Professional Documents

Culture Documents

TRANSPORT

Uploaded by

omkar maharana0 ratings0% found this document useful (0 votes)

10 views2 pagesThe PNB Transport Scheme provides term loans and overdraft facilities to individuals and companies to purchase commercial vehicles like autos, taxis, e-rickshaws, and cargo vehicles. Eligible vehicles can be new or up to 2 years old. Loan amounts are up to Rs. 5 crore for term loans and Rs. 10 lakh for overdrafts. Margin requirements vary from 10-25% depending on vehicle age. Loans have maximum tenures of 36-60 months. Primary security is hypothecation of the vehicle and collateral may be required above Rs. 10 lakh loans.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe PNB Transport Scheme provides term loans and overdraft facilities to individuals and companies to purchase commercial vehicles like autos, taxis, e-rickshaws, and cargo vehicles. Eligible vehicles can be new or up to 2 years old. Loan amounts are up to Rs. 5 crore for term loans and Rs. 10 lakh for overdrafts. Margin requirements vary from 10-25% depending on vehicle age. Loans have maximum tenures of 36-60 months. Primary security is hypothecation of the vehicle and collateral may be required above Rs. 10 lakh loans.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesTRANSPORT

Uploaded by

omkar maharanaThe PNB Transport Scheme provides term loans and overdraft facilities to individuals and companies to purchase commercial vehicles like autos, taxis, e-rickshaws, and cargo vehicles. Eligible vehicles can be new or up to 2 years old. Loan amounts are up to Rs. 5 crore for term loans and Rs. 10 lakh for overdrafts. Margin requirements vary from 10-25% depending on vehicle age. Loans have maximum tenures of 36-60 months. Primary security is hypothecation of the vehicle and collateral may be required above Rs. 10 lakh loans.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

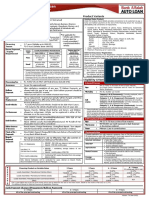

PNB TRANSPORT SCHEME

PARAMETERS PARTICULARS

Purpose/ To purchase Autos, Taxies, E-rickshaws, Commercial Vehicles

Objective (LCV/MCV/HCV), Cargo Vehicles etc. operating on any kind of energy

which are permitted by State/ Local authorities etc.

Eligibility Individual, Partnership, Sole Proprietorship, Private Ltd. / Public Ltd.

companies/LLPs/ Registered Transport Operators.

Area of All Branches are eligible

Operation

Type of facility i. Term Loan: To purchase commercial vehicles

ii. OD limit: For meeting of day to day expenses

Loan Amount For Term Loan: Max. upto Rs. 5.00 Crore

For financing Used/ Second Hand Vehicles minimum purchase

price of the vehicle should be Rs. 5.00 lac

OD Limit: Rs. 50000/- per vehicle financed by our Bank subject

to maximum Rs.10.00 lac per borrower.

OD limit shall be allowed against the vehicles financed by our

Bank only, having on-road purchase price of Rs. 5.00 lac and

above.

Margin For New Vehicles:

erforma invoice of the Dealer.

-showroom Price,

insurance, Registration for fully built up vehicles.

OR

15% of the cost on purchase of chasis, cost of body building, road

tax & insurance expenses.

10% in case of loans upto Rs.2.00 lac

In case of E-Rickshaws total Term Loan including replacement

cost of batteries (Upto 2 batteries) shall be sanctioned in the

beginning by keeping minimum margin of 10%. The TL for

batteries will be disbursed through the same A/c after one & two

year subsequently. The EMI will be fixed in such a way the total

Term Loan is adjusted in 36 months.

For Used/ Second hand Vehicles:

25% for used/ second hand Light Commercial Vehicle /MCV/HCV

not older than 2 years. (Second hand E-rickshaws shall not be

financed)

Tenure of Loan Loans upto Rs. 2.00 lac: Up to 36 months

Loans above Rs. 2.00 lac: Upto 60 months for new vehicles.

In case of used/ second hand vehicle, maximum repayment period

shall be 60 months from the 1st registration date of the vehicle i.e.

(60 months minus age of the vehicle)

Moratorium Max. moratorium period upto 3 months in cases where body building is

required for the vehicle may be allowed.

Primary Hypothecation of Light Commercial Vehicle /MCV/HCV /Auto / Taxi/ E-

Security rickshaws . (The

hypothecation clause shall be registered with RTO)

Collateral Loan upto Rs.10.00 Lacs:

Security

No collateral security to be obtained. However, in such cases, the

facility shall invariably be covered under CGTMSE.

Loan amount above Rs. 10.00 Lacs:

50% collateral Security in the shape of immovable property/ eligible

liquid security from the borrower.

OR

Credit Guarantee Coverage under CGTMSE/CGSSI for the entire

exposure as per the extent guidelines.

Rate of

Interest

You might also like

- CAR LOAN-Consolidated Guidelines 45-2021Document77 pagesCAR LOAN-Consolidated Guidelines 45-2021Sanjay GondwalNo ratings yet

- Commercial Trucking Insurance for Veteran Truckers: How to Save Money, Time, and a Lot of HeadachesFrom EverandCommercial Trucking Insurance for Veteran Truckers: How to Save Money, Time, and a Lot of HeadachesNo ratings yet

- Chapter 6 - Strategy Analysis and ChoiceDocument28 pagesChapter 6 - Strategy Analysis and ChoiceSadaqat AliNo ratings yet

- Review Notes On Securities Regulation Code A. State Policy, PurposeDocument9 pagesReview Notes On Securities Regulation Code A. State Policy, PurposeReagan Sabate Peñaflor JD100% (1)

- Car Rent ContractDocument16 pagesCar Rent ContractrainNo ratings yet

- Car FinanceDocument32 pagesCar FinanceAshish V MeshramNo ratings yet

- Is Your Insurance Company Listening To You?Document10 pagesIs Your Insurance Company Listening To You?beingviswaNo ratings yet

- Car Policy: Salient FeaturesDocument3 pagesCar Policy: Salient FeaturesHafiz Yasir SaleemNo ratings yet

- Motor Insurance HandbookDocument10 pagesMotor Insurance HandbookdaramanishNo ratings yet

- There Are 3 Types of Car Loans Available in IndiaDocument11 pagesThere Are 3 Types of Car Loans Available in IndiaAshis Kumar MuduliNo ratings yet

- The Importance of Sustainability in BusinessDocument2 pagesThe Importance of Sustainability in BusinessHi CustomersNo ratings yet

- CRMA Reference ResourcesDocument1 pageCRMA Reference ResourcesJoe FrostNo ratings yet

- New ContractDocument3 pagesNew ContractRegina LotillaNo ratings yet

- Car Rental / Mini-Leasecontract ProposalDocument5 pagesCar Rental / Mini-Leasecontract ProposalMansoor AliNo ratings yet

- Chapter 3-5 To 3-13Document9 pagesChapter 3-5 To 3-13XENA LOPEZNo ratings yet

- Tugas 5 (Soal) Auditing IIDocument6 pagesTugas 5 (Soal) Auditing IIrahmat idrusNo ratings yet

- HR Competency Directory PDFDocument6 pagesHR Competency Directory PDFlaloo01100% (1)

- Self Drives ConditionsDocument11 pagesSelf Drives Conditionssri charithaNo ratings yet

- Canara Vehicle Loan - (603) - Four Wheeler: NF-546 NF-965 NF-928 NF-990 NF-967 NF-373Document8 pagesCanara Vehicle Loan - (603) - Four Wheeler: NF-546 NF-965 NF-928 NF-990 NF-967 NF-373Santosh KumarNo ratings yet

- Alfalah Auto Loan: Policy One PagerDocument1 pageAlfalah Auto Loan: Policy One PagerbilalasifNo ratings yet

- List of Motor Add-On Covers Proposed To Be Filed With IRDA ImportantDocument26 pagesList of Motor Add-On Covers Proposed To Be Filed With IRDA ImportantAnonymous LPN7RIBNo ratings yet

- Proposal For Renting A CarDocument2 pagesProposal For Renting A CarahazzeenaNo ratings yet

- 3045TW0057673Document2 pages3045TW0057673Amit KumarNo ratings yet

- Four Wheeler LoanDocument1 pageFour Wheeler LoanMANOJ KUMARNo ratings yet

- 1 Oriental Sme Development Scheme EligibilityDocument4 pages1 Oriental Sme Development Scheme EligibilitydocsanshmNo ratings yet

- PDFDocument49 pagesPDFSreedhar SrdNo ratings yet

- Arohan 2024 With 2023Document127 pagesArohan 2024 With 2023varthiNo ratings yet

- Boi Star Doctor PlusDocument8 pagesBoi Star Doctor PlusNirmal RajNo ratings yet

- Union Parivahan SchemeDocument1 pageUnion Parivahan SchemeBUDU GOLLARYNo ratings yet

- Finance Company To Finance Auto RickshawDocument14 pagesFinance Company To Finance Auto RickshawNetflix ChillNo ratings yet

- Individual Car Loan Agreement SampleDocument32 pagesIndividual Car Loan Agreement Sampleey019.aaNo ratings yet

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDocument1 pageInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingSNo ratings yet

- Policy No Policy OnDocument6 pagesPolicy No Policy OnSudhakar RNo ratings yet

- N Ramanaiah001Document3 pagesN Ramanaiah001AnandNo ratings yet

- 2016 Ford Everest - Christopher N. AriasDocument4 pages2016 Ford Everest - Christopher N. Ariasalmagpelino1322No ratings yet

- Auto Loan - Product - N - FeaturesDocument9 pagesAuto Loan - Product - N - FeaturesAyushi LalwaniNo ratings yet

- Loconav India PVT LTD: General InsuranceDocument10 pagesLoconav India PVT LTD: General InsuranceShivansh AgarwalNo ratings yet

- Banking OadsdDocument85 pagesBanking Oadsdkalis vijayNo ratings yet

- 85 - Motor Add - On Covers - 30th April 2010Document26 pages85 - Motor Add - On Covers - 30th April 2010JKNo ratings yet

- Agreement For Hire of EquipmentDocument3 pagesAgreement For Hire of EquipmentLOKOLONo ratings yet

- Satr AUTOFINDocument14 pagesSatr AUTOFINAmbrish TiwariNo ratings yet

- AVIS Taiwan Rental Notice 租Document5 pagesAVIS Taiwan Rental Notice 租Te-yu OuNo ratings yet

- Chapter 3Document13 pagesChapter 3Aayush KaulNo ratings yet

- Chapter-4 RETAIL LENDING SCHEMES PDFDocument64 pagesChapter-4 RETAIL LENDING SCHEMES PDFNanda KishoreNo ratings yet

- KT 1070169204Document4 pagesKT 1070169204shivu patilNo ratings yet

- Rural Loan PolicyDocument3 pagesRural Loan PolicyVivek AnandNo ratings yet

- ED Bank E FundingDocument8 pagesED Bank E FundingNAVYASHREE B 1NC21BA050No ratings yet

- Car LoanDocument16 pagesCar LoanRajkot academyNo ratings yet

- Term Report Group 3 Islamic Banking & FinanceDocument10 pagesTerm Report Group 3 Islamic Banking & FinanceYashra NaveedNo ratings yet

- Vehicle Rental AgreementDocument4 pagesVehicle Rental AgreementHaqim KimmNo ratings yet

- Credit Processing For CVDocument5 pagesCredit Processing For CVBhaskar GarimellaNo ratings yet

- Interest Rate PolicyDocument8 pagesInterest Rate Policyraghuraman1511No ratings yet

- SBI Car Loan - Jan 2012Document17 pagesSBI Car Loan - Jan 2012mevrick_guyNo ratings yet

- GuidelinesonAdanicarleasescheme 2018Document8 pagesGuidelinesonAdanicarleasescheme 2018Shubham GuptaNo ratings yet

- Dealer Agreement RenTripDocument5 pagesDealer Agreement RenTripNESKIVANo ratings yet

- Retail Banking AssignmentDocument11 pagesRetail Banking AssignmentSubham ChoudhuryNo ratings yet

- Corpglance Aug 2019Document7 pagesCorpglance Aug 2019svmkishoreNo ratings yet

- Synopsis: Submitted in The Partial Fulfillment of Requireent For The Award of The Degree ofDocument21 pagesSynopsis: Submitted in The Partial Fulfillment of Requireent For The Award of The Degree ofsakaray mohana vidyaNo ratings yet

- RTB ASSIGNMENT On Vechile LoanDocument21 pagesRTB ASSIGNMENT On Vechile Loan19DM001 Ashis0% (1)

- Audit Program For Vehicle MaintenanceDocument3 pagesAudit Program For Vehicle MaintenanceARSALAN SATTAR0% (1)

- Tender For Tata Indica Vehicle On Monthly Hiring Basis For Concor Cfs Mulund (East)Document13 pagesTender For Tata Indica Vehicle On Monthly Hiring Basis For Concor Cfs Mulund (East)Varthia ParmeshNo ratings yet

- What Is Motor InsuranceDocument14 pagesWhat Is Motor Insurancesaketsuman01No ratings yet

- CHAPTER 1 Introduction For Project On STFCDocument10 pagesCHAPTER 1 Introduction For Project On STFCmahammed saheedNo ratings yet

- Motor InsuranceDocument7 pagesMotor InsuranceRammya RajNo ratings yet

- Car FinancingDocument7 pagesCar FinancingZeeshan RajputNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- JCI ID Card SriDocument2 pagesJCI ID Card Sriomkar maharanaNo ratings yet

- The Odisha Gazette: Extraordinary Published by AuthorityDocument174 pagesThe Odisha Gazette: Extraordinary Published by Authorityomkar maharanaNo ratings yet

- Building /site Permission /approval From Municipality/Nagar PanchayatDocument2 pagesBuilding /site Permission /approval From Municipality/Nagar Panchayatomkar maharanaNo ratings yet

- Egg Storage and Supply: Trupti EnterprisesDocument33 pagesEgg Storage and Supply: Trupti Enterprisesomkar maharana100% (1)

- Rice MillDocument14 pagesRice Millomkar maharanaNo ratings yet

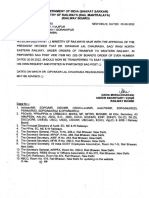

- Msme& Mid Corporate Credit Division, Head Office Plot No.4, Sector-10, Dwarka, New Delhi-110075Document2 pagesMsme& Mid Corporate Credit Division, Head Office Plot No.4, Sector-10, Dwarka, New Delhi-110075omkar maharanaNo ratings yet

- Category Margin Micro & Small Enterprises (As Per MSME Defined Ceiling) 10% Medium Enterprises (As Per MSME Defined Ceiling) 15% Others 25%Document3 pagesCategory Margin Micro & Small Enterprises (As Per MSME Defined Ceiling) 10% Medium Enterprises (As Per MSME Defined Ceiling) 15% Others 25%omkar maharanaNo ratings yet

- AIFDocument2 pagesAIFomkar maharanaNo ratings yet

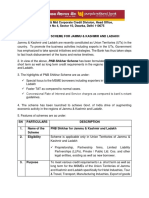

- PNB Shikhar SchemeDocument3 pagesPNB Shikhar Schemeomkar maharanaNo ratings yet

- Msme Prime Plus: SN Parameters ParticularsDocument2 pagesMsme Prime Plus: SN Parameters Particularsomkar maharanaNo ratings yet

- HO MSME Scheme For Financing MSME MFG Unit PNB NIRMATADocument3 pagesHO MSME Scheme For Financing MSME MFG Unit PNB NIRMATAomkar maharanaNo ratings yet

- Overdraft: Need BasedDocument2 pagesOverdraft: Need Basedomkar maharanaNo ratings yet

- PROFESSIONALDocument2 pagesPROFESSIONALomkar maharanaNo ratings yet

- Co - Lending by BanksDocument3 pagesCo - Lending by Banksomkar maharanaNo ratings yet

- OYO - A New Global Chain of Hotels EmergesDocument10 pagesOYO - A New Global Chain of Hotels EmergesEENo ratings yet

- Halal Investment ChecklistDocument28 pagesHalal Investment ChecklistSo' FineNo ratings yet

- Examination of GoodsDocument10 pagesExamination of GoodsJhecyl Ann BasagreNo ratings yet

- Changala2012 LEIDODocument17 pagesChangala2012 LEIDOPía Di NannoNo ratings yet

- UPU-3414 UPU0217 EN Final WebDocument32 pagesUPU-3414 UPU0217 EN Final WebMil AdyNo ratings yet

- BMM 2021 Assignment 1Document1 pageBMM 2021 Assignment 1Ishita jain-RM 20RM921No ratings yet

- Class 6 10th FebDocument2 pagesClass 6 10th FebArubaNo ratings yet

- 1.44 22-10-2020 Revision of Fee To ArbitratorsDocument2 pages1.44 22-10-2020 Revision of Fee To ArbitratorsGuramrit Pal Singh BalNo ratings yet

- Managing The Sales Training ProcessDocument5 pagesManaging The Sales Training ProcessGerlene DinglasaNo ratings yet

- Wicon Waste Case NotesDocument2 pagesWicon Waste Case NotesKumar PatelNo ratings yet

- E (O) IIIs Order 05 - 08 - 2022Document4 pagesE (O) IIIs Order 05 - 08 - 2022rajesh MehtaNo ratings yet

- Title Insurance in Real Estate ProjectsDocument10 pagesTitle Insurance in Real Estate ProjectsjjainNo ratings yet

- IA 2 Major Project Liberty Chapter 2 & 3Document25 pagesIA 2 Major Project Liberty Chapter 2 & 3Akshat ShrivastavNo ratings yet

- 2.-Anexos - Informe - Gas FNE FinalDocument160 pages2.-Anexos - Informe - Gas FNE FinalFrancisco AgüeroNo ratings yet

- Piranha Strategy OverviewDocument4 pagesPiranha Strategy OverviewmchotiyajiNo ratings yet

- Indiabulls Housing Finance Limited: D D M M Y Y Y YDocument2 pagesIndiabulls Housing Finance Limited: D D M M Y Y Y YSwastik MaheshwaryNo ratings yet

- RCBC Vs Royal Cargo DigestDocument2 pagesRCBC Vs Royal Cargo DigestJeremae Ann CeriacoNo ratings yet

- RPS Analisa Laporan Keuangan Agustus 2020Document24 pagesRPS Analisa Laporan Keuangan Agustus 2020Shiel VhyNo ratings yet

- Opsession GD-PI CompendiumDocument10 pagesOpsession GD-PI CompendiumvidishaniallerNo ratings yet

- Classifications of Retail Stores and Shopping Centres - Some Methodological IssuesDocument10 pagesClassifications of Retail Stores and Shopping Centres - Some Methodological IssuesSita W. SuparyonoNo ratings yet

- Political Virtue and Economic Leadership - Lee Kuan Yew and Ferdinand Marcos ComparedDocument20 pagesPolitical Virtue and Economic Leadership - Lee Kuan Yew and Ferdinand Marcos ComparedRheyNo ratings yet

- MANAGERIAL ECONOMICS-JURAZ-1ST MODULEDocument7 pagesMANAGERIAL ECONOMICS-JURAZ-1ST MODULEhologaj313No ratings yet

- FC ProjectDocument25 pagesFC ProjectRaut BalaNo ratings yet