Professional Documents

Culture Documents

Day 2

Day 2

Uploaded by

PrasanthOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Day 2

Day 2

Uploaded by

PrasanthCopyright:

Available Formats

CH.SUDHEER C.A, C.M.

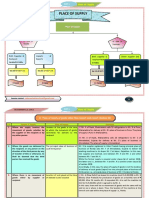

A DAY 2 Supply – Sec 7 of CGST Act

SUPPLY – SEC 7 OF CGST ACT

Chapter 2

Supply include Excludes Govt by notification specify

transactions to be treated as

All forms of Activities Activities to Activities or

sale, transfer specified be treated as Activities or Supply of Supply of

transactions

barter, in supply of transactions service not goods & not

Importation undertaken

exchange schedule- I goods or specified in as a supply as a supply of

of service by CG/SG/LA

licence, rental services as Schedule – III of goods service

as may be

lease or referred to in notified by

disposal Schedule- II Govt

Made or Made or Refer page Refer page

agreed to be agreed to 2.3 2.4

made be made

For For Without

consideration consideration consideration

In the course Whether or not

of business In the course of

or business or

furtherance furtherance of

of business business

Queries contact: vjabranchofsircoficai@gmail.com 2.1

CH.SUDHEER C.A, C.M.A DAY 2 Supply – Sec 7 of CGST Act

Chapter 2

Schedule-I (without Consideration)

In these cases, even though consideration is not charged, it shall be regarded as supply

Permanent Supply b/w Supply of Supply

transfer/ distinct goods or Principal & between

disposal of persons services by Agent related

business assets employer to persons

employee

Eg: A person having Any goods

Outside the

reg.est in one supplied to

Transfer of assets course of Shall be

state and agent shall be Import of

by H.Co to S.Co employment regarded as

another reg.est regarded as service

Donate old supply

in other state supply

laptop to Schools shall be distinct

A cloth retailer persons

giving clothes Gifts not exceeding

free to his friend 50,000 in year are not

Stock transfers by a supply Refer page Only if made in the course

one unit to other 2.10 (CASE 7) of Business

This provision will

unit of other state

apply only when ITC Employer gives dussera

is a supply

has been availed by gift of 55,000 - treated as

Transferor supply for levy of GST

Queries contact: vjabranchofsircoficai@gmail.com 2.2

CH.SUDHEER C.A, C.M.A DAY 2 Supply – Sec 7 of CGST Act

Chapter 2

Schedule – II: Activities to be treated as Supply of Goods or Services

Transfer Land or Building Transfer of Business Assets

Supply of supply of Supply of service Supply of goods Supply of Service

goods service

Lease, tenancy,

easement, licence Goods forming part When the business is Goods held for

-Title in goods Right in goods without to occupy land of business assets ceased, then stock left business but put to

-Tiltle in goods under transfer of goods are disposed whether shall be deemed to be private use with or

agreement at future date or not for consideration supplied and liable to GST without consideration

Exception

Business transferred as Going concern A director using car

provided by co. for

personal travels

Treatment or process Certain specified service Composite supplies Supply of service by unincorporated

AOP/ BOI to its members for cash or

Supply of service 1.Renting of Immovable properties Supply of services deferred payment

2. Construction of civil structure, complex etc..,

Treatment of process 3.Temporary transfer or permitting use of IPR

applied to other person's 4.Development, design, upgradation etc., of IT s/w 1. Works contract services 1. Club membership fees-service

goods 5.Agreeing to obligation to refrain from an act or 2. Supply being food or drink 2. A local club supplies snacks

tolerance of an act or situation or to do an act or any article for human during monthly meeting for

Eg:- 6. Transfer of right to use any goods for any purpose consumption nominal payment.-service

Jobwork performed by

jobworker on goods

supplied by Principal Treated as supply of services

Manufacturer

Queries contact: vjabranchofsircoficai@gmail.com 2.3

CH.SUDHEER C.A, C.M.A DAY 2 Supply – Sec 7 of CGST Act

Schedule – III: NEGATIVE LIST OF UNDER SERVICES

Services by Services by Services of Actionable Functions performed by

District a) Sale of land claims

Employee to a) Funeral M.P’s, M.L.A & other

courts b) Sale of Building

employer in b) Burial constitutional Duties

c) Crematorium Where entire

the course of

Services by d) Mortuary consideration is received

employment after completion

e) Transportation

(i.e salary) certificate

of deceased

However works contract

would come under GST

In case payment to directors

TDS u/s 192 TDS u/s 194J

No GST GST chargeable (but under RCM)

NEGATIVE LIST OF UNDER GOODS

Supply of goods from outside Supply of goods by the consignee to any other Supply of warehoused goods to

India to Outside India without person by endorsement of documents of title to any person before clearance for

such goods entering into India the goods after the goods have been dispatched home consumption

from the port of origin located outside India but

before clearance for Home Consumption (i.e.,

High sea sales)

Queries contact: vjabranchofsircoficai@gmail.com 2.4

CH.SUDHEER C.A, C.M.A DAY 2 Supply – Sec 7 of CGST Act

COMPOSITE AND MIXED SUPPLIES (SECTION 8)

Composite Supply Mixed Supply

Naturally bundled in the ordinary course of business Artificially bundled and not in the ordinary course of Business

Comprising two or more supplies one of which is principal Comprising of two or more supplies

supply

Shall be treated as supply of that particular principal supply Treated as supply of such supply that attracts highest rate of tax

Example

Example

S Ltd. Manufacturers entered into a contract with XYZ Ltd. for supply

of readymade shirts packed in designer boxes at XYZ Ltd.’s outlet. Supply of package consisting of food, sweets, chocolates,

Further, S Ltd Manufacturers would also get them insured during cakes, dry fruits for a single price is mixed supply. Each

transit. So, supply of goods, packing materials, transport & insurance is of these items can be supplied independently. Hence it is a

a composite supply wherein supply of goods is principal supply mixed supply.

A shopkeeper selling storage water bottles along with

When a consumer buys a television set and he also gets warranty and refrigerator. It is a mixed supply

a maintenance contract with the TV, this supply is a composite supply.

In this example, supply of TV is the principal supply, warranty and

maintenance services are ancillary

Queries contact: vjabranchofsircoficai@gmail.com 2.5

CH.SUDHEER C.A, C.M.A DAY 2 Supply – Sec 7 of CGST Act

Clarification (C.No.92/11/2019 dt.07/03/2019)

Free samples and gifts If ITC is taken- then distribution of Free samples and gifts should be

treated as supply as per Sch-I

If ITC is not taken- transaction made without consideration shall not be

regarded as supply

Buy one get one free offer For example, buy one soap and get one soap free or

Get one tooth brush free along with the purchase of tooth paste.

In fact, it is not an individual supply of free goods but a case of

two or more individual supplies where a single price is being

charged for the entire supply. It can at best be treated as

supplying two goods for the price of one

It is also clarified that ITC shall be available to the supplier

Queries contact: vjabranchofsircoficai@gmail.com 2.7

CH.SUDHEER C.A, C.M.A DAY 2 Supply – Sec 7 of CGST Act

Principal & Agent- Deemed supply & Mandatory Registration-

Clarification (Circular No. 57/31/2018-GST)

Scenario 1

Mr. A appoints Mr. B to procure certain goods from the market. Mr. B identifies various suppliers

who can provide the goods as desired by Mr. A, and asks the supplier (Mr. C) to send the goods

and issue the invoice directly to Mr. A. In this scenario, Mr. B is only acting as the procurement

agent, and has in no way involved himself in the supply or receipt of the goods. Hence, in

accordance with the provisions of this Act, Mr. B is not an agent of Mr. A for supply of goods in

terms of Schedule I.

Scenario 2

M/s XYZ, a banking company, appoints Mr. B (auctioneer) to auction certain goods. The auctioneer

arranges for the auction and identifies the potential bidders. The highest bid is accepted and the

goods are sold to the highest bidder by M/s XYZ. The invoice for the supply of the goods is issued

by M/s XYZ to the successful bidder. In this scenario, the auctioneer is merely providing the

auctioneering services with no role played in the supply of the goods. Even in this scenario, Mr. B

is not an agent of M/s XYZ for the supply of goods in terms of Schedule I.

Scenario 3

Mr. A, an artist, appoints M/s B (auctioneer) to auction his painting. M/s B arranges for the

auction and identifies the potential bidders. The highest bid is accepted and the painting is sold to

the highest bidder. The invoice for the supply of the painting is issued by M/s B on the behalf of

Mr. A but in his own name and the painting is delivered to the successful bidder. In this scenario,

M/s B is not merely providing auctioneering services, but is also supplying the painting on behalf

of Mr. A to the bidder, and has the authority to transfer the title of the painting on behalf of Mr. A.

This scenario is covered under Schedule. A similar situation can exist in case of supply of goods as

well where the C&F agent or commission agent takes possession of the goods from the principal

and issues the invoice in his own name. In such cases, the C&F/commission agent is an agent of

the principal for the supply of goods in terms of Schedule I. The disclosure or non-disclosure of the

name of the principal is immaterial in such situations.

Note: In scenario 1 and scenario 2, Mr. B shall not be liable to obtain registration in

terms of clause (vii) of section 24 of the CGST Act. He , however, would be liable for

registration if his aggregate turnover of supply of taxable services exceeds the threshold

specified in sub-section (1) of section 22 of the CGST Act. In scenario 3, M/s B shall be liable

for compulsory registration in terms of the clause (vii) of section 24 of the CGST Act

Queries contact: vjabranchofsircoficai@gmail.com 2.8

You might also like

- Tax Invoice Manoj Kumar: Feb, 2022 22/02/2022 430.7 Immediate 455.7Document2 pagesTax Invoice Manoj Kumar: Feb, 2022 22/02/2022 430.7 Immediate 455.7PrasanthNo ratings yet

- Day 6 & 7Document23 pagesDay 6 & 7PrasanthNo ratings yet

- Charge of GST: 1. Charging Section 9 of CGST Act/ Section 5 of Igst ActDocument9 pagesCharge of GST: 1. Charging Section 9 of CGST Act/ Section 5 of Igst ActPrasanthNo ratings yet

- Value of Supply: A. Supply To Unrelated Persons Where Price Is The Sole Consideration ForDocument19 pagesValue of Supply: A. Supply To Unrelated Persons Where Price Is The Sole Consideration ForPrasanthNo ratings yet

- Service Wise Clarification: 1. Charitable and Religious Activity Related ServicesDocument10 pagesService Wise Clarification: 1. Charitable and Religious Activity Related ServicesPrasanthNo ratings yet

- Time of Supply: General Time Limit For Raising InvoicesDocument4 pagesTime of Supply: General Time Limit For Raising InvoicesPrasanthNo ratings yet

- Day 3Document13 pagesDay 3PrasanthNo ratings yet

- Real Estate Sector: Types of Construction Projects & It'S TaxabilityDocument7 pagesReal Estate Sector: Types of Construction Projects & It'S TaxabilityPrasanthNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)