Professional Documents

Culture Documents

Annual Report of IOCL 173

Uploaded by

NikunjCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Report of IOCL 173

Uploaded by

NikunjCopyright:

Available Formats

Indian Oil Corporation Limited 3rd Integrated Annual Report 61st Annual Report 2019-20

About the Report

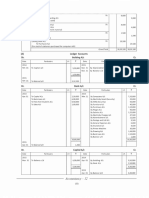

NOTES TO FINANCIAL STATEMENTS NOTES TO FINANCIAL STATEMENTS

Note - 11 : CASH AND CASH EQUIVALENTS Note - 14 : EQUITY SHARE CAPITAL

(₹ in Crore) (₹ in Crore)

Particulars March 31, 2020 March 31, 2019 Particulars March 31, 2020 March 31, 2019

Chairman’s Desk

Bank Balances with Scheduled Banks : Authorized:

From the

In Current Account 931.22 341.14 15000000000 Equity Shares of ₹ 10 each 15,000.00 15,000.00

In Fixed Deposit - Maturity within 3 months 407.89 444.74 Issued Subscribed and Paid Up:

1,339.11 785.88 9414158922 (2019: 9414158922) 9414.16 9,414.16

Bank Balances with Non-Scheduled Banks 93.27 129.71 Equity Shares of ₹ 10 each fully paid up

About IndianOil

Cheques, Drafts in hand 1.75 15.16 Less: Equity Shares held under IOC Shares Trust 233.12 233.12

Cash in Hand, Including Imprest 0.48 2.34 233118456 (2019: 233118456)

TOTAL 1434.61 933.09 Equity Shares of ₹ 10 each fully paid up

TOTAL 9,181.04 9,181.04

Description of Capitals

Note - 12 : BANK BALANCES OTHER THAN ABOVE A. Reconciliation of No. of Equity Shares

(₹ in Crore) Opening Balance 9414158922 9711809928

Particulars March 31, 2020 March 31, 2019 Shares bought back - 297651006

Fixed Deposits A 812.34 82.61 Closing Balance 9414158922 9414158922

Earmarked Balances B 48.31 44.58

B. Terms/Rights attached to Equity Shares

Board of Directors, etc.

Blocked Account C 0.74 0.68

Other Bank Balances D 0.01 0.01

The Holding Company has only one class of equity shares having par value of ₹ 10 each and is entitled to one vote per share.

TOTAL 861.40 127.88 In the event of liquidation of the corporation, the holders of equity shares will be entitled to receive the remaining assets of

the Company in proportion to the number of equity shares held.

A. Earmarked in favour of Statutory Authorities. 8.20 8.00

B. Pertains to IOC Shares Trust (Shareholder) has waived its right to receive the dividend w.e.f. March 2, 2020.

- Unpaid Dividend 48.29 44.56

Directors’ Report

C. Details of shareholders holdings more than 5% shares

- Fractional Share Warrants 0.02 0.02

C. There exists restrictions on banking transactions in Libya due to political unrest.

March 31, 2020 March 31, 2019

D. There exists restrictions on repatriation from bank account in Myanmar. Name of Shareholder

Number of Percentage of Number of Percentage of

shares held Holding shares held Holding

Discussion & Analysis

THE PRESIDENT OF INDIA 4848133178 51.50 4912149459 52.18

Management’s

Note - 13 : ASSETS HELD FOR SALE

OIL AND NATURAL GAS CORPORATION LIMITED 1337215256 14.20 1337215256 14.20

(₹ in Crore)

LIFE INSURANCE CORPORATION OF INDIA 610467282 6.48 612921292 6.51

Particulars Note March 31, 2020 March 31, 2019

OIL INDIA LIMITED 485590496 5.16 485590496 5.16

Freehold land A 1.56 1.65

Building 0.30 0.32

Responsibility Report

D. For the period of preceding five years as on the Balance Sheet date, the:

Plant and Equipment 235.11 224.81

Business

Office Equipment B 0.59 0.52 (a) Aggregate number and class of shares allotted as fully paid up pursuant to contract(s) without payment being

Nil

received in cash

Transport Equipment 0.02 0.08

(b) Aggregate number of shares allotted as fully paid up by way of bonus shares:

Furniture and Fixtures 0.03 0.02

- During FY 2016-17 (October 2016) in ratio of 1:1 2427952482

Corporate Governance

Total 237.61 227.40

- During FY 2017-18 (March 2018) in ratio of 1:1 4855904964

Report on

A. The Group has surplus land at various locations such as LPG Plant , Depots and RO’s etc. which is under the process of

disposal. The management intends to sell the land. No impairment was recognised on reclassification of land as held (c) Aggregate number and class of shares bought back - During FY 2018-19 (February 2019) 297651006

for sale as the Group expects that the fair value (estimated based on the recent market prices of similar properties in

similar locations) less costs to sell is higher than the carrying amount.

Financial Statements

B. Includes non current assets retired from active use earlier used in various segments and held for disposal through

Consolidated

tendering process within a year.

During the year, the Group has recognized impairment loss of ₹ 42.32 crore (2019: ₹ 150.36 crore) on write-down of asset

to fair value less costs to sell and the same has been shown in Provision/loss on Other Assets sold or written off under

‘Other Expenses’ in the Statement of Profit and Loss.

340 Financial Statements Financial Statements 341

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Project Work Accountancy 8Document1 pageProject Work Accountancy 8NikunjNo ratings yet

- Project Work Accountancy 22Document1 pageProject Work Accountancy 22NikunjNo ratings yet

- Project Work Accountancy 47Document1 pageProject Work Accountancy 47NikunjNo ratings yet

- Project Work Accountancy 52Document1 pageProject Work Accountancy 52NikunjNo ratings yet

- Project Work Accountancy 25Document1 pageProject Work Accountancy 25NikunjNo ratings yet

- Project Work Accountancy 7Document1 pageProject Work Accountancy 7NikunjNo ratings yet

- Project Work Accountancy 51Document1 pageProject Work Accountancy 51NikunjNo ratings yet

- Project Work Accountancy 46Document1 pageProject Work Accountancy 46NikunjNo ratings yet

- Project Work Accountancy 2Document1 pageProject Work Accountancy 2NikunjNo ratings yet

- Project Work Accountancy 6Document1 pageProject Work Accountancy 6NikunjNo ratings yet

- Project Work Accountancy 53Document1 pageProject Work Accountancy 53NikunjNo ratings yet

- Project Work Accountancy 24Document1 pageProject Work Accountancy 24NikunjNo ratings yet

- Project Work Accountancy 37Document1 pageProject Work Accountancy 37NikunjNo ratings yet

- Rich Dad Poor Dad 188Document1 pageRich Dad Poor Dad 188NikunjNo ratings yet

- Rich Dad Poor Dad 186Document1 pageRich Dad Poor Dad 186NikunjNo ratings yet

- Annual Report of IOCL 69Document1 pageAnnual Report of IOCL 69NikunjNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ICAI Handbook On Annual Return Under GSTDocument93 pagesICAI Handbook On Annual Return Under GSTManoj GNo ratings yet

- Deed of Sale of Motor Vehicle With Assumption of Mortgage 1Document3 pagesDeed of Sale of Motor Vehicle With Assumption of Mortgage 1Richelle TanNo ratings yet

- Garage Lease AgreementDocument3 pagesGarage Lease Agreementmckenzie.lynnn.91No ratings yet

- A Study On Financial Ratio Analysis of Tata MotorsDocument65 pagesA Study On Financial Ratio Analysis of Tata MotorsSaiprasad VasalaNo ratings yet

- ICAEW Advanced Level Corporate Reporting Study Manual Chapter Wise Interactive Questions With Immediate AnswersDocument191 pagesICAEW Advanced Level Corporate Reporting Study Manual Chapter Wise Interactive Questions With Immediate AnswersOptimal Management Solution100% (1)

- Book Value Per ShareDocument2 pagesBook Value Per ShareShe Rae PalmaNo ratings yet

- DRAFT 1. Executive Summary and IntroductionDocument12 pagesDRAFT 1. Executive Summary and IntroductionAllana NacinoNo ratings yet

- Solution Manual of Chapter 5 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C Brewer Pages DeletedDocument25 pagesSolution Manual of Chapter 5 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C Brewer Pages DeletedSkfNo ratings yet

- Intermediate 1A: Problem CompilationDocument24 pagesIntermediate 1A: Problem CompilationPatricia Nicole Barrios100% (4)

- ToolKit Roads&Highways Low-ResDocument896 pagesToolKit Roads&Highways Low-ResAbd Aziz MohamedNo ratings yet

- Đề thi thử Deloitte-ACE Intern 2021Document60 pagesĐề thi thử Deloitte-ACE Intern 2021Đặng Trần Huyền TrâmNo ratings yet

- Charrie Mae MDocument2 pagesCharrie Mae MRaymond GanNo ratings yet

- BSP C1135 Settlement of Electronic Payments Under NRPSDocument5 pagesBSP C1135 Settlement of Electronic Payments Under NRPSJoanna Robles-TanNo ratings yet

- The Foreign Exchange Market NoteDocument12 pagesThe Foreign Exchange Market Noteరఘువీర్ సూర్యనారాయణNo ratings yet

- Barings Bank CaseDocument15 pagesBarings Bank CaseRamya MattaNo ratings yet

- 8-6 PayrollDocument7 pages8-6 Payrollapi-341598565No ratings yet

- FINANCIAL ANALY-WPS OfficeDocument9 pagesFINANCIAL ANALY-WPS OfficeJoy PlacidoNo ratings yet

- Vitthal Mandir Audit ReportDocument4 pagesVitthal Mandir Audit ReportHindu Janajagruti SamitiNo ratings yet

- Depreciation, Impairments, and DepletionDocument41 pagesDepreciation, Impairments, and DepletionJofandio AlamsyahNo ratings yet

- No. Tipe Akun Kode Perkiraan NamaDocument6 pagesNo. Tipe Akun Kode Perkiraan Namapkm.sdjNo ratings yet

- Office of The State ComptrollerDocument4 pagesOffice of The State ComptrollerflippinamsterdamNo ratings yet

- Individual Account ApplicationDocument5 pagesIndividual Account ApplicationZaineb AbbadNo ratings yet

- What Is Decentralized Finance (DeFi)Document8 pagesWhat Is Decentralized Finance (DeFi)GodPacoNo ratings yet

- Workmen Emplyed in Associated Rubber Industries Limited Vs Associated Rubber IndustriesDocument21 pagesWorkmen Emplyed in Associated Rubber Industries Limited Vs Associated Rubber IndustriesShaishavi Kapshikar0% (1)

- Bitcoin To $1M, Ethereum To $180,000 by 2030 ARKDocument1 pageBitcoin To $1M, Ethereum To $180,000 by 2030 ARKOwen HalpertNo ratings yet

- Padma Oil Jamuna Oil Ratio AnalysisDocument17 pagesPadma Oil Jamuna Oil Ratio AnalysisMd.mamunur Rashid0% (2)

- Setup Task Lists FinancialsDocument23 pagesSetup Task Lists FinancialsWaseem TanauliNo ratings yet

- Berkenkotter vs. Cu Unjieng, Mabalacat Sugar, and Sheriff of Pampanga G.R. No. L-41643, July 31, 1935Document1 pageBerkenkotter vs. Cu Unjieng, Mabalacat Sugar, and Sheriff of Pampanga G.R. No. L-41643, July 31, 1935Edeniel CambarihanNo ratings yet

- LNT Grasim CaseDocument9 pagesLNT Grasim CaseRickMartinNo ratings yet

- IR Presentation: Mitsubishi UFJ Financial Group, IncDocument90 pagesIR Presentation: Mitsubishi UFJ Financial Group, IncyolandaNo ratings yet