0% found this document useful (0 votes)

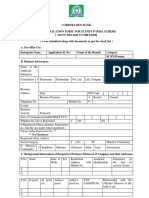

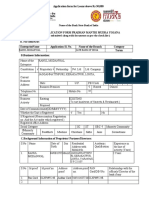

221 views3 pagesMSE Loan Application Form

This document is an application form for micro, small and medium enterprises (MSEs) to apply for credit facilities from Bank of Baroda. The form requests information such as the enterprise name and address, date of establishment, names and details of proprietors/partners/directors, existing and proposed activities and credit facilities, past performance and future projections, and a certification that all information provided is true. The applicant is also requesting loan for machinery purchase and providing collateral security details.

Uploaded by

chandan4allCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

221 views3 pagesMSE Loan Application Form

This document is an application form for micro, small and medium enterprises (MSEs) to apply for credit facilities from Bank of Baroda. The form requests information such as the enterprise name and address, date of establishment, names and details of proprietors/partners/directors, existing and proposed activities and credit facilities, past performance and future projections, and a certification that all information provided is true. The applicant is also requesting loan for machinery purchase and providing collateral security details.

Uploaded by

chandan4allCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd