Professional Documents

Culture Documents

Aa330222042632u Ro25022022

Uploaded by

P .Yazhini Parthiban0 ratings0% found this document useful (0 votes)

9 views1 page1. This document is an order cancelling the GST registration of Parthiban for failing to file monthly returns since September 2021.

2. The effective date of cancellation is September 1, 2021. No tax, interest, penalty or other amounts are determined to be payable pursuant to the cancellation.

3. Parthiban is required to pay any final tax liabilities determined upon filing of final returns, but currently no amounts are shown as due.

Original Description:

Original Title

AA330222042632U_RO25022022 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. This document is an order cancelling the GST registration of Parthiban for failing to file monthly returns since September 2021.

2. The effective date of cancellation is September 1, 2021. No tax, interest, penalty or other amounts are determined to be payable pursuant to the cancellation.

3. Parthiban is required to pay any final tax liabilities determined upon filing of final returns, but currently no amounts are shown as due.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageAa330222042632u Ro25022022

Uploaded by

P .Yazhini Parthiban1. This document is an order cancelling the GST registration of Parthiban for failing to file monthly returns since September 2021.

2. The effective date of cancellation is September 1, 2021. No tax, interest, penalty or other amounts are determined to be payable pursuant to the cancellation.

3. Parthiban is required to pay any final tax liabilities determined upon filing of final returns, but currently no amounts are shown as due.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

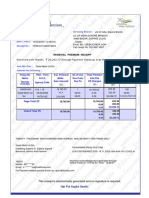

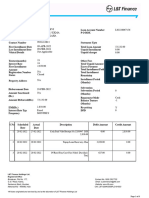

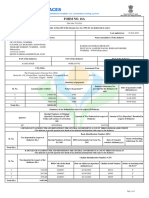

FORM GST REG-19

[See Rule 22(3)]

Reference Number: ZA330222108351C Date: 25/02/2022

To

PARTHIBAN

No.9,Rajesh Garden, Chettiyar Agaram,Chennai,Tiruvallur,Tamil Nadu,600095

GSTIN/ UIN :33CPGPP8579C1ZK

Application Reference No. (ARN): AA330222042632U Dated: 15/02/2022

Order for Cancellation of Registration

This has reference to your reply dated 25/02/2022 in response to the notice to show cause dated 15/02/2022

Whereas the undersigned has examined your reply and submissions made at the time of hearing, and is of the opinion that your

registration is liable to be cancelled for following reason(s).

1. The dealer has not filed monthly return from Sep'21

The effective date of cancellation of your registration is 01/09/2021

Determination of amount payable pursuant to cancellation:

Accordingly, the amount payable by you and the computation and basis thereof is as follows:

The amounts determined as being payable above are without prejudice to any amount that may be found to be payable you on

submission of final return furnished by you.

You are required to pay the following amounts on or before failing which the amount will be recovered in accordance with the

provisions of the Act and rules made thereunder.

Head Central Tax State Tax/UT Tax Integrated Tax Cess

Tax 0 0 0 0

Interest 0 0 0 0

Penalty 0 0 0 0

Others 0 0 0 0

Total 0.0 0.0 0.0 0.0

Place: VANAGARAM (C)

Date :25/02/2022

Signature Not Verified

R Sumathi

Digitally signed by DS GOODS AND

SERVICES TAX NETWORK(4) Assistant Commissioner(Circle)

Date: 2022.02.25 15:30:46 IST

VANAGARAM

You might also like

- Aa0905221261689 Ro08092022Document1 pageAa0905221261689 Ro08092022sitapurlokvaniNo ratings yet

- NoticeDocument1 pageNoticenagesh abbaramainaNo ratings yet

- Form GST Reg-19: (See Rule 22 (3) )Document1 pageForm GST Reg-19: (See Rule 22 (3) )Ashish Yadav & AssociatesNo ratings yet

- PaymentReceipt 36341744Document1 pagePaymentReceipt 36341744showkat Ahmad bhatNo ratings yet

- PaymentReceipt 14800709Document1 pagePaymentReceipt 14800709devansht888No ratings yet

- Received With Thanks ' 24,020.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 24,020.00 Through Payment Gateway Over The Internet FromChintu MarriNo ratings yet

- Non Resident Account: Tax InvoiceDocument2 pagesNon Resident Account: Tax InvoiceEmanuelsön Caverä BreezÿNo ratings yet

- TNNHIS, Madurai, AC10481, M Mahalingam-1Document3 pagesTNNHIS, Madurai, AC10481, M Mahalingam-1yog eshNo ratings yet

- CBDTSMChallanForm02 09 2022Document1 pageCBDTSMChallanForm02 09 2022asok maitiNo ratings yet

- FORM-GST-RFD-02: (See Rules90 (1), 90 (2) and 95 (2) )Document2 pagesFORM-GST-RFD-02: (See Rules90 (1), 90 (2) and 95 (2) )Vishal JainNo ratings yet

- Tax StatementDocument3 pagesTax StatementAimen Shoukat 771-FMS/BSAF/S22No ratings yet

- CC-3189 Dec'22Document2 pagesCC-3189 Dec'22Asif AhmedNo ratings yet

- Declaration. 3740560059248Document4 pagesDeclaration. 3740560059248Fizzah Fatimah MinhasNo ratings yet

- Sub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961Document1 pageSub: Allotment of Tax Deduction Account Number (TAN) As Per Income Tax Act, 1961tewod31076No ratings yet

- NX 22091418442499939893341Document1 pageNX 22091418442499939893341Rajkumar PatelNo ratings yet

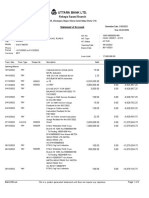

- NRB Commercial Bank Limited Principal Branch Statement of AccountsDocument3 pagesNRB Commercial Bank Limited Principal Branch Statement of Accountsamdadul hoqueNo ratings yet

- Lic ReceiptDocument1 pageLic ReceiptMohammed Aarif AnsariNo ratings yet

- aGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceDocument2 pagesaGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceSandeep KumarNo ratings yet

- DFLKJHDocument1 pageDFLKJHvenkyNo ratings yet

- ERS - SOA - Main - 2022-12-01T121903.235Document16 pagesERS - SOA - Main - 2022-12-01T121903.235pramod royNo ratings yet

- Medipath TDS 1st Oct 22Document1 pageMedipath TDS 1st Oct 22asok maitiNo ratings yet

- Invoice 1266283220Document2 pagesInvoice 1266283220Nitesh NituNo ratings yet

- TWR028206828157 - Soa MDocument5 pagesTWR028206828157 - Soa Madimaygupta1123No ratings yet

- Aaaca4267a Q1 2023-24-1Document2 pagesAaaca4267a Q1 2023-24-1amrj27609No ratings yet

- Aa211220016500d SCN23122020Document1 pageAa211220016500d SCN23122020Brajaraj TripathyNo ratings yet

- Official Receipt GeneratorDocument2 pagesOfficial Receipt GeneratorAal AliNo ratings yet

- Suda JHDocument2 pagesSuda JHPrAnAv RaNjAnNo ratings yet

- LIC RecpitDocument1 pageLIC RecpitRizwibabar AliNo ratings yet

- New Freedom 200 Local Minutes 12 Months Commitment: Tax Invoice/Credit NoteDocument6 pagesNew Freedom 200 Local Minutes 12 Months Commitment: Tax Invoice/Credit NoteRohit MethilNo ratings yet

- Ho 94H NC June 22Document2 pagesHo 94H NC June 22Rupeshkumar JhaNo ratings yet

- 42 Zimetrics Einv1Document1 page42 Zimetrics Einv1workp2726No ratings yet

- Renewal Premium Receipt: Har Pal Aapke Sath!!Document1 pageRenewal Premium Receipt: Har Pal Aapke Sath!!BISHAN DASSNo ratings yet

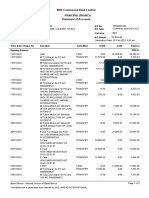

- Statement of Account - 15 - 21 - 22Document3 pagesStatement of Account - 15 - 21 - 22rushikeshovhal9697No ratings yet

- Statement of Account - 22!24!17Document3 pagesStatement of Account - 22!24!17Raghav SharmaNo ratings yet

- Mpdo Offce 26 Nov 22Document1 pageMpdo Offce 26 Nov 22Free FireNo ratings yet

- Aa2710220322221 SCN08102022Document1 pageAa2710220322221 SCN08102022GSTMS ANSARINo ratings yet

- Devleena ESS PROF TX EChallanDocument2 pagesDevleena ESS PROF TX EChallanABHINEET KRISHNA VARSHNEYNo ratings yet

- BillDocument5 pagesBillnewo arcegaNo ratings yet

- Statement 2022MTH09 11406353Document3 pagesStatement 2022MTH09 11406353arsh helplineNo ratings yet

- Soa L02228067156Document6 pagesSoa L02228067156nitishNo ratings yet

- Casio CDS-Y27-P004017Document2 pagesCasio CDS-Y27-P004017SHASHANKNo ratings yet

- Bill PaymentDocument1 pageBill PaymentSakshiNo ratings yet

- Payment Receipt 261755Document1 pagePayment Receipt 261755NamrataShahaniNo ratings yet

- Megh Man I 06Document1 pageMegh Man I 06KAYPEE MECHANICALNo ratings yet

- Aino Communique 110th Dec EditionDocument12 pagesAino Communique 110th Dec EditionSwathi JainNo ratings yet

- BhinabaiDocument1 pageBhinabaiBasvaraj DigeNo ratings yet

- Aaaca4267a Q2 2023-24Document2 pagesAaaca4267a Q2 2023-24amrj27609No ratings yet

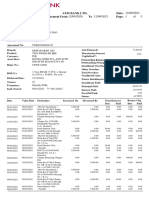

- Account StatementDocument1 pageAccount StatementJALARAM TRADINGNo ratings yet

- ACFrOgAeZiQBn012d5of1Y9a5RCevBOUSJNp3LUu 7jfDnC0po7KEun5bzNEX3NXGAz1 - 3 C587WPz8M66clwXFpdggKp2zCIEs 4rmGnndM5CCh3IzrhKUMbeDEtgDocument3 pagesACFrOgAeZiQBn012d5of1Y9a5RCevBOUSJNp3LUu 7jfDnC0po7KEun5bzNEX3NXGAz1 - 3 C587WPz8M66clwXFpdggKp2zCIEs 4rmGnndM5CCh3IzrhKUMbeDEtgved22deokateNo ratings yet

- TWR 028207101374Document6 pagesTWR 028207101374ganga.ram208No ratings yet

- LICINSTAODocument1 pageLICINSTAOmanmojilo4 bharwadNo ratings yet

- Order For Cancellation of RegistrationDocument1 pageOrder For Cancellation of RegistrationSOURAV GUPTANo ratings yet

- Form 16Document9 pagesForm 16Satyam MaramNo ratings yet

- Received With Thanks ' 25,102.00 Through Payment Gateway Over The Internet FromDocument1 pageReceived With Thanks ' 25,102.00 Through Payment Gateway Over The Internet FromSwegot DashNo ratings yet

- GP Order ZD090322015298H 20220309014031Document4 pagesGP Order ZD090322015298H 20220309014031SHYAM SUNDAR SOMANINo ratings yet

- LIC Receipt Jeevan AnandDocument1 pageLIC Receipt Jeevan AnandChandra ShekarNo ratings yet

- PFMS Transaction Details Sr. No. DDO Name Account No Ifsc Code Id Amount Scroll Status Beneficiary NameDocument18 pagesPFMS Transaction Details Sr. No. DDO Name Account No Ifsc Code Id Amount Scroll Status Beneficiary Nameajay kumarNo ratings yet

- Invoice 1251572320Document2 pagesInvoice 1251572320SanjuNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Credit PolicyDocument46 pagesCredit Policymujuni brianmjuNo ratings yet

- Remedies For Non Performance of ContractsDocument3 pagesRemedies For Non Performance of ContractsSidharth50% (2)

- Nil Report RedactedDocument6 pagesNil Report Redactedapi-608875555No ratings yet

- DTP Form B2Document54 pagesDTP Form B2MAULIK RAVALNo ratings yet

- Case Digest Ethics 2Document1 pageCase Digest Ethics 2Salvador III V. SantosNo ratings yet

- Individual Trust QuestionnaireDocument7 pagesIndividual Trust QuestionnairePatrick SullivanNo ratings yet

- Sop For Willfull and Unauthorised AbsenceDocument7 pagesSop For Willfull and Unauthorised AbsenceAnkit YadavNo ratings yet

- Affidavit of Fact: Najih Ghalib Islam Bey Hikuptah Yehudia Cosmo BeyDocument7 pagesAffidavit of Fact: Najih Ghalib Islam Bey Hikuptah Yehudia Cosmo BeyAlahdeen Moroc BeyNo ratings yet

- Sample Brgy ResolutionDocument4 pagesSample Brgy ResolutionMarj Apolinar100% (1)

- Separation AgreementDocument8 pagesSeparation AgreementCynthia RoystonNo ratings yet

- Vendor AMCDocument2 pagesVendor AMCmanna.dass76No ratings yet

- The Law On Trademarks, Service Marks and Trade NamesDocument1 pageThe Law On Trademarks, Service Marks and Trade NamesKersh YuNo ratings yet

- Amended JudgementDocument3 pagesAmended JudgementMelissa MontalvoNo ratings yet

- En Allgemeine-Teilnahmebedingungen FcbayernmomenteDocument4 pagesEn Allgemeine-Teilnahmebedingungen FcbayernmomenteGeorgeNo ratings yet

- Electrical Permit ApplicationDocument28 pagesElectrical Permit Applicationteodoro,jr. quintanaNo ratings yet

- NNPWE Employment of Contract AgreementDocument5 pagesNNPWE Employment of Contract Agreementwait a min mofuNo ratings yet

- In-N-Out Burger, Inc. vs. Sehwani, Incorporated, 575 SCRA 535, G.R. No. 179127 December 24, 2008Document10 pagesIn-N-Out Burger, Inc. vs. Sehwani, Incorporated, 575 SCRA 535, G.R. No. 179127 December 24, 2008Lyka Angelique CisnerosNo ratings yet

- The Anti Narcotic Force ActDocument9 pagesThe Anti Narcotic Force ActFarhan BhuttoNo ratings yet

- Cagayan Fishing Devt Vs SandikoDocument2 pagesCagayan Fishing Devt Vs SandikoAmanda ButtkissNo ratings yet

- Law of Contract IDocument5 pagesLaw of Contract IIshan ShahiNo ratings yet

- 5paisa Capital Ltd.Document6 pages5paisa Capital Ltd.Shakshi SharmaNo ratings yet

- Warning Letter For SleepingDocument3 pagesWarning Letter For Sleepingapi-374906683% (6)

- Interim Order in Civil CasesDocument7 pagesInterim Order in Civil CasesRadheyNo ratings yet

- Compiled Notes LTDDocument107 pagesCompiled Notes LTDarellano lawschool100% (1)

- GOI Vs Vedanta Judgment PDFDocument66 pagesGOI Vs Vedanta Judgment PDFDev DubeyNo ratings yet

- SBI Current Account Form For Other Than Sole Proprietorship FirmDocument16 pagesSBI Current Account Form For Other Than Sole Proprietorship FirmKartik KumarNo ratings yet

- Civil Legal System FinalDocument20 pagesCivil Legal System Finalkdareeba khanNo ratings yet

- Warehouse Stock Audit - Audit Contract Ver 9-FY20 & 21 (Two Years)Document3 pagesWarehouse Stock Audit - Audit Contract Ver 9-FY20 & 21 (Two Years)AhisjNo ratings yet

- Balonan vs. Abellana, G.R. No. L-15153, Aug. 31, 1960Document3 pagesBalonan vs. Abellana, G.R. No. L-15153, Aug. 31, 1960Xryn MortelNo ratings yet

- Forms Provisional RemediesDocument13 pagesForms Provisional RemediesJoyanne DiwaNo ratings yet