATE FINANCE Final Exam June 2022Fungai MajuriraNo ratings yet

- Managerial Finance For Ratio AnalysisDocument7 pagesManagerial Finance For Ratio AnalysisShahzadraeesNo ratings yet

- NHTM - BTDocument16 pagesNHTM - BTNguyễn Hải Thanh100% (1)

- XII-ACCOUNT L DeshettyDocument5 pagesXII-ACCOUNT L DeshettyL DeshettyNo ratings yet

- Ch14 Required QuestionsDocument31 pagesCh14 Required QuestionsMaha M. Al-MasriNo ratings yet

- Unit-5 Mefa.Document12 pagesUnit-5 Mefa.Perumalla AkhilNo ratings yet

- Fin Man Case Problems Financial Ratio AnalysisDocument5 pagesFin Man Case Problems Financial Ratio AnalysisCoreen Andrade50% (2)

- FM12 CH 14 Solutions ManualDocument21 pagesFM12 CH 14 Solutions ManualRizwanasaleemNo ratings yet

- Faculty of Higher Education: Assignment Cover SheetDocument11 pagesFaculty of Higher Education: Assignment Cover SheetSyed Ali Hussain BokhariNo ratings yet

- College Accounting A Contemporary Approach 3rd Edition Haddock Solutions ManualDocument36 pagesCollege Accounting A Contemporary Approach 3rd Edition Haddock Solutions Manualsynomocyeducable6pyb8k100% (24)

- Assignment Week 2 - Maya Wulansari - 09111840000040Document4 pagesAssignment Week 2 - Maya Wulansari - 09111840000040mayasari50% (2)

- Financial RatiosDocument2 pagesFinancial RatiosAlexa Isobel TicarNo ratings yet

- Self-Constructed Assets TutorialDocument3 pagesSelf-Constructed Assets TutorialSalma Hazem100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Construction Material Haulage CapacityDocument2 pagesConstruction Material Haulage CapacityMahesh ShindeNo ratings yet

- Jakki Mohr, Sanjit Sengupta, Stanley Slater Marketing of High-Technology Products and InnovationsDocument569 pagesJakki Mohr, Sanjit Sengupta, Stanley Slater Marketing of High-Technology Products and InnovationsArshed Rosales100% (3)

- Intitulé Du Module: Business English Durée de La Formation: 30 Hours Déroulé J1Document5 pagesIntitulé Du Module: Business English Durée de La Formation: 30 Hours Déroulé J1benzidaNo ratings yet

- Chari Boru Bariso's Econ GuidsesDocument19 pagesChari Boru Bariso's Econ GuidsesSabboona Gujii GirjaaNo ratings yet

- 2.3 Planeacion de Requirimientos de RecursosDocument22 pages2.3 Planeacion de Requirimientos de RecursosYenifer PerezNo ratings yet

- Name: Student ID: 19P00024 Subject: Date: Submitted To: Ume LailaDocument6 pagesName: Student ID: 19P00024 Subject: Date: Submitted To: Ume LailaUmme Laila JatoiNo ratings yet

- Module 1Document113 pagesModule 1Anirudh SNo ratings yet

- Orgman LT# 1&2 Week 6Document2 pagesOrgman LT# 1&2 Week 6RanielJohn GutierrezNo ratings yet

- StarbucksDocument3 pagesStarbucksMonika SharmaNo ratings yet

- Infosys-A Case Study Decision SheetDocument3 pagesInfosys-A Case Study Decision SheetRAW STARNo ratings yet

- Dayrit V CA DigestDocument3 pagesDayrit V CA DigestReplyNo ratings yet

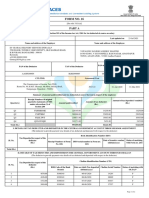

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinuthna ChinnapaNo ratings yet

- Lone Pine CafeDocument4 pagesLone Pine CafeRahul TiwariNo ratings yet

- DSD Fee Study 12.04.202Document27 pagesDSD Fee Study 12.04.202April ToweryNo ratings yet

- Auto Loan ApplicationDocument2 pagesAuto Loan ApplicationArcher InfanteNo ratings yet

- BKash ProfileDocument10 pagesBKash ProfileAshik Md Siam100% (1)

- Inland Fish Farming URDUDocument17 pagesInland Fish Farming URDUbaloch75100% (4)

- Minola Luxus 674Document2 pagesMinola Luxus 674emir.muderizovicNo ratings yet

- BAH Public Finance GE 4th Semester PDFDocument4 pagesBAH Public Finance GE 4th Semester PDFAkistaa100% (1)

- Supplier Code of ConductDocument6 pagesSupplier Code of ConductsureshNo ratings yet

- Performance Measurement in Decentralized Organizations-1Document84 pagesPerformance Measurement in Decentralized Organizations-1Ashar IsmailNo ratings yet

- Royal Enfield Project 36 Organisation StudyDocument45 pagesRoyal Enfield Project 36 Organisation StudyVijay AravindNo ratings yet

- Class Test-1: Manpreet Singh 2K19/DMBA/48 Ans 1)Document2 pagesClass Test-1: Manpreet Singh 2K19/DMBA/48 Ans 1)Roronoa ZoldyckNo ratings yet

- DTI Ratio SpreadsDocument7 pagesDTI Ratio SpreadsFranklin HallNo ratings yet

- BSBMKG 501 Identify and Evaluate Marketing OpportunitiesDocument17 pagesBSBMKG 501 Identify and Evaluate Marketing Opportunitiesbabluanand100% (1)

- Parate EksekusiDocument15 pagesParate EksekusiWanda WandaNo ratings yet

- Traditional Correspondence: Memos and LettersDocument9 pagesTraditional Correspondence: Memos and LettersHala Tawfik MakladNo ratings yet

- Digital Marketing Master FileDocument30 pagesDigital Marketing Master Filejinal patadiyaNo ratings yet

- Aris A. Syntetos, Service Parts Management - Demand Forecasting and Inventory Control-Springer-Verlag London (2011)Document327 pagesAris A. Syntetos, Service Parts Management - Demand Forecasting and Inventory Control-Springer-Verlag London (2011)Agung SudrajatNo ratings yet

- Budgeting: Accounting: A Malaysian Perspective, 5e (Adapted From Accounting 26e: Warren, Reeve & Duchac)Document58 pagesBudgeting: Accounting: A Malaysian Perspective, 5e (Adapted From Accounting 26e: Warren, Reeve & Duchac)Asyikin OsmanNo ratings yet