Professional Documents

Culture Documents

Service Wise Clarification: 1. Charitable and Religious Activity Related Services

Uploaded by

PrasanthOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Service Wise Clarification: 1. Charitable and Religious Activity Related Services

Uploaded by

PrasanthCopyright:

Available Formats

CH.SUDHEER C.A, C.M.

A DAY 9 Service Wise Clarification

SERVICE WISE

Chapter 9 CLARIFICATION

1. CHARITABLE AND RELIGIOUS ACTIVITY RELATED SERVICES

1 Services by an entity registered u/s 12AA of the Income-tax Act, 1961 by way of charitable

activities.

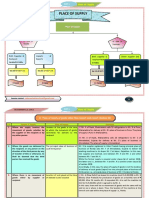

In order to claim exemption under Entry 1 of the Notification, following two conditions must

be satisfied

The entity is registered under The entity carries out one or

section 12AA of the Income more of the specified

tax Act, 1961, and charitable activities.

Meaning of term ‘charitable activities’ Activities relating to-

(i) PUBLIC HEALTH (ii) ADVANCEMENT (iii) ADVANCEMENT (iv)

by way of- OF RELIGION, OF EDUCATIONAL PRESERVATION OF

spirituality or yoga; PROGRAMMES/SKILL ENVIRONMENT

DEVELOPMENT including

(A) Care or counseling of relating to,-

watershed, forests

(I) Terminally ill persons or persons & wildlife.

with severe physical or mental

disability;

(II) Persons afflicted with HIV or AIDS;

(A) (B) (C) (D) Persons

(III) Persons addicted to a dependence- Abandoned Physically or Prisoners; over the

forming substance such as narcotics

, orphaned mentally or age of 65

drugs or alcohol; or

or abused and years

(B) Public awareness of preventive homeless traumatized residing in

health, family planning or prevention children; persons a rural area

of HIV infection;

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.1

CH.SUDHEER C.A, C.M.A DAY 9 Service Wise Clarification

Liability to pay GST

There could be many services provided by charitable and religious trusts - registered under section

12AA of the Income-tax Act, 1961 - which are not covered by the definition of charitable activities

and hence, such services would attract GST

For instance, grant of advertising rights to a person on the premises of the charitable/religious

trust or on publications of the trust, or granting admission to events, functions, celebrations,

shows against admission tickets or fee etc. would attract GST.

Arranging yoga and meditation camp by charitable trusts

Residential programmes or camps where the fee charged includes cost of lodging and boarding

shall be exempt as long as the primary and predominant activity, objective and purpose of such

residential programmes or camps is advancement of religion, spirituality or yoga.

However, if charitable or religious trusts merely or primarily provide accommodation or serve

food and drinks against consideration in any form including donation, such activities will be

taxable. Similarly, activities such as holding of fitness camps or classes such as those in aerobics,

dance, music etc. will be taxable.

Services by an old age home run by:

9D Central Government, State Government or

an entity registered under section 12AA of the Income-tax Act, 1961

to its residents (aged 60 years or more) against consideration upto ₹ 25,000 per month per

member, provided that the consideration charged is inclusive of charges for boarding, lodging

and maintenance.

Services by a person by way of-

(a) conduct of any religious ceremony;

(b) renting of precincts of a religious place meant for general public by charitable or religious

trust under section 12AA / 10(23C)(v) / 10(23BBA) of Income Tax act

Exception to point (b)

However, nothing contained in entry (b) of this exemption shall apply to-

13

(i) Renting of (ii) Renting of premises, (iii) Renting of shops or

rooms where community halls, other spaces for business or

charges are ` kalyanmandapam or open area, commerce where charges

1,000 or more per and the like where charges are

are 10,000 or more p.m

day; 10,000 or more per day;

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.2

CH.SUDHEER C.A, C.M.A DAY 9 Service Wise Clarification

Religious ceremonies

are life-cycle rituals

including special

Religious place means General public means The exemption is religious poojas

a place which is the body of people at applicable to conducted in terms of

primarily meant for large sufficiently renting of precincts religious texts by a

conduct of prayers or defined by some of religious places person so authorized

worship pertaining to a common quality of of all religions. by such religious texts.

religion, meditation, or public or impersonal

Occasions like birth,

spirituality. nature

marriage, and death

involve elaborate

religious ceremonies.

60 Services by a specified organization in respect of a religious pilgrimage facilitated by the

Government of India, under bilateral arrangement.

Religious yatras or pilgrimage

Religious Yatras/pilgrimage Only such services of religious The term specified

organised by any charitable or pilgrimage as are provided by organization means

religious trust are not exempt. specified organization in - Kumaon Mandal Vikas Nigam

Further, services of respect of a religious Limited (KMVN), a Government

transportation of passengers pilgrimage facilitated by the of Uttarakhand Undertaking;

for a pilgrimage by the Government of India (GoI), or

charitable trust are not exempt under bilateral arrangement,

from GST. are exempt from GST. - State Haj Committee

including Joint State

Committee

Services by way of training or coaching in recreational activities relating to-

(a) Arts or culture, or

80 (b) Sports

(c) By charitable entities registered under section 12AA of the Income-tax Act.

Recreational activities mean all forms of dance, music, painting, sculpture making, theatre and

sports etc..,

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.3

CH.SUDHEER C.A, C.M.A DAY 9 Service Wise Clarification

Services provided

GST on services to charitable or

provided TO religious trusts are

charitable trusts not outside the

ambit of GST.

Unless specifically

exempted, all goods and

services supplied to

charitable or religious

trusts are leviable to GST.

2. AGRICULTURE RELATED SERVICES

Services relating to cultivation of plants and rearing of all life forms of animals,

except the rearing of horses, for food, fibre, fuel, raw material or other similar

products or agricultural produce by way of—

(a) agricultural operations directly related to production of any agricultural

produce including cultivation, harvesting, threshing, plant protection or testing;

(b) supply of farm labour;

(c) processes carried out at an agricultural farm including tending, pruning,

cutting, harvesting, drying, cleaning, trimming, sun drying, fumigating, curing,

sorting, grading, cooling or bulk packaging and such like operations which do not

alter the essential characteristics of agricultural produce but make it only

54 marketable for the primary market;

(d) renting or leasing of agro machinery or vacant land with or without a

structure incidental to its use;

(e) loading, unloading, packing, storage or warehousing of agricultural produce;

(f) agricultural extension services;

(g) Services by any Agricultural Produce Marketing Committee or Board or

services provided by a commission agent for sale or purchase of agricultural

produce.

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.4

CH.SUDHEER C.A, C.M.A DAY 9 Service Wise Clarification

Entry 54 include activities like breeding of fish Further, the term ‘agricultural produce’ means

(pisciculture), rearing of silk worms (sericulture), any produce out of cultivation of plants and

cultivation of ornamental flowers (floriculture) rearing of all life forms of animals, except the

and horticulture, forestry, etc. rearing of horses

Entry 54

Thus, in terms of the definition of agricultural (b) Process which makes agricultural produce

produce, following processes are liable to GST:- marketable in the retail market: The processes

(a) Process which alters the essential of grinding, sterilizing, extraction packaging in

characteristics of the agricultural produce: For retail packs of agricultural products, which make

instance, potato chips or tomato ketchup are the agricultural products marketable in retail

manufactured through processes which alter the market, would NOT be covered in this entry. Only

essential characteristic of farm produce such processes are covered in this entry which

(potatoes and tomatoes in this case) makes agricultural produce marketable in the

primary market.

Warehousing of agriculture produce

Item (e) of the entry exempts loading, unloading, packing, storage or warehousing of agricultural

produce. In this regard, following are not agricultural Produce & warehousing of following items

were liable to GST

Processed Tea

and coffee

Jaggery

Pulses

(dehusked or

split)

processed

dry fruits

processed

cashew nuts

However, whole pulse grains such as whole gram, rajma etc. are covered in the definition of

agricultural produce.

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.5

CH.SUDHEER C.A, C.M.A DAY 9 Service Wise Clarification

Custom milling of paddy into rice

Milling of paddy into rice also changes its essential

characteristics. Hence it is chargeable to GST

Classification of leguminous vegetables when subject to mild heat treatment

(parching)

Leguminous vegetables which Such goods if branded and In all other cases such goods

are subjected to mere heat packed in a unit container would be exempted from GST

treatment for removing would attract GST at the rate

moisture, or for softening and of 5%

puffing or removing the skin,

and not subjecting to any

other processing or addition

of any other ingredients such

as salt and oil.

Entry No. Description of services

24 Services by way of loading, unloading, packing, storage or warehousing of rice.

24A Services by way of warehousing of minor forest produce.

24B Services by way of storage or warehousing of cereals, pulses, fruits, nuts and

vegetables, spices, copra, sugarcane, jaggery, raw vegetable fibres such as cotton, flax,

jute etc., indigo, unmanufactured tobacco, betel leaves, tendu leaves, coffee and tea

53A Services by way of fumigation in a warehouse of agricultural produce.

55 Carrying out an intermediate production process as job work in relation to cultivation of

plants and rearing of all life forms of animals, except the rearing of horses, for food,

fibre, fuel, raw material or other similar products or agricultural produce.

55A Services by way of artificial insemination of livestock (other than horses).

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.6

CH.SUDHEER C.A, C.M.A DAY 9 Service Wise Clarification

EDUCATIONAL INSTITUTION

Taxability Input services (Entry 66(b))

I. Transport of Students, Faculty,

Educational All are exempt

For (a)-exempt II. Catering (incl. midday meals

Institute Under Entry 66(a)

III. Security/Cleaning/House Keeping Input service Output service

For (a) (b) (c)

exempt IV. Conduct of examination a) Preschool & Higher

Secondary (or) Equal

a) School Fee

For (b)-exempt V. Online Education Journals b) As part of curriculum b) Bus Fee

Recognized by Indian law c) Application Fee

d) Tuition Fee

c) Approved Vocational courses

e) Entrance Fee

Taxable for all VI. Any other services

-MESC f) Exam Fee

g) Hostel Fee

- ITI / ITC

Note h) Admission Fee

i) Fines, Penalties

j) Uniform Fee

Output service by IIM k) Books fees

2 years full time post graduation – Exempt

(Entry 67) l) Co circular activities Fee

Executive Development programme- Taxable

5 years Integrated programme- Exempt

(Indian Institute of Management)

Fellow programme in Management- Exempt

Note: Training of courses recognized by foreign law is Taxable

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.7

CH.SUDHEER C.A, C.M.A DAY 9 Service Wise Clarification

3. EDUCATION SERVICES

Composite and mixed supply in so far

as education is concerned

Boarding schools – Composite supply- Exempt

Course in a college leads to dual qualification only one of which is recognized by law-

Mixed Supply- highest rate of tax to be paid on entire value

However, incidental auxiliary courses provided by way of hobby classes or extra-

curricular activities in furtherance of overall well-being will be an example of naturally

bundled course, and therefore treated as composite supply.

One relevant consideration in such cases will be the amount of extra billing being done for

the unrecognized component viz-a-viz the recognized course. If extra billing is being done,

it may be a case of artificial bundling of two different supplies, not supplied together in the

ordinary course of business, and therefore will be treated as a mixed supply, attracting the

rate of the higher taxed component for the entire consideration.

Supply of

food in a

mess or

canteen

If the catering services is one of the services provided by an educational institution to its

students, faculty and staff and the said educational institution is covered by the definition of

‘educational institution’ as given above, then the same is exempt

If the catering services, i.e., supply of food or drink in a mess or canteen, is provided by anyone

other than the educational institution, i.e. the institution outsources the catering activity to an

outside contractor, then it is a supply of service to the concerned educational institution by such

outside caterer and attracts GST

Note: It may be noted that said services when provided to an educational institution providing

pre-school education or education up to higher secondary school or equivalent are exempt from

tax.

Fees charged from prospective employers (i.e., Campus placement Fee)

Educational institutes such as IITs, IIMs charge a fee from prospective employers like corporate

houses/MNCs, who come to the institutes for recruiting candidates through campus interviews

in relation to campus recruitments. Such services shall also be liable to tax

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.8

CH.SUDHEER C.A, C.M.A DAY 9 Service Wise Clarification

4. HEALTH CARE SERVICES

74 Services by way of-

a. Health care services by a clinical establishment, an authorized medical practitioner or para-

medics;

b. Services provided by way of transportation of a patient in an ambulance, other than those

specified in (a) above.

Health care services

Means any service by way Includes services by way Does not include hair

of diagnosis or treatment of transportation of the transplant or cosmetic or

or care for illness, injury, patient to and from a plastic surgery, except when

deformity, abnormality or clinical establishment, undertaken to restore or to

pregnancy in any but reconstruct anatomy or

recognized system of functions of body affected due

medicines in India to congenital defects,

developmental abnormalities,

injury or trauma

As it is apparent from the definition of health care services, only services in recognized systems of

medicines in India are exempt under this entry. Following systems of medicines are the recognized

systems of medicines in India8:-

Any other

Allopathy system of

medicine that

Yoga may be

recognized by

C. Govt.

Recognized

Naturopathy systems Unani

Siddha

Ayurveda

Homeopat

hy

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.9

CH.SUDHEER C.A, C.M.A DAY 9 Service Wise Clarification

Rent of rooms • Rent of rooms provided to in-patients in hospitals

provided to in- is exempt [Circular No. 27/01/2018 GST dated

patients 04.01.2018].

Food supplied to the patients

Food supplied to the in- Other supplies of food by a

patients as advised by the hospital to patients (not

doctor/nutritionists is a admitted) or their attendants

part of composite supply or visitors are taxable

of healthcare and not [Circular No. 32/06/2018 GST

separately taxable. dated 12.02.2018].

Services other than health care services in clinical establishment’s premises Supply of services

other than healthcare services such as renting of shops, auditoriums in the premises of the clinical

establishment, display of advertisements etc. will be subject to GST.

Entry Description of services

No.

46 Services by a veterinary clinic in relation to health care of animals or birds.

73 Services provided by the cord blood banks by way of preservation of stem cells or any

other service in relation to such preservation.

74A Services provided by rehabilitation professionals recognized under the Rehabilitation

Council of India Act, 1992 (34 of 1992) at

75 Services provided by operators of the common bio-medical waste treatment facility

to a clinical establishment by way of treatment or disposal of bio-medical waste or the

processes incidental thereto.

SUDHEER TAX CLASSES, CONTACT: 8688398888 - 9491780817 9.10

You might also like

- GSTImplicationson Charitable Institutionsincluding Healthcare Education SectorDocument119 pagesGSTImplicationson Charitable Institutionsincluding Healthcare Education SectorsanjayNo ratings yet

- Chapter 5 - Exemptions From GSTDocument35 pagesChapter 5 - Exemptions From GSTkarnimasoni12No ratings yet

- Chapter 5 - Exemptions From GST - Plus Notes - Part 1Document10 pagesChapter 5 - Exemptions From GST - Plus Notes - Part 1Addicted To MusicNo ratings yet

- Chapter 5 - Exemptions From GSTDocument53 pagesChapter 5 - Exemptions From GSTPremNo ratings yet

- GST Charitable Religious TrustsDocument4 pagesGST Charitable Religious TrustsPrakash WarrierNo ratings yet

- Saint LuciaDocument2 pagesSaint Luciarafaelamorim34hNo ratings yet

- Quebec Bill 62Document12 pagesQuebec Bill 62Howard FriedmanNo ratings yet

- Registration of Charitable and Religious TrustDocument16 pagesRegistration of Charitable and Religious TrustAstha TrivediNo ratings yet

- Booklet On Charitable TrustDocument159 pagesBooklet On Charitable TrustNawazuddin AhmedNo ratings yet

- Letter To Gov. Sisolak From 200+ Nevada PastorsDocument15 pagesLetter To Gov. Sisolak From 200+ Nevada PastorsShah AhmadNo ratings yet

- 2020.05.14.sisolak LTRDocument15 pages2020.05.14.sisolak LTRJacob SolisNo ratings yet

- Decision: Promotion of Religious Harmony For The Benefit of The PublicDocument3 pagesDecision: Promotion of Religious Harmony For The Benefit of The PublicMin Khant LwinNo ratings yet

- BetterCareTogether HRDocument47 pagesBetterCareTogether HRgolden_screemNo ratings yet

- GST - Lecture 4 - Exemptions From GSTDocument28 pagesGST - Lecture 4 - Exemptions From GSTrahulmehta1578No ratings yet

- Tax ExemptionDocument2 pagesTax ExemptionHeber BacolodNo ratings yet

- Taxation On Religious InstitutionsDocument2 pagesTaxation On Religious InstitutionsJeru SagaoinitNo ratings yet

- Republic Act 9257 - Robles, Michele T.Document9 pagesRepublic Act 9257 - Robles, Michele T.Bernadette Joyce PascualNo ratings yet

- Irish EndowmentDocument8 pagesIrish EndowmentSusan AliNo ratings yet

- A Study of Charitable Trusts and The Reasons For Exempting It Under Income Tax Act AbstractDocument3 pagesA Study of Charitable Trusts and The Reasons For Exempting It Under Income Tax Act AbstractAmudha MonyNo ratings yet

- Hr-Rights of The ElderlyDocument36 pagesHr-Rights of The ElderlyAira Mae P. LayloNo ratings yet

- Safe Worship GuidelinesDocument8 pagesSafe Worship Guidelinesthe kingfishNo ratings yet

- Senior Citizens LawDocument9 pagesSenior Citizens LawalyNo ratings yet

- CharitiesDocument18 pagesCharitiessfsefseNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument5 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledIvy Michelle HabagatNo ratings yet

- Formation, Registration of Charitable Trusts/Societies / Companies & Important Compliance Under The Maharashtra Public Trusts ActDocument37 pagesFormation, Registration of Charitable Trusts/Societies / Companies & Important Compliance Under The Maharashtra Public Trusts ActSunny UdasiNo ratings yet

- Equity and Trust 1 AssignmentDocument16 pagesEquity and Trust 1 AssignmentterathereshaNo ratings yet

- Trust AgreementDocument2 pagesTrust AgreementMich Angeles100% (3)

- Trust Formation Deed DraftingDocument27 pagesTrust Formation Deed DraftingAbhishekNo ratings yet

- Endowments ProjectDocument30 pagesEndowments ProjectTasaduqNo ratings yet

- Covid 19 Pho Order Gatherings EventsDocument33 pagesCovid 19 Pho Order Gatherings EventsMau apikNo ratings yet

- Republic Act No. 9994Document4 pagesRepublic Act No. 9994Anna Dominique VillanuevaNo ratings yet

- Should Church Be TaxedDocument4 pagesShould Church Be TaxedDangel MonacoNo ratings yet

- FREEDOM of RELIGION NotesDocument3 pagesFREEDOM of RELIGION NotesMichelle Mae MabanoNo ratings yet

- Church of Scientology 1996 Staff ContractDocument4 pagesChurch of Scientology 1996 Staff ContractThe Department of Official InformationNo ratings yet

- Guide For CharitiesDocument115 pagesGuide For CharitiesscyhosexzqrhzgfsrqNo ratings yet

- 222 AustralianPentecostalDocument18 pages222 AustralianPentecostalBhaktha SinghNo ratings yet

- A New Level of The Mental Health and Wellbeing SystemDocument4 pagesA New Level of The Mental Health and Wellbeing Systems3935159No ratings yet

- Ra 9994Document9 pagesRa 9994fullpizzaNo ratings yet

- Legal Size - DCFS Folded Brochure - CharityDocument2 pagesLegal Size - DCFS Folded Brochure - CharityNadia ByfieldNo ratings yet

- American MFG ComplaintDocument51 pagesAmerican MFG ComplaintMinnesota Public RadioNo ratings yet

- Ra 9994Document4 pagesRa 9994Xyrus BucaoNo ratings yet

- D'aguiar V Commissioner of Inland RevenueDocument7 pagesD'aguiar V Commissioner of Inland Revenuenur syazwinaNo ratings yet

- Health Care Access: Citizen Action Needed: Issue # 222 October 2008Document8 pagesHealth Care Access: Citizen Action Needed: Issue # 222 October 2008Central Kentucky Council for Peace and JusticeNo ratings yet

- American Bible Society V City of ManilaDocument3 pagesAmerican Bible Society V City of ManilaThrees SeeNo ratings yet

- Guide For CharitiesDocument110 pagesGuide For CharitiesLakeCoNewsNo ratings yet

- Quebec's Proposed Charter of ValuesDocument20 pagesQuebec's Proposed Charter of ValuesGlobal_Montreal100% (1)

- Expanded Senior Citizen Act: G U I D E L I N E SDocument1 pageExpanded Senior Citizen Act: G U I D E L I N E SPrecious Faith SabalaNo ratings yet

- Sectors Estrada Admin. Arroyo Admin. Aquino AdminDocument5 pagesSectors Estrada Admin. Arroyo Admin. Aquino AdminDaniel Nacorda75% (4)

- Roman Catholic Archbishop of Manila vs. SSC PDFDocument9 pagesRoman Catholic Archbishop of Manila vs. SSC PDFdanexrainierNo ratings yet

- Centeno V Villalon-PernillosDocument2 pagesCenteno V Villalon-PernillosJosef MacanasNo ratings yet

- Art 3 Sec 5Document8 pagesArt 3 Sec 5KDNo ratings yet

- 9 - CharitiesDocument34 pages9 - CharitiesstraNo ratings yet

- Bar Questions, Sec.5-8Document3 pagesBar Questions, Sec.5-8ToniMariePerdiguerra-EscañoNo ratings yet

- 53 18november21 UPDATE COVID - 19 GENERAL LITURGICAL GUIDELINESDocument8 pages53 18november21 UPDATE COVID - 19 GENERAL LITURGICAL GUIDELINESMichael WijonoNo ratings yet

- Consti 2Document10 pagesConsti 2Erna BayagaNo ratings yet

- Provision of Food, Accommodation, and Meal Allowance To PHWsDocument6 pagesProvision of Food, Accommodation, and Meal Allowance To PHWsNoel Ephraim AntiguaNo ratings yet

- The Clergyman's Hand-book of Law: The Law of Church and GraveFrom EverandThe Clergyman's Hand-book of Law: The Law of Church and GraveNo ratings yet

- The People’s Modern Era, Bill of Rights, Forty Moral Commandments & Vows DeclarationsFrom EverandThe People’s Modern Era, Bill of Rights, Forty Moral Commandments & Vows DeclarationsNo ratings yet

- Tax Invoice Manoj Kumar: Feb, 2022 22/02/2022 430.7 Immediate 455.7Document2 pagesTax Invoice Manoj Kumar: Feb, 2022 22/02/2022 430.7 Immediate 455.7PrasanthNo ratings yet

- ChatLog Mule 9 - 30am IST Class 2022-03-09 10 - 23Document1 pageChatLog Mule 9 - 30am IST Class 2022-03-09 10 - 23PrasanthNo ratings yet

- Tax Invoice Manoj Kumar: Billing Period Invoice Date Amount Payable Due Date Amount After Due DateDocument2 pagesTax Invoice Manoj Kumar: Billing Period Invoice Date Amount Payable Due Date Amount After Due DatePrasanthNo ratings yet

- Value of Supply: A. Supply To Unrelated Persons Where Price Is The Sole Consideration ForDocument19 pagesValue of Supply: A. Supply To Unrelated Persons Where Price Is The Sole Consideration ForPrasanthNo ratings yet

- Day 6 & 7Document23 pagesDay 6 & 7PrasanthNo ratings yet

- Charge of GST: 1. Charging Section 9 of CGST Act/ Section 5 of Igst ActDocument9 pagesCharge of GST: 1. Charging Section 9 of CGST Act/ Section 5 of Igst ActPrasanthNo ratings yet

- Time of Supply: General Time Limit For Raising InvoicesDocument4 pagesTime of Supply: General Time Limit For Raising InvoicesPrasanthNo ratings yet

- Real Estate Sector: Types of Construction Projects & It'S TaxabilityDocument7 pagesReal Estate Sector: Types of Construction Projects & It'S TaxabilityPrasanthNo ratings yet

- Day 3Document13 pagesDay 3PrasanthNo ratings yet

- Fire BehaviourDocument4 pagesFire BehaviourFirezky CuNo ratings yet

- Microporous WikiDocument2 pagesMicroporous WikiIris BalcarceNo ratings yet

- Msds SilverDocument5 pagesMsds SilverSteppenwolf2012No ratings yet

- 7B Form GRA Original - Part499 PDFDocument1 page7B Form GRA Original - Part499 PDFRicardo SinghNo ratings yet

- Windows Perfectpath: Promise Multipath DriverDocument3 pagesWindows Perfectpath: Promise Multipath Driverpd904526No ratings yet

- 2.3 & 2.5 Cell DivisionDocument14 pages2.3 & 2.5 Cell DivisionJhonnyNo ratings yet

- Helicopter Logging Operations - ThesisDocument7 pagesHelicopter Logging Operations - ThesisAleš ŠtimecNo ratings yet

- Sialoree BotoxDocument5 pagesSialoree BotoxJocul DivinNo ratings yet

- Differential Partitioning of Betacyanins and Betaxanthins Employing Aqueous Two Phase ExtractionDocument8 pagesDifferential Partitioning of Betacyanins and Betaxanthins Employing Aqueous Two Phase ExtractionPaul Jefferson Flores HurtadoNo ratings yet

- Circulatory SystemDocument51 pagesCirculatory SystemTina TalmadgeNo ratings yet

- This Study Resource WasDocument3 pagesThis Study Resource WasNayre JunmarNo ratings yet

- Dig Inn Early Summer MenuDocument2 pagesDig Inn Early Summer MenuJacqueline CainNo ratings yet

- Eric CHE326 JournalpptDocument33 pagesEric CHE326 JournalpptRugi Vicente RubiNo ratings yet

- The Mystique of The Dominant WomanDocument8 pagesThe Mystique of The Dominant WomanDorothy HaydenNo ratings yet

- CGMP Training ToolDocument21 pagesCGMP Training Toolbabusure99No ratings yet

- Radial Lead Varistors LA Varistor SeriesDocument13 pagesRadial Lead Varistors LA Varistor SeriesLeman SihotangNo ratings yet

- LapasiDocument3 pagesLapasiWenny MellanoNo ratings yet

- BATES CH 6 The Thorax and LungsDocument2 pagesBATES CH 6 The Thorax and LungsAngelica Mae Dela CruzNo ratings yet

- Entrepreneurship Paper 2Document3 pagesEntrepreneurship Paper 2kisebe yusufNo ratings yet

- Reading TOEFL - Short Reading Per Question TypeDocument25 pagesReading TOEFL - Short Reading Per Question Typejax7202No ratings yet

- Non-Binary or Genderqueer GendersDocument9 pagesNon-Binary or Genderqueer GendersJuan SerranoNo ratings yet

- Project Report On MKT Segmentation of Lux SoapDocument25 pagesProject Report On MKT Segmentation of Lux Soapsonu sahNo ratings yet

- Sore Throat, Hoarseness and Otitis MediaDocument19 pagesSore Throat, Hoarseness and Otitis MediaainaNo ratings yet

- Material Specification: Mechanical Property RequirementsDocument2 pagesMaterial Specification: Mechanical Property RequirementsNguyễn Tấn HảiNo ratings yet

- Pinch & Piston ValvesDocument8 pagesPinch & Piston ValvesJaldhij Patel100% (1)

- Sasol Polymers PP HNR100Document3 pagesSasol Polymers PP HNR100Albert FortunatoNo ratings yet

- D2C - Extensive ReportDocument54 pagesD2C - Extensive ReportVenketesh100% (1)

- Electronic Fetal MonitoringDocument4 pagesElectronic Fetal MonitoringMauZungNo ratings yet

- Msds Aluminium SulfatDocument5 pagesMsds Aluminium SulfatduckshaNo ratings yet