Professional Documents

Culture Documents

Indiabulls Housing Finance Limited: D D M M Y Y Y Y

Uploaded by

Swastik MaheshwaryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indiabulls Housing Finance Limited: D D M M Y Y Y Y

Uploaded by

Swastik MaheshwaryCopyright:

Available Formats

APPLICATION FORM INDIABULLS HOUSING FINANCE LIMITED ASBA APPLICATION TRANCHE I ISSUE OPENS ON : SEPTEMBER 6, 2021

(FOR RESIDENT APPLICANTS) Credit Rating: CRISIL AA/Stable by CRISIL Ratings Ltd., & BWR AA+ /Negative by Brickwork Ratings India Pvt. Ltd. FORM TRANCHE I ISSUE CLOSES ON* : SEPTEMBER 20, 2021

To, *For details of Early Closure or extension of the Issue, please refer to page No. 12 of the Abridged Prospectus.

The Board of Directors, Application

INDIABULLS HOUSING FINANCE LIMITED Form No. 53962160

PUBLIC ISSUE OF SECURED, REDEEMABLE, NON-CONVERTIBLE DEBENTURES OF FACE VALUE ` 1,000/- EACH (”SECURED NCDs”) AND/OR UNSECURED, SUBORDINATED, REDEEMABLE NON-CONVERTIBLE DEBENTURES

TEAR HERE

OF FACE VALUE OF ₹1,000 EACH (“UNSECURED NCDs”, AND TOGETHER WITH THE SECURED NCDs, THE “NCDs”) VIDE THE SHELF PROSPECTUS AND TRANCHE I PROSPECTUS BOTH DATED SEPTEMBER 1, 2021

I/We hereby confirm that I/We have read and understood the terms and conditions of this Application Form and the attached Abridged Prospectus and agree to the ‘Applicant’s Undertaking’ as

given overleaf. I/We hereby confirm that I/We have read the instructions for filling up the Application Form given overleaf.

LEAD MANAGER / CONSORTIUM MEMBER SUB CONSORTIUM MEMBERS/ AGENT’S SCSB BRANCH STAMP REGISTRAR’S / SCSB DATE OF

STAMP & CODE STAMP & CODE STAMP & CODE & CODE SERIAL NO RECEIPT

6677

1. APPLICANT’S DETAILS - PLEASE FILL IN BLOCK LETTERS (Please refer to page no 13 of the Abridged Prospectus)

First Applicant (Mr./ Ms./ M/s.)

Date of Birth D D M M Y Y Y Y Name of Guardian (if applicant is minor) (Mr./ Ms.)

Address __________________________________________________________________________________________________________________________

Pin Code (compulsory)_________________ Tel. No. (with STD Code) / Mobile ________________________ Email _____________________________________

Second Applicant (Mr./ Ms./ M/s.)

Third Applicant (Mr./ Ms./ M/s.)

2. INVESTOR CATEGORY (Pls. refer overleaf) Category I Category II Category III Category IV Sub Category Code (Pls. refer overleaf)

3. PLEASE PROVIDE APPLICANT’S DEPOSITORY DETAILS (For NSDL enter 8 digit DP ID followed by 8 digit Client ID / For CDSL enter 16 digit Client ID)

NSDL / CDSL

4. INVESTMENT DETAILS (For details, please refer Issue Structure overleaf)

Series I II III IV V VI VII VIII IX X

Frequency of Interest Payment Annual Cumulative Monthly Annual Cumulative Monthly Annual Monthly Annual Monthly

Minimum Application ` 10,000 (10 NCDs) across all Series

Face Value/ Issue Price of NCDs (`/ NCD) `1,000

In Multiples of thereafter (`) ` 1,000 (1 NCD)

Type of Instrument (Secured NCDs / Unsecured NCDs) Secured NCDs Unsecured NCDs

Tenor 24 Months 24 Months 24 Months 36 Months 36 Months 36 Months 60 Months 60 Months 87 Months 87 Months

Coupon (% per annum) for NCD Holders in Category I & II 8.35% NA 8.05% 8.50% NA 8.20% 8.75% 8.43% 9.25% 8.89%

Coupon (% per annum) for NCD Holders in Category III & IV 8.75% NA 8.42% 9.00% NA 8.66% 9.25% 8.89% 9.75% 9.35%

Effective Yield (per annum) for NCD Holders in Category I & II 8.35% 8.35% 8.35% 8.50% 8.50% 8.50% 8.75% 8.75% 9.25% 9.25%

Effective Yield (per annum) for NCD Holders in Category III & IV 8.75% 8.75% 8.75% 9.00% 9.00% 9.00% 9.25% 9.25% 9.75% 9.75%

Mode of Interest Payment Through various mode available

PLEASE FILL IN BLOCK LETTERS

Amount (` / NCD) on Maturity for NCD Holders in Category I & II `1,000 `1,174.00 `1,000 `1,000 `1,277.60 `1,000 `1,000 `1,000 `1,000 `1,000

Amount (`/ NCD) on Maturity for NCD Holders in Category III & IV `1,000 `1,182.70 `1,000 `1,000 `1,295.35 `1,000 `1,000 `1,000 `1,000 `1,000

Maturity / Redemption Date (Years from the Deemed Date of Allotment) 24 Months 24 Months 24 Months 36 Months 36 Months 36 Months 60 Months 60 Months 87 Months 87 Months

Put and Call Option Not Applicable

No. of NCDs applied

Amount Payable (`)

Grand Total (`) Total No. of NCDs: Total Amount Payable (`) :

5. PAYMENT DETAILS

Amount paid (` in figures) (` in words)

LEAD MANAGER’S / CONSORTIUM MEMBER'S / SUB-

ASBA Bank A/c. No. CONSORTIUM MEMBER'S / BROKER'S / TRADING MEMBER'S

/SCSB BRANCH'S STAMP (ACKNOWLEDGING UPLOAD OF

ASBA A/c. Holder Name____________________________________________________________________________________________ APPLICATION IN STOCK EXCHANGE SYSTEM) (MANDATORY)

(in case Applicant is different from ASBA A/c. Holder)

Bank Name & Branch _____________________________________________________________________________________________

OR UPI ID (Maximum 45 characters)

5A. PAN & SIGNATURE OF 5B. PAN & SIGNATURE OF 5C. PAN & SIGNATURE OF 5D. SIGNATURE OF ASBA BANK ACCOUNT HOLDER( S)

SOLE/ FIRST APPLICANT SECOND APPLICANT THIRD APPLICANT (AS PER BANK RECORDS)

PAN PAN PAN I/We authorize the SCSB to do all acts as are necessary to make

the Application in the Issue

1

Furnishing PAN of the Applicant is mandatory, including Minor’s PAN in case of Application by Minor. 3

Date _________________ Please refer page 16 of the Abridged Prospectus.

TEAR HERE

Acknowledgement Slip for Lead Manager/ Application

INDIABULLS HOUSING Consortium Member / Sub-Consortium Members/ 53962160

FINANCE LIMITED Brokers / Trading Members / SCSBs/ CRTA / CDP Form No.

PUBLIC ISSUE OF SECURED, REDEEMABLE, NON-CONVERTIBLE DEBENTURES OF FACE VALUE ` 1,000/- EACH (”SECURED NCDs”) AND/OR UNSECURED, SUBORDINATED, REDEEMABLE NON-CONVERTIBLE DEBENTURES

OF FACE VALUE OF ₹1,000 EACH (“UNSECURED NCDs”, AND TOGETHER WITH THE SECURED NCDs, THE “NCDs”) VIDE THE SHELF PROSPECTUS AND TRANCHE I PROSPECTUS BOTH DATED SEPTEMBER 1, 2021

DPID / CLID PAN

Amount Paid (` in figures)______________________ Bank & Branch ____________________________________________ Date Stamp & Signature of SCSB

(Mandatory)

ASBA Bank A/c. No. / UPI ID_____________________________________________________________________________

Dated

Received from Mr./ Ms./ M/s.

Telephone/Mobile ___________________________ Email ____________________________________________________

--------------------------------------------------------------------------------------------------------TEAR HERE----------------------------------------------------------------------------------------------------

Printed by : www.mgmprinttech.com

PUBLIC ISSUE OF SECURED, REDEEMABLE, NON-CONVERTIBLE DEBENTURES OF FACE VALUE ` 1,000/- EACH (”SECURED NCDs”) AND/OR UNSECURED, SUBORDINATED, REDEEMABLE NON-CONVERTIBLE DEBENTURES

TEAR HERE

OF FACE VALUE OF ₹1,000 EACH (“UNSECURED NCDs”, AND TOGETHER WITH THE SECURED NCDs, THE “NCDs”) VIDE THE SHELF PROSPECTUS AND TRANCHE I PROSPECTUS BOTH DATED SEPTEMBER 1, 2021

Series I II III IV V VI VII VIII IX X Date Stamp & Signature of Lead Name of Sole / First Applicant (Mr./Ms./M/s.)

FINANCE LIMITED

Manager / Consortium Member / Broker /

Issue Price/Face Value/NCD’s ` 1,000.00

INDIABULLS

Trading Member / SCSB / CRTA / CDP

HOUSING

No. of NCD’s applied for

Acknowledgement Slip for Applicant

Amount Payable ( `) Applications submitted without being uploaded on the terminals of the

Stock Exchanges will be rejected.

Grand Total ( `)

Acknowledgement is subject to realisation of Availability of Funds in the ASBA account.

All future communication in connection with this

ASBA Bank A/c. No. / UPI ID Dated application should be addressed to the Registrar of

Application

(Names of Bank & Branch)

Issue. For details, please refer overleaf.

Acknowledgment Slip for Applicant Form No.

53962160

While submitting the Application Form, the Applicant should ensure that the date stamp being put on the Application Form by the Lead Manager / Consortium Member / Brokers / Trading Members / SCSB(s) / CRTA / CDP

matches with the date stamp on the Acknowledgement Slip. Applications submitted without being uploaded on the terminals of the Stock Exchange will be rejected.

APPLICANT’S UNDERTAKING

I/We hereby agree and confirm that:

1. I/We have read, understood and agreed to the contents and terms and conditions of INDIABULLS HOUSING FINANCE LIMITED’s Shelf Prospectus dated September 1, 2021 and Tranche I Prospectus dated September 1, 2021

(Collectively the “Prospectus”).

2. I/We hereby apply for allotment of the NCDs to me/us and the amount payable on application is remitted herewith.

3. I/We hereby agree to accept the NCDs applied for or such lesser number as may be Allotted to me/us in accordance with the contents of the Prospectus subject to applicable statutory and/or regulatory requirements.

4. I/We irrevocably give my/our authority and consent to IDBI TRUSTEESHIP SERVICES LIMITED, (the “Debenture Trustee”) to act as my/our trustee and for doing such acts as are necessary to carry out its duties in such capacity.

5. I am/We are Indian national(s) resident in India and I am/ we are not applying for the said NCDs as nominee(s) of any person resident outside India and/or foreign national(s).

6. The application made by me/us does not exceed the investment limit on the maximum number of NCDs which may be held by me/us under applicable statutory and/or regulatory requirements.

7. In making my/our investment decision, I/we have relied on my/our own examination of Indiabulls Housing Finance Limited the Issuer and the terms of the Issue, including the merits and risks involved and my/our decision to make this

application is solely based on disclosures contained in the Prospectus.

8. I/We have obtained the necessary statutory and/or regulatory permissions/approvals for applying for, subscribing to, and seeking allotment of the NCDs applied for.

9. UPI Mechanism for Blocking Fund would be available for Retail Individual Investors, who have submitted bid for an amount not more than `200,000 in any of the bidding options in the Issue (including HUFs applying through their

Karta and does not include NRIs).

- Please ensure that your Bank is offering UPI facility for Public Issues

- Please mention UPI Id clearly in CAPITALLETTERS only

- Ensure that the: (a) bank where the bank account linked to their UPI ID is maintained; and (b) the Mobile App and UPI handle being used for making the Bid, are listed on the website of SEBI at

https://www.sebi.gov.in/sebiweb/other/OtherAction.do?doRecognisedFpi=yes&intmId=43

- UPI Id cannot exceed 45 characters.

- Applicants using the UPI Mechanism shall ensure that details of the Bid are reviewed and verified by opening the attachment in the UPI Mandate Request and then proceed to authorise the UPI Mandate Request. For further

details, see "Issue Procedure" on page 111 of the Tranche I Prospectus.

10.Additional Undertaking in case of ASBA Applicants:

1) I/We hereby undertake that I/We am/are an ASBA Applicant(s) as per applicable provisions of the SEBI Regulations; 2) In accordance with ASBA process provided in the SEBI Regulations and disclosed in the Prospectus, I/We authorize

(a) the Lead Manager(s), Consortium Member, Trading Members (in Specified cities only), Broker, CRTA, CDP or the SCSBs, as the case may be, to do all acts as are necessary to make the Application in the Issue, including uploading my/our

application, blocking or unblocking of funds in the bank account maintained with the SCSB as specified in the Application Form or in the bank account of the Applicant linked with the UPI ID provided in the Application Form, as the case may be,

transfer of funds to the Public Issue Account on receipt of instruction from the Lead Manager and Registrar to the Issue or the Sponsor Bank, as the case may be, after finalization of Basis of Allotment; and (b) the Registrar to the Issue or

Sponsor Bank, as the case may be, to issue instruction to the SCSBs to unblock the funds in the specified bank account upon finalization of the Basis of Allotment. 3) In case the amount available in the specified Bank Account is insufficient as

per the Application, the SCSB shall reject the Application.

11. I/We confirm that I/We shall be allocated and allotted Series IV NCDs wherein I/We have not indicated the choice of the relevant Series of NCDs.

IMPERSONATION

Attention of the Applicants is specifically drawn to the provisions of sub-section (1) of section 38 of the Companies Act, 2013, which is reproduced below: “Any person who: (a) makes or abets making of an application in a fictitious name to a

company for acquiring, or subscribing for, its securities; or (b) makes or abets making of multiple applications to a company in different names or in different combinations of his name or surname for acquiring or subscribing for its securities; or (c)

otherwise induces directly or indirectly a company to allot, or register any transfer of, securities to him, or to any other person in a fictitious name, shall be liable for action under section 447.”

ISSUE RELATED INFORMATION FOR FILLING THE APPLICATION FORM

INVESTOR CATEGORIES:

Category I (Institutional Investors) Sub-category Category II (Non-Institutional Investors) Sub-category

code code

Public financial institutions, scheduled commercial banks, and Indian multilateral and bilateral development 10 Companies within the meaning of section 2(20) of the Companies Act, 2013; 21

financial institutions which are authorised to invest in the NCDs; Statutory bodies/ corporations and societies registered under the applicable laws in India and authorised to 22

Provident funds and pension funds with minimum corpus of `25 crore, and superannuation funds and gratuity invest in the NCDs;

11

funds, which are authorised to invest in the NCDs; Co-operative banks and regional rural banks; 23

Alternative Investment Funds subject to investment conditions applicable to them under the Securities and 12 Public/private charitable/ religious trusts which are authorised to invest in the NCDs; 24

Exchange Board of India (Alternative Investment Funds) Regulations, 2012, as amended; Scientific and/or industrial research organisations, which are authorized to invest in the NCDs; 25

Resident Venture Capital Funds registered with SEBI; 13 Partnership firms in the name of the partners; 26

Limited liability partnerships formed and registered under the provisions of the Limited Liability Partnership 27

Insurance Companies registered with IRDA; 14 Act, 2008 (No. 6 of 2009);

State industrial development corporations; 15 Association of Persons; and 28

Insurance funds set up and managed by the army, navy, or air force of the Union of India; 16 Any other incorporated and/ or unincorporated body of persons 29

Category III (“High Networth Individuals”)/(“HNIs”)

Insurance funds set up and managed by the Department of Posts, the Union of India; 17

High Net-worth individuals which include Resident Indian individuals or Hindu Undivided Families through the 31

National Investment Fund set up by resolution no. F. No. 2/3/2005-DDII dated November 23, 2005 of the 18 Karta applying for an amount aggregating to above `10 Lakh across all series of NCDs in this Tranche I Issue

Government of India published in the Gazette of India;

Category IV (“Retail Individual Investors”) /(“RIIs”)

Systemically important non-banking financial companies being non-banking financial companies registered

with the Reserve Bank of India and having a net worth of more than `500 crores as per its last audited

19 Resident Indian individuals or HUFs applying through the Karta, for NCDs for an amount aggregating up to and 41

financial statements; and including `10 Lakh, across all series of NCDs in this Tranche I Issue and shall include Retail Individual Investors,

who have submitted bid for an amount not more than `200,000 in any of the bidding options in this Tranche I

Mutual Funds registered with SEBI 20 Issue (including HUFs applying through their Karta and does not include NRIs) through UPI Mechanism

The specific terms of each instrument are set out below:

ISSUE STRUCTURE

Series I II III IV* V VI VII VIII IX X

Frequency of Interest Payment Annual Cumulative Monthly Annual

Cumulative Monthly Annual Monthly Annual Monthly

Minimum Application ` 10,000 (10 NCDs) across all Series

Face Value/ Issue Price of NCDs (`/ NCD) `1,000

In Multiples of thereafter (`) ` 1,000 (1 NCD)

Type of Instrument (Secured NCDs / Unsecured NCDs) Secured NCDs Unsecured NCDs

Tenor 24 Months 24 Months 24 Months 36 Months 36 Months 36 Months 60 Months 60 Months 87 Months 87 Months

Coupon (% per annum) for NCD Holders in Category I & II 8.35% NA 8.05% 8.50% NA 8.20% 8.75% 8.43% 9.25% 8.89%

Coupon (% per annum) for NCD Holders in Category III & IV 8.75% NA 8.42% 9.00% NA 8.66% 9.25% 8.89% 9.75% 9.35%

Effective Yield (per annum) for NCD Holders in Category I & II 8.35% 8.35% 8.35% 8.50% 8.50% 8.50% 8.75% 8.75% 9.25% 9.25%

Effective Yield (per annum) for NCD Holders in Category III & IV 8.75% 8.75% 8.75% 9.00% 9.00% 9.00% 9.25% 9.25% 9.75% 9.75%

Mode of Interest Payment Through various mode available

Amount (` / NCD) on Maturity for NCD Holders in Category I & II `1,000 `1,174.00 `1,000 `1,000 `1,277.60 `1,000 `1,000 `1,000 `1,000 `1,000

Amount (`/ NCD) on Maturity for NCD Holders in Category III & IV `1,000 `1,182.70 `1,000 `1,000 `1,295.35 `1,000 `1,000 `1,000 `1,000 `1,000

Maturity / Redemption Date (Years from the Deemed Date of Allotment) 24 Months 24 Months 24 Months 36 Months 36 Months 36 Months 60 Months 60 Months 87 Months 87 Months

Put and Call Option Not Applicable

*Our Company shall allocate and allot Series IV NCDs wherein the Applicants have not indicated the choice of the relevant NCD Series.

With respect to Series where interest is to be paid on an annual basis, relevant interest will be paid on each anniversary of the Deemed Date of Allotment on the face value of the NCDs. The last interest payment under annual Series will be

made at the time of redemption of the NCDs. In the event, the interest / pay-out of total coupon / redemption amount is a fraction and not an integer, such amount will be rounded off to the nearest integer.

Subject to applicable tax deducted at source, if any

Applicants are advised to ensure that they have obtained the necessary statutory and/or regulatory permissions/consents/approvals in connection with applying for, subscribing to, or seeking Allotment of NCDs pursuant to the Tranche I Issue. For

further details, see “Issue Procedure” on page 111 of the Tranche I Prospectus.

Please refer to Annexure D of Tranche I Prospectus for details pertaining to the cash flows of the Company in accordance with the SEBI Circular bearing number SEBI/HO/DDHS/P/CIR/2021/613 dated August 10, 2021.

Category III and IV of Investors in the proposed Issue who are also NCD(s)/bond(s) previously issued by our Company, and/ or our Subsidiaries as the case may be, and/or are equity shareholder(s) of Indiabulls Housing Finance Limited as the case

may be (“Primary Holder(s)”) on the Deemed Date of Allotment and applying in Series I, Series III, Series IV, Series VI, Series VII Series VIII, Series IX and/or Series X shall be eligible for additional incentive of 0.25% p.a. provided the NCDs issued

under the proposed Issue are held by the investors on the relevant Record Date applicable for payment of respective coupons, in respect of Series I, Series III, Series IV, Series VI, Series VII Series, VIII, Series IX and/or Series X.

Category III and IV of Investors in the proposed Issue who are also Primary Holder(s) on the Deemed Date of Allotment applying in Series II and/or V, the maturity amount at redemption along with the additional yield would be `1,811.10 per NCD

and/or `1,304.30 per NCD respectively provided the NCDs issued under the proposed Issue are held by the investors on the relevant Record Date applicable for redemption in respect of Series II and/or Series V.

Note: a. Basis of Allotment : For details, please refer to page no. 23 of the Abridged Prospectus. b. For Grounds for Technical Rejection. “Please refer to page no. 21 of the Abridged Prospectus”. c. The Company shall allocate and

allot Series IV NCD’s wherein the Applicants have not indicated their choice of the relevant NCD Series. d. If the Deemed Date of Allotment undergoes a change, the coupon payment dates, redemption dates, redemption amounts

and other cash flow workings shall be changed accordingly. For details of the interest payment please refer to "Interest / Premium and Payment of Interest/ Premium" at page no. 98 of the Tranche I Prospectus. For further

information please refer to section titled “Issue Related Information” on page 79 of the Tranche I Prospectus. For further details please refer to the Shelf Prospectus dated September 1, 2021 and Tranche I Prospectus dated

September 1, 2021.

--------------------------------------------------------------------------------------------------------TEAR HERE----------------------------------------------------------------------------------------------------

• In case of queries related to allotment/ credit of Allotted NCD/Refund, the Applicants COMPANY CONTACT DETAILS REGISTRAR CONTACT DETAILS

should contact Registrar to the Issue or the Company.

INDIABULLS HOUSING FINANCE LIMITED Kfin Technologies Private Limited (CIN: U72400TG2017PTC117649 )

• In case of ASBA Application submitted to the SCSBs, the Applicants should contact

the relevant SCSB. Corporate Identity Number: L65922DL2005PLC136029 Selenium Tower B, Plot No – 31 and 32, Financial District, Nanakramguda,

• In case of queries related to upload of ASBA Applications submitted Registered Office: M 62&63, First Floor, Connaught Place, Serilingampally, Hyderabad Rangareddy, Telangana - 500 032 Hyderabad,

to the Lead Manager / Consortium Member / Trading Members / CRTA / CDP / New Delhi - 110 001, Delhi, India; Telephone No.: +91 11 4353 2950; Tel: +91 40 6716 2222 Facsimile No.: +91 40 2343 1551

SCSB, Applicants should contact the,relevant Lead Manager / Consortium Member Facsimile No.: +91 11 4353 2947 Email: ibhfl.ncdipo@kfintech.com

Trading Members/ CRTA / CDP / SCSB.

• The grievance arising out of Applications for NCD’s made through Trading Members

Company Secretary and Compliance Officer: Mr. Amit Kumar Jain Investor Grievance Email: einward.ris@kfintech.com

may be addressed directly to exchanges.. Telephone No.: +91 124 668 1199; Facsimile No.: +91 124 668 1240; Website: www.kfintech.com Contact Person: Mr. M Murali Krishna

• Acknowledgment is subject to availability of Funds in the ASBA account. E-mail: ajain@indiabulls.com SEBI Registration Number: INR000000221

2 INDIABULLS HOUSING FINANCE LIMITED

You might also like

- SWOT ANALYSIS and PESTLEDocument20 pagesSWOT ANALYSIS and PESTLEGia Porqueriño0% (2)

- ReplacedDocument4 pagesReplacedLuno coin100% (1)

- Duke Cannon Inv 88607Document2 pagesDuke Cannon Inv 88607api-609272624No ratings yet

- Application Form (For Resident Applicants) Sakthi Finance LimitedDocument2 pagesApplication Form (For Resident Applicants) Sakthi Finance LimitedraviNo ratings yet

- Application Form (For Resident Applicants) Asba Application Form India Infoline Finance LimitedDocument2 pagesApplication Form (For Resident Applicants) Asba Application Form India Infoline Finance LimitedMosses HarrisonNo ratings yet

- Edelweiss Financial Services Limited NCD April 21Document2 pagesEdelweiss Financial Services Limited NCD April 21abdriver2000No ratings yet

- Edelweiss Broking Limited July 22Document36 pagesEdelweiss Broking Limited July 22Project AtomNo ratings yet

- Application Form (For Resident Applicants) Asba Application FormDocument2 pagesApplication Form (For Resident Applicants) Asba Application FormProject AtomNo ratings yet

- ICCL CustomersDocument2 pagesICCL CustomersJoseph KimNo ratings yet

- Muthoot 1Document1 pageMuthoot 1Sanjeev Bisht-CrayontekNo ratings yet

- Indore Municipal Corporation1Document1 pageIndore Municipal Corporation1Sanjeev Bisht-CrayontekNo ratings yet

- JM Financial Credit Solutions Limited NCDDocument48 pagesJM Financial Credit Solutions Limited NCDVVRAONo ratings yet

- Application Form2024Document22 pagesApplication Form2024anandhrock123No ratings yet

- Application Form (For Resident Applicants) Common Application Form For Asba Shriram Transport Finance Company LimitedDocument1 pageApplication Form (For Resident Applicants) Common Application Form For Asba Shriram Transport Finance Company LimitedPatel SumitNo ratings yet

- Muthoot Finance Limited: Bajaj Capital Ltd. INZ000007732Document1 pageMuthoot Finance Limited: Bajaj Capital Ltd. INZ000007732umanarayanvaishnavNo ratings yet

- Sunita Sharma: Application Form (For Resident Applicants) Asba Application FormDocument1 pageSunita Sharma: Application Form (For Resident Applicants) Asba Application Formitsyour vinESNo ratings yet

- PowerFinance31713161 3Document4 pagesPowerFinance31713161 3aman khatriNo ratings yet

- Mut Hoot 73533434Document1 pageMut Hoot 73533434Rajesh ManogaranNo ratings yet

- NFO Form - Edelweiss Focused Equity SchemeDocument3 pagesNFO Form - Edelweiss Focused Equity SchemeAvinashNo ratings yet

- Common Application Form: For Lump Sum/Systematic InvestmentsDocument4 pagesCommon Application Form: For Lump Sum/Systematic Investmentspunitwishes7157No ratings yet

- ICICI Equity & DEBT Form With Auto Debit FormDocument2 pagesICICI Equity & DEBT Form With Auto Debit FormSaurabh JainNo ratings yet

- Application Form For Mses: Name of The BankDocument5 pagesApplication Form For Mses: Name of The BankRITESH GUPTANo ratings yet

- Check List For Loan Process-1Document8 pagesCheck List For Loan Process-1kiran.3ddesignerNo ratings yet

- SME Application FormDocument12 pagesSME Application FormSomnath DasGuptaNo ratings yet

- Online Application Form JAT Holdings Limited 32Document2 pagesOnline Application Form JAT Holdings Limited 32cpasl123No ratings yet

- Birla SIP Cum NACH FormDocument6 pagesBirla SIP Cum NACH FormarunimaapkNo ratings yet

- Application Form: Arn - ArnDocument4 pagesApplication Form: Arn - ArnRavindraNo ratings yet

- Application Form For Mses: Name of The BankDocument5 pagesApplication Form For Mses: Name of The BankdhivyaNo ratings yet

- Amrd - Payment - ChallanDocument1 pageAmrd - Payment - Challanelluri.sudhakarNo ratings yet

- Loan Application For Finance Against Mortgageof Immovable Property Branch Name Date of Application Borrower GuarantorDocument4 pagesLoan Application For Finance Against Mortgageof Immovable Property Branch Name Date of Application Borrower Guarantorkishor patelNo ratings yet

- Payment Challan Clerical 10042010Document1 pagePayment Challan Clerical 10042010p_nikhil05No ratings yet

- Irfc 20048056Document4 pagesIrfc 20048056me.lucha.badmashNo ratings yet

- IBHFL IPO Abridged ProspectusDocument48 pagesIBHFL IPO Abridged Prospectusratan203No ratings yet

- Power Finance Corporation LTDDocument4 pagesPower Finance Corporation LTDAritra BhattacharjeeNo ratings yet

- PFC Bonds Application Form Capital Gain 2022 2023Document4 pagesPFC Bonds Application Form Capital Gain 2022 2023Sunil KumarNo ratings yet

- Andhra Pragathi Grameena Bank Andhra Pragathi Grameena BankDocument1 pageAndhra Pragathi Grameena Bank Andhra Pragathi Grameena BankdayaNo ratings yet

- DSKNCDAUG14Document1 pageDSKNCDAUG14Amitava GhoshNo ratings yet

- SIP DebitMandateNACH-FormDocument2 pagesSIP DebitMandateNACH-FormDevesh SinghNo ratings yet

- DocumentDocument15 pagesDocumentRAJESH KUMARNo ratings yet

- Non-Resident Full FormDocument12 pagesNon-Resident Full FormAbisekNo ratings yet

- Edelweiss Securities Ltd. 01/121: DdmmyyyyDocument2 pagesEdelweiss Securities Ltd. 01/121: DdmmyyyySarah DeanNo ratings yet

- IRFC Tax Free Bond Dec15Document48 pagesIRFC Tax Free Bond Dec15Robin FlyerNo ratings yet

- Application Form For Mses: Bank of BarodaDocument4 pagesApplication Form For Mses: Bank of BarodaSuresh JainNo ratings yet

- HDFC Sip Nach FormDocument6 pagesHDFC Sip Nach FormPraveen KumarNo ratings yet

- Equity Broking Account Opening (Products)Document3 pagesEquity Broking Account Opening (Products)odan81No ratings yet

- Sip Pause Form: (For Investment Through ECS (Debit Clearing) /direct Debit Facility /standing Instruction/NACH)Document2 pagesSip Pause Form: (For Investment Through ECS (Debit Clearing) /direct Debit Facility /standing Instruction/NACH)SANJEEV SANGAINo ratings yet

- Form A Application FormDocument6 pagesForm A Application FormBoinzb TNo ratings yet

- Challan Form (Cash Voucher) - 01 Challan Form (Cash Voucher) - 01Document2 pagesChallan Form (Cash Voucher) - 01 Challan Form (Cash Voucher) - 01abhi046btecheeeNo ratings yet

- NRI DP Equity Form - Version 7.2Document46 pagesNRI DP Equity Form - Version 7.2Krishna SankarNo ratings yet

- Gocf 1662511181 Briccio MatacsilDocument1 pageGocf 1662511181 Briccio MatacsilBsm GwapuNo ratings yet

- Form14052021 ARDocument5 pagesForm14052021 ARKasim ShaikhNo ratings yet

- Syndicate PoDocument1 pageSyndicate Posurya_a4No ratings yet

- LNT PF DeclarationForm-11 (New)Document5 pagesLNT PF DeclarationForm-11 (New)Bikash KumarNo ratings yet

- HDFC Sip FormDocument3 pagesHDFC Sip FormspeedenquiryNo ratings yet

- Shriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Document48 pagesShriram City Union Finance Non Convertible Debentures Application Form Call Wealth Advisor Anandaraman at 9843146519Mutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Employees' Provident Fund Organization: Form No. 11 (New) Declaration FormDocument3 pagesEmployees' Provident Fund Organization: Form No. 11 (New) Declaration FormDANo ratings yet

- Vehicle Insurance Certificate in IndiaDocument2 pagesVehicle Insurance Certificate in IndiaED STORYNo ratings yet

- Employees' Provident Fund Organization: Declaration FormDocument3 pagesEmployees' Provident Fund Organization: Declaration FormroseNo ratings yet

- JM Mutual FundDocument4 pagesJM Mutual FundRakesh LahoriNo ratings yet

- One Time Debit Mandate Form NACH / Auto Debit: Mutual FundsDocument2 pagesOne Time Debit Mandate Form NACH / Auto Debit: Mutual FundsNothing NothingNo ratings yet

- Application Form MsmeDocument3 pagesApplication Form Msmechandan4allNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- SCC Admission Schedule 2023 16Document1 pageSCC Admission Schedule 2023 16Swastik MaheshwaryNo ratings yet

- Rp-Sanjivgoenka Group: Ov M Er2Document3 pagesRp-Sanjivgoenka Group: Ov M Er2Swastik MaheshwaryNo ratings yet

- Https Sdmis - Nios.ac - in Search Pcp-Hall-TicketDocument2 pagesHttps Sdmis - Nios.ac - in Search Pcp-Hall-TicketSwastik MaheshwaryNo ratings yet

- Office Circular 93 Dated 08.08.2023 Independence Day CelebrationDocument1 pageOffice Circular 93 Dated 08.08.2023 Independence Day CelebrationSwastik MaheshwaryNo ratings yet

- Decimal Place Value Riddles 4aDocument2 pagesDecimal Place Value Riddles 4aSwastik MaheshwaryNo ratings yet

- Case Study - WadeshwarDocument14 pagesCase Study - WadeshwarSwastik MaheshwaryNo ratings yet

- 5328860314Document81 pages5328860314Swastik MaheshwaryNo ratings yet

- Plagiarism Scan Report: Plagiarised Unique Words CharactersDocument2 pagesPlagiarism Scan Report: Plagiarised Unique Words CharactersSwastik MaheshwaryNo ratings yet

- Robin Hood Case - Stratgic AnalysisDocument21 pagesRobin Hood Case - Stratgic AnalysispragadeeshwaranNo ratings yet

- Indiabulls Housing Finance Limited Shelf Prospectus September 01 2021 0800936001630569902Document688 pagesIndiabulls Housing Finance Limited Shelf Prospectus September 01 2021 0800936001630569902Swastik MaheshwaryNo ratings yet

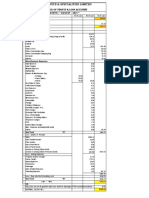

- Analysis of Profit & Loss Account: Month - " August - 2021 "Document3 pagesAnalysis of Profit & Loss Account: Month - " August - 2021 "Swastik MaheshwaryNo ratings yet

- Daily Production & Performance Report: Ludlow Jute & Specialities LTDDocument2 pagesDaily Production & Performance Report: Ludlow Jute & Specialities LTDSwastik MaheshwaryNo ratings yet

- Candidate Hall TicketDocument2 pagesCandidate Hall TicketSwastik MaheshwaryNo ratings yet

- Case Study RobinhoodDocument4 pagesCase Study RobinhoodSwastik MaheshwaryNo ratings yet

- Raw Jute Consumption Reconciliation For 2019 2020 Product Wise 07.9.2020Document34 pagesRaw Jute Consumption Reconciliation For 2019 2020 Product Wise 07.9.2020Swastik MaheshwaryNo ratings yet

- Case Study RobinhoodDocument4 pagesCase Study RobinhoodSwastik MaheshwaryNo ratings yet

- Jute Cost 2020-21Document19 pagesJute Cost 2020-21Swastik MaheshwaryNo ratings yet

- Plagiarism Scan Report: Plagiarised Unique Words CharactersDocument2 pagesPlagiarism Scan Report: Plagiarised Unique Words CharactersSwastik MaheshwaryNo ratings yet

- Raw Jute Consumption Reconciliation For 2019 2020 Product Wise 07.9.2020Document26 pagesRaw Jute Consumption Reconciliation For 2019 2020 Product Wise 07.9.2020Swastik MaheshwaryNo ratings yet

- Chapter 13Document9 pagesChapter 13Swastik MaheshwaryNo ratings yet

- Sub Sektor Industri Makanan Dan MinumanDocument4 pagesSub Sektor Industri Makanan Dan MinumanFRASETYO ANGGA SAPUTRA ARNADINo ratings yet

- Fin 404 AssignmentDocument2 pagesFin 404 AssignmentIrfanul HoqueNo ratings yet

- Chapter 5: Intercompany Profit Transactions - Inventories: Advanced AccountingDocument39 pagesChapter 5: Intercompany Profit Transactions - Inventories: Advanced AccountingRifqa Aulia NabylaNo ratings yet

- Patterns in Stock Prices PIVOTE Jesse LivermoreDocument7 pagesPatterns in Stock Prices PIVOTE Jesse Livermorekuky6549369No ratings yet

- CH 13-Market Economic SystemDocument3 pagesCH 13-Market Economic SystemDivya SinghNo ratings yet

- Sourin Mukherjee (PG-10-084)Document17 pagesSourin Mukherjee (PG-10-084)ppoooopopopooopopNo ratings yet

- Research in Accounting Regulation: Balachandran Muniandy, Muhammad Jahangir AliDocument11 pagesResearch in Accounting Regulation: Balachandran Muniandy, Muhammad Jahangir AliIam ThineshNo ratings yet

- CG199090 Urban Platter MacadamiaDocument12 pagesCG199090 Urban Platter MacadamiaDipanwitaNo ratings yet

- Chapter 4Document2 pagesChapter 4Dai Huu0% (1)

- Michael E. PorterDocument21 pagesMichael E. PorterAnshikaNo ratings yet

- Estimate NCS/NW/582: Nexsus Cyber Solutions Opc PVT LTDDocument2 pagesEstimate NCS/NW/582: Nexsus Cyber Solutions Opc PVT LTDmkm969No ratings yet

- BA185IU Commercial Banking Final Exam Spring 2021 SignedDocument27 pagesBA185IU Commercial Banking Final Exam Spring 2021 SignedSỹ Hoàng TrầnNo ratings yet

- 2020 Mini ProjectDocument22 pages2020 Mini ProjectPema NingtobNo ratings yet

- Quotation For SRMSCET BAREILLYDocument2 pagesQuotation For SRMSCET BAREILLYRajesh KumarNo ratings yet

- Problems in Overhead AllocationDocument2 pagesProblems in Overhead AllocationMEERA JOSHY 1927436No ratings yet

- Akl 1 - TM7Document4 pagesAkl 1 - TM7Ardhani PrianggaNo ratings yet

- Peter Drucker: Father of Post-War Management ThinkingDocument12 pagesPeter Drucker: Father of Post-War Management Thinkingamit chavaria100% (1)

- Limni CoDocument3 pagesLimni CoDavid Jung ThapaNo ratings yet

- Interface Between Government and Public EnterprisesDocument21 pagesInterface Between Government and Public EnterprisesGemechu BirehanuNo ratings yet

- Jainism in Odisha Chapter 1Document13 pagesJainism in Odisha Chapter 1Bikash DandasenaNo ratings yet

- CF Unit 2 Solutions 09-01-2022Document22 pagesCF Unit 2 Solutions 09-01-2022SuganyaNo ratings yet

- Jetblue Airways: Deicing at Logan AirportDocument5 pagesJetblue Airways: Deicing at Logan AirportNarinderNo ratings yet

- Abm - TIMELINE FEASIBILITY 3I and WI 2022 1Document4 pagesAbm - TIMELINE FEASIBILITY 3I and WI 2022 112 ABM 2A-BORRES, JEAN ROSENo ratings yet

- Assignment 2 GuidanceDocument4 pagesAssignment 2 GuidanceNguyễn AnNo ratings yet

- Module 2 Impairment of AssetsDocument52 pagesModule 2 Impairment of AssetsRIZLE SOGRADIELNo ratings yet

- Index S.No Chapter P.No 1. 1 2. 7 3. 16 4. 24 5. 33 6. 40 7. 48 8. 56 9. 64 10. 72Document47 pagesIndex S.No Chapter P.No 1. 1 2. 7 3. 16 4. 24 5. 33 6. 40 7. 48 8. 56 9. 64 10. 72Suryansh jainNo ratings yet

- RedSeer - Job Description - Associate ConsultantDocument3 pagesRedSeer - Job Description - Associate ConsultantAnshuman MohantyNo ratings yet