Professional Documents

Culture Documents

GCC

Uploaded by

omkar maharanaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GCC

Uploaded by

omkar maharanaCopyright:

Available Formats

PNB GENERAL CREDIT CARD (GCC) SCHEME

1. OBJECTIVE:

The objective of the scheme is to increase the flow of credit to individuals for

entrepreneurial activity in the non-farm sector provided through the General

Credit Card.

2. ELIGIBILITY:

All non-farm entrepreneurial credit extended to individuals which is eligible for

classification under the priority sector guidelines.

3. PURPOSE OF LIMIT:

To provide credit to individuals for entrepreneurial activity in the non-farm sector.

4. EXTENT OF LIMIT:

The need based limit be fixed with a maximum of Rs. 10.00 Lakh, on case to case

basis, after analyzing credit needs and repaying capacity of the borrower.

5. NATURE OF FACILITY:

The credit facility extended under the Scheme will be in the nature of revolving credit

through cash credit account.

- WC

- WCTL, in case it includes Term loan component also.

- WCTL is to be given on reducing DP basis.

6. AREA OF OPERATION:

The Scheme is to be implemented by all branches across the country.

7. SECURITY:

a) Primary Security: Personal security of the borrower / asset

created by the bank finance.

b) Collateral Security: NIL, to be covered under CGTMSE for eligible activities.

8. RATE OF INTEREST:

As per Bank guidelines.

9. REPAYMENT:

GCC limit shall be repayable in 12 months with the following stipulations;

(a) Aggregate credits into the account during 12 months period should at least be

equal to the maximum outstanding in the account.

(b) No drawal in the account should remain outstanding for more than 12 months.

Page | 1

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Building /site Permission /approval From Municipality/Nagar PanchayatDocument2 pagesBuilding /site Permission /approval From Municipality/Nagar Panchayatomkar maharanaNo ratings yet

- Egg Storage and Supply: Trupti EnterprisesDocument33 pagesEgg Storage and Supply: Trupti Enterprisesomkar maharana100% (1)

- The Odisha Gazette: Extraordinary Published by AuthorityDocument174 pagesThe Odisha Gazette: Extraordinary Published by Authorityomkar maharanaNo ratings yet

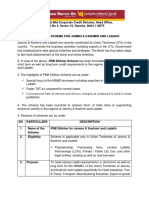

- PNB Shikhar SchemeDocument3 pagesPNB Shikhar Schemeomkar maharanaNo ratings yet

- Msme& Mid Corporate Credit Division, Head Office Plot No.4, Sector-10, Dwarka, New Delhi-110075Document2 pagesMsme& Mid Corporate Credit Division, Head Office Plot No.4, Sector-10, Dwarka, New Delhi-110075omkar maharanaNo ratings yet

- TRANSPORTDocument2 pagesTRANSPORTomkar maharanaNo ratings yet

- HO MSME Scheme For Financing MSME MFG Unit PNB NIRMATADocument3 pagesHO MSME Scheme For Financing MSME MFG Unit PNB NIRMATAomkar maharanaNo ratings yet

- Category Margin Micro & Small Enterprises (As Per MSME Defined Ceiling) 10% Medium Enterprises (As Per MSME Defined Ceiling) 15% Others 25%Document3 pagesCategory Margin Micro & Small Enterprises (As Per MSME Defined Ceiling) 10% Medium Enterprises (As Per MSME Defined Ceiling) 15% Others 25%omkar maharanaNo ratings yet

- AIFDocument2 pagesAIFomkar maharanaNo ratings yet

- Msme Prime Plus: SN Parameters ParticularsDocument2 pagesMsme Prime Plus: SN Parameters Particularsomkar maharanaNo ratings yet

- PROFESSIONALDocument2 pagesPROFESSIONALomkar maharanaNo ratings yet

- Co - Lending by BanksDocument3 pagesCo - Lending by Banksomkar maharanaNo ratings yet

- Overdraft: Need BasedDocument2 pagesOverdraft: Need Basedomkar maharanaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)