Professional Documents

Culture Documents

Correction: For Items 4 and 5 Using The 1/365: Method

Uploaded by

Sia DLSLOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Correction: For Items 4 and 5 Using The 1/365: Method

Uploaded by

Sia DLSLCopyright:

Available Formats

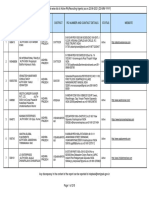

Chapter 22

1. b 6. b 11. b 16. b 21. d 26. d

2. a 7. c 12. a* 17. d 22. d 27. d

3. a 8. a 13. d* 18. a 23. c 28. d

4. c 9. c 14. a* 19. d 24. d 29. c

5. c 10, c 15, a 20. a 25. c 30. a

1-3:

To compute the motor premium income earned during the year ended December 31, 20x7, are as follows:

Gross premium written in the year……………………………………….. P3,000,000 .

Less: Premium ceded on reinsurance…………………………………… ( 300,000) .

Net premium………………………………………………………………….. P2,700,000 (1)

Less: Increase in unearned premium reserve (P1,200,000 –

P960,000)…………………………………………………………………. __240,000 (2)

Earned premium……………………………………………………………… P2,460,000 (3)

Correction: For Items 4 and 5…using the 1/365th method;

…the unexpired risk period of this policy…from January 1, 20x5 to September 30, 20x5

…the insurer has another…. written on December 31, 20x4 instead of 20x3

4. P37,500 x (273 days /365 days – 1/1/20x5-9/30/20x5) = P28,048, nearest answer is letter (c)

5. Additional data: For the Second Policy, the increased in the unearned premium on December 31, 20x4 (with an

insurance rate of 35%) …

P50,000 x (334 days /365 days – 1/1/20x5-11/30/20x5) = P45,753, nearest answer is letter (c)

6. P71,093.25 – nearest answer is letter (b)

Using the 1/24th method, the unearned premium reserve as of December 31, 20x7 amounted to P89,895.82, computed as

follows:

Unearned

Unexpired Premium

Premiums period Reserve

January………………………………….. P 18,750 1/24 P 781.250

February…………………………………. 15,625 3/24 1,953.125

March……………………………………. 12,500 5/24 2,604.167

April………………………………………. 9,375 7/24 2,734.375

May………………………………………. 12,500 9/24 4,687.500

June……………………………………… 9,375 11/24 4,296.875

July……………………………………….. 15,625 13/24 8,463.542

August…………………………………… 21,875 15/24 13,671.875

September………………………………. 21,875 17/24 15,494.792

October…………………………………. 18,750 19/24 14,843.750

November………………………………. 25,000 21/24 21,875.000

December………………………………. __21,875 23/24 _20,963.542

P203,125 P 112,369.793

In contrast, under the fixed percentage method, using the usual rate for fire insurance, which is 35%, the unearned premium

reserve as of December 31, 20x7 amounted to P71,093.75 (P203,125 x 35%). Incidentally, the summarized journal entries to

recognize the premiums written for the year and the unearned premium reserve are presented as follows:

1/24th method Fixed percentage method

Pesos Pesos

Cash/premium receivable………… 203,125 203,125

Premium revenue…………….. 203,125 203,125

Premium revenue……………………. *56,119.80 4,687.50

Unearned premium reserve… *56,119.80 4,687.50

* The UPR balance brought forward from the previous year amounted to P56,250; P112,369.793 – P56,250 = P56,119.793

** The UPR balance brought forward from the previous year amounted to P56,250;

P203,125 x 30% = P60,937.50 – P56,250 = P4,687.50

Correction: In relation to No. 6

7. c - P147,005.20 = (P203,125 – P56,119.80), refer to No. 6 for further computations.

8. a - ** The UPR balance brought forward from the previous year amounted to P56,250;

P203,125 x 30% = P60,937.50 – P56,250 = P4,687.50. refer to No. 6 for further computations.

Correction: In relation to No. 8

9. c - P198,437.50 = P203,125 – P4,687.50 refer to No. 6 for further computations.

10. c – refer to the problem

11. b – P212,000 – P126,562.50

12. * Financial guarantee contract – there is no specified uncertain future event; the payment is

required whatever happens to the debt;

Deferred annuity contract – the insurer can re-price the mortality risk, it will become an insurance contract only when the

annuity rates is fixed

Before the “loan contract”, the borrower faced no risk corresponding to the prepayment fee, thus, no risk has been

transferred.

31 b 36. c 41. a 46. d 51. c

32. a 37. c 42. b 47. a

33. b 38. a 43. a 48. b

34. c 39. c 44. d 49. d

35. d 40. a 45. c 50, c

You might also like

- Akm 2Document10 pagesAkm 2Putu DenyNo ratings yet

- Marking Guide - Code 4 - Midterm FA - Sem 2 - 21.22Document3 pagesMarking Guide - Code 4 - Midterm FA - Sem 2 - 21.22TRANG NGUYỄN THỊ HÀNo ratings yet

- Harrison FA IFRS 11e CH09 SMDocument106 pagesHarrison FA IFRS 11e CH09 SMShako GrdzelidzeNo ratings yet

- Harrison Fa Ifrs 11e Ch09 SMDocument107 pagesHarrison Fa Ifrs 11e Ch09 SMAshleyNo ratings yet

- AKM - Kelompok 5Document8 pagesAKM - Kelompok 5lailafitriyani100% (1)

- Brief Exercise D-2 (1) A. 6% 3 Periods (2) A. 5% 8 Periods B. 4% 8 Periods B. 3% 12 PeriodsDocument13 pagesBrief Exercise D-2 (1) A. 6% 3 Periods (2) A. 5% 8 Periods B. 4% 8 Periods B. 3% 12 PeriodsMarisolNo ratings yet

- Solutions CH 14Document63 pagesSolutions CH 14Abdalelah FrarjehNo ratings yet

- Ch14 Required QuestionsDocument31 pagesCh14 Required QuestionsMaha M. Al-MasriNo ratings yet

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Document5 pagesRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTANo ratings yet

- Answers - Problems For PracticeDocument8 pagesAnswers - Problems For PracticeBich VietNo ratings yet

- Ch. 17 Exercises and Answers - TaggedDocument6 pagesCh. 17 Exercises and Answers - TaggedHaitham Ebrahim100% (1)

- Larson16ce QuickStudySolutions Ch03Document11 pagesLarson16ce QuickStudySolutions Ch03zdgf dfg562465No ratings yet

- Weygandt Accounting Principles, 12e, Chapter Six Solutions To Challenge ExercisesDocument3 pagesWeygandt Accounting Principles, 12e, Chapter Six Solutions To Challenge ExercisesHương ThưNo ratings yet

- Ch14 Suggested HWDocument21 pagesCh14 Suggested HWLalangelaNo ratings yet

- Tutorial Test 4 AnswerDocument5 pagesTutorial Test 4 AnswerHoang Bich Kha NgoNo ratings yet

- IA2Document9 pagesIA2Claire BarbaNo ratings yet

- Intermediate Accounting 17th Edition Kieso Solutions ManualDocument22 pagesIntermediate Accounting 17th Edition Kieso Solutions Manualdilysiristtes5100% (31)

- Intermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDocument43 pagesIntermediate Accounting 17Th Edition Kieso Solutions Manual Full Chapter PDFDebraWhitecxgn100% (11)

- CHAPTER 2 - Partnership OperationsDocument10 pagesCHAPTER 2 - Partnership OperationsRominna Dela RuedaNo ratings yet

- F.A. - Robles Empleo MC CH 1 2 3 4 5 6 7 8 9Document12 pagesF.A. - Robles Empleo MC CH 1 2 3 4 5 6 7 8 9Carlyn Joy Paculba67% (9)

- Accounts Payable and Notes PayableDocument3 pagesAccounts Payable and Notes PayablenjsrzaNo ratings yet

- Model Solutions: Cma December, 2020 Examination Professional Level - I Subject: 101. Intermediate Financial AccountingDocument7 pagesModel Solutions: Cma December, 2020 Examination Professional Level - I Subject: 101. Intermediate Financial AccountingTaslima AktarNo ratings yet

- Solutions WK 6Document8 pagesSolutions WK 6simamo4203No ratings yet

- Gov. Walz 2022 Tax Returns - RedactedDocument21 pagesGov. Walz 2022 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Primary 4 Competition Answer SheetDocument2 pagesPrimary 4 Competition Answer SheetAileen MimeryNo ratings yet

- Review Questions For Final Exam ACC210Document13 pagesReview Questions For Final Exam ACC210AaaNo ratings yet

- Solutions To Exercises - CHAP4Document16 pagesSolutions To Exercises - CHAP4InciaNo ratings yet

- Akuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-IDocument14 pagesAkuntansi Keuangan Menengah 1: Kelompok 5 1. Maya Putri Wijaya (142200210) 2. Muhammad Alfarizi (142200278) Kelas EA-Imuhammad alfariziNo ratings yet

- 30MajorClubs K9831 060122Document373 pages30MajorClubs K9831 060122Sergio ImbrigiottaNo ratings yet

- Net Present ValueDocument22 pagesNet Present ValueAbnet BeleteNo ratings yet

- Financial and Managerial Accounting Group AssignmentDocument9 pagesFinancial and Managerial Accounting Group AssignmentDagmawit NegussieNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationAlijah MercadoNo ratings yet

- Jawaban P11-10Document2 pagesJawaban P11-10nurlaeliyahrahayuNo ratings yet

- Finman Chapter 7Document6 pagesFinman Chapter 7Maria Kathreena Andrea AdevaNo ratings yet

- Managerial Accounting 330: Chapter 3 AssignmentDocument6 pagesManagerial Accounting 330: Chapter 3 AssignmentAngeli ViveroNo ratings yet

- 4 5845855793034823826Document36 pages4 5845855793034823826Gena HamdaNo ratings yet

- 2024 9math T1 AssignmentDocument5 pages2024 9math T1 Assignmentmusah seiduNo ratings yet

- SM 9Document12 pagesSM 9wtfNo ratings yet

- Chapter 3 - Brief Exercises - SolutionsDocument4 pagesChapter 3 - Brief Exercises - SolutionsHa Dang Huynh NhuNo ratings yet

- Tutorial Solution Lease LessessDocument13 pagesTutorial Solution Lease LessessOm PrakashNo ratings yet

- 02 FAR02-answersDocument18 pages02 FAR02-answersBea GarciaNo ratings yet

- Ea Form 2018 PDFDocument1 pageEa Form 2018 PDFSpeederz freakNo ratings yet

- Solutions - Chapter 11Document3 pagesSolutions - Chapter 11sajedulNo ratings yet

- Ch10 Tutorials Intermed Acctg Acquisition and Disposition of PPEDocument6 pagesCh10 Tutorials Intermed Acctg Acquisition and Disposition of PPESarah GherdaouiNo ratings yet

- Quant Checklist 149 PDF 2022 by Aashish AroraDocument82 pagesQuant Checklist 149 PDF 2022 by Aashish Arorarajnish sharmaNo ratings yet

- Financial Markets and Institutions: Assignment-3Document3 pagesFinancial Markets and Institutions: Assignment-3diveshNo ratings yet

- Form of Return of Withholding Tax Under The Income-Tax Ordinance, 1984 (Ord. XXXVI OF 1984) (Return Under Section 75A) For Company Taxpayers OnlyDocument4 pagesForm of Return of Withholding Tax Under The Income-Tax Ordinance, 1984 (Ord. XXXVI OF 1984) (Return Under Section 75A) For Company Taxpayers OnlyRidwan Haque DolonNo ratings yet

- Exercise 21Document8 pagesExercise 21raihan aqilNo ratings yet

- Balance SheetDocument1 pageBalance SheetVinod PanickerNo ratings yet

- Primary 5 Competition Answer SheetDocument2 pagesPrimary 5 Competition Answer SheetAileen MimeryNo ratings yet

- MC Graw Hill Chapter 11 Selected SolutionsDocument6 pagesMC Graw Hill Chapter 11 Selected SolutionspareenNo ratings yet

- By The Numbers, Inc.Document51 pagesBy The Numbers, Inc.mailfrmajithNo ratings yet

- Chapter 8: Self - Study 5 SolutionsDocument4 pagesChapter 8: Self - Study 5 SolutionssqhaaNo ratings yet

- Chapter 6 - Teacher's Manual - Ifa Part 1aDocument12 pagesChapter 6 - Teacher's Manual - Ifa Part 1aCharmae Agan CaroroNo ratings yet

- Budget 2023Document9 pagesBudget 2023Saba ChoudharyNo ratings yet

- Financial Markets and Institutions: Assignment-4Document4 pagesFinancial Markets and Institutions: Assignment-4diveshNo ratings yet

- Level 4 Code 1 Answer-1Document10 pagesLevel 4 Code 1 Answer-1biniam100% (1)

- نماذج الاضواء لشهر نوفمبر 2022 ماث بالاجابات خامسة ابتدائيDocument14 pagesنماذج الاضواء لشهر نوفمبر 2022 ماث بالاجابات خامسة ابتدائيRehab AlyNo ratings yet

- QUIZ 2 Airline IndustryDocument4 pagesQUIZ 2 Airline IndustrySia DLSLNo ratings yet

- Chapter 22Document51 pagesChapter 22Sia DLSLNo ratings yet

- Chapter 23Document17 pagesChapter 23Sia DLSLNo ratings yet

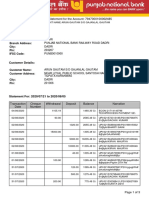

- PBB RelatedPartyTransactionPolicyDocument5 pagesPBB RelatedPartyTransactionPolicySia DLSLNo ratings yet

- Notes On Inventory-ManagementDocument19 pagesNotes On Inventory-ManagementSia DLSLNo ratings yet

- Topic 8Document6 pagesTopic 8Sia DLSLNo ratings yet

- Online Research DatabasesDocument2 pagesOnline Research DatabasesSia DLSLNo ratings yet

- Problem I Philippine ViewpointDocument14 pagesProblem I Philippine ViewpointSia DLSLNo ratings yet

- Problem I Cost ModelDocument76 pagesProblem I Cost ModelSia DLSLNo ratings yet

- Elimination of Unrealized Profit On Intercompany Sales of InventoryDocument102 pagesElimination of Unrealized Profit On Intercompany Sales of InventorySia DLSLNo ratings yet

- Chapter 3 AnswerDocument16 pagesChapter 3 AnswerSia DLSLNo ratings yet

- Solution Chapter 23 Rev FinalDocument1 pageSolution Chapter 23 Rev FinalSia DLSLNo ratings yet

- Annual ReportDocument42 pagesAnnual ReportAbdu MohammedNo ratings yet

- Elemental Realty - Top 10 Real Estate Entrepreneurs - 2020' - Mr. Arun Kumar Aleti, CEODocument1 pageElemental Realty - Top 10 Real Estate Entrepreneurs - 2020' - Mr. Arun Kumar Aleti, CEOAkhila AdusumilliNo ratings yet

- Bio-Energy Distributors Solution LimitedDocument8 pagesBio-Energy Distributors Solution LimitedKaso MuseNo ratings yet

- Inv 0019Document1 pageInv 0019urkirannandaNo ratings yet

- Practice Exam - Part 3: Multiple ChoiceDocument4 pagesPractice Exam - Part 3: Multiple ChoiceAzeem TalibNo ratings yet

- Accounting Information Systems - Yola-170-171Document2 pagesAccounting Information Systems - Yola-170-171dindaNo ratings yet

- PQ 0047220Document3 pagesPQ 0047220Divino Edgar LacambraNo ratings yet

- Products Price List and ProceduresDocument4 pagesProducts Price List and ProceduresmanugeorgeNo ratings yet

- RemittanceDocument2 pagesRemittancePankaj NagarNo ratings yet

- Bujor George Petrisor: Contact DetailsDocument2 pagesBujor George Petrisor: Contact DetailsGeorge BujorNo ratings yet

- SSRN Id1709011Document30 pagesSSRN Id1709011Cristiana CarvalhoNo ratings yet

- SMS 209 Intro To Finance PDFDocument87 pagesSMS 209 Intro To Finance PDFDvd AdonisNo ratings yet

- API Advisory 10 Invoicing and Payment Terms English Translation 20191220Document2 pagesAPI Advisory 10 Invoicing and Payment Terms English Translation 20191220Yusri WyeuserieyNo ratings yet

- Ra List ReportDocument218 pagesRa List Reportsatish vermaNo ratings yet

- Indonesia Jakarta Rental Apartment Q1 2021Document2 pagesIndonesia Jakarta Rental Apartment Q1 2021Grace SaragihNo ratings yet

- NEW BRITISH UNION Manifesto MMXVIIIDocument29 pagesNEW BRITISH UNION Manifesto MMXVIIIThe Cringe crusaderNo ratings yet

- UGRD Schedule 2021 Main Campus Ver 1.4Document48 pagesUGRD Schedule 2021 Main Campus Ver 1.4Ahmed NisarNo ratings yet

- VP and USPDocument34 pagesVP and USPJoycee Mae JabinesNo ratings yet

- Transportation Freight Trucking and Towing Open MyFlorida BusinessDocument5 pagesTransportation Freight Trucking and Towing Open MyFlorida BusinessalejandrosantizoNo ratings yet

- Corporate Financial AnalysisDocument21 pagesCorporate Financial AnalysisMOHD.ARISH100% (1)

- San Fernando Rural Bank Vs Pampanga Omnibus Development CorporationDocument2 pagesSan Fernando Rural Bank Vs Pampanga Omnibus Development CorporationPACNo ratings yet

- Dirco Annualreport20212022reducedDocument425 pagesDirco Annualreport20212022reducedSuper RadoiNo ratings yet

- Arun Gautam PDFDocument3 pagesArun Gautam PDFRohit kumarNo ratings yet

- Sps. Evangelista Vs Mercator Finance Corp. (G.R. No. 148864 August 21, 2003)Document5 pagesSps. Evangelista Vs Mercator Finance Corp. (G.R. No. 148864 August 21, 2003)Ann ChanNo ratings yet

- BO Temporary KeysDocument5 pagesBO Temporary Keysamanblr12No ratings yet

- Advanced Manufacturing Tutorial AnswersDocument12 pagesAdvanced Manufacturing Tutorial Answerswilfred chipanguraNo ratings yet

- BMKT675 - Chapter 3 - Consumer Motivation and Personality - VO PART 4Document10 pagesBMKT675 - Chapter 3 - Consumer Motivation and Personality - VO PART 4Fatima El MousaouiNo ratings yet

- Case 4 The Bribery Scandal at SiemensDocument19 pagesCase 4 The Bribery Scandal at Siemensvijayselvaraj0% (2)

- Accounting Research Journal September 2015Document25 pagesAccounting Research Journal September 2015Firehun GichiloNo ratings yet

- Importance of Negotiable InstumentDocument3 pagesImportance of Negotiable Instumentraazoo19100% (4)