Professional Documents

Culture Documents

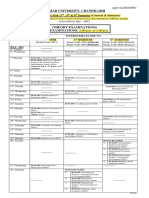

SAPM

SAPM

Uploaded by

Sumit Sharma0 ratings0% found this document useful (0 votes)

6 views22 pagesInvestment

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInvestment

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views22 pagesSAPM

SAPM

Uploaded by

Sumit SharmaInvestment

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 22

stor

_ What is investment management?

- Discuss the features of a good invest

. What is investment process?

| What are the main elements of inve:

. Write a short note on need for in

|. Differentiate investments from savi

. Investment vs. Speculation.

Long Answer Type Questions

1. Whatis meantby investment manag

in the process of investment mai

2. Discuss the features of an invest

should an investor follow to make ar

3. Define investment. Discuss the

vestment.

. Differentiate between ‘investment’

they differ from gambling?

. What are the different concepts of ir

detail.

. “Investment is a carefully planned sp

»MPANIES

6,000 5% Cumulative Preference Shares \ SS 0

DPT- Py. a

: fing oceSS: And, how itis dior.

Dine “Speculation ang Gambling, give its Comparative differ- yard

(Marks 15)

(Marks 5)

(r

investment is different from speculation? (Marks 5)

@ steps

t steps

; of in-

jow do

uss in

ight of

tment

ibling-

=

lation.

rks 5)

est

e 15)

ion.

fe 5)

it

nt a

aw

pe SAVING schemes?

in mutual funds?

ataeceter textes <9,

ions ae aside to ae: 1

rates “9,

«al

fd

Investment Philos

Ss

and Strategy PY

Vee

Examination Style Questions .-

4. Define investment strategy.

2. What is investment philosophy?

3. What do you mean by growth investing?

4. Explain value investing.

5. Give importance of investment philosophy.

6. What is blended investing?

7. What is the difference between value and growth investing?

8. What are the ingredients of an investment philosophy?

9. What do you known about individual investors?

10. Write a note on institutional investors.

11. Why do you need of an investment strategy?

12. How an investment strategy is designed?

13. What do you mean by aggressive investment strategy?

1. What do you mean by value investing? Give its merts anc

demerits.

2. Discuss in detail two basic investment philosophies. Also

discuss difference between them.

3. Define growth investing. What factors to be considered ©

growth investing?

4. What is value investing? What are the factor influencing vue

investing? ;

5. What do you mean by investment management? Discuss in

detail the strategies of individual and institutional investors.

6. Discuss in detail three basic investment strategies. Aiso SSS

difference between the three. re

7. What are the different types of investors? Explain their DS

tives and constraints.

Stich.

[8] What do you understand by investment st'=!

factors should be considered whie adopting © 82°:

284

inguish between ‘Systematic risk and unsystem

atic risk.

(Marks 5)

er the return, higher will be the risk." In this context, dis-

various risks associated with an asset. (Marks 15)

ed?

he risk and

yer CAPM?

sure risk?

nvolved in

jonship 's

rity Analysis 4

Fundamental Ay, Anat is indus

Alyy \p ® analyst.

ly 0 How compan

10° secision?

:: Examination Style Questions .. ane =

hort Answer Type Questions * analysis

Write a short note on economic analysis. 4p. Discuss var

Write a note on gross domestic product. es :

What is industry analysis? er ps

What do you mean by fundamental analysis?

What is company analysis?

What are the objectives of fundamental analysis?

What is the need of fundamental analysis?

Write short note on industry classification.

. Describe non-financial indicators.

10. Give characteristics of industry analysis.

41. What is income statement?

12. Write a short note on the need of company analysis

43. What do you mean by intrinsic value?

Long Answer Type Questions

1. Explain the significance of economic analysis. What are

key economic factors which are looked upon whil

economic analysis?

a Describe indicators approach to economic analysis. Ex

how different indicators are studied to gauge the direct’

the market.

3. What are the components of fundamental analysis?

investment manager how would you carry out the funda”

analysis?

4. Whatare the various ndamen?

analysis? strengths and weaknesses of fu!

How is ful 4 ‘i

ae undamental analysis useful to a prospective '"

ss in detail three phases lysis.

Explain what is coy of fundamental an2ty a

mpany analysis in the context of 15. ns |

planning. What i :

analysis? important factors should be conside"®?'

8. What is the need of ji

how would you carry

©@NODEON=

oo

Industry analysis? As a financial arr

Out the industry analysis?

288

referers 4.90.

Ww

yaad

erve

DPT-PU-4

Security Analysis & Portfolio Mgt

0 the securtty

: 9. Whatis industry ite cycle? Bring out its relevance t

, analyst,

e investment

10. How company analysis helps in making an effective inv

decision?

f company

11. Define company analysis. Also explain the scope of

analysis.

the finan-

2016 MAY.{4] What are the methods adopted to.

2016 MAYS] How does the Technical Analysis differ from funda

mental analysis ? (Marks 15)

BME, What i is meant by Technical Analysis? ao oes

differ from fundamental analysis? We 3

(61 Ditierentizt és a Discuss the types of candles. arks 2

Differentiate between fundamental analysis and wena anal 24

290

+e

security Analysis & 5

gO) Discuss the concep o :

techniques na

got? MAY.[10) What

es technical analysis

g

G

it be

ations

COMPANIES

o

| THON OF

\

: Examination Style Quest

ee re Gucstera

4. What do you mean by portfolio management?

2 What do you understand by portfolio management scheme?

a What is diversification?

4. What is portfolio construction?

5. What do you mean by the term portfolio? Give examples

6. Give types of portfolio management scheme.

Ty tions

a os 4. Whatare the steps involved in traditional approach to portfolio

eee construction?

5,000. 2. Discuss the concept of portfolio. Also discuss how correlation

can maximize retum and minimize risk for a portfolio.

3. Define diversification. Also give merits of diversification.

4. Whatdo you mean by portfolio management scheme? Discuss

various factors to be considered before choosing a portfolio

management scheme.

5. What do you understand by portfolio management? Explain

its objectives.

2016 MAY.[1](d) What is risk management ? (Marks 5)

[6] What do you understand by portfolio management? Discuss its

need and advantages. (Marks 15)

2017 MAY.{5] What is meant by Portfolio management?(Marks 5)

AIS MATE) State the explain the concept of Portfolio ener

(Marks

tan What fase the elements of Portfolio Management ? What a

factors that a portfolio manager should keep in mind while

aay , (Marks 15)

292

OOND MEYONS

o

aN

ome?

; n which the Modern Portfolio Theory

iat is Sharpe enue Index Moder?

Olip Optimum porttolio is developed under Sharpe Model?

rtfolio e advantages of single index modo

lation Application of Modern Portfolio Theory to non-financial assets.

Questions

you think that the effect of a combination of securities can

BCUSS g about a balanced portfolio? Discuss.

folio Discuss in detail Markowitz theory of portfolio analysis

ee “What is modern portfolio theory? What are its assumptions

conclusions?

Sod 4. fe Sharpe's Model an improvement over Markowitz Portfolio

f Discuss in detail. Pea

i i 's Single In

ks 5) 5. Discuss in detail Sharpe : ease otto theory given by

ss its 6. Discuss the main pitfalls of

s 15) Markowitz. 4 d Modern Portfolio Theory:

ks 5) eerentete ee Model? What are its assumptions and

age- B. What is Sharpe's Index

8. 7 sea 3

«s 5) * conclusions is an improverent oVOr Marton

t are ¥ harpe’s model is a (Marks

pile 2019 MAY.{12) S pe

, 15) del. Discuss.

ar

pron en Funan

emi 1260 7 :

°F 5000 a oars

Examination Style Questions

‘Short Answer Type Questions

4. Define efficient

ee market,

Ficing 2. What do you understand by si

Marist Theory? y Semi-strong form of Efficient

; rs Explain randomness of the market.

4, Describe random walk and its applicat

5, What are the thr viel othe

rece cs forms of market efficiency?

: re the relationship betwe

= ee en random walk and efficient

wer Type Questions

4. What is Random Wak Theory? What are its assumptions?

nd CAPM. 2. Whatare the techniques ‘of testing the various forms of Efficient

odel. Also Market Theory?

3. What is Efficient Market Theory? Explain its implications?

ion on the 4. Explain the type of tests that are ‘commonly employed to verity

the weak form of efficient market hypothesis,

- empirical 6. What are the different forms of market efficiency? How does

efficient market hypothesis help in investment decisions?

2 equation

cations On

=

(Marks 5)

odel.

marks 12)

‘mars 15)

(Marks ©)

ind isa”

it tine ae

yarks 15)

ng Mote

marks 1°) 295

Portfolio Perform

> Evaluation and Revision

ityle Questions ::

estions

do you mean by performance plan?

portfolio revision? ©

Q ne portfolio performance evaluation.

en i. Name any three methods of evaluating portfolio performance.

___ 5. What is Sharpe's performance measure for portfolios?

6. Discuss formula plan.

7. What do you mean by Rupee Cost Averaging?

What do you mean by constant plan?

. Explain Variable Ratio Plan.

lestions

1. Discuss in detail various models for portfolio performance

measurement.

2. What is the essential difference between the Sharpe and

Treynor indexes of portfolio performance?

3. What are the objectives of portfolio revision? Explain different

approaches to portfolio revision.

4. Discuss in detail various formula plans. Also discuss its imi-

tations.

5. What do you understand by portfolio revision? What are its

6.

ke

8.

9.

constraints? Explain.

. Discuss Jensen's Differential Return Model in detail.

. Write a note on portfolio performance evaluation.

. Discuss in detail Sharpe’s and Treyner's measures of portiolio

performance.

|. What is Rupee Value Plan? Also discuss its disadvantages.

10. Explain value averaging. Comparison between value averaai"9

and rupee cost averaging.

2016 MAY.(1](e) What is portfolio evaluation ? (Maris 9)

_{7| Discuss the Jensen and Treynor Model. (Marks

or Model.

11]/Explain in-dstall the Wengen and Treynes oy

a Me

Java FO pre

dis: pant 90.000 (on ow

oS Tener? 19,000 Z a4

sa a0 Tal

dtd

IS & Portfolio Mgt. DPT -PU-4

is the need of Portfolio €valuation? How is it revised?

(Marks 15)

1] What do you mean by portfolio management ? Dis-

ANCE

and

erent

fimi-

re its

detail portfolio revision techniques. (Marks 15)

do you mean by portfolio evaluation ? Discuss the meth-

portfolio performance evaluation in detail by distinguishing

Sharpe and Treynor model. (Marks 15)

i ion is needed ?

5] Why portfolio performance evaluation is aa a

Global Investing

# Examination Style Questions ::

Short Answer Type Questions

What is global investing?

What are the risks involved in global investing?

What do you mean by depository receipts?

What is the difference between ADR and GDR?

Define global mutual funds.

Explain process of issuing a depository receipt.

Explain any two challenges faced in international investing

Define foreign currency convertible bonds.

Explain Eurobonds.

Long Answer Type Questions

1. Whatis global investing? What are the various options avai

for global investing?

. What are the benefits of investing internationally? Also cis:

the risks involved in the same.

. What are the challenges that an investor faces while div

his portfolio internationally?

. Define Depository Receipts. What are the advantages

offered by the depository receipts to the issuer an

investor?

5. What do you mean by global mutual funds? Explain the

for investing in global mutual funds.

6. Define ADRs and GDRs. What are the advantages ©

receipts to the investors?

eee

2016 MAY.[9] Explain the advantages of Global a .

(Ma

Y.[6] What is the benefit of global investmen’? \'

2017 MAY. ime!

[14] Discuss in brief the various options for global invest"

2018 MAY.{14] Explain the various benefits of glob! ae

and discuss its options available to Indian investors. \°

EN GUT iO ak

-» © DN

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- HonsDocument3 pagesHonsSumit SharmaNo ratings yet

- Issues in Marketing in Developing Economy-IDocument42 pagesIssues in Marketing in Developing Economy-ISumit SharmaNo ratings yet

- DocScanner 07-Feb-2022 1-00 PMDocument1 pageDocScanner 07-Feb-2022 1-00 PMSumit SharmaNo ratings yet

- Panjab University, Chandigarh: Examination (Offline Mode) To Be Held in July - 2022Document2 pagesPanjab University, Chandigarh: Examination (Offline Mode) To Be Held in July - 2022Sumit SharmaNo ratings yet

- Adobe Scan 31-Mar-2021Document1 pageAdobe Scan 31-Mar-2021Sumit SharmaNo ratings yet

- School Sarpanch FormDocument2 pagesSchool Sarpanch FormSumit SharmaNo ratings yet

- Business Card 7 Jun 2022Document17 pagesBusiness Card 7 Jun 2022Sumit SharmaNo ratings yet

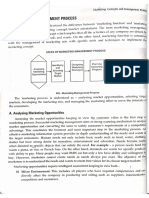

- Marketing Management ProcessDocument4 pagesMarketing Management ProcessSumit SharmaNo ratings yet

- Adv AccountingDocument38 pagesAdv AccountingSumit SharmaNo ratings yet

- 0822Document2 pages0822Sumit SharmaNo ratings yet