Professional Documents

Culture Documents

DRAFT - 04/18/22: Application For Automatic Extension of Time To File U.S. Individual Income Tax Return

DRAFT - 04/18/22: Application For Automatic Extension of Time To File U.S. Individual Income Tax Return

Uploaded by

João Felipe da FragaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DRAFT - 04/18/22: Application For Automatic Extension of Time To File U.S. Individual Income Tax Return

DRAFT - 04/18/22: Application For Automatic Extension of Time To File U.S. Individual Income Tax Return

Uploaded by

João Felipe da FragaCopyright:

Available Formats

DRAFT -- 04/18/22

Application for Automatic Extension of Time

4868

Form

To File U.S. Individual Income Tax Return

OMB No. 1545-0074

Department of the Treasury

Internal Revenue Service (99)

▶ Go to www.irs.gov/Form4868 for the latest information. 2021

There are three ways to request an automatic extension of time to

file a U.S. individual income tax return. Pay Electronically

1. You can pay all or part of your estimated income tax due and

indicate that the payment is for an extension using Direct Pay, You don’t need to file Form 4868 if you make a payment using our

the Electronic Federal Tax Payment System, or using a credit electronic payment options. The IRS will automatically process an

or debit card. See How To Make a Payment, later. extension of time to file when you pay part or all of your estimated

2. You can file Form 4868 electronically by accessing IRS e-file income tax electronically. You can pay online or by phone. See

using your tax software or by using a tax professional who Making Payments Electronically, later.

uses e-file. E-file Using Your Tax Software

3. You can file a paper Form 4868 and enclose payment of your or Through a Tax Professional

estimate of tax due (optional).

Refer to your tax software package or tax preparer for ways to file

It’s Convenient, electronically. Be sure to have a copy of your 2020 tax return—

Safe, and Secure you’ll be asked to provide information from the return for taxpayer

verification. If you wish to make a payment, you can pay by

IRS e-file is the IRS’s electronic filing program. You can get an electronic funds withdrawal or send your check or money order to

automatic extension of time to file your tax return by filing Form the address shown in the middle column under Where To File a

4868 electronically. You’ll receive an electronic acknowledgment Paper Form 4868, later.

once you complete the transaction. Keep it with your records. Don’t

mail in Form 4868 if you file electronically, unless you’re making a

payment with a check or money order. See Pay by Check or Money

File a Paper Form 4868

Order, later.

If you wish to file on paper instead of electronically, fill in the Form

Complete Form 4868 to use as a worksheet. If you think you may 4868 below and mail it to the address shown under Where To File a

owe tax when you file your return, you’ll need to estimate your total Paper Form 4868, later.

tax liability and subtract how much you’ve already paid (lines 4, 5,

and 6 below). For information on using a private delivery service, see Private

Delivery Services, later.

Several companies offer free e-filing of Form 4868 through the

Free File program. For more details, go to www.irs.gov/FreeFile. Note: If you’re a fiscal year taxpayer, you must file a paper Form 4868.

General Instructions

Purpose of Form 1. Properly estimate your 2021 tax liability using the information

available to you,

Use Form 4868 to apply for 6 more months (4 if “out of the

country” (defined later under Taxpayers who are out of the country) 2. Enter your total tax liability on line 4 of Form 4868, and

and a U.S. citizen or resident) to file Form 1040, 1040-SR, 1040-NR, 3. File Form 4868 by the regular due date of your return.

1040-PR, or 1040-SS.

Gift and generation-skipping transfer (GST) tax return (Form

709). An extension of time to file your 2021 calendar year income

▲

!

CAUTION

Although you aren’t required to make a payment of the tax

you estimate as due, Form 4868 doesn’t extend the time to

pay taxes. If you don’t pay the amount due by the regular

tax return also extends the time to file Form 709 for 2021. However, due date, you’ll owe interest. You may also be charged penalties.

it doesn’t extend the time to pay any gift and GST tax you may owe For more details, see Interest and Late Payment Penalty, later. Any

for 2021. To make a payment of gift and GST tax, see Form 8892. If remittance you make with your application for extension will be

you don’t pay the amount due by the regular due date for Form 709, treated as a payment of tax.

you’ll owe interest and may also be charged penalties. If the donor You don’t have to explain why you’re asking for the extension.

died during 2021, see the instructions for Forms 709 and 8892. We’ll contact you only if your request is denied.

Don’t file Form 4868 if you want the IRS to figure your tax or

Qualifying for the Extension you’re under a court order to file your return by the regular due date.

To get the extra time, you must:

▼ DETACH HERE ▼

Application for Automatic Extension of Time

Form 4868 To File U.S. Individual Income Tax Return

OMB No. 1545-0074

Department of the Treasury

Internal Revenue Service (99) For calendar year 2021, or other tax year beginning , 2021, and ending , 20 .

2021

Part I Identification Part II Individual Income Tax

1 Your name(s) (see instructions) 4 Estimate of total tax liability for 2021 . . $ 0

JOAO FELIPEDAFRAGA 5 Total 2021 payments . . . . . . 0

Address (see instructions) 6 Balance due. Subtract line 5 from line 4.

5001 MAGGIORE ST See instructions . . . . . . . . 0

7 Amount you’re paying (see instructions) . ▶ 0

City, town, or post office State ZIP code 8 Check here if you’re “out of the country” and a U.S.

citizen or resident. See instructions . . . . . . ▶

CORAL GABLES F L 33146 9 Check here if you file Form 1040-NR and didn’t receive

2 Your social security number 3 Spouse’s social security number

wages as an employee subject to U.S. income tax

156-39-3053 withholding . . . . . . . . . . . . . ▶

For Privacy Act and Paperwork Reduction Act Notice, see instructions later. Cat. No. 13141W Form 4868 (2021)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Albina Khaliapova, Piano James Alexander, Violin Dennis Parker, CelloDocument1 pageAlbina Khaliapova, Piano James Alexander, Violin Dennis Parker, CelloJoão Felipe da FragaNo ratings yet

- Albina Khaliapova, Piano James Alexander, Violin Dennis Parker, CelloDocument1 pageAlbina Khaliapova, Piano James Alexander, Violin Dennis Parker, CelloJoão Felipe da FragaNo ratings yet

- Return To School/work Letter: Name: DobDocument1 pageReturn To School/work Letter: Name: DobJoão Felipe da FragaNo ratings yet

- João - The Loophole (Sketch of A Script)Document1 pageJoão - The Loophole (Sketch of A Script)João Felipe da FragaNo ratings yet

- Program For The MasterclassDocument1 pageProgram For The MasterclassJoão Felipe da FragaNo ratings yet

- Program: Vi Ol I N Sonata No. 2 I N A Mi Nor, BWV 1003 J. S. BachDocument1 pageProgram: Vi Ol I N Sonata No. 2 I N A Mi Nor, BWV 1003 J. S. BachJoão Felipe da FragaNo ratings yet

- Midsummer Cuts UpdatedDocument1 pageMidsummer Cuts UpdatedJoão Felipe da FragaNo ratings yet

- Master Agreement 2017-2018Document4 pagesMaster Agreement 2017-2018João Felipe da FragaNo ratings yet

- Kathakali Dance Drama (1950) Depicts A GuruDocument1 pageKathakali Dance Drama (1950) Depicts A GuruJoão Felipe da FragaNo ratings yet

- CIR Vs Benguet Corp.Document1 pageCIR Vs Benguet Corp.Sui GenerisNo ratings yet

- IPPB Accidental InsuranceDocument3 pagesIPPB Accidental InsuranceAnil TalariNo ratings yet

- E-Way Bill SystemDocument1 pageE-Way Bill SystemAnil SainiNo ratings yet

- Tax Practice Math Solution PDFDocument1 pageTax Practice Math Solution PDFnurulaminNo ratings yet

- Ae 208 Bustax ProblemDocument3 pagesAe 208 Bustax ProblemPaulo OronceNo ratings yet

- HRA at Capital CostDocument1 pageHRA at Capital Costsudhir mishraNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- AUSL Tax 2 SyllabusDocument4 pagesAUSL Tax 2 Syllabuskaira marie carlosNo ratings yet

- CpaDocument17 pagesCpaKeti AnevskiNo ratings yet

- Uber Philippines Centre of Excellence LLC: PayslipDocument1 pageUber Philippines Centre of Excellence LLC: PayslipKatey Yumul - OdiamanNo ratings yet

- Pay Slip For April 2022: Fujitsu Consulting India Private LimitedDocument1 pagePay Slip For April 2022: Fujitsu Consulting India Private Limitedavisinghoo7No ratings yet

- Solution Manual For College Accounting 22nd EditionDocument23 pagesSolution Manual For College Accounting 22nd EditionMissKellyWilliamsondawe100% (40)

- Taxation Quiz Week 9Document4 pagesTaxation Quiz Week 9Vee MaNo ratings yet

- GST Registration PPT Ver6 28042017Document46 pagesGST Registration PPT Ver6 28042017Sonal AggarwalNo ratings yet

- DrtftyDocument1 pageDrtftySri Ganesh ComputersNo ratings yet

- June SalaryslipDocument1 pageJune SalaryslipParveen SainiNo ratings yet

- Taxability of Free Supplies Under GSTDocument7 pagesTaxability of Free Supplies Under GSTThandapani PalaniNo ratings yet

- Crop Flipkart Labels 13 Feb 2024-05-29Document5 pagesCrop Flipkart Labels 13 Feb 2024-05-2904vijilNo ratings yet

- Session 1 Introduction To Program BudgetingDocument9 pagesSession 1 Introduction To Program BudgetingOFORINo ratings yet

- Worksheet Unit1Document8 pagesWorksheet Unit1Kaushal pateriyaNo ratings yet

- Quarterly Contribution Return and Report of Wages: REMINDER: File Your DE 9 and DE 9C TogetherDocument2 pagesQuarterly Contribution Return and Report of Wages: REMINDER: File Your DE 9 and DE 9C TogetherWomen Cup2No ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAnkur murarkaNo ratings yet

- Taxsheet 10007162Document2 pagesTaxsheet 10007162Narender KapoorNo ratings yet

- Guide To CGST, SGST and IGST: Inter-State Vs Intra-StateDocument6 pagesGuide To CGST, SGST and IGST: Inter-State Vs Intra-StateSuman IndiaNo ratings yet

- Economics KnutDocument4 pagesEconomics KnutPotchi Chinchin RamirezNo ratings yet

- Dynamic ModelDocument48 pagesDynamic ModelJohnny BravoNo ratings yet

- Solved in 2002 Florence Purchased 30 Acres of Land She HasDocument1 pageSolved in 2002 Florence Purchased 30 Acres of Land She HasAnbu jaromiaNo ratings yet

- Mauritius Personal Income Tax 2023 - 2024Document1 pageMauritius Personal Income Tax 2023 - 2024sr moosunNo ratings yet

- PIN Certificate: This Is To Certify That Taxpayer Shown Herein Has Been Registered With Kenya Revenue AuthorityDocument1 pagePIN Certificate: This Is To Certify That Taxpayer Shown Herein Has Been Registered With Kenya Revenue Authorityseres jakoNo ratings yet

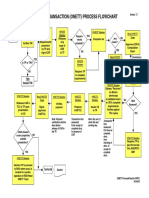

- One-Time Transaction (Onett) Process Flowchart: StartDocument1 pageOne-Time Transaction (Onett) Process Flowchart: StartJenely Joy Areola-TelanNo ratings yet