Professional Documents

Culture Documents

Navi Finserv Private Limited - HL - Fee and Schedule - 20202312 - 1000

Uploaded by

sachin Bharti0 ratings0% found this document useful (0 votes)

14 views2 pagesThis document outlines the fees and schedules for home loans from Navi Finserv Limited effective May 10th, 2022. It details various processing, legal, valuation and administrative fees for loans as well as charges for late payments, foreclosure, switching rates and other services. Most home loan fees are nil while processing fees for loans against property are up to 2% of the loan amount and legal/valuation charges are Rs. 5,000. Penal interest is charged at 2% per month for missed EMIs and prepayment charges range from nil to 2% of the amount prepaid depending on the type of loan.

Original Description:

Original Title

Navi Finserv Private Limited_HL_Fee and Schedule_20202312_1000

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the fees and schedules for home loans from Navi Finserv Limited effective May 10th, 2022. It details various processing, legal, valuation and administrative fees for loans as well as charges for late payments, foreclosure, switching rates and other services. Most home loan fees are nil while processing fees for loans against property are up to 2% of the loan amount and legal/valuation charges are Rs. 5,000. Penal interest is charged at 2% per month for missed EMIs and prepayment charges range from nil to 2% of the amount prepaid depending on the type of loan.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

14 views2 pagesNavi Finserv Private Limited - HL - Fee and Schedule - 20202312 - 1000

Uploaded by

sachin BhartiThis document outlines the fees and schedules for home loans from Navi Finserv Limited effective May 10th, 2022. It details various processing, legal, valuation and administrative fees for loans as well as charges for late payments, foreclosure, switching rates and other services. Most home loan fees are nil while processing fees for loans against property are up to 2% of the loan amount and legal/valuation charges are Rs. 5,000. Penal interest is charged at 2% per month for missed EMIs and prepayment charges range from nil to 2% of the amount prepaid depending on the type of loan.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

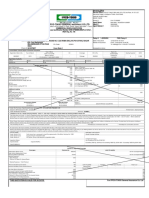

Fee and Schedule for Home Loans

Effective from – 10th May 2022

Fee Description Amount (Exclusive of GST)

Pre-Disbursal Charges

NIL (Home Loan)

Processing Fee

Up to 2% of the loan amt (LAP)

NIL (Home Loan)

Legal and Valuation Charges

Rs 5,000 (LAP)

Login Fees NIL

Administrative Fee NIL

SRO Search Charges NIL

Property Swapping Rs. 15,000

Post Dated Cheque/ECS/NACH Swapping Charges NIL

Loan Cancellation charges Rs. 15,000

Documentation Charges

Retrieval charges for copies of loan /property document in NIL

custody

IT Exemption/Rebate Certificate NIL

Loan Statement NIL

No Due Certificate NIL

CIBIL Query Charges NIL

CERSAI Charges NIL

Late Fee Charges

Cheque Bounce Rs. 500

EMI Bounce Charges Rs. 3,000

Penal Interest 2% per month for the outstanding EMIs

Pre-payment / Foreclosure / Balance Transfer Charges

Pre-payment, Foreclosure – Floating Rate home loan NIL

Pre-payment, Foreclosure – Fixed Rate home loan 2% of the amount pre-paid during the

period of applicability of the Fixed Rate of

interest

Pre-payment, Foreclosure – Loan against property (if NIL

floating rate LAP sanctioned for non-business purpose)

Pre-payment, Foreclosure – Loan against property (if LAP 2% of the amount pre-paid

sanctioned for business purpose)

Pre-payment, Foreclosure – Fixed Rate LAP 2% of the amount pre-paid during the

period of applicability of the Fixed Rate of

interest

Rate Change

Fixed to Floating Up to 0.25% of the Principal Outstanding

and undisbursed amount (if any) at the

Navi Finserv Limited

E: corporate_finserv@navi.com Formerly known as Chaitanya Rural Intermediation Development

Services Private Limited

T: +91 8951904682

Ground Floor, Salarpuria Business Center, 93, 5th A

www.navifinserv.com

Block, Koramangala Industrial Layout, Bengaluru –

CIN: U65923KA2012PLC062537 560 095, Karnataka, India.

time of Conversion or a cap of ₹25,000

plus taxes whichever is lower

Floating to Fixed Up to 0.25% of the Principal Outstanding

and undisbursed amount (if any) at the

time of Conversion or a cap of ₹25,000

plus taxes whichever is lower

Reduction in Floating Rate (same product variant) Up to 0.25% of the Principal Outstanding

and undisbursed amount (if any) at the

time of Conversion or a cap of ₹25,000

plus taxes whichever is lower

Switch between different product variants (e.g. floating Up to 0.25% of the Principal Outstanding

external linked to floating internal linked) and undisbursed amount (if any) at the

time of Conversion or a cap of ₹25,000

plus taxes whichever is lower

Other Charges

Suit, Legal, Recovery Charges On Actuals

Recovery charges for over-due collections Rs. 200 per visit

Visit charges ZERO

Retrieval of property documents in original (except at the Rs. 2,000 per request

time of loan closure)

Certification of the documents submitted to Navi Rs. 500 per request

Navi Finserv Limited

E: corporate_finserv@navi.com Formerly known as Chaitanya Rural Intermediation Development

Services Private Limited

T: +91 8951904682

Ground Floor, Salarpuria Business Center, 93, 5th A

www.navifinserv.com

Block, Koramangala Industrial Layout, Bengaluru –

CIN: U65923KA2012PLC062537 560 095, Karnataka, India.

You might also like

- 0333 2w InsuranceDocument4 pages0333 2w InsuranceGattigundlaRamuNo ratings yet

- Vihaan Direct Selling (India) Pvt. Ltd. - Account Summary PDFDocument2 pagesVihaan Direct Selling (India) Pvt. Ltd. - Account Summary PDFHemanth NalluriNo ratings yet

- Motor Two Wheelers Package Policy Schedule Cum Certificate of InsuranceDocument2 pagesMotor Two Wheelers Package Policy Schedule Cum Certificate of InsuranceAbhisek KumarNo ratings yet

- Motor Two Wheelers Package Policy Schedule Cum Certificate of InsuranceDocument2 pagesMotor Two Wheelers Package Policy Schedule Cum Certificate of Insurancekhem karanNo ratings yet

- StatementDocument4 pagesStatementSUBHAM CHAKRABORTYNo ratings yet

- Bajaj Allianz General Insurance Company LTD.: Vehicle QuoteDocument4 pagesBajaj Allianz General Insurance Company LTD.: Vehicle QuoteLucky RawatNo ratings yet

- Electronic Record and Signature DisclosureDocument4 pagesElectronic Record and Signature DisclosureVhince BaltoresNo ratings yet

- Exim Bank 2020 Financial StatementDocument1 pageExim Bank 2020 Financial StatementLucas MgangaNo ratings yet

- DQBPK2884N - Loan Detail StatementsDocument1 pageDQBPK2884N - Loan Detail StatementsInfitness GamingNo ratings yet

- Bjaz GC Policy ScheduleDocument4 pagesBjaz GC Policy ScheduleKoushik DeyNo ratings yet

- Loan Account Statement 019763997Document2 pagesLoan Account Statement 019763997Nikhil JadonNo ratings yet

- Statement of Accounts - 200212680Document6 pagesStatement of Accounts - 200212680DheerajNo ratings yet

- Account Statement 1649661081074Document2 pagesAccount Statement 1649661081074manas trivediNo ratings yet

- Student Account SummaryDocument1 pageStudent Account SummaryBasel HamwiNo ratings yet

- ES LoanStatement 25dec21 24dec22 2Document2 pagesES LoanStatement 25dec21 24dec22 2Sanjeet Singh ThakurNo ratings yet

- Statement of Account: BranchDocument2 pagesStatement of Account: BranchNihar DemblaNo ratings yet

- Account StatementDocument1 pageAccount StatementJALARAM TRADINGNo ratings yet

- Navi Loan Account StatementDocument2 pagesNavi Loan Account Statementashish singhNo ratings yet

- Account Statement 1000013254935Document1 pageAccount Statement 1000013254935Ebrahim MaruNo ratings yet

- Toyota Bus Policy 2022Document4 pagesToyota Bus Policy 2022Swam T WNo ratings yet

- PolycyDocument10 pagesPolycyShivamDave100% (1)

- Policy Copy (5) - UnlockedDocument6 pagesPolicy Copy (5) - UnlockedVignesh PNo ratings yet

- Homepo NTDocument1 pageHomepo NTMissa RoseNo ratings yet

- OL-49 AccountStatementDocument3 pagesOL-49 AccountStatementVireshNo ratings yet

- Account StatementDocument6 pagesAccount StatementHxor Haxor0% (1)

- Account StatementDocument2 pagesAccount StatementAteeq UllahNo ratings yet

- Policy Schedule Cum Certificate of InsuranceDocument2 pagesPolicy Schedule Cum Certificate of Insurance058 PAUL MICHAEL SNo ratings yet

- Agent Name Khivraj Motors Agent Code MIS1000132 Agent Contact No 9108694880Document2 pagesAgent Name Khivraj Motors Agent Code MIS1000132 Agent Contact No 9108694880SanthoshNo ratings yet

- Loan StatementDocument4 pagesLoan StatementkappilNo ratings yet

- Loan Account Statement For 4080cdia297899: Component Due (RS.) Receipt (RS.) Overdue (RS.)Document2 pagesLoan Account Statement For 4080cdia297899: Component Due (RS.) Receipt (RS.) Overdue (RS.)mulaparthi RaviNo ratings yet

- INVDocument1 pageINVGulshan KumarNo ratings yet

- Account StatementDocument7 pagesAccount StatementShravan HussekarNo ratings yet

- N Sure PolicyDocument2 pagesN Sure Policymadhav100% (2)

- Ibs Alor Setar 1 30/09/21Document24 pagesIbs Alor Setar 1 30/09/21Encik AlifNo ratings yet

- Hughbjbjbgug Insurance Policy FormatDocument4 pagesHughbjbjbgug Insurance Policy FormatTheiieid SohtunNo ratings yet

- 9.refund VoucherDocument18 pages9.refund VoucherSamrat ManchekarNo ratings yet

- Quote 10756643Document2 pagesQuote 10756643Raja PeramNo ratings yet

- AccountStatement - 06 DEC 2022 - To - 06 JUN 2023Document7 pagesAccountStatement - 06 DEC 2022 - To - 06 JUN 2023hancyboxNo ratings yet

- Car RelianceDocument5 pagesCar RelianceAnupam AwasthiNo ratings yet

- Recharge Amount: Mobile ServicesDocument2 pagesRecharge Amount: Mobile ServicesKshitij JoshiNo ratings yet

- Policy No 26020531196210020451 Proposal No. & Date Policy Issued On Period of Insurance Insured Name Previous Policy No. Insured Add Previous InsurerDocument2 pagesPolicy No 26020531196210020451 Proposal No. & Date Policy Issued On Period of Insurance Insured Name Previous Policy No. Insured Add Previous InsurerSanjay SharmaNo ratings yet

- Mobile BillDocument4 pagesMobile BillPiyush VaishNo ratings yet

- InvoiceDocument2 pagesInvoiceRaju KumarNo ratings yet

- Commercial Vehicle Package Policy-5Document3 pagesCommercial Vehicle Package Policy-5Sunil KumarNo ratings yet

- Bill SepDocument2 pagesBill SepAbhishek GorisariaNo ratings yet

- Mundhwa Suryoday Small Finance Bank LimitedDocument3 pagesMundhwa Suryoday Small Finance Bank LimitedakshayNo ratings yet

- Room Reservation Confirmation Mr. Fahad IDAPDocument1 pageRoom Reservation Confirmation Mr. Fahad IDAPKamran TufailNo ratings yet

- Invoice 1434857Document1 pageInvoice 1434857mieayamjamurNo ratings yet

- Mar2017 PDFDocument2 pagesMar2017 PDFShubham MahapatraNo ratings yet

- TaxInvoice AIN2021000598956Document2 pagesTaxInvoice AIN2021000598956Aditya SinghNo ratings yet

- Account Statement (PDF Statement) GuideDocument4 pagesAccount Statement (PDF Statement) GuideShah RulNo ratings yet

- Invoice and Payment For Invoice Confir - 202201071635Document1 pageInvoice and Payment For Invoice Confir - 202201071635Engelbert BalderNo ratings yet

- Ankit ChaudharyDocument3 pagesAnkit ChaudharyheartheckerNo ratings yet

- 1673 00T3s00002oE1AjEAKDocument6 pages1673 00T3s00002oE1AjEAKJonas GonzalesNo ratings yet

- Service Request Affidavit - CANADA - 12 - 21 - 17 - RogersDocument2 pagesService Request Affidavit - CANADA - 12 - 21 - 17 - RogersSangeetha BajanthriNo ratings yet

- Airtel BillDocument3 pagesAirtel Billsonuindia88No ratings yet

- Charges 20131130Document3 pagesCharges 20131130SssNo ratings yet

- Fees and Charges W.E.F. 13th Dec, 2021Document4 pagesFees and Charges W.E.F. 13th Dec, 2021Chandrashekar ReddyNo ratings yet

- Fees and Charges W.E.F. 17th Mar, 2021Document3 pagesFees and Charges W.E.F. 17th Mar, 2021MANOJ PANSENo ratings yet

- Service Charges - Loans and Advances 14 NovDocument21 pagesService Charges - Loans and Advances 14 Novsamuelbihari2012No ratings yet

- Tcs Bancs For Life, Annuity & Pensions: InsuranceDocument4 pagesTcs Bancs For Life, Annuity & Pensions: Insurancesachin BhartiNo ratings yet

- Social Work 621 Section 67334/35 and 67342/3Document24 pagesSocial Work 621 Section 67334/35 and 67342/3sachin BhartiNo ratings yet

- Sachin Bharti: Brief Overview / Career Objective / SummaryDocument2 pagesSachin Bharti: Brief Overview / Career Objective / Summarysachin BhartiNo ratings yet

- Major Kalshi Classes Pvt. LTD.: Cds-2022 (I) Answer Key EnglishDocument2 pagesMajor Kalshi Classes Pvt. LTD.: Cds-2022 (I) Answer Key Englishsachin BhartiNo ratings yet

- Financial Management Final Exam Solutions - F19401118 Jocelyn DarmawantyDocument11 pagesFinancial Management Final Exam Solutions - F19401118 Jocelyn DarmawantyJocelynNo ratings yet

- HypothecationDocument3 pagesHypothecationanu0% (1)

- LandDocument7 pagesLandYakub Dewaine bey100% (1)

- Global Financial Crisis OverviDocument12 pagesGlobal Financial Crisis Overvispinor01238No ratings yet

- Evaluation and Analysis of Financial InstitutionsDocument2 pagesEvaluation and Analysis of Financial InstitutionsKhaireen Sofea Khairul NizamNo ratings yet

- 56 Philippine Savings Bank vs. Mañalac, Jr.Document2 pages56 Philippine Savings Bank vs. Mañalac, Jr.CJ CasedaNo ratings yet

- Michael Tkach ResumeDocument2 pagesMichael Tkach ResumeMike TkachNo ratings yet

- Gitman - PPT - ch06 Bond ValuationDocument56 pagesGitman - PPT - ch06 Bond ValuationFerry GumilarNo ratings yet

- Updated A Project Report by Anu Jindal..............Document67 pagesUpdated A Project Report by Anu Jindal..............pkjindle100% (1)

- Kotak Bank Company ProfileDocument17 pagesKotak Bank Company Profilemohammed khayyumNo ratings yet

- Questions Asked On A Credit ReportDocument8 pagesQuestions Asked On A Credit ReportCharlie WhiteNo ratings yet

- Rosario Textile Mills V Home BankersDocument2 pagesRosario Textile Mills V Home BankersRad IsnaniNo ratings yet

- EVANGELISTA vs. MERCATOR FINANCEDocument1 pageEVANGELISTA vs. MERCATOR FINANCEelaine bercenioNo ratings yet

- Lim Tay Vs CADocument1 pageLim Tay Vs CAMa Lorely Liban-CanapiNo ratings yet

- Balance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)Document8 pagesBalance Sheet As On 31/12/2016 (Balance Sheet After Reconstruction)GauravNo ratings yet

- GRM - Day 1.1Document279 pagesGRM - Day 1.1Tim KraftNo ratings yet

- Global Financial CrisisDocument47 pagesGlobal Financial Crisismaahmoooda96% (27)

- Mba Project 2023-24Document53 pagesMba Project 2023-24Rupali PatilNo ratings yet

- 2023 Private Capital Markets ReportDocument149 pages2023 Private Capital Markets ReportGuru Gobind GuchhaitNo ratings yet

- Civil LawReview Refresher by Atty RabuyaDocument4 pagesCivil LawReview Refresher by Atty RabuyaJ Velasco PeraltaNo ratings yet

- Letter of Intent To Purchase Property - TemplateDocument4 pagesLetter of Intent To Purchase Property - Templatemichael lumboyNo ratings yet

- Economic Analysis of Investment in Real Estate Development ProjectsDocument30 pagesEconomic Analysis of Investment in Real Estate Development ProjectsAhmed EL-OsailyNo ratings yet

- Quiz 3Document6 pagesQuiz 3lleiryc7No ratings yet

- The Financial Crisis British English Teacher Ver2Document9 pagesThe Financial Crisis British English Teacher Ver2Hammam AbdelbaryNo ratings yet

- Sem 9 PP Question Bank 17ar18 Anjali KolangaraDocument11 pagesSem 9 PP Question Bank 17ar18 Anjali KolangaraAnjali KolangaraNo ratings yet

- Premium EliteDocument2 pagesPremium Elitehulala laNo ratings yet

- Real Estate Option AgreementDocument7 pagesReal Estate Option AgreementRaymond RomanoNo ratings yet

- Money Market AssignmentDocument20 pagesMoney Market AssignmentVijay Arjun Veeravalli100% (7)

- Ocus Complaint RERADocument113 pagesOcus Complaint RERAMilind Modi100% (1)

- Solvencia GRIFOLSDocument3 pagesSolvencia GRIFOLSamparooo20No ratings yet