Professional Documents

Culture Documents

K. Rama Swamy and P.A. Choudary, JJ.: Equiv Alent Citation: (1987) 64C TR (AP) 217, (1987) 164ITR675 (AP)

Uploaded by

SAI SUVEDHYA ROriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

K. Rama Swamy and P.A. Choudary, JJ.: Equiv Alent Citation: (1987) 64C TR (AP) 217, (1987) 164ITR675 (AP)

Uploaded by

SAI SUVEDHYA RCopyright:

Available Formats

MANU/AP/0052/1985

Equivalent Citation: (1987)64C TR(AP)217, [1987]164ITR675(AP)

IN THE HIGH COURT OF ANDHRA PRADESH

Case Referred No. 106 of 1979

Decided On: 28.02.1985

Appellants: Parvathi Devi and Ors.

Vs.

Respondent: Commissioner of Income Tax

Hon'ble Judges/Coram:

K. Rama Swamy and P.A. Choudary, JJ.

Counsels:

For Appellant/Petitioner/Plaintiff: Y. Rathnakar, Adv.

For Respondents/Defendant: M.V. Suryanarayana Murthy, Adv.

JUDGMENT

P.A. Choudary, J.

1 . In this Referred Case No. 106 of 1979, the following two questions have been

referred for the opinion of this court. The two questions are :

"1. Whether, on the facts and in the circumstances of the case, the purchase by

the assessee of acres 10-13 guntas of land on March 17, 1961, and the

subsequent sales of the land on September 4, 1961, and September 20, 1962,

constituted an adventure in the nature of trade ?

2. Whether, on the facts and in the circumstances of the case, the profit arising

on the sale of land could be assessed in the hands of the assessee as an

association of persons ?"

2. The facts of the case are :

One Parvathi Devi, w/o Ramaswamy and one Radhakumari, w/o Umamaheswara

Rao, joined with one K. Suryanarayana and V. Dasaradha Ramaiah and

purchased acres 10-13 guntas (about 50,000 sq. yards) of land situated in

Kheiratabad by a registered sale deed dated March 17, 1961, for a total

consideration of Rs. 45,000. The land was purchased from the original owner,

Mohammed Mirza, and nine others and the four persons had converted this

portion of land which was of non-agricultural rocky land into building sites.

Within three months after the date of purchase, the aforesaid four persons

jointly entered into an agreement dated June 15, 1961, with the Posts and

Telegraphs Office Co-operative Housing Society, agreeing to sell a portion of

the land, viz., 20,542 sq. yards, at the rate of Rs. 4.12 per sq. yard and an

advance of Rs. 4,000 was paid by the buyer-society. With respect to the

balance of the land, viz., 38,382 sq. yards, the aforementioned four persons

22-06-2022 (Page 1 of 5) www.manupatra.com Damodaram Sanjivayya National Law University

entered into another agreement dated April 15, 1962, agreeing to sell again

jointly the remaining portion to one Gramodyog Co-operative Housing Society

Ltd., for a total consideration of Rs. 2,11,101 which works out to Rs. 5.50 per

sq. yard. An advance of Rs. 4,000 was paid by the buyer-society. In pursuance

of that agreement, a document of sale was registered in favour of the said

Gramodyog Co-operative Housing Society on September 20, 1962.

3. The question that arose before the Income Tax Officer is regarding the nature of the

profit which the aforesaid four vendors had made under the above transactions. The

Income Tax Officer rejected the contentions of the assessees and held that the lands are

not agricultural lands and the whole transaction was an adventure in the nature of

trade. Accordingly, the Income Tax Officer assessed the profits made by the assessees

in the above transaction under the head "Business income". Before the Income Tax

Officer, it appears that the assessees had not taken any serious objection to the

contention of the Revenue that the income should be treated and assessed in the status

of an association of persons of the aforementioned four individuals.

4 . The order of assessment made by the Income Tax Officer was confirmed by the

Appellate Assistant Commissioner and finally by the Income Tax Appellate Tribunal. The

assessees had, therefore, applied for and obtained a reference of the above two

questions for the opinion of this court.

5. The first question that has been argued at considerable length is that the purchase by

the assessees of the aforementioned acres 10-13 guntas of land did not constitute an

adventure in the nature of trade. It was argued by Mr. Y. Rathnakar that this purchase

was a single transaction and there were no further and subsequent steps taken on the

part of the assessees for the development of the land. He also referred to some

statements made by one of the assessees before the Income Tax Officer to show that

the purchase of these lands was not for business purpose.

6 . It has been found by all the three authorities in this case that the purchase by the

assessees of this Ac. 10-13 guntas of land is an adventure in the nature of trade. It is

no doubt true that that finding is open to question in this reference, because the answer

to such a question is never considered as one of pure fact. But we must note that the

Supreme Court had observed in G. Venkataswami Naidu & Co. v. CIT

MANU/SC/0065/1958 : [1959]35ITR594(SC) that it is impossible to evolve any formula

in determining the character of isolated transactions of purchase of lands which came

before the courts in tax proceedings. Bearing that in mind, we refer to the facts of this

case which, in our opinion, are decisive in answering the first question referred for our

opinion.

7. The extent of the land that has been purchased is about 10 acres. It was purchased

by four persons joining together. The land which has been purchased has already been

converted into non-agricultural land. Its boundaries show that it is in the midst of a

fully developed area. It would, therefore, be reasonable for us to conclude that the land

must have been purchased not as agricultural land nor as house sites, but for only

trading purposes. Among the four persons, one is a retired school teacher and another

is a Government servant of a lower rank. None of them are persons who can be said to

have an intention to use the land of 10 acres for the purpose of constructing houses. In

these circumstances, the purpose of purchasing and keeping that land could not have

been dominated by an intention to use it except as a stock-in-trade in their business.

One of the assessees, Dasaradha Ramaiah, is a man of no property. He says that he

borrowed money from his brother. Parvathi Devi's husband, Ramaswamy, was a person

22-06-2022 (Page 2 of 5) www.manupatra.com Damodaram Sanjivayya National Law University

who had been dealing in purchasing and selling real estates. Parvathi Devi herself had

purchased and sold house sites earlier in 1958-1960. The husband of Radhakumari, one

Umamaheswara Rao, was a Government servant and the President of Venkatramana Co-

operative Housing Society. The character of the land is such that it cannot be used as

agricultural land nor can it be put to any other use, except as house sites. In G.

Venkataswami Naidu & Co. v. CIT MANU/SC/0065/1958 : [1959]35ITR594(SC) the

Supreme Court indicated some of the factors which would reveal the real nature of the

transaction. The questions which the Supreme Court referred to are, what is the nature

of the commodity purchased and resold and in what quantity was it purchased and

resold ? If the commodity purchased is generally the subject-matter of trade and if it is

purchased in very large quantities, it would tend to eliminate the possibility of

investment for personal use, possession or enjoyment. In view of the facts of this case,

it is impossible for us to say that this property has been purchased for personal use or

possession or for enjoyment or for investment. Immediately within three months after

this property has been purchased for Rs. 45,000, the assessees had sold under a

registered sale deed dated May 4, 1961, a part of this land to a house building society.

Within a period of one year thereafter, they entered into an agreement with another

neighbouring co-operative society agreeing to sell the remaining land which they had

actually sold on September 20, 1962. Those were the days when in Hyderabad even

society respected people were doing real estate business. There is also evidence to

show that these four assessees were not known to each other. Considering all these

facts, we have no hesitation in holding that the purchase of this land has been made not

as an investment, but clearly for the purpose of trading in the land. We accordingly hold

that the transaction is an adventure in the nature of trade.

8. Mr. Rathnakar had referred to several cases. In many of these cases, the courts have

held that the transactions involved therein were not adventures in the nature of trade.

But, we are of the opinion that no reference to, nor any discussion of, those cases

would be useful, because those are all cases which have been decided on the particular

facts of those cases. The only point of law Mr. Rathnakar raises in this case is that a

single transaction may not be regarded as an adventure in the nature of trade. But we

have the authority of the Supreme Court in Raja J. Rameshwar Rao v. CIT

MANU/SC/0192/1961 : [1961]42ITR179(SC) holding that even a single venture may be

regarded as being in the nature of trade or business. In view of our appraisement and

assessment of the facts in this case which we have mentioned above, we answer the

first question in favour of the Revenue and against the assessees.

9. The next argument of Mr. Rathnakar is that the income in the case of these assessees

should not be assessed in the status of an association of persons. His argument is that

the document dated March 17, 1961, under which they had purchased these lands

shows that these assessees are tenants-in-common and that, therefore, tenants-in-

common cannot constitute an association of persons.

1 0 . In support of this contention, he greatly relied upon the decision in CGT v. R.

Valsala Amma MANU/SC/0251/1971 : [1971]82ITR828(SC) . In that case, two sisters

who had acquired some property in definite shares under a will executed by their

mother had gifted away that property under one document in favour of their brother.

The question was raised whether the gift is liable under the Gift-tax Act to suffer gift-

tax having been made by an association of persons or as having been made by

individuals. The Supreme Court ruled that each one of the donors had a right to half of

the properties which they gifted to their brother and that they were holding the property

and made gifts as tenants-in-common and that, therefore each one of them should be

assessed as an individual though the gift was made through one single document. On

22-06-2022 (Page 3 of 5) www.manupatra.com Damodaram Sanjivayya National Law University

that basis, the Supreme Court held that the gift was not liable to be assessed in the

status of an association of persons. In that case, the Supreme Court never found that

there is anything legally impossible for tenants-in-common to constitute an association

of persons. In fact, it would not logically be possible to lay down that tenants-in-

common can never constitute an association of persons within the meaning of either of

the Gift-tax Act or of the Income Tax Act with which we are now presently concerned.

In CIT v. Indira Balkrishna MANU/SC/0181/1960 : [1960]39ITR546(SC) the Supreme

Court interpreted the word "association of persons" as meaning an association in which

two or more persons join in a common purpose or common action with the object of

producing income, profits or gains. This definition of "association of persons" does not

render it impossible for tenants-in-common to constitute an association of persons.

Where there are two or more persons associated by the bonds of income-making

activity without any specification as to the method of sharing of income, they will be

treated for the purpose of the Income Tax Act as an association of persons, whether

they are tenants-in-common or not. A tenancy-in-common is to be contrasted with joint

tenancy. A joint tenancy has to satisfy the four requirements, called the four unities,

viz., unity of possession, unity of interest, unity of title and unity of time, whereas a

tenancy-in-common requires only the unity of possession. This distinction between a

joint tenancy and tenancy-in-common so prominent for the purpose of property law

appears to us to be wholly immaterial for deciding whether two or more persons who

are tenants-in-common can constitute an association of persons. The observations of

the Supreme Court, therefore, cannot be understood as laying down that tenants-in-

common can never qualify themselves to be members of an association of persons

within the meaning of the Income Tax Act. We, therefore, find it not possible to agree

with the contention of Mr. Rathnakar that the four persons in this case who had

purchased the land and traded in it cannot be called as an association of persons merely

because they are tenants-in-common.

11. In the above view of ours, it would not really be necessary to notice the difference

of opinion that has developed over the interpretation put by this court in the above

Valsala Amma's case MANU/SC/0251/1971 : [1971]82ITR828(SC) . In (sic) our High

Court ruled that a group of individuals can be a body of individuals though not an

association of persons within the meaning of the Income Tax Act. In so holding, a

Division Bench of this court held that Valsala Amma's case MANU/SC/0251/1971 :

[1971]82ITR828(SC) should be confined only to gift-tax cases. That view of our

Division Bench was disagreed from either in whole or in part by the High Courts of

Gujarat, Madras and Kerala. But we may note that in none of those cases any of the

courts had taken the view that tenants-in-common cannot legally constitute an

association of persons. After all, tenants-in-common, like all other human beings, can

carry on activities, either individually or collectively, making profits, losses and gains. It

would, therefore, seem to be impossible to say that two or more persons cannot

associate themselves for purposes of producing income and thus constitute members of

an association of persons for the purpose of making profits merely because they are

tenants-in-common. We accordingly reject this argument of Sri Rathnakar advanced at

great length.

12. Accordingly, we examine, in the facts and circumstances of this case, whether there

is evidence to show that the-four persons have associated themselves for the purpose of

producing income and making profit. The facts which have been stated above would

hardly admit of any doubt to that question. There is evidence to show that these four

persons are not known to each other. According to the document, they have purchased

this property jointly and sold the same jointly. As we have already held, the purpose of

purchase and sale was for making profit. Theirs is not a partnership for the purpose of

22-06-2022 (Page 4 of 5) www.manupatra.com Damodaram Sanjivayya National Law University

the Income Tax Act. If four strangers unite and produce profit by a joint venture

otherwise than as partners, it would hardly be possible to say that they would not

acquire the status of an association of persons. In view of that conclusion, we answer

the second question also against the assessee and in favour of the Revenue. The two

questions, referred, for the opinion of this court, are answered accordingly and the

referred case is disposed of. No costs.

© Manupatra Information Solutions Pvt. Ltd.

22-06-2022 (Page 5 of 5) www.manupatra.com Damodaram Sanjivayya National Law University

You might also like

- SC Judgment On Rights of Karta Over Sale of Ancestral PropertyDocument14 pagesSC Judgment On Rights of Karta Over Sale of Ancestral PropertyLatest Laws TeamNo ratings yet

- Financial Statement Analysis: Submitted By: Saket Jhanwar 09BS0002013Document5 pagesFinancial Statement Analysis: Submitted By: Saket Jhanwar 09BS0002013saketjhanwarNo ratings yet

- Partnership Deed Day of February Two Thousand Nineteen in BetweenDocument6 pagesPartnership Deed Day of February Two Thousand Nineteen in Betweenradha83% (6)

- UST GOLDEN NOTES 2011-InsuranceDocument35 pagesUST GOLDEN NOTES 2011-InsuranceAnthonette MijaresNo ratings yet

- Part 2 - Vol 1 - Trasnet - Report of The State Capture Commission PART II Vol I 010222Document506 pagesPart 2 - Vol 1 - Trasnet - Report of The State Capture Commission PART II Vol I 010222Primedia Broadcasting88% (8)

- Diamond Service SoftwareDocument42 pagesDiamond Service Softwareqweqwe50% (2)

- Suit For Declaration Alonwith Application Under Order 39r1&2 CPCDocument14 pagesSuit For Declaration Alonwith Application Under Order 39r1&2 CPCNarender Kumar75% (4)

- Velasco V People GR No. 166479Document2 pagesVelasco V People GR No. 166479Duko Alcala EnjambreNo ratings yet

- Land and Agrarian Reform in The PhilippinesDocument36 pagesLand and Agrarian Reform in The PhilippinesPrix John EstaresNo ratings yet

- Andhra High Court - Raidurg Cooperative SocietyDocument20 pagesAndhra High Court - Raidurg Cooperative SocietyRavi Prasad GarimellaNo ratings yet

- Sports Law Material For Discussion - Mr. P.Bayola Kiran PDFDocument406 pagesSports Law Material For Discussion - Mr. P.Bayola Kiran PDFSAI SUVEDHYA RNo ratings yet

- Summary SuitDocument15 pagesSummary SuitRajvi ChatwaniNo ratings yet

- Ranvir Singh Vs Land Acquisition Collector and ... On 16 January, 2019Document13 pagesRanvir Singh Vs Land Acquisition Collector and ... On 16 January, 2019super smithNo ratings yet

- CPC ProjectDocument13 pagesCPC ProjectPrithish DekavadiaNo ratings yet

- Concern Readymix at para 35, 36Document19 pagesConcern Readymix at para 35, 36Pival K. PeddireddiNo ratings yet

- Mode of Calculating Compensation For Land Acquisition Re-Explained by Supreme Court 2012 SCDocument13 pagesMode of Calculating Compensation For Land Acquisition Re-Explained by Supreme Court 2012 SCSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (2)

- Delay and Latches 13202 - 2020 - 2 - 1501 - 34739 - Judgement - 06-Apr-2022Document12 pagesDelay and Latches 13202 - 2020 - 2 - 1501 - 34739 - Judgement - 06-Apr-2022NishantvermaNo ratings yet

- MPID Act Rana Case Judgment Nagpur BenchDocument26 pagesMPID Act Rana Case Judgment Nagpur BenchAnand BhautikNo ratings yet

- MPID Act Rana Case Judgment Nagpur Bench PDFDocument26 pagesMPID Act Rana Case Judgment Nagpur Bench PDFAnand BhautikNo ratings yet

- RAHUL S SHAH Vs JINENDRA KUMAR GANDHIDocument33 pagesRAHUL S SHAH Vs JINENDRA KUMAR GANDHISanjay Kumar SinghNo ratings yet

- In The Court of District Magistrate (Kapashera) Old Terminal Tax Building, Kapashera, New Delhi-110037Document7 pagesIn The Court of District Magistrate (Kapashera) Old Terminal Tax Building, Kapashera, New Delhi-110037Mitul BarmanNo ratings yet

- Case No.: Appeal (CRL.) 1392 of 2007 Petitioner: Inder Mohan Goswami & Another Respondent: State of Uttaranchal & OthersDocument13 pagesCase No.: Appeal (CRL.) 1392 of 2007 Petitioner: Inder Mohan Goswami & Another Respondent: State of Uttaranchal & Otherssamsungindian 2015No ratings yet

- Displayphp 3 527500Document2 pagesDisplayphp 3 527500Vibhash SinghNo ratings yet

- Norman BHAIDocument16 pagesNorman BHAIPulkitAgrawalNo ratings yet

- Directions by Supreme Court To Ensure Timely Execution of decrees-SC 2021Document11 pagesDirections by Supreme Court To Ensure Timely Execution of decrees-SC 2021Samarth AgarwalNo ratings yet

- Inder Mohan Goswami v. State of Uttaranchal (2007) (Summon and Warrant)Document13 pagesInder Mohan Goswami v. State of Uttaranchal (2007) (Summon and Warrant)MD AATIF IQBALNo ratings yet

- P. Krishna Bhatta and OrsDocument11 pagesP. Krishna Bhatta and Orsshashank saurabhNo ratings yet

- DRT Ramakanth Inani Vs Madhukar R.bhangayDocument10 pagesDRT Ramakanth Inani Vs Madhukar R.bhangayMoneylife FoundationNo ratings yet

- Kausalya Devi Bogra and Ors Vs Land Acquisition Ofs840241COM778909Document7 pagesKausalya Devi Bogra and Ors Vs Land Acquisition Ofs840241COM778909ApoorvnujsNo ratings yet

- RT - Perumal - Vs - John - Deavin - and - Ors - 24121958 - MADHCt600129COM428466Document10 pagesRT - Perumal - Vs - John - Deavin - and - Ors - 24121958 - MADHCt600129COM428466prashansha kumudNo ratings yet

- Case BriefsDocument16 pagesCase Briefshamper jaguarNo ratings yet

- DM&RM Unit 1 Part 1 SYBBADocument15 pagesDM&RM Unit 1 Part 1 SYBBASarvesh PadwalNo ratings yet

- Kumar Ganganand Singh and Ors Vs Maharaja Sir RameB0270054COM913684Document18 pagesKumar Ganganand Singh and Ors Vs Maharaja Sir RameB0270054COM913684SME 865No ratings yet

- BetweenDocument25 pagesBetweenPRAKRUTHI SHELTERSNo ratings yet

- Manupatrain1472580700 PDFDocument18 pagesManupatrain1472580700 PDFnesanNo ratings yet

- Irrevocable Power of Attorney Also Binding On Legal Heirs of The DonorDocument17 pagesIrrevocable Power of Attorney Also Binding On Legal Heirs of The DonorsantoshthatiNo ratings yet

- Ejectment SCR GPADocument16 pagesEjectment SCR GPAmaheshmrplegalisNo ratings yet

- Rajasthan HCDocument8 pagesRajasthan HCsubhashni kumariNo ratings yet

- Land Acquisition-Compensation.Document32 pagesLand Acquisition-Compensation.api-19981421No ratings yet

- Chhattar Singh and Ors Vs Union of India UOI 02082d051056COM83672Document3 pagesChhattar Singh and Ors Vs Union of India UOI 02082d051056COM83672cnzvszjrjxNo ratings yet

- S Sampoornam Vs CK Shanmugam and Ors 05042022 MADTN2022200422165415256COM137281Document9 pagesS Sampoornam Vs CK Shanmugam and Ors 05042022 MADTN2022200422165415256COM137281Jennifer WingetNo ratings yet

- AIR 2019 Mad 188 - Relied by Appellant - N.manoharan - S.a.945 of 2010Document5 pagesAIR 2019 Mad 188 - Relied by Appellant - N.manoharan - S.a.945 of 2010foreswarcontactNo ratings yet

- Kedar Nath Motani and Ors. Vs Prahlad Rai and Ors. On 25 September, 1959Document8 pagesKedar Nath Motani and Ors. Vs Prahlad Rai and Ors. On 25 September, 1959Sandeep ReddyNo ratings yet

- 4175 2015 5 1501 16815 Judgement 18-Sep-2019Document67 pages4175 2015 5 1501 16815 Judgement 18-Sep-2019Roshan NazarethNo ratings yet

- Jagdishbhai Madhubhai Patel Vs Saraswatiben Wd/O Asharam ... On 29 July, 2019Document34 pagesJagdishbhai Madhubhai Patel Vs Saraswatiben Wd/O Asharam ... On 29 July, 2019mentorNo ratings yet

- M - S. Prime Properties Vs M - S. Bhagyanagar Plot Owners ... On 29 June, 2020Document31 pagesM - S. Prime Properties Vs M - S. Bhagyanagar Plot Owners ... On 29 June, 2020ganapathilawsassociatesNo ratings yet

- In The High Court of Patna: Equiv Alent Citation: (1947) 15ITR484 (Patna)Document4 pagesIn The High Court of Patna: Equiv Alent Citation: (1947) 15ITR484 (Patna)SAI SUVEDHYA RNo ratings yet

- Valji Khimji and Company Vs Official Liquidator Ofs081151COM110454Document5 pagesValji Khimji and Company Vs Official Liquidator Ofs081151COM110454Vinod RahejaNo ratings yet

- 2020 NEG - Gmmco Limited v. Sub-Collector, (Madras)Document4 pages2020 NEG - Gmmco Limited v. Sub-Collector, (Madras)J VenkatramanNo ratings yet

- When Land Acquisition Amounts To Fraud 2011 SCDocument36 pagesWhen Land Acquisition Amounts To Fraud 2011 SCSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- CounselsDocument4 pagesCounselsrakesh sharmaNo ratings yet

- ICT AllahabadDocument11 pagesICT AllahabadRajeev RockwellNo ratings yet

- Supreme Court of India: Kayjay Industries (P) Ltd. - Appellant vs. Asnew Drums (P) Ltd. and Others - RespondentDocument7 pagesSupreme Court of India: Kayjay Industries (P) Ltd. - Appellant vs. Asnew Drums (P) Ltd. and Others - RespondentS Shabir HussainNo ratings yet

- Maharani Deepinder Kaur and ... Vs Raj Kumari Amrit Kaur and Others On 16 December, 2011 PDFDocument6 pagesMaharani Deepinder Kaur and ... Vs Raj Kumari Amrit Kaur and Others On 16 December, 2011 PDFAshu Saran SinghNo ratings yet

- In The High Court For The States of Punjab and Haryana at ChandigarhDocument24 pagesIn The High Court For The States of Punjab and Haryana at ChandigarhnidhiNo ratings yet

- In The Supreme Court of India Civil Appellate Jurisdiction: ReportableDocument23 pagesIn The Supreme Court of India Civil Appellate Jurisdiction: ReportableMadhusudan AloneyNo ratings yet

- VASU DEVAN & ORS V v. NAIR - (1985) 1 MLJ 13Document9 pagesVASU DEVAN & ORS V v. NAIR - (1985) 1 MLJ 13=paul=No ratings yet

- Bhagyanagar Plot Owners Welfare ... Vs State of Telangana On 4 June, 2019Document30 pagesBhagyanagar Plot Owners Welfare ... Vs State of Telangana On 4 June, 2019Shashank GinjupalliNo ratings yet

- Mohd Inam Vs Sanjay Kumar Singhal and Ors 26062020SC20203006201159291COM16762Document13 pagesMohd Inam Vs Sanjay Kumar Singhal and Ors 26062020SC20203006201159291COM16762ganapathilawsassociatesNo ratings yet

- Spec. Relief Sec 6 AIR 2002 SUPREME COURT 1152Document4 pagesSpec. Relief Sec 6 AIR 2002 SUPREME COURT 1152Vishwakarma & Asso.No ratings yet

- Housing Cooperative Case LawDocument8 pagesHousing Cooperative Case LawadvsagaranandNo ratings yet

- Para 23 - Lr. of Late Smt. Virendra Kanwar RathoreDocument15 pagesPara 23 - Lr. of Late Smt. Virendra Kanwar Rathorevipashyana.hilsayanNo ratings yet

- 2008 (4) ALL MR 882.htmlDocument5 pages2008 (4) ALL MR 882.htmlJ VenkatramanNo ratings yet

- Ravishek PNDDocument61 pagesRavishek PNDravishek kumarNo ratings yet

- Narpat Singh and Ors Vs Jaipur Development Authoris020361COM917450Document6 pagesNarpat Singh and Ors Vs Jaipur Development Authoris020361COM917450Bharat Bhushan ShuklaNo ratings yet

- (1999) 1 MLJ 487 1980 58 STC 208Document3 pages(1999) 1 MLJ 487 1980 58 STC 208Sumanth RoxtaNo ratings yet

- Dharmaji - Shankar - Shinde - and - Ors - Vs - Rajaram - ShripadSC2019250419164624160COM14075 HighlightedDocument11 pagesDharmaji - Shankar - Shinde - and - Ors - Vs - Rajaram - ShripadSC2019250419164624160COM14075 HighlightednamanNo ratings yet

- Bureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamFrom EverandBureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamNo ratings yet

- Laxman Omana Vs State of Karnataka - KAR HC - 2001Document5 pagesLaxman Omana Vs State of Karnataka - KAR HC - 2001SAI SUVEDHYA RNo ratings yet

- Anju Garg Vs Hotel Association of India & Ors. - 2008 - SCDocument19 pagesAnju Garg Vs Hotel Association of India & Ors. - 2008 - SCSAI SUVEDHYA RNo ratings yet

- Jagadish Singh Vs Heeralal & Ors. - 2014 - SCDocument15 pagesJagadish Singh Vs Heeralal & Ors. - 2014 - SCSAI SUVEDHYA RNo ratings yet

- Veena Kalia Vs Jatinder Nath Kalia and Ors 05051990827d960049COM436103Document11 pagesVeena Kalia Vs Jatinder Nath Kalia and Ors 05051990827d960049COM436103SAI SUVEDHYA RNo ratings yet

- Frank M Costanzo and Ors Vs The Regional PassportT102526COM584330Document5 pagesFrank M Costanzo and Ors Vs The Regional PassportT102526COM584330SAI SUVEDHYA RNo ratings yet

- Minor L THR Guardian J Vs State and Ors 04112023 DEOR20230203942COM320549Document3 pagesMinor L THR Guardian J Vs State and Ors 04112023 DEOR20230203942COM320549SAI SUVEDHYA RNo ratings yet

- Jakir Hussain Kosangi and Ors Vs State of Andhra PAP201721081716393012COM209535Document23 pagesJakir Hussain Kosangi and Ors Vs State of Andhra PAP201721081716393012COM209535SAI SUVEDHYA RNo ratings yet

- Ad ActDocument9 pagesAd ActSAI SUVEDHYA RNo ratings yet

- YaswanthDocument3 pagesYaswanthSAI SUVEDHYA RNo ratings yet

- Sui Generis Protection For Plant Varieties and Traditional Agricultural Knowledge: The Example of IndiaDocument19 pagesSui Generis Protection For Plant Varieties and Traditional Agricultural Knowledge: The Example of IndiaAnitaNo ratings yet

- History of Legal ProfessionDocument16 pagesHistory of Legal ProfessionSAI SUVEDHYA RNo ratings yet

- P Ethics-IntDocument27 pagesP Ethics-IntSAI SUVEDHYA RNo ratings yet

- Right To PracticeDocument5 pagesRight To PracticeSAI SUVEDHYA RNo ratings yet

- International Criminal LawDocument18 pagesInternational Criminal LawSAI SUVEDHYA RNo ratings yet

- CARTAL - Payment GuideDocument6 pagesCARTAL - Payment GuideSAI SUVEDHYA RNo ratings yet

- Ethics 1Document18 pagesEthics 1SAI SUVEDHYA RNo ratings yet

- Sports LawDocument41 pagesSports LawSAI SUVEDHYA RNo ratings yet

- Iel Cases Mid SemDocument28 pagesIel Cases Mid SemSAI SUVEDHYA RNo ratings yet

- SLPC Ten Reforms ReportDocument59 pagesSLPC Ten Reforms ReportSejal LahotiNo ratings yet

- Youtube Links - International Environmental Law - Case LawsDocument1 pageYoutube Links - International Environmental Law - Case LawsSAI SUVEDHYA RNo ratings yet

- SYLLABUSDocument1 pageSYLLABUSSAI SUVEDHYA RNo ratings yet

- Historical Reviewof General Electionsin IndiaDocument19 pagesHistorical Reviewof General Electionsin IndiaSAI SUVEDHYA RNo ratings yet

- MARA Labs - Claim StatementDocument9 pagesMARA Labs - Claim StatementSAI SUVEDHYA RNo ratings yet

- Brochure - Linklaters 7th CARTAL ConferenceDocument8 pagesBrochure - Linklaters 7th CARTAL ConferenceSAI SUVEDHYA RNo ratings yet

- Hari Sankaran V UOI &others 2019 Indlaw SC 586Document9 pagesHari Sankaran V UOI &others 2019 Indlaw SC 586SAI SUVEDHYA RNo ratings yet

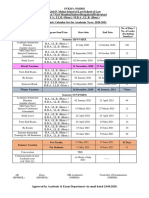

- Academic Calendar UG II To V Yr.2020 21 KPMSOL RevisedDocument1 pageAcademic Calendar UG II To V Yr.2020 21 KPMSOL RevisedSAI SUVEDHYA RNo ratings yet

- B.a., Ll.b. Hons. - 2019 20Document3 pagesB.a., Ll.b. Hons. - 2019 20SAI SUVEDHYA RNo ratings yet

- International Arbitration - The New Frontier of Business and HumanDocument29 pagesInternational Arbitration - The New Frontier of Business and HumanSAI SUVEDHYA RNo ratings yet

- JD - CampusHire - AS Level - 14-NOV-2022Document3 pagesJD - CampusHire - AS Level - 14-NOV-2022SAI SUVEDHYA RNo ratings yet

- Mayo Et Al v. Krogstel Et Al - Document No. 6Document2 pagesMayo Et Al v. Krogstel Et Al - Document No. 6Justia.comNo ratings yet

- Original Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full ChapterDocument41 pagesOriginal Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full Chapterbetty.neverson777100% (26)

- J.B. Cooper by Dr. S.N. SureshDocument16 pagesJ.B. Cooper by Dr. S.N. SureshdrsnsureshNo ratings yet

- Muhannad Evidence 1 Contemporary PresentationDocument24 pagesMuhannad Evidence 1 Contemporary PresentationMuhannad LallmahamoodNo ratings yet

- Rule 30 - TrialDocument5 pagesRule 30 - TrialCecil BernabeNo ratings yet

- Office of The Municipal Economic Enterprise and Development OfficerDocument11 pagesOffice of The Municipal Economic Enterprise and Development Officerrichard ferolinoNo ratings yet

- Slide 4 Code of Conducts Professional PracticeDocument23 pagesSlide 4 Code of Conducts Professional PracticeAjim Senamo D'clubNo ratings yet

- I. Definitions 1. "Agreement" Means This Settlement Agreement and Full and Final ReleaseDocument27 pagesI. Definitions 1. "Agreement" Means This Settlement Agreement and Full and Final Releasenancy_sarnoffNo ratings yet

- Introduction and Summary: ListedDocument118 pagesIntroduction and Summary: Listedkcc2012No ratings yet

- Due Diligence InvestmentsDocument6 pagesDue Diligence InvestmentselinzolaNo ratings yet

- State Common Entrance Test Cell, Maharashtra: Provisional Selection Letter (CAP 2)Document1 pageState Common Entrance Test Cell, Maharashtra: Provisional Selection Letter (CAP 2)Vrushali ShirsathNo ratings yet

- Women Under The Gun: How Gun Violence Affects Women and 4 Policy Solutions To Better Protect ThemDocument52 pagesWomen Under The Gun: How Gun Violence Affects Women and 4 Policy Solutions To Better Protect ThemCenter for American ProgressNo ratings yet

- Your English Pal Business English Lesson Plan Consumer Rights v2Document4 pagesYour English Pal Business English Lesson Plan Consumer Rights v2Yulia PetrishakNo ratings yet

- NGP To Ahemdabad Train Ticket PDFDocument2 pagesNGP To Ahemdabad Train Ticket PDFSaurabh UkeyNo ratings yet

- Quotation For Am PM Snack and Lunch 100 Pax Feu Tech 260Document3 pagesQuotation For Am PM Snack and Lunch 100 Pax Feu Tech 260Heidi Clemente50% (2)

- Windows Server Longhorn Beta 3 Release TS Gateway Server SDocument82 pagesWindows Server Longhorn Beta 3 Release TS Gateway Server Skay tubeNo ratings yet

- COA 10 March 2020Document2 pagesCOA 10 March 2020Gabriel TalosNo ratings yet

- HIS102 (KFI) - Fall of Roman EmpireDocument22 pagesHIS102 (KFI) - Fall of Roman EmpireTasnim Alam Piyash 1731712No ratings yet

- Assignment 2Document3 pagesAssignment 2deepika snehi100% (1)

- The Astonishing Rise of Angela Merkel - The New YorkerDocument87 pagesThe Astonishing Rise of Angela Merkel - The New YorkerveroNo ratings yet

- The Box - 1st and 2nd ConditionalsDocument3 pagesThe Box - 1st and 2nd Conditionalsshanay afshar50% (2)

- Rubio vs. AlabataDocument9 pagesRubio vs. AlabataCathy BelgiraNo ratings yet

- Book Review - An Undocumented Wonder - The Great Indian ElectionsDocument18 pagesBook Review - An Undocumented Wonder - The Great Indian Electionsvanshika.22bap9539No ratings yet