Professional Documents

Culture Documents

07 Quiz 1-StrategicCost

Uploaded by

Alliah PesebreCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

07 Quiz 1-StrategicCost

Uploaded by

Alliah PesebreCopyright:

Available Formats

Sheena Marie C.

Lopez

BSAIS 3A

June Company’s actual data for 201A are given as follows:

Units produced 25,000

Units sold 24,000

Selling price per unit P200

Direct material costs 30

Direct labor 20

Variable manufacturing overhead 60

Variable selling costs 20

Fixed manufacturing costs P600,000

Fixed administrative costs 300,000

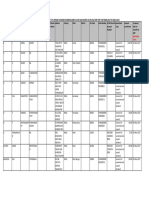

Prepare an income statement under (1) absorption costing, (2) variable costing, and (3) throughput

costing.

June Company

Income Statement (Absorption Costing)

December 31, 201A

Sales (24,000 x P200) P4,800,000

Less: Cost of Goods Sold (24,000 x P134) 2,016,000

Gross Profit 1,584,000

Less: Selling and Administrative Expenses

Variable Selling (24,000 x P20) 480,000

Fixed Administrative 300,000 780,000

Net Income P804,000

*The cost of goods sold by P134 per unit is computed as the sum of variable and fixed

manufacturing costs per unit and direct material cost and labor {P30+20+60+ (600,000/25,000)

June Company

Income Statement (Variable Costing)

December 31, 201A

Sales (24,000 x P200) P4,800,000

Less: Variable Cost

Cost of Goods Sold (24,000 x P110) 2,640,000

Selling Costs (24,000 x 20) 480,000 3,120,000

Contribution Margin 1,680,000

Less: Fixed Costs

Manufacturing Costs 600,000

Administrative Costs 300,000 900,000

Net Income P780,000

June Company

Income Statement (Throughput Costing)

December 31, 201A

Sales (24,000 x 200) P4,800,000

Less: Direct Materials (24,000 x 30) 720,000

Throughput Margin 4,080,000

Less:

Variable Manufacturing Costs (25,000 x 30) 750,000

Variable Selling Expenses (24,000 x 20) 480,000

Fixed Manufacturing Costs 600,000

Fixed Administrative Expenses 300,000 2,130,000

Net Income P1,950,000

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Fixed Asset Register SampleDocument55 pagesFixed Asset Register SampleClarisse30No ratings yet

- Melissa Printing ShopDocument3 pagesMelissa Printing Shopjoint accountNo ratings yet

- Unclaimed Dividend Data As On 23.9.2016Document1,775 pagesUnclaimed Dividend Data As On 23.9.2016Swapnilsagar VithalaniNo ratings yet

- Discipline 3 Learing Activity and 3 LONG QUIZ BY WallflowerDocument38 pagesDiscipline 3 Learing Activity and 3 LONG QUIZ BY WallflowerAlmirah33% (6)

- BL-NSCI-121-LEC-1922S PHYSICAL Science /for Antips: Question TextDocument236 pagesBL-NSCI-121-LEC-1922S PHYSICAL Science /for Antips: Question TextAlliah PesebreNo ratings yet

- Narrative ReportDocument4 pagesNarrative ReportAlliah PesebreNo ratings yet

- OAM-122-20172S: Week 20: Quarterly ExamDocument26 pagesOAM-122-20172S: Week 20: Quarterly ExamAlliah PesebreNo ratings yet

- Statement of Changes in Equity (Final)Document27 pagesStatement of Changes in Equity (Final)Alliah PesebreNo ratings yet

- Work Immersion NirelDocument35 pagesWork Immersion NirelAlliah PesebreNo ratings yet

- Pedh 11 20Document47 pagesPedh 11 20Alliah PesebreNo ratings yet

- Econ Week 20Document36 pagesEcon Week 20Alliah PesebreNo ratings yet

- Question Text: FeedbackDocument21 pagesQuestion Text: FeedbackAlliah PesebreNo ratings yet

- Trends Week 20 Second Quarter Exam by Kuya Ivan 1Document7 pagesTrends Week 20 Second Quarter Exam by Kuya Ivan 1Alliah PesebreNo ratings yet

- Physical EducationDocument3 pagesPhysical EducationAlliah PesebreNo ratings yet

- Week 1 Worksheet: MY STI IDENTITY: A. The Jungle of PersonalitiesDocument3 pagesWeek 1 Worksheet: MY STI IDENTITY: A. The Jungle of PersonalitiesAlliah PesebreNo ratings yet

- Ils in Basic Food 102Document37 pagesIls in Basic Food 102Alliah PesebreNo ratings yet

- Religion Humss 111 Quizzes W11 20Document23 pagesReligion Humss 111 Quizzes W11 20Alliah Pesebre100% (1)

- UTS Pengantar Akutansi 2Document3 pagesUTS Pengantar Akutansi 2Pia panNo ratings yet

- Con ConDocument4 pagesCon ConcpacpacpaNo ratings yet

- Ratio AnalysisDocument22 pagesRatio AnalysismAnisH MNo ratings yet

- Capital Budgeting - FinmarDocument3 pagesCapital Budgeting - FinmarnerieroseNo ratings yet

- Chapter 13 Equity ValuationDocument28 pagesChapter 13 Equity ValuationSakthi PriyadharshiniNo ratings yet

- Fundamental Accounting Principles 22nd Edition Wild Solutions ManualDocument35 pagesFundamental Accounting Principles 22nd Edition Wild Solutions Manualloanmaiyu28p7100% (20)

- Chapter One Overview of Financial Management: 1.1. Finance As An Area of StrudyDocument33 pagesChapter One Overview of Financial Management: 1.1. Finance As An Area of Strudysamuel kebedeNo ratings yet

- John A., CPA Tracy, Tage Tracy - How To Manage Profit and Cash Flow - Mining The Numbers For Gold (2004) PDFDocument242 pagesJohn A., CPA Tracy, Tage Tracy - How To Manage Profit and Cash Flow - Mining The Numbers For Gold (2004) PDFPatman MutomboNo ratings yet

- Financial Reporting Course (Scrib)Document173 pagesFinancial Reporting Course (Scrib)Nguyen Dac ThichNo ratings yet

- PGDA July 2019 Final Exam Question 2 Scenario and RequiredDocument8 pagesPGDA July 2019 Final Exam Question 2 Scenario and RequiredValerie Verity MarondedzeNo ratings yet

- Mutual Funds Correction PDFDocument48 pagesMutual Funds Correction PDFPrethesh JainNo ratings yet

- Acctg-Prelim ExamDocument5 pagesAcctg-Prelim Examrodelyn waclinNo ratings yet

- Connect2India Advanced Company ReportDocument20 pagesConnect2India Advanced Company ReportBabar Khan100% (1)

- Cost Classification and Terminologies Harambe University CollegeDocument12 pagesCost Classification and Terminologies Harambe University Collegeአረጋዊ ሐይለማርያምNo ratings yet

- CH 02Document42 pagesCH 02Joby JoseNo ratings yet

- Identify The IndustryDocument5 pagesIdentify The IndustryLucas Dadone25% (4)

- Acc117 Chapter 8Document27 pagesAcc117 Chapter 8Fadilah JefriNo ratings yet

- ADJUSTING ENTRIES PPT TacsanDocument31 pagesADJUSTING ENTRIES PPT TacsanDanicaNo ratings yet

- 1 Seminar Business PlanDocument35 pages1 Seminar Business PlanAashishAcharyaNo ratings yet

- NG-HNDQS-10-27 AccDocument17 pagesNG-HNDQS-10-27 Accmophamed ashfaqueNo ratings yet

- Accounting Equation Format - Superior ClampsDocument5 pagesAccounting Equation Format - Superior ClampsdeadNo ratings yet

- Manajemen Keuangan Silabus Genap 2013-2014 - Ing - PDFDocument6 pagesManajemen Keuangan Silabus Genap 2013-2014 - Ing - PDFDilla Andyana SariNo ratings yet

- 34703bos24444 Finalp5 cp2 PDFDocument108 pages34703bos24444 Finalp5 cp2 PDFMilan OndhiyaNo ratings yet

- ARKAN 13 06 x2011Document5 pagesARKAN 13 06 x2011Muhammad IlyasNo ratings yet

- 03 Financial Statement AnalysisDocument46 pages03 Financial Statement Analysissimao.lipscombNo ratings yet

- Wac12 2019 May A2 MS PDFDocument34 pagesWac12 2019 May A2 MS PDFAbu Daiyan Bin Saleh ZidaneNo ratings yet

- Case1 SecC GroupJDocument7 pagesCase1 SecC GroupJNimish JoshiNo ratings yet