Professional Documents

Culture Documents

IMC Tax Table 2021

Uploaded by

SATHISH SOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IMC Tax Table 2021

Uploaded by

SATHISH SCopyright:

Available Formats

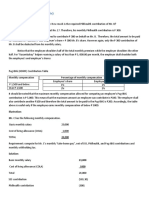

Tax rates to be used from 1 December 2021

Candidates will not be provided with tax rates in the exam; these must be learned by the

candidate

Personal tax allowance: 12,570

Income tax:

Starting rate for savers: £5,000

Basic rate: £0 - £37,700

Higher rate: £37,701 - £150,000

Additional rate: £150,001 and above

Dividend tax:

Dividend allowance: £2,000

Basic rate: 7.50%

Higher rate: 32.50%

Additional rate: 38.10%

Capital gains tax:

Capital gains tax exempt amount: £12,300

Basic rate: 10%

Higher rate: 20%

Basic rate on residential property: 18%

Higher rate on residential property: 28%

Inheritance tax:

Inheritance tax threshold: £325,000

Inheritance tax rate: 40.00%

Corporation tax rate: 19%

Pensions annual allowance: £40,000

ISA annual limits: £20,000

Enterprise Investment Scheme (EIS) tax relief rate: 30% up to £1,000,000

Seed EIS tax relief limit: 50% up to £100,000

Venture Capital Trust Relief limit: 30% up to £200,000

You might also like

- Tax Rates and Allowances (FA23)Document6 pagesTax Rates and Allowances (FA23)nancybao0316No ratings yet

- FTX (Uk) JDocument4 pagesFTX (Uk) JpavishneNo ratings yet

- f6 Mock QuestionDocument24 pagesf6 Mock QuestionSarad KharelNo ratings yet

- Taxtable 2022 23 - FinalDocument3 pagesTaxtable 2022 23 - FinalfmpallabNo ratings yet

- Tax Table December 2020Document3 pagesTax Table December 2020Mohamed ShaminNo ratings yet

- 14 - Tax TableDocument5 pages14 - Tax Tableayushagarwal23No ratings yet

- TX Uk j22 m23 TaxtablesDocument5 pagesTX Uk j22 m23 TaxtablesShafna ShamnasNo ratings yet

- TX Uk Tax Rates June23 Mar24Document5 pagesTX Uk Tax Rates June23 Mar24Big SmutNo ratings yet

- Tax Rates 2019/20: Precise. Proven. PerformanceDocument4 pagesTax Rates 2019/20: Precise. Proven. PerformanceIssa BoyNo ratings yet

- Tax-Uk-J23-M24 Examinable Documents-Fa 2022Document6 pagesTax-Uk-J23-M24 Examinable Documents-Fa 2022chumnhomauxanhNo ratings yet

- November 6 - CorporationsDocument2 pagesNovember 6 - CorporationsDarius DelacruzNo ratings yet

- Resident Citizen NRC, Ra, Nra-Etb Nra-Netb Regular Income Passive Income (Within The PH) Capital Gains Subject To CGTDocument19 pagesResident Citizen NRC, Ra, Nra-Etb Nra-Netb Regular Income Passive Income (Within The PH) Capital Gains Subject To CGTKrizza TerradoNo ratings yet

- Summary Tax Data 2022Document5 pagesSummary Tax Data 2022Ammaarah PatelNo ratings yet

- ACCA TX (F6) Tax Rates and Allowance Exam Formulae 2018Document3 pagesACCA TX (F6) Tax Rates and Allowance Exam Formulae 2018Katuta MwenyaNo ratings yet

- Cii Tax Tables 2020 2021 Tax Tables 310321 To 310821Document5 pagesCii Tax Tables 2020 2021 Tax Tables 310321 To 310821stellaNo ratings yet

- ACCA F6 Mock Exam QuestionsDocument22 pagesACCA F6 Mock Exam QuestionsGeo Don100% (1)

- UK TaxDocument8 pagesUK TaxAvinash sncsNo ratings yet

- Tax HomeworkDocument4 pagesTax HomeworkMatthew WittNo ratings yet

- TRAIN Law BriefingDocument30 pagesTRAIN Law BriefingJoselito PabatangNo ratings yet

- Tax Tables 2018 19 - 4Document8 pagesTax Tables 2018 19 - 4Alellie Khay JordanNo ratings yet

- Taxation Law 1 Taxation Law 1 Atty. Vicente V. Cañoneo Atty. Vicente V. CañoneoDocument3 pagesTaxation Law 1 Taxation Law 1 Atty. Vicente V. Cañoneo Atty. Vicente V. CañoneoHannah Beatriz Cabral0% (1)

- CPD Course: 30 MinsDocument12 pagesCPD Course: 30 MinsDavid BriggsNo ratings yet

- Finance Act 2021 - ACCA GlobalDocument56 pagesFinance Act 2021 - ACCA GlobalhfdghdhNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN)Document187 pagesTax Reform For Acceleration and Inclusion (TRAIN)Janna GunioNo ratings yet

- Taxation - United Kingdom (TX - UK) : Applied SkillsDocument17 pagesTaxation - United Kingdom (TX - UK) : Applied Skillsbuls eyeNo ratings yet

- Finance Act 2020 - ACCA GlobalDocument62 pagesFinance Act 2020 - ACCA GlobalhfdghdhNo ratings yet

- f6 Uk Specimen s16Document28 pagesf6 Uk Specimen s16Waleed QasimNo ratings yet

- Advanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsDocument14 pagesAdvanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsRaza AliNo ratings yet

- Advanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsDocument15 pagesAdvanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsONASHI DEVNANI BBANo ratings yet

- TX NotesDocument157 pagesTX Notessahalacca123No ratings yet

- Examinable Documents, K and ATX-UK - FA 2019 Exam Docs June 20 To March 21 - Draft 2 (Clean) PDFDocument5 pagesExaminable Documents, K and ATX-UK - FA 2019 Exam Docs June 20 To March 21 - Draft 2 (Clean) PDFJudithNo ratings yet

- Finance Act 2020 - ACCA GlobalDocument65 pagesFinance Act 2020 - ACCA GlobalRaza AliNo ratings yet

- TX-UK and ATX-UK - FA 2020 Exam Docs June 21 To March 22 - FinalDocument7 pagesTX-UK and ATX-UK - FA 2020 Exam Docs June 21 To March 22 - FinalRidwan AhmedNo ratings yet

- Tax Calculation Summary Notes 2022Document53 pagesTax Calculation Summary Notes 2022Haroon khanNo ratings yet

- Taxation Law - NIRC Vs TRAINDocument3 pagesTaxation Law - NIRC Vs TRAINGemma F. Tiama100% (2)

- Tx-Uk Mock 1Document20 pagesTx-Uk Mock 1Lalan JaiswalNo ratings yet

- SGV Train LawDocument149 pagesSGV Train LawEm-em CantosNo ratings yet

- Tax Reform For Acceleration and Inclusion (TRAIN) LAW: FeaturesDocument5 pagesTax Reform For Acceleration and Inclusion (TRAIN) LAW: FeaturesAnni PagkatipunanNo ratings yet

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- Assignment 1 Taxes On IndividualsDocument7 pagesAssignment 1 Taxes On IndividualsMarynissa CatibogNo ratings yet

- Train LawDocument25 pagesTrain LawMariel Mangalino BautistaNo ratings yet

- Dividend Tax CalculatorDocument2 pagesDividend Tax Calculatornoonetwothreefour56No ratings yet

- It Compliance 2019 20Document8 pagesIt Compliance 2019 20Giri SukumarNo ratings yet

- Atxuk-2019-Marjun Sample-Q PDFDocument12 pagesAtxuk-2019-Marjun Sample-Q PDFONASHI DEVNANI BBANo ratings yet

- Exam Paper - MainDocument10 pagesExam Paper - Main2016-ME-15 AnsabNo ratings yet

- ACC 3013 Taxation RevisionDocument4 pagesACC 3013 Taxation Revisionfalnuaimi001No ratings yet

- d18 Atxuk QPDocument15 pagesd18 Atxuk QPakankshaNo ratings yet

- BAIBF 09011 Business Taxation Group DDocument15 pagesBAIBF 09011 Business Taxation Group DShahaab ZulkiflyNo ratings yet

- Advanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsDocument13 pagesAdvanced Taxation - United Kingdom (Atx - Uk) : Strategic Professional - OptionsRaza AliNo ratings yet

- ACCA ATX Paper Sep 2018Document16 pagesACCA ATX Paper Sep 2018Dilawar HayatNo ratings yet

- Chargeable Transfers - UKDocument8 pagesChargeable Transfers - UKAlellie Khay JordanNo ratings yet

- Answer 1Document5 pagesAnswer 1mayetteNo ratings yet

- TXROM 2018 Dec QDocument16 pagesTXROM 2018 Dec QKAH MENG KAMNo ratings yet

- Tax Reform For Acceleration and Inclusion Act - AnalysisDocument4 pagesTax Reform For Acceleration and Inclusion Act - AnalysisAlthea DumabokNo ratings yet

- Notes in Train Law PDFDocument11 pagesNotes in Train Law PDFJanica Lobas100% (1)

- Philhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationDocument5 pagesPhilhealth Contribution (Table) : Illustration: Mr. C Has The Following Monthly CompensationMaraiah InciongNo ratings yet

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Document4 pagesLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNo ratings yet

- Workshop1 CapitalStructure SolutionsDocument7 pagesWorkshop1 CapitalStructure Solutionsriyat0601No ratings yet

- Sec. 24 Tax On IndividualsDocument4 pagesSec. 24 Tax On IndividualsJan P. ParagadosNo ratings yet

- Wealth Management Planning: The UK Tax PrinciplesFrom EverandWealth Management Planning: The UK Tax PrinciplesRating: 4.5 out of 5 stars4.5/5 (2)

- Guru99 VBADocument69 pagesGuru99 VBASATHISH SNo ratings yet

- Unit 1 Syllabus Edition 19Document17 pagesUnit 1 Syllabus Edition 19SATHISH SNo ratings yet

- IMC Unit 1 Mock Exam 1 V12Document24 pagesIMC Unit 1 Mock Exam 1 V12SATHISH SNo ratings yet

- IMC Unit 1 Mock Exam 1 V15Document25 pagesIMC Unit 1 Mock Exam 1 V15SATHISH SNo ratings yet

- IMC IE ED18 Syllabus Update HighlightedDocument87 pagesIMC IE ED18 Syllabus Update HighlightedSATHISH SNo ratings yet

- IMC Unit 2 Syllabus - Edition 18Document19 pagesIMC Unit 2 Syllabus - Edition 18SATHISH SNo ratings yet

- IMC Unit 2 Mock Exam 2 V18 March 2021Document33 pagesIMC Unit 2 Mock Exam 2 V18 March 2021SATHISH SNo ratings yet

- IMC Unit 2 Mock Exam 1 V18 March 2021Document33 pagesIMC Unit 2 Mock Exam 1 V18 March 2021SATHISH SNo ratings yet

- IMC Unit 1 Syllabus - Edition 18Document17 pagesIMC Unit 1 Syllabus - Edition 18SATHISH SNo ratings yet

- IMC Unit 1 Mock Exam 2 V17 June 2020 Final Version 11Document25 pagesIMC Unit 1 Mock Exam 2 V17 June 2020 Final Version 11SATHISH SNo ratings yet