Professional Documents

Culture Documents

Exercises On Foreign Exchange Translation - Foreign To Functional (Questionnaire)

Uploaded by

Becky Gonzaga0 ratings0% found this document useful (0 votes)

6 views3 pagesOriginal Title

9. Exercises on Foreign Exchange Translation - Foreign to Functional (Questionnaire)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views3 pagesExercises On Foreign Exchange Translation - Foreign To Functional (Questionnaire)

Uploaded by

Becky GonzagaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

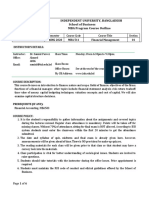

BA 118.

2 Advanced Accounting II

Second Semester, A.Y. 2021-2022

Illustrative Examples – Foreign Exchange Translation (Foreign to Functional)

Black Panther Corp. (BPC) is a subsidiary of a US-based company, The Avengers. BPC is domiciled in the hidden

and technologically advanced kingdom of Wakanda. Their currency is Wakandan Vibranium Dollar (WVD).

The following information refers to BPC’s operations in Wakanda:

1. The US Dollar is determined to be the functional currency. BPC’s books are in WVD.

2. The parent company acquired BPC on January 1, 20X1.

3. BPC began operations on January 1, 20X0.

4. Sales to parent company are billed in WVD, and all receivables from parent have been collected except

for the amount shown in the account “Due from Parent”. All other sales are billed in WVD as well.

5. Inventory is recorded at its market value of WVD30,000. Its historical cost is WVD32,000. The

historical cost of sales is based on first-in, first-out (FIFO) cost flow assumption. Ending inventory

consists of the following:

a. WVD10,000 acquired on October 1, 20X1

b. WVD22,000 acquired on November 1, 20X1

6. The prepaid insurance represents prepayments that were acquired on October 1, 20X1.

7. The depreciable assets, with 10-year useful lives, were acquired as follows:

a. WVD80,000 acquired on January 1, 20X0*

b. WVD60,000 acquired on July 1, 20X1

*WVD20,000 of these assets were sold on July 1, 20X1 for US$19,760.

8. The cost of sales consists of the following purchases:

a. WVD20,000 acquired on December 1, 20X0

b. WVD60,000 acquired on March 1, 20X1

c. WVD80,000 acquired on July 1, 20X1

d. WVD20,000 acquired on October 1, 20X1

9. The “Other expenses” account includes WVD3,000 of insurance expense that was originally prepaid on

October 1, 20X1. The balance of other expenses was incurred uniformly throughout the year.

10. The land and the related mortgage were acquired on March 1, 20X1.

11. The relevant exchange rates were as follows (WVD1.00 = $XX):

January 1, 20X0 $0.980 July 1, 20X1 $1.040

July 1, 20X0 $1.010 October 1, 20X1 $1.045

December 1, 20X0 $0.990 November 1, 20X1 $1.043

January 1, 20X1 $1.000 December 31, 20X1 $1.050

March 1, 20X1 $1.015 20X1 average $1.030

Account Title In WVD Relevant Exchange Rate In USD

Cash 10,000

Accounts receivable 21,000

Allowance for doubtful accounts (1,000)

Due from Parent 14,000

Inventory (at market) 30,000

Prepaid insurance 3,000

Land 18,000

Depreciable assets 120,000

Accumulated depreciation (15,000)

Cost of goods sold 180,000

Depreciation expense 10,000

Income tax expense 30,000

Other expenses 23,000

Total 443,000

Accounts payable 20,000

Taxes payable 30,000

Accrued interest payable 1,000

Mortgage payable – land 10,000

Common stock 80,000

Retained earnings 20,000

Sales 280,000

Gain on sale of depreciable assets 2,000

Total 443,000

Required: Prepare the USD financial statements of Black Panther Co.

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- BA 116 / 1 Semester, AY 2013-2014 Activity-Based Costing (ABC) Systems: Handout #7Document2 pagesBA 116 / 1 Semester, AY 2013-2014 Activity-Based Costing (ABC) Systems: Handout #7Becky GonzagaNo ratings yet

- University Job Fair 2023: Partnership ProposalDocument17 pagesUniversity Job Fair 2023: Partnership ProposalBecky GonzagaNo ratings yet

- 00 Quick Notes On Income TaxDocument11 pages00 Quick Notes On Income TaxBecky GonzagaNo ratings yet

- DividendsDocument3 pagesDividendsBecky GonzagaNo ratings yet

- Audit of Cash and Cash Equivalents BA 123 Exercise Set: Kevin Durant (Petty Cash)Document10 pagesAudit of Cash and Cash Equivalents BA 123 Exercise Set: Kevin Durant (Petty Cash)Becky GonzagaNo ratings yet

- Audit of Inventories and Trade Payables BA 123 Exercise Set BDocument6 pagesAudit of Inventories and Trade Payables BA 123 Exercise Set BBecky GonzagaNo ratings yet

- BA 123 2 Sem AY 22-23 (Aratea/Magana/Placido)Document42 pagesBA 123 2 Sem AY 22-23 (Aratea/Magana/Placido)Becky GonzagaNo ratings yet

- BA 123 2 Sem AY 22-23 (Aratea/Magana/Placido)Document146 pagesBA 123 2 Sem AY 22-23 (Aratea/Magana/Placido)Becky GonzagaNo ratings yet

- BA 123 2 Sem AY 22-23 (Aratea/Magana/Placido)Document51 pagesBA 123 2 Sem AY 22-23 (Aratea/Magana/Placido)Becky GonzagaNo ratings yet

- Brandstorm 2023 Mission DocumentDocument23 pagesBrandstorm 2023 Mission DocumentBecky GonzagaNo ratings yet

- Audit of Revenue and Receipts Cycle BA 123 Exercise Set 1: Problem 1: ABC COMPANY (Sales Cutoff Test)Document3 pagesAudit of Revenue and Receipts Cycle BA 123 Exercise Set 1: Problem 1: ABC COMPANY (Sales Cutoff Test)Becky GonzagaNo ratings yet

- 00 Quick Notes On Expenditure and Disbursements Cycle & Correction of Errors PDFDocument4 pages00 Quick Notes On Expenditure and Disbursements Cycle & Correction of Errors PDFBecky GonzagaNo ratings yet

- VIA 2021 PR For OrganizationDocument7 pagesVIA 2021 PR For OrganizationBecky GonzagaNo ratings yet

- IAS 21 Effects of Changes in Foreign Exchange RatesDocument10 pagesIAS 21 Effects of Changes in Foreign Exchange RatesBecky GonzagaNo ratings yet

- 00 Quick Notes - Revenue and Receipt Cycle PDFDocument5 pages00 Quick Notes - Revenue and Receipt Cycle PDFBecky GonzagaNo ratings yet

- 03.5 Correction On Problem 3Document6 pages03.5 Correction On Problem 3Becky GonzagaNo ratings yet

- 00 Quick Notes - Cash and Cash Equivalents PDFDocument6 pages00 Quick Notes - Cash and Cash Equivalents PDFBecky GonzagaNo ratings yet

- (Make/Buy, Drop/Continue, Special Order, Sell at Split-Off/process FurtherDocument17 pages(Make/Buy, Drop/Continue, Special Order, Sell at Split-Off/process FurtherBecky GonzagaNo ratings yet

- DocxDocument5 pagesDocxBecky GonzagaNo ratings yet

- Quiz Accounting For VHWO Ver. 7Document9 pagesQuiz Accounting For VHWO Ver. 7Becky GonzagaNo ratings yet

- CSupport 2.0 Partnership Letter For OrgsDocument4 pagesCSupport 2.0 Partnership Letter For OrgsBecky GonzagaNo ratings yet

- 02a Creating - An - Investment - Policy - StatementDocument16 pages02a Creating - An - Investment - Policy - StatementBecky GonzagaNo ratings yet

- TechEx 2021 Partnership ProposalDocument9 pagesTechEx 2021 Partnership ProposalBecky GonzagaNo ratings yet

- Purok Mangingisda: Project Punta GraciaDocument3 pagesPurok Mangingisda: Project Punta GraciaBecky GonzagaNo ratings yet

- Empty Bubbles The Case of The Missing Tablets PreviewDocument7 pagesEmpty Bubbles The Case of The Missing Tablets PreviewBecky GonzagaNo ratings yet

- Society of The Philippines - Mapua Student Chapter (EASTS-TSSP-MSC) !Document2 pagesSociety of The Philippines - Mapua Student Chapter (EASTS-TSSP-MSC) !Becky GonzagaNo ratings yet

- Project Primer: Punta GraciaDocument12 pagesProject Primer: Punta GraciaBecky GonzagaNo ratings yet

- Society of The Philippines - Mapua Student Chapter (EASTS-TSSP-MSC) !Document2 pagesSociety of The Philippines - Mapua Student Chapter (EASTS-TSSP-MSC) !Becky GonzagaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Introduction To Transforming MT103, MT202 Messages To Payment OrderDocument3 pagesIntroduction To Transforming MT103, MT202 Messages To Payment OrderRiahiNo ratings yet

- NIOS Class 12 ACC Most Important QuestionDocument8 pagesNIOS Class 12 ACC Most Important QuestionKaushil SolankiNo ratings yet

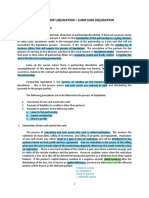

- IM-PARTNERSHIP LUMP SUM LIQUIDATION With ExercisesDocument16 pagesIM-PARTNERSHIP LUMP SUM LIQUIDATION With ExercisesAisea Juliana VillanuevaNo ratings yet

- Corp Fin Test 2 PDFDocument9 pagesCorp Fin Test 2 PDFT Surya Kandhaswamy100% (2)

- Capital Budgeting Can Be Defined Finance EssayDocument4 pagesCapital Budgeting Can Be Defined Finance EssayHND Assignment HelpNo ratings yet

- Value Investing in Private Credit (Trivedi, Glazek) SP2022Document6 pagesValue Investing in Private Credit (Trivedi, Glazek) SP2022Rui Isaac FernandoNo ratings yet

- Deduction Allowed and Not Allowed Under The Head Income From Business PDFDocument6 pagesDeduction Allowed and Not Allowed Under The Head Income From Business PDFMuhammad sheran sattiNo ratings yet

- Open-End vs. Closed-End Real Estate and Infrastructure FundsDocument6 pagesOpen-End vs. Closed-End Real Estate and Infrastructure FundsЗолоNo ratings yet

- Financial Statement Analysis Probs On Funds Flow Analysis PDFDocument15 pagesFinancial Statement Analysis Probs On Funds Flow Analysis PDFSAITEJA ANUGULANo ratings yet

- Lahore School of Economics Financial Management II The Basics of Capital Budgeting - 1Document3 pagesLahore School of Economics Financial Management II The Basics of Capital Budgeting - 1Daniyal AliNo ratings yet

- Far 3: Shareholder'S Equity: Shareholder's Equity Book Value Per Share Earnings Per Share Share-Based PaymentsDocument6 pagesFar 3: Shareholder'S Equity: Shareholder's Equity Book Value Per Share Earnings Per Share Share-Based PaymentsZech PackNo ratings yet

- Assigment IiDocument18 pagesAssigment IiIsuu JobsNo ratings yet

- HDTX - Audit Report 2018 PDFDocument85 pagesHDTX - Audit Report 2018 PDFFajar PambudiNo ratings yet

- Fabm2 Module 3Document18 pagesFabm2 Module 3Rea Mariz Jordan50% (2)

- Accounting IAS Model Answers Series 2 2009Document14 pagesAccounting IAS Model Answers Series 2 2009Aung Zaw HtweNo ratings yet

- December 2021 Financial Acocunting and Reporting UK GAAPDocument11 pagesDecember 2021 Financial Acocunting and Reporting UK GAAPChoo LeeNo ratings yet

- Corporate Finance 1 & 2 - Prof Krishnan - Course OutlineDocument3 pagesCorporate Finance 1 & 2 - Prof Krishnan - Course OutlineAbhishek JainNo ratings yet

- FMI PresentationDocument21 pagesFMI PresentationUNNATI SHUKLANo ratings yet

- Finance For Non Financial Managers 7th Edition Bergeron Solutions ManualDocument9 pagesFinance For Non Financial Managers 7th Edition Bergeron Solutions ManualAzaliaSanchezNo ratings yet

- A Study On Working Capital Management With Special ReferenceDocument97 pagesA Study On Working Capital Management With Special ReferencePrem KumarNo ratings yet

- AA (F8) - Test (Part I + Part II) - F8 - SolutionDocument12 pagesAA (F8) - Test (Part I + Part II) - F8 - SolutionPham Cam Anh QP0146No ratings yet

- 6-Final AccountsDocument43 pages6-Final AccountsPriya RanjanNo ratings yet

- List of Financial RatiosDocument9 pagesList of Financial RatiosPrinces Aliesa BulanadiNo ratings yet

- Study Guide RCCPDocument31 pagesStudy Guide RCCPtineNo ratings yet

- CH 3Document44 pagesCH 3alfi100% (1)

- Mba511 Spring 2020Document6 pagesMba511 Spring 2020Kazi MostakimNo ratings yet

- IAS 36 Impairment of AssetsDocument45 pagesIAS 36 Impairment of AssetsvidiNo ratings yet

- Penguin Corporation Acquired 80 Percent of The Outstanding Voting StockDocument1 pagePenguin Corporation Acquired 80 Percent of The Outstanding Voting Stocktrilocksp SinghNo ratings yet

- Estatement - 2022 09 19Document2 pagesEstatement - 2022 09 19Ishvinder SinghNo ratings yet

- Financial Institution & Investment Management - Final ExamDocument5 pagesFinancial Institution & Investment Management - Final Exambereket nigussie100% (4)