Professional Documents

Culture Documents

Financial Services Guide: As at 5 October 2021

Uploaded by

Nick KOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Services Guide: As at 5 October 2021

Uploaded by

Nick KCopyright:

Available Formats

Financial Services

Guide

As at 5 October 2021

About this document

This document is a Financial Services Guide (FSG) issued by Vanguard Investments Australia Ltd

ABN 72 072 881 086 / AFSL 227263 (‘Vanguard’, ‘we’, ‘us’, ‘our’). This FSG is designed to help you

decide whether to use any of the services offered by Vanguard. It includes information about the

financial products and services we provide, the remuneration we receive and our process for handling

any complaints that you may have.

Important information

Before you can invest in any of our products or services, you will need to obtain a copy of the relevant

disclosure document - a Product Disclosure Statement (PDS), Prospectus or Investor-Directed

Portfolio Service (IDPS) Guide. These disclosure documents each contain information about a

particular product to assist you in making an informed decision about that product. The disclosure

documents include information relating to the features, fees and charges, investment strategy and

benefits and risks of the product.

You can download a copy of the relevant disclosure from our website at www.vanguard.com.au or by

contacting Vanguard Personal Investor on 1300 655 101.

Financial Services Guide 1

About Vanguard

Vanguard is a wholly owned subsidiary of The Vanguard Group, Inc. – one of the

world’s largest global investment management companies. In Australia, Vanguard

has been serving financial advisers, retail clients and institutional investors for

more than 25 years.

Financial services we provide

Vanguard holds an Australian Financial Services Licence (No. 227263) under the

Corporations Act 2001 (Cth).

We are licensed to provide general financial product advice, deal with interests in

managed and exchange traded funds (ETFs) and cross-listed US ETF securities.

We are also licensed to operate registered managed investment schemes and an

Investor Directed Portfolio Service, called Vanguard Personal Investor.

Any general financial product advice we provide does not take into account your

personal financial situation, objectives or needs. Rather, it should be viewed as

general information for you to consider and discuss with your financial adviser

(after taking into account your circumstances) before making your investment

decision. If you do not currently have a financial adviser, you can contact the

Financial Planning Association of Australia Limited in your state for a list of

qualified advisers.

What commissions, fees or charges are paid or received?

Vanguard does not charge any fees for information or general financial product

advice that we provide.

As manager of the funds and cross-listed US ETF securities, Vanguard or The

Vanguard Group, Inc receives management fees in relation to the products that we

offer. These fees are described in detail in the relevant PDS or Prospectus. As the

Operator of the Vanguard Personal Investor IDPS, Vanguard charges an account

fee and a brokerage fee as described in the Vanguard Personal Investor Guide

(IDPS Guide). There are no commissions payable to Vanguard for any advice or

service delivered.

Vanguard may also receive payments from The Vanguard Group, Inc for services it

provides.

Vanguard staff receive a salary and may receive bonuses and other benefits from

time to time. Remuneration is not directly attributable to the investments made by

the retail clients with whom they deal.

Except as noted above, none of Vanguard’s related companies, directors,

employees or associates receives any other remuneration or benefits in respect of

financial services provided to our retail clients.

Payments to financial advisers and management cost rebates

No adviser will receive any commission from Vanguard relating to your investment

in a fund or for having a Vanguard Personal Investor Account.

Vanguard may from time to time enter into arrangements to provide management

cost rebates to certain wholesale investors who invest sizeable amounts in the

Vanguard Funds. Vanguard makes these payments from its own resources.

Financial Services Guide 2

Assets held by Vanguard

Where Vanguard holds assets on your behalf through the Vanguard Personal Investor

IDPS, Vanguard will hold such assets in trust for you. Where a sub-custodian is

appointed to provide custody services in relation to certain assets, they will hold those

assets on trust for us and we will in turn hold the interest in those assets for you. The

role of the sub-custodian is to hold, maintain and deal with assets in accordance with

directions received from us. The directions we give the sub-custodian will be based on

instructions that we receive from you.

Vanguard and any sub-custodian appointed by Vanguard may hold your assets in omnibus

accounts pooled together with the assets of other investors. Records are maintained to

enable the proper attribution of assets and income to you and each other client.

Where you invest in the Vanguard Personal Investor IDPS, a Vanguard Cash Account will

be opened for you (as described in the IDPS Guide). The cash held within your Vanguard

Cash Account will be pooled with the cash balance of other investors and invested in bank

accounts with Australia and New Zealand Banking Group Limited (ANZ).

When you apply to invest in the Vanguard Personal Investor IDPS, you consent to the

use of omnibus accounts by Vanguard and any appointed sub-custodian.

Additional Information

How can I give you instructions?

You can contact Vanguard by using the contact details set out below in the section

‘Contacting Vanguard’. Information on how you can transact with us can be found in

the Produce Disclosure Statement, Prospectus, reference guide or IDPS Guide for your

product.

Professional Indemnity Insurance

Vanguard is covered by professional indemnity insurance satisfying the requirements

under s912B of the Corporations Act 2001 (Cth) for compensation arrangements.

Vanguard has the benefit of insurance coverage for fraud and professional liability

including Investment Company Blanket Bond and a policy of Directors & Officers/

Errors & Omissions Liability Insurance, and is satisfied with the adequacy of that

cover. The cover available to Vanguard extends to losses arising from the conduct

of former employees or representatives of Vanguard (which occurred during their

employment with, or service for Vanguard) as if those persons were still employed by,

or were still representatives of Vanguard. Senior management reviews the insurance

coverage and policies annually.

How does Vanguard protect my privacy?

Vanguard is committed to respecting the privacy of your personal information. We

recognise that your relationship with us is based on trust, and that you expect us to

act responsibly towards you.

In order to provide our products and services to you and to establish and manage

your investment, we need to collect your personal information. Where practicable, we

will collect your personal information directly from you, or from anyone authorised

by you or acting on your behalf. We may also collect additional personal information

throughout the course of managing your investment for purposes which we consider

an individual would reasonably expect.

If you do not provide your personal information as requested, we may not be able

to process an application, provide services to you or provide you with information

about our products and services. Further details about how we handle your personal

information can be located in Vanguard’s Privacy Policy. To obtain a copy of the

Vanguard Privacy Policy, please visit www.vanguard.com.au.

Financial Services Guide 3

What should I do if I have a complaint?

If you have a complaint, please contact us so that we can work together towards a

resolution.

You can contact Vanguard on:

Email: clientservices@vanguard.com.au

Phone: 1300 655 101 (from 8:00am to 6:00pm AET, Monday to Friday)

Secure message: via Vanguard Online Secure Message Portal

Mail: Vanguard Investments Australia

GPO Box 1837

Melbourne VIC 3001

Our Complaints Handling Policy is available on our website and in hard copy upon

request.

We aim to resolve your complaint as quickly as possible. For most standard

complaints, we will provide you with a written internal dispute resolution response

within 30 calendar days after receiving your complaint. Complex complaints

may have a different maximum timeframe for responding. We will notify you if a

different maximum will apply to your complaint.

In the event that you are not satisfied with the outcome of your complaint, you

have the right to refer the matter to an external dispute resolution process – the

Australian Financial Complaints Authority (AFCA).

AFCA provides fair and independent financial services complaint resolution that is

free to consumers. You can make a Complaint to AFCA online, by letter, email or

by phone.

It is important to note that time limits apply to some types of complaints lodged

with the AFCA.

Australian Financial Complaints Authority

Website: www.afca.org.au

Email: info@afca.org.au

Telephone: 1800 931 678 (free call)

In writing to: Australian Financial Complaints Authority

GPO Box 3

Melbourne VIC 3001

Financial Services Guide 4

Contacting Vanguard

If you have any further questions relating to this guide, please do not hesitate to

contact us:

By mail:

Client Services

Vanguard Investments Australia Ltd

GPO Box 1837

Melbourne VIC 3001

By phone:

Client services 1300 655 101

8:00am to 6:00pm Melbourne time,

Monday to Friday.

By email:

clientservices@vanguard.com.au

Connect with Vanguard®

vanguard.com.au

1300 655 101

Vanguard Investments Australia Ltd (ABN 72 072 881 086/AFS Licence 227263) is the product issuer and the Operator of Vanguard Personal Investor.

This guide contains general information and is intended to assist you. We have not taken into account the circumstances of any particular person when

preparing this information so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our

IDPS Guide, Product Disclosure Statements (“PDSs”), or Prospectus before making any investment decision or recommendation. You can access our

disclosure documents at vanguard.com.au or by calling 1300 655 101.

© 2021 Vanguard Investments Australia Ltd. All rights reserved.

VIAFSG 092021

You might also like

- PDS SuperOptionsDocument32 pagesPDS SuperOptionsNick KNo ratings yet

- Australiansuper: Product Disclosure StatementDocument32 pagesAustraliansuper: Product Disclosure StatementNick KNo ratings yet

- GHD Superannuation Plan: Product Disclosure StatementDocument32 pagesGHD Superannuation Plan: Product Disclosure StatementNick KNo ratings yet

- TTR Income: Product Disclosure StatementDocument52 pagesTTR Income: Product Disclosure StatementNick KNo ratings yet

- Life Insurance PdsDocument43 pagesLife Insurance PdsNick KNo ratings yet

- PDS PublicSectorDocument16 pagesPDS PublicSectorNick KNo ratings yet

- Australiansuper Select: Product Disclosure StatementDocument16 pagesAustraliansuper Select: Product Disclosure StatementNick KNo ratings yet

- AU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryDocument4 pagesAU-Unitholder-notice-Vanguard AMMA Tax Statement GlossaryNick KNo ratings yet

- Personal Plan: Product Disclosure StatementDocument28 pagesPersonal Plan: Product Disclosure StatementNick KNo ratings yet

- AU-Vanguard Managed Funds-Reference GuideDocument19 pagesAU-Vanguard Managed Funds-Reference GuideNick KNo ratings yet

- AU-Vanguard Personal Investor Investment MenuDocument12 pagesAU-Vanguard Personal Investor Investment MenuNick KNo ratings yet

- Generations Personal Super and Pension Additional InformationDocument22 pagesGenerations Personal Super and Pension Additional InformationNick KNo ratings yet

- Generations Super and Pension Product Disclosure StatementDocument39 pagesGenerations Super and Pension Product Disclosure StatementNick KNo ratings yet

- AU-Vanguard Personal Investor Guide Part ADocument28 pagesAU-Vanguard Personal Investor Guide Part ANick KNo ratings yet

- Epic Rogue of Seven Sneak Attacks A Round A Creature (3Document4 pagesEpic Rogue of Seven Sneak Attacks A Round A Creature (3Nick KNo ratings yet

- Medtronic MM780G New Insulin Pump Order FormDocument4 pagesMedtronic MM780G New Insulin Pump Order FormNick KNo ratings yet

- Info Card 2016-17Document12 pagesInfo Card 2016-17Nick KNo ratings yet

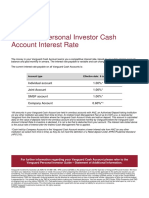

- AU-Vanguard Personal Investor-Cash Account Interest RateDocument1 pageAU-Vanguard Personal Investor-Cash Account Interest RateNick KNo ratings yet

- Ill Wind in FriezfordDocument36 pagesIll Wind in FriezfordNick KNo ratings yet

- Common Riverbank Weeds Lower Hawk Nepean BookletDocument68 pagesCommon Riverbank Weeds Lower Hawk Nepean BookletNick KNo ratings yet

- Richmond Bridge Duplication and Traffic Improvements: Frequently Asked QuestionsDocument5 pagesRichmond Bridge Duplication and Traffic Improvements: Frequently Asked QuestionsNick KNo ratings yet

- FMA Informative Issue184Document11 pagesFMA Informative Issue184Nick KNo ratings yet

- Richmond Bridge Duplication and Traffic Improvements: Community Update - Route Investigation November 2019Document5 pagesRichmond Bridge Duplication and Traffic Improvements: Community Update - Route Investigation November 2019Nick KNo ratings yet

- Woolworths Supermarkets Agreement 2018 Final 02.10.2018Document68 pagesWoolworths Supermarkets Agreement 2018 Final 02.10.2018Nick KNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Union Registration: Procedure 1. RequirementsDocument7 pagesUnion Registration: Procedure 1. RequirementsErika WijangcoNo ratings yet

- Microsoft Dynamics 365 For Finance and Operations, Business EditionDocument13 pagesMicrosoft Dynamics 365 For Finance and Operations, Business EditionjoseNo ratings yet

- Part II Brgy. Inarado, Daraga - Findings and RecommendationsDocument11 pagesPart II Brgy. Inarado, Daraga - Findings and RecommendationsBaby M FoodhubNo ratings yet

- Business Report - 2 (GODIGIT Bank)Document10 pagesBusiness Report - 2 (GODIGIT Bank)Rahul100% (1)

- Resumen de Contactos y Sensores Q409533Document19 pagesResumen de Contactos y Sensores Q409533Francisco Javier BurgosNo ratings yet

- Philippine Nurses Licensure Examination Results Released in Ten (10) Working DaysDocument5 pagesPhilippine Nurses Licensure Examination Results Released in Ten (10) Working DaysRapplerNo ratings yet

- EDII, Chennai-Revised Mentors List PDFDocument6 pagesEDII, Chennai-Revised Mentors List PDFVanita ValluvanNo ratings yet

- HandbookDocument31 pagesHandbookfrkmrd7955No ratings yet

- FinanceDocument196 pagesFinancePampa KaranNo ratings yet

- LM Business Math - Q1 W6 - MELC3 Module 8Document15 pagesLM Business Math - Q1 W6 - MELC3 Module 8Cristina C MarianoNo ratings yet

- Strategic Cost Management: AssignmentDocument2 pagesStrategic Cost Management: AssignmentPranai MehtaNo ratings yet

- Unit-4 Inventory and Management ProcessDocument83 pagesUnit-4 Inventory and Management ProcessUzma Rukhayya ShaikNo ratings yet

- Memorandum of Association OF Rehbar FoundationDocument14 pagesMemorandum of Association OF Rehbar FoundationAyaz ManiNo ratings yet

- AirAsia Group Berhad - AR2020 - Part 4Document212 pagesAirAsia Group Berhad - AR2020 - Part 4NUR RAHIMIE FAHMI B.NOOR ADZMAN NUR RAHIMIE FAHMI B.NOOR ADZMANNo ratings yet

- The Military Simulation, Modelling, and Virtual Training Market 2013-2023Document28 pagesThe Military Simulation, Modelling, and Virtual Training Market 2013-2023VisiongainGlobal100% (1)

- Pratik BBDocument74 pagesPratik BBPratik PadmanabhanNo ratings yet

- Pond's Relaunch StrategyDocument15 pagesPond's Relaunch StrategyAvnit kumarNo ratings yet

- ESG Explained - Article Series Exploring ESG From The Very Basics - #2 Where Do You Start With ESG ReportingDocument13 pagesESG Explained - Article Series Exploring ESG From The Very Basics - #2 Where Do You Start With ESG Reportingsujaysarkar85No ratings yet

- AssignmentDocument9 pagesAssignmentBaekhunnie ByunNo ratings yet

- Lenovo Mobiles Consumer Satisfaction Full ProjectDocument47 pagesLenovo Mobiles Consumer Satisfaction Full ProjectAnn Amitha AntonyNo ratings yet

- Esri Course CatalogDocument44 pagesEsri Course CatalogMelvin MagbanuaNo ratings yet

- Exporting HeadphoneDocument5 pagesExporting HeadphoneNguyễn Huyền100% (1)

- Viewtinet Presentación Big Data BIDocument21 pagesViewtinet Presentación Big Data BIMari CarmenNo ratings yet

- Tourism in Africa:: Harnessing Tourism For Growth and Improved LivelihoodsDocument12 pagesTourism in Africa:: Harnessing Tourism For Growth and Improved LivelihoodsDIPIN PNo ratings yet

- Full Download Test Bank For Jazz 2nd by Deveaux PDF Full ChapterDocument18 pagesFull Download Test Bank For Jazz 2nd by Deveaux PDF Full Chaptercotiserampirenocx100% (20)

- Group 4 - Womenomics in JapanDocument15 pagesGroup 4 - Womenomics in JapanFerdinand LoNo ratings yet

- Scholars Contract and LOIDocument4 pagesScholars Contract and LOIMisha Madeleine GacadNo ratings yet

- This Study Resource Was: 1. in The Audit of The Heats Corporation's Financial Statements at December 31, 2005, TheDocument5 pagesThis Study Resource Was: 1. in The Audit of The Heats Corporation's Financial Statements at December 31, 2005, TheIvy BautistaNo ratings yet

- Project Report (Rishab)Document44 pagesProject Report (Rishab)Aryan singh The blue gamerNo ratings yet

- Billing Information For New ClientsDocument6 pagesBilling Information For New ClientsBantug De Ocampo JinkeeNo ratings yet