0% found this document useful (0 votes)

23K views16 pagesIndividual Assignment FIN533

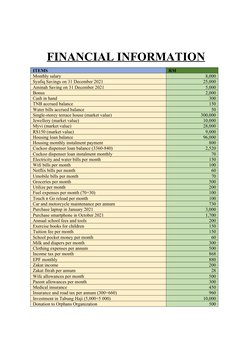

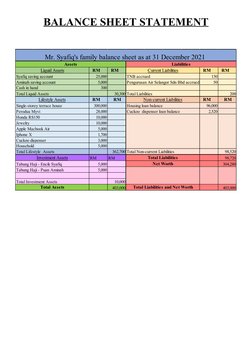

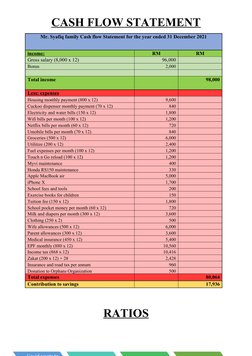

The document provides biographical and financial information for Mr. Muhammad Syafiq Bin Hj. Abu Bakar and his family. It details their assets, including a house valued at RM300,000, jewelry worth RM10,000, vehicles valued at RM28,000 and RM9,000, and savings of RM25,000 and RM5,000. It also lists their monthly expenses, loans, and investments. The document appears to be a family financial plan prepared by a student for an assignment.

Uploaded by

SHAHRIZMAN INDRACopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

23K views16 pagesIndividual Assignment FIN533

The document provides biographical and financial information for Mr. Muhammad Syafiq Bin Hj. Abu Bakar and his family. It details their assets, including a house valued at RM300,000, jewelry worth RM10,000, vehicles valued at RM28,000 and RM9,000, and savings of RM25,000 and RM5,000. It also lists their monthly expenses, loans, and investments. The document appears to be a family financial plan prepared by a student for an assignment.

Uploaded by

SHAHRIZMAN INDRACopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

- Acknowledgement

- Biography of the Family

- Financial Information

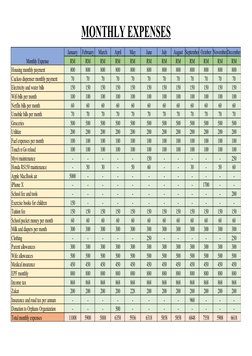

- Monthly Expenses

- Balance Sheet Statement

- Cash Flow Statement

- Ratios

- Comment and Advice

- Income Tax Year Assessment 2021

- COVID-19 Affects Family’s Financial Planning

- Recommendations