Professional Documents

Culture Documents

ICCT Colleges Foundation, Inc.: Income Taxation - CBTAX01

Uploaded by

bbrightvc 一ไบร์ทOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ICCT Colleges Foundation, Inc.: Income Taxation - CBTAX01

Uploaded by

bbrightvc 一ไบร์ทCopyright:

Available Formats

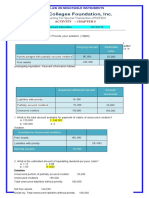

ICCT Colleges Foundation, Inc.

Income Taxation – CBTAX01

CHAPTER 1 – ACTIVITY /ASSIGNMENT

FUNDAMENTAL PRINCIPLES OF TAXATION

AL Vincent Miravalles TA190719

Direction: Answer the following questions/statements in not less than

5 sentences.

1. Explain the elements of sound system:

a) Fiscal adequacy means that the sources of revenue, taken as a whole, should be sufficient to

meet the expanding expenditures of the govern- ment regardless of business conditions, export

taxes, trade balances, and problems of economic adjustment. It means that the revenues should be

capable of expanding or contracting annually in response to variations of public expenditures.

The alternatives are to incur the risk of a series of deficits or surpluses due to inelastic revenues or

to adjust the amount of public expenditures and services to fit the flow of funds, probably by

curtailing expenditures for defense, education, or other activities so that the budget may be

balanced and the public credit maintained.

Examples of Fiscal adequacy in a sentence

Fiscal adequacy, which is one of the characteristics of a sound

tax system, requires that sources of revenues must be adequate to meet

government expenditures and their variations.

Fiscal adequacy is a fundamental requirement for a tax system

given the government’s need for revenue to ensure good governance.

A Fiscal Adequacy Fiscal adequacy refers to the ability of taxation law to finance Government

expenditure.

Fiscal adequacy is a fundamental requirement for a tax system given the Government’s need for

revenue to ensure good governance.As discussed above, tax

revenue provides a primary rationale for wine taxation.

Fiscal adequacy refers to the ability of taxation law to

finance government expenditure.

b) Theoretical justice or equity which means that the

tax burden should be proportionate to the taxpayer’s ability to pay (this is the so-called ability to

pay principle)

It means that taxes levied must be based upon the ability of the citizen to pay. Justice and equality

are vague terms . They are furthermore relative to popular concepts of justice which prevails at any time

and place.

Also includes distribution based on a third distributive rule, the special needs of individuals under

consideration for rewards, although few studies have included the study of

need (Schwinger, 1986). Justice motive theory states that the relations

among group members in the distribution and/or receipt of the rewards

determine which of these three basic rules or approaches to reward

distribution is used

c) Administrative feasibility This principle connotes that in a

successful tax system, such tax should be clear and plain to

taxpayers, capable of enforcement by an adequate and well-trained staff of public office,

convenient as to the time and manner of payment, and not unduly burdensome upon or

discouraging to business activity.

which means that the tax law should be capable of convenience, just and effective administration.

Administrative feasibility means tax laws and regulations must be capable of being effectively

enforced with the least inconvenience to the taxpayer. And theoretical justice means that a sound tax

system must be based on the taxpayers’ ability to pay.

Operating a policy must be within the administrative capability of the department or agency

involved. For instance, metering supplies requires a certain level of household visits, and billing staff. A

drive for conservation needs to be backed up by qualified staff to advise households, industries or farmers

on technology and improved water management and use. By

the same token, supply augmentation schemes are not the easy

option they may appear if they require intensive monitoring and

maintenance.

New policies will be worthless unless their

implementation is monitored and enforced. For instance, the

system of water transfer practised in some states of the USA

requires official approval for each transaction. The control of

water pollution implies regular monitoring and inspection, and a willingness to penalize the offenders.

Water pricing requires regular collection of revenue and a willingness to prosecute non-payers, coupled

with appropriate administrative arrangements for funds collected to be channelled back to the water

system.

2. What do you mean by Taxpayer’s suit? Give examples.

An action brought by an individual whose income is

subjected to charges imposed by the state or federal

government, for the benefit of that individual and others in

order to prevent the unlawful diversion of public funds.

In a taxpayer's suit, one is allowed to sue where there is an assertion that public funds are

illegally disbursed or deflected to an illegal purpose, or that there is a wastage of public funds

through the enforcement of an invalid or unconstitutional law. On the other hand, in a citizen's

suit, the person complaining must allege that he has been or is about to be denied some right or

privilege to which he is lawfully entitled or that he is about to be subjected to some burdens or

penalties by reason of the statute or act complained of (GR No. 183591, October 14, 2008).

A taxpayer's suit requires that the act being complained of directly involves the illegal

disbursement of public funds derived from taxation. To be sure, standing as a citizen has been

upheld by the Court in case where a petitioner is able to craft an issue of transcendental

importance or when paramount public interestis involved.

A citizen's suit is a rule whereby any Filipino citizen in representation of others, including

minors or generations yet unborn may file an action to enforce rights or obligations under

environmental laws.

For example, because every taxpayer of a town has an interest in the preservation of an

orderly government, many state laws grant individual taxpayers the right to sue town officers,

boards, or commissions to recover money that has been wrongfully spent.

You might also like

- How America was Tricked on Tax Policy: Secrets and Undisclosed PracticesFrom EverandHow America was Tricked on Tax Policy: Secrets and Undisclosed PracticesNo ratings yet

- ICCT Colleges Foundation, Inc.: - Activity / AssignmentDocument2 pagesICCT Colleges Foundation, Inc.: - Activity / AssignmentDamayan XeroxanNo ratings yet

- AssignmentDocument4 pagesAssignmentAmazon Virtual assistantNo ratings yet

- Idl 56974Document40 pagesIdl 56974Odhiambo JaredNo ratings yet

- Critical Review Paper On TaxDocument4 pagesCritical Review Paper On TaxShannia LouieNo ratings yet

- Taxation and Fiscal PoliciesDocument279 pagesTaxation and Fiscal PoliciesFun DietNo ratings yet

- Lesson 1 - 4Document12 pagesLesson 1 - 4visiontanzania2022No ratings yet

- Taxation Is The ProcessDocument7 pagesTaxation Is The ProcessJaneil FrancisNo ratings yet

- Business TaxDocument10 pagesBusiness Taxgelalata0816No ratings yet

- Aggregate Expenditure: Fundamentals of Taxation (Nature and Purpose)Document6 pagesAggregate Expenditure: Fundamentals of Taxation (Nature and Purpose)Riche ArdaNo ratings yet

- Taxation ActivityDocument7 pagesTaxation ActivityJohn Cedric Ybañez ParkNo ratings yet

- Micky Tax LawDocument39 pagesMicky Tax LawŤşinu MđNo ratings yet

- Tax Policy Guide: 6 Principles for Good DecisionsDocument4 pagesTax Policy Guide: 6 Principles for Good DecisionsFrancis ChikombolaNo ratings yet

- Accounting 9 AssignmentDocument5 pagesAccounting 9 AssignmentKhriza Joy SalvadorNo ratings yet

- Theory and Basis of Taxation: Lifeblood Principle and Benefit-Received ConceptDocument4 pagesTheory and Basis of Taxation: Lifeblood Principle and Benefit-Received ConceptJiyu50% (2)

- Jurnal Pajak 4Document20 pagesJurnal Pajak 4Fadli Mochamad KurniawanNo ratings yet

- Tax Theory and ManagementDocument18 pagesTax Theory and Managementomoding benjaminNo ratings yet

- Theory and Basis of TaxationDocument4 pagesTheory and Basis of TaxationJiyuNo ratings yet

- Tax System: KPMG's Questionable Tax Shelters Ethics CaseDocument15 pagesTax System: KPMG's Questionable Tax Shelters Ethics CaseWriting OnlineNo ratings yet

- Objectives and Principles of Taxation - GeeksforGeeksDocument5 pagesObjectives and Principles of Taxation - GeeksforGeeksLMRP2 LMRP2No ratings yet

- Using The Various System of Tax Orientation, Initiate A Theoretical Position On Which Tax System Is Best For Your OrganisationDocument10 pagesUsing The Various System of Tax Orientation, Initiate A Theoretical Position On Which Tax System Is Best For Your OrganisationIntroducing New SoundsNo ratings yet

- I. General Principles of Taxation A. Definition and Concept of TaxationDocument20 pagesI. General Principles of Taxation A. Definition and Concept of TaxationGabrielAblolaNo ratings yet

- Understanding the Importance and Implications of TaxationDocument2 pagesUnderstanding the Importance and Implications of TaxationexquisiteNo ratings yet

- Taxbites October 2013Document3 pagesTaxbites October 2013Regine May AbarquezNo ratings yet

- TaxationDocument15 pagesTaxationgyytgvyNo ratings yet

- PUBLIC FISCAL ADMINISTRATION - docxSUMDocument20 pagesPUBLIC FISCAL ADMINISTRATION - docxSUMRenalyn FortezaNo ratings yet

- Notes On TaxationDocument30 pagesNotes On TaxationBeyond PaperNo ratings yet

- Taxation Principles ExplainedDocument4 pagesTaxation Principles ExplainedJoyNo ratings yet

- San Beda Tax Reviewer 2012Document26 pagesSan Beda Tax Reviewer 2012Lenard Trinidad50% (2)

- Recoletos Law Center Pre-Week Notes in Taxation Law Bar Exam 2021Document23 pagesRecoletos Law Center Pre-Week Notes in Taxation Law Bar Exam 2021Daniel BrownNo ratings yet

- Taxation - Definition - IncometaxDocument6 pagesTaxation - Definition - IncometaxBianca BerdinNo ratings yet

- Eneral Rinciples OF Axation F P T: TaxationDocument7 pagesEneral Rinciples OF Axation F P T: TaxationMarconie Nacar100% (1)

- Taxation DiazDocument3 pagesTaxation DiazRyan DiazNo ratings yet

- Adam Smith's Canons of TaxationDocument23 pagesAdam Smith's Canons of TaxationPriscilla AdebolaNo ratings yet

- Tax Complience: Introduction and BackgroundDocument13 pagesTax Complience: Introduction and Backgroundally jumanneNo ratings yet

- $137 MILLION: Eneral Rinciples OF AxationDocument28 pages$137 MILLION: Eneral Rinciples OF AxationGABRIELLA ANDREA TRESVALLESNo ratings yet

- General Principles of TaxationDocument53 pagesGeneral Principles of TaxationGelai RojasNo ratings yet

- Fundamental Principles in TaxationDocument50 pagesFundamental Principles in TaxationKristine AllejeNo ratings yet

- DSSC Taxation Law Mid Term ModuleDocument77 pagesDSSC Taxation Law Mid Term ModuleJetroy DiazNo ratings yet

- DSSC Taxation Law Mid Term ModuleDocument77 pagesDSSC Taxation Law Mid Term ModuleNELLIE GRACE POTENTENo ratings yet

- Eneral Rinciples OF Axation F P T: TaxationDocument39 pagesEneral Rinciples OF Axation F P T: TaxationAiza CabenianNo ratings yet

- General Principles of TaxationDocument50 pagesGeneral Principles of TaxationKJ Vecino BontuyanNo ratings yet

- Fundamental Principles in TaxationDocument44 pagesFundamental Principles in TaxationIrish SedromeNo ratings yet

- Module 1 Taxation PrinciplesDocument15 pagesModule 1 Taxation PrinciplesmmhNo ratings yet

- A Short Discourse On The Present Philippine Tax System and Administration From A Law Student's PerspectiveDocument16 pagesA Short Discourse On The Present Philippine Tax System and Administration From A Law Student's Perspectivemaica_prudenteNo ratings yet

- Module 2 - CAT Level 3 (Material #1)Document4 pagesModule 2 - CAT Level 3 (Material #1)UFO CatcherNo ratings yet

- General Principles of TaxationDocument37 pagesGeneral Principles of TaxationWendy CassidyNo ratings yet

- Canons of TaxationDocument11 pagesCanons of Taxationgetahun tesfayeNo ratings yet

- General Principles of Taxation 2018Document112 pagesGeneral Principles of Taxation 2018Aleezah Gertrude RaymundoNo ratings yet

- Notes in Taxation I PDFDocument77 pagesNotes in Taxation I PDFMin ArumpacNo ratings yet

- E. Principles of A Sound Tax SystemDocument5 pagesE. Principles of A Sound Tax SystemdanieNo ratings yet

- ACT 205 - Tax Theory Practice - Lecture 1Document8 pagesACT 205 - Tax Theory Practice - Lecture 1Kaycia HyltonNo ratings yet

- Lecture One - Introduction To TaxationDocument49 pagesLecture One - Introduction To TaxationIbsa AbrahimNo ratings yet

- Bar NIEL Final TAX PrintDocument48 pagesBar NIEL Final TAX PrintNiel S. DefensorNo ratings yet

- Principles of TaxationDocument36 pagesPrinciples of TaxationyeyNo ratings yet

- General Principles of Taxation FundamentalsDocument43 pagesGeneral Principles of Taxation FundamentalsChristine Joy Rejas-TubianoNo ratings yet

- BAINCTAX Notes (REAL)Document2 pagesBAINCTAX Notes (REAL)Ashley BrevaNo ratings yet

- Chapter 4 - TaxationDocument34 pagesChapter 4 - TaxationGlaiza D VillenaNo ratings yet

- Day 2 SlidesDocument24 pagesDay 2 SlidesEyob MogesNo ratings yet

- DS 432Document10 pagesDS 432chris fwe fweNo ratings yet

- PBBM Now Free From Covid 19 Symptoms PhysicianDocument2 pagesPBBM Now Free From Covid 19 Symptoms Physicianbbrightvc 一ไบร์ทNo ratings yet

- FINANCIAL ACCOUNTING TOPICSDocument8 pagesFINANCIAL ACCOUNTING TOPICSbbrightvc 一ไบร์ทNo ratings yet

- Pampanga Logs 51 New COVID-19 CasesDocument2 pagesPampanga Logs 51 New COVID-19 Casesbbrightvc 一ไบร์ทNo ratings yet

- Metro Manila's New COVID-19 Cases Climb To 955Document1 pageMetro Manila's New COVID-19 Cases Climb To 955bbrightvc 一ไบร์ทNo ratings yet

- Senators Propose Measures To Boost Covid-19 Vax CampaignDocument2 pagesSenators Propose Measures To Boost Covid-19 Vax Campaignbbrightvc 一ไบร์ทNo ratings yet

- Fresh COVID Wave Sweeps Asia New Zealand Warns of Pressure On HospitalsDocument4 pagesFresh COVID Wave Sweeps Asia New Zealand Warns of Pressure On Hospitalsbbrightvc 一ไบร์ทNo ratings yet

- NCR COVID-19 Positivity Rate Up To 11.5% 1K Cases Expected Thursday - OCTADocument2 pagesNCR COVID-19 Positivity Rate Up To 11.5% 1K Cases Expected Thursday - OCTAbbrightvc 一ไบร์ทNo ratings yet

- Remulla Back To On-Site Work After Bout With Covid-19Document2 pagesRemulla Back To On-Site Work After Bout With Covid-19bbrightvc 一ไบร์ทNo ratings yet

- FDA Authorizes Novavax Covid-19 Vaccine For Emergency UseDocument3 pagesFDA Authorizes Novavax Covid-19 Vaccine For Emergency Usebbrightvc 一ไบร์ทNo ratings yet

- Olongapo City Posts 7 New COVID-19 CasesDocument2 pagesOlongapo City Posts 7 New COVID-19 Casesbbrightvc 一ไบร์ทNo ratings yet

- National COVID-19 Positivity Rate Now at 10.9% - OCTADocument2 pagesNational COVID-19 Positivity Rate Now at 10.9% - OCTAbbrightvc 一ไบร์ทNo ratings yet

- South Africa To Resume Covid-19 Grants After Millions Go UnpaidDocument1 pageSouth Africa To Resume Covid-19 Grants After Millions Go Unpaidbbrightvc 一ไบร์ทNo ratings yet

- COVID19 Sore Throat Now The Most Common Coronavirus Symptom, Data SuggestsDocument3 pagesCOVID19 Sore Throat Now The Most Common Coronavirus Symptom, Data Suggestsbbrightvc 一ไบร์ทNo ratings yet

- Netherlands Latest Country To Detect COVID-19 Centaurus SubvariantDocument3 pagesNetherlands Latest Country To Detect COVID-19 Centaurus Subvariantbbrightvc 一ไบร์ทNo ratings yet

- ICCT Colleges Foundation, Inc.: Directions: Show Your Solution On POST TEST 8 in Good FormDocument3 pagesICCT Colleges Foundation, Inc.: Directions: Show Your Solution On POST TEST 8 in Good Formbbrightvc 一ไบร์ทNo ratings yet

- (Done) Activity-Chapter 9Document3 pages(Done) Activity-Chapter 9bbrightvc 一ไบร์ทNo ratings yet

- COVID-19 Active Infections Jump To 16,244, After 2,371 New CasesDocument2 pagesCOVID-19 Active Infections Jump To 16,244, After 2,371 New Casesbbrightvc 一ไบร์ทNo ratings yet

- Palace Welcomes Improved Covid-19 Recovery Index RankingDocument3 pagesPalace Welcomes Improved Covid-19 Recovery Index Rankingbbrightvc 一ไบร์ทNo ratings yet

- US To Lift COVID Testing Requirement For Air Travelers Entering CountryDocument3 pagesUS To Lift COVID Testing Requirement For Air Travelers Entering Countrybbrightvc 一ไบร์ทNo ratings yet

- This Study Resource Was: Miscellaneous TopicsDocument2 pagesThis Study Resource Was: Miscellaneous Topicsbbrightvc 一ไบร์ทNo ratings yet

- ICCT Colleges Foundation, Inc.: Profe01-Accounting For Special TransactionsDocument1 pageICCT Colleges Foundation, Inc.: Profe01-Accounting For Special Transactionsbbrightvc 一ไบร์ทNo ratings yet

- Innuendo Bingo Returning To Radio 1 After Covid ShutdownDocument4 pagesInnuendo Bingo Returning To Radio 1 After Covid Shutdownbbrightvc 一ไบร์ทNo ratings yet

- Maharashtra COVID Updates 3,081 News Cases Recorded in A Day Mumbai Reports 1Document3 pagesMaharashtra COVID Updates 3,081 News Cases Recorded in A Day Mumbai Reports 1bbrightvc 一ไบร์ทNo ratings yet

- Types of Major Accounts QuizDocument6 pagesTypes of Major Accounts Quizbbrightvc 一ไบร์ทNo ratings yet

- Ontario Records Steep Week-Over-Week Decline in COVID Hospitalizations As SciencDocument3 pagesOntario Records Steep Week-Over-Week Decline in COVID Hospitalizations As Sciencbbrightvc 一ไบร์ทNo ratings yet

- ICCT Colleges Foundation, Inc.: Profe01-Accounting For Special TransactionsDocument2 pagesICCT Colleges Foundation, Inc.: Profe01-Accounting For Special Transactionsbbrightvc 一ไบร์ทNo ratings yet

- ICCT Colleges Foundation, Inc.: Profe01-Accounting For Special TransactionsDocument1 pageICCT Colleges Foundation, Inc.: Profe01-Accounting For Special Transactionsbbrightvc 一ไบร์ทNo ratings yet

- Accounting for Partnership Contributions and AdjustmentsDocument3 pagesAccounting for Partnership Contributions and Adjustmentsbbrightvc 一ไบร์ทNo ratings yet

- China Calls COVID 'Lab Leak' Theory A Lie After WHO ReportDocument3 pagesChina Calls COVID 'Lab Leak' Theory A Lie After WHO Reportbbrightvc 一ไบร์ทNo ratings yet

- ICCT Colleges Foundation, Inc.: Accounting For Special Transaction-PROFE01Document2 pagesICCT Colleges Foundation, Inc.: Accounting For Special Transaction-PROFE01bbrightvc 一ไบร์ทNo ratings yet

- Analisis Faktor-Faktor Yang Memotivasi Manajemen PerusahaanDocument16 pagesAnalisis Faktor-Faktor Yang Memotivasi Manajemen PerusahaanFernandus gultomNo ratings yet

- Taxation Concepts, Principles and AdministrationDocument5 pagesTaxation Concepts, Principles and AdministrationJayen0% (1)

- CAF-06 RISE Tax Complete Book by Sir Adnan RaufDocument417 pagesCAF-06 RISE Tax Complete Book by Sir Adnan RaufSaim KhanNo ratings yet

- Income Tax ProblemsDocument6 pagesIncome Tax Problemskristian eldric BondocNo ratings yet

- U.S. Individual Income Tax Return: (See Instructions.)Document2 pagesU.S. Individual Income Tax Return: (See Instructions.)Daniel RamirezNo ratings yet

- Employer: 1. Introduction To PAYEDocument16 pagesEmployer: 1. Introduction To PAYELindaBakóNo ratings yet

- Rakeshreceipt BU 2223 2208 2Document2 pagesRakeshreceipt BU 2223 2208 2Aman MahatoNo ratings yet

- Hyderabad Electric Supply Company bill detailsDocument2 pagesHyderabad Electric Supply Company bill detailsaurang zaibNo ratings yet

- Preliminary Assessment NoticeDocument3 pagesPreliminary Assessment NoticeHanabishi RekkaNo ratings yet

- TAX INVOICE Unique Glass 30janDocument1 pageTAX INVOICE Unique Glass 30janRupam SahaNo ratings yet

- Annex-7-Barangay-Financial-Report CARUANDocument2 pagesAnnex-7-Barangay-Financial-Report CARUANRomulo Sierra Jr.100% (1)

- RITA 32 Form-Quarterly TaxDocument2 pagesRITA 32 Form-Quarterly Taxjtu3834No ratings yet

- Philippine Bank of Communications Vs Commissioner of Internal RevenueDocument2 pagesPhilippine Bank of Communications Vs Commissioner of Internal RevenueNFNL100% (1)

- CBDT E-Payment Request FormDocument1 pageCBDT E-Payment Request FormAlicia Barnes67% (21)

- New Income Tax Calculator for Old & New Tax Regime for Salaried EmployeeDocument4 pagesNew Income Tax Calculator for Old & New Tax Regime for Salaried EmployeeKiran KumarNo ratings yet

- COD delivery of music posterDocument11 pagesCOD delivery of music postertalwar.lucky@gmail.comNo ratings yet

- ACC 143 Quiz 2Document9 pagesACC 143 Quiz 2Riezel PepitoNo ratings yet

- SLU property and reproduction restrictionsDocument16 pagesSLU property and reproduction restrictionsAllaine ParkerNo ratings yet

- Value Added Tax Definition Examples InvestopediaDocument7 pagesValue Added Tax Definition Examples InvestopediaZicoNo ratings yet

- Td1 Fill 23eDocument2 pagesTd1 Fill 23eCornelius AgbogunNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearFMG PATELNo ratings yet

- InvoiceDocument1 pageInvoicelakhan jethaniNo ratings yet

- Minimum Corporate Income Tax (MCIT) Improperly Accumulated Earnings Tax (IAET) Gross Income Tax (GIT)Document18 pagesMinimum Corporate Income Tax (MCIT) Improperly Accumulated Earnings Tax (IAET) Gross Income Tax (GIT)Anne Mel Bariquit100% (1)

- Privatization: Excerpt From The Book, Whither Socialism? by Joseph StiglitzDocument19 pagesPrivatization: Excerpt From The Book, Whither Socialism? by Joseph StiglitzEconomy of Pakistan100% (1)

- Template Perhitungan Pajak THRDocument1 pageTemplate Perhitungan Pajak THRtangjinhuaNo ratings yet

- Form No.16: Page 1 of 2 (SAHTRUGHAN SINGH TOMAR - Asst. Yr.: 2020-2021)Document2 pagesForm No.16: Page 1 of 2 (SAHTRUGHAN SINGH TOMAR - Asst. Yr.: 2020-2021)Ankit SijariyaNo ratings yet

- Chasity D EnglishDocument7 pagesChasity D EnglishbpspillkillNo ratings yet

- Fillable Bir Form 1701 2013 Version FillableDocument12 pagesFillable Bir Form 1701 2013 Version FillableCJNo ratings yet

- 650 Chap002 Fa14Document66 pages650 Chap002 Fa14MaywellNo ratings yet

- Proforma Invoice: No-61, Om Sakthi Nagar, Madagadipet, Gstin/Uin: 34ABBFM1856E1ZK State Name: Puducherry, Code: 34Document1 pageProforma Invoice: No-61, Om Sakthi Nagar, Madagadipet, Gstin/Uin: 34ABBFM1856E1ZK State Name: Puducherry, Code: 34surajdoraNo ratings yet